Asia Pacific Access Control Market

Asia Pacific Access Control Market by Offering (Hardware - Card-based, Biometric, & Multi-technology Readers, Electronics Locks, Controllers; Software; Services), ACaaS (Hosted, Managed, Hybrid), Vertical, and Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

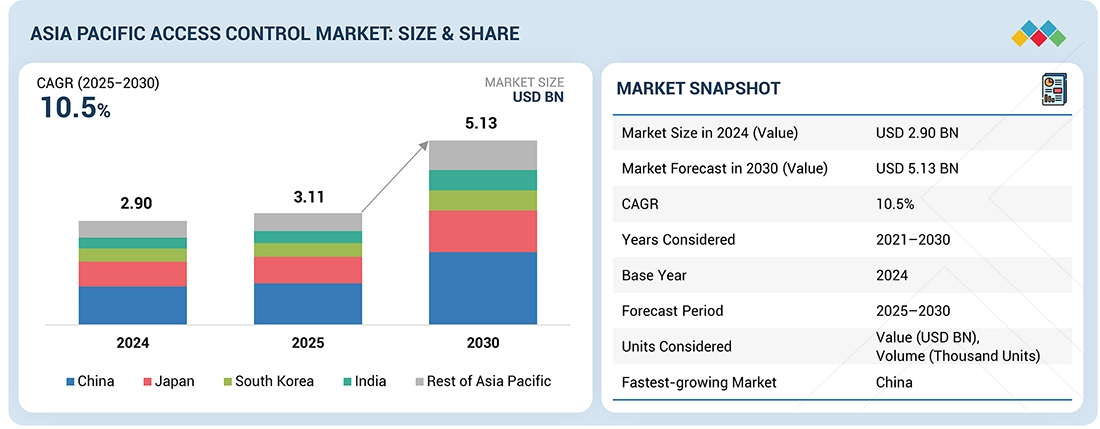

The Asia Pacific access control market is projected to reach USD 5.13 billion by 2030 from USD 3.11 billion in 2025, at a CAGR of 10.5% from 2025 to 2030. Asia Pacific access control market is experiencing robust growth driven by rapid urbanization, rising demand for security systems in smart-city and infrastructure projects across countries like India and China, and increasing adoption of biometric, cloud- and AI-enabled access solutions.

KEY TAKEAWAYS

-

BY COUNTRYBy country, China is expected to dominate the market, growing at a CAGR of 11.8% during the forecast period.

-

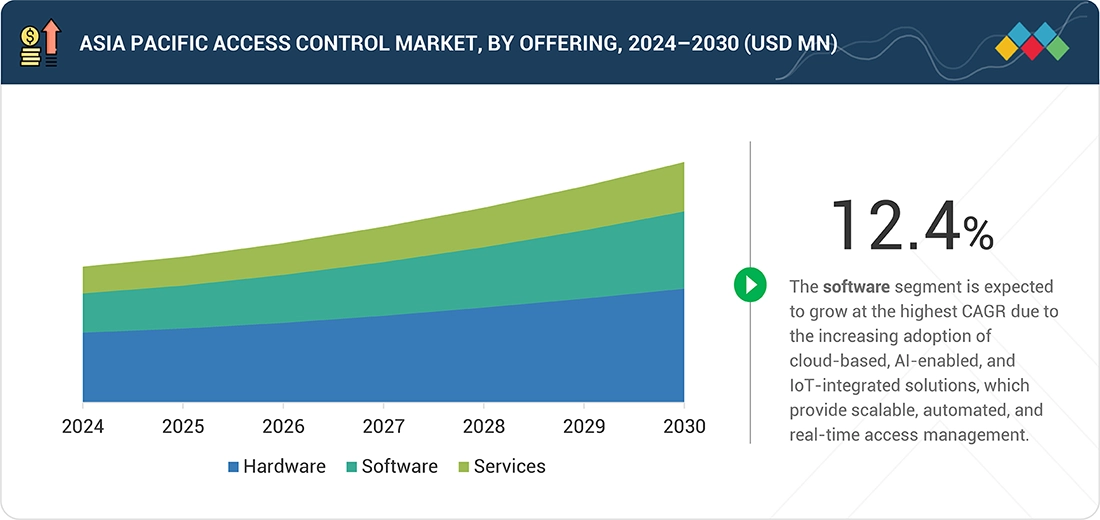

BY OFFERINGBy offering, the software segment is expected to register the highest CAGR of 12.4%.

