AI in Remote Patient Monitoring (RPM) Market: Growth, Size, Share, and Trends

AI in Remote Patient Monitoring (RPM) Market by Component (Device: Wearable, Implantable, Portable; Software, Service), Indication (Cardiac, Neuro, Onco, Diabetes, Sleep, Mental Health), End User (Hospitals, Clinics, Payer), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global AI in remote patient monitoring market is projected to reach USD 8.44 billion by 2030 from USD 1.97 billion in 2024, at a high CAGR of 27.5% during the forecast period. The AI in remote patient monitoring market, is driven by chronic disease prevalence, digital health adoption, and demand for predictive, home-based patient care..

KEY TAKEAWAYS

-

BY REGIONThe North America AI in remote patient monitoring market dominated, with a share of 54.0% in 2023.

-

BY COMPONENTBy component, the software segment is projected to grow at the fastest rate from 2024 to 2030.

-

BY INDICATIONBy indication, the mental health segment is expected to register the highest CAGR of 28.9%.

-

BY END USERBy end user, the healthcare providers segment dominated the market in 2023.

-

COMPETITIVE LANDSCAPECompany Medtronic, ResMed, Inc., and GE HealthCare were identified as some of the star players in the AI in remote patient monitoring market (global), given their strong market share and product footprint.

The AI in remote patient monitoring market is driven by the surge of real-time patient data from connected devices and the need for personalized, proactive healthcare. The market is further fueled by cost pressures, regulatory support, and advances in AI analytics enabling predictive, efficient care.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The AI in remote patient monitoring (RPM) market is being shaped by key trends, including the shift toward value-based care, increasing adoption of wearables, advancements in AI and predictive analytics, and expanding reimbursement policies. Hospitals, healthcare payers, patients, and pharma & biotech companies are the primary users of RPM solutions. Rising demand for personalized and remote care, coupled with global digital health initiatives, is driving the adoption and revenues of end users.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing telehealth and remote patient monitoring markets

-

Growing adoption of mhealth apps

Level

-

Regulatory variation across regions

-

Shortage of skilled professionals to operate AI based tools

Level

-

Growing opportunities in emerging economies

-

Increase in the partnership and collaboration among healthcare providers and AI based companies

Level

-

Scarcity of high-quality healthcare data and lack of accuracy

-

Lack of interoperability

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing telehealth and remote patient monitoring narkets

Many countries are increasingly supporting telehealth and AI in remote patient monitoring by establishing statewide coverage, defining reimbursement policies, and developing legal frameworks for patient monitoring practices. In November 2024, the Centers for Medicare & Medicaid Services (CMS) finalized changes to telehealth payment policies for 2025, including extending specific flexibilities such as virtual supervision for teaching physicians and permitting telehealth services for behavioral health in the home setting. These updates aim to incorporate telehealth more seamlessly while ensuring regulatory oversight remains intact. Additionally, in November 2024, the Drug Enforcement Administration (DEA) extended telehealth prescribing flexibilities for controlled substances through the end of 2024.

Restraint: Regulatory variation across regions

There are significant variations in laws and policies governing AI in remote patient monitoring practices between different states and countries, which leads to a lack of specifications. For instance, as wearables become more popular, it is crucial to recognize that they may be classified as medical devices according to the regulations in different regions, such as Europe, North America, and China. The European Medical Device Regulation 2017/745 (MDR) sets the criteria for the classification of smart wearables in the EU. It is worth noting that the definitions of medical devices differ between the EU's MDR and the US Food Drug and Cosmetic Act's Medical Device Amendments (US FD&C Act). In addition, the classification of software is particularly complex under the EU-MDR.

Opportunity: Growing opportunities in emerging economies

Australia, China, Japan, Singapore, India, Australia, New Zealand, Thailand, and South Korea are major AI in remote patient monitoring markets in Asia Pacific. Government initiatives for the implementation of AI in remote patient monitoring solutions, developing healthcare infrastructure, the rise in government spending on healthcare systems, growth in medical tourism, and increase in the number of skilled IT experts are major factors favoring the adoption of AI in RPM solutions in the emerging markets across the Asia Pacific region. For instance, in October 2022, Australian government invested USD 7.5 million to trial wearable health devices and on-the-spot blood analysis in remote Northern Territory communities. The funding aims to improve health monitoring, including tracking blood pressure, physical symptoms, and early detection of conditions like sepsis. In this regard, the International Finance Corporation (IFC), a part of the World Bank Group that invests in the private sector in emerging markets, launched TechEmerge, a program designed to accelerate technology deployment in emerging markets

