Asia Pacific Data Center Rack Market

Asia Pacific Data Center Rack Market by Rack Type (Open Frame, Enclosed), Type (Server Racks, Network Racks), Rack Height (42U & Below, 43U up to 52U), Rack Width (19 Inch, 23 Inch), Data Center Type (Enterprise, Colocation, Hyperscale) - Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

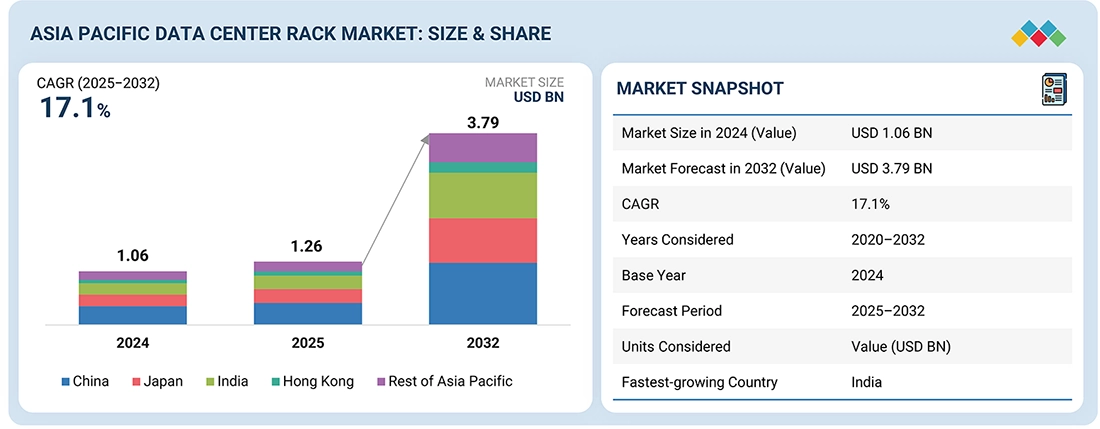

The Asia Pacific data center rack market is projected to reach USD 3.79 billion by 2032 from USD 1.26 billion in 2025, at a CAGR of 17.1%. The Asia Pacific data center rack market is currently being driven by hyperscale expansion, the increase of cloud adoption, and the accelerated growth of AI workloads. Traditional rack densities are expected to increase from 6-10 kW to 25-40 kW as the rollout of GPU systems continues to grow, as such, there will be a corresponding need for reinforced racks that have higher power capabilities, improved airflow, and liquid-cooling readiness. The trend toward modular racks is also being witnessed as operators turn toward them to accommodate both in-country and edge locations. In addition, sustainability and power limitations will greatly influence purchasing decisions. As a result, increasing the number of energy-efficient racks with built-in monitoring and data center infrastructure management (DCIM) capabilities will also occur.

KEY TAKEAWAYS

-

BY COUNTRYIndia is emerging as the fastest-growing country in the Asia Pacific data center rack market.

-

BY OFFERINGThe services segment is expected to grow at the fastest rate of 18.0% in the Asia Pacific data center rack market during the forecast period.

