Aluminum Fluoride (AlF3) Market

Aluminum Fluoride (AlF3) Market by Product Type (Anhydrous, Dry, Wet), Bulk Density (Low, High), Form (Powder, Granules), Grade (Smelter, Catalyst, Technical, High-purity), Application (Electrolyte Additive, Flux Agent, Catalyst/Catalyst Support, Optical Coating Material), End-use Industry (Aluminum, Electronics & Optics, Ceramics & Glass, Automotive) - Global Forecast to 2030

ALUMINUM FLUORIDE MARKET OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The aluminum fluoride (AlF3) market was valued at USD 2.34 billion in 2025 and is projected to reach USD 3.12 billion by 2030, growing at 5.9% cagr from 2025 to 2030. Aluminum fluoride is an inorganic compound primarily used as a flux in aluminum smelting and as a component in specialty chemicals and ceramics. Its market growth is driven by increasing aluminum production, rising demand from the automotive, aerospace, and construction industries, and expanding applications in chemicals and ceramics. Additionally, supportive government policies in key aluminum-producing countries that improve smelting efficiency and reduce energy consumption are boosting aluminum fluoride production and revenues.

KEY TAKEAWAYS

-

BY PRODUCT TYPEThe aluminum fluoride market comprises anhydrous, dry, and wet forms. Anhydrous aluminum fluoride holds the largest share and is primarily used in aluminum smelting for fluxing, while dry and wet forms are applied in specialty chemical and industrial processes.

-

BY BULK DENSITYHigh-bulk-density aluminum fluoride dominates the market due to its superior flowability and efficiency in smelting operations, whereas low-bulk-density variants find limited applications in niche chemical processes.

-

BY FORMPowdered aluminum fluoride represents the largest segment, favored for its ease of handling, precise dosing, and rapid dissolution in electrolytes during smelting. Granules and pellets are used in applications where controlled release or handling characteristics are required, such as in specialized chemical reactions or industrial processes. The form of aluminum fluoride directly affects operational efficiency, storage, and transportation logistics.

-

BY GRADESmelter-grade aluminum fluoride accounts for the largest market share, driven by the global demand for aluminum production and the critical role of aluminum fluoride in enhancing smelting efficiency. Catalyst-grade aluminum fluoride is utilized in chemical processes to promote reactions, while technical and laboratory grades are employed in research, development, and small-scale industrial applications. High-purity grades are required in electronics, optical coatings, and specialized chemical industries, where extremely low impurities are critical for performance.

-

BY APPLICATIONElectrolyte additives are the largest application segment, as aluminum fluoride is essential in the electrolytic smelting of aluminum, reducing energy consumption and increasing process efficiency. Other significant applications include its use as a flux agent in ceramics and glass, as a catalyst or catalyst support in chemical processes, as a functional additive for material modification, as an optical coating material, and as a fluoro intermediate in specialty chemical production. The versatility of aluminum fluoride across these applications underpins its growing market demand.

-

BY END-USE INDUSTRYThe aluminum industry leads in consumption due to the necessity of aluminum fluoride in smelting processes. The automotive and aerospace industries follow, leveraging aluminum for lightweight and high-strength components, indirectly boosting demand for aluminum fluoride. The construction sector, ceramics & glass industry, chemical & petrochemical sector, and electronics & optics industries also contribute to demand, driven by requirements for enhanced material performance, energy efficiency, and innovative applications.

-

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies, including partnerships and investments. For instance, Fluorsid renewed its strategic partnership with Norsk Hydro ASA, one of the world’s leading aluminum producers. Under the agreement, Fluorsid’s Odda plant will allocate approximately 50% of its aluminum fluoride production to supply Hydro’s five aluminum smelters over the next five years. This includes the Sunndal facility, the largest primary aluminum plant in Europe.

