Asia Pacific PEEK Market

Asia Pacific PEEK Market by Reinforcement Type (Glass Filled, Carbon Filled, Unfilled), Processing Method (Extrusion, Injection Molding), End-Use Industry (Electrical & Electronics, Aerospace, Automotive, Oil & Gas, Medical), and Country - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Asia Pacific PEEK market is projected to grow from USD 0.57 billion in 2025 to USD 0.85 billion by 2030, at a CAGR of 8.6% during the forecast period. As manufacturing hubs in China, Japan, South Korea, and India push toward higher reliability, miniaturization, lightweighting, and heat-resistant components, PEEK has become a preferred material due to its exceptional thermal stability, mechanical strength, chemical resistance, and durability. The region is also witnessing growing localization of PEEK compounding and component production, making the material more accessible for diverse applications. With strong technological upgrades, expanding electric vehicle and semiconductor industries, and a shift toward premium engineering plastics, Asia Pacific is emerging as the most dynamic and strategically important market for PEEK globally.

KEY TAKEAWAYS

-

BY COUNTRYChina is the fastest-growing country in the Asia Pacific PEEK market, registering a CAGR of 9.4%, in terms of volume, during the forecast period.

-

BY REINFORCEMENT TYPEBy reinforcement type, the glass-filled segment accounted for a 38.4% share in terms of value in 2024.

-

BY PROCESSING METHODBy processing method, the injection molding segment is expected to dominate the Asia Pacific PEEK market during the forecast period.

-

BY END-USE INDUSTRYBy end-use industry, the electrical & electronics segment is the largest end user of PEEK in Asia Pacific, accounting for a share of 32.0%, in terms of value, in 2024.

-

Competitive Landscape - Key PlayersJilin Joinature Polymer Co., Ltd., Junhua, and Mitsubishi Chemical Group were identified as some of the star players in the Asia Pacific PEEK market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsPEEK China, Zhejiang Pfluon Technology Co., Ltd., and Perfect Polymers, among others, have distinguished themselves as startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Asia Pacific is emerging as the most dynamic and strategically important market for PEEK globally. The region is also witnessing growing localization of PEEK compounding and component production, making the material more accessible for diverse applications. With strong technological upgrades, expanding electric vehicle and semiconductor industries, and a shift toward premium engineering plastics.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The Asia Pacific PEEK market is growing rapidly due to expanding industrialization, increasing adoption of high-performance materials, and the region’s shift toward advanced manufacturing. Strong demand from the electrical & electronics, aerospace, automotive, and medical sectors, driven by needs for thermal stability, strength, chemical resistance, and lightweight design, is accelerating PEEK consumption. Glass-filled and other reinforced PEEK grades are increasingly replacing metals, while extrusion and injection molding support high-volume production of precision components. With semiconductor growth, device miniaturization, and rising use of PEEK in aerospace, mobility, and medical implants, the region is becoming a global hub for high-performance polymers. Strengthening local supply chains and growing domestic manufacturing further reinforce Asia Pacific’s dominant PEEK market outlook.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid expansion of electronics and semiconductor manufacturing

-

Increasing adoption in medical devices

Level

-

Limited large-scale production capacity within the region

-

Complex processing requirements

Level

-

Increasing use of PEEK in advanced semiconductor equipment

-

Growing adoption of 3D printing and additive manufacturing

Level

-

Strong competition from other advanced polymers

-

Environmental and sustainability pressures

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid expansion of electronics and semiconductor manufacturing

The Asia Pacific PEEK market is primarily influenced by the rapid growth of electronics and semiconductor manufacturing, which is also supported by solid industrial and technological data. The region is home to the world's largest electronics production base, with China as the largest market for consumer electronics and telecom equipment, South Korea and Taiwan leading in the production of advanced semiconductors, and Japan supplying high-precision components and materials. PEEK is extensively used for wafer-handling parts, chip-processing components, chemical-resistant fixtures, and precision insulating elements because of the region’s new fabs and investment in advanced process nodes. The rising production of 5G equipment, high-frequency connectors, and miniaturized electronic assemblies also contributes to increased demand for PEEK. The rapid industrial expansion in the Asia Pacific region, which is the major source of global semiconductor output and consumer electronics manufacturing, is driving PEEK adoption in the region.

Restraint: Limited large-scale production capacity within the region

The inability of large-scale production in the Asia Pacific region is clearly linked to structural and technical factors that limit PEEK demand growth to a considerable extent. PEEK production is extremely specialized, demanding highly accurate and intricate polymerization, sophisticated reactor systems, and rigorous quality control, which very few global players have been able to master. Hence, Asia Pacific is still heavily dependent on a few international suppliers for PEEK resin of the highest purity. This results in tight supply, longer lead times, and increased raw material costs, particularly during times of high demand from electronics, automotive, and aerospace sectors. The demand for PEEK is rapidly increasing in China and India, but local manufacturers, though still scaling up, often cannot match the volume, quality, and specialty grades of the established global suppliers. This situation compels many downstream processors and OEMs to rely on imported resins and compounds, which not only adds to costs but also exposes manufacturers to currency fluctuations and supply chain disruptions. Thus, the region's limited large-scale production capacity constitutes a bottleneck that inhibits the global adoption of PEEK.

Opportunity: Increasing use of PEEK in advanced semiconductor equipment

The Asia Pacific region is rapidly moving towards the utilization of PEEK in advanced semiconductor manufacturing equipment as chip manufacturers are aiming for smaller dimensions, higher production, and more rigorous environments in terms of chemicals and heat. The modern semiconductor manufacturing process is a series of events that take place in an extreme environment with high temperatures, aggressive chemicals for etching, and full exposure to plasma, along with tight controls for contamination, which, among others, require materials with exceptional properties such as chemical resistance, thermal stability, and ultra-low particle generation. PEEK is the perfect material for these processes, which is why it is increasingly used for wafer-handling components, socket frames, valve seats, insulating parts, chemical-resistant fixtures, and precision modules in lithography, etching, deposition, and cleaning equipment. As Asia Pacific continues to expand its semiconