Asia Pacific Autonomous Underwater Vehicle Market

Asia Pacific Autonomous Underwater Vehicle Market by Shape (Torpedo, Laminar Flow Body, Streamlined Rectangular Style, Multi-Hull), Type (Shallow, Medium, Large), System, Speed, Propulsion, Application, Cost, and Country – Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Asia Pacific autonomous underwater vehicle market is expected to reach USD 1.23 billion by 2030, from USD 0.80 billion in 2025, with a CAGR of 9.0%. In terms of volume, it will likely rise from 297 units in 2025 to 436 units by 2030. This growth is driven by expanding offshore energy and subsea infrastructure projects, increasing investments in autonomous naval systems for regional security, and accelerating deep-ocean research initiatives across Asia Pacific.

KEY TAKEAWAYS

-

By CountryChina is estimated to account for a 46.9% revenue share in 2025.

-

By ShapeThe torpedo segment is expected to register the highest CAGR of 9.6% between 2025 and 2030.

-

By PropulsionThe electric AUV segment is expected to be dominant during the forecast period.

-

Competitive LandscapeMSubs, Falmouth Scientific, and Advanced Navigation were identified as the star players in the Asia Pacific autonomous underwater vehicle market, given their strong market share and product footprint.

The Asia Pacific autonomous underwater vehicle market is witnessing accelerated demand driven by maritime security requirements, offshore energy expansion, and the need for deep-ocean mapping to support coastal resilience and blue-economy initiatives.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ customers in the Asia Pacific autonomous underwater vehicle market is driven by rising requirements for maritime domain awareness, offshore energy inspection, and deep-sea resource mapping across the South China Sea, Indian Ocean, and Western Pacific. Rapid expansion of offshore wind and subsea infrastructure projects in China, Japan, South Korea, and Taiwan is accelerating the need for autonomous, long-endurance AUV platforms. National ocean research programs in India, Australia, and Southeast Asia are also increasing demand for high-resolution seabed intelligence and multi-mission survey capabilities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid naval modernization and maritime security expansion

-

Growth in offshore energy and subsea infrastructure development

Level

-

Limited deep-water operational infrastructure in emerging markets

-

High acquisition and lifecycle costs

Level

-

Expansion of national deep-ocean research programs

-

Need for port security and underwater infrastructure inspection

Level

-

Complex operating environments and extreme weather conditions

-

Limited interoperability and regional standardization

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid naval modernization and maritime security expansion

Rising investment in unmanned undersea capabilities across Asia Pacific is boosting demand for AUVs to support ISR, anti-mine missions, and seabed surveillance. Increased maritime tension and the need for real-time maritime domain awareness are accelerating fleet upgrades and autonomous system integration.

Restraint: Limited deep-water operational infrastructure in emerging markets

Several coastal economies still lack advanced subsea communications, launch-and-recovery systems, and trained autonomous mission operators. This infrastructure gap limits the deployment of deep-rated AUVs and slows the expansion into high-end scientific and defense missions.

Opportunity: Expansion of national deep-ocean research programs

Growing government-backed initiatives in ocean mapping, subsea mineral assessment, and climate research are creating a strong pipeline for long-endurance scientific AUVs. Increased funding for deep-sea observatories and autonomous sampling missions is opening multi-year procurement opportunities.

Challenge: Complex operating environments and extreme weather conditions

Asia Pacific’s strong monsoon-driven currents, typhoon-prone waters, and rugged seabed terrain pose challenges for navigation, endurance, and sensor accuracy. These harsh conditions require more robust autonomy stacks, advanced obstacle avoidance, and enhanced durability for reliable mission execution.