-

ACCESS CONTROL AS A SERVICEBy access control as a service, the hybrid segment is projected to grow at the fastest rate from 2025 to 2030.

-

BY VERTICALBy vertical, the commercial segment will hold the largest market share in 2030.

-

COMPETITIVE LANDSCAPEASSA ABLOY (Sweden), dormakaba Group (Switzerland), and Johnson Controls (Ireland) were identified as some of the star players in the Asia Pacific access control market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPEForcefield Security (Australia) and Cansec Systems Ltd. (Canada), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Countries such as China, Japan, and South Korea are major players in the Asia Pacific access control market. This growth is driven by factors like rapid urbanization, smart city initiatives, and an increase in both commercial and residential infrastructure development. Additionally, there is a rising adoption of advanced access solutions, including biometric systems, cloud-based technologies, and AI-enabled solutions. These nations are also experiencing increased investments in security technologies from both enterprises and governments, which further supports market expansion throughout the region.

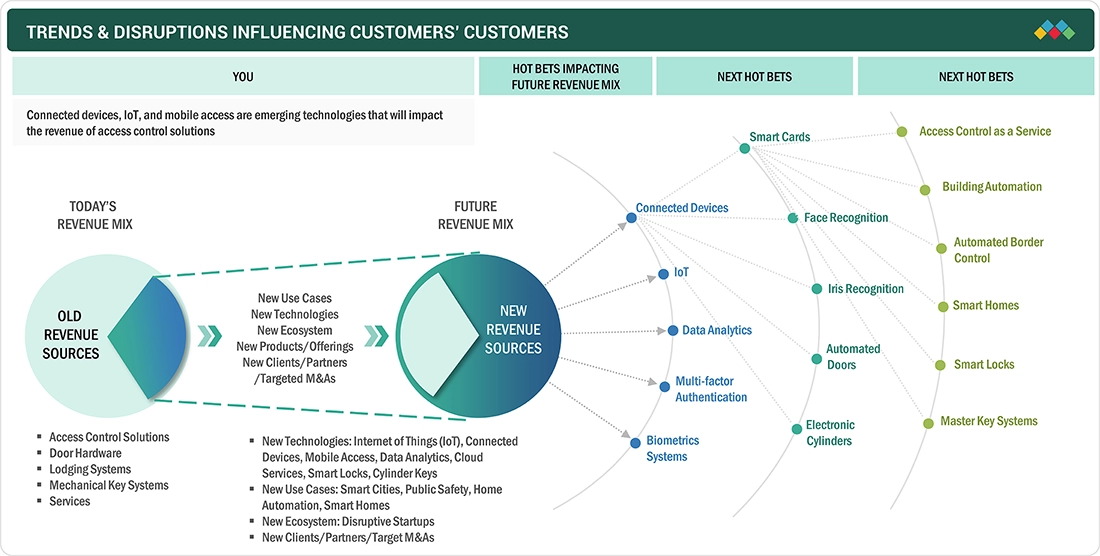

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Asia Pacific access control market is experiencing a rapid transformation, with future revenue increasingly driven by emerging technologies. While traditional solutions currently account for around 20% of the market, innovations such as IoT-enabled systems, connected devices, mobile access, cloud services, data analytics, and smart locks are expected to generate 80% of future revenue. Key growth segments include biometrics, multi-factor authentication, and automated doors, supporting applications across smart cities, residential automation, public safety, and commercial infrastructure. This shift is further accelerated by the rise of disruptive startups, strategic collaborations, and evolving technology ecosystems, positioning the region to adopt next-generation access control solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing awareness about home security

-

Rising number of smart infrastructure and smart city projects

Level

-

High installation, maintenance, and ownership costs of access control systems

-

Security and privacy concerns related to unauthorized access and data breaches in access control environments

Level

-

Rapid urbanization in emerging countries

-

Adoption of ACaaS as cost-effective and flexible solution

Level

-

Low awareness among users about availability and benefits of advanced security solutions

-

Availability of free access control services

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing awareness about home security

Growing awareness of home security across Asia Pacific is driving strong adoption of advanced access control solutions. Rising concerns about burglary, rapid urbanization, and increasing use of smart home ecosystems are fueling demand for mobile-enabled locks, video doorbells, and biometric systems. Telecom operators and home automation providers increasingly bundle access control into subscription-based security offerings, strengthening residential market growth across countries like China, Japan, South Korea, and India.

