Aluminum Extrusion Market

Aluminum Extrusion Market by Product (Solid Profiles, Semi-Hollow Profiles, and Hollow Profiles), Alloy Grade (6xxx, 1xxx, 5xxx, Other grades), Surface Finish, End-use Industry (Construction & Infrastructure, Automotive & Mass Transport, Electrical & Electronics, Machinery & Equipment, and Other End-use Industries), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The aluminum extrusion market is projected to reach USD 166.65 billion by 2030 from USD 118.81 billion in 2025, at a CAGR of 7.0% from 2025 to 2030. Aluminum extruded products are produced by pushing aluminum alloy material through a die that has a particular cross-sectional shape, resulting in hollow, semi-hollow, or solid sections. These products act as lightweight, strong, and corrosion-resistant parts extensively used in different sectors like construction (windows, doors, curtain walls, and frames), transportation (vehicle frames and body parts for fuel efficiency), electrical & electronics (heat sinks and busbars), aerospace, machinery, and consumer durables. The aluminum extrusion process allows the production of complex shapes like tubes, rods, profiles, and structural sections with satisfactory mechanical and thermal properties, addressing the requirements of performance and sustainability.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is expected to register the highest CAGR of 7.0% during the forecast period, driven by strong adoption in the construction & infrastructure, automotive & mass transport, and other end-use industries.

-

BY PRODUCTBy product, the solid profiles segment held the largest market share of 53.0% in 2024.

-

BY ALLOY GRADEBy alloy grade, the 1xxx alloy grade is expected to register the highest CAGR of 8.5% in terms of value during the forecast period.

-

BY SURFACE FINISHBy surface finish, the mill-finished segment is expected to dominate the market during the forecast period.

-

BY END-USE INDUSTRYBy end-use Industry, the construction & infrastructure industry is one of the largest consumer of aluminum extruded products.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSThe major market players have adopted both organic and inorganic strategies, including partnerships and investments. Kaiser Aluminum, Hindalco Industries Limited, and Alcoa Corporation entered into a number of agreements and partnerships to cater the growing demand for aluminum extruded products across innovative applications.

-

COMPETITIVE LANDSCAPE- STARUPUPS/SMESAronic and Albras have distinguished themselves among startups and SMEs due to their well developed marketing channels and extensive funding to build their product portfolios.

The aluminum extrusion market is projected to grow rapidly over the next decade due to demand for lightweight, corrosion-resistant extrusions in buildings and BIPV systems, supported by global infrastructure investments, especially in Asia Pacific's urbanizing economies like China and India. Stricter emissions regulations push vehicle lightweighting, with aluminum used in EV chassis , panels, and engines; North America's EV growth and US infrastructure plans amplify this.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions affect consumers' businesses. These shifts influence the revenues of end users. As a result, the revenue changes for end users are likely to impact the revenues of aluminum extruded product suppliers, which, in turn, affect the revenues of aluminum extruded product manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand from automotive sector

-

Cross industry adoption

Level

-

Capital intensity

-

High energy consumption

Level

-

Advanced manufacturing technologies

-

Unmet needs for premium alloys or services

Level

-

Raw material cost volatility

-

Energy consumption and sustainability

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand from automotive sector

The increasing demand for lightweighting to improve fuel efficiency, increase the range of electric vehicles, and satisfy strict global emission norms in automobiles propels the aluminum extrusion market. The electric vehicle industry demands large volumes of aluminum extrusions to offset the weight of batteries, increasing the vehicle's range by as much as 15%. The stricter EPA and global regulations require lower vehicle emissions, and as a result, automakers are forced to replace steel with extrusions in vehicle body panels, bumpers, and heat exchangers to achieve 10-20% weight reduction. The Asia Pacific and North American regions are at the forefront of the EV market, with major EV manufacturing bases in the US, China, and India, where complex profiles are in high demand for crash and thermal management applications.