ASIA PACIFIC AUTONOMOUS UNDERWATER VEHICLE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Energy and port authorities required autonomous inspection systems to assess submerged jetty structures, pipelines, and coastal assets along India’s eastern coastline, where diver-based inspections were unsafe due to turbidity, depth, and tidal currents. | It delivers high-resolution imaging in low-visibility waters, reduces inspection time and diver risk, and enables predictive maintenance with automated reporting for critical coastal infrastructure. |

|

The Royal Australian Navy required a stealthy, extra-large AUV for persistent ISR and autonomous undersea patrols across vast maritime zones, where conventional submarines were costly and unsuitable for continuous unmanned missions. | It enables long-duration covert surveillance, expands autonomous defense capability at lower lifecycle cost, and improves undersea situational awareness across remote and contested regions. |

|

Oceanographic researchers required ultra-deep AUV capabilities to map volcanic structures and tectonic activity around the Japan Trench, where traditional ROVs and towed systems could not withstand extreme pressure or deliver continuous navigation accuracy. | It provides high-precision deep-sea mapping, supports seismic risk assessment, and enables long-duration scientific missions with minimal operational interruption. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific autonomous underwater vehicle market comprises major OEMs such as MSubs, C.S.I. Technologies, Mitsubishi Heavy Industries, Larsen & Toubro, and ST Engineering, supported by specialized innovators like Advanced Navigation, Planck Aerosystems, BeeX, and C2 Robotics. These companies integrate advanced sensors, propulsion systems, and autonomy software to deliver mission-ready AUV platforms for defense, offshore energy, and marine research. Collaboration across manufacturers, subsystem suppliers, and end users drives continuous innovation and supports rapidly expanding operational requirements in the Asia Pacific underwater domain.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Autonomous Underwater Vehicle Market, By Type

Large AUVs (>1,000 m) dominate the Asia Pacific market as regional missions increasingly extend into deep trenches, mid-ocean ridges, and vast EEZ boundaries. Their endurance and payload capacity make them suitable for subsea cable surveillance, deep-energy asset inspection, and strategic maritime domain awareness across expansive and contested waters. The shift toward autonomous deep-water operations is accelerating the adoption of this class.

Asia Pacific Autonomous Underwater Vehicle Market, By Shape

Torpedo is the leading segment due to its ability to maintain speed and directional stability across long distances, which is crucial for wide-area oceanographic surveys and naval patrol routes in monsoon and typhoon-prone waters. Its streamlined hydrodynamics reduce energy consumption, enabling multi-hour missions for mapping, current profiling, and offshore infrastructure inspections in dynamic marine environments.

Asia Pacific Autonomous Underwater Vehicle Market, By Propulsion

Electric AUVs dominate the Asia Pacific market as investments accelerate in high-density marine batteries, low-noise propulsion, and renewable-powered charging systems to support environmentally sensitive operations. Their minimal acoustic footprint is increasingly prioritized for marine conservation studies and silent ISR patrols, while improved endurance and reliability make them well-suited for deep-water deployments across fast-evolving defense and commercial missions.

Asia Pacific Autonomous Underwater Vehicle Market, By System

Payload & sensor systems hold the largest share as end users demand advanced imaging, synthetic aperture sonar, real-time environmental sensing, and AI-enabled data fusion to support seabed resource assessments, offshore energy development, and marine hazard modeling. Rapid expansion of subsea infrastructure and national research initiatives is driving the integration of more complex and higher-resolution payload suites.

Asia Pacific Autonomous Underwater Vehicle Market, By Application

The military & defense segment is supported by heightened maritime vigilance needs, underwater threat detection programs, and improved focus on autonomous mine countermeasure capabilities. Regional forces are scaling AUV deployments to monitor strategic sea lanes, enhance undersea situational awareness, and reduce operational risk in areas with large-scale naval activity and complex seabed terrain.

REGION

India to be fastest-growing country in Asia Pacific autonomous underwater vehicle market during forecast period

The Indian autonomous underwater vehicle market is expected to register the highest CAGR during the forecast period, driven by expanding naval modernization programs, ongoing offshore energy exploration in the Bay of Bengal and Arabian Sea, and growing investments in indigenous ocean research and seabed-mapping initiatives.