-

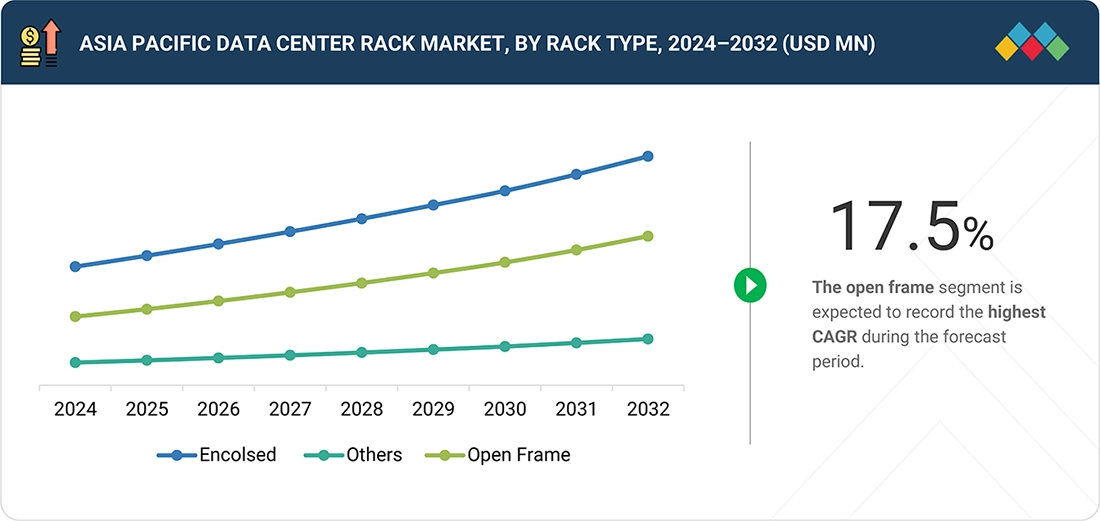

BY RACK TYPEEnclosed racks will account for the largest share in the Asia Pacific data center rack market.

-

BY SERVICESSupport & maintenance services will register the fastest growth in the Asia Pacific data center rack market as dense, multi-site deployments demand continuous uptime, compliance, and rapid remediation.

-

BY TYPEServer racks are expected to account for the largest market share of the Asia Pacific data center rack market by 2032.

-

BY RACK HEIGHTBy rack height, the above 52U segment is expected to register the highest CAGR of 17.7% in the Asia Pacific data center rack market during the forecast period.

-

BY RACK WIDTHBy rack width, 19-inch racks are expected to account for the largest share of the Asia Pacific data center rack market during the forecast period.

-

BY DATA CENTER SIZELarge data centers will capture a larger market due to hyperscale investments, AI-driven density, and superior operational scale efficiencies.

-

BY DATA CENTER TYPEBy data center type, hyperscale will show the fastest growth as large-scale colocation demand and capital-backed capacity consolidation intensify.

-

BY ON-PREMISES/ENTERPRISE VERTICALBy vertical, BFSI will capture the largest share due to strict uptime requirements, regulatory compliance needs, and transaction-intensive digital platforms.