The aluminum fluoride market is expected to expand significantly over the next decade, supported by innovations in raw material sourcing and sustainable production processes. Aluminum fluoride is essential in reducing energy consumption and improving efficiency in aluminum electrolysis, making it a critical material for modern smelters. Growing investments in aluminum production and the modernization of smelting facilities are increasing the demand for high-quality aluminum fluoride. Additionally, the adoption of alternative production methods, such as fluorosilicic acid (FSA)-based processes, and the emphasis on minimizing environmental impact are creating opportunities for producers to offer more efficient and eco-friendly solutions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business arises from customer trends or disruptions in the aluminum industry. Aluminum smelters are the primary clients of aluminum fluoride manufacturers, while downstream industries such as automotive, construction, and packaging represent the end-user applications of aluminum. Shifts in these sectors, including changes in aluminum demand, technological upgrades, or regulatory requirements, can influence the operational costs and procurement strategies of end users. Any variation in the revenue or production volumes of aluminum consumers will, in turn, impact the purchasing requirements of smelters, which subsequently affects the revenues of aluminum fluoride manufacturers. This interconnected relationship demonstrates how trends, disruptions, or changes in demand across the aluminum value chain can directly affect market conditions and the financial performance of aluminum fluoride producers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

ALUMINUM FLUORIDE MARKET DYNAMICS

Level

-

Surging aluminum production to elevate aluminum fluoride requirements in electrolytic processes

-

Improved smelter utilization ensures steady demand

Level

-

Declining fluorite and aluminum hydroxide prices exert margin pressure on producers

Level

-

Shift toward fluorosilicic acid (FSA)-based aluminum fluoride production

-

Growing adoption of vertical integration by aluminum producers to supply aluminum fluoride and stabilize costs

Level

-

Regulatory pressure on hydrofluoric acid use

-

Just-in-time procurement by aluminum smelters limits demand recovery

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surging aluminum production to elevate aluminum fluoride requirements in electrolytic processes

The expansion of global aluminum production is significantly increasing the demand for aluminum fluoride, an essential component in the electrolytic production of aluminum. Aluminum fluoride functions to lower the melting point of alumina and enhance the conductivity of the electrolyte, ensuring efficient and stable electrolytic operations. As the scale of aluminum production rises to meet growing requirements from sectors such as construction and automotive, the quantity of aluminum fluoride required in smelting processes increases proportionally. Furthermore, advancements in aluminum production technologies aimed at improving energy efficiency and reducing carbon emissions necessitate precise control of electrolyte composition, which further elevates the consumption of high-purity aluminum fluoride. The establishment of new smelting facilities and the expansion of existing capacities in regions including Asia, the Middle East, and Latin America contribute additional growth to regional demand. These factors position aluminum fluoride as a critical input to produce aluminum, making it indispensable for sustaining large-scale, efficient, and technologically advanced smelting operations, thereby driving steady growth in the global aluminum fluoride market.

Restraint: Declining fluorite and aluminum hydroxide prices exert margin pressure on producers

The decline in prices of fluorite and aluminum hydroxide is placing considerable margin pressure on aluminum fluoride producers, which can act as a restraint on the growth of the aluminum fluoride market. Aluminum fluoride production relies heavily on fluorite and aluminum hydroxide as primary raw materials, and price fluctuations directly impact production costs and profitability. Sustained reductions in raw material prices may constrain the financial capacity of manufacturers to invest in production expansion, technological improvements, and process optimization, limiting overall market growth. Furthermore, price volatility in key inputs can introduce uncertainty in long-term supply agreements and strategic planning, discouraging large-scale procurement by downstream aluminum producers. In certain instances, cost pressures may compel producers to compromise on quality standards, potentially affecting the performance of aluminum fluoride in electrolytic processes and reducing its market appeal. As a result, despite increasing global demand for aluminum, the financial and operational pressures from declining fluorite and aluminum hydroxide prices are a significant limiting factor, moderating production expansion and restricting growth in the global aluminum fluoride market.

