Aluminum Metal Powder Market

Aluminum Metal Powder Market by Type (Powder, Flakes), Process (Atomization, Comminution, Electrolysis), Purity (92%-98%, 98%-99%, >99%), End-Use Industry (Paints & Coatings, Construction & Infrastructure, Industrial, Electronics, Automotive, Aerospace & Defense) and Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The aluminum metal powder market is projected to reach USD 2.64 billion by 2030 from USD 2.17 billion in 2025, at a CAGR of 4.0% from 2025 to 2030, driven by rising consumption in construction materials such as AAC blocks and refractories, growing demand for lightweight components in automotive and aerospace applications, and increasing use of atomized powders in additive manufacturing and thermal spray coatings. Expanding EV and electronics production, along with advancements in high-purity and specialty alloy powders, further supports steady market growth across major regions.

KEY TAKEAWAYS

- The Asia Pacific region is expected to register the highest CAGR of 4.3% during forecast period.

- By type, the powder segment is accounted for a 86.1% market share in 2024.

- By process, Comminution segment is expected to register the highest CAGR of 4.03% during forecast period.

- By purity, the >99% segment is accounted for a largest market share in 2024.

- By end-use industry, the paints & coatings segment is expected to dominate the market.

- Toyo Aluminium, Kymera International, Hoganas AB, Valimet and AMG were identified as some of the star players in the aluminum metal powder market, given their strong market share and product footprint.

- Schlenk SE, American Elements and United States Metal Powders and among others,have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential emerging market leaders

The aluminum metal powder market is experiencing steady growth driven by its expanding use in construction materials, automotive lightweight components, aerospace alloys, industrial formulations, and electrical & electronics applications. Advancements in atomization and comminution technologies are enabling the production of high-purity, uniform, and application-specific powders with improved flowability, thermal conductivity, and reactivity, supporting wider adoption across high-performance sectors. The construction industry's rising use of AAC blocks and specialty chemicals, along with the automotive sector’s focus on lightweight structures and enhanced thermal management for EVs, continues to boost demand. Additionally, the increasing utilization of aluminum powders in additive manufacturing, thermal spray coatings, and metallurgical processes—combined with growth in electronics and defense applications requiring precise, high-strength materials—is further strengthening the market’s momentum across global markets.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of aluminum metal powder suppliers, which, in turn, impacts the revenues of aluminum metal powder manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand from automotive and aerospace sectors for lightweight materials, thermal management components

-

Increasing adoption of aluminum powders in AAC blocks, refractories, due to rapid infrastructure expansion

Level

-

Sensitivity of aluminum powder to oxidation, requiring controlled handling, packaging, and storage

-

High energy consumption and operational complexity associated with atomization and high-purity production

Level

-

Expanding use of aluminum powders in EV battery housings, conductive coatings, and heat dissipation applications

-

Growing adoption in additive manufacturing and 3D printing technologies, particularly for aerospace and industrial parts

Level

-

Volatility in aluminum prices and energy costs directly impacting powder production economic

-

Stringent environmental, safety, and dust-control regulations for powder handling and manufacturing

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand from automotive and aerospace sectors for lightweight materials and thermal management components

Automotive and aerospace industries are increasingly adopting aluminum metal powders to produce lightweight structural parts, heat exchangers, coatings, and alloy components that enhance fuel efficiency and reduce emissions. Aluminum powders provide superior thermal conductivity, making them ideal for EV battery cooling plates, engine components, and aerospace-grade heat-dissipation systems. As both sectors invest heavily in lightweighting and high-performance materials, demand for high-purity and atomized aluminum powders continues to rise.

Restraint: Sensitivity of aluminum powder to oxidation, requiring controlled handling, packaging, and storage

Aluminum metal powders are highly reactive and prone to oxidation, which can deteriorate their performance characteristics, especially for applications requiring high purity or controlled reactivity. To prevent contamination and ignition risks, manufacturers must maintain inert environments, specialized packaging, moisture-free storage, and strict handling procedures. This increases operational costs and limits flexibility in logistics and warehousing.

Opportunity: Expanding use of aluminum powders in EV battery housings, conductive coatings, and heat dissipation applications

The rapid growth of electric vehicles is generating strong demand for aluminum powders used in thermal interface materials, conductive pastes, battery cooling components, and lightweight casings. Aluminum’s high thermal conductivity, low density, and compatibility with advanced coatings make it suitable for improving battery performance and safety. As EV adoption accelerates globally, aluminum powders are becoming critical in next-generation thermal and electrical systems.

