Anhydrous Hydrofluoric Acid Market

Anhydrous Hydrofluoric Acid Market by Grade (High-purity Grade, Standard Grade), Type (Fluorite-based, Fluorosilicic Acid), Distribution Channel (Direct Sales, Online Retailers), Application (Intermediate in Chemical Reactions, Fuming Agents), End-use Industry (Catalysts, Fluorocarbons) - Global Forecast to 2030

Updated on : December 11, 2025

ANHYDROUS HYDROFLUORIC ACID MARKET

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global anhydrous hydrofluoric acid market was valued at USD 6.9 billion in 2025 and is projected to reach USD 8.4 billion by 2030, growing at 4.0% cagr from 2025 to 2030. The AHF industry is experiencing consistent growth driven by various factors across multiple end-use sectors. A primary catalyst for this expansion is the expanding chemical industry, where AHF serves as an essential raw material for the production of fluorocarbons and fluoropolymers. These substances are extensively utilized in refrigeration, air conditioning, and as blowing agents, especially in emerging economies undergoing industrialization. Furthermore, the semiconductor and electronics sectors also significantly contribute to market growth. AHF is employed in etching and cleaning silicon wafers, and owing to the rising demand for consumer electronic devices coupled with ongoing technological innovations, the market's demand for high-purity AHF continues to increase annually.

KEY TAKEAWAYS

-

BY TYPEFluorite, also known as fluorspar and calcium fluoride mineral CaF2, is the most commonly used source of dysprosium in anhydrous hydrofluoric acid (AHF) production, thanks to its high purity, stable chemical structure, and established industry processing methods. Fluorspar can be processed with sulfuric acid to produce hydrogen fluoride efficiently and with low impurities, which is crucial for creating highly pure AHF used in vital applications like semiconductors, medicine, and high-grade materials.

-

BY GRADEHigh-purity grade anhydrous hydrofluoric acid is preferred over standard grade because it contains very low levels of metal and particulate impurities, which makes it essential for semiconductor, electronics, and high-performance fluorochemical applications where even trace contaminants can impact product quality and process efficiency. Its superior purity ensures accurate etching, increased yield, and less equipment corrosion, all of which are critical for manufacturing integrated circuits, solar cells, and specialty fluoropolymers.

-

BY APPLICATIONAs an intermediate in a reaction sequence, anhydrous hydrofluoric acid (AHF) has a vast number of uses - the biggest being as a key role in the synthesis of various important fluorine-based compounds. AHF is an essential precursor to perform fluorocarbon production, fluoropolymer compositions, and other organofluorines with varying features that are used in the pharmaceutical, agrochemical, refrigerant, and other industries.

-

BY END-USE INDUSTRYCatalysts could emerge as the largest end-use segment of AHF market, because of the vital role AHF plays in the petroleum refinement industry, especially in relation to alkylation. AHF serves as a catalyst to create high-octane components of gasoline through the alkylation of isobutane with olefins to meet international fuel quality requirements and emissions standards. Refiners continue to look for easy ways to comply with environmental regulations and improve fuel emission quality, and they are eager to produce cleaner-burning fuels and ultra-low sulfur gasoline.

-

BY REGIONAsia Pacific accounts for the largest market share for several reasons. Firstly, the region benefits from an abundant supply of raw materials necessary for the production of AHF, with hydrofluoric acid itself ranking as the second most important raw material. Additionally, the region hosts extensive downstream industries and possesses substantial market demand. Furthermore, Asia Pacific is a global leader and one of the largest producers of fluorspar (calcium fluoride), which is the primary raw material for manufacturing AHF. Given China's significant reserves of fluorspar and its reliable, cost-effective raw material supply, the region holds a strategic position in the market.

-

COMPETITIVE LANDSCAPEMarket growth is propelled by escalating demand within the fluoropolymer, refrigerant, semiconductor, and aluminum industries, facilitated by the global transition toward low-GWP refrigerants and sophisticated electronic materials. Solvay sustains a robust presence through its comprehensive AHF production capabilities and downstream fluorochemical integration, underscoring its commitment to supply reliability and adherence to safety standards. Honeywell concentrates on high-purity AHF for applications in the semiconductor and specialty chemical sectors, utilizing advanced material handling techniques and technical expertise.