Challenge: Scarcity of high-quality healthcare data and lack of accuracy

The adoption of AI in remote patient monitoring is hindered by a lack of high-quality data, resulting in reduced accuracy and potential risks. Challenges include data fragmentation, privacy concerns, costs, and expertise gaps. In November 2023, the WHO issued guidelines emphasizing safety, transparency, and regulatory measures for AI in healthcare, addressing risks and proposing solutions like data standardization, public-private partnerships, synthetic data, and AI-powered curation tools. Overcoming these barriers requires collaboration, robust legal frameworks, and further research into ethical and regulatory aspects to maximize AI's potential in remote patient monitoring

: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

AI-powered RPM platform integrating device data and predictive analytics for continuous patient monitoring. | Enables early detection of health risks, reduces hospital readmissions, and supports proactive care management. |

|

Cloud-based AI platform combining patient vitals, wearables, and EMR data for real-time clinical insights. | Improves clinical decision-making, enhances care coordination, and boosts operational efficiency. |

|

Intelligent RPM system connecting multi-site care networks with AI-driven patient triage and alert systems. | Standardizes patient monitoring processes and accelerates intervention for critical cases. |

|

AI-integrated monitoring solution using sensor and device data to track chronic conditions remotely. | Strengthens patient adherence, improves outcome predictability, and reduces manual data review workload. |

|

AI-enabled home monitoring ecosystem linking blood pressure, ECG, and activity data for continuous analysis. | Promotes preventive care, real-time patient engagement, and reduces emergency event frequency. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AI in remote patient monitoring market ecosystem consists of key players (Medtronic,GE HealthCare, OMRON Healthcare) providing integrated cloud-based AI in RPM platforms; other players (Blue Spark Technologies, Inc., Brook Inc., Biointellisense, Inc.) offering specialized niche solutions; cloud service providers (AWS, Microsoft Azure, IBM Cloud) delivering secure,; and end users (Mayo clinics, Apollo Hospital, Cleveland Clinic) implementing solutions for remote patient monitoring services.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI in Remote Patient Monitoring Market, By Component

In 2023, the devices segment held the largest share of the AI in remote patient monitoring market, as it forms the backbone of data collection and patient engagement. Wearables, biosensors, smart patches, and connected medical devices continuously capture vital health parameters such as heart rate, glucose levels, and oxygen saturation. The integration of AI within these devices enables real-time data analysis, early anomaly detection, and personalized alerts, significantly improving clinical decision-making. Rising consumer adoption of fitness trackers, increasing prevalence of chronic diseases, and growing investments in connected healthcare technologies further strengthen the dominance of the devices segment in the AI-driven RPM ecosystem.

AI in Remote Patient Monitoring Market, By Indication

In 2023, cardiology held the largest share of the AI in remote patient monitoring market by indication, driven by the high global burden of cardiovascular diseases and the growing need for continuous cardiac monitoring. AI-enabled RPM solutions are increasingly used to detect arrhythmias, monitor blood pressure, and predict cardiac events through data from ECG patches, wearable sensors, and smart devices. These systems help clinicians identify early warning signs, reduce hospital readmissions, and improve patient outcomes through timely interventions.

AI in Remote Patient Monitoring Market, By End User

In 2023, healthcare providers segment holds the largest share in the AI in Remote Patient Monitoring (RPM) market, as hospitals, clinics, and health systems are the primary adopters of AI-driven monitoring solutions. They leverage AI-powered RPM tools to enhance patient management, optimize resource utilization, and improve care coordination across acute and chronic conditions. By integrating real-time patient data with predictive analytics, providers can detect potential health risks earlier and deliver personalized interventions.

REGION

Asia Pacific to be fastest-growing region in global AI in remote patient monitoring market during forecast period

The Asia Pacific market is the fastest-growing region in the AI in remote patient monitoring (RPM) market, driven by rapid digital health adoption and expanding healthcare infrastructure. Rising prevalence of chronic diseases, increasing government initiatives for telehealth, and growing investments in AI-driven healthcare technologies are accelerating market growth. Countries such as China, India, Japan, and South Korea are witnessing significant uptake of wearable devices and remote monitoring platforms. Additionally, favorable policies, improving internet connectivity, and the presence of emerging health tech startups are further propelling the expansion of AI in RPM across the Asia Pacific region.

