Asia Pacific EV Battery Market

Asia Pacific EV Battery Market by Battery Type (Li-ion, NiMH, SSB), Vehicle Type (PC, Van/Light Truck, MHCV, Bus, OHV), Propulsion, Battery Form, Material Type, Battery Capacity, Method, Li-ion Battery Component, and Country – Forecast to 2035

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Asia Pacific EV battery market is driven by large-scale expansions in cell and material capacity. LFP is gaining market share because of stable iron and phosphate inputs, while the high nickel NCM 8 series remains the preferred choice for long-range segments. Manufacturers are developing prismatic and large-format cylindrical cell platforms. Production lines are adopting faster coating, high-pressure calendaring, and early-stage dry electrode processes. Ecosystem players are securing lithium, nickel, and graphite supplies through long-term contracts to stabilize costs. China’s industrial policy and India’s PLI program are speeding up local production of cathodes, anodes, and pack assemblies. Safety regulations are promoting wider adoption of cell-to-pack and cell-to-chassis integration, which increases volumetric energy density, reduces component count, and lowers costs per kilowatt hour.

KEY TAKEAWAYS

-

By RegionIn 2025, China is estimated to hold the largest share of 95.7% in the Asia Pacific EV battery market.

-

By Battery Capacity>300 MWh is expected to be the fastest-growing segment with a CAGR of 18.4% during the forecast period.

-

By Battery TypeThe solid-state segment is expected to record a CAGR of 21.6% between 2025 and 2035.

-

By Material TypeIron is estimated to be at USD 27.59 billion in 2025.

-

By PropulsionBEV is expected to be the largest segment during the forecast period.

-

By Vehicle TypeThe off-highway vehicle segment is expected to exhibit the fastest growth during the forecast period.

-

Competitive LandscapeCATL (China), BYD (China), LG Energy Solution (South Korea), CALB (China), and SK Innovation (South Korea) were identified as key players in the EV battery market, given their strong market share and product footprint.

The Asia Pacific EV battery market is driven by rising demand in passenger EVs, commercial fleets, and two-wheelers, each with unique requirements for cell format and performance. Passenger EVs seek higher range, leading to increased use of high nickel cathode systems and larger pack capacities. Fleet operators prioritize rapid charge readiness and thermal stability, favoring LFP and mid nickel chemistries. Additionally, grid integration is creating demand for repurposing retired EV batteries, influencing vehicle pack design. Charging expansion is also increasing demand for cells that can handle higher current loads and maintain tighter resistance control in production.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Asia Pacific EV battery market is evolving as regulatory pressure, platform consolidation, and energy system planning shape demand patterns for cell technologies and pack configurations. Standardization of module and pack interfaces is expected to gain traction, which will streamline qualification cycles and concentrate demand around a smaller number of cell formats. Requirements for fast charge compatibility are expected to rise with higher power charging infrastructure, which will increase demand for cells with low impedance and improved lithium transport characteristics. End-of-life recovery targets are expected to tighten, which will shift demand toward materials and pack structures that support easier dismantling and higher recovery rates, and this will influence procurement strategies for cathode and anode inputs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increased government incentives and OEM investments

-

Advancements in battery technologies

Level

-

Geopolitical instability and supply chain disruptions

-

Shortage of charging infrastructure in emerging economies

Level

-

Rise of Battery-as-a-Service model

-

Development of innovative solid-state batteries

Level

-

Cost disparity between electric and conventional vehicles

-

Shortage of lithium

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased government incentives and OEM investments

Government incentives in the Asia Pacific region are promoting the expansion of EV batteries by reducing capital costs for new cell and materials manufacturing plants, and enhancing investment returns for upstream components such as cathodes, anodes, and precursor units. In China, strong policy support, including tax breaks, affordable land, and funding from local governments, facilitates the rapid establishment and scaling of factories. Additionally, regional subsidies for EV purchases boost demand for battery packs and support investments in gigafactories. Research and development support mitigates risks associated with innovative chemistries and new production techniques. Moreover, recycling and recovery regulations help establish a framework for circular supply chains, while preferential duty programs expedite equipment upgrades and capacity expansion.

