Asia Pacific Facility Management Market

Asia Pacific Facility Management Market by Solution (Integrated Workplace Management, Building Information Modeling, Facility Operations & Security Management, Facility Environment Management, Facility Property Management) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Asia Pacific facility management market size is projected to grow from USD 14.6 billion in 2025 to USD 36.8 billion by 2030 at a CAGR of 20.3% during the forecast period. The market is driven by rapid urban growth, continued commercial construction, and rising investment in institutional infrastructure across both emerging and mature economies. Countries, including China, India, Japan, Australia, and several Southeast Asian markets, are experiencing higher demand for professional facility services as buildings and asset portfolios expand in scale. Facility management providers are increasingly involved in supporting offices, industrial sites, healthcare facilities, and transport-related infrastructure. Across the Asia Pacific region, facility operations are handled through a mix of outsourced services and internal teams. Digital systems are increasingly used to oversee activities spread across multiple sites. Awareness of cost control, service consistency, and regulatory compliance is further supporting market growth in both the public and private sectors.

KEY TAKEAWAYS

-

By OfferingThe solutions segment accounted for a 70.6% share in 2025.

-

By Facility Operations and Security MnagamentThe emergency and incident management segment is expected to register the highest CAGR of 21.3%.

-

By End UserThe government & public sector segment is projected to grow at the highest rate from 2025 to 2030.

-

Competitive LandscapeCompanies such as CBRE Group, Jones Lang LaSalle, and Johnson Controls were identified as some of the star players in the Asia Pacific facility management market, given their strong market share and product footprint.

One of the key developments influencing facility management in the Asia Pacific region is the growth of large mixed-use projects that combine offices, retail spaces, residential buildings, and transportation facilities. Major cities such as Shanghai, Mumbai, Jakarta, Bangkok, and Manila are continuing to expand in both scale and density, which increases the need for coordinated facility operations across different types of assets. Facility management providers are increasingly required to support high-traffic sites with complex utility systems and long operating hours. In many Asia-Pacific markets, new facilities are being developed from the ground up rather than being upgraded from older stock. This situation is creating demand for early involvement in facility planning, operational setup, and maintenance models that can scale as cities continue to grow.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the Asia Pacific, facility management plays a key role in keeping businesses running smoothly, supporting employees, and protecting physical assets in dense operating settings. Organizations across various sectors, including manufacturing, healthcare, utilities, and government, depend on structured facility services to maintain power stability, ensure safe operations, and keep critical equipment operational. In many fast-growing markets, uneven infrastructure makes routine maintenance and on-site monitoring more critical. As organizations grow their presence across cities and national markets, facility coordination increasingly needs to be managed at a central level. Consistent facility operations help reduce service interruptions, maintain predictable service standards, and support expansion across locations with different regulatory and infrastructure conditions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid growth of industrial and logistics facilities

-

Accelerated urbanization and expansion of commercial real estate

Level

-

Uneven maturity of facility management practices across countries

-

High reliance on manual processes in emerging economies

Level

-

Digital monitoring for large multi-site portfolios

-

Rising outsourcing of facility services by multinational enterprises

Level

-

Regulatory inconsistency across markets

-

Managing service standardization across culturally diverse markets

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid growth of industrial and logistics facilities

The Asia Pacific region is experiencing strong growth in manufacturing, warehousing, and logistics facilities driven by e-commerce and regional supply chain expansion. These facilities require structured maintenance, effective safety management, and operations focused on uptime. As asset values rise, owners are increasingly relying on professional facility management services to protect their long-term performance. Industrial clients often require standardized processes across multiple sites, resulting in a steady demand for outsourced services. This trend is particularly visible in China, India, Southeast Asia, and Australia, supporting sustained market growth.

Restraint: Uneven maturity of facility management practices across countries

The level of facility management adoption differs significantly across the Asia Pacific markets. In developed economies, outsourcing models are already in place, while in many emerging countries, services are still managed in-house or through multiple local vendors. The benefits of professional facility management are not always well understood, which has slowed adoption, especially among small and mid-sized building owners. Inconsistent service expectations and pricing sensitivity further constrain market development. This uneven maturity makes it difficult for regional providers to deploy uniform service models and technology platforms.

Opportunity: Digital monitoring for large multi-site portfolios

Large enterprises in the Asia Pacific increasingly manage geographically dispersed facility portfolios. Digital monitoring platforms allow centralized oversight of energy use, equipment health, and service performance. This creates an opportunity for facility management providers to offer scalable, technology-enabled services without heavy on-site staffing. Sectors such as retail, banking, and telecom are early adopters. Providers that can demonstrate measurable improvements in uptime and operating efficiency are well positioned to win long-term contracts.