-

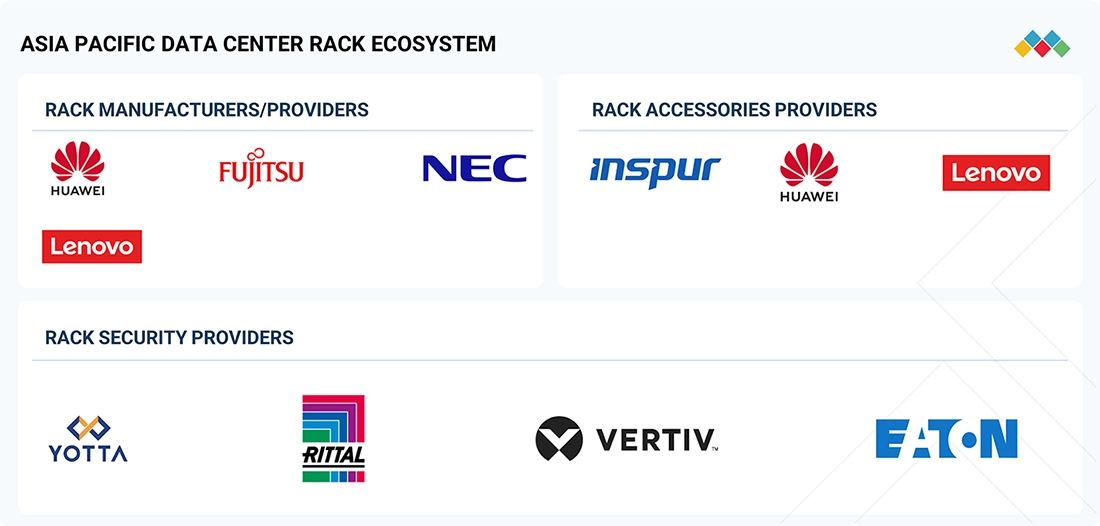

COMPETITIVE LANDSCAPE - KEY PLAYERSFujitsu, Huawei, Lenovo, and NEC Corporation are among the major players in the Asia Pacific data center rack market, collaborating with enterprises to deliver cloud-based replication, automated failover, isolated recovery environments, and compliance-ready resilience across hybrid and multi-cloud architectures. Fujitsu, Huawei, Lenovo, and NEC Corporation are among the major players in the Asia Pacific data center rack market, collaborating with operators to deliver high-density, modular, and liquid-cooling-ready rack systems that support rapid deployment, space optimization, and regulatory-compliant infrastructure across hyperscale, colocation, and enterprise data center environments.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMEsChevel, Yotta Infrastructure, and Inspur systems have distinguished themselves among startups and SMEs due to their robust product portfolios and effective business strategies.

A surge in data center rack capacity is occurring due to new builds away from coastal areas and in areas with power restrictions, such as Singapore, Japan, India, and China. As a result, data center operators need better solutions to optimize available space and deploy systems quickly than before. There is also greater demand for high-load, seismically compliant, and liquid-cooled racks due to increased use of AI clusters. This trend will continue as data centers densify at the edge. As data center operators continue their trend toward standardized rack architectures, these designs will enable them to roll out multiple sites more efficiently, improve overall energy efficiency, and mitigate risks associated with retrofits across diverse regulatory and climatic environments.

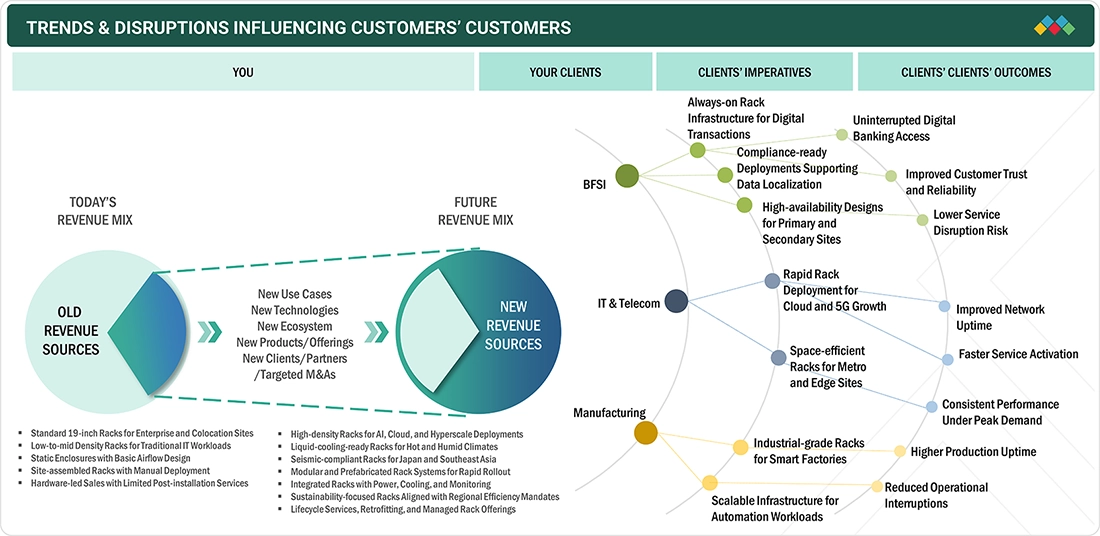

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the Asia Pacific data center rack market, customer and end-user expectations are being influenced by hyperscale consolidation, AI-driven density requirements, and tightening efficiency and compliance standards. BFSI, IT and telecom, and manufacturing customers increasingly expect space-optimized, resilient, and scalable infrastructure. These forces are driving the adoption of modular, high-density rack architectures that support rapid deployment, operational reliability, and consistent service delivery across the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Accelerated hyperscale and AI-led capacity expansion across Asia Pacific