The growth of the anhydrous hydrogen fluoride (AHF) industry is driven by its essential role in various industrial sectors, especially in the fluorochemical, electronics, and aluminum industries. A major factor behind the expansion of the AHF market is its widespread use as a crucial feedstock in manufacturing fluorochemicals, including fluoropolymers like PTFE, PVDF, and FEP, as well as refrigerants such as HFCs, HCFCs, and next-generation HFOs.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Shifts in industrial demand patterns or regulatory changes directly affect the anhydrous hydrogen fluoride (AHF) industry. Changes in the use of fluorochemicals, fluoropolymers, or aluminum fluoride can greatly impact the purchasing habits of AHF end-users, such as fluorochemical, semiconductor, and aluminum manufacturers. These fluctuations directly influence the revenues of AHF suppliers and the operational stability of producers along the fluorochemical supply chain. As the market increasingly relies on high-purity and environmentally friendly AHF grades, even small disruptions in industrial output, environmental policies, or raw material supply can have significant effects throughout the AHF supply network.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Transition to smaller nodes and 3D architecture accelerates demand

-

Growing demand for fluorinated chemicals

Level

-

High toxicity and handling risks

Level

-

Growing investments in clean energy solutions (e.g., Lithium-ion batteries)

-

Advancements in fluoropolymer industry

Level

-

Dependence on high-quality fluorspar in the production of AHF

-

Regulatory delays and permitting challenges in the AHF production

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Transition to smaller nodes and 3D architecture

The movement toward smaller semiconductor nodes and three-dimensional architectures significantly propels the demand for high-purity Anhydrous Hydrofluoric Acid (AHF), owing to its critical role in next-generation etching processes. As semiconductor devices decrease to sub-10nm dimensions and adopt advanced 3D structures such as FinFETs and 3D NAND, manufacturing procedures necessitate more precise and controlled etching methods. AHF is essential in the removal of silicon dioxide (SiO2) layers during these processes. In particular, vapor phase etching (VPE) with AHF offers greater accuracy compared to traditional wet etching techniques and is suitable for delicate structures in microelectromechanical systems (MEMS) and high-end semiconductor devices.

Restraint: High toxicity and handling risks

The high hazard and toxicity associated with handling pose significant deterrents to the AHF industry. AHF is substantially corrosive and toxic, leading to severe chemical burns and systemic toxicity upon skin contact or inhalation. It can cause tissue damage extending to deep bones and internal organs, often without immediate stinging sensations, which may delay treatment and elevate health risks. Consequently, strict safety protocols are imperative, involving the use of highly specialized personal protective equipment (PPE), advanced ventilation systems, and comprehensive emergency response procedures during handling, transportation, and application.

Opportunity: Growing investments in clean energy solutions (e.g., Lithium-ion batteries)

The global transition to clean energy sources, particularly the increasing dependence on lithium-ion batteries, is creating significant opportunities for the AHF market. AHF is a key raw material in the production of high-purity lithium compounds such as lithium hexafluorophosphate (LiPF6), which is the primary electrolyte salt used in lithium-ion batteries. Hydrofluoric acid is essential in the manufacturing process of LiPF6, as the quality of this compound directly impacts the performance, safety, and overall efficiency of the batteries.

Challenge: Dependence on high-quality fluorspar in production of AHF

The global shift to clean energy, particularly the growing reliance on lithium-ion batteries, is revealing a tremendous potential for the AHF market. AHF is employed as one of the large-scale raw materials in the production of high-purity lithium chemicals such as lithium hexafluorophosphate (LiPF6), the dominant electrolyte salt of lithium-ion batteries. Hydrofluoric acid plays a crucial part in the manufacturing of LiPF6 because the quality of the compound determines the efficiency, safety, and performance of the entire battery.

