Asia Pacific Collaborative Robot Market

Asia Pacific Collaborative Robot Market by Payload (Less than 5 kg, 5-10 kg, 11-25 kg, More than 25 kg), Component (Hardware, Software), Application (Handling, Assembling & Disassembling, Dispensing, Processing), Industry - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Asia Pacific collaborative robot market is expected to grow to USD 1.60 billion by 2030 from USD 0.59 billion in 2025, at a CAGR of 22.1% from 2025 to 2030. Collaborative robots will experience strong growth in the Asia Pacific region, driven by rapid industrial automation, especially in electronics, automotive, and manufacturing hubs. Increasing labor costs in countries such as China, South Korea, and Singapore are encouraging companies to adopt human-robot collaboration to boost productivity.

KEY TAKEAWAYS

-

By CountryChina is expected to hold 33% of the Asia Pacific market in 2024.

-

By PayloadBy payload, the more than 25 kg segment is expected to register the highest CAGR of 28.0%.

-

By IndustryBy industry, the electronics segment is projected to grow at the fastest rate of 24.4% from 2025 to 2030.

-

Competitive LandscapeFANUC Corporation (Japan) and Techman Robot Inc. (Taiwan) were identified as some of the Star players in the Asia Pacific collaborative robot market, given their strong market share and product footprint.

-

Competitive LandscapeHuiling-Tech Robotic Co., Ltd. (China) has distinguished itself among startups and SMEs by securing a strong foothold in specialized niche areas, underscoring its potential as a Progressive Company.

Collaborative robots will expand rapidly in the Asia Pacific region due to the rapidly growing manufacturing industry and the increasing demand for flexible automation. Rising labor shortages and higher wages across countries such as China and Japan are encouraging industries to adopt human-robot collaboration. Strong government support for Industry 4.0 and smart factory implementation further accelerates cobot deployment throughout the Asia Pacific region.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The logistics industry is experiencing a major shift with the introduction of collaborative robots, or cobots, which greatly improve operational efficiency by automating repetitive tasks such as picking, packing, and sorting. This automation not only speeds up order processing but also allows human workers to concentrate on more complex and value-adding roles such as quality control and troubleshooting. In various sectors, companies and research groups are developing innovative cobot solutions designed for specific logistics tasks, such as autonomous picking robots and mobile manipulation platforms. This push for innovation drives rapid progress and addresses the needs of specialized applications. The result is a significant boost in productivity and efficiency, along with better product quality, less downtime, increased worker safety, and greater flexibility to market changes. For example, AI-powered cobots with vision systems can perform product inspections more accurately than humans, while predictive maintenance strategies help prevent unexpected equipment breakdowns, highlighting the transformative role of IIoT and AI in industrial manufacturing.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid Industrial Automation Growth

Level

-

High Initial Integration and Customization Costs

Level

-

Strong Government Support for Smart Manufacturing

Level

-

Lack of Skilled Workforce for Robot Programming

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid Industrial Automation Growth

The Asia Pacific region is experiencing a rise in automation investments, especially in electronics, automotive, and general manufacturing. Companies are implementing collaborative robots to boost productivity and decrease reliance on manual labor. This robust movement toward Industry 4.0 is speeding up cobot adoption throughout Asia Pacific.

Restraint: High Initial Integration and Customization Costs

Despite their smaller size, collaborative robots still require integration, safety assessments, and employee training, which increases initial costs. Many small and mid-sized manufacturers in Asia Pacific find these expenses difficult to justify. As a result, cost sensitivity slows adoption in several emerging markets.

Opportunity: Strong Government Support for Smart Manufacturing

Asia Pacific governments are heavily promoting smart factories through subsidies, tax incentives, and national robotics programs. These policies encourage businesses to adopt automation solutions such as cobots for higher efficiency. This ongoing support is creating a large pipeline of demand for collaborative robots.

Challenge: Lack of Skilled Workforce for Robot Programming

Many industries in the Asia Pacific, especially those in developing countries, lack skilled technicians capable of deploying and operating advanced robotic systems. This skills gap increases training time and delays return on investment. Limited workforce readiness remains a major barrier to scaling cobot adoption across the region.