Challenge: Volatility in aluminum prices and energy costs directly impacting powder production economic

Aluminum powder production is highly sensitive to fluctuations in primary aluminum prices, driven by global market dynamics, supply disruptions, and energy cost volatility. Since atomization and milling processes are energy-intensive, increases in electricity or gas prices directly raise production costs. These fluctuations affect profitability, complicate pricing strategies, and make long-term planning challenging for both producers and end users.

Aluminum Metal Powder Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses atomized aluminum powders in automotive lightweight components, thermal spray coatings, and conductive materials for EV power electronics. | Enhances vehicle efficiency through weight reduction, improves heat dissipation in EV systems, and supports high-performance surface protection. |

|

Utilizes aluminum flakes and powders in industrial coatings, sealants, and reflective materials for infrastructure and safety applications. | Provides superior reflectivity, corrosion resistance, and durability, enabling long-lasting performance in high-stress industrial environments. |

|

Applies high-purity aluminum powders in additive manufacturing for lightweight aerospace parts and thermal management components. | Enables production of complex geometries, reduces fuel consumption through lightweight parts, and improves thermal stability under extreme operating conditions. |

|

Uses aluminum metal powder in heat-conductive pastes and EMI shielding materials for electronic devices and battery components. | Boosts thermal conductivity, enhances device reliability, and supports miniaturization of high-power electronics with improved shielding capabilities. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The aluminum metal powder ecosystem, highlighting the interconnected roles of upstream raw material suppliers, specialized aluminum powder manufacturers, and key end-use industries. Leading primary aluminum producers such as Rusal, Hydro, Rio Tinto, and Vedanta supply the base metal required for powder production. Manufacturers including Höganäs, Toyal, and AMG convert this raw aluminum into powder through atomization and other processes, offering tailored grades for industrial applications. These powders are ultimately consumed by end users such as PPG Industries, Nippon Paint, and Toyota, where they are utilized in paints and coatings, automotive components, electronics, and other high-performance applications. This value chain overview demonstrates the coordinated flow of materials from extraction to final industrial use.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Aluminum Metal Powder Market, By Type

The powder segment led the aluminum metal powder market due to its broad applicability across construction, industrial, automotive, aerospace, and chemical sectors. Powder-grade aluminum is widely used in AAC blocks, refractories, metallurgical additives, pigments, and industrial formulations, giving it a dominant share. Its versatility ranging from fine reactive powders for chemical processes to coarse grades for metallurgy makes it the preferred choice for mass-volume applications. Additionally, advancements in atomization and improved production consistency have strengthened its adoption in additive manufacturing, thermal spray coatings, and high-performance alloys, further reinforcing the leadership of the powder segment in the overall market.

Aluminum Metal Powder Market, By Purity

The >99% purity segment dominated the Aluminum Metal Powder Market primarily due to their critical role in lightweighting, especially in the automotive industry, where they are essential for fuel efficiency and electric vehicle battery thermal management. These sheets consist of aluminum alloy cores clad with low-melting aluminum-silicon brazing alloys, provThe >99% purity segment dominated the aluminum metal powder market due to its essential role in high-performance applications that demand exceptional material consistency, low impurity levels, and superior mechanical and thermal properties. Ultra-high-purity aluminum powders are widely used in aerospace alloys, electronics, advanced additive manufacturing, thermal interface materials, and precision metallurgical processes where even minor contamination can impact reliability and performance. Their growing use in EV battery components, high-conductivity coatings, and specialized industrial formulations has further strengthened the dominance of this purity category, making it the preferred choice for industries requiring stringent quality and performance standards.iding superior thermal conductivity, corrosion resistance, and strong joints. Their widespread use in automotive heat exchangers, HVAC systems, and aerospace & defense applications is driven by high strength-to-weight ratios and thermal performance advantages. The growth is further fueled by technological advancements in brazing alloys, and stringent environmental regulations promoting aluminum recycling and energy efficiency.

Aluminum Metal Powder Market, By Process

The atomization process segment dominated the aluminum metal powder market due to its ability to produce highly spherical, uniform, and contamination-free powders that meet the stringent requirements of advanced applications. Atomized powders offer superior flowability, packing density, and consistency, making them the preferred choice for additive manufacturing, thermal spray coatings, aerospace alloys, and high-performance automotive components. The process also supports the production of specialized alloy powders and ultra-fine grades used in electronics, EV battery cooling systems, and precision metallurgical applications. As industries increasingly shift toward sophisticated, high-quality powder materials, the atomization process continues to hold the largest share of the overall market.

