Ammonium Metatungstate Market

Ammonium Metatungstate Market by Raw Material (Virgin Ore Route, Secondary/ Recycled Route), Form (Powder, Aqueous Solution, Crystalline), Grade, Application, End-use Industry, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The ammonium metatungstate market is projected to grow from USD 0.90 billion in 2025 to USD 1.16 billion by 2030, at a CAGR of 5.2% during the forecast period. The market for ammonium metatungstate (AMT) is witnessing steady growth driven by its expanding use across catalyst, metallurgy, and advanced material applications.

KEY TAKEAWAYS

-

By Raw MaterialThe virgin ore route is expected to hold the largest market share in the AMT market during the forecast period, primarily due to its ability to produce high-purity and consistent-quality material, which is critical for demanding end-use applications such as catalysts, electronics, and advanced ceramics.

-

By FormThe aqueous solution form of AMT is expected to hold the largest market share, primarily because of its high versatility and ease of handling in industrial and laboratory applications. AMT in aqueous solution form offers excellent solubility, uniform dispersion, and direct usability in catalytic processes, metal finishing, and chemical synthesis, eliminating the need for additional dissolution or preparation steps.

-

By GradeThe reagent grade of AMT is expected to be the second-fastest-growing grade in terms of value during the forecast period, driven by its expanding use in research, analytical applications, and high-precision industrial processes.

-

By ApplicationIn terms of value, the catalysts application is expected to be the fastest-growing of the overall AMT market. This growth is supported by the accelerating global transition toward cleaner fuels and energy-efficient chemical processes. AMT serves as a critical precursor for manufacturing tungsten-based catalysts used in hydroprocessing, oxidative coupling, and selective catalytic reduction (SCR) systems.

-

By End-use IndustryDuring the forecast period, the chemical end-use industry is expected to experience the fastest growth. This growth is driven by the increasing use of tungsten-based intermediates in advanced chemical synthesis and catalytic processes. AMT is becoming an essential ingredient in the production of high-performance catalysts, specialty tungsten compounds, and functional oxides, which serve as fundamental components for a variety of downstream products.

-

By RegionThe Asia Pacific region is projected to be the fastest-growing market for AMT during the forecast period, driven by its rapidly expanding industrial base and strategic role in the global tungsten supply chain. Countries such as China, Japan, South Korea, and India are at the forefront of tungsten production, processing, and downstream consumption, giving the region a natural advantage in AMT manufacturing and application.

-

COMPETITIVE LANDSCAPEThe major players active in the AMT market are based in North America, Europe, and the Asia Pacific. H.C. Starck Tungsten GmbH (Germany), Global Tungsten & Powders (US), Masan High-Tech Materials Corporation (Vietnam), Ganzhou Grand Sea Tungsten Co., Ltd. (China), and Ereztech LLC (US) have engaged in multiple agreements and strategic initiatives to address the rising demand for AMT across chemical and electronics applications.

AMT serves as a key precursor for tungsten-based catalysts used in hydrocracking, desulfurization, and denitrification processes, with demand rising as global fuel standards tighten and refineries adopt cleaner, more efficient technologies. In metallurgy, it is increasingly utilized for producing tungsten oxides, metal powders, and carbides essential for hard metals, cutting tools, and wear-resistant alloys. Additionally, AMT’s role in emerging electronic, energy, and coating materials has strengthened its demand in high-value sectors. The shift toward more sustainable, aqueous-based tungsten processing routes and growing downstream integration in major producing regions further support the market’s upward trajectory.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The AMT market is undergoing a dynamic transformation, driven by the growing need for high-purity, sustainable, and performance-oriented tungsten-based materials across industries. Traditionally dominated by commodity-grade AMT used in petrochemical catalysts and metal finishing, the market is rapidly shifting toward advanced formulations tailored for electronics, energy recovery, and high-performance coatings. Over the next 4–5 years, the revenue mix is expected to evolve significantly, as innovation in AMT-derived materials, secondary tungsten sourcing, and predictive process technologies reshape customer ecosystems. This transition reflects an industry-wide push toward improved catalytic efficiency, lower environmental footprint, and enhanced traceability—positioning AMT as a critical enabler in the next generation of sustainable industrial chemistry.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Regulatory compliances in end-use industries