Restraint: High installation, maintenance, and ownership costs of access control systems

High installation and ownership costs remain a significant restraint in the Asia Pacific access control market. Advanced hardware such as biometric scanners, wireless controllers, and electrified locks raises initial capex, while cloud licensing, cybersecurity upgrades, and recurring maintenance add to long-term expenses. Retrofitting older buildings common in parts of Southeast Asia further increases cost barriers, discouraging SMEs and budget-sensitive institutions from adopting enterprise-grade access systems.

Opportunity: Rapid urbanization in emerging countries

Rapid urbanization, massive infrastructure development, and modernization of commercial complexes, hospitals, industrial parks, and transport hubs present major opportunities for access control vendors. Smart city programs, rising construction of data centers, and growing digitalization of building management systems are driving demand for advanced identity solutions. Increasing focus on safety, compliance, and centralized access monitoring further strengthens market potential in the region.

Challenge: Availability of free access control services

The growing availability of free or low-cost access control and visitor management apps presents a challenge in the Asia Pacific market, especially for startups and small businesses. While these solutions offer basic functionality, they often lack the cybersecurity safeguards, encrypted credentials, multi-site control, and analytics needed for enterprise environments. Their widespread use slows investment in comprehensive, paid access control platforms across the region.

ASIA PACIFIC ACCESS CONTROL MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

dormakaba cloud-based access control solutions implemented in hotels, corporate campuses, and healthcare facilities across the Asia Pacific, enabling mobile credentials, remote monitoring, and visitor management. | Enhanced convenience and user experience, real-time monitoring, reduced administrative overhead, and improved emergency response through remote lock/unlock functionality. |

|

HID access control solutions deployed across corporate offices, universities, and government buildings in the Asia Pacific, integrating mobile credentials, smart cards, and biometric authentication with cloud-based platforms. | Enabled frictionless authentication, centralized management, and enhanced physical security | Improved regulatory compliance with local data protection standards and reduced administrative overhead. |

|

Allegion electronic and wireless locks adopted in commercial buildings, hospitals, and retail chains in the Asia Pacific to modernize door security and integrate with IoT-enabled building management systems. | Improved security and operational efficiency, reduced installation costs compared to wired solutions, and supported scalable multi-site access control. |

|

Access control platforms implemented in industrial plants, government offices, and transport infrastructure across the Asia Pacific with unified command-center monitoring, video surveillance integration, and intrusion detection. | High-level protection of mission-critical assets, improved situational awareness, reduced downtime, and faster incident response. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific access control market ecosystem involves hardware providers, software & cloud-based access control providers, system integrators & service providers, distribution & channel partners, and end users. Each section collaborates to advance the market by sharing knowledge, resources, and expertise.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Access Control Market, by Offering

The hardware segment is expected to hold the largest share of the Asia Pacific access control market due to the rapid expansion of commercial real estate, smart city programs, and infrastructure modernization. Organizations across the region widely deploy biometric readers, proximity/card-based systems, smart locks, electronic locks, and access controllers as the foundation of their physical security systems. Rising adoption of facial recognition technologies especially in public spaces, transportation hubs, retail centers, and large enterprise campuses is strengthening hardware demand.

Access Control As a Service Market

Hosted access control as a service (ACaaS) is projected to witness strong growth and hold a significant market share in the Asia Pacific by 2030, driven by the region’s rapid adoption of cloud-based security solutions across enterprises, financial institutions, manufacturing facilities, and educational campuses. Hosted ACaaS offers cost-effective, scalable access management without the need for on-premises servers, an advantage particularly appealing for SMEs and large multi-site organizations in the Asia Pacific region.

Access Control Market, by Vertical

The commercial vertical is expected to register the largest market share in the Asia Pacific access control market, driven by rising incidents of theft, workplace security breaches, and the need for advanced security in office buildings, IT parks, retail environments, hospitals, manufacturing plants, and logistics centers. Rapid urbanization and expansion of modern commercial infrastructure across countries such as China, Japan, India, South Korea, Singapore, and Australia are fueling demand for biometric access systems, electronic door controls, and integrated video-access solutions.

