Asia Pacific Digital Cockpit Market

Asia Pacific Digital Cockpit Market by Equipment (Front, Passenger & Rear Infotainment, HUD, Instrument Cluster, Center Console, Driver Monitoring System), Application, Vehicle Type, EV Type, Display Type, Display Size, Country - Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

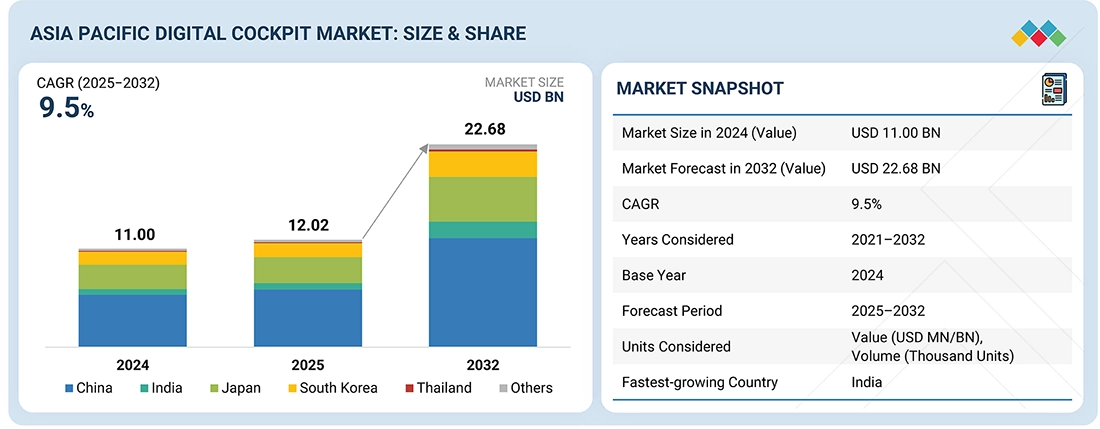

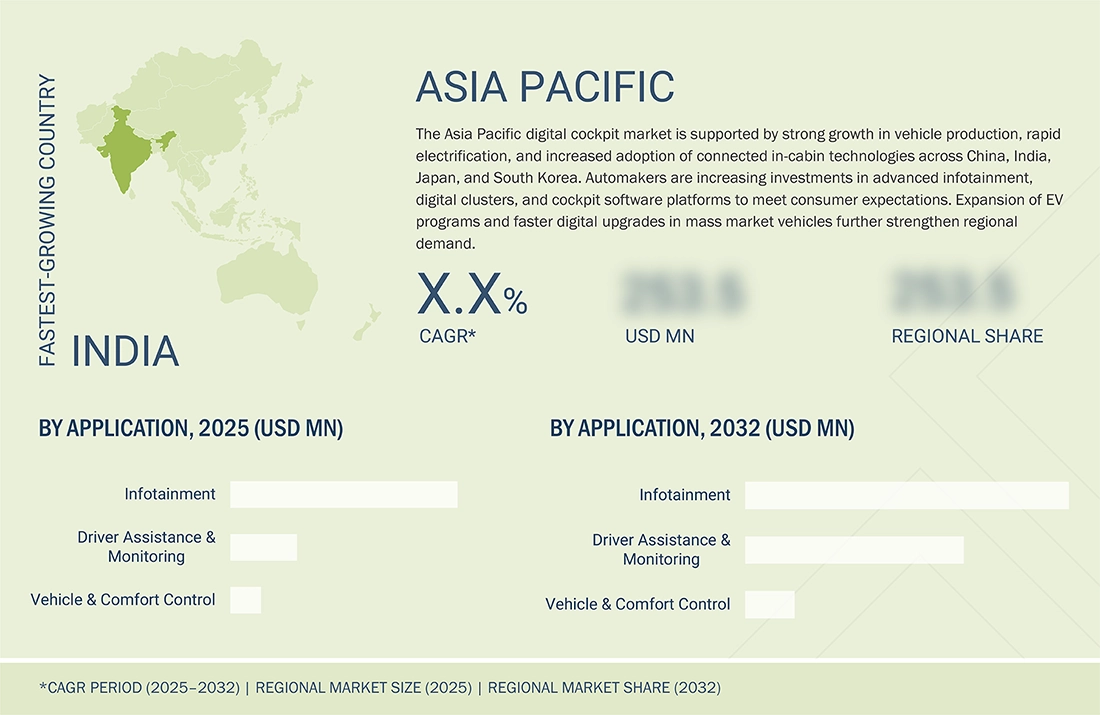

The Asia Pacific digital cockpit market is projected to grow from USD 12.02 billion in 2025 to USD 22.68 billion by 2032, at a CAGR 9.5%. This market is primarily driven by software-defined vehicle architectures that unify computing and support advanced display and infotainment systems. High-resolution multi-display integration and multi-modal HMIs (touch, voice, gesture) enhance user interaction and responsiveness. Additionally, high-bandwidth in-vehicle networking (e.g., Automotive Ethernet) enables fast, reliable communication between cockpit domains and other vehicle systems.

KEY TAKEAWAYS

-

By CountryChina is estimated to account for 53.6% of the revenue share in 2025.

-

By Vehicle TypeThe passenger car segment is estimated to hold the largest market share of 95.0% in 2025.

-

By EquipmentThe driver monitoring system segment is expected to record the highest CAGR of 20.5% during the forecast period.

-

By ApplicationThe driver assistance & monitoring segment is expected to record the highest CAGR of 18.1% during the forecast period.

-

By Display SizeThe <5" segment is estimated to account for 47.4% of the Asia Pacific digital cockpit market in 2025.

-

By Display TypeThe TFT-LCD segment is estimated to account for 39.0% of the Asia Pacific digital cockpit market in 2025.

-

By EV TypeThe BEV segment is expected to record a CAGR of 15.6% during the forecast period.

-

Competitive LandscapeDenso Corporation, ECARX, LG Electronics Inc., and Pioneer Corporation are identified as major players in the market given their strong product portfolios and extensive global presence.

Automotive digital cockpit suppliers in the Asia Pacific region are expanding their product portfolios as local OEMs opt for connected, software-driven cabin architectures. Companies in China, Japan, South Korea, and India are focusing on larger display systems, central computing platforms, and integrated HMIs to provide safer interfaces and more personalized in-vehicle experiences. As a result, partnerships with semiconductor suppliers and more in-house development of cockpit software are taking place.

