Veterinary Dermatology Market: Growth, Size, Share, and Trends

Veterinary Dermatology Market by Route of Administration, Product type (Antibacterial, Antifungal, Antiparasitic Drugs, Monoclonal Antibodies), Condition type (Parasitic Infections, Infectious Diseases, Skin Cancer), Animal type - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global veterinary dermatology market is projected to reach USD 30.31 billion by 2030 from USD 20.11 billion in 2025 at a CAGR of 8.5% during the forecast period. The growth of the global veterinary dermatology market is primarily driven by the expanding companion animal population, increasing pet ownership, and rising concerns over infectious zoonotic diseases.

KEY TAKEAWAYS

-

By Route of AdministrationThe topical segment accounted for the largest share of the veterinary dermatology market in 2024. The high market share of the topical segment is mainly due to the ease of application of topical products and the rapid onset of action in the targeted area.

-

By Product TypeThe antiparasitic drugs segment accounted for the largest share in 2024 and highest CAGR during the forecast period of the veterinary dermatology market . The large market share and the high growth rate of this segment is mainly due to the high prevalence of parasitic infections in both companion and livestock animals and the increasing awareness among pet owners and farmers.

-

By Condition TypeThe parasitic infections segment is expected to witness the highest CAGR during the forecast period in the veterinary dermatology market. This growth of the segment is primarily due to the widespread occurrence of these infestations and their significant impact on animal health.

-

By Animal TypeThe companion animals segment is projected to experience the fastest growth rate in the market, due to factors such as rising pet adoption rate, increasing urbanization, and growing expenditure on pet care.

-

By End UserThe veterinary hospitals and clinics segment accounted for the largest share of the veterinary dermatology market in 2024. The high market share of the veterinary hospitals and clinics segment is mainly due to the growing demand for specialized skin care and treatments in animals.

-

By RegionThe Asia Pacific region is expected to be the fastest-growing veterinary dermatology market. This growth is driven by the increasing trend of pet ownership across countries such as Japan, China, India, Australia, New Zealand, and South Korea.

-

Competitive LandscapeThe global veterinary dermatology market is highly consolidated, with a few major players holding a significant share and competing through partnerships with distributors and group purchasing organizations. While smaller companies focus on affordable products and innovation to sustain growth, larger players dominate through strong global networks, advanced R&D capabilities, and established brand presence

The major factors that are driving the market are expanding companion animal population and pet ownership, growing concerns about infectious zoonotic diseases, rising awareness initiatives by government and animal welfare organizations, and increased adoption of pet insurance and high animal healthcare expenditure. The opportunities in the market are technological advancements and product launches, high growth potential in emerging economies, and a surging number of veterinary practitioners in developed markets

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The veterinary dermatology market is shifting from basic topicals and steroids to targeted therapies, better diagnostics, and teledermatology, enabled by rising pet spending and insurance. These changes improve access, speed itch relief, and support long-term control of common skin diseases while creating new revenue in biologics, oral therapies, and integrated digital-care bundles.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expanding companion animal population and pet ownership

-

Growing concerns about infectious zoonotic diseases

Level

-

Rising pet care costs

-

Restrictions on use of parasiticides for food-producing animals

Level

-

Technological advancements and product launches

-

High growth potential in emerging economies

Level

-

Growing resistance to parasiticides

-

Diversity in parasite species

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expanding companion animal population and pet ownership

The veterinary dermatology market is expanding with the growing population of companion animals and pet ownership across the globe. In developed regions such as North America and Europe and emerging economies such as India and China, more individuals are keeping pets, which is increasing the demand for veterinary dermatological services. The American Pet Products Association (APPA) indicated that 86.9 million US households (66%) had a pet during the 2023-2024 period, and the American Veterinary Medical Association (AVMA) indicated an increase in households owning dogs from 31.3 million in 1996 to 59.8 million in 2024. In 2021, about 63.0 million US households had dogs, and 41.8 million had cats as pets. Additionally, as per the European Pet Food Industry Federation (FEDIAF), there was an increase in the number of dogs from 104.34 million in 2022 to 106.36 million in 2023. According to the Indian Dairy Association, India had a cattle population of more than 305 million in 2021, the highest in the world. With more companion animals in need of special skin treatment, the veterinary dermatology market is set to grow and develop in the future