Opportunity: Shift toward fluorosilicic acid (FSA)-based aluminum fluoride production

The increasing adoption of fluorosilicic acid (FSA)-based processes for aluminum fluoride production presents significant opportunities for the aluminum fluoride market. FSA-based production offers several technical and economic advantages over traditional methods, including lower energy consumption, reduced dependency on high-purity fluorite, and the ability to utilize by-products from the phosphate industry, thereby enhancing sustainability. The flexibility of FSA-based production allows manufacturers to optimize process efficiency and control product quality, meeting the growing demand for high-purity aluminum fluoride in advanced aluminum smelting operations. Additionally, the use of FSA provides cost advantages in regions where fluorosilicic acid is readily available as a by-product of phosphoric acid production, enabling localized production and reducing reliance on imported raw materials. The environmental benefits associated with FSA-based processes, such as reduced waste generation and improved resource utilization, align with global trends toward sustainable industrial practices. Consequently, the shift toward FSA-based aluminum fluoride production not only supports more efficient and environmentally responsible operations but also opens avenues for market expansion, technological innovation, and increased adoption of aluminum fluoride across diverse smelting regions.

Challenge: Regulatory pressure on hydrofluoric acid use

Regulatory pressure on hydrofluoric acid (HF) presents a significant challenge for the aluminum fluoride market, as HF is a critical raw material in its production. Stricter environmental and safety regulations in key producing regions aim to limit HF emissions and manage its handling due to its highly corrosive and toxic nature. Compliance with these regulations often requires substantial investments in safety infrastructure, emission control systems, and process modifications, increasing production costs for aluminum fluoride manufacturers. In some cases, stringent restrictions may limit production capacity or delay plant expansions, constraining market supply. Furthermore, regulatory restrictions can lead to uncertainties in the supply of raw materials, as hydrofluoric acid suppliers may be subject to production limits or transportation restrictions, which can adversely impact aluminum fluoride manufacturers. These factors may also slow the adoption of aluminum fluoride in emerging markets where regulatory frameworks are evolving. Consequently, the imposition of tighter controls on hydrofluoric acid use increases operational complexity, raises production costs, and may restrict supply growth, posing a considerable challenge to the expansion and stability of the global aluminum fluoride market.

Aluminum Fluoride (AlF3): COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Aluminum fluoride is used in primary aluminum electrolysis to improve cell stability, enhance metal purity, and optimize production efficiency. | Enhanced electrolyte conductivity, lower energy consumption, improved aluminum yield |

|

Application of aluminum fluoride in advanced smelting cells enables controlled alumina dissolution, consistent electrolysis, and reduced energy consumption. | Reduced alumina melting point, stabilized electrolysis, extended cell life |

|

Aluminum fluoride is used in global primary aluminum smelters to optimize electrolysis, improve energy efficiency, and consistently produce high-quality aluminum. | Enhanced electrolysis efficiency, lower energy consumption, improved aluminum yield and quality |

|

Specialty electrical-grade aluminum incorporates aluminum fluoride to enhance conductivity, reduce defects, and maintain consistent material properties for electrical applications. | Improved conductivity, reduced defects, stable quality for electrical components |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

ALUMINUM FLUORIDE MARKET ECOSYSTEM

The aluminum fluoride ecosystem involves identifying and analyzing interconnected relationships among stakeholders, including raw material suppliers, manufacturers, distributors, and end users. The raw material suppliers provide critical inputs such as hydrofluoric acid, fluorite, and aluminum hydroxide to aluminum fluoride manufacturers. The manufacturers utilize processes such as the hydrofluoric acid route and fluorosilicic acid (FSA)-based production to produce high-purity aluminum fluoride for electrolytic aluminum production. The distributors and suppliers serve as intermediaries between manufacturers and end users, ensuring the efficient flow of aluminum fluoride to aluminum smelters and other downstream industries. By consolidating the supply chain, these stakeholders enhance operational efficiency, reduce logistical complexities, and support profitability, while enabling consistent and timely delivery of aluminum fluoride to meet the growing demand in global aluminum production.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