Restraint: Geopolitical instability and supply chain disruptions

Geopolitics significantly impacts the EV battery market through government-imposed export controls on key materials like lithium, nickel, and graphite. These restrictions change sourcing patterns and heighten supply risks. As a result, procurement is increasingly shifting toward regional suppliers that comply with new trade restrictions and origin tracing regulations. Additionally, strategic alliances and state-backed investments are directing capital into securing material sourcing and processing routes. Consequently, manufacturers are compelled to redesign their supply chains and explore battery chemistries that rely less on constrained minerals.

Opportunity:Rise of Battery-as-a-Service model

The Battery-as-a-Service (BaaS) model presents a significant growth opportunity for the EV battery market by providing an alternative to traditional battery ownership. This model separates the battery from the vehicle, allowing consumers to rent the battery on a monthly basis instead of buying it outright. By using this approach, consumers can reduce their initial costs and avoid worries about battery depreciation over time. For manufacturers, the BaaS model creates a more predictable demand, as they can better estimate market size by partnering with companies that offer battery rental services.

Challenge: Cost disparity between electric and conventional vehicles

Currently, the cost of EVs is significantly higher than that of ICE vehicles. This difference in price is primarily due to the expensive rechargeable lithium-ion batteries required for EVs. The cost of these batteries is largely affected by the prices of their components, such as cobalt, nickel, lithium, and magnesium, all of which are costly materials. Additionally, producing high-range EVs incurs higher costs because these vehicles require batteries with advanced specifications, incorporate sophisticated manufacturing technologies, and use expensive parts.

ASIA PACIFIC EV BATTERY MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supplying LFP and high nickel cells to major automakers for large scale EV programs. | Stable high-volume supply and lower cost per kilowatt hour. |

|

Deploying blade batteries across passenger cars and electric bus fleets. | Higher safety and longer service life for fleet operations. |

|

Providing pouch and cylindrical cells for premium EV and PHEV production. | Consistent long-range performance and reliable quality. |

|

Supplying LFP and ternary batteries for mass market EV platforms. | Cost efficient options with steady performance for high volume models. |

|

Delivering high nickel cells for performance focused electric cars. | Stronger range capability and faster charging. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific EV battery market ecosystem involves raw material suppliers like Glencore, which extract and process critical elements such as lithium, cobalt, and nickel. These materials then flow to anode material suppliers like SGL Carbon, which produces graphite anodes, a crucial battery cell component. Cathode material suppliers such as BASF play a vital role in producing materials like lithium cobalt oxide and lithium iron phosphate for the cathode. Subsequently, battery cell/pack suppliers like CATL, BYD, and LG Energy Solutions assemble these components into high-performance battery cells and packs. OEMs such as Tesla, BMW, NIO, and others integrate these batteries into their EVs, completing the cycle. This interconnected ecosystem drives innovation and ensures EV battery technology’s continuous development and advancement.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific EV Battery Market, By Battery Capacity

The 50–110 kWh segment is projected to lead the Asia Pacific EV battery market, driven by the increasing demand for mid-range EVs that balance cost, performance, and range. Batteries in this range are particularly suited for mass-market vehicles, as they provide an adequate driving range for everyday use while maintaining affordability.

Asia Pacific EV Battery Market, By Battery Form

The prismatic segment is projected to lead the Asia Pacific EV battery market, subject to its high energy density, compact design, and structural flexibility, which makes it ideal for modern EV architectures. This form is increasingly favored by battery manufacturers, including Samsung SDI, LG Energy Solution, and Panasonic Holdings Corporation, for maximizing energy storage while ensuring efficient space utilization in vehicle designs.

Asia Pacific EV Battery Market, By Battery Type

The lithium-ion segment is projected to hold the largest share in the Asia Pacific EV battery market due to its technological maturity, reliability, and safety. Decades of advancements in these batteries have led to their high energy density, long lifespans, and quick charging. The decreasing cost of lithium-ion batteries is also contributing to the broader adoption of EVs, making them more affordable and accessible to consumers.

Asia Pacific EV Battery Market, By Material Type

The natural graphite segment is projected to witness the fastest growth, driven by its role as the primary anode material in lithium-ion batteries. Its high conductivity, long cycle life, and cost effectiveness make it crucial for EV battery performance. The push for localized supply chains further boosts investments in graphite mining and processing, driving developments by key players in this area.

Asia Pacific EV Battery Market, By Propulsion

The BEV segment is expected to dominate the Asia Pacific EV battery market due to the growing consumer preference for fully electric vehicles over hybrid options. This demand for BEVs stems from their zero-emission capabilities and low long-term maintenance costs. Additionally, advancements in battery technology, including improvements in energy density and charging speeds, enhance the appeal of BEVs, addressing common consumer concerns such as range anxiety.