ASIA PACIFIC AUTONOMOUS UNDERWATER VEHICLE MARKET: COMPANY EVALUATION MATRIX

In the Asia Pacific autonomous underwater vehicle market, MSubs (Star) leads with a substantial market share and a broad product footprint, backed by its extensive range of deep-water and multi-mission AUVs deployed across defense, energy, and ocean research programs. Kawasaki (Emerging Leader) is strengthening its position through advanced large-class AUV platforms and specialized propulsion technologies that support high-endurance inspection and subsea infrastructure missions. While MSubs maintains dominance through its global deployments and integrated autonomy capabilities, Kawasaki shows significant potential to advance toward the leaders’ quadrant as demand grows for long-range, high-payload autonomous systems across commercial and government sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- MSubs (Submergence Group) (China)

- Falmouth Scientific (China)

- Advanced Navigation (Australia)

- ST Engineering Ltd (Singapore)

- Mitsubishi Heavy Industries (Japan)

- Larsen & Toubro Ltd (India)

- LSG Next Co., Ltd. (Japan)

- Kawasaki Heavy Industries (Japan)

- Hyundai Heavy Industries (South Korea)

- Planys Technologies Pvt. Ltd (India)

- THI Corporation (Japan)

- Hanwha Systems Co., Ltd (South Korea)

- BeeX Pte. Ltd (Singapore)

- C2 Robotics Pty Ltd (Australia)

- EASTON Oceanics Co., Ltd (South Korea)

- Hanwha Ocean (South Korea)

- Ocean Space Robotics Co., Ltd (South Korea)

- Deeanu Systems Pte. Ltd (Singapore)

- ASID Marine Technologies (South Korea)

- Alpha Design Technologies Pvt. Ltd (India)

- Hi-Tech Robotics Systemz Ltd (India)

- Aqua Nautics Robotics Pvt. Ltd (India)

- Sagar Defence Engineering Pvt. Ltd (India)

- Mazagon Dock Shipbuilders Ltd (MDL) (India)

- Carotia Technologies Pvt. Ltd (India)

- Garden Reach Shipbuilders & Engineers (GRSE) (India)

- Kalyani Strategic Systems Ltd (KSSL) (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.75 BN |

| Market Forecast in 2030 (Value) | USD 1.23 BN |

| Growth Rate | CAGR of 9.0% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN/BN), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | China, Japan, India, South Korea, Australia, Indonesia, Malaysia, Thailand, Vietnam, Philippines |

WHAT IS IN IT FOR YOU: ASIA PACIFIC AUTONOMOUS UNDERWATER VEHICLE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at the regional/global level to gain an understanding of market potential by each country |

| Emerging Leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for a more targeted understanding of the total addressable market |

RECENT DEVELOPMENTS

- December 2024 : Japan Maritime Self-Defense Force (JMSDF) signed a contract with Mitsui E&S + Exail for the integration of A18-M AUVs into Japan’s next-generation Mine Countermeasure program. This move expands Japan’s autonomous underwater mine warfare capability using advanced SAS-equipped AUVs.

- February 2025 : Australian Defence Science and Technology Group (DSTG) formalized a strategic AUV development partnership with Advanced Navigation (Australia) and Thales Australia to co-develop next-generation long-endurance autonomous underwater platforms for naval ISR and maritime domain awareness.

- March 2025 : South Korea’s Defense Acquisition Program Administration (DAPA) awarded a multi-year acquisition and development contract to LIG Nex1 for modular AUV systems for the Republic of Korea Navy, including payload upgrades and deep-water mission configurations.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the Asia Pacific autonomous underwater vehicle market. Exhaustive secondary research was done to collect information on the Asia Pacific autonomous underwater vehicle market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analysis was conducted to estimate the overall market size. After that, market breakdown and data triangulation procedures were employed to estimate the sizes of various segments and subsegments within the Asia Pacific autonomous underwater vehicle market.

