Asia Pacific Medical Tubing Market

Asia Pacific Medical Tubing Market by Material (Plastics, Rubber, Specialty Polymers), Application (Bulk Disposable Tubing, Catheters & Cannulas, Drug Delivery Systems), Structure (Single-Lumen, Multi-Lumen, Co-Extruded, Braided), and Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Asia Pacific medical tubing market size is projected to grow from USD 3.96 billion in 2026 to USD 5.61 billion by 2030, registering a CAGR of 9.2% during the forecast period. Demand for medical tubing in the Asia Pacific is driven by the increasing number of aged people and the rising number of chronic diseases. Moreover, there is a rise in expenditure on health care and the development of hospital facilities. The rise of medical device manufacturing hubs in China and India also supports the market growth.

KEY TAKEAWAYS

-

By CountryChina dominated the Asia Pacific medical tubing market, accounting for a 37.2% share, in terms of value, in 2025.

-

By MaterialBased on material, the specialty polymers segment is the fastest-growing segment with a CAGR of 9.3% in the medical tubing market during the forecast period.

-

By StructureThe co-extruded segment is estimated to account for the highest market share of 60%, in terms of value, during the forecast period.

-

By ApplicationThe catheters & cannulas segment is the largest application of the medical tubing market.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSCompanies such as Freudenberg Medical, B. Braun, and Terumo Corporation were identified as some of the star players in the Europe medical tubing market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE- STARTUPSjMedtech, Cubit Medisurge, and Ami Polymer, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The medical tubing market in Asia Pacific is steadily progressing due to the higher demand for less invasive devices, the opening of new hospital facilities, and growing home healthcare practices. The market is undergoing changes due to strategic partnerships between original equipment manufacturers (OEMs) and material suppliers, investment in research and development, and improvement in technology.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The medical tubing market in Asia Pacific is steadily growing due to the demand for less invasive devices, opening of new healthcare facilities, and growing home healthcare practices, which all require high-quality and biocompatible tubes. The market is undergoing changes due to agreements and developments, such as strategic partnerships between original equipment manufacturers (OEMs) and material suppliers, investment in research and development, advancements in technology, and the creation of strong and eco-friendly composites.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid healthcare expansion in China and India

-

Medical tourism & aging populations in Asia Pacific

Level

-

Price sensitivity and strong local competition

-

Volatile raw-material and import costs

Level

-

Localisation and CDMO growth

-

Premium & specialty products

Level

-

Regulatory fragmentation across Asia Pacific

-

Infrastructure & skills gaps in emerging markets

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid healthcare expansion in China and India

The swift development of the healthcare sector in China and India is the primary factor driving the Asia Pacific medical tubing market. Both countries are investing significantly in building up their medical infrastructure, improving healthcare access, and supporting the local medical-device industry. The Chinese government has implemented programs to encourage the production of high-value devices. This has led to an increase in demand for advanced tubing materials, such as silicone, PVC, TPE, and multi-lumen designs, which are used in IV sets, catheters, cannulas, respiratory circuits, and diagnostic devices. The program, Ayushman Bharat, along with the growing number of tertiary-care hospitals and the escalating use of minimally invasive procedures in cardiology, oncology, and orthopedics, are some of the factors that are driving the healthcare sector in India. Both countries are slowly becoming global manufacturing centers for medical devices. The increase in chronic diseases, more admissions to ICUs, and more frequent use of single-use devices are all contributing to increased medical tubing consumption. Moreover, the existence of favorable policies that encourage import substitution and low-cost production helps to achieve faster scalability and economical supply. All in all, China and India are the backbone of the Asia Pacific medical tubing market in terms of manufacturing and consumption.

Restraint: Price sensitivity and strong local competition

In the Asia Pacific region, price sensitivity and local competition are the factors that highly restrict the medical tubing market, especially in China, India, and Southeast Asia, where a high volume of manufacturing is done. The region has small and medium-sized extrusion companies that produce silicone, PVC, TPE, and specialty tubing at very competitive prices. This is giving rise to intense pressure on the margins of global and premium suppliers. On the other hand, the local manufacturers enjoy the benefits of low labor costs, flexible production methods, and proximity to the OEMs. Due to these factors, they can sell the tubing at prices that are often 20 to 40% lower than those of the international competitors. Hospitals, diagnostic centers, and local device manufacturers in Asia Pacific usually have cost as their main focus. This compels players from the international market to either decrease prices, localize production, or partner with regional converters to stay competitive. In addition, the policies of governments in countries such as China and India are increasingly favoring the local sourcing of materials and imposing restrictions on imports, which in turn gives domestic competitors an even stronger position. Consequently, it becomes difficult for the suppliers to make their products stand out. Those who manufacture high-precision, multi-lumen, or specialty polymer tubing find it difficult to justify the high prices. The strong competition on price is a big hindrance to the acceptance of tubing solutions with higher value.