Asia Pacific EV Battery Market, By Vehicle Type

The passenger car segment’s dominance is driven by the elevated consumer demand for passenger cars, stringent emission regulations, and rapid advancements in battery technology. Governments worldwide offer incentives and subsidies to promote EV adoption, while automakers are investing heavily in expanding their EV production capacities.

REGION

India is the fastest growing country in the APAC EV Battery Market

India’s EV battery market is expected to grow at a rapid pace, driven by rising demand across passenger cars, commercial fleets, and two-wheelers. Domestic production is set to grow under the ACC PLI program, where gigafactory scale cell lines are configured for LFP, high nickel, and future solid state platforms. Material producers build electrode, electrolyte, and precursor units, and integrated plants for LiPF6 and cathode inputs move into commercial stages to cut import dependence. OEMs prepare local pack and module programs to meet policy requirements and align platform timelines with domestic cell availability. Pilot operations validate coating, calendaring, and formation steps, and planned high-throughput facilities position India to support fast-growing EV and stationary storage demand.

ASIA PACIFIC EV BATTERY MARKET: COMPANY EVALUATION MATRIX

In the Asia Pacific EV battery market, Contemporary Amperex Technology Co Ltd (CATL) (Star) leads as the company offers vehicle battery systems and energy storage systems (ESS). It is also involved in supplying batteries for special vehicles that are used at airports. It has augmented its global presence by creating alliances and partnerships with automakers like Tesla, Toyota Motor Corporation, Ford Motor Company, and Mercedes-Benz. ZTE Corporation (Emerging Leader) is rapidly expanding. The product portfolio of the company covers critical electronic components, devices, and modules. It also offers complete solutions and production equipment for manufacturing lines across industries.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Contemporary Amperex Technology Co., Limited (China)

- LG Energy Solution (South Korea)

- BYD Company Ltd. (China)

- Panasonic Holdings Corporation (Japan)

- SK Innovation Co., Ltd (South Korea)

- Samsung SDI (South Korea)

- CALB (China)

- Gotion (China)

- Sunwoda Electronic Co., Ltd. (China)

- Farasis Energy (GanZhou) Co., Ltd. (China)

- Toshiba Corporation (Japan)

- Mitsubishi Corporation (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 32.93 BN |

| Market Forecast in 2035 (Value) | USD 138.18 BN |

| Growth Rate | CAGR of 12.2% from 2025–2035 |

| Years Considered | 2021–2035 |

| Base Year | 2024 |

| Forecast Period | 2025–2035 |

| Units Considered | Value (USD MN/BN), Volume (Thousand Units/MWh) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Company Share, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | China, India, Japan, South Korea |

WHAT IS IN IT FOR YOU: ASIA PACIFIC EV BATTERY MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Need visibility on supply chain risks in Asia Pacific | Provided an assessment of raw material sourcing shifts, regional processing capacity, I and import exposure across major economies | Supported the client in understanding which markets offer stable supply and where bottlenecks may influence long term procurement |

| Request for insight on cost trends across battery chemistries | Analyzed cost movement across lithium iron phosphate, nickel-based chemistries, early solid-state development, linked to production scale and contract structures | Helped the client benchmark future pricing expectations and identify chemistries suited for volume programs and cost sensitive vehicle platforms |

| Interest in understanding OEM battery sourcing strategies | Reviewed supply agreements, joint ventures, and outsourcing patterns among leading OEMS in China, Japan, Korea, and Southeast Asia | Allowed the client to assess partnership models and anticipate future sourcing behaviour across regional EV programs |

| Need clarity on regional investment and manufacturing trends | Delivered insights on new factory announcements, capacity upgrades, and localisation moves across China, India, South Korea | Equipped the client with knowledge of where production is expanding and how this influences competitive positioning and procurement timelines |

| Request to understand how charging infrastructure impacts EV battery demand | Provided analysis of how fast charging expansion, home charging access, and public policy support are influencing battery capacity preferences and chemistry choices | Gave the client a clear view of how charging availability shapes consumer adoption and battery pack specifications in upcoming vehicle programs |

| Need a view on the role of fleet electrification | Highlighted adoption patterns in commercial fleets, logistics, and mobility services, linked to total cost of ownership and regulatory pressure | Enabled the client to track fleet driven volume commitments that support long term battery demand stability |

| Request for competitive benchmarking among battery suppliers | Delivered comparison of production scale, technology portfolios, supply chain integration, and long term supply commitments among leading regional manufacturers | Helped the client identify supplier strengths, partnership potential, and differentiation factors that influence sourcing decisions |

RECENT DEVELOPMENTS

- November 2025 : Guangde Qingna Technology Co., Ltd. signed an agreement for the setup of a 20 GWH sodium-ion battery gigafactory in Sichuan, China, with an investment of USD 835 million.