Anhydrous Hydrofluoric Acid Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use as a catalyst in petroleum refining for alkylation processes to produce high-octane gasoline | Efficient and economical production of high-quality fuel | Recyclable catalyst | Improved refinery yields |

|

Production of fluoropolymers such as Teflon and PTFE for various industrial applications | Exceptional heat resistance | Non-stick and chemically inert properties | Versatile use in aerospace, cookware, and more |

|

Etching and cleaning silicon wafers in semiconductor manufacturing | Precise creation of microscopic features | Ensures atomically clean surfaces | Supports advanced electronics |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem study on AHF provides a detailed description of the relationships, features, and activities associated with the production, distribution, and consumption of AHF. The study also shows the clear importance of the suppliers of raw materials, especially high-purity fluorspars, AHF producers, downstream electronics and chemical industries, automotive AHF sectors, and environmental safety regulation authorities. Through tracking these interactions, ecosystem analysis captures value chain relationships and likely choke points, along with new ways to highlight for other investors interested in exploiting the complexities and analyze underlying industry economics and ecosystem dynamics of AHF market interactions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Anhydrous Hydrofluoric Acid Market, By Type

The fluorite-based segment is projected to dominate the type segment of the AHF market throughout the forecast period. Fluorite, also known as fluorspar and calcium fluoride mineral (CaF2), serves as the primary source for anhydrous hydrofluoric acid (AHF) due to its high purity, stable chemical structure, and the industry's well-established processing methods. Fluorspar can be efficiently processed with sulfuric acid to produce hydrogen fluoride with minimal impurities, making it ideal for creating AHF of exceptional purity used in critical applications such as semiconductors, medicine, and high-grade materials.

Anhydrous Hydrofluoric Acid Market, By Grade

The high-purity grade anhydrous hydrofluoric acid segment is the largest and fastest-growing in the industry, surpassing the standard grade due to its essential role in high-precision applications like semiconductor manufacturing, electronics, and specialty fluorochemicals. Its exceptionally low impurity levels ensure better etching accuracy, product consistency, and lower contamination risks, which are crucial for producing advanced chips, solar cells, and high-performance materials. The increasing demand for smaller and more efficient electronic components continues to boost the dominance of the high-purity segment over the standard grade.

Anhydrous Hydrofluoric Acid Market, By Application

The intermediate chemicals segment is the largest application for anhydrous hydrofluoric acid (AHF) because AHF is a vital raw material for making a wide variety of fluorine-based chemicals. In chemical manufacturing, intermediates such as fluorocarbons, fluoropolymers, refrigerants, and specialty fluorochemicals depend heavily on AHF as a starting material due to its high reactivity and its ability to add fluorine atoms to both organic and inorganic compounds. This demand is boosted by the rapid growth of downstream industries like pharmaceuticals, agrochemicals, and high-performance plastics, where these fluorinated intermediates are essential for producing active ingredients or high-value specialty materials.

Anhydrous Hydrofluoric Acid Market, By End-use industry

Catalysts constitute the primary end-use industry for Anhydrous Hydrofluoric Acid (AHF), given its extensive application as a crucial catalyst in petroleum refining and chemical synthesis processes. Its exceptional capacity to protonate and activate hydrocarbons renders it indispensable in alkylation procedures, which generate high-octane gasoline components. This demand is driven by the global petroleum and petrochemical sectors, where substantial volumes of AHF are essential to facilitate efficient and high-yield reactions.

REGION

Asia Pacific to be fastest-growing region in global anhydrous hydrofluoric acid market during forecast period

Asia Pacific is the largest region for the anhydrous hydrofluoric acid (AHF) industry due to a combination of high industrial demand, strong downstream chemical production, and expanding infrastructure. The region hosts major fluorochemical and petrochemical manufacturing hubs, particularly in China, India, Japan, and South Korea, where AHF is extensively used as a raw material for intermediates, catalysts, refrigerants, and specialty chemicals. Rapid industrialization, urbanization, and growing automotive and electronics sectors further boost demand for high-performance materials like fluoropolymers and high-octane fuels, all of which rely on AHF.

Anhydrous Hydrofluoric Acid Market: COMPANY EVALUATION MATRIX

In the anhydrous hydrofluoric acid (AHF) industry landscape, Solvay Chemicals (Star) leads with a dominant market share and a strong global presence, supported by its extensive range of AHF products widely used in fluoropolymer production and semiconductor manufacturing. Honeywell (Emerging leaders) leverages its advanced processing technologies and consistent product innovations to strengthen its competitive position, especially in North America and Europe. Meanwhile, Daikin Industries (Participants) is expanding its visibility through a diversified specialty chemicals portfolio, emphasizing AHF applications in refrigeration and automotive industries. While Solvay Chemicals maintains leadership through scale and technological expertise, Honeywell and Daikin show rising potential to capture greater market share as demand for high-purity fluorinated compounds and sustainable industrial solutions continues to grow.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 6.8 Billion |