Restraint: Rising pet care costs

The American Pet Products Association (APPA) reported that the expense of veterinary care ranked second compared to other pet expenses, and the total amount of money spent by consumers in 2024 stood at USD 150.6 billion, which has a projection of reaching USD 200 billion by 2030. The price of prolonged dermatological procedures serves as a primary factor towards this expense. PetMD suggests that an average pet would incur between USD 250 and USD 4,500 for veterinary charges, while specialized veterinarians may claim between USD 5,000 and USD 20,000 for dermatological surgeries. The prices associated with the treatment of skin ailments through immunotherapy, laser surgery, and allergy testing are steep, thus making it expensive for pet owners. Furthermore, these steep expenses negatively impact uninsured pet owners and those from lower socioeconomic backgrounds, thus restraining market growth. Despite the growing availability of pet insurance, coverage for dermatological services remains substantially restricted, resulting in significant out-of-pocket expenses for pet owners. The annual increase in veterinary treatment costs, approximately 12%, can be attributed to escalating fees associated with specialist consultations and the lower income levels experienced by veterinarians relative to other medical professions. Consequently, these dynamics discourage pet owners from seeking veterinary care for skin conditions, thereby impeding the expansion of the veterinary dermatology market.

Opportunity: Technological advancements and product launches

Emerging technologies and product launches are being witnessed in the veterinary dermatology market. Merck & Co., Inc. (US) received approval from the European Commission for marketing authorization of BRAVECTO TriUNO (Tablet) in November 2024; the tablet is a new formulation of a fluralaner for internal and external parasites in dogs. The product is also authorized in several key markets, including Peru, Guatemala, Nicaragua, and Costa Rica. Zoetis Inc. (US) launched Apoquel Chewable (Tablet) in the US in October 2023; it marked the first chewable formulation for the treatment of pruritus and atopic dermatitis in dogs. In November 2024, Bimeda expanded its antiparasitic portfolio with the launch of MoxiSolv Injection (Injectables), an FDA-approved injectable solution available in a non-shattering 500 mL plastic bottle. Such innovations improve the convenience and efficacy of treatment and augment product portfolios and competitive tension in the market. This highlights how technological advancements and the introduction of new products are enabling better management of dermatological conditions in animals, thus creating growth opportunities in the veterinary dermatology market. Investing in the development of dermatological products will continue to bring enhanced treatment adherence and accessibility for curing dermatological conditions for pets.

Challenge: Growing resistance to parasiticides

In veterinary dermatology, antiparasitic resistance refers to the ability of parasites to survive treatments that were previously effective, a phenomenon caused by the selection of resistant parasites after susceptible ones are eliminated. Resistant parasites pass on their genes, resulting in a population that is difficult to control. This challenge is particularly critical in managing dermatological conditions like mange or flea infestations in animals. According to the US FDA, the agency launched the Antiparasitic Resistance Management Strategy in 2024, emphasizing the sustainable use of dewormers and antiparasitic drugs in livestock, poultry, and horses to mitigate resistance. It underscores the importance of precise dosing, rotation of effective drugs, and alternative control measures to prolong the efficacy of available treatments. In 2023, researchers at the University of Queensland discovered ivermectin-resistant strains of mange-causing mites in cattle and sheep in Australia, significantly impacting animal welfare and farm productivity. In addition, research was conducted in 2023 through databases, PubMed, Web of Science, and Google Scholar, using terms related to ivermectin, human and veterinary ectoparasites, and resistance, which identified ivermectin resistance, such as target site resistance, and metabolic resistance in ectoparasites. A 2024 study published in the Journal of Veterinary Parasitology highlighted growing resistance in fleas treated with fipronil among dogs in the US, leading to recurring infestations despite regular treatments.