ASIA PACIFIC COLLABORATIVE ROBOT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of collaborative robots in electronics and semiconductor assembly lines for precision handling, testing, and inspection | Enhanced production accuracy, reduced defect rates, and improved efficiency in high-volume electronics manufacturing |

|

Cobots used in automotive component manufacturing across China, Japan, and South Korea for machine tending, welding, and part handling | Increased flexibility, faster changeover for mixed-model production, and improved worker safety |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the collaborative robot (cobot) market includes robot accessories providers, integrators, and end users, with accessories providers playing a key role in supplying items such as end effectors, vision systems, and sensors. A few of the top companies offering collaborative robots in this ecosystem are Universal Robots A/S (Denmark), FANUC Corporation (Japan), ABB (Switzerland), Techman Robot (Taiwan), KUKA AG (Germany), and Doosan Robotics Inc. (South Korea). Nearly all players provide a wide range of collaborative robots with varying payload capacities. These robots are widely used in industries such as automotive, electronics, metals & machining, plastics & polymers, food & beverages, furniture & equipment, healthcare, and others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Collaborative Robot Market, By Payload

The up to 5 kg payload segment accounts for the largest share of the Asia Pacific cobot market because it is highly favored by SMEs, which dominate the region’s manufacturing landscape. These cobots are affordable, compact, and easy to integrate into electronics, assembly, and packaging workflows in common industries across the Asia Pacific. Additionally, first-time automation adopters prefer low-payload cobots due to their safety, lower setup requirements, and faster return on investment.

Asia Pacific Collaborative Robot Market, By Application

Handling applications constitute the largest segment of the Asia Pacific cobot market, as industries such as electronics, automotive, and consumer goods depend significantly on tasks including pick-and-place, sorting, and material handling. Cobots provide high precision and consistency, rendering them suitable for these rapid and high-volume processes. Moreover, labor shortages and escalating wages across the Asia Pacific region bolster demand for automated handling solutions that enhance efficiency and reduce operational expenses.

Asia Pacific Collaborative Robot Market, By Industry

The automotive industry constitutes the largest segment of the Asia Pacific cobot market, attributable to the region’s robust manufacturing sector in countries such as China, Japan, and South Korea. Collaborative robots are extensively employed in activities including assembly, welding, inspection, and material handling, thereby assisting automakers in enhancing production efficiency and ensuring consistent quality standards. The rising production of electric vehicles and escalating investments in automation further expedite the adoption of cobots within the Asia Pacific automotive industry.

Asia Pacific Collaborative Robot Market, By Country

China accounts for the largest share of the Asia Pacific cobot market due to its massive manufacturing sector and strong government support for industrial automation under initiatives like “Made in China 2025.” The country’s electronics, automotive, and consumer goods industries extensively adopt cobots to improve productivity and reduce reliance on manual labor. Additionally, the rapid growth of domestic cobot manufacturers and competitive pricing further accelerates large-scale deployment across Chinese factories.

REGION

India to be the fastest-growing Asia Pacific region in the collaborative robots market during the forecast period

India is expected to have the highest growth rate in the Asia Pacific cobot market due to rapid industrial expansion and increasing automation adoption among SMEs. Rising labor costs and the need for better productivity are encouraging manufacturers to deploy cobots in the automotive, electronics, and FMCG sectors. Additionally, government initiatives promoting smart manufacturing and digital transformation are speeding up cobot adoption nationwide.

The North American collaborative robot market is projected to grow from USD 0.37 billion in 2025 to USD 0.91 billion by 2030, registering a CAGR of 19.4%. The major market drivers include higher return on investment than traditional industrial robotic systems, increased demand in e-commerce and logistics sectors, significant benefits in businesses of all sizes, and easy programming of cobots. The opportunities include an increasing focus of automation experts on pairing robotic arms with mobile platforms such as AMRS or AGVs, a growing number of subscriptions for the Robotics-as-a-Service (RaaS) model, and rising demand for automation in the healthcare industry.

The Europe collaborative robot market is projected to grow from USD 0.41 billion in 2025 to USD 0.81 billion by 2030, registering a CAGR of 14.4%. The major market drivers include a higher return on investment compared to traditional industrial robotic systems, increased demand in the e-commerce and logistics sectors, significant benefits for businesses of all sizes, and the ease of programming cobots. The opportunities include an increasing focus on pairing robotic arms with mobile platforms, such as AMRs or AGVs, a growing number of subscriptions for the Robotics-as-a-Service (RaaS) model, and a rising demand for automation in the healthcare industry.