-

Technological advancements and performance superiority

Level

-

Volatility in raw material prices

-

Technical complexity in downstream applications

Level

-

High growth technology sectors

-

Circular economy and recycling

Level

-

Supply chain vulnerabilities

-

High barriers to new production

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Regulatory compliances in end-use industries

Government mandates designed to protect public health and the environment are the most significant driver of AMT consumption. These regulations create an essential demand by requiring the use of AMT-derived products for market access in key industries. One notable example is the ultra-low sulfur fuel mandates. The global movement toward cleaner transportation fuels has sparked a series of regulations that directly necessitate the use of high-activity hydrodesulfurization (HDS) catalysts. In the US, the Environmental Protection Agency (EPA) has progressively tightened sulfur limits in diesel fuel, reducing it from levels as high as 5,000 parts per million (ppm) to the current standard of ultra-low sulfur diesel (ULSD), which is just 15 ppm for all highway, non-road, locomotive, and marine (NRLM) diesel fuel.

Restraint: Volatility in raw material prices

The price of AMT is closely tied to the price of its upstream precursor, APT, as well as the overall tungsten market, which is known for its significant price volatility. Historical data from the US Geological Survey (USGS) indicates that APT prices have varied greatly, ranging from lows near USD 150 per metric ton unit (MTU) to peaks exceeding USD 450/MTU between 2015 and 2023. This volatility is largely influenced by Chinese production quotas and export policies, which can change suddenly and without warning. Such price fluctuations create considerable uncertainty for both AMT producers and end-users, complicating long-term planning and potentially making AMT-derived products less competitive against substitutes like molybdenum, especially in price-sensitive applications.

Opportunity: High growth technology sectors

The most significant long-term growth opportunities for AMT are found in emerging high-tech sectors where tungsten's unique properties can lead to breakthrough performance. One notable example is advanced batteries. H.C. Starck Tungsten Powders has made a strategic investment in Nyobolt, a UK-based company that is developing ultra-fast charging lithium-ion batteries. Nyobolt’s technology features a proprietary niobium-tungsten oxide (NTO) anode material, allowing batteries to be charged to over 90% capacity in less than five minutes. These batteries also offer ten times the power density and durability of conventional lithium-ion cells, along with enhanced safety features.

Challenge: Supply chain vulnerabilities

Developing alternative, non-Chinese sources of tungsten is challenging, creating significant barriers to entry that maintain the current supply concentration. In addition, the processing of tungsten is particularly complex. It requires furnaces that can withstand temperatures of up to 6,142°F and handle highly corrosive chemicals such as hydrofluoric acid. The capital investment needed to establish a new, integrated mine and refinery is substantial and can be very high. Additionally, the time from project approval to production typically takes five to seven years.

AMMONIUM METATUNGSTATE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplies high-purity AMT for catalyst production in petrochemical refining, hydrocracking, and desulfurization processes | Ensures superior catalytic efficiency, thermal stability, and consistent product quality for large-scale industrial operations |

|

Manufactures AMT used in metal finishing, pigment formulations, and hardmetal precursors | High conversion efficiency, good solubility, controlled particle morphology for uniform coatings and compounds |

|

Develops AMT as a precursor for tungsten-based catalysts and alloys used in automotive and energy industries | Enhances process yield, purity, and material strength; supports sustainable and high-efficiency manufacturing |

|

Supplies AMT for industrial catalysts and tungsten oxide production derived from domestic ore and recycling routes | Competitive pricing, stable regional supply, and suitable for large-volume industrial applications |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AMT market ecosystem consists of raw material suppliers in this segment, including CMOC Group Limited (China), Jiangxi Tungsten Holding Group Co., Ltd. (JXHC) (China), Masan High-Tech Materials (MHT) (Vietnam), etc. Major global manufacturers include Global Tungsten & Powders Corp. (GTP) (US), H.C. Starck Tungsten Powders (Germany), Masan High-Tech Materials (MHT) (Vietnam), etc. Prominent distributors in this space include North Metal & Chemical Company (US), Advantage Materials, Inc. (US), Sigma-Aldrich (Merck KGaA) (Germany/US), etc. Key end-users are Exxon Mobil Corp. (USA), Shell PLC (UK), Siemens Healthineers (Germany), etc. Manufacturers develop eco-friendly, high-performance formulations, while distributors ensure availability, technical support, and localized expertise. End users across chemical, petrochemical, and electronics drive demand.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Ammonium Metatungstate Market, by Raw Material

