AR Glass Market Size, Share & Trends

AR Glass Market by Standalone AR Glass, Tethered AR Glass, Markerless Augmented Reality, Marker-based Augmented Reality, Display, Sensor, Lens, Processor & Memory, Controller, Camera, Case & Connector and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The AR glass market is anticipated to grow from USD 0.98 billion in 2025 to USD 9.98 billion by 2030, at a CAGR of 59.0%. Increasing adoption in industrial and enterprise environments, rapid advancements in display and sensor technologies, and rising investments from leading technology companies are key factors driving the growth of the AR glass market. In addition, expanding applications in healthcare, aerospace, and defense industries, and the integration with AI and emerging technologies are expected to provide ample opportunities for payers in the AR glass market.

KEY TAKEAWAYS

-

BY COMPONENTThe AR glass market is segmented into displays, sensors, lenses, processors & memory controllers, cameras, cases & connectors, and other components. Displays are estimated to account for the largest share, driven by advancements in microdisplay technologies, high resolution, and energy-efficient designs suitable for both consumer and industrial applications. Increasing demand for compact and lightweight AR glasses with high visual clarity is fueling growth across other component categories as well.

-

BY TECHNOLOGYThe market is categorized into marker-based AR and markerless AR, with markerless AR capturing the largest share. This growth is propelled by enhanced user experience, the ability to operate in diverse environments without reliance on predefined markers, and increasing adoption in enterprise, healthcare, and commercial applications.

-

BY CONNECTIVITYAR glasses are segmented into tethered and standalone types. Standalone AR glasses dominate the market, supported by improvements in embedded processors, battery life, and wireless communication standards that allow untethered usage for industrial, commercial, and consumer applications.

-

BY APPLICATIONThe market is divided into consumer, commercial, enterprise & industrial, healthcare, aerospace & defense, automotive, energy, and other applications. Enterprise & industrial applications are set to account for the largest share, driven by use cases such as remote assistance, training, maintenance, and productivity enhancements across manufacturing, logistics, and field services.

-

BY REGIONThe AR glass market is segmented into North America, Europe, Asia Pacific, and Rest of the World (RoW). North America is estimated to dominate the market, supported by high technology adoption, robust digital infrastructure, strong enterprise use cases, and the presence of key AR hardware and software providers.

-

COMPETITIVE LANDSCAPEKey players in the AR Glass market include XReal, Inc. (China), Magic Leap, Inc. (US), Microsoft Corporation (US), Seiko Epson Corporation (Japan), and Rokid (US). These companies are actively focusing on developing lightweight, high-performance AR glasses with advanced optics, improved display brightness, and seamless spatial computing capabilities. Continuous innovation in microdisplay integration, AI-based user interaction, and edge processing is driving product differentiation. Strategic partnerships with enterprise clients and ecosystem collaborations with software developers and component suppliers are further strengthening their market presence and enhancing user experience across consumer and industrial applications.

The AR glass market is expected to experience robust growth in the coming years, driven by the rising adoption of augmented reality across consumer, enterprise, and industrial sectors. Increasing demand for lightweight, high-performance smart glasses with advanced optical engines, high brightness, and improved field of view is fueling market expansion. The integration of AI, spatial computing, and 5G connectivity is enhancing user experience and enabling real-time data visualization for applications in manufacturing, healthcare, logistics, and defense. Growing investments in immersive enterprise solutions, digital transformation initiatives, and hands-free computing are further accelerating adoption. As a key enabler of the next wave of extended reality (XR) applications, AR glass technology is poised to transform how users interact with digital content in both professional and everyday environments.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The AR glass market is evolving rapidly as industries transition from conventional screens and handheld devices to immersive, hands-free interfaces powered by augmented reality. Rising demand for operational efficiency, remote collaboration, and enhanced user experience drives the adoption across industrial, healthcare, defense, and enterprise sectors. Players such as XREAL, Inc. (China), Magic Leap Inc. (US), Microsoft (US), Seiko Epson Corporation (Japan), and Rokid (China) are spearheading this transformation by launching lightweight, high-resolution AR glasses equipped with spatial computing capabilities, AI integration, and seamless connectivity with mobile and cloud-based platforms. These innovations enable real-time data overlays, interactive training, and smart collaboration in fieldwork and on-site operations. The market shift aligns with a broader digital transformation trend, where AR wearables are vital in enabling smarter workflows and safer work environments. As more enterprises modernize their infrastructure, the demand for scalable and ergonomic AR solutions continues to rise, opening new growth opportunities across developed and emerging regions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing adoption of AR in industrial and enterprise applications