ALUMINUM FLUORIDE MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Aluminum Fluoride (ALF3) Market, By Product Type

Anhydrous aluminum fluoride holds the largest share in the aluminum fluoride market due to its essential role in large-scale aluminum smelting. Its high thermal stability and low moisture content make it ideal for electrolytic reduction cells, ensuring consistent electrolyte composition, high current efficiency, and reduced energy losses. Compared to wet aluminum fluoride, the anhydrous type is more effective in maintaining optimal cryolite ratios and stable molten bath chemistry. It is also easier to handle, store, and transport, supporting long-distance supply chains. With modern smelters optimized for anhydrous grades, its dominance is reinforced and expected to continue alongside global aluminum capacity expansion.

Aluminum Fluoride (ALF3) Market, By Bulk Density

High bulk density aluminum fluoride accounts for the largest share in the market due to its operational and logistical advantages in aluminum production. Materials with higher bulk density occupy less volume per unit weight, allowing for more efficient storage and transportation, which is particularly important for large-scale smelters and long-distance supply chains. In electrolytic aluminum production, high bulk density aluminum fluoride improves handling in dosing systems, ensures uniform distribution in the electrolyte, and supports stable molten bath chemistry, contributing to higher current efficiency and consistent metal quality. Furthermore, it reduces shipping and storage costs compared to low-density grades, making it economically attractive for smelters. These combined technical and cost benefits make high bulk density aluminum fluoride the preferred choice for modern aluminum smelting operations, sustaining its dominant market share.

Aluminum Fluoride (ALF3) Market, By Form

Powdered aluminum fluoride dominates the market due to its versatility in aluminum smelting and other industrial applications. Its fine particle size provides a higher surface area, enhancing reactivity and enabling faster dissolution in the molten bath, which ensures uniform electrolyte composition and stable cell performance. Powdered aluminum fluoride also allows precise dosing and easier blending with other additives, supporting efficient process control. Logistically, it can be packaged in bags or bulk containers, integrates seamlessly with automated feeding systems, and reduces manual handling and material loss. The production process is well-established and scalable, ensuring a reliable global supply. Additionally, its adaptability extends to ceramics, glass, and chemical manufacturing, making powdered aluminum fluoride the most widely used and preferred form in the market.

Aluminum Fluoride (ALF3) Market, By Grade

Smelter-grade aluminum fluoride holds the largest share in the market because it directly serves aluminum smelters, the primary consumers of aluminum fluoride. This grade is specifically designed for large-scale electrolytic cells, ensuring optimal cryolite ratio, stable bath conditions, and enhanced current efficiency during continuous aluminum production. Produced in bulk and optimized for cost-effectiveness, smelter-grade aluminum fluoride is preferred for high-volume operations requiring consistent quality at competitive pricing. Its standardization ensures compatibility with feeding systems across different smelter designs, reducing the need for customization. The global expansion of aluminum smelting capacity and the requirement for reliable, large-scale supply chains further reinforce the dominance of smelter-grade aluminum fluoride, making it indispensable for day-to-day aluminum production.

Aluminum Fluoride (ALF3) Market, By Application

Electrolyte additive is the largest application of aluminum fluoride because it is directly linked to the scale and continuity of aluminum smelting operations. Unlike secondary uses, aluminum fluoride as an electrolyte additive is consumed continuously due to losses from evaporation and chemical reactions in reduction cells, creating consistently high demand. Maintaining the correct aluminum fluoride -to-alumina ratio in the cryolite bath is essential for stable pot performance and aluminum quality, preventing smelters from reducing usage without affecting output. As global aluminum production grows, aluminum fluoride consumption increases proportionally, reinforcing its recurring requirement. Additionally, most production capacity is designed to supply smelters with this form, and with no effective substitutes, the electrolyte additive application remains the primary driver of market demand.