Aluminum Metal Powder Market, By End-use Industry

The paints & coatings industry holds the largest share in the aluminum metal powder market due to the extensive use of aluminum flakes and powders in industrial, automotive, architectural, and protective coatings. Aluminum-based pigments provide superior metallic effects, excellent UV and corrosion resistance, strong barrier properties, and high reflectivity making them essential for high-performance coating formulations. Their use in protective marine coatings, heat-resistant paints, and automotive finishes further strengthens demand. Additionally, the shift toward durable, energy-efficient, and specialty coatings in construction and manufacturing continues to drive the strong dominance of the paints & coatings segment in the overall market.

REGION

Asia Pacific to be fastest-growing market for aluminum metal powder during forecast period

Asia Pacific is projected to be the fastest-growing market for aluminum metal powder during the forecast period due to rapid industrialization and urbanization in key economies like China, India, Japan, and South Korea. These countries are expanding their manufacturing sectors, particularly in automotive, electronics, industrial, and construction industries, driving demand for aluminum metal powder. The push towards electric vehicles and sustainable manufacturing, along with government policies promoting energy-efficient materials, further fuels growth. technological advancements in aluminum powder manufacturing increasing investments in infrastructure development enhance product performance and market adoption.

Aluminum Metal Powder Market: COMPANY EVALUATION MATRIX

Within the aluminum metal powder market market matrix, Toyal (Star) maintains a dominant position, characterized by a substantial market share and an extensive range of products, propelled by its aluminum metal powder product that is extensively utilized in various industrial sectors. MMP Industries (Emerging Leader) is increasingly gaining market position through innovation and niche product offerings. Although Toyal remains the market leader due to its scale and diversified portfolio, MMP Industries demonstrates considerable potential to ascend to the leading quadrant as the demand for high-strength aluminum metal powder continues to grow.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.09 Billion |

| Market Forecast in 2032 (Value) | USD 2.64 Billion |

| Growth Rate | CAGR of 4.0% from 2025 to 2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, and the Middle East & Africa |

WHAT IS IN IT FOR YOU: Aluminum Metal Powder Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive OEM | Benchmarking of aluminum powder suppliers for sintered drivetrain components, thermal management materials, and EV-specific alloy formulations; Mapping of powder quality, purity grades, and consistency across global producers; Cost–performance comparison between atomized and comminuted powders for high-volume automotive use | Identify reliable, high-volume suppliers; Optimize sourcing for lightweight vehicle platforms; Highlight cost-reduction potential in EV component production |

| Additive Manufacturing (3D Printing) Service Provider | Evaluation of fine and ultra-fine powder grades suitable for laser powder bed fusion and DED systems; Assessment of flowability, PSD, morphology, and purity levels; Compatibility mapping for aerospace, tooling, and industrial AM applications | Ensure print consistency and part quality; Reduce powder wastage and improve recyclability; Enable adoption of aluminum alloys for high-performance AM components |

| Chemical & Industrial Materials Manufacturer | Application analysis for aluminum powders in pigments, coatings, reactive additives, and thermite processes; Comparison of purity-level performance across industrial formulations; Regulatory and safety compliance benchmarking | Improve product performance in paints, coatings, and chemical processes; Strengthen supply-chain compliance; Identify opportunities for using recycled-grade aluminum powders |

| Construction Material Producer | Evaluation of AAC block manufacturing compatibility with various purity levels; Assessment of aluminum powder particle sizes for gas-generation performance; Analysis of cost-to-output efficiency for large construction material plants | Enhance AAC block consistency and strength; Improve production efficiency; Identify cost advantages in large-scale construction-material formulations |

| Electronics OEM | Mapping of aluminum powder applications in conductive pastes, thermal interface materials, and alloy formulations; Purity and PSD benchmarking for electronics-grade applications; Supplier profiling for high-purity powders | Support miniaturization and heat management; Secure reliable sources for high-purity powders; Identify performance-enhancing alloy blends |

RECENT DEVELOPMENTS

- April 2025 : A non-binding agreement was signed by Valimet, Inc. and APWORKS GmbH to atomize Scalmalloy alloy powder domestically in the United States for use in additive manufacturing.