ASIA PACIFIC COLLABORATIVE ROBOT MARKET: COMPANY EVALUATION MATRIX

Within the Asia Pacific collaborative robot market landscape, FANUC Corporation (designated as 'Star') maintains a leading position, characterized by a substantial global presence and an extensive portfolio of cobots. Its capability to provide scalable, artificial intelligence-driven, and safety-compliant solutions across diverse industries—including automotive, electronics, and logistics—has solidified Universal Robots A/S's status as a predominant market participant. Additionally, Doosan Robotics Inc. (noted as 'Emerging Leader') is experiencing rapid expansion of its market presence through vigorous adoption across various sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- FANUC Corporation (Japan)

- Techman Robot Inc. (Taiwan)

- AUBO Beijing Robotics Technology Co., Ltd.(China)

- Doosan Robotics Inc. (South Korea)

- Denso Corporation (Japan)

- Yaskawa Electric Corporation (Japan)

- Siasun Robot & Automation Co., Ltd. (China)

- ElephantRobotics (China)

- Elite Robots (China)

- Hanwha Corporation (South Korea)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.51 Billion |

| Market Forecast in 2030 (Value) | USD 1.60 Billion |

| Growth Rate | CAGR of 22.1% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | Asia Pacific (China, South Korea, Japan, Taiwan, Thailand, India) |

WHAT IS IN IT FOR YOU: ASIA PACIFIC COLLABORATIVE ROBOT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| E-commerce & Fulfillment Operator |

|

|

| Automotive OEM |

|

|

RECENT DEVELOPMENTS

- March 2025 : FANUC Corporation unveiled its latest industrial and collaborative robotic solutions for warehousing and logistics at ProMat 2025.

- October 2024 : Universal Robots A/S unveiled its AI Accelerator, a ready-to-use hardware and software toolkit created to further enable the development of AI-powered cobot applications. Designed for commercial and research applications, the UR AI Accelerator provides developers with an extensible platform to build applications, accelerate research, and reduce the time to market for AI products.

- May 2024 : Techman Robot Inc. introduced the TM AI Cobot TM30S, which can carry up to 35 kg and has a reach of 1,702 mm across six joints. The TM30S offers the best reach-to-weight ratio among cobots in the 30 kg category.

Table of Contents

Methodology

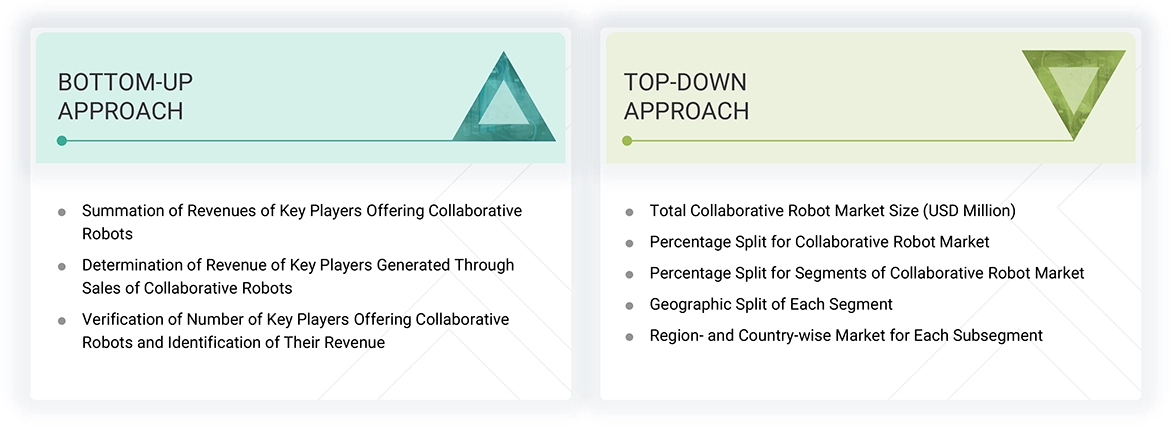

The study involved major activities in estimating the current size of the Asia Pacific Collaborative Robot Market. Exhaustive secondary research was done to collect information on collaborative robots. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the collaborative robot.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information relevant to this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research was mainly carried out to obtain critical information about the industry’s supply chain, value chain, the total pool of key players, and market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold-and silver-standard websites; directories; and databases. Data was also collected from secondary sources, such as the International Federation of Robotics (IFR), the International Trade Centre (ITC) (Switzerland), and the Robotics Business Review (RBR).