Aluminum Fluoride (ALF3) Market, By End-Use Industry

The aluminum industry is the largest end-use segment in the aluminum fluoride market due to its high consumption volume and dependence on the material for smelting operations. Unlike ceramics, glass, or specialty chemicals, where aluminum fluoride is used in limited applications, aluminum smelters require it as a critical operational input across all facilities. Most aluminum fluoride production is aligned with aluminum demand to ensure a consistent, large-volume supply. The industry’s dominance is reinforced by major smelting clusters in China, the Middle East, and Russia, and long-term procurement contracts create stable, predictable demand. As global aluminum production grows to serve construction, automotive, and aerospace sectors, aluminum fluoride consumption increases proportionally, securing the aluminum industry’s position as the primary end-use segment.

REGION

Asia Pacific to be the largest and fastest-growing region in the global aluminum fluoride market during the forecast period

The Asia Pacific region is the largest and fastest-growing market for aluminum fluoride due to its dominant position in global aluminum production and ongoing industrial expansion. Countries such as China, India, Japan, and South Korea host extensive aluminum smelting capacities, accounting for a substantial share of global output. Rising demand from key downstream sectors, including automotive, construction, and electrical industries, drives the need for continuous and large-scale aluminum fluoride consumption. China is home to some of the world’s largest smelters, which require high-purity aluminum fluoride to maintain stable electrolytic processes, optimize current efficiency, and improve metal quality. Additionally, governments in the region are investing in modernizing smelting facilities with energy-efficient and environmentally compliant technologies, further increasing the demand for high-quality aluminum fluoride. Well-established raw material supply chains, including fluorite and hydrofluoric acid, support local production and reduce dependence on imports, enhancing market stability. Rapid industrialization, urbanization, and growth in aluminum-intensive sectors, combined with large-scale smelting infrastructure and strong government support, collectively make Asia Pacific the largest and fastest-growing global market for aluminum fluoride.

Aluminum Fluoride (AlF3): COMPANY EVALUATION MATRIX

The aluminum fluoride market is characterized by a mix of emerging leaders, participants, pervasive players, and dominant stars. The chart highlights Fluorsid as a strong market leader in terms of both market share and product footprint, occupying the "Stars" quadrant. Alufluoride Limited falls within the "Emerging Leaders" quadrant. Several smaller players cluster in the "Participants" and "Pervasive Players" zones, reflecting niche positioning or early-stage growth potential. Overall, market dynamics suggest strong competition, with global giants driving innovation while smaller companies strive for differentiation and market penetration.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

ALUMINUM FLUORIDE MARKET PLAYERS

- Fluorsid (Italy)

- Industries Chimiques du Fluor (Tunisia)

- Do-Fluoride New Materials Co., Ltd. (China)

- Alufluor (Sweden)

- Alufluoride Limited (India)

- Orbia Fluor & Energy Materials (US)

- Gulf Fluor (UAE)

- Hunan Nonferrous Fluoride Chemical Group Co., Ltd. (China)

- AB LIFOSA (Lithuania)

- PhosAgro Group (Russia)

- DERIVADOS DEL FLUOR (Spain)

- Tanfac Industries Ltd. (India)

- Navin Fluorine International limited (India)

- HENAN JINHE INDUSTRY CO.,LTD (China)

- Henan Weilai Aluminum (Group) Co., Ltd (China)

ALUMINUM FLUORIDE MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.2 Billion |

| Market Forecast in 2030 (value) | USD 3.1 Billion |

| Growth Rate | 5.9% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, North America, Europe, Middle East & Africa, South America |