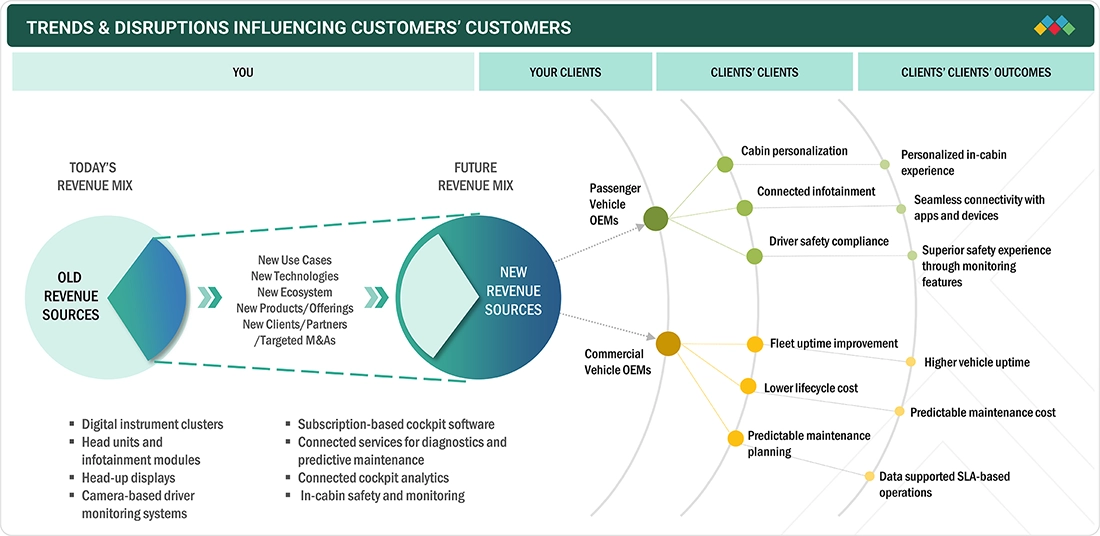

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The need for automotive digital cockpits is gradually changing the primary source of revenue to connected, software-centric platforms as OEMs are implementing larger displays, centralized computing, and integrated infotainment systems. Suppliers are focused on personalization and increased connectivity through OTA updates. The changing revenue mix is mainly due to the strong commitment to EVs, the proliferation of domain controllers, and the increased use of AI-based driver monitoring, both in passenger and commercial vehicles. While OEMs are moving forward with smart cabin strategies, suppliers are turning to advanced HMI technologies and multiscreen layouts.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid automotive technology adoption

-

Push for software-defined vehicles and in-vehicle connectivity

Level

-

High integration and component complexity

-

Cybersecurity and data privacy pressures

Level

-

Implementation of connectivity and communications standards

-

Local technology alliances and platform collaboration

Level

-

Standardization and interoperability gaps

-

OTA complexity across distributed cockpit and vehicle compute units

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid automotive technology adoption

Automotive manufacturers in China, India, Japan, and South Korea are equipping their vehicles with digital instrument clusters and ultra-high-resolution infotainment systems. The use of augmented reality heads-up displays (AR-HUDs) that give the driver a better view of the surroundings is growing rapidly. Through the use of voice-activated assistants and AI-powered interfaces, the companies aim to provide a superior user experience in the car.

Restraint: High integration and component complexity

Digital cockpits rely on multiple displays, AI processors, and layered software modules that are complex to integrate. Consistent performance across heterogeneous ECUs and legacy platforms remains difficult for suppliers and OEMs.

Opportunity: Implementation of connectivity and communications standards

Industry alliances such as the 5G Automotive Association (5GAA) are pushing standardized vehicle connectivity protocols (e.g., C-V2X). Such frameworks expand digital cockpit capability, enabling richer telematics and real-time services that platform suppliers can leverage for new cockpit value-added features.

Challenge: Standardization and interoperability gaps

Lack of uniform automotive software and cockpit interface standards increases development costs. Suppliers must build multiple variants for different OEMs, slowing economies of scale and delaying deployments.

asia-pacific-digital-cockpit-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Full-stack digital cockpit platform (Antora computing platforms + Cloudpeak software) integrating infotainment, navigation, OTA services, and smartphone/third-party ecosystem support. | Consolidates displays and functions into a unified system, reduces architecture complexity, provides scalable software stack, and enhances connectivity & user experience. |

|

AI-enabled intelligent cabin platforms (e.g., G10PH) leveraging advanced SoCs for adaptive UI, real-time processing, and personalized cabin interactions. | Enables high-performance AI/graphics, real-time adaptive assistance, seamless UI personalization, and richer in-vehicle experiences. |

|

eCockpit services integrating instrument cluster, IVI, telematics, and ADAS features on unified ECU, with multimodal HMI (gesture/voice) and scalable OS integration (Android/QNX/Linux). | Reduces hardware overhead via ECU consolidation, supports OTA updates, enhances HMI engagement, and improves system security and lifecycle support. |

|

AI-driven in-vehicle interaction systems with on-device multi-modal AI models for active service and personalized UI generation. | Provides proactive cockpit interaction, faster multi-modal command handling, customizable UI themes based on user context, and stronger data privacy by local AI processing. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific digital cockpit ecosystem spans raw material suppliers, semiconductor companies, software providers, and Tier-1 integrators that deliver complete cockpit platforms to global automakers. Display glass makers, chip suppliers, and HMI software firms support the development of high-performance infotainment units, clusters, HUDs, and monitoring systems. Tier-1 players such as Denso Corporation, ECARX, and Desay SV integrate hardware, software, and connectivity to meet OEM requirements across passenger and commercial vehicles. Collaboration across these groups strengthens system reliability, accelerates cockpit upgrades, and enables scalable deployment of next-generation in-cabin technologies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Digital Cockpit Market, By Equipment