Veterinary Dermatology Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integrated dermatology portfolio combining oclacitinib (APOQUEL) for pruritus control, lokivetmab (CYTOPOINT) monoclonal antibody for canine atopic dermatitis, topical antimicrobials/antifungals, and reference-lab dermatology assays embedded in practice software | Rapid relief of itch within hours to days reduces self-trauma and secondary infections, improves medication adherence with long-acting biologics, and decreases repeat flare visits, lifting quality of life and client satisfaction while stabilizing practice revenue through chronic-care plans |

|

Prescription parasiticides and otic/derm topicals paired with allergen-specific immunotherapy services and clinic education programs | Broad ectoparasite and ear disease control lowers recurrent otitis and dermatitis cases, while personalized immunotherapy reduces steroid reliance and long-term flare frequency, cutting follow-up costs and antimicrobial exposure |

|

Comprehensive allergy and skin pipeline including anti-pruritic small molecules, otitis externa therapeutics, and medicated shampoos/ear cleansers supported by teledermatology detailing and adherence tools | End-to-end regimen simplifies chronic management, improves owner compliance through clear protocols and reminders, and shortens time-to-control in mixed bacterial/yeast otitis, decreasing treatment failures and returns |

|

Parasiticide platforms with dermatologic indications, point-of-care diagnostic support, and data-driven adherence programs through connected practice solutions | Reliable mite/flea/tick prevention reduces hypersensitivity dermatitis incidence, while connected reminders raise refill rates and sustained protection, lowering seasonal flare spikes and chair time per case |

|

Dermatology-focused portfolio with essential fatty acid supplements, antiseptic/antifungal shampoos, ear solutions, and novel topical antibacterial technologies | Skin barrier restoration and targeted microbe control reduce recurrence and antibiotic use, enabling step-down maintenance protocols that are cost-effective for owners and predictable for clinics |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Leading players in this market include well-established and financially stable service providers of veterinary dermatology products. These companies have been operating in the market for several years and possess a diversified product portfolio, advanced technologies, and a strong global presence.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Veterinary Dermatology Market, By Route of Administration

By route of administration, the market is segmented into topical, injectables, and oral. The oral segment is projected to record the fastest growth during the forecast period (2025-2030). The growth is largely due to the fact that oral medications are easier to administer. Oral products offer a convenient and effective solution for pet owners and veterinarians. These products include antibiotics, antifungals, corticosteroids, and immunomodulators designed to address bacterial, fungal, and allergic skin diseases. Oral medications provide systemic treatment, ensuring a more comprehensive approach to managing chronic and severe dermatological disorders than topical applications. Their ease of administration and ability to deliver consistent therapeutic effects contribute to their widespread use in veterinary dermatology. They also enable predictable dosing and absorption into the system, thereby converting into a potent therapy against chronic skin disorders like allergies or infections. According to an article published in the National Library of Medicine (NLM) in 2022, cefpodoxime antibiotic tablets were the most commonly prescribed medicine for skin infections, accounting for 18.8% of total prescriptions. This highlights the widespread reliance on oral antibiotics in treating dermatological conditions in animals.

Veterinary Dermatology Market, By Product Type

Based on product type, the market has been segmented into antiparasitic drugs, antifungal drugs, antibacterial drugs, monoclonal antibodies, and other product types. In 2024, the largest and fastest growing segment was the antiparasitic drugs. This large share and high CAGR is mainly attributed to the increasing incidences of parasites such as fleas, ticks, and mites, which are among the most identified dermatological conditions in animals. A 2023 survey on drug usage by veterinarians in Turkey, published by the National Institute of Health (NIH), reported frequent use of antiparasitic drugs in large animals (42.34%), cats and dogs (32.95%), small ruminants (21.09%), poultry (1.98%), and horses (0.82%). The increasing awareness among pet owners about parasitic skin conditions and their impact on animal health further contributes to the growth of this segment. According to a 2022 study by AnimalhealthEurope, the market for dog and cat parasiticides has grown from 31% to 34% over the last decade and is expected to increase by an additional 6% from 2022 to 2027. This emphasizes the rising demand for effective antiparasitic treatments in veterinary dermatology.