-

Enterprise digitalization and data localization enforcement across regulated sectors

Level

-

Facility readiness constraints in legacy and urban data centers

-

Long approval timelines for power and facility upgrades

Level

-

Shift toward modular, standardized and liquid-ready rack architectures

-

Expansion of in-country and non-metro data center deployments

Level

-

Managing deployment complexity across diverse regulatory and climatic environments

-

Aligning density growth with regional sustainability mandates

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Accelerated hyperscale and AI-led capacity expansion across Asia Pacific

The demand for racks in the Asia Pacific region is being driven by the rapid growth of hyperscale technologies in countries such as China, India, Southeast Asia, and Australia. As cloud regionalization becomes more widespread, three primary factors are influencing this demand: the expansion of AI training workloads, the growth of digital platforms across various sectors, and the increased rack density due to a high volume of equipment loads combined with tightly integrated power and cooling technologies. Operators are transitioning from standard racks to reinforced, high-density racks that are capable of liquid cooling to accommodate GPU clusters. This shift is essential for ensuring high reliability and enabling the rapid deployment of large-scale cloud services.

Restraint: Facility readiness constraints in legacy and urban data centers

Most Asia Pacific data centers have been built in developed metro areas, such as Singapore, Tokyo, and Hong Kong, to support lower density enterprise workloads. Existing buildings face floor load limitations, restricted power availability due to older generation infrastructure, and older generation mechanical systems, making it difficult to deploy new higher density rack systems. Retrofitting existing buildings is a capital intensive and time consuming process that can result in significant delays for new rack systems and require the operator to relocate growth to a greenfield site.

Opportunity: Shift toward modular, standardized and liquid-ready rack architectures

More operators in the Asia Pacific region are choosing prefabricated and modular data center models to speed up their ability to introduce capacity into growing markets. As a result, there is a significant opportunity for rack manufacturers to develop standardized, high-density liquid-cooling racks to reduce the engineering complexity required and the time to deploy new racks. Demand for racks that can be added incrementally across different climate conditions and that work seamlessly with prefabricated power and cooling blocks has also increased.

Challenge: Managing deployment complexity across diverse regulatory and climatic environments

Different seismic standards, climatic conditions, and building codes complicate the standardization and integration of racks throughout the Asia Pacific region, particularly for high-power racks. Vendors and operators must strike a balance between maintaining consistency across platforms and customizing projects to meet the specific needs of each location. Additionally, implementation teams will need to address the skills gap between various rack manufacturers and navigate the challenges associated with coordinating installation and commissioning activities for these multi-country projects.

ASIA PACIFIC DATA CENTER RACK MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Fujitsu and ATR optimize high-density data center racks | 30% reduction in rack power consumption (FY2013) | Power efficiency improved to 90% via HVDC +12V | 10–20% lower rack power losses | Stable rack operation above 40°C | Higher rack density without added cooling | Reduced rack-level TCO |

|

Huawei and Shenzhen Port enable smart modular rack infrastructure | 25% improvement in energy efficiency | 580,000 kWh annual electricity savings | ~340 tons annual carbon reduction | 90 standardized racks at 6 kW per rack | Faster deployment via modular rack architecture | 20% improvement in rack and space utilization |

|

Western Digital, Quobyte, and NEC enable ultra-dense HPC racks | Over 2.0 PB raw storage capacity per rack | Sustained bandwidth exceeding 50 GBps within three 19-inch racks | Enabled 10 PB-plus capacity in space-constrained rack footprint | Reduced rack-level power and cooling overhead through optimized airflow | High-density 4U storage design improving rack utilization | Simplified rack scaling with 2–3× future capacity upgrade path |