- April 2025 : CATL introduced new EV battery products at its Super Tech Day event. The company showed a second-generation fast-charging battery that can add about 520 km of range in five minutes of charging. It also launched its first sodium-ion battery brand, named Naxtra, which is cheaper and safer compared with traditional lithium-ion batteries.

- Febuary 2025 : Tesla started production in its new Chinese Gigafactory set up in Shanghai. The factory has a capacity of 10,000 megapacks, made for its Model 3 RWD EV.

- November 2024 : CATL launched the Tectrans series of batteries for heavy commercial vehicles. The Tectrans battery features 4C superfast charging and a range of up to 500 km on a single charge.

- September 2024 : Panasonic Holdings Corporation revamped its Wakayama Factory in western Japan to support the production of the next generation of 4680 automotive lithium-ion battery cells.

Table of Contents

Methodology

The research uses extensive secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the Asia Pacific EV battery market. Primary sources, such as experts from related industries, OEMs, and suppliers, have been interviewed to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study include corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; whitepapers and electric vehicles and EV Battery-related journals; certified publications; articles by recognized authors; directories; and databases. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

After understanding the Asia Pacific EV battery market scenario through secondary research, extensive primary research has been conducted. Primary interviews have been conducted with market experts from both demand and supply sides across Asia Pacific. Approximately 43% of interviews have been conducted from the demand side, while 57% of primary interviews have been conducted from the supply side. The primary data has been collected through questionnaires, emails, and telephone interviews.

In the canvassing of primaries, various departments within organizations, such as sales and operations, have been covered to provide a holistic viewpoint in this report. Primary sources from the supply side include various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders have also been interviewed.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the web content management market. The first approach involves estimating the market size by companies’ revenue generated through the sale of WCM products.