-

Rapid advances in display and sensor technologies

Level

-

High costs of AR devices

-

Privacy and security concerns

Level

-

Expanding applications in healthcare and aerospace & defense industries

-

Integration with AI and emerging technologies

Level

-

Lack of robust and scalable software ecosystem

-

Latency and real-time performance barriers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing adoption of AR in industrial and enterprise applications

AR glasses are rapidly gaining traction in industrial and enterprise environments due to their ability to enhance productivity, accuracy, and safety. In manufacturing, logistics, and utilities, they provide hands-free access to data, real-time collaboration, and visual overlays for maintenance and training. Integration with IoT and enterprise platforms further optimizes workflows, reducing downtime and errors. As digital transformation accelerates, enterprise adoption of AR glasses continues to expand globally.

Restraint: High costs of AR devices

The high cost of AR glasses remains a major barrier to mass adoption, primarily due to expensive components such as sensors, processors, and microdisplays. Additional costs arise from software customization, system integration, and maintenance. These expenses limit affordability for small and mid-sized enterprises. Until economies of scale are achieved and component prices fall, adoption will remain concentrated in high-value sectors such as defense, manufacturing, and industrial training.

Opportunity: Integration with AI and emerging technologies

Integrating augmented reality (AR) glasses with artificial intelligence (AI) is significantly expanding their functionality across industrial and consumer applications. AI-driven features such as object recognition, real-time task guidance, and voice command interaction make AR glasses more intuitive and efficient. For instance, Vuzix’s 2025 partnership with Germany-based AI startup Rambir introduced AI task assistants for its M400 glasses, improving accuracy and task completion speed. Similarly, Meta’s Orion AR glasses demonstrated AI-enabled contextual assistance, showcasing how AI integration enhances usability, productivity, and human-computer interaction across diverse environments.

Challenge: Lack of robust and scalable software ecosystem

A limited and fragmented AR software ecosystem remains a major challenge in the AR glass market. Unlike established mobile platforms, many AR devices rely on proprietary operating systems with fewer developers and minimal third-party support. Building AR-specific applications demands expertise in 3D modeling, spatial computing, and real-time rendering, increasing development costs and timelines. Even advanced devices like Magic Leap 2 have struggled due to a lack of engaging content and limited enterprise software ecosystems. Without a mature, developer-friendly AR platform, innovation and large-scale adoption remain constrained, slowing market expansion.

AR Glass Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses AR glasses to guide technicians during complex aircraft wire assembly, displaying 3D wiring diagrams and step-by-step instructions directly in the worker’s field of view | Reduces wiring time by up to 25%, minimizes human error, and enhances worker efficiency and training accuracy |

|

Employs AR glasses for remote maintenance and quality inspections in manufacturing plants, allowing experts to assist on-site technicians through live AR annotations | Decreases machine downtime, improves inspection precision, and reduces travel costs for technical support teams. |

|

Integrates AR glasses for vehicle assembly and logistics operations, providing visual instructions and real-time component positioning to line workers | Improves assembly accuracy, reduces rework, and enhances production line throughput and safety |

|

Deploys AR smartglasses in warehouses for “vision picking,” where workers receive item locations and picking lists through head-up displays | Increases order-picking speed by 15–20%, minimizes manual errors, and improves worker ergonomics |

|

Uses AR glasses for remote client demonstrations and immersive training sessions, allowing teams to visualize digital twins and simulated environments in real-time | Boosts client engagement, reduces training costs, and enables interactive collaboration across global teams |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The AR glass ecosystem comprises R&D institutes/universities/labs, hardware component providers, software providers, and AR glass manufacturers. Major players operating in the AR glass market with a significant global presence include XReal, Inc. (China), Magic Leap, Inc. (US), Microsoft (US), Seiko Epson Corporation (Japan), Rokid (US), MEIZU (China), RealWear Inc. (US), RayNeo (China), Red Six Aerospace, Inc. (US), and Hong Kong Lawaken Technology Limited (China).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AR Glass Market, by Technology

The markerless AR segment is estimated to lead due to its ability to deliver dynamic, context-aware visualization without the need for physical markers. This technology supports spatial mapping and object tracking, enabling hands-free operation in complex industrial and healthcare environments. Markerless AR is gaining strong traction in enterprise applications for training, inspection, and remote assistance. Meanwhile, marker-based AR remains relevant in controlled scenarios such as retail demonstrations and education. Continuous advances in AI, SLAM, and 3D modeling are enhancing AR glasses’ accuracy, interactivity, and adaptability across diverse environments.