|

Fujitsu and Packet Power enable rack-level energy transparency | Accurate rack-level energy billing across hosted customers | Real-time visibility from room to rack, PDU, and device level | Improved rack load balancing and cooling efficiency | Wireless, cable-free rack monitoring enabling rapid retrofit | On-demand scalability across 284+ racks without service disruption | Proactive rack-level alerts preventing power and thermal incidents |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific data center rack industry includes manufacturing, and deployment of racks, cabinets, and enclosures utilized to accommodate servers, storage systems, and networking hardware. Vendors also supply rack-level solutions for power distribution, cooling, security, and monitoring. As data centers expand to provide infrastructure for cloud computing, artificial intelligence, and big data workloads, the requirement for scalable and secure rack systems continues to increase. In addition, market growth is supported by hyperscale development, colocation service providers, and increased infrastructure security needs.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Data Center Rack Market, by Offering

The solutions segment holds the largest share of the Asia Pacific data center rack market, driven by operator investments in integrated rack infrastructures. These investments aim to enable rapid capacity expansion, enhance the density of AI-assisted computing, and improve the integration of power and cooling systems. Consequently, numerous data center investments are underway in China, India, Southeast Asia, and Australia. These investments focus on enclosed racks, open-frame systems, and containment solutions to address challenges such as space limitations, climate issues, and strict regulatory protocols. The combination of unified modular rack ecosystems and the ability to maintain consistent performance across multiple countries is generating momentum that shapes investment decisions. This trend emphasizes solution-led purchasing practices, making comprehensive rack platforms the primary focus for data center operators in the Asia Pacific region.

Asia Pacific Data Center Rack Market, by Rack Type

The data center rack market in the Asia Pacific is experiencing rapid growth as operators increasingly adopt open-frame racks. This trend is driven by the need for cost-effective solutions for building out edge sites, network rooms, and secondary locations. Factors such as the growth of telecommunications edge aggregation, regional internet exchanges, and enterprise digitalization in India and Southeast Asia, along with the expansion of urban areas, are fueling this demand. Open frame racks are ideal for these deployments due to their quick installation, efficient airflow design, and flexibility for rapid expansion, making them suitable for projects with limited space and tight budgets.

Asia Pacific Data Center Rack Market, by Services

Installation and deployment services play a crucial role in the Asia Pacific data center rack market, particularly due to the high volume of new data centers being established in Singapore. The strict requirements for power availability and high-density design leave little room for errors during installation. Operators rely on specialized companies to handle all aspects of the installation and deployment process, including configuring the system for proper load distribution, ensuring effective airflow containment, and adhering to local safety and efficiency regulations. The constant demand for quick facility commissioning, along with the need to maximize usable white space, has increased the need for expert installation services. This makes deployment support an essential component of achieving "operational readiness" in the Asia Pacific region.

Asia Pacific Data Center Rack Market, by Type

The Asia Pacific region is witnessing a rise in the number of server racks (hosting equipment) in data centers, driven by hyper-scale cloud service companies and the expansion of compute-focused environments in businesses. There is strong demand for these new racks to support the growth of AI-driven processing, address declines in cloud service availability in certain areas, and facilitate the digitalization of business operations. This demand is leading to the development of racks designed to better manage higher loads, enhance airflow management, and facilitate efficient power distribution. Furthermore, the adaptability of these racks for use in both multi-tenant and hyperscale data centers is contributing to their growing adoption.

Asia Pacific Data Center Rack Market, by Rack Height

Due to their compliance with standard floor loading, ceiling heights, and cooling designs across hyperscale, colocation, and enterprise data centers, racks sized at 42U or less will dominate the Asia Pacific data center rack market. These 42U and under racks are specifically designed to facilitate optimal equipment operation, including structured cabling and balanced airflow. This design is commonly used in mixed-density facilities. Operators are encouraged to adopt this rack size to ensure consistency across different countries while reducing the complexity of deploying, maintaining, and operating racks within rapidly expanding regional data center portfolios.