Market Size Estimation Methodology- Top-down approach

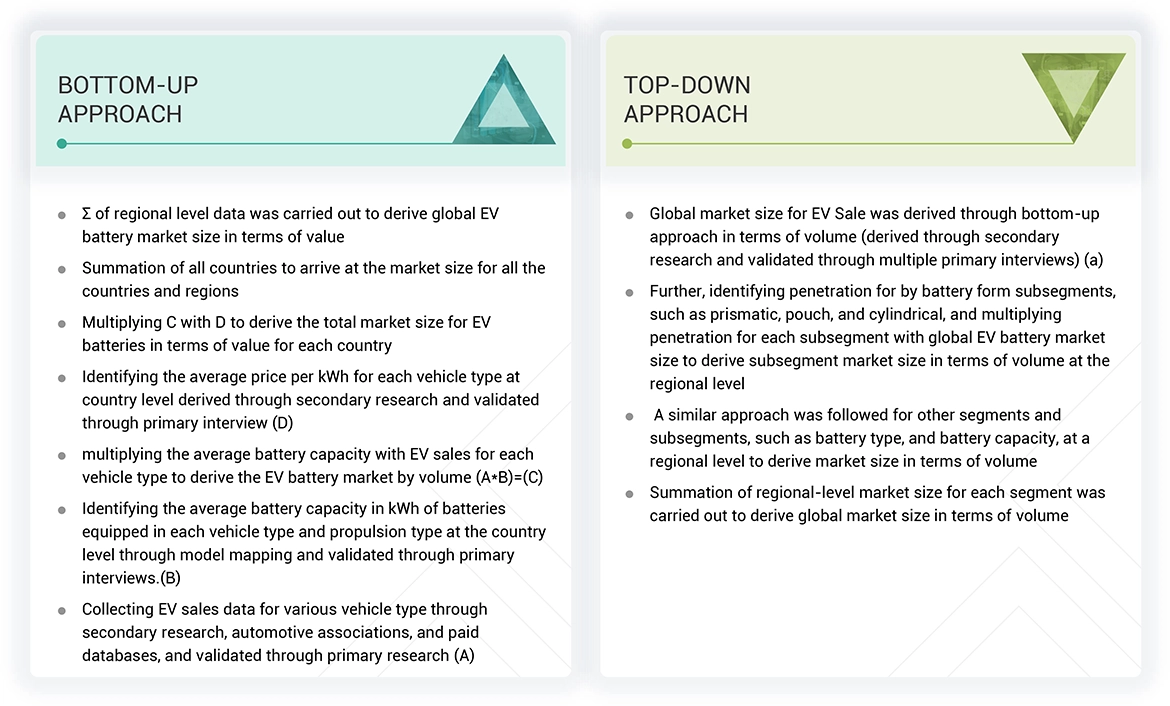

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Asia Pacific EV battery market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Asia Pacific EV Battery Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size of the global market through the methodology mentioned above, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and sub-segments, wherever applicable. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand and supply-side participants.

Market Definition

According to the Batteries Directive 2006/66/EC, batteries are defined as any source of electrical energy generated by direct conversion of chemical energy and consisting of one or more primary battery cells (non-rechargeable) or one or more secondary battery cells (rechargeable). An EV battery is a rechargeable battery used to power BEVs), PHEVs, and HEVs. An EV battery usually comprises numerous small, individual cells arranged in series or parallel to achieve the desired voltage and capacity.

Stakeholders

- Automotive OEMs

- Battery-related Service Providers

- End Users

- Asia Pacific EV Battery Casing Manufacturers

- EV Component Manufacturers

- Asia Pacific EV Battery Manufacturing Organizations

- Asia Pacific EV Battery Cell Manufacturing Organizations

- Asia Pacific EV Battery Pack Manufacturing Organizations

- Asia Pacific EV Battery Raw Material Miners and Suppliers

- Asia Pacific EV Battery Raw Material Refinery Companies

- EV Infrastructure Component Manufacturers

- EV Infrastructure Developers

- Government Bodies (who directly and indirectly provide incentives, aid, and orders to EV manufacturers)

- Manufacturers of Electric Vehicles (EVs)

- Regulatory Bodies

- Traders and Distributors of Electric Vehicles

- Traders, Distributors, and Suppliers of Asia Pacific EV Battery Components

Report Objectives

- To analyze and forecast the Asia Pacific EV battery market in terms of volume (thousand units) and value (USD million) from 2024 to 2035

-

To segment the market by Battery Capacity, Battery Form, Battery Type, Lithium-ion Battery Component, Material Type, Method, Propulsion, Vehicle Type, and Region

- To segment and forecast the market by Battery Capacity (<50 kWh, 51-110 kWh, 111-200 kWh, 201-300 kWh, and >301 kWh)

- To segment and forecast the market by Battery Form (Prismatic, Pouch, and Cylindrical)

- To segment and forecast the market by Battery Type (Lithium-ion, Nickel-metal Hydride, Solid-state, and Sodium-ion)

- To segment and forecast the market by Lithium-ion Battery Component (Negative electrode, Positive electrode, Electrolyte, and Separator)

- To segment and forecast the market by Material Type (Cobalt, Lithium, Natural Graphite, Manganese, Iron, Phosphate, and Nickel)

- To segment and forecast the market by Method (Wire Bonding, Laser Bonding, and Ultrasonic Metal Welding)

- To segment and forecast the market by Propulsion (Battery Electric Vehicles, Plug-In Hybrid Electric Vehicles, Fuel Cell Electric Vehicles, and Hybrid Electric Vehicles)

- To segment and forecast the market by Vehicle Type (Passenger Cars, Vans/Light Trucks, Medium & Heavy Trucks, Buses, and Off-highway Vehicles)

- To identify and analyze key drivers, challenges, restraints, and opportunities influencing the market growth

- To strategically analyze the market for individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

- Pricing Analysis

- Investment and Funding Scenario

- Value Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- HS Code

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Key Stakeholders and Buying Criteria

- Key Conferences and Events

- To strategically profile the key players and comprehensively analyze their market share and core competencies

- To analyze the impact of AI on the market

- To track and analyze competitive developments such as deals, product launches/developments, expansions, and other activities undertaken by the key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company's specific needs.

- Additional Company Profiles (Up to 5)

- Asia Pacific EV battery market, By Propulsion Type, at Country Level

- Asia Pacific EV battery market, By Propulsion Type at Vehicle Type Level

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific EV Battery Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific EV Battery Market