Asia Pacific Cloud Computing Market

Asia Pacific Cloud Computing Market by Service Model (IaaS [Compute, Storage, Networking], PaaS [Application Development & Integration, Database & Data Analytics & Reporting], SaaS [CRM, SCM, Collaboration & Productivity]), Impact of AI - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Asia Pacific cloud computing market is projected to grow from USD 348.75 billion in 2025 to USD 752.78 billion by 2030, at a CAGR of 16.6%. Growth is supported by rising internet usage, expanding mobile access, and the shift of business and consumer services to digital platforms. Organizations across the region are moving away from traditional IT systems and using cloud platforms to manage variable workloads and ensure service availability. Country-specific investments are strengthening this trend. Country-level investments are playing a key role in supporting cloud adoption across Asia Pacific. In China, spending is directed toward state-backed cloud infrastructure used by government agencies and large industrial systems. India is expanding cloud usage across digital public services, banking platforms, and fintech applications as part of broader digital programs. In Japan and South Korea, cloud investments focus on smart manufacturing, robotics, and data-driven analytics. Across Southeast Asia, markets such as Singapore, Malaysia, and Indonesia are building regional cloud zones to support e-commerce platforms and small business growth. The rising use of AI, data analytics, and 5G-enabled services is increasing demand for scalable computing environments. In response, cloud providers are expanding data centers and edge facilities to reduce latency, meet data localization needs, and support regulated industries.

KEY TAKEAWAYS

-

BY COUNTRYChina is estimated to account for the largest share with a market size of USD 128.74 billion in 2025.

-

BY SERVICE MODELSaaS is estimated to be the largest segment with a market size of USD 187.98 billion in 2025.

-

BY DEPLOYMENT MODELThe hybrid cloud segment is projected to grow at the highest CAGR of 19.3% during the forecast period.

-

BY ORGANIZATION SIZEThe large enterprises segment is estimated to account for the largest market share in 2025.

-

BY VERTICALThe healthcare & life sciences segment is projected to grow at the highest CAGR during the forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSMajor market players in the cloud computing market have pursued both organic and inorganic strategies, including partnerships, technology integrations, and strategic investments. Microsoft (US), Google (US), AWS (US), IBM (US), and Oracle (US) have strengthened their cloud portfolios to meet rising demand for AI-enabled services, hybrid deployments, and secure, scalable platforms supporting digital transformation across diverse industries.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESZymr, Vultr, JDV Technologies, and Tudip Technologies operate as nimble startups/SMEs in the Asia Pacific cloud ecosystem, competing by offering specialized, cost-efficient cloud services and developer-focused solutions.

Businesses and governments across Asia Pacific use cloud platforms to run digital services, online commerce, and smart infrastructure systems. Cloud infrastructure supports payment platforms, citizen service portals, logistics operations, and enterprise applications across the region. Countries such as India and Singapore depend on cloud platforms for large-scale public digital services, while China and Japan use cloud systems to support industrial operations and government workloads. Investment is increasing in AI tools, edge computing, and local cloud infrastructure to improve performance and reliability. Telecom-led edge deployments in South Korea and Australia enable low-latency applications, while localized data centers in Southeast Asia support data residency needs. As a result, cloud computing is becoming a core operational layer for both the public and private sectors in Asia Pacific.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Cloud computing in Asia Pacific is being shaped by technology shifts and changing market conditions. Rapid growth in digital services is increasing pressure on cloud platforms to handle higher traffic and more complex workloads. Industries such as software and IT services, BFSI, healthcare, and retail are moving faster than others, which is creating uneven demand across the market. Further, rising customer expectations for always-on digital access are pushing cloud providers to improve reliability and response times. Changes in how users access services, especially through mobile apps and online platforms, are also affecting how cloud resources are used. These trends are influencing how cloud providers plan capacity, design services, and price their offerings across the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Adoption of advanced technologies (AI/ML, IoT, Big Data)

-

Growth of E-commerce and FinTech

Level

-

Data security & privacy concerns

-

Trust deficit beyond basic security

Level

-

Government-led cloud initiatives

-

AI & ML infusion into cloud platforms

Level

-

Multi-cloud complexity and integration challenges

-

Integration & operational silos

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Adoption of advanced technologies (AI/ML, IoT, Big Data)

Operational stability and compliance requirements are a key driver of cloud adoption across Asia Pacific. Organizations are facing more cyber threats and closer scrutiny over how data is stored and protected. To deal with this, many companies avoid relying on a single cloud setup. Instead, they spread workloads across hybrid or multi-cloud environments so critical systems stay available while local data rules are met. Disaster recovery planning and the need to shift workloads quickly have also become part of everyday cloud decision-making in the region.