Asia Pacific Data Center Rack Market, by Rack Width

The 23-inch rack-width segment is gaining traction in the Asia Pacific data center rack market, as telcom- and network-heavy data centers implement 5G core networks, build international submarine cable landing stations, and create regional internet exchange hubs. 23-inch racks will provide denser networking, better cable management, and increased airflow requirements for carrier-grade equipment. The growth of cross-border connectivity, edge aggregation sites, and cloud on-ramps across Southeast Asia, India, and Australia will further encourage the uptake of 23-inch rack formats.

Asia Pacific Data Center Rack Market, by Data Center Size

Small and mid-sized data centers are expected to experience the fastest growth as data center development in the Asia Pacific region expands beyond large hyperscale campuses to include more distributed locations. The construction of new data centers in these areas has been rapidly increasing to meet the demand for data localization driven by enterprise cloud adoption and the need for low-latency services. To accommodate this rapid growth, many facilities have chosen to implement modular designs and standardized rack infrastructure, allowing for quick deployments and phased expansion.

Asia Pacific Data Center Rack Market, by Data Center Type

In the Asia Pacific data center rack market, on-premises and enterprise facilities are expected to hold the largest market share. This dominance is driven by stringent data residency regulations, regulatory oversight, and security requirements in sectors such as banking, financial services, insurance (BFSI), government, healthcare, and manufacturing. The Asia Pacific region is also experiencing strong momentum in enterprise digitization, with large domestic organizations and increasing adoption of hybrid IT solutions, which are encouraging ongoing investment in in-house data centers. Many enterprises are modernizing their facilities to accommodate latency-sensitive and mission-critical workloads, driving steady demand for standardized rack infrastructure.

Asia Pacific Data Center Rack Market, by On-premises/Enterprise Vertical

The healthcare sector is one of the fastest-growing segments in the Asia Pacific data center rack market. Digital health initiatives are increasing the need for on-site computing and storage in hospitals and health networks. The expansion of telemedicine, electronic medical records, and diagnostic imaging is driving the development of hospital-owned and regional data centers. These facilities require standardized racks to accommodate dense servers, ensure secure storage, and provide reliable power and cooling. Stringent regulations on patient data residency and uptime further underscore the need for dedicated rack infrastructure, making healthcare a key growth driver of rack demand in the region.

REGION

China is expected to hold the largest market share in the Asia Pacific Data Center Rack market during the forecast period

The Asia Pacific data center rack market is experiencing significant growth driven by the ongoing expansion of hyperscale facilities and the planning of centralized infrastructure. China is leading this market thanks to its well-established domestic manufacturing ecosystem, allowing it to capture a majority of the market share. Emerging rack vendors and solution providers can benefit from substantial opportunities for large-scale, repeatable deployments. They also have the potential to form partnerships with cloud operators, telecommunications companies, and engineering, procurement, and construction (EPC) firms for long-term capacity projects.

ASIA PACIFIC DATA CENTER RACK MARKET: COMPANY EVALUATION MATRIX

Fujitsu (Star) has positioned itself as a leader in the Asia Pacific data center rack market. This success is attributed to its diverse range of high-density, energy-efficient modular rack solutions, a solid market share, and continuous innovation in power and thermal management systems. In contrast, Huawei (Emerging Leader) has garnered significant attention for its scalable, AI-ready racks and enterprise-focused data centers. The company is also expanding its capabilities in hybrid and cloud data centers throughout the Asia Pacific region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Schneider Electric (France)

- Vertiv (US)

- Eaton (Ireland)

- Rittal (Germany)

- Dell Technologies (US)

- Fujitsu (Japan)