Challenge: Regulatory inconsistency across markets

Asia Pacific includes multiple regulatory environments with differing safety, labor, and building standards. Facility managers must adapt service delivery to local rules, increasing complexity and compliance risk. Cross-border contracts require careful localization, which raises costs and limits the speed of deployment. This challenge is structural and is unlikely to disappear in the near term. Providers must balance regional scale with local compliance expertise to remain competitive.

ASIA PACIFIC FACILITY MANAGEMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides smart facility management services for Schneider Electric’s manufacturing and office sites in Southeast Asia, integrating energy analytics, asset monitoring, and sustainability reporting. | Reduces energy intensity, improves asset visibility, and supports decarbonization goals. |

|

Delivers integrated facility management for large IT parks and technology campuses in Bengaluru and Hyderabad, serving multinational technology firms. | Improves service quality, enhances safety performance, and lowers total cost of operations. |

|

Manages facilities for AEON Group’s retail malls and healthcare properties across Japan, focusing on preventive maintenance, hygiene management, and energy efficiency. | Enhances customer experience, ensures safety compliance, and improves operational reliability. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific facility management ecosystem comprises solution providers, service providers, and regulatory bodies that support day-to-day building operations across a wide range of facilities. Service providers such as CBRE, Aramark, and Sodexo deliver integrated hard and soft services supported by data-driven maintenance and energy optimization tools. Solution providers, including ISS, AEON Delight, Aden Group, Tenon Group, CBRE, and Trimble, supply Computer-Aided Facility Management (CAFM) and Integrated Workplace Management System (IWMS) platforms. While regulatory organizations, including the Japan Industrial Safety & Health Association (JISHA), influence safety and building performance standards.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Facility Management Market, By Solution

Environmental management solutions in the Asia Pacific are widely used to address practical operating issues in dense urban areas. Large cities face ongoing pressure to manage indoor air quality, waste handling, water use, and energy reliability across commercial and public buildings. To address these needs, facility teams rely on monitoring systems to control ventilation, maintain stable temperatures, and track utility consumption in high-occupancy spaces. Concerns around air quality, extreme weather events, power stability, and rising utility costs have further increased dependence on such systems. In dense environments, weak environmental performance can quickly disrupt operations or affect occupant health.

Asia Pacific Facility Management Market, By Facility Property Management

Space and reservation systems across the Asia Pacific are largely shaped by dense workplaces and frequent use of shared facilities. Large enterprises, technology parks, universities, and business hubs rely on these tools to organize access to meeting rooms, training spaces, parking, and common work areas. Reservation platforms help facility teams manage peak usage, ease congestion, and align services with flexible seating and shift-based work models. In countries such as India, China, and those in Southeast Asia, the focus is less on reducing office space and more on utilizing existing space more efficiently. Uptake is strongest in corporate campuses, coworking locations, and education environments where space demand changes throughout the day.

REGION

Southeast Asia is expected to be the fastest-growing region in the Asia Pacific facility management market during the forecast period.

Southeast Asia is expected to emerge as the fastest-growing region within the Asia Pacific facility management market during the forecast period. This growth is largely linked to ongoing commercial construction, steady urban expansion, and a rising preference for outsourcing building operations. Countries such as Singapore, Indonesia, Vietnam, Thailand, and Malaysia are experiencing a surge in demand for professional facility services across offices, industrial parks, data centers, and mixed-use properties. Increasing foreign investment and the growth of regional headquarters are pushing organizations to adopt more consistent and compliance-driven facility practices. At the same time, wider use of digital tools for asset visibility, maintenance scheduling, and energy tracking is supporting market expansion, as building owners place greater emphasis on cost discipline, service reliability, and operational continuity.

ASIA PACIFIC FACILITY MANAGEMENT MARKET: COMPANY EVALUATION MATRIX

In the Asia Pacific facility management market company evaluation matrix, CBRE Group (Star) leads with a strong market share and large service footprint. The company offers a comprehensive range of integrated services, including facilities operations, project delivery, and workplace support, which are widely utilized across multi-site portfolios. Sodexo is placed in the emerging leader category and is expanding through sector-focused services in healthcare, education, and government facilities. While CBRE benefits from scale and broad outsourcing coverage, Sodexo’s growth is supported by its operational specialization and long-term service contracts.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Aden Group (Singapore)

- CBRE Group (US)

- AEON Delight Group (Japan)

- Sodexo S.A (France)

- Tenon Group (India)

- DTSS Facility Services (India)

- InnoMaint (India)

- QuickFMS (India)

- CPG Corporation (Singapore)

- Savills Singapore Pte Ltd (Singapore)

- Downer Group (Australia)

- Hive Japan K.K. (Japan)

- Nouvel Facilities Pvt Ltd (India)

- Colliers International (Canada)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 12.7 Billion |

| Market Forecast in 2030 (Value) | USD 36.8 Billion |

| Growth Rate | CAGR of 20.3% during 2025-2030 |

| Years Considered | 2017-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific |

WHAT IS IN IT FOR YOU: ASIA PACIFIC FACILITY MANAGEMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Company Information | Detailed analysis and profiling of additional market players (up to 5) |

|

RECENT DEVELOPMENTS

- July 2024 : Sodexo announced the extension of multiple facilities management and workplace services contracts across Asia Pacific, supporting healthcare, education, and corporate clients.