Opportunity: Localization & CDMO growth

The Asia Pacific medical tubing market is significantly benefited by the localization of manufacturing as well as by the rise of contract development and manufacturing organizations (CDMOs). The establishment of extrusion lines, Class-7/8 cleanrooms, and sterilization facilities in Malaysia, India, China, Vietnam, and Thailand results in a drastic reduction of lead times, logistics, and tariff costs and also aids suppliers in meeting the local content and purchasing preferences. CDMOs provide the scaling up of the capacity, regulatory know-how, and quick prototyping. This means that global OEMs and regional device makers are enabled to turn designs into manufacturable tubing assemblies, while also ensuring traceability and quality consistency. The relocation of tubing production closer to the end-user not only reduces the risks associated with supply disruptions from overseas but also enables a faster turnaround of custom designs, including multi-lumen tubing and sensor-integrated tubing. It also complements the services offered, which include overmolding, connector assembly, and final sterilization. For hospitals and local OEMs, the proximity to nearby CDMOs results in a minimized time to market and easier sourcing. Strategic alliances between material specialists from the international market and Asia Pacific CDMOs can facilitate access to high-grade polymers and accurate extrusion at competitive prices. This increases the availability of premium tubing across the region.

Challenge: Regulatory fragmentation across Asia Pacific

One of the biggest hurdles in the medical tubing market is the fragmentation of regulations in the Asia Pacific region. Every country has different approval routes, testing standards, and documentation requirements. The same is true for the NMPA of China, the CDSCO of India, the PMDA of Japan, the MFDS of South Korea, and the regulatory authorities in the ASEAN countries, as they all use different timelines, classification systems, and safety standards for the materials. Such inconsistency poses a problem for manufacturers of tubing in devising a uniform compliance strategy. For high-quality products such as multi-lumen, implant-grade, or specialty silicone and fluoropolymer tubing, manufacturers typically undergo a process of retesting their products for biocompatibility, conducting quality audits, and performing sterilization validations for various markets. Consequently, this adds to the costs and delays in producing the products. Although the ASEAN Medical Device Directive and similar initiatives aim to standardize rules, the rate of implementation remains very low. Minor markets still need independent approvals. The current situation makes the supply chain for international trade challenging, and new tubing solutions are being introduced more slowly to the market. Moreover, it forces companies to have region-specific documentation as well as separate production batches. Global suppliers and regional SMEs thus suffer from a longer time to market and higher compliance costs as a shared consequence.

ASIA PACIFIC MEDICAL TUBING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Medical tubing for infusion sets, dialysis circuits, and catheter-based systems used in hospitals, home-care settings, and regional healthcare networks across APAC, engineered for high biocompatibility and seamless integration into clinical workflows | Improved patient safety, accurate fluid delivery, low infection risk, and strong material compatibility, enhancing clinical efficiency and supporting better treatment outcomes across varied Asia Pacific care environments |

|

Specialized catheter and cannula tubing for vascular access, minimally invasive procedures, ICU therapies, and dialysis applications produced for major healthcare systems in Japan, China, and India, incorporating precise extrusion and sterilization processes | High operational reliability, superior flow accuracy, and strong customization flexibility, ensuring adherence to Asia Pacific regulatory standards and improving device performance in critical and chronic care settings |

|

Advanced multi-lumen, silicone, and thermoplastic tubing solutions for respiratory care, surgical devices, diagnostic systems, and sensor-integrated catheters tailored to diverse Asia Pacific medical technology requirements | Higher manufacturing precision, reduced device malfunction risk, improved patient safety, and strong support for complex device assemblies requiring integrated sensing and minimally invasive functionality |

|

Reinforced, braided, and extruded tubing systems designed for interventional cardiology, urology, anesthesia, and home-care medical devices used across India, China, and Southeast Asia, ensuring durable performance in high-pressure and procedure-intensive environments | Enhanced fluid and drug delivery accuracy, long-term mechanical durability, improved compatibility with minimally invasive procedures, and strong regulatory compliance tailored to Asia Pacific healthcare markets |