Secondary research was mainly used to obtain critical information about the supply chain of the industry, the value chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments from both the market and technology-oriented perspectives. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

Extensive primary research was conducted after understanding and analyzing the current scenario of the Asia Pacific Collaborative Robot Market through secondary research. Several primary interviews were conducted with key opinion leaders from both the demand and supply sides across Asia Pacific. Approximately 25% of the primary interviews were conducted with the demand side, while 75% were conducted with the supply side. This primary data was collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Questionnaires and e-mails were also used to collect data.

Market Size Estimation

This report implements both top-down and bottom-up approaches to estimate and validate the size of the Asia Pacific Collaborative Robot Market and various other dependent submarkets. Secondary research identifies key players in this market, and their market shares in the respective regions are determined through primary and secondary research.

This report implements both top-down and bottom-up approaches to estimate and validate the size of the Asia Pacific Collaborative Robot Market and various other dependent submarkets. Secondary research identifies key players in this market, and their market shares in the respective regions are determined through primary and secondary research.

Top-Down Approach

- Identifying key participants in the Asia Pacific Collaborative Robot Market that influence the entire market

- Analyzing major manufacturers of collaborative robots involves studying their portfolios and understanding the various types of products they offer to strengthen their market presence and strategic positioning within the industry

- Analyzing trends pertaining to the use of collaborative robots for different industries

- Tracking the ongoing and upcoming developments in the market, such as investments, R&D activities, product/service launches, collaborations, and partnerships, and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand recent trends in the collaborative robot (cobot) market, thereby analyzing the breakup of the scope of work carried out by major companies

- Deriving market estimates involves analyzing the revenues generated by companies and then aggregating them to obtain the overall market estimate

- classifying the overall market into various other market segments

- Verifying and cross-checking the estimate at every level from the discussion with key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts in MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

- Focusing initially on the top-line investments and expenditures being made in the ecosystem of the Asia Pacific Collaborative Robot Market, further splitting the key market areas based on payload, application, industry, and region, and listing the key developments

- Identifying all leading players in the Asia Pacific Collaborative Robot Market based on payload, application, and industry through secondary research and thoroughly verifying them through a brief discussion with industry experts

- Analyzing revenues, product mix, geographic presence, and key applications served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Asia Pacific Collaborative Robot Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the Asia Pacific Collaborative Robot Market from the estimation process explained above, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed (wherever applicable) to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The size of the Asia Pacific Collaborative Robot Market was validated using both top-down and bottom-up approaches..

Market Definition

According to the International Federation of Robotics (IFR), robots intended for collaborative use need to adhere to the International Organization for Standards (ISO) standard 10218-1. This standard establishes essential criteria and recommendations to guarantee the safe design, effective protective measures, and comprehensive usage guidelines for industrial robots. By adhering to these standards, a secure and efficient environment can be ensured for both operators and machinery.

Collaborative robots (also known as cobots) are designed to work alongside humans with precision, strength, and speed to achieve greater efficiency in production. Using robots to assist humans can help significantly reduce the workload of human workers and relieve them of monotonous, repetitive tasks. As an emerging automation technology, cobots complement the existing industrial robotics market. The total cost of ownership of factory automation solutions, especially for small and medium-sized enterprises (SMEs), can be significantly reduced by adopting cobots. Cobot operations are primarily governed by the ISO 15066:2016 standard that further specifies various safety requirements. Other standards governing the safe operations of cobots include ISO 10218-1:2011, RIA/ANSI R15.06-2012, ISO 12100:2010, and ISO 13849-1:2008.

Key Stakeholders

- Original equipment manufacturers (OEMs)

- OEM technology solution providers

- Research institutes

- Market research and consulting firms

- Forums, alliances, and associations

- Technology investors

- Governments and financial institutions

- Analysts and strategic business planners

- End users who want to know more about technology and the latest technological developments in industry

Report Objectives

- To describe and forecast the Asia Pacific Collaborative Robot Market by payload, component, application, and industry, in terms of value and volume

- To provide detailed information regarding factors, including drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To provide a detailed overview of the cobot value chain

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, ASP analysis, Porter’s five forces analysis, 2025 US tariff and AI/Gen AI impact analyses, and regulations pertaining to the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments

- To benchmark players operating in the market using the proprietary Company Evaluation Matrix, which analyzes market players using multiple parameters within the broad categories of business and product strategy

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as collaborations, agreements, partnerships, product developments, and research and development (R&D) in the market

- To evaluate the impact of macroeconomic factors on the regional market

Available Customizations

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Collaborative Robot Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Collaborative Robot Market