REGION

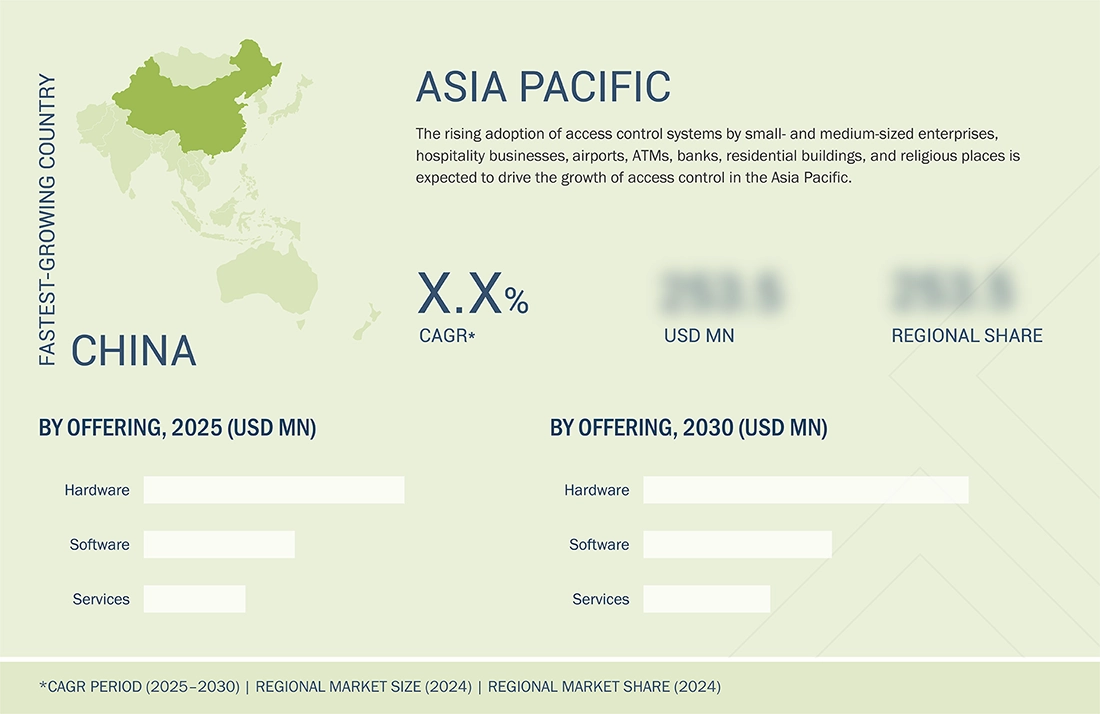

China is expected to be the fastest-growing country across the Asia Pacific access control market during the forecast period

China is expected to grow at the highest CAGR in the Asia Pacific access control market due to its rapid infrastructure expansion, nationwide digital security initiatives, and large-scale adoption of smart city technologies. The country is aggressively deploying biometric and facial-recognition-based access systems across transportation hubs, commercial complexes, residential communities, industrial parks, and public-safety projects.

ASIA PACIFIC ACCESS CONTROL MARKET: COMPANY EVALUATION MATRIX

In the Asia Pacific access control market matrix, ASSA ABLOY (Sweden) and dormakaba Group (Switzerland) lead with a strong market presence and a wide product portfolio, driving large-scale adoption across various industries, including commercial and residential.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- ASSA ABLOY (Sweden)

- dormakaba Group (Switzerland)

- Johnson Controls (Ireland)

- Allegion plc (Ireland)

- Honeywell International Inc. (US)

- Nedap N.V. (Netherlands)

- Suprema Inc. (South Korea)

- Thales (US)

- Axis Communications AB (Sweden)

- NEC Corporation (Japan)

- Cansec Systems Ltd. (Canada)

- Forcefield Security (Australia)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.90 Billion |

| Market Forecast in 2030 (Value) | USD 5.13 Billion |

| Growth Rate | CAGR of 10.5% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific (China, Japan, South Korea, India, and the Rest of Asia Pacific) |