: COMPANY EVALUATION MATRIX

In the AI in remote patient monitoring market matrix, Medtronic (Star) leads with a dominant market position, driven by connected devices and cloud-based analytics for continuous patient monitoring across cardiology, diabetes. The company’s deep clinical expertise, global presence, and focus on predictive, value-based care strengthen its leadership in remote patient management. Masimo (Emerging Leader) is rapidly gaining traction through its advanced sensor technologies and AI-enabled monitoring solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 1.55 BN |

| Market Forecast in 2030 (value) | USD 8.44 BN |

| Growth Rate | CAGR of 27.5% from 2024-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Local Competitive Landscape | Profiles of key AI in RPM vendors (e.g., Medtronic, GE HealthCare, OMRON, ResMed) covering segmental presence, pharma client base, pricing tiers, regulatory compliance, and cloud/AI integration roadmap. | Enables competitive benchmarking, identifies functional and compliance gaps, and supports vendor selection, partnership evaluation, and market positioning strategies. |

| Regional Market Entry Strategy | In-depth assessment of regional compliance mandates (FDA, EMA, CDSCO, PMDA), digital health infrastructure readiness, telehealth adoption rates, healthcare provider clusters, and localization needs for data hosting | Reduces entry barriers for RPM providers, accelerates go-to-market strategy, strengthens regulatory alignment and localization for regional deployment, |

| Local Risk & Opportunity Assessment | Identification of evolving data privacy regulations (HIPAA, GDPR), cybersecurity requirements, AI/ML validation burdens, interoperability challenges, and growth opportunities in predictive analytics, wearable integration, personalized care, and hospital-at-home models | Supports proactive risk mitigation, regulatory compliance planning, and investment prioritization for next-generation AI-enabled RPM platforms that deliver early intervention, reduce hospitalizations |

| Technology Adoption by Region | Mapping of AI in RPM adoption maturity across North America, Europe, and Asia Pacific; analysis of cloud transition trends, integration with EHR/EMR/telehealth platforms, and drivers like chronic disease prevalence, and digital transformation initiatives | Guides regional product strategy, R&D focus, and investment in scalable, interoperable AI-powered RPM solutions aligned with value-based care models, home healthcare expansion |

RECENT DEVELOPMENTS

- August 2024 : Medtronic and Abbott partnered to strengthen Medtronic's Diabetes Care segment by integrating Abbott's advanced glucose monitoring technology to enhance Medtronic's product offerings and improve patient outcomes in diabetes management.

- July 2024 : Philips and Bon Secours Mercy Health formed a multi year partnership to enhance patient monitoring across 49 hospitals (BSMH) to improve care quality and reduce costs

- February 2024 : The collaboration between GE Healthcare and Biofourmis integrates Biofourmis’ AI powered, FDA cleared algorithms with GE HealthCare’s FlexAcuity monitoring and virtual care solutions such as Mural ICU and Command Center

Table of Contents

Methodology

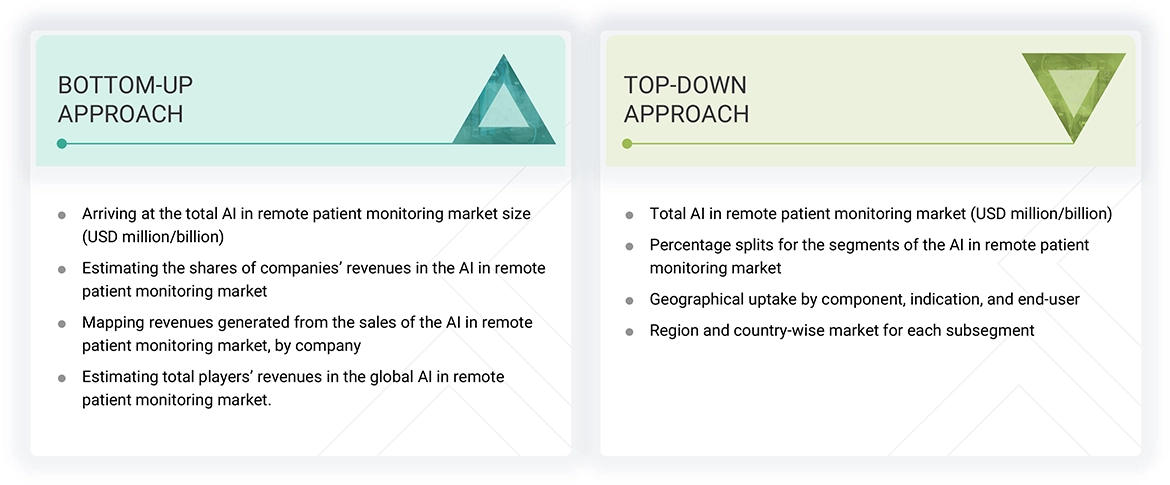

The study involved major activities in estimating the current market size for the AI in remote patient monitoring market. Exhaustive secondary research was done to collect information on the AI in remote patient monitoring industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the AI in remote patient monitoring market.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for the study of AI in remote patient monitoring market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