AR Glass Market, by Component

AR glass displays are set to lead, driven by the rapid advancements in microdisplay technologies such as OLED-on-silicon (OLEDoS) and MicroLED. These displays offer superior brightness, resolution, and contrast, making them suitable for both consumer and enterprise AR applications. The demand for compact, lightweight, and power-efficient display modules is accelerating as manufacturers focus on improving visual clarity and comfort. Other components, such as sensors, lenses, cameras, and processors, are also evolving, integrating AI and computer vision capabilities to enable real-time environmental interaction and seamless user experiences.

AR Glass Market, by Connectivity

Standalone AR glasses dominated the market, attributed to their independence from external computing devices and growing hardware sophistication. Standalone AR glasses integrate onboard processors, batteries, and sensors, providing a seamless, untethered user experience. These glasses are widely adopted in enterprise and defense applications, where mobility and ease of use are critical. Tethered models continue to find use in consumer entertainment and design visualization, where high performance and real-time rendering are priorities. Continuous improvements in wireless connectivity, battery efficiency, and on-device computing are propelling standalone AR glass adoption.

AR Glass Market, by Application

The enterprise & industrial segment application of AR glass is estimated to lead, fueled by demand across manufacturing, logistics, energy, and utilities. AR glasses enhance workforce productivity by enabling real-time data visualization, remote guidance, and immersive training. Consumer adoption is also growing, driven by entertainment, navigation, and lifestyle applications. The healthcare sector increasingly uses AR glasses for surgical assistance and patient care visualization, while defense and automotive industries leverage them for simulation and operational efficiency. The growing integration of AR glasses with AI, IoT, and digital twin technologies is expanding their application scope globally.

REGION

Asia Pacific to be fastest-growing region in global near-eye display market during forecast period

Asia Pacific is projected to emerge as the fastest-growing region in the AR Glass market, driven by the rapid adoption of augmented reality technologies across China, Japan, South Korea, and India. Strong demand for AR glasses in manufacturing, logistics, healthcare, and defense is supported by government initiatives promoting digital transformation, Industry 4.0, and smart infrastructure. China’s robust electronics and optical component manufacturing base, Japan’s leadership in consumer and industrial innovation, South Korea’s thriving entertainment and gaming ecosystem, and India’s expanding enterprise digitalization initiatives are key growth contributors. Additionally, strategic collaborations between AR glass manufacturers, semiconductor suppliers, and software developers are accelerating product innovation and strengthening the region’s position as a global hub for AR technology development.

AR Glass Market: COMPANY EVALUATION MATRIX

In the AR Glass market matrix, XREAL, Inc. (China) leads with a strong market presence, offering high-performance smart glasses with advanced optics, AI-assisted features, and standalone operation capabilities. XREAL’s comprehensive ecosystem, combined with strategic collaborations with enterprise and consumer AR developers, positions it as a dominant force driving large-scale adoption of AR glasses globally. MEIZU (China), as an emerging leader, is gaining traction with innovative lightweight AR glasses and integrated software solutions. While XREAL dominates through product performance and enterprise partnerships, MEIZU demonstrates strong potential to move toward the leaders’ quadrant by scaling its hardware innovations and expanding adoption across consumer and industrial applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size, 2024 (Value) | USD 1.09 Billion |

| Market Forecast, 2030 (Value) | USD 9.98 Billion |

| Growth Rate | CAGR of 59.0% from 2025 to 2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Rest of the World |

WHAT IS IN IT FOR YOU: AR Glass Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| AR Glass Manufacturers |

|

|

| Enterprise & Industrial Solution Providers |

|

|

| Component & Optics Suppliers |

|

|

| AR Software & Content Developers |

|

|

| Investors & Venture Capital Firms |

|

|

RECENT DEVELOPMENTS

- May 2025 : RayNeo launched its flagship X3 Pro AR glasses at the “See the Extraordinary” event in China. Powered by the Qualcomm AR1 platform, the X3 Pro features a cinematic 43-inch full-color 3D display enabled by nano-lithography waveguides and RayNeo’s proprietary micro-LED light engine.

- January 2024 : RayNeo unveiled its X2 Lite AR glasses at CES 2024, marking their official debut following a preview at the Qualcomm Snapdragon Summit 2023. Designed for consumer use, the glasses feature full-color 3D AR visuals and advanced AI integration in an ultra-light form factor.

- May 2023 : Rokid launched its latest consumer AR glasses, Rokid Max, positioned as a high-performance virtual display device. Featuring 1080p micro-OLED displays with a 120Hz refresh rate and a 50° field of view, the glasses offer an immersive viewing experience equivalent to a 215-inch screen from 19 feet away. They support 3D mode and include manual diopter adjustments for users with vision needs.