The secondary or recycled route accounts for the second-largest share in the AMT market primarily due to its growing role in circular economy practices and resource conservation, even though virgin ore remains the dominant feedstock. Recycling of tungsten-containing scrap—such as carbide tools, catalysts, and metal powders—has become increasingly viable due to improved recovery and purification technologies that allow the production of high-purity AMT comparable to ore-derived material. However, despite these advances, recycled feedstock still faces limitations in terms of supply consistency, impurity control, and scalability, which prevent it from overtaking primary production.

Ammonium Metatungstate Market, by Form

The powder form of AMT is expected to be the second-fastest-growing segment within the market, driven by its increasing adoption across metallurgical, catalyst, and advanced materials applications. Powder AMT offers notable advantages in terms of handling, transportation, and storage—providing greater stability and ease of use compared to aqueous or crystalline forms. Its dry, free-flowing nature allows accurate dosing and efficient blending during downstream conversion processes, making it well-suited for producing tungsten oxides, carbides, and metal powders used in hard metals, wear-resistant alloys, and electronic components.

Ammonium Metatungstate Market, by Grade

The standard grade of AMT holds the largest market share primarily because it offers the optimal balance between performance, cost, and purity for a wide range of industrial applications. This grade meets the quality requirements of most end-use sectors—such as catalysts, metal finishing, ceramics, and chemical synthesis—without the added expense associated with high-purity or reagent-grade variants. Industries engaged in large-scale production prefer standard-grade AMT because it provides consistent composition, stable solubility, and reliable catalytic behavior suitable for bulk manufacturing processes.

Ammonium Metatungstate Market, by Application

The metal finishing application holds the second-largest share in the AMT market due to its critical role in improving the surface quality, durability, and corrosion resistance of metals used across industries such as automotive, aerospace, electronics, and industrial equipment. AMT serves as a precursor for producing tungsten-based coatings and conversion layers, which impart exceptional hardness, oxidation resistance, and wear protection to metal substrates. These coatings are highly valued for components exposed to extreme temperatures, friction, or corrosive environments, such as engine parts, cutting tools, and electronic contacts.

Ammonium Metatungstate Market, by End-use Industry

The electronics end-use industry holds the second-largest share in the AMT market due to the compound’s essential role as a precursor in producing high-purity tungsten oxides and other advanced tungsten materials used in electronic components. AMT’s excellent solubility, purity, and thermal stability make it ideal for applications such as thin-film transistors, semiconductors, capacitors, and electrochromic displays, where material precision and consistency are critical. Its ability to yield uniform, high-purity tungsten oxide coatings ensures superior electrical conductivity, optical clarity, and heat resistance, which are vital in miniaturized and high-performance electronic devices.

REGION

Asia Pacific to be fastest-growing region in global ammonium metatungstate market during forecast period

Asia Pacific is emerging as the fastest-growing market for AMT, driven by rapid industrialization, strong manufacturing output, and growing investments in high-performance materials. Countries such as China, Japan, South Korea, and India are witnessing surging demand for tungsten-based chemicals, fueled by expanding applications in catalysts, metallurgy, electronics, and energy materials. The region’s robust refining and petrochemical industries are key consumers of AMT for hydrocracking and desulfurization catalysts, while its dominance in electronics and semiconductor manufacturing drives the use of high-purity tungsten compounds in precision components. Additionally, the growth of the automotive and renewable energy sectors, particularly electric vehicles and energy storage systems, is accelerating AMT consumption for advanced alloys and functional materials. Supportive government policies, rising R&D investments, and a shift toward sustainable tungsten processing technologies are further strengthening Asia Pacific’s position as the most dynamic growth hub in the global AMT market.