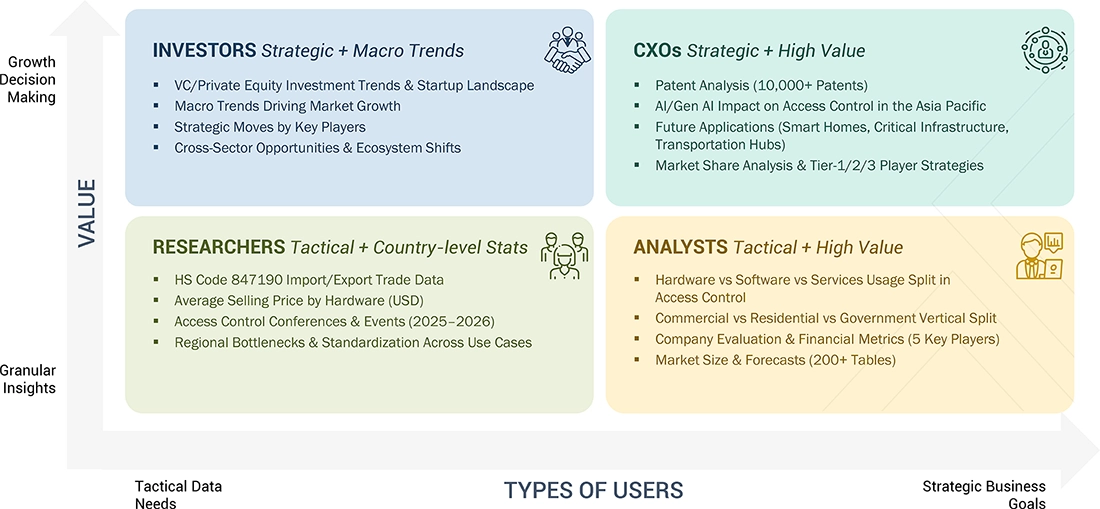

WHAT IS IN IT FOR YOU: ASIA PACIFIC ACCESS CONTROL MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Security System OEM/Hardware Manufacturer | Benchmarking of hardware performance versus leading Asia Pacific competitors, evaluation of compliance with country-specific regulations (Japan, South Korea, Australia), analysis of technology adoption in commercial, manufacturing, and infrastructure sectors, and identification of expansion opportunities in emerging markets like India and Southeast Asia. | Strengthens product localization strategies, accelerates innovation planning, and enhances competitive differentiation across highly fragmented Asia Pacific markets. |

| Software Vendor/System Integrator | Analysis of cloud adoption maturity across Asia Pacific countries, evaluation of integration potential with regional identity management and cybersecurity platforms, subscription model sizing for SMEs in India and ASEAN, and competitor benchmarking across Japan, Australia, and China. | Supports scalable ACaaS expansion, improves GTM strategy, and helps optimize product bundling and partner networks for faster customer acquisition across the Asia Pacific. |

| Distributor/Channel Partner | Asia Pacific-wide market sizing by product type, partner ecosystem mapping, pricing and margin benchmarking, and analysis of supply chain gaps for fast-growing markets such as India, Vietnam, and Indonesia. | Optimizes product portfolio planning, strengthens distributor strategy, and enhances profitability through data-backed pricing and inventory decisions. |

RECENT DEVELOPMENTS

- August 2025 : ASSA ABLOY acquired SiteOwl, a US-based cloud platform for physical security lifecycle management. The move strengthens ASSA ABLOY’s access control offering by enhancing how integrators, service providers, and end users manage infrastructure. Combining SiteOwl’s digital platform with ASSA ABLOY’s expertise enables new growth opportunities, streamlines lifecycle management, and positions the company as a leader in the digital transformation of security.

- August 2025 : Allegion acquired Brisant Secure Limited, a UK-based provider of residential security hardware known for its Ultion high-security locks and key systems. The deal strengthens Allegion’s European portfolio, complementing Allegion UK’s non-residential offerings and recent UAP acquisition.

- June 2025 : Suprema expanded its Access Control Unit (ACU) portfolio with the CoreStation 20 (CS-20) and Door Interface (DI-24) module. The CS-20 is a compact RFID controller supporting 500,000 users with PoE+ and encrypted communication, while the DI-24 manages two doors and four readers. These devices enhance scalability, security, and deployment flexibility for diverse facilities.

Table of Contents

Methodology

The research process for this technical, market-oriented, and commercial study of the Asia Pacific Access Control market included the systematic gathering, recording, and analysis of data about companies operating in the market. It involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) to identify and collect relevant information. In-depth interviews were conducted with various primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess the growth prospects of the market. Key players in the Asia Pacific Access Control Market were identified through secondary research, and their market rankings were determined through primary and secondary research. This included studying annual reports of top players and interviewing key industry experts, such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. These include annual reports, press releases, and investor presentations of companies, whitepapers, certified publications, and articles from recognized associations and government publishing sources. Research reports from a few consortiums and councils were also consulted to structure qualitative content. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; Journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases.