Table of Contents

Methodology

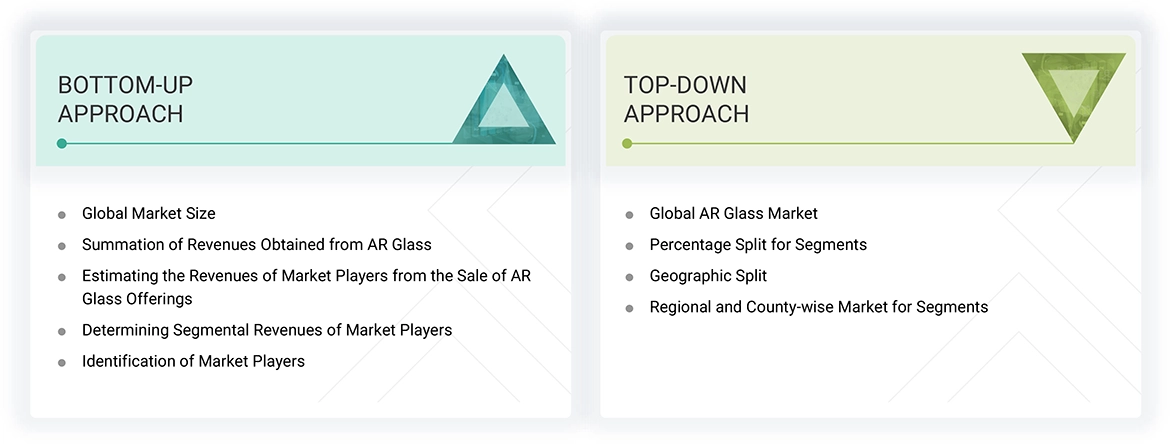

The research study involved four major activities in estimating the size of the AR glass market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to to identify and collect information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from market and technology perspectives.

In the AR glass market report, the global market size has been estimated using the top-down and bottom-up approaches, along with several other dependent submarkets. Major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

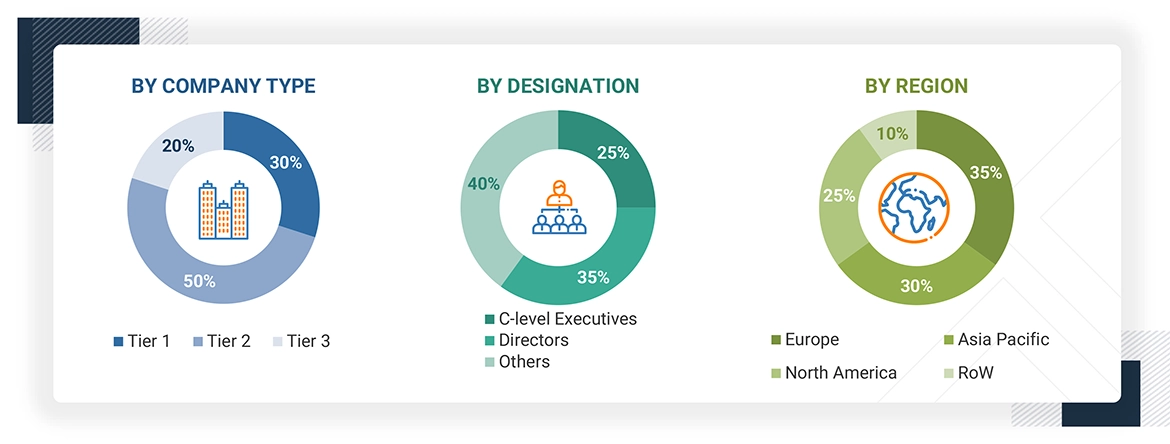

Primary Research

Extensive primary research has been conducted after understanding the AR glass market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from the demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data was collected mainly through telephonic interviews, which comprised 80% of the total primary interviews; questionnaires and emails were also used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the primary research findings. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report.

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches and data triangulation methods have been used to estimate and validate the size of the AR glass market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying top-line investments and spending in the ecosystem, and considering segment-level splits and major market developments

- Identifying different stakeholders in the AR glass market that influence the entire market, along with participants across the supply chain

- Analyzing major manufacturers in the AR glass market and studying their product portfolio

- Analyzing trends related to the adoption of AR glass products

- Tracking recent and upcoming market developments, including investments, R&D activities, product launches, expansions, acquisitions, partnerships, collaborations, agreements, and investments, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of AR glasses.