Restraint: High energy consumption

High energy consumption is a significant restraining factor to the growth of the aluminum extrusion market. This increases production costs and raises sustainability challenges and scalability issues in regions with energy constraints. The extrusion process involves heating billets to 450-550°C, which requires 1,000-1,500 kWh of energy per ton, up to 14,000 kWh per tonne in conventional processes, mainly for reheating, pressing, and quenching, which comprises 70-80% of the total energy use. Energy-intensive processes increase operational costs by 20-30% in regions with high energy costs, such as Europe and North America. The high CO2 emissions contradict net-zero targets and discourage investment due to energy price volatility. In Asia Pacific, energy shortages and reliance on coal increase costs and lead times, limiting capacity expansions despite market demand from the automotive and construction industries, with only 5-10% improvements from new technologies such as induction heating.

Opportunity: Advanced manufacturing technologies

The advanced manufacturing and value-added services in the aluminum extrusion industry have undergone a paradigm shift with the integration of technology, improving accuracy, efficiency, and customization. Modern aluminum extrusion involves the use of advanced presses and multi-hole dies to manufacture complex high-precision profiles with close tolerances and superior surface finish. Emerging technologies such as additive manufacturing (3D printing) have complemented extrusion processes to manufacture complex dies and rapid prototyping of complex profiles, allowing functional features such as internal cooling channels or lattice structures to be incorporated during the manufacturing process. Automation, robotics, and AI-driven systems are increasingly being adopted to automate material handling, quality inspection, and process optimization, improving product yield, minimizing defects, and shortening lead times.

Challenge: Raw material cost volatility

Volatility in the cost of raw materials, especially aluminum billet prices, is a significant challenge to the growth of the aluminum extrusion market. This is due to the high energy requirements of the production process and the impact of tariffs. Variations in the price of London Metal Exchange (LME) aluminum between USD 1,800-2,400 per ton are driven by Chinese smelter capacity, uncertain energy prices (accounting for 40% of production costs), and geopolitical trade policies like US 50% import tariffs, which pushed the Midwest Premium up by 250%. Bauxite availability and smelting electricity prices (13-15 MWh per ton) contribute to price variations of USD 1,500-3,500 per metric ton. Raw materials account for 70-80% of operating costs in extrusion facilities, and any price increase will directly eat into gross margins (25-35%) and cause project delays. Suppliers are squeezed, and some manufacturers turn to scrap recycling. However, the recycled material is worth less due to contamination, which can reduce its value by 10-50%.

ALUMINUM EXTRUSION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Chassis, crash management systems, EV battery enclosures, and roof rails | Weight reduction (up to 40% vs. steel) increases fuel efficiency and EV range | High energy absorption for safety |

|

Window/door frames, curtain walls, facades, and solar panel mounting systems | Corrosion resistance in harsh weather and high recyclability for green building certifications (LEED) |

|

Floor beams, seat tracks, wing skins, and satellite structural components | Exceptional strength-to-weight ratio and performance under extreme thermal stress |

|

CPU/LED heat sinks, busbars, power transmission lines, and laptop casings | High thermal and electrical conductivity | Non-magnetic properties prevent interference |

|

Robotic frameworks, automation rails, and pneumatic cylinders | Design flexibility for complex near-net shapes reduces machining time and material waste |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The aluminum extrusion ecosystem involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, contractors, and end users. The first step of aluminum extrusion ecosystem is the extraction of key raw materials like bauxite, which is further processed. Bauxite is crushed, dried, and ground in special mills to produce Alumina. Afterwards, smelters use Alumina to produce primary aluminum through a reduction process. The alumina is further preheated, extruded into solid, semi-hollow, and hollow profiles, which is further used by end-use industries like construction & infrastructure, automotive & mass transport, electronics & electrical, and other end-use industries

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Aluminum Extrusion Market, By Product

Solid profiles dominated the overall aluminum extrusion market owing to their ease of manufacturing and structural stability. Solid profiles include shapes like rods, bars, flat bars, angles (L-profiles), channels (U or C shapes), and beams, offering high material density for strength without internal openings. They are extruded using straightforward solid dies, making production faster and more cost-effective than complex profiles like semi-hollow and hollow profiles.

Aluminum Extrusion Market, By Alloy Grade

6xxx series aluminum alloys dominate the aluminum extrusion market due to their optimal combination of extrudability, medium-to-high strength, corrosion resistance, and heat-treatable properties. These alloys, primarily alloyed with magnesium (Mg) and silicon (Si) to form magnesium silicide, enable complex shapes and thin-walled profiles essential for extrusions.