| Revenue Forecast in 2030 | USD 8.4 Billion |

| Growth Rate | CAGR of 4.0% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Anhydrous Hydrofluoric Acid Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Country-Level Breakdown | In-depth analysis of AHF demand and supply across key regions, including the US, China, Japan, Germany, and India; report includes production trends, import/export flows, and regulatory frameworks | Helps stakeholders identify high-growth national markets, plan accurate entry strategies, and forecast demand with better precision |

| Application-Specific Deep Dive | Customized analysis of AHF applications with detailed sub-segmentation: Catalysts (e.g., petroleum refining), fluoropolymers (e.g., Teflon production), and etching agents (e.g., semiconductor manufacturing); includes industry-specific insights | Supports clients in targeting niche applications, optimizing R&D investments, and building specialized product portfolios for diverse industries |

| Purity/Form Type Customization | Comparative analysis of AHF available in different purity levels (e.g., technical-grade, high-purity) and forms (e.g., gas, liquid); covers performance benchmarks such as solubility, stability, and shelf life across pharmaceuticals and industrial uses | Enables manufacturers and buyers to optimize selection based on performance, cost, and suitability, while unlocking opportunities in high-purity and premium-grade applications |

| Competitive Benchmarking | Extended profiling of global and regional players such as Solvay Chemicals, Honeywell, and Daikin Industries; includes SWOT analysis, product positioning, pricing, and innovation pipelines | Provides clients with a clear competitive landscape, helping them identify positioning opportunities, potential partners, and strategies for market entry or acquisitions |

RECENT DEVELOPMENTS

- July 2023 : Navin Fluorine announced a new capital expenditure of ?450 crore (USD 54.22 million) to establish a 40,000 tons per annum anhydrous hydrofluoric acid (AHF) production facility at Dahej, India, through its subsidiary, NFASL. The plant is expected to be operational by early 2025 and aims to strengthen the company’s position in the global fluorochemicals market.

- July 2020 : Specialty materials company Arkema disclosed its intention to establish a USD 150 million AHF production facility in North Carolina, pursuant to a newly formalized long-term supply agreement with Nutrien Ltd., an agricultural corporation.

- August 2024 : Honeywell International Inc. acquired CAES provides advanced electronics for aerospace & defense, including RF and microelectronic components. This acquisition strengthened Honeywell’s position in semiconductor-related markets, where AHF is critical for etching and cleaning processes.

Table of Contents

Methodology

The study involved four major activities in estimating the market size of Anhydrous Hydrofluoric Acid (AHF). Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key AHF market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

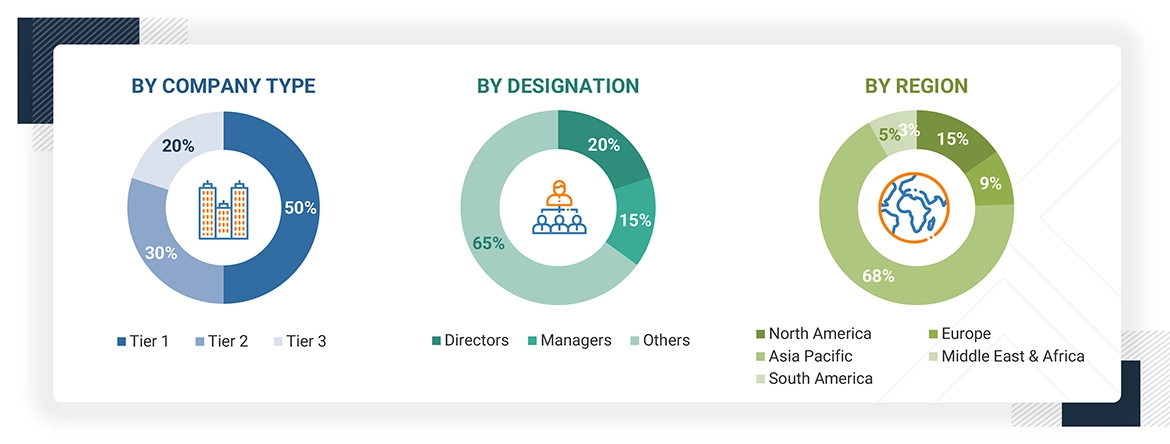

AHF comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the AHF have been interviewed to obtain qualitative and quantitative information. The interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the AHF industry.