- May 2024 : Aden Group announced the expansion of its integrated facility management operations in Southeast Asia, focusing on energy management, industrial site services, and sustainability-led facility management delivery for multinational clients.

- April 2024 : AEON Delight reported the expansion of facility management services for large commercial and retail properties in Japan and Southeast Asia, with emphasis on building maintenance and energy-saving operations.

Table of Contents

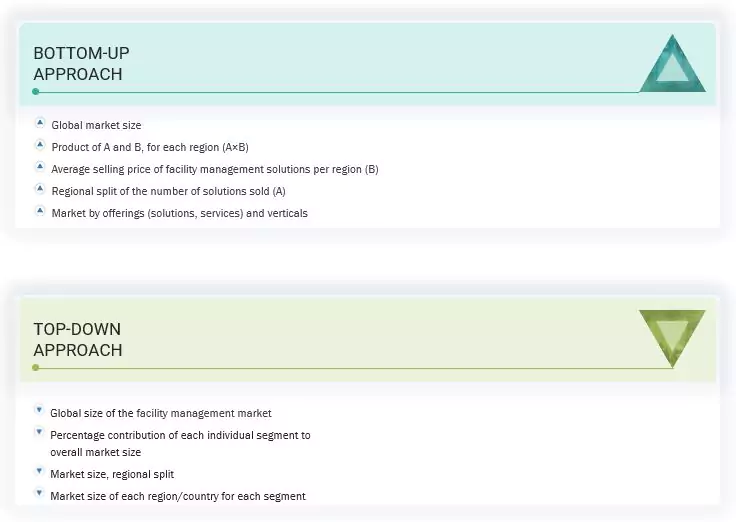

Methodology

The research study involved four major activities in estimating the Asia Pacific facility management market size. Exhaustive secondary research has been done to collect essential information about the market and peer markets. The next step was to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. The top-down and bottom-up approaches were used to estimate the market size. After the market breakdown, data triangulation was utilized to estimate the sizes of segments and sub-segments.

Secondary Research

The market size of the companies offering Asia Pacific facility management solutions to various end users was determined based on the secondary data available through paid and unpaid sources, analyzing the product portfolios of major companies in the ecosystem, and rating the companies based on their performance and quality. In the secondary research process, various sources were referred to identify and collect information for the study. These include annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Secondary research was mainly used to obtain critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation based on the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from Asia Pacific facility management solutions vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from platforms and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use Asia Pacific facility management solutions, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their use of Asia Pacific facility management solutions which is expected to affect the overall Asia Pacific facility management market growth.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Asia Pacific facility management market. These methods were also used extensively to estimate the size of various subsegments in the market.

Asia Pacific Facility Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

The Asia Pacific facility management market was split into several segments and sub-segments after determining the overall market size from the above estimation process. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were used, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. The Asia Pacific facility management market size was validated using top-down and bottom-up approaches.

Market Definition

According to IBM, facility management can be defined as the tools and services that support the functionality, safety, and sustainability of buildings, grounds, infrastructure, and real estate. Asia Pacific facility management includes lease management (lease administration and accounting), capital project planning and management, maintenance and operations, energy management, occupancy and space management, employee and occupant experience, emergency management and business continuity, and real estate management.

BOMI Institute defines Asia Pacific facility management as the process of coordinating the physical workplace with the people and work of an organization. The primary function of Asia Pacific facility management is to plan, establish, and maintain a work environment that effectively supports the goals and objectives of the organization.

Stakeholders

- Asia Pacific facility management solution providers

- Managed service providers

- Integration service providers

- Cloud service providers

- Asia Pacific facility management service providers

- Building automation solution providers

- Architects, engineers, and contractors

- Consultancy firms and advisory firms

- Regulatory agencies

- Technology consultants

- Governments

Report Objectives

- To determine, segment, and forecast the Asia Pacific facility management market by offering, solution, service, vertical, and region in terms of value

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing market growth

- To study the complete value chain and related industry segments, and perform a value chain analysis of the Asia Pacific facility management market landscape

- To strategically analyze the macro and micro markets concerning individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the Asia Pacific facility management market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North America market into countries contributing 75% to the regional market size

- Further break-up of the Latin America market into countries contributing 75% to the regional market size

- Further break-up of the Middle East & African market into countries contributing 75% to the regional market size

- Further break-up of the Europea market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Facility Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Facility Management Market