Aluminum Extrusion Market, By Surface Finish

The mill-finished segment is expected to dominate the market and register the highest CAGR during the forecast period. Lower production costs from skipping finishing processes make mill-finished extrusions attractive for high-volume manufacturing, especially amid rising raw material prices and inflation pressures. This segment benefits from shorter lead times, enabling quick supply to industrial users who apply custom finishes later.

Aluminum Extrusion Market, By End-use Industry

The construction industry is one of the major end users of aluminum extruded products. Aluminum is considered one of the most viable building materials due to the wide range of benefits it offers, such as light strength-to-weight ratio, sustainability, recyclability, and versatility. Aluminum is widely used in construction as it helps building projects qualify for green building status under the Leadership in Energy and Environmental Design (LEED) standards.

REGION

Asia Pacific to be fastest-growing region in the aluminum extrusion market during forecast period

The Asia Pacific aluminum extrusion market is expected to register the highest CAGR during the forecast period, driven by rapid urbanization, industrialization, and substantial investments in construction & infrastructure, automotive & mass transport, and electrical & electronics. Major manufacturers in countries such as China, Japan, India, and South Korea are increasingly adopting aluminum extruded products for applications such as components, thanks to their excellent conductivity and strength. The rising consumer demand and ongoing R&D initiatives in the region are fostering innovation and expanding graphene applications across industries.

ALUMINUM EXTRUSION MARKET: COMPANY EVALUATION MATRIX

In the aluminum extrusion market matrix, Hindalco Industries Limited (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across industries like construction & infrastructure and automotive & mass transport. Norsk Hydro ASA (Emerging Leader) is gaining traction with sustainable aluminum extrusion applications. While Kaiser Aluminum dominates with scale, Norsk Hydro ASA shows strong growth potential to advance toward the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Jindal Aluminum Limited (India)

- Hindalco Industries Ltd. (India)

- Alcoa Corporation (US)

- Aluminum Corporation of China Limited (China)

- RuSAL (Russia)

- Century Aluminum Company (US)

- Norsk Hydro ASA (Norway)

- Constellium (France)

- Kaiser Aluminum (US)

- Hammerer Aluminum Industries (Austria)

- Banco Aluminium Private Limited (India)

- Maan Aluminium Limited (India)

- Shenzhen Oriental Turdo Ironwares Co., Ltd. (China)

- ETEM (Greece)

- Alom Group (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 111.88 Billion |

| Market Forecast in 2030 (Value) | USD 166.65 Billion |

| Growth Rate | CAGR of 7.0% from 2025 to 2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: ALUMINUM EXTRUSION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Aluminum Extruded Products Manufacturer |

|

|

| Aluminum Extrusion Profile Manufacturer |

|

|

| Car Parts Manufacturer |

|

|

| US-based Aluminum Raw Material Supplier |

|

|

| Automotive Aluminum Extrusion Customer |

|

|

RECENT DEVELOPMENTS

- September 2025 : Constellium announced the extension of its long-term partnership with Embraer to supply high-performance aluminum solutions, including its advanced aluminum lithium alloy Airware, supporting Embraer’s commercial aviation, executive jets, and defense and security programs.

- April 2023 : ETEM SA completed a merger by absorption with Cosmos Aluminium SA, creating a significantly larger entity in the aluminium extrusion market that strengthened the combined production footprint and capability.

- September 2022 : Alcoa introduced two significant advancements in alloys. A210 ExtruStrong provides more than 40% greater strength while enabling thinner, lighter extrusions for automotive and construction applications. C611 EZCast received an international accolade for facilitating large, one-piece automotive mega-castings.

- August 2021 : ETEM Bulgaria spun off its extruded aluminium profiles production and processing business into joint venture subsidiaries with Gestamp, including a major investment plan for new extrusion line capacity.