|

Tubing for IV sets, catheters, infusion devices, and renal therapy systems manufactured for hospitals and chronic-care providers in Japan, China, and India, focusing on affordability and high-volume production | Better patient comfort, consistent device performance, reduced treatment frequency, and safe disposable-use compliance, supporting the expansion of chronic-care therapies and home-based treatment models across Asia Pacific |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific medical tubing ecosystem includes raw material suppliers that provide medical-grade polymers, silicones, thermoplastics, and specialty additives to local tubing manufacturers. These manufacturers create high-precision, biocompatible tubing for hospitals, home care, diagnostics, and minimally invasive therapies. Distributors, contract development and manufacturing organizations (CDMOs), and medical device OEMs connect tubing producers with end users. They ensure the timely delivery of finished tubing sets and assemblies across Asia Pacific markets. Local manufacturing hubs in China, India, Malaysia, and Southeast Asia support affordable production and help meet regulatory requirements. Together, these hubs create a smooth process for sourcing certified materials and producing quality- controlled, sterilization-ready tubing. This ultimately results in safe, reliable, and high-performance solutions for critical medical devices and patient care systems.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Medical Tubing Market, By Structure

The Asia Pacific medical tubing market is segmented based on structure into single-lumen, co-extruded, multi-lumen, tapered or bump, and braided tubing. Multi-lumen tubing leads the market as it can handle complex fluid delivery and various applications. Single-lumen and co-extruded tubing are often used for simpler procedures. Tapered, bump, and braided tubing are becoming more popular in specialized applications that require improved flexibility, strength, and durability.

Asia Pacific Medical Tubing Market, By Material

The Asia Pacific medical tubing market is segmented based on material into plastics, rubbers, specialty polymers, and other materials. Rubbers, such as silicone and TPE, are the most popular because they are flexible, biocompatible, and suitable for long-term or implantable applications. Plastics are often used for disposable devices due to their low cost and flexibility. Specialty polymers, such as fluoropolymers and PEEK, are gaining traction in applications that need chemical resistance and precision. Other materials, including bioabsorbable polymers, meet specific needs, such as drug delivery systems.

Asia Pacific Medical Tubing Market, By Application

The Asia Pacific medical tubing market is segmented based on application into bulk disposable tubing, catheters & cannulas, drug delivery systems, and specialized applications. Catheters and cannulas are widely used in minimally invasive procedures and long-term care. Meanwhile, drug delivery and specialized tubing applications are seeing increased adoption. Demand for tubing designed for specific applications is expected to grow as innovations in medical devices and patient-focused solutions continue to spread across healthcare settings.

REGION

India to be fastest-growing country in Europe medical tubing market during forecast period

India is poised to be the fastest-growing market for medical tubing in Asia Pacific. This growth results from the rapid expansion of healthcare infrastructure, an increase in people opting for minimally invasive procedures, and government programs like Ayushman Bharat that enhance access to hospitals and diagnostic services. The country's medical device manufacturing sector is also expanding. Low production costs and supportive policies attract local and international OEMs. Additionally, the growing demand for home healthcare, chronic care treatments, and medical tourism increases the need for high-quality, biocompatible tubing in India.

ASIA PACIFIC MEDICAL TUBING MARKET: COMPANY EVALUATION MATRIX

In the Asia Pacific medical tubing market, B. Braun (Star) leads due to its strong presence in the region and a diverse portfolio that includes infusion, vascular access, and specialty tubing. This edge comes from its manufacturing abilities and extensive hospital network. Nipro Corporation (Emerging Leader) is improving its market position by venturing into biopharma and single-use assemblies. The company leverages its expertise in silicone extrusion and molding to support rapidly growing areas, such as mRNA and cell therapy applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- B. Braun (Germany)

- Freudenberg Medical (US)

- Terumo Corporation (Japan)

- Teleflex (US)

- W. L. Gore & Associates (US)

- Saint-Gobain (France)

- Trelleborg Medical Solutions (US)

- Tekni-Plex (US)

- Nordson (US)

- Nipro Corporation (Japan)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 3.61 Billion |

| Market Forecast in 2030 (value) | USD 5.61 Billion |

| Growth Rate | CAGR of 9.2% from 2026-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2025 |

| Forecast Period | 2026–2030 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | China, India, South Korea, Japan, Thailand, Malaysia, and Rest of Asia Pacific |

WHAT IS IN IT FOR YOU: ASIA PACIFIC MEDICAL TUBING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-Based Medical Device Manufacturer | Polyurethane, thermoplastic elastomers, composite structures, quality certifications (ISO 13485, REACH), production scalability, Asia-Pacific supply chain mapping for cost efficiency. |

|

| Hospital & Healthcare Systems |

|

|

| Catheters & Cannulas |

|

|

| European Medical Tubing Supplier |

|

|

| Drug Delivery System |

|

|

RECENT DEVELOPMENTS

- Aug-24 : Nordson Corporation acquired Atrion Corporation, a prominent provider of medical infusion and cardiovascular solutions, thereby broadening Nordson’s medical portfolio and extending its reach into additional markets.