AMMONIUM METATUNGSTATE MARKET: COMPANY EVALUATION MATRIX

In the AMT market matrix, H.C. Starck Tungsten Powders maintains a leading position, backed by its high-purity product range, advanced processing capabilities, and established presence across catalyst, metal powder, and specialty chemical applications. The company’s consistent quality, traceability, and process innovation continue to drive its dominance among industrial and research-grade users. Meanwhile, Ganzhou Grand Sea Tungsten Co., Ltd. is emerging as a strong challenger, gaining traction through cost-effective production and expanding supply capacity for catalyst and chemical feedstock applications. While H.C. Starck leads through technological depth and quality assurance, Ganzhou Grand Sea shows promising potential to move upward in the matrix as global demand for reliable, high-purity, and sustainable tungsten chemicals continues to increase.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- H.C. Starck Tungsten GmbH (Germany)

- Global Tungsten & Powders (US)

- Masan High-Tech Materials Corporation (Vietnam)

- Ganzhou Grand Sea Tungsten Co., Ltd. (China)

- Ereztech LLC (US)

- Ganzhou CF Tungsten Co., Ltd. (China)

- United Wolfram (India)

- ATT Advanced Elemental Materials Co., Ltd. (US)

- Noah Chemicals (US)

- North Metal & Chemical Co. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 0.90 Billion |

| Market Forecast in 2030 (Value) | USD 1.16 Billion |

| Growth Rate | CAGR of 5.2% from 2025–2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Ton) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | By Raw Material (Virgin Ore Route, Secondary/Recycled Route), Form (Powder, Aqueous Solution, Crystalline), Grade (Standard Grade, High-Purity Grade, Reagent Grade), Application (Catalysts, Pigments, Metal Finishing, X-ray Shielding, Analytical Chemistry, Glass & Ceramic Production, Other Applications), End-use Industry (Chemical, Electronics, Medical, Aerospace & Defense, Metallurgy, Other End-use Industries) |

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: AMMONIUM METATUNGSTATE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Catalyst Manufacturer |

|

|

| Advanced Materials Producer |

|

|

| Petrochemical Company |

|

|

| Asian Tungsten Processor |

|

|

| European Electronics Component Manufacturer |

|

|

RECENT DEVELOPMENTS

- December 2024 : Mitsubishi Materials Europe B.V. (MMEU), a subsidiary of Japan-based Mitsubishi Materials Corporation (MMC), completed the acquisition of H.C. Starck Holding (Germany) GmbH. The acquisition includes H.C. Starck Tungsten GmbH, with production facilities in Germany, Canada, and China, as well as sales offices in the US, China, and Japan.

- December 2021 : The Plansee Group has signed a definitive agreement to acquire Mi-Tech Tungsten Metals, a US supplier of tungsten-based products based in Indianapolis. The agreement was finalized in December 2021. Mi-Tech, founded in 1978 and employing around 100 people, manufactures high-precision tungsten composite components for industries such as energy, engineering, and aerospace. The acquisition, executed through Plansee’s US subsidiary Global Tungsten & Powders (GTP), strengthens the group’s market position for tungsten products in North America. According to Plansee executives, the move will enable customers to benefit from an expanded product range and improved supply security.

Table of Contents

Methodology

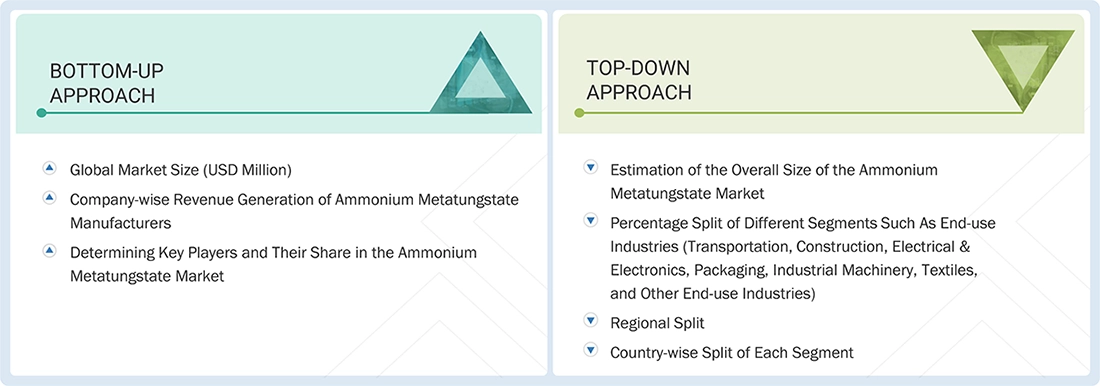

The study involves two major activities in estimating the current market size for the Ammonium Metatungstate (AMT) market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering Ammonium Metatungstate market information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends, to the bottom-most level, and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the Ammonium Metatungstate market, which was validated by primary respondents.