Interviews with experts were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of AHF and future outlook of their business, which will affect the overall market.

The breakdown of profiles of the interviews with experts is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for AHF for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns based on type, grade, distribution channel, application, end-use industry, and region were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Data Triangulation

After arriving at the total market size from the estimation process above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both, the demand and supply sides. Along with this, the market size has been validated by using both, the top-down and bottom-up approaches and interviews with experts. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and interviews with experts. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Anhydrous hydrofluoric acid (AHF) is a colorless, fuming liquid or gaseous form of hydrofluoric acid (HF, see figure below), with a very pungent odor and no water content, and is a very corrosive & toxic substance. AHF consists of both, HF in anhydrous form or as a gas that has undergone purification and distillation to artificially remove water, unlike its aqueous form (HF(a)). Most AHF is produced when fluorspar (calcium fluoride, CaF2), is reacted with sulfuric acid at elevated temperatures (approximately 265°C) to produce hydrogen fluoride (HF). The HF is purified and distilled to remove water to produce AHF, as the absence of water in the environmental form of AHF is desirable. On the other hand, AHF can be produced using fluorosilicic acid (H2SiF6), a by-product of phosphoric acid production in the phosphate fertilizer industry, via a series of specially designed vessels that allow ammoniation, filtration, and calcination to produce AHF. These systems provide sustainability by developing a product from a standard waste by-product that was previously disposed of as waste. AHF is an important raw material for many applications due to its reactivity, and its dissolving power for silicates and oxides. In the chemical and petrochemical industry, AHF acts as an intermediate in chemical reactions, and plays a key role in producing fluorochemicals, such as fluorocarbons (HFCs and HCFCs) and fluoropolymers. Fluorocarbons (HFCs and HCFCs) are used in the manufacture of refrigerants, air conditioning products, and aerosol propellants due to their chemical stability. AHF is also used in the refining of petroleum as a catalyst in the production of alkylation, whereby olefins combine with isobutane to give high-octane gasoline components for improved fuel efficiency.

Stakeholders

- Anhydrous Hydrofluoric Acid Manufacturers

- Anhydrous Hydrofluoric Acid Traders, Distributors, and Suppliers

- Raw Material Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the AHF market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, grade, distribution channel, application, end-use industry, and region

- To forecast the size of the market with respect to major regions, namely, North America, Asia Pacific, Europe, Middle East & Africa, South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To track and analyze recent developments such as product launches, partnerships, acquisitions, and expansions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Which factors influence the growth of the AHF market?

The growth of the anhydrous hydrofluoric acid (AHF) market is driven by its rising use in fluorochemical production, semiconductor manufacturing, and lithium-ion battery components. Increasing demand for refrigerants, high-performance electronics, and clean energy solutions further accelerates market expansion.

Which country is expected to account for the largest share of the anhydrous hydrofluoric acid (AHF) market?

China leads the global anhydrous hydrofluoric acid (AHF) market due to its abundant fluorspar reserves, cost-effective production, and strong domestic demand. Its well-developed chemical industry uses AHF in key applications like fluorochemicals, aluminum fluoride, and lithium battery materials.

Who are the major manufacturers?

The major manufacturers are Honeywell International Inc. (US), Solvay (Belgium), LANXESS (Germany), Orbia Flour & Energy Materials (Mexico), Zhejiang Yonghe Refrigerant Co., Ltd. (China), Stella Chemifa Corporation (Japan), Donguye Group Ltd. (China), SRF Limited (India), Gulf Flour (UAE), BASF (Germany), Navin Flourine International Limited (India), and Arkema (France).

What are the opportunities in the AHF market?

The clean energy shift and lithium-ion battery boom drive strong demand for anhydrous hydrofluoric acid (AHF), essential for producing battery electrolyte salts like LiPF6.

Which application has the largest share in the AHF market?

Anhydrous hydrofluoric acid (AHF) is mainly used as a chemical intermediate due to its key role in producing fluorinated compounds like fluorocarbons, fluoropolymers, and LiPF6. Its versatility and wide industrial use make it the largest application segment in the market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Anhydrous Hydrofluoric Acid Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Anhydrous Hydrofluoric Acid Market