- Lenovo (China)

- Huawei (China)

- NEC Corporation (Japan)

- Chevel (Japan)

- Yotta Infrastructure (India)

- Inspur Systems (Japan)

- RackBank Datacenters ( India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.06 Billion |

| Market Forecast in 2032 (Value) | USD 3.79 Billion |

| Growth Rate | CAGR of 17.1% from 2025–2032 |

| Years Considered | 2020–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Countries Covered | China, Japan, India, Hong Kong, Rest of Asia Pacific |

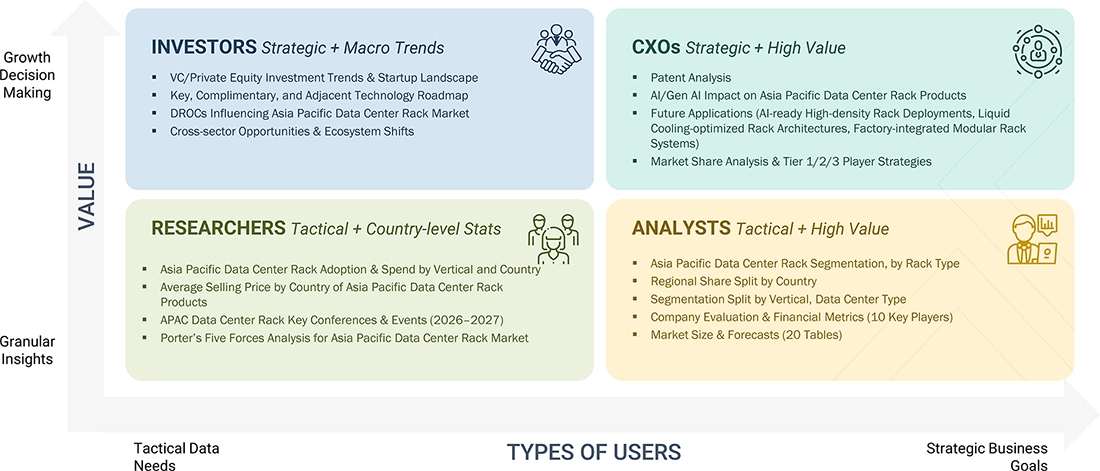

WHAT IS IN IT FOR YOU: ASIA PACIFIC DATA CENTER RACK MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Cloud Service Provider | Cross-segment market sizing for rack deployments across hyperscale, colocation, and cloud-edge zones in the Asia Pacific, competitive benchmarking of rack density, power capacity, and thermal management strategies | Improved rack capacity planning across sites, clear visibility into high-density readiness for GPU workloads, and faster site selection through benchmarking insights |

| Telecom Operator | Competitive benchmarking: Comparison of data center rack architectures, density configurations, cooling compatibility, and deployment models across peer telecom operators in the Asia Pacific | Identified infrastructure standardization gaps, optimized rack deployment strategies, and supported informed decisions on scalable, high-density rack investments to improve network performance and rollout speed across regional facilities |

RECENT DEVELOPMENTS

- April 2025 : Legrand has acquired Computer Room Solutions, a Sydney-based company with nearly 20 years of experience in server racks, security caging, and uninterruptible power supplies (UPS). This acquisition strengthens Legrand's data center hardware portfolio and expands its presence in the Asia Pacific region, enhancing its ability to serve edge computing, colocation, and enterprise deployments.

- March 2025 : A three-way partnership among Schneider Electric, ETAP, and NVIDIA integrates digital twin technology with NVIDIA Omniverse to enable dynamic chip-level power modeling, supporting rack densities of up to 132 kW. This collaboration aims to enhance real-time operational efficiency for AI factories and high-density environments. It builds on Schneider's liquid-cooled reference design, set for release in December 2024, and on the launch of its microgrid and data center R&D lab in Massachusetts in March 2025, further establishing its leadership in AI-optimized, sustainable infrastructure.