WHAT IS IN IT FOR YOU: Aluminum Fluoride (AlF3) REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Country-Level Breakdown | Instead of just regional coverage, the report can provide country-specific market data (e.g., India, Brazil, Saudi Arabia, South Africa, Mexico). This includes demand drivers, production capacities, import/export trends, and regulatory outlooks. | Helps companies identify high-growth national markets and plan market entry strategies with greater accuracy |

| Bulk Density-Specific Deep Dive | A customized focus on specific aluminum fluoride density, such as low-bulk density and high-bulk density. Includes end-user adoption rates, OEM partnerships, and future demand projections for each bulk density. | Supports clients targeting niche segments, enabling them to design product portfolios or allocate R&D spending more effectively |

| Form Customization | Comparative analysis of powdered and granule forms. Covers performance benchmarks, technical advantages, pricing, and suitability for different industries. | Enables manufacturers and buyers to optimize purity selection, align pricing with performance |

| Competitive Benchmarking | Extended profiling of regional and niche players alongside global leaders (Fluorsid and Industries Chimiques du Fluor). Includes SWOT analysis, product differentiation, technology focus, and market positioning. | Provides a clear competitive landscape, helping clients identify potential partners, acquisition targets, or competitive threats |

RECENT DEVELOPMENTS

- June 2025 : Orbia Fluor & Energy Materials announced a corporate rebranding to unify its identity under the Orbia Fluor & Energy Materials (Orbia F&EM) brand. Effective immediately, this brand will serve as the sole identity for the business, both internally and externally, replacing the previous Koura brand.

- April 2024 : Fluorsid renewed its strategic partnership with Norsk Hydro ASA, one of the world’s leading aluminum producers. Under the agreement, Fluorsid’s Odda plant will allocate approximately 50% of its aluminum fluoride production to supply Hydro’s five aluminum smelters over the next five years. This includes the Sunndal facility, the largest primary aluminum plant in Europe.

- April 2024 : RUSAL and PhosAgro strengthened their long-term collaboration by extending the supply agreement for aluminum fluoride until 2044. As part of this partnership, PhosAgro’s facility will increase production capacity from 75,000 tons to 96,000 tons annually, with additional supplies expected from mid-2026.

- November 2024 : PhosAgro undertook a significant expansion initiative as part of its strategic development plan toward 2025, with a record investment of USD 0.8 billion. This expansion focuses on increasing aluminum fluoride production capacity across key facilities, including the Cherepovets and Volkhov plants.

- May 2021 : Alufluoride Limited commenced commercial production at its newly expanded aluminum fluoride plant in Visakhapatnam, increasing its production capacity to 12,000 TPA. This expansion marked a key milestone in the company’s growth, enabling it to meet the growing demand for aluminum fluoride from both domestic and international customers.