Table of Contents

Methodology

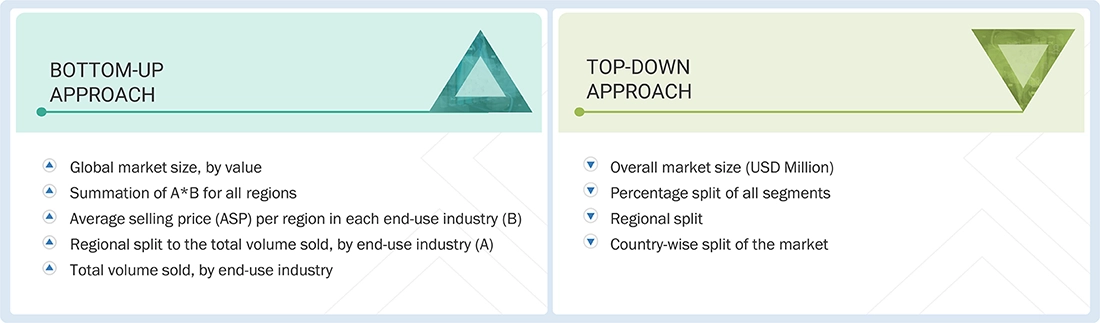

The study involves two major activities in estimating the current market size for the aluminum extrusion market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering aluminum extrusion services and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry's value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. Secondary data was collected and analyzed to arrive at the overall size of the aluminum extrusion market, which was validated by primary respondents.

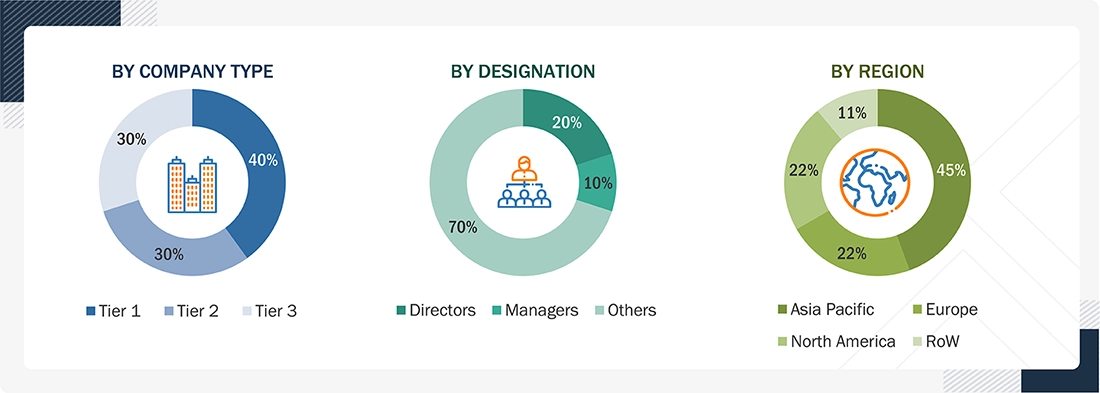

Primary Research

Extensive primary research was conducted after obtaining information regarding the aluminum extrusion market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from aluminum extrusion industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to materials, source, technology, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using aluminum extrusion technologies, were interviewed to understand the buyer's perspective on the suppliers, products, component providers, and their current usage of recycled materials and future outlook of their business, which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the aluminum extrusion market includes the following details. The sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in aluminum extrusion in different industries at a regional level. Such procurements provide information on the demand aspects of aluminum extrusion and aluminum extrusion-based materials for each application. For each material, all possible segments of the aluminum extrusion market were integrated and mapped.

Aluminium Extrusion Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Aluminum extruded products are manufactured by forcing aluminum alloy material through a die that creates a specific cross-sectional profile, producing hollow, semi-hollow, or solid shapes. These products serve as lightweight, durable, and corrosion-resistant components widely used across various industries, including building and construction (windows, doors, curtain walls, framing), automotive and transport (vehicle frames, body parts for fuel efficiency), electrical and electronics (heat sinks, busbars), aerospace, machinery, and consumer durables. The aluminum extrusion process enables the creation of complex shapes such as tubes, rods, profiles, and structural components with good mechanical and thermal properties, meeting demands for performance and sustainability.

Key Stakeholders

- Aluminum Extrusion Companies

- Government and Research Organizations

- National and Local Government Organizations

- Institutional Investors

- Aluminum Suppliers

- End Users

Report Objectives

- To define, describe, and forecast the aluminum extrusion market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the aluminum extrusion market by product, alloy grade, surface finish, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw

- the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Available customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the aluminum extrusion market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Aluminum Extrusion Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Aluminum Extrusion Market