The infotainment unit segment leads the market due to the increasing integration of connected services, navigation, and media features in vehicle platforms. Automakers are promoting easy-to-use user interfaces and smooth smartphone connectivity, thereby increasing the demand for advanced infotainment systems.

Asia Pacific Digital Cockpit Market, By Display Size

The <5" segment is prevalent as it takes into account space, cost, and simplicity. These displays are frequently found in instrument clusters of small and low-priced vehicles, as well as secondary information panels. However, in the coming years, larger screens (5–10") are going to lead the mainstream infotainment and advanced cockpit experiences.

Asia Pacific Digital Cockpit Market, By EV Type

The BEV segment is expected to record the strongest growth, driven by increasing EV production and the rising need for energy monitoring, charging insights, and connected cockpit functions. BEVs rely heavily on digital interfaces to communicate range, performance, and vehicle health, accelerating adoption of integrated cockpit systems.

Asia Pacific Digital Cockpit Market, By Application

The driver assistance & monitoring segment is expected to grow at the fastest rate as the focus increases on in-cabin safety, driver attention tracking, and meeting regulatory requirements. OEMs are adopting camera-based monitoring systems, real-time alerts, and predictive analytics to enhance safety compliance, thereby accelerating the integration of these technologies into new vehicle platforms.

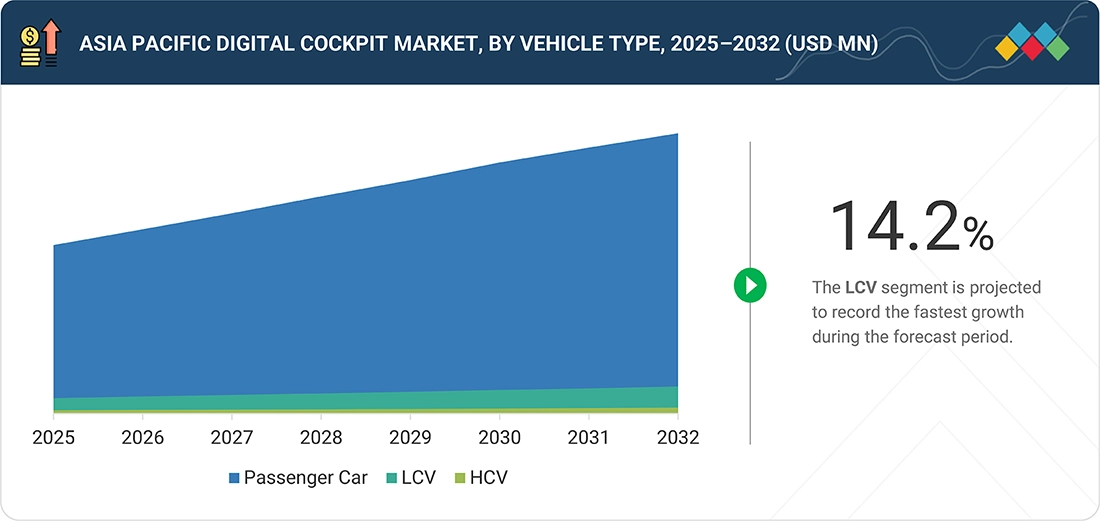

Asia Pacific Digital Cockpit Market, By Vehicle Type

Automotive manufacturers increasingly focus on connected infotainment, advanced instrument clusters, and enhanced safety monitoring features, and passenger cars will likely remain the largest adopters of digital cockpit technologies. The demand for personalized cabin experiences and the seamless integration of smart devices are also driving widespread adoption in upcoming vehicle models.