- January 2025 : Fujitsu has partnered with Supermicro and Nidec to launch a service to improve energy efficiency in data centers. This collaboration combines Fujitsu’s liquid-cooling control software, Supermicro’s GPU servers, and Nidec’s advanced cooling systems to reduce power usage effectiveness (PUE) and minimize environmental impact. Fujitsu has begun testing this solution at its Tatebayashi Data Center, with plans to deploy it fully by the fourth quarter of fiscal year 2025. A commercial offering is expected to launch in Japan in the first quarter of fiscal year 2025 under a subscription model.

- October 2024 : Lenovo and Cisco have expanded their strategic partnership to provide integrated data center solutions that are factory and rack-ready. Lenovo is now incorporating Cisco networking into pre-engineered racks, which combine computing, storage, and switches. This collaboration aims to accelerate deployment, simplify management, and support AI and hybrid cloud workloads through standardized and thoroughly tested rack architectures.

Table of Contents

Methodology

This research study on the Asia Pacific Data Center Rack Market involved extensive secondary sources, directories, several journals, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the Asia Pacific Data Center Rack Market. Primary sources were industry experts from core and related industries, preferred system developers, service providers, resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with different primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

These included key industry participants, subject-matter experts, C-level executives of key companies, and industry consultants. Primary sources were mainly industry experts from the core and related industries, preferred Data center rack providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess growth prospects. The following figure highlights the market research methodology applied to make the Asia Pacific Data Center Rack Market report.

Secondary Research

The market size of companies offering data center rack solutions and services was determined based on secondary data available through paid and unpaid sources. It was also evaluated by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

Various sources were considered in the secondary process to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals and related magazines. Data center rack spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain the key information related to the industry’s value chain and supply chain to identify key players, market classification, and segmentation according to offerings of major players and key developments from market and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing data center rack solutions and services. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities.

In the market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform market estimation and market forecasting for the overall market segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information/insights throughout the report.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and identify the segmentation, industry trends, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the Asia Pacific Data Center Rack Market. The first approach involved estimating the market size by the summation of the companies’ revenue generated through the sale of services.

The research methodology used to estimate the market size included the following.

- Primary and secondary research was conducted to assess the revenue contributions of major market participants in each country, with secondary research identifying these participants.

- Critical insights were obtained by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

- Primary sources were used to verify all percentage splits and breakups, calculated using secondary sources.

Data Triangulation

Once the overall market size was determined, the market was divided into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from the government entities’ supply and demand sides.

Market Definition

Considering the views of various sources and associations, MarketsandMarkets defines “a data center rack as a steel and electronic framework designed to house servers, networking devices, cables, and other data center computing equipment. This physical structure provides equipment placement and orchestration within a data center facility.”

Stakeholders

- Rack Manufacturers

- Colocation Providers

- Telecom Operators

- IT Infrastructure Providers

- System Integrators

- Network Operators

- Component Providers

- Consultants & Data Center Designers

- Data Center Operators

- Channel Partners & Distributors

- Internet Service Providers (ISPs)

- Regulatory Bodies / Standards Organizations

Report Objectives

- To define, describe, and forecast the Asia Pacific Data Center Rack Market in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To forecast the market by offering (solutions, services), type, rack height, rack width, data center size, data center type, on-premises/enterprise verticals, and region

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To profile the key market players, including top vendors and startups; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as mergers & acquisitions (M&A), product launches/enhancements, agreements, partnerships, collaborations, expansions, and R&D activities, in the market

Available Customizations

MarketsandMarkets provides customizations based on the company’s unique requirements using market data. The following customization options are available for the report.

Product Analysis

- The product matrix provides a detailed comparison of each company’s portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the Asia Pacific Data Center Rack Market

Company Information

- Detailed analysis and profiling of five additional market players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Data Center Rack Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Data Center Rack Market