Restraint: Trust deficit beyond basic security

Despite progress in cloud security, trust remains a concern in several sectors. Government agencies, defense bodies, and highly regulated industries are often cautious about placing sensitive data on shared cloud platforms. Concerns usually center on audit access, data ownership, and the impact of overseas laws such as the US CLOUD Act. To address these issues, many organizations prefer sovereign or private cloud setups that offer tighter control. While this approach improves oversight, it often increases costs and reduces the flexibility typically associated with public cloud services.

Opportunity: Government-led cloud initiatives

The growing use of AI and machine learning presents a strong opportunity for cloud providers in Asia Pacific. Cloud platforms are increasingly offering built-in automation, analytics, and AI-based tools as part of standard services. Generative AI and large language models are being used to speed up application development, support cost management, and improve security operations. These capabilities are encouraging organizations to use cloud platforms not just for infrastructure, but also as tools to improve productivity and innovation.

Challenge: Multi-cloud complexity and integration challenges

Multi-cloud adoption is growing, but it introduces practical challenges. Managing multiple cloud environments involves dealing with different system interfaces, security controls, and data governance rules. Integration becomes more complex when workloads move across platforms. These issues are more visible in hybrid environments where performance consistency and data synchronization require closer monitoring. Many enterprises are now seeking common management tools and standardized frameworks to reduce operational complexity.

ASIA PACIFIC CLOUD COMPUTING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Infosys worked with IBM to help banks in India modernize their core banking systems using Finacle on IBM Cloud. The solution addressed challenges linked to legacy infrastructure, regulatory compliance, and rising digital transaction volumes. By adopting a hybrid cloud model, banks were able to move critical workloads to the cloud without disrupting existing systems. The approach aligned well with India’s regulated BFSI environment and cloud adoption needs. | Banks achieved better scalability and flexibility to handle high transaction volumes and digital demand. The hybrid deployment model helped reduce the total cost of ownership by up to 35% while improving operational efficiency. Clients recorded higher returns on assets and improved cost-to-income ratios compared to peers. The solution also strengthened security, compliance, and resilience for mission-critical banking operations. |

|

Jeongyookgak, a fast-growing food commerce startup in Japan, migrated its cloud environment to Microsoft Azure to support business expansion and data integration after an acquisition. The move helped align different database systems and improve the handling of real-time order data. Azure provided direct technical support and a stable platform for running both existing and new services. The migration was completed quickly without impacting daily operations. | The company gained a more flexible and scalable cloud environment that supports ongoing business growth. Data integration across Jeongyookgak and Chorocmaeul improved operations in ordering, distribution, and logistics. Real-time data processing became more efficient while maintaining accuracy for high-order volumes. Close collaboration with Microsoft and partners reduced operational strain and strengthened long-term technology planning. |

|

Blogmint, an influencer marketing platform in India, adopted Alibaba Cloud to support rapid growth in users and traffic. With over 20,000 active bloggers, the platform needed a cloud setup that could scale quickly during high-traffic campaigns. Alibaba Cloud provided flexible, pay-as-you-go infrastructure to handle sharp traffic spikes. The solution supported reliable performance while keeping infrastructure costs under control. | Blogmint was able to scale computing resources in real time during campaigns and reduce them when traffic dropped. The pay-as-you-go model helped avoid idle infrastructure and lowered overall IT costs. Built-in security and fault-tolerant services improved platform reliability and data protection. As a result, Blogmint maintained stable performance despite monthly traffic growth of over 100%. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific cloud computing ecosystem includes several participant groups. Network and hardware providers such as Huawei and Cisco supply core infrastructure for data centers and cloud networks. Cloud service providers, including AWS, Microsoft Azure, Alibaba Cloud, and Tencent Cloud, deliver computing, storage, and platforms to businesses and governments. System integrators and consulting firms such as Infosys, TCS, and NTT Data help organizations migrate to the cloud and manage ongoing operations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Cloud Computing Market, by Service Model

SaaS is expected to take the largest share of cloud spending in Asia Pacific, as it is simple to use and quick to roll out. Many organizations do not want to spend time or money managing complex IT systems anymore. With SaaS, applications can be accessed through subscriptions and adjusted as usage changes, which works well for both large enterprises and smaller businesses. SaaS tools are commonly used for customer management, internal communication, supply chain coordination, and reporting needs. The continued use of remote work models, mobile devices, and cloud-based work processes is keeping SaaS as the most widely used cloud service model in the region.

Asia Pacific Cloud Computing Market, by IaaS

In the IaaS segment, networking is expected to be the fastest-growing segment. As more applications shift to the cloud, enterprises are paying closer attention to network reliability and security. Cloud platforms, edge deployments, and connected devices all rely on strong network performance. The rollout of 5G, wider use of hybrid cloud models, and increasing movement of data across borders are driving demand for advanced cloud networking services.