Table of Contents

Methodology

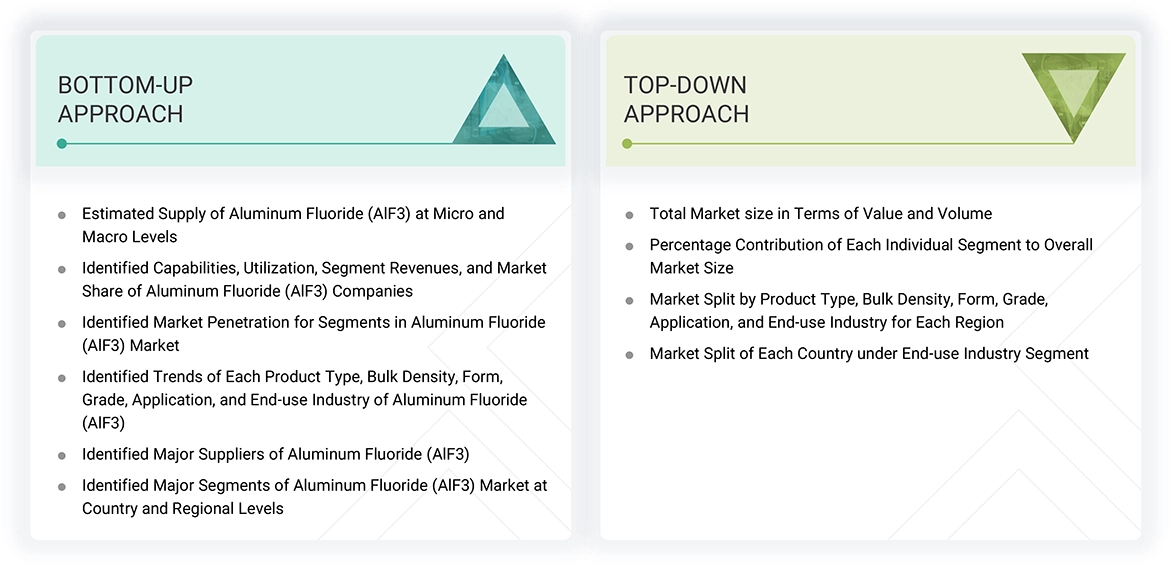

The study involved four main activities to estimate the aluminum fluoride (AlF3) market size. Extensive secondary research was conducted to gather information on the market, related markets, and the parent market. The next step was to validate these findings, assumptions, and size estimates with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to determine the total market size. Later, market breakdown and data triangulation methods were employed to estimate the sizes of segments and subsegments.

Secondary Research

Various sources were consulted during the secondary research process to gather information for this study. These sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, reputable websites, and databases. Secondary research was used to obtain key details about the industry’s value chain, monetary chain, market classification, and segmentation based on industry trends down to the most specific level, and regional markets. It also helped gather information about major developments from a market-oriented perspective.

Primary Research

The aluminum fluoride (AlF3) market includes several stakeholders in the supply chain, such as raw material suppliers, manufacturers, and end users. Various key sources from both the supply and demand sides of the aluminum fluoride (AlF3) market have been interviewed to gather qualitative and quantitative data. On the demand side, primary interviewees include influential leaders in end-use industries. On the supply side, primary sources consist of manufacturers, associations, and institutions involved in the AlF3 industry.

Primary interviews were conducted to gather insights such as market statistics, revenue data from products and services, market breakdowns, market size estimates, market forecasts, and data triangulation. Primary research also helped understand various product types, forms, grades, bulk densities, applications, end-use industries, and regional trends. Stakeholders from the demand side, including CIOs, CTOs, and CSOs, were interviewed to understand the buyers’ perspectives on suppliers, products, component providers, and their current use of AlF3, as well as the future outlook of their business, which will influence the overall market.

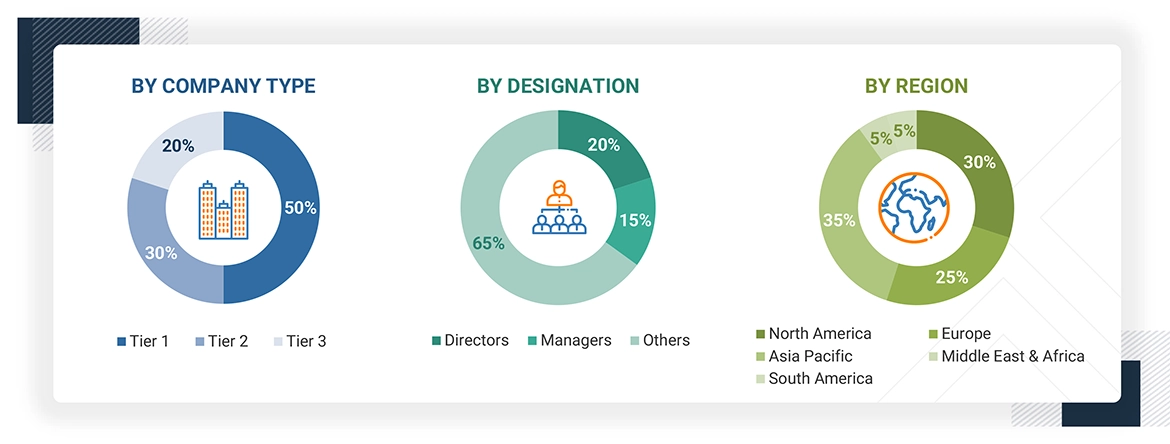

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024, available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets of the AlF3 market for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain has been mapped out using both primary and secondary research.