REGION

North America dominated the market in 2024

The veterinary dermatology market is segmented into five regions – North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest market share in 2024. This is mainly due to the growing pet population in developed countries like the US and Canada and the presence of top veterinary dermatology companies in the region. Higher pet healthcare expenditure, advanced veterinary infrastructure, and increased awareness about animal dermatological conditions are further driving the demand for veterinary dermatology products in the region. The surging number of veterinary professionals in North America also supports market growth. According to the Workforce Needs in Veterinary Medicine report by the National Academy of Sciences, the number of active veterinarians in the region was ~90,200 in 2012; it is projected to reach 108,900 by 2030. The expansion in veterinary practices is likely to enhance access to advanced diagnostic and therapeutic solutions, which is driving the demand for veterinary dermatology products in North America. In addition, advancements in veterinary dermatological treatments, such as monoclonal antibody therapies (e.g., Cytopoint) and innovative topical treatments, are fueling the market.

Veterinary Dermatology Market: COMPANY EVALUATION MATRIX

In the veterinary dermatology market, Zoetis Inc. (US) is recognized as a star player due to its strong product portfolio, extensive global presence, and robust business strategies such as partnerships and acquisitions. Bimeda, Inc. (Ireland), on the other hand, represents an emerging leader, focusing on product innovation and portfolio enhancement but with comparatively limited growth strategies and market reach.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 20.11 BN |

| Market Size in 2030 (Value) | USD 30.31 BN |

| CAGR | 8.5% |

| Years Considered | 2023−2030 |

| Base Year | 2024 |

| Forecast Period | 2025−2030 |

| Units Considered | Value (USD MN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America and Middle East and Africa |

WHAT IS IN IT FOR YOU: Veterinary Dermatology Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Comparison of veterinary dermatological products: Topical, Oral, Injectables | Helps clients identify the most suitable product type for different therapeutic and clinical procedures, supporting informed procurement and investment decisions |

| Company Information | Key players: Elanco Animal Health Incorporated (US), Merck & Co., Inc. (US), Virbac (France), Zoetis Inc. (US), Boehringer Ingelheim International GmbH (Germany); Top 3-5 players market share analysis at the country-level of the Asia Pacific and Europe | Provides clarity on competitive positioning and market dynamics, enabling benchmarking against leading players and evaluating partnership or expansion opportunities |

| Geographic Analysis | Further breakdown of the rest of Europe’s market into Austria, Finland, the Netherlands, and Switzerland, and the rest of Latin America’s market into Argentina, Colombia, and Chile | Delivers deeper regional insights, allowing clients to target niche markets and tailor regional strategies for higher market penetration |

RECENT DEVELOPMENTS

- November 2024 : Merck & Co., Inc. (US) received a European Commission grant for marketing authorization of BRAVECTO TriUNO, a new fluralaner formulation for dogs targeting internal and external parasites. The formulation has also been approved in Peru, Guatemala, Nicaragua, and Costa Rica

- November 2024 : Bimeda, Inc. (Ireland) expanded its antiparasitic portfolio with the launch of MoxiSolv Injection (moxidectin), the FDA-approved injectable available in a non-shattering 500 mL plastic bottle

- September 2024 : Norbrook (Ireland) invested USD 1.5 million to officially open the newly upgraded sterile injectable manufacturing site in Newry, Northern Ireland, to produce products that are critical in treating and preventing infections in livestock and pets

- July 2024 : Dechra Pharmaceuticals plc (UK) acquired Invetx (US), which specializes in developing protein-based therapeutics for chronic conditions in companion animals, with a focus on monoclonal antibodies (mAbs)

- November 2023 : Two of the US’s leading names in the pet industry, Adopt-A-Pet (US) and Zoetis Inc. (US), partnered to improve access to care for shelter pets, as well as to deploy educational resources for shelter veterinary healthcare teams and pet owners across the country

Table of Contents

Methodology

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the veterinary dermatology market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include project/sales/marketing/business development managers, presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, chief information officers, chief medical information officers related to the veterinary dermatology markets. Primary sources from the demand side include professionals from veterinary hospitals and clinics, academic & research institutes, pet owners and livestock farm owners.