Asia Pacific Digital Cockpit Market, By Display Type

The TFT LCD segment will continue to hold the largest share as automakers favor cost-efficient, reliable, and scalable display technologies that support multi-screen cockpit layouts and high clarity infotainment interfaces.

REGION

India to witness the fastest growth in the Asia Pacific Digital Cockpit market

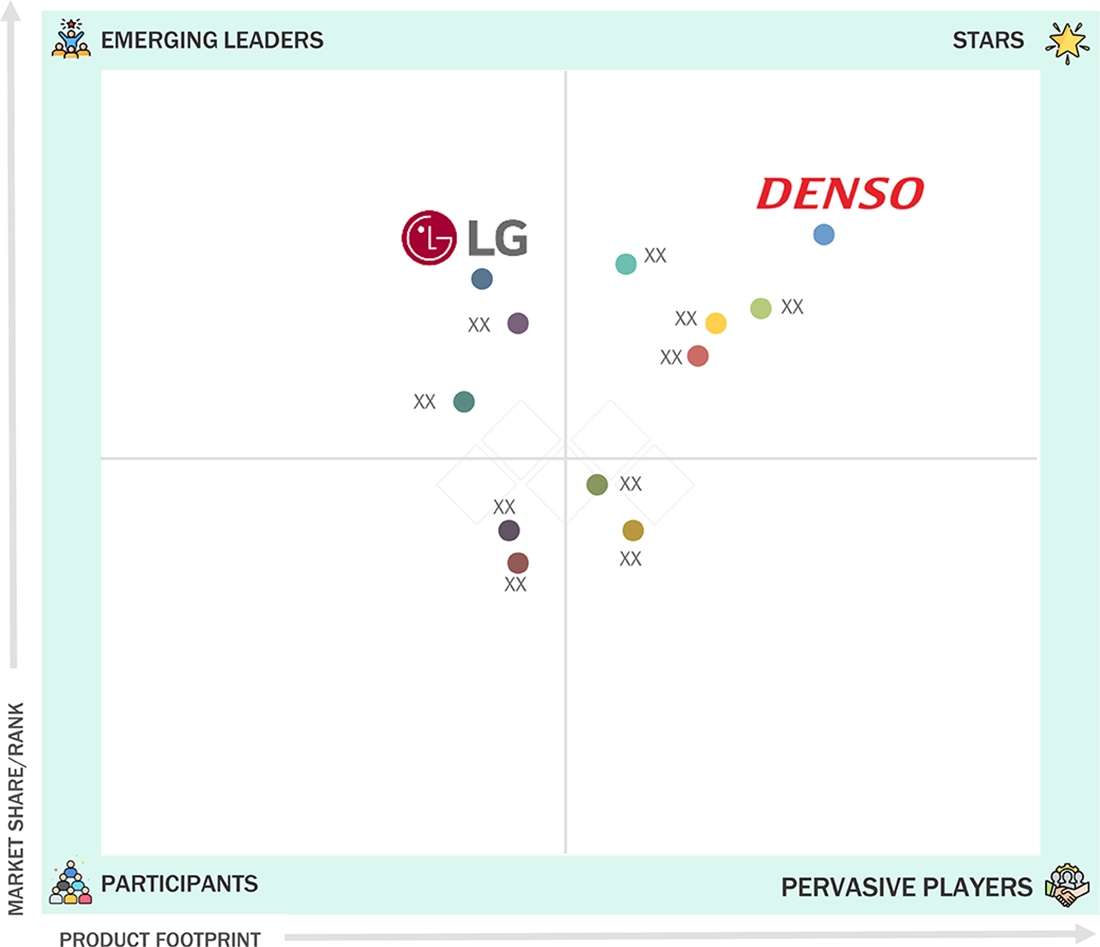

asia-pacific-digital-cockpit-market: COMPANY EVALUATION MATRIX

Denso Corporation (Star) is strengthening its position with a broad portfolio of digital cockpit hardware, such as instrument clusters, center information displays, head-up displays, and driver status monitors that form core elements of modern in-vehicle HMI systems. LG Electronics Inc. (Emerging Leader) is gaining prominence as it expands its cockpit solutions, display technologies, and HMI capabilities for global automakers. Both companies are enhancing their competitiveness through technology upgrades, deeper customer partnerships, and steady expansion across high-growth vehicle programs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Desay SV Automotive