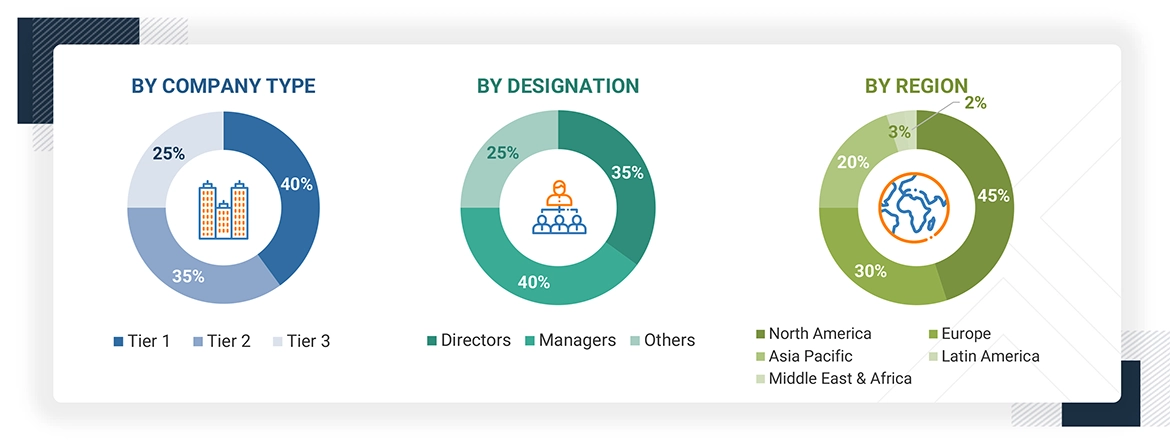

Extensive primary research was conducted after acquiring basic knowledge about the global AI in remote patient monitoring market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital directors, Hospital Vice Presidents, Department heads, and Critical care specialists ) and supply side (such as C-level and D-level executives, technology experts, product managers, marketing and sales managers, among others) across five major regions—North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews

Breakdown of Primary Participants

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers of companies are defined on the basis of their total revenues in 2023. Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the AI in remote patient monitoring market. These methods were also used extensively to estimate the size of various subsegments in the market.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the AI in remote patient monitoring market.

Market Definition

The AI in Remote Patient Monitoring (RPM) refers to the integration of artificial intelligence (AI) technologies into AI in remote patient monitoring systems to enhance the collection, analysis, and interpretation of patient health data. This combination allows for more proactive, personalized, and efficient healthcare delivery outside of traditional clinical settings.

Stakeholders

- RPM Equipment and devices Manufacturers

- Suppliers and Distributors of RPM Equipment

- RPM software provider

- Healthcare IT Service Providers

- Healthcare Insurance Companies/Payers

- Healthcare Institutions/Providers (Hospitals, Clinics, Medical Groups, Physician Practices, Diagnostic Centers, and Outpatient Clinics)

- Venture Capitalists

- Government Bodies/Regulatory Bodies

- Corporate Entities

- Accountable Care Organizations

- RPM Resource Centers

- Research and Consulting Firms

- Medical Research Institutes

- Clinical Departments

Report Objectives

- To define, describe, and forecast the global AI in remote patient monitoring market based on component, indication, end user, and region.

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall AI in remote patient monitoring market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To strategically analyze the market structure profile of the key players of the AI in remote patient monitoring market and comprehensively analyze their core competencies.

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- To track and analyze competitive developments such as product launches and enhancements and investments, partnerships, collaborations, acquisitions, expansions, funding, grant, agreements, sales contracts, product testing, FDA approval, product approval, and alliances in the AI in remote patient monitoring market during the forecast period.

Key Questions Addressed by the Report

-

Devices

- Wearable devices

- Implantable devices

- Handheld & portable devices

- Stationary devices

- Software

- Services

-

Healthcare Providers

- Hospitals

- Ambulatory surgery centers, ambulatory care centers, and other outpatient settings

- Long-term care & assisted living facilities

- Home healthcare

- Other healthcare providers (diagnostics & imaging centers)

- Healthcare payers

- Patients

- Pharmaceutical & biotechnology companies

- MedTech companies

- Other end users (employer groups, government organizations, academic institutes, research centers, and others)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI in Remote Patient Monitoring (RPM) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI in Remote Patient Monitoring (RPM) Market