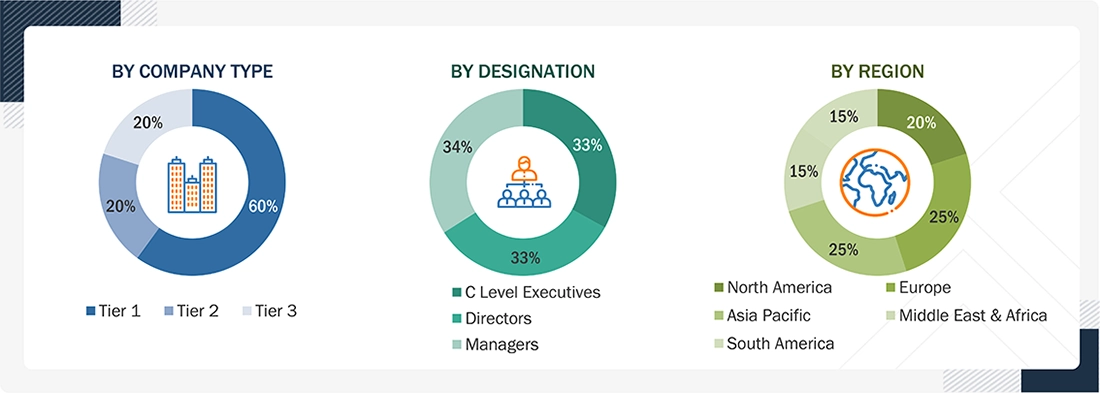

Primary Research

Extensive primary research was conducted after obtaining information regarding the Ammonium Metatungstate market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as chief executive officers (CXOs), vice presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from the Ammonium Metatungstate industry vendors, material providers, distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to product type, treatment method, base material, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking Ammonium Metatungstate services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of AMT and future outlook of their business, which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the Ammonium Metatungstate market includes the following details. The market sizing was undertaken from the demand side. The market was upsized based on the demand for AMT in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the Ammonium Metatungstate industry for each end-use industry. For each end-use, all possible segments of the AMT market were integrated and mapped.

Ammonium Metatungstate Market : Bottom-Up and Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The Ammonium Metatungstate market refers to the global landscape for the production, supply, and utilization of Ammonium Metatungstate, a high-purity tungsten compound widely used as a precursor for manufacturing tungsten oxides, metal powders, carbides, and catalysts. It plays a critical role in industries such as petroleum refining, petrochemicals, metallurgy, electronics, and advanced materials, where it supports key processes like hydrocracking, desulfurization, and precision component fabrication. The market spans both virgin ore-based and recycled production routes, reflecting a growing emphasis on sustainability, resource efficiency, and cleaner tungsten processing technologies. Overall, the AMT market forms an essential part of the broader tungsten chemicals sector, driven by increasing demand for high-performance and eco-efficient materials across industrial and technological applications.

Key Stakeholders

- Ammonium Metatungstate Manufacturers

- Ammonium Metatungstate Distributors and Suppliers

- End-use Industries

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the Ammonium Metatungstate market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing the Ammonium Metatungstate market growth

- To analyze and project the global Ammonium Metatungstate market by raw material, form, grade, application, end-use industry, and region

- To forecast the Ammonium Metatungstate market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall Ammonium Metatungstate market

- To analyze the Ammonium Metatungstate market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, partnerships, collaborations, and product developments/product launches, to draw the competitive landscape in the Ammonium Metatungstate market

- To strategically profile the key players and comprehensively analyze their core competencies in the Ammonium Metatungstate market

Available customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the ammonium metatungstate market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Ammonium Metatungstate Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Ammonium Metatungstate Market