- ECARX

- Denso Corporation

- HYUNDAI MOBIS

- Panasonic Holdings Corporation

- Pioneer Corporation

- LG Electronics Inc.

- Samsung Display

- Telechips

- Sony Coporation

- Mitsubishi Electric Corporation

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2025 | USD 12.02 BN |

| Revenue Forecast in 2032 | USD 22.68 BN |

| Growth Rate | CAGR of 9.5% from 2025–2032 |

| Actual Data | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD MN/BN), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | China, India, Japan, South Korea, Thailand, Others |

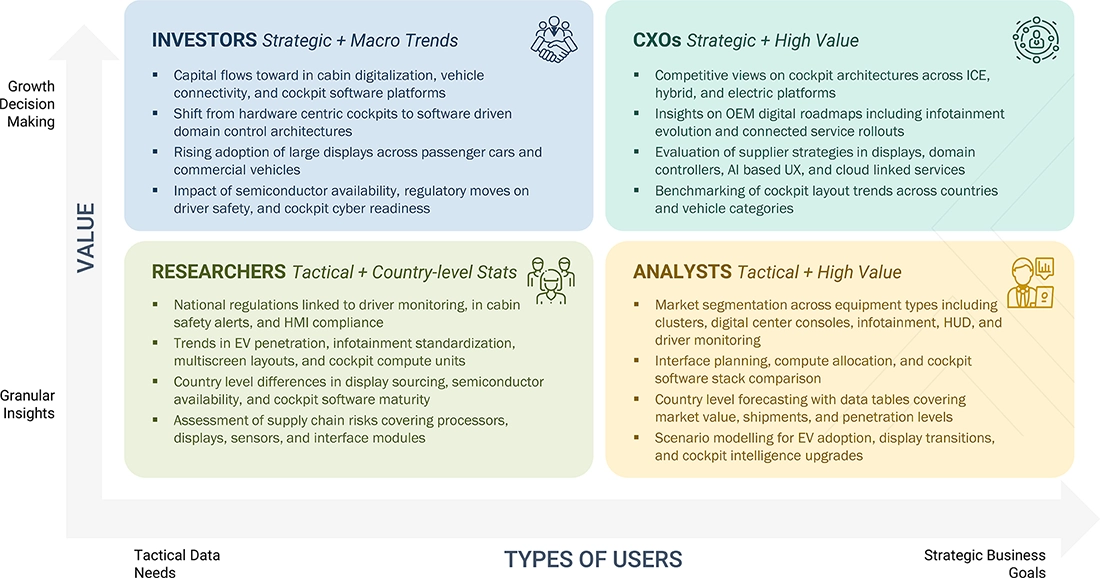

WHAT IS IN IT FOR YOU: asia-pacific-digital-cockpit-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Passenger Vehicle OEM (Japan) | Assessment of OEM digital cockpit strategies, benchmarking of infotainment, clusters, HUDs, and driver monitoring features, and evaluation of semiconductor and display sourcing readiness. | Enabled cockpit platform roadmap alignment, improved supplier selection, and supported transition toward software defined cockpit architectures. |

| Commercial Vehicle OEM (India) | Optimization study for multi display layouts, evaluation of connected services for fleet monitoring, assessment of domain controller integration, and cost benefit analysis for cockpit upgrades. | Strengthened digital cockpit planning, improved feature allocation across trims, and enabled adoption of centralized compute platforms. |

| EV Manufacturer (Korea) | Mapping cockpit requirements for BEVs, evaluation of energy visualization interfaces, benchmarking of in cabin personalization features, and analysis of OTA capability readiness. | Identified priority user experience elements, refined feature development pipeline, and improved clarity on cockpit software investments. |

| Semiconductor Supplier (Japan) | Study of compute, graphics, and connectivity requirements by vehicle class, assessment of OEM platform roadmaps, and mapping opportunities across infotainment, ADAS, and cockpit controllers. | Supported next generation chipset positioning, guided product planning, and strengthened OEM engagement strategies. |