- Jul-24 : Nipro announced a new major medical device manufacturing facility in Greenville, North Carolina, aimed at serving patients with diabetes and chronic kidney disease. The facility is expected to produce renal and infusion devices featuring comprehensive medical tubing assemblies.

- February 2024 : Trelleborg AB acquired Baron Group, a leading producer of advanced precision silicone components, integrating it into Trelleborg Medical Solutions.

- May 2023 : Terumo is investing approximately USD 0.33 billion to establish a new manufacturing facility at its Kofu East site in Japan, aimed at supporting its CDMO operations and the production of products such as peritoneal dialysis sets, which feature complex medical tubing assemblies.

- August 2021 : Freudenberg Medical enhanced its catheter manufacturing capabilities by expanding sensor integration, advanced extrusion, handle and shaft development, and balloon forming technologies.

Table of Contents

Methodology

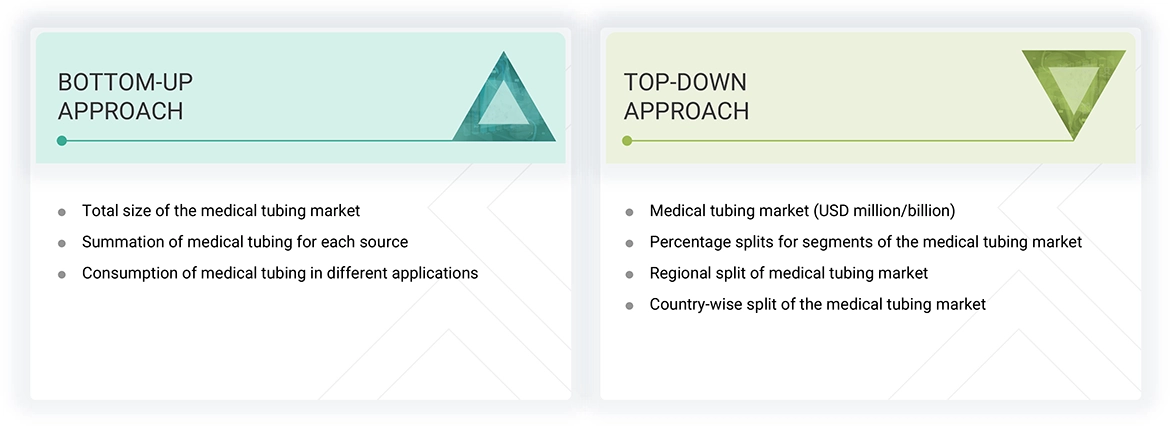

The study involved four major activities for estimating the current size of the Asia Pacific medical tubing market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of Asia Pacific medical tubing through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the Asia Pacific medical tubing market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred, to identify and collect information for this study on the Asia Pacific medical tubing market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The Asia Pacific medical tubing market comprises several stakeholders in the supply chain, which include raw material suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the asia pacific medical tubing market. Primary sources from the supply side include associations and institutions involved in the asia pacific medical tubing market, key opinion leaders, and processing players.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the Asia Pacific medical tubing market by material, application, structure, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders such as directors and marketing executives to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the Asia Pacific medical tubing market from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Medical tubing is flexible, hollow tubing used in a range of medical and pharmaceutical uses for the transfer of fluids and gases. Medical tubing is a critical component in healthcare environments for uses including drug delivery, respiratory therapy, catheters, intravenous (IV) therapy, and peristaltic pumps. Medical tubing is produced from materials such as silicone, polyvinyl chloride (PVC), thermoplastic elastomers (TPE), and polyethylene, providing biocompatibility, chemical resistance, and flexibility. The market for medical tubing is growing due to improving healthcare spending, expanding demand for minimally invasive treatments, and technological innovation in medical devices. The growing prevalence of chronic diseases, such as cardiovascular diseases and diabetes, has also fueled demand for medical tubing solutions.

Stakeholders

- Asia Pacific Medical Tubing Manufacturers

- Raw Material Suppliers

- Regulatory Bodies and Government Agencies

- Distributors and Suppliers

- End-Use Industries

- Associations and Industrial Bodies

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the size of the Asia Pacific medical tubing market in terms of value and volume.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To forecast the market size based on material, application, structure, and region.

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders.

- To strategically profile leading players and comprehensively analyze their key developments such as new product launches, expansions, and deals in the Asia Pacific medical tubing market.

- To strategically profile key players and comprehensively analyze their market shares and core competencies.

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Medical Tubing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Medical Tubing Market