Secondary Research

During the secondary research process, various sources were consulted to identify and collect information for this study. These include government sources, such as SIPRI; corporate filings, including annual reports, press releases, and investor presentations from companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Asia Pacific autonomous underwater vehicle market scenario through secondary research. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

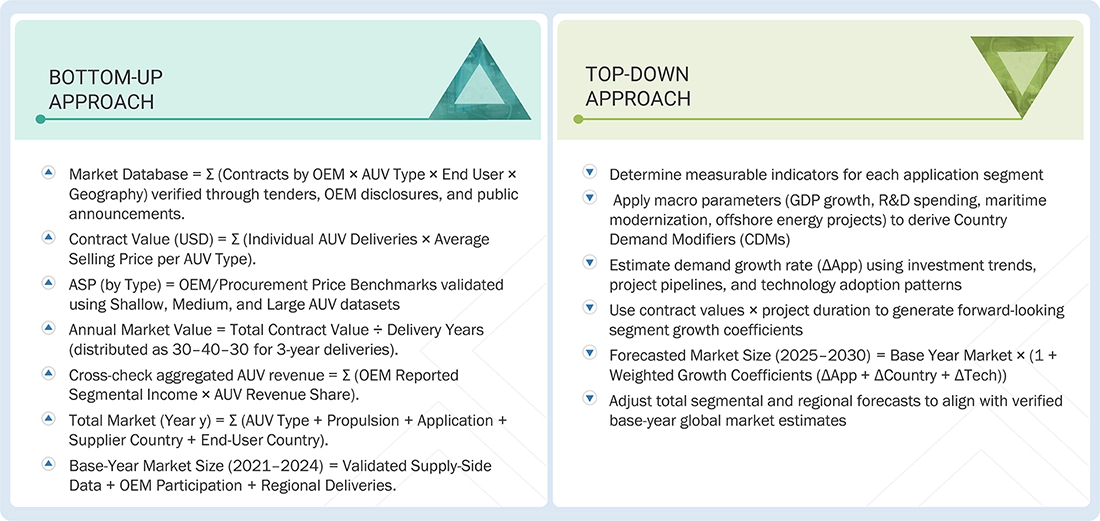

The top-down and bottom-up approaches were used to estimate and validate the size of the Asia Pacific autonomous underwater vehicle market. The research methodology used to estimate the size of the market included the following details:

- Key players in the Asia Pacific autonomous underwater vehicle market were identified through secondary research, and their market shares were determined through a combination of primary and secondary research. This included a study of the annual and financial reports of the top market players, as well as extensive interviews with leaders, including directors, engineers, marketing executives, and other key stakeholders of leading companies operating in the market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the Asia Pacific autonomous underwater vehicle market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Asia Pacific Autonomous Underwater Vehicle Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size, the total market was divided into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size was validated using top-down and bottom-up approaches.

Market Definition

Autonomous underwater vehicle is a self-propelled, untethered underwater robotic platform capable of independent navigation and task execution without real-time human control, used for applications such as seafloor mapping, inspection, surveillance, and data collection across defense, research, and commercial domains.

Key Stakeholders

- OEMs

- Component Suppliers

- System Integrators

- Service Providers

- Regulatory and Certification Bodies

- Research and Technology Institutions

- Investors and Funding Agencies

Report Objectives

- To define, describe, and forecast the Asia Pacific autonomous underwater vehicle market based on type, shape, speed, propulsion, application, system, cost, and region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micro markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the degree of competition in the market by analyzing recent developments adopted by leading players

- To strategically profile the key market players and comprehensively analyze their core competencies

- To provide a detailed competitive landscape of the market, along with a market share analysis and revenue analysis of key players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Asia Pacific autonomous underwater vehicle market

- Profiling of other market players (up to five)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Asia Pacific autonomous underwater vehicle market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Autonomous Underwater Vehicle Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Autonomous Underwater Vehicle Market