RECENT DEVELOPMENTS

- November 2025 : ECARX deepened its partnership with Volkswagen Group to supply advanced digital cockpit solutions (Antora 1000 & Cloudpeak software) for multiple Volkswagen models, integrating Google Automotive Services and expanding platform support.

- September 2025 : PATEO CONNECT+ launched an AI-enabled intelligent cockpit platform with device-cloud integration and multi-modal interaction, advancing cockpit AI and real-time monitoring capabilities.

- July 2025 : Minda Corporation partnered with Qualcomm Technologies to co-develop next-generation smart cockpit solutions for the Indian automotive market using Snapdragon Cockpit platforms.

Table of Contents

Methodology

The study involved analyzing the recent developments, digital cockpit software/hardware, feature analysis mapping of the players, and the regional Asia Pacific Digital Cockpit Market in 2024, along with the projections for 2030. The analysis was based on the sales volume of the ICE & EV passenger cars at the regional level and understanding the digital cockpit penetration with the help of model-wise mapping. The study analyses the digital cockpit as entry, mid, and high-end cockpit solutions and by the display size (<10”, 10-15”,>15”). Exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with the industry experts. The bottom-up approach was employed to estimate the complete market size of the digital cockpit.

Secondary Research

The secondary sources referred to for this research study include automotive OEMs, Tier I/II companies, and publications from government sources, automotive associations, and databases [such as country-level automotive associations and organizations, International Energy Agency (IEA), MarkLines, and others]; corporate filings (annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to determine the overall sales volume.

Market Size Estimation

The bottom-up approach was used to estimate and validate the Asia Pacific Digital Cockpit Market. This approach was also used to identify the sales of various subsegments in the Asia Pacific Digital Cockpit Market. The research methodology used to estimate the market includes the following:

Market Definition

The Asia Pacific Digital Cockpit Market outlook for 2024 includes the regional analysis of the Asia Pacific Digital Cockpit Market, penetration of digital cockpit in ICE and EVs, penetration of entry, and mid and high-end digital cockpits in passenger cars. Analysis of SoC and operating system suppliers in the Asia Pacific Digital Cockpit Market. The other sections include feature analysis, technology trends, BOM analysis, monetization strategies, and detailed OEM profiles, including details about software/hardware, feature analysis, product innovations, and recent developments.

Stakeholders

- Automobile Organizations/Associations

- Automotive OEMs

- Country-specific Automotive Associations

- Digital Cockpit Software Solution Providers

- Digital Cockpit SoC suppliers

- Digital Cockpit Domain Controller Suppliers

- Digital Cockpit Component Suppliers

- Digital Cockpit Operating System Providers

- European Automobile Manufacturers Association (ACEA)

- EV Manufacturers

- EV Component Manufacturers

- Government & Research Organizations

- Traders, Distributors, and Suppliers of Automotive Components

Report Objectives

- To analyze the Asia Pacific Digital Cockpit Market performance till 2030

- To analyze the OEMs across the regions with the potential for in-house manufacturing capabilities

- To analyze the features for each OEM, including intelligent voice control, AR-Navigation, AI- Personalization, OTA Updates, ADAS systems

- To competitively benchmark the OEMs based on the display sizes and display positions.

- To identify major growth segments and opportunities till 2030.

- To analyze the SoC suppliers and details about their OEM customers

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), product developments, and other activities carried out by key industry participants.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Digital Cockpit Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Digital Cockpit Market