Asia Pacific Cloud Computing Market, by PaaS

In PaaS, database and data management services account for the largest market share. Organizations across Asia Pacific are dealing with a large amount of data collected from digital platforms, online transactions, and connected systems. Cloud-based solutions make it easier to store and manage this data without constantly upgrading physical infrastructure. These services are widely adopted to support analytics, AI workloads, and real-time applications, especially in e-commerce, digital payments, and online services.

Asia Pacific Cloud Computing Market, by SaaS

Supply chain management solutions offered through SaaS are expected to grow at the fastest rate during the forecast period. Businesses in manufacturing, logistics, and e-commerce deal with complex supply chains and frequent changes in demand. Cloud-based SCM platforms help improve visibility across inventory, suppliers, and distribution networks. Many organizations use these tools to support planning, reduce delays, and respond faster when disruptions occur. The use of analytics and automation within SCM platforms is becoming more common as companies try to manage uncertainty more effectively. (27%)

Asia Pacific Cloud Computing Market, by Deployment Model

By deployment model, public cloud is expected to account for the largest share of the cloud computing market in Asia Pacific. Many organizations prefer public cloud because it removes the need for heavy upfront spending on physical IT infrastructure. Applications and data can be set up quickly and adjusted as business needs change. Public cloud helps businesses to handle complex workloads, peak usage periods, and new digital initiatives without overplanning capacity. Easy access to public cloud services also makes it suitable for fast-growing businesses.

Asia Pacific Cloud Computing Market, by Organization Size

Small and medium-sized enterprises are expected to adopt cloud services at the fastest rate. SMEs focus to modernize digital operation with a limited budget. Cloud platforms allow access to advanced tools through subscription pricing rather than large capital investments. Quick setup, flexible pricing, and the ability to scale when needed make cloud services especially practical for smaller organizations, including those with remote or distributed teams.

Asia Pacific Cloud Computing Market, by Vertical

The software and IT services sector is the largest user of cloud services in Asia Pacific. Cloud platforms are used daily for building applications, running tests, deploying updates, and managing systems. Many teams also depend on cloud infrastructure for data handling, collaboration tools, and remote development work. As businesses rely on digital products and online services, cloud usage in software & IT sector continues to grow. The increasing use of analytics and AI tools further strengthens the need for flexible and scalable cloud environments.

REGION

India to be the fastest-growing country in Asia Pacific cloud computing market during the forecast period

India is expected to be the fastest-growing market for cloud computing in Asia Pacific. The rapid expansion of the digital economy, along with strong government involvement, is supporting cloud adoption. Initiatives such as Digital India and Aadhaar-based services are pushing both public and private organizations to use cloud platforms. Data localization rules are also encouraging companies to host and manage data within the country. At the same time, the rapid rise of startups, digital payment systems, and online commerce is creating steady demand for cloud infrastructure that can scale easily without high upfront costs.

ASIA PACIFIC CLOUD COMPUTING MARKET: COMPANY EVALUATION MATRIX

In the Asia Pacific cloud computing market, Microsoft holds a leading position, largely due to its wide range of cloud services and strong use among enterprise customers. Azure is commonly used across industries and is being adopted for workloads that increasingly involve AI. Alibaba Cloud continues to build its presence in the region by adding local data centers and offering services that align with regional compliance requirements. Alibaba focuses on AI-based cloud services to meet growing customer demand.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Microsoft (US)

- Google (US)

- AWS (US)

- IBM (US)

- Oracle (US)

- Tencent Cloud (China)

- Alibaba Cloud (China)

- Huawei (China)

- NTT Data Corporation (Japan)

- Fujitsu (Japan)

- NEC Corporation (Japan)

- Reliance Jio (India)

- OneAsia (Hong Kong)

- CtrlS (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 291.31 Billion |

| Market Forecast in 2030 (value) | USD 752.78 Billion |

| Growth Rate | CAGR of 16.6% from 2025 to 2030 |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Countries Covered | China, Japan, Australia & New Zealand, Singapore, India, South Korea, Rest of Asia Pacific |

WHAT IS IN IT FOR YOU: ASIA PACIFIC CLOUD COMPUTING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Cloud Service Provider |

|

|

| Telecom Operator |

|

|

| Enterprise |

|

|

RECENT DEVELOPMENTS

- May 2025 : In May 2025, Alibaba Cloud outlined plans to build a global cloud network following Alibaba Group’s 380 billion yuan (USD 52.7 billion) investment in computing and AI infrastructure. The expansion focused on Japan, South Korea, Southeast Asia, the Middle East, Europe, and the Americas. The initiative aimed to provide a consistent cloud and AI infrastructure for Chinese enterprises operating both within China and overseas. Alibaba Cloud leveraged its existing footprint of 87 availability zones across 29 regions to support this rollout. The move strengthened its position in Asia Pacific while supporting the international expansion of Chinese enterprises.