List of key secondary sources

|

Sources |

WEB LINK |

|

International Biometric Society (IBS) |

www.biometricsociety.org |

|

Federal Aviation Administration (FAA) |

www.faa.gov |

|

Security Industry Association (SIA) |

www.securityindustry.org |

|

Electronic Security Association (ESA) |

www.esaweb.org |

|

Electronic Security Association of India (ESAI) |

www.esai.in |

|

Resilient Navigation and Timing Foundation (RNT) |

www.rntfnd.org |

|

GPS Innovation Alliance (GPSIA) |

www.gpsalliance.org |

|

Association for Biometrics (AFB) |

www.afb.org.uk |

|

Central Station Alarm Association (CSAA) |

www.csaaintl.org |

|

International Association for Healthcare Security & Safety (IAHSS) |

www.iahss.org |

|

International Institute of Security (IISec) |

www.iisec.co.uk |

|

International Professional Security Association (IPSA) |

www.ipsa.org.uk |

Primary Research

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the Asia Pacific Access Control Market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Extensive primary research has been conducted after acquiring knowledge about the Asia Pacific Access Control Market scenario through secondary research. Several primary interviews have been conducted with experts from both the demand (end users) and supply side (access control manufacturers/providers) across Asia Pacific. Approximately 80% and 20% of the primary interviews were conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the Asia Pacific Access Control Market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

- Identifying various verticals wherein access control systems are implemented

- Analyzing each vertical and identifying the providers of access control systems and services to these verticals

- Understanding the demand generated by companies in each vertical

- Tracking the ongoing and upcoming implementation of access control systems by various companies in each region and forecasting the size of the Asia Pacific Access Control Market based on these developments and other critical parameters

- Analyzing major companies in the access control ecosystem, studying their portfolios, and understanding different types of access control solutions

- Estimating the market for access control systems for each vertical

- Multiplying the penetration of access control technology by the estimated revenue generated from access control solutions to arrive at the expected market size of access control in 2024

- Tracking the ongoing and upcoming developments in the market, such as investments, R&D activities, product developments, and partnerships, and forecasting the market based on these developments and other critical parameters

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

- Carrying out multiple discussions with key opinion leaders to understand different access control offerings, services, verticals, and recent trends in the market, and analyzing the breakup of the scope of work carried out by major companies

- Verifying and cross-checking the estimates at every level through discussion with key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts in MarketsandMarkets

Top-Down Approach

- Focusing initially on the top-line investments and expenditures made in the access control ecosystem, further splitting the key market areas into offerings, verticals, and regions, and listing key developments

- Identifying all leading players and end users in the Asia Pacific Access Control Market based on type and offering, through secondary research, and fully verifying them through a brief discussion with industry experts

- Analyzing revenues, product mixes, geographic presence, and key applications served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with the industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

After arriving at the overall market size from the market size estimation process, as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Market Definition

Access control is a security technique that regulates communication between users and systems. It restricts the entry of unauthorized individuals into restricted areas to protect people and assets. An access control system provides secure access to physical resources by validating user credentials. Every vertical has specific security requirements—from excluding intruders and limiting access to dangerous or sensitive areas to protecting valuable assets and equipment or ensuring the safety of secluded areas.

Key Stakeholders

- Suppliers of raw materials and manufacturing equipment

- Providers and manufacturers of components

- Providers of software solutions

- Manufacturers and providers of devices

- Original equipment manufacturers (OEMs)

- ODM and OEM technology solution providers

- Suppliers and distributors of access control devices

- System integrators

- Middleware providers

- Assembly, testing, and packaging vendors

- Market research and consulting firms

- Associations, organizations, forums, and alliances related to the access control industry

- Technology investors

- Governments, regulatory bodies, and financial institutions

- Venture capitalists, private equity firms, and startups

- End users

Report Objectives

- To define, describe, segment, and forecast the size of the Asia Pacific Access Control Market, in terms of offering, access control as a service, vertical, and region

- To give detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the Asia Pacific Access Control market

- To provide value chain analysis, ecosystem analysis, case study analysis, patent analysis, trade analysis, technology analysis, pricing analysis, key conferences and events, key stakeholders and buying criteria, Porter's five forces analysis, investment and funding scenario, and regulations pertaining to the Asia Pacific Access Control market

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the total Asia Pacific Access Control market

- To analyze opportunities for stakeholders by identifying high-growth segments of the Asia Pacific Access Control market

- To strategically profile the key players, comprehensively analyze their market positions in terms of ranking and core competencies, and provide a competitive market landscape of the Asia Pacific Access Control market

- To analyze strategic approaches, such as product launches, acquisitions, agreements, and partnerships, in the Asia Pacific Access Control Market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 7)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Access Control Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Access Control Market