A breakdown of the primary respondents is provided below:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Tiers are defined based on a company’s total revenue. As of 2023: Tier 1 = >USD 500 million, Tier 2 = USD 200 million to USD 500 million, and Tier 3 = < USD 200 million.

To know about the assumptions considered for the study, download the pdf brochure

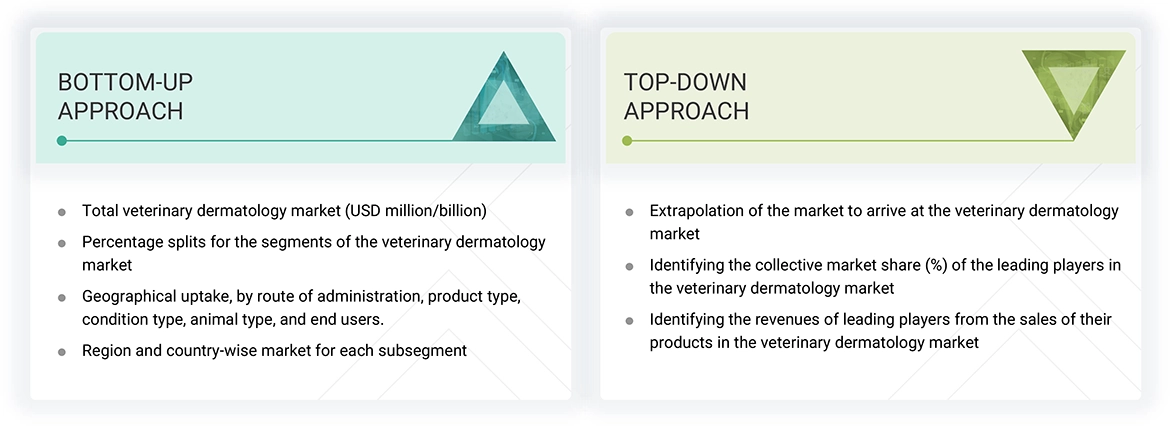

Market Size Estimation

The total size of the veterinary dermatology market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in the market engineering process.

Market Definition

Veterinary dermatology focuses on therapeutic products for managing dermatological conditions in animals, including allergies, infections, irritations, parasitic infestations, atopic dermatitis, skin cancer, and chronic skin disorders. It serves both companion and livestock animals with treatments like topical solutions, oral medications, and injectables. These products aim to treat various dermatological diseases and enhance the coat quality, skin health, and the overall well-being of the animal.

Stakeholders

- Manufacturing companies of veterinary dermatology products

- Distributors of products associated with veterinary dermatology diseases

- Veterinary hospitals and clinics

- Veterinary practitioners

- Veterinary consultants

- Medical research institutes

- Market research and consulting firms

- Venture capitalists and investors

- egulatory agencies and government bodies

Report Objectives

- To define, describe, and forecast the veterinary dermatology market by route of administration, product type, condition type, animal type, end user, and region

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, challenges, and industry trends, influencing the market growth

- To strategically analyze the regulatory scenario, value chain analysis, supply chain analysis, Porter’s Five Forces analysis, ecosystem analysis, trade analysis, pricing analysis, patent analysis, impact of AI on veterinary dermatology market, case study analysis, adjacent market analysis, unmet needs/end user expectations in veterinary dermatology market, and trends/disruption impacting customer business in the market

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically analyze the market in five regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To strategically profile the key players in this market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches and approvals, acquisitions, partnerships, collaborations, and expansions in the market

Key Questions Addressed by the Report

- By Route of administration

- By Product

- By Condition Type

- By Animal Type

- By End User

- By Region

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Veterinary Dermatology Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Veterinary Dermatology Market