- April 2024 : Microsoft committed USD 2.9 billion to expand AI and cloud infrastructure in Japan, with investments planned over 2024–2026. The investment focuses on increasing hyperscale cloud capacity, adding advanced GPUs for AI workloads, and strengthening cybersecurity collaboration with the Japanese government. Microsoft is also expanding AI and digital skills training to reach 3 million people over three years. In parallel, the company is establishing its first Microsoft Research Asia lab in Tokyo to support long-term AI research and innovation.

- September 2023 : Tencent Cloud launched its first Web3-native product, Tencent Cloud Blockchain RPC, marking a major step in its commitment to supporting decentralized application development. Co-developed with Ankr, the service provided ultra-low-latency blockchain access, high concurrency performance, and a stable, distributed node infrastructure that helped developers avoid the high costs and operational complexity of running their own nodes. The offering included public, premium, and enterprise versions, enabling scalable access to Ethereum, BNB Smart Chain, and Polygon PoS across Hong Kong and Singapore availability zones. With enhanced stability, flexible billing, and 24/7 enterprise support, the product strengthened Tencent Cloud’s position in the global Web3 ecosystem and advanced its strategy to empower developers building next-generation Web3 applications.

Table of Contents

Methodology

This research study on the Asia Pacific cloud computing market involved extensive secondary sources, directories, IEEE Communication-Efficient: Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred cloud service providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the Asia Pacific cloud computing spending of various countries was extracted from the respective sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and cloud service providers. It also included key executives from Asia Pacific cloud computing solution vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

To know about the assumptions considered for the study, download the pdf brochure

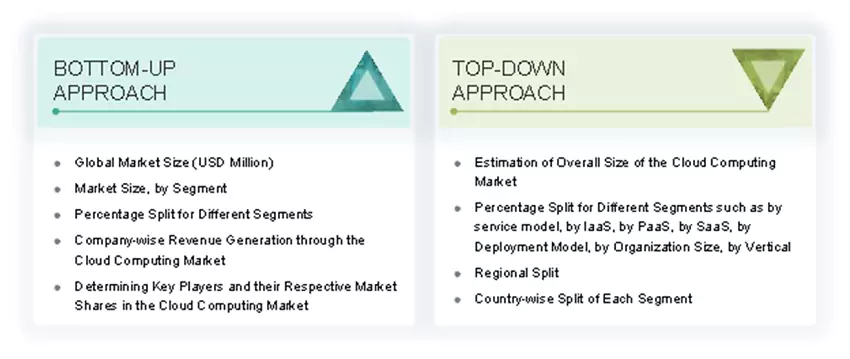

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the Asia Pacific cloud computing market. The first approach involved estimating the market size by companies’ revenue generated through the sale of Asia Pacific cloud computing services.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering products in the Asia Pacific cloud computing market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on platform, degree of customization, type, application, end user, and region. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of cloud computing services among different verticals in key countries, with respect to their regions contributing the most to the market share, was identified. For cross-validation, the adoption of cloud computing services among enterprises, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the Asia Pacific cloud computing market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major Asia Pacific cloud computing providers, and organic and inorganic business development activities of regional and global players were estimated.

Asia Pacific Cloud Computing Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

The cloud computing market involves delivering computing services such as servers, storage, databases, networking, software, and analytics over the internet, enabling organizations to access and manage data and applications remotely. It includes public, private, and hybrid cloud deployment models and supports various service models such as Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Cloud computing helps businesses reduce capital expenditure, improve scalability, enhance collaboration, and accelerate innovation. It plays a vital role in digital transformation, supporting emerging technologies such as AI, IoT, big data, and machine learning across industries.

Stakeholders

- Cloud Service Providers (CSPs)

- Networking companies

- Information Technology (IT) infrastructure providers

- Consultants/Consultancies/Advisory firms

- Component providers

- Telecom service providers

- System Integrators (SIs)

- Support and maintenance service providers

- Support service providers

- Third-party providers

- Government organizations and standardization bodies

- Datacenter providers

- Regional associations

- Independent hardware and software vendors

- Value-added resellers and distributors

Report Objectives

- To define, describe, and forecast the Asia Pacific cloud computing market based on service model, Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS), deployment model, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the Asia Pacific cloud computing market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Asia Pacific cloud computing market

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the Asia Pacific cloud computing market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements and product launches, acquisitions, and partnerships & collaborations, in the Asia Pacific cloud computing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the Asia Pacific cloud computing market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Cloud Computing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Cloud Computing Market