- The global market was then divided into five major regions, which industry experts confirmed.

- All percentage shares, splits, and breakdowns based on product type, bulk density, form, grade, application, end-use industry, and regions were determined from secondary sources and verified through primary sources.

- All possible parameters influencing the markets discussed in this research were thoroughly examined, verified through primary research, and analyzed to produce the final quantitative and qualitative data. This data was then consolidated, supplemented with detailed inputs and analysis, and presented in this report.

Data Triangulation

After estimating the total market size for Aluminum Fluoride (AlF3), the overall market has been divided into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the market analysis and determine accurate statistics for all segments. The data was triangulated by examining various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches, along with primary interviews. Therefore, three sources were utilized for each data segment: top-down approach, bottom-up approach, and expert interviews. The data was considered accurate when the values from the three sources matched.

Market Definition

Aluminum Fluoride (AlF3) is a crucial chemical compound widely used in aluminum production to boost the smelting process’s efficiency by lowering alumina’s melting point, reducing energy use, and increasing overall output. Its main use is aluminum smelting, which helps increase production while maintaining operational efficiency. Beyond aluminum, AlF3 is also used in chemical manufacturing, ceramics, and glass-making, showing its versatility across different industries. The demand for aluminum fluoride closely follows the growth of aluminum production and expanding industrial activities that need lightweight, durable metals. Factors like the availability of raw materials, advancements in production technology, and the focus on high-purity, environmentally friendly manufacturing all support the market’s steady growth. As industrialization rises, infrastructure projects grow, and energy-efficient production methods become more common, the importance and long-term prospects of the aluminum fluoride (AlF3) market worldwide continue to strengthen.

Stakeholders

- AlF3 manufacturers

- AlF3 traders, distributors, and suppliers

- Raw material suppliers

- Government and private research organizations

- Associations and industrial bodies

- R&D institutions

- Environmental support agencies

Report Objectives

- To define, describe, and forecast the size of the aluminum fluoride (AlF3) market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on product type, bulk density, form, grade, application, end-use industry, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, the Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments, such as partnerships and expansions, in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Which factors influence the growth of the aluminum fluoride (AlF3) market?

Growth is driven by increasing aluminum production, smelting capacity expansions, and rising demand for lightweight materials in industries such as automotive, electronics, and optics. The Hall-Héroult process depends heavily on AlF3, directly linking its demand to global aluminum output. The availability of low-cost energy in emerging markets is further encouraging new smelter projects, fueling AlF3 consumption.

Which region is expected to have the largest market share in the aluminum fluoride (AlF3) market?

Asia Pacific is expected to dominate due to strong aluminum smelting capacity in China, India, and Southeast Asia, along with favorable industrial policies, energy resources, and robust AlF3 production infrastructure.

Who are the major manufacturers?

Key manufacturers include Fluorsid, Industries Chimiques du Fluor, Do-Fluoride New Materials, Alufluor, Alufluoride Limited, Orbia Fluor & Energy Materials, Gulf Fluor, Hunan Nonferrous Fluoride Chemical Group, AB LIFOSA, and PhosAgro Group.

What are the opportunities in the aluminum fluoride (AlF3) market?

Opportunities include the development of alternative production methods to reduce hydrofluoric acid use, expansion into new smelting regions like Africa and Central Asia, and forming long-term supply contracts. Growth is also expected in specialty and high-performance formulations.

Which end-use industry holds the largest aluminum fluoride (AlF3) market share?

The aluminum industry remains the primary end-use sector, accounting for the majority of AlF3 consumption due to its role in electrolytic aluminum production.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Aluminum Fluoride (AlF3) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Aluminum Fluoride (AlF3) Market