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

AR Glass Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall AR glass market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data was triangulated by studying various factors and trends from the perspectives of demand and supply. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

Augmented reality (AR) glass encompasses wearable technology, such as smart eyewear or head-mounted displays (HMDs), designed to overlay digital elements onto the real-world environment. These devices offer interactive, real-time visualizations, enabling users to engage with their surroundings while seamlessly accessing digital content without using their hands.

The AR glass market comprises eyewear, smart glasses, and HMDs, available as tethered or standalone systems. These solutions are deployed in diverse use cases, such as remote support, equipment maintenance, surgical procedures, warehouse operations, design validation, training environments, and defense applications. By improving operational efficiency, situational awareness, and decision-making, AR Glass is revolutionizing workflows across industries such as healthcare, manufacturing, logistics, retail, automotive, and defense. As organizations increasingly invest in digital transformation, AR glass is an essential interface bridging the physical and digital worlds.

The AR glass market is segmented based on connectivity, component, technology, application, and region. In terms of connectivity, AR glasses are categorized into tethered and standalone types. Tethered glasses rely on external devices such as smartphones or PCs, while standalone glasses have built-in processors and operate independently. The component segment includes displays, sensors, lenses, processors & memory, controllers, cameras, cases, connectors, and other related parts. For technology, the market is divided into marker-based AR and markerless AR. Marker-based AR uses visual markers to trigger digital content, whereas markerless AR operates without markers, using environmental understanding. The application segment covers various sectors, such as consumer, commercial, enterprise, healthcare, aerospace and defense, automotive, energy, and other fields. This segmentation helps understand how AR glasses are used across different industries and how their components and technologies vary based on specific needs.

Key Stakeholders

- AR Glass Manufacturers

- Component Suppliers

- Software & Platform Developers

- Application Developers & Integrators

- End-use Industries (Buyers/Users)

- Distributors & Channel Partners

- Research Institutions & Standard Bodies

- Technology Investors

- Government, Financial Institutions, and Investment Communities

Report Objectives

- To describe and forecast the overall AR glass market, by connectivity, component, technology, and application in terms of value

- To forecast the market, by connectivity, in terms of volume

- To describe different types of AR glasses, namely, head-mounted and eyewear

- To describe and forecast the market for four key regions: North America, Europe, Asia Pacific, and RoW, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the supply chain of the AR glass ecosystem, along with the average selling prices of the product type

- To strategically analyze the ecosystem, Porter’s five forces, key stakeholders & buying criteria, technology analysis, investment and funding scenario, key conferences & events, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market

- To analyze the impact of AI/Gen AI and the US tariff on the AR glass market

- To analyze competitive developments, such as product launches, expansions, partnerships, and collaborations, in the market

- To strategically profile the key players in the market and comprehensively analyze their market ranking and core competencies

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and RoW

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What was the global AR glass market size in 2024, and at what CAGR will it grow during the forecast period?

The AR glass market was valued at 1.09 billion in 2024 and is projected to reach USD 9.98 billion by 2030, at a CAGR of 59.0% from 2025 to 2030.

Who are the key players in the global AR glass market?

XReal, Inc. (China), Magic Leap, Inc. (US), Microsoft (US), Seiko Epson Corporation (Japan), and Rokid (US) are the key market players.

Which region is expected to hold the largest market share in 2025 and why?

North America is expected to hold the largest market share in the AR glass market due to strong enterprise adoption, technological leadership, and significant defense sector investments. US-based companies, including Microsoft, Magic Leap, RealWear Inc., Rokid, and Red Six Aerospace, are at the forefront of AR innovation, supported by government initiatives, such as IVAS and funding from agencies such as DARPA and NSF.

What are the primary forces fueling growth and the significant opportunities within the AR glass market?

Rising enterprise adoption, hands-free operational needs, and rapid advancements in display and sensor technologies drive the AR glass market. Major tech firms are investing heavily in scaling adoption. Opportunities lie in expanding use across healthcare, aerospace, and defense, alongside AI integration and remote collaboration tools, paving the way for broader, cross-industry deployment and intelligent AR solutions.

What are the prominent strategies adopted by market players?

Key players adopt strategies such as product launches, acquisitions, collaborations, partnerships, investments, agreements, and expansions to strengthen their position in the AR glass market.

What is the impact of Gen AI/AI on the AR glass market on a scale of 1–10 (1 - least impactful and 10 - most impactful)?

The impact is as follows: Smarter Real-Time Object Recognition & Context Awareness 9 Voice, Gesture, and Eye-Tracking AI Models for Natural UX 8 Faster and More Efficient Content Generation at Scale 7 Personalized User Experiences Through Gen AI 6

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AR Glass Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AR Glass Market