- September 2024 : Gränges Powder Metallurgy is a new business unit that aims to become a leading maker of custom and specialty aluminum powders for the additive manufacturing (AM) market. The company has powder production facilities in St Avold, France, and technical/build-out facilities in Velbert, Germany. It targets high-growth end-markets such as aerospace and automotive, while utilizing Gränges' legacy in aluminum and alloy development, notably for heat-exchanger applications.

- February 2024 : Kymera International has acquired the majority of Royal Metal Powders Inc's assets following the company's decision to close its Maryville, Tennessee operation. This acquisition expands Kymera's position in the copper and specialty metal powder industries by incorporating Royal's atomized metal powder capabilities. Royal Metal Powders, situated in Maryville, Tennessee, manufactures water and air atomized powders such as copper, brass, bronze, nickel/silver, tin, and phos copper.

Table of Contents

Methodology

The study involves two major activities in estimating the current market size for the aluminum metal powder market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering aluminum metal powder and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends, to the bottom-most level, and regional markets. Secondary data was collected and analyzed to arrive at the overall size of the aluminum metal powder market, which was validated by primary respondents.

Primary Research

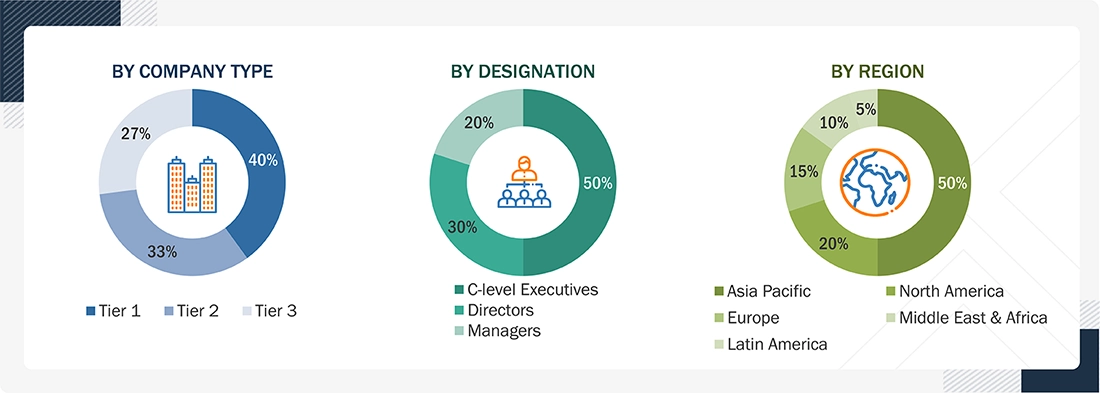

Extensive primary research was conducted after obtaining information regarding the aluminum metal powder market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief experience officers (CXOs), vice presidents (VPs), business development/marketing directors, product development/innovation teams, related key executives from the aluminum metal powder industry, distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to product type, process, purity, end-use industry, and region. Stakeholders from the demand side, including CIOs, CTOs, CSOs, and installation teams of customers/end users for aluminum metal powder, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of aluminum metal powder and future outlook of their business, which will affect the overall market.

Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the aluminum metal powder market includes the following details. The market size was determined from the demand side. The market was upsized based on the demand for aluminum metal powder in different end-use industries at the regional level. Such procurements provide information on the demand aspects of the aluminum metal powder industry for each industry. For each end-use industry, all possible segments of the aluminum metal powder market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Aluminum Metal Powder refers to finely divided particles of aluminum produced through atomization, comminution, or electrolysis processes. It is available in various physical forms such as powders and flakes, and in multiple purity grades (92%–98%, 98%–99%, and >99%), depending on the end-user requirements. Commercially, aluminum metal powder is extensively used in paints & coatings, construction & infrastructure, industrial manufacturing, electronics, automotive, and aerospace & defense sectors. Its applications range from metallic pigments and conductive pastes to aerated concrete, pyrotechnics, additive manufacturing, and powder metallurgy.

The Aluminum Metal Powder Market encompasses the global production, distribution, and utilization of these materials, segmented by type (powder, flakes), process (atomization, comminution, electrolysis), purity levels, end-use industry, and region. The market study assesses current and future trends, demand-supply dynamics, technological developments, and competitive landscape to forecast growth opportunities through 2030.

Stakeholders

- Aluminum Metal Powder Manufacturers

- Aluminum Metal Powder Distributors And Suppliers

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the aluminum metal powder market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze and project the global aluminum metal powder market by type, process, purity, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product developments/product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Aluminum Metal Powder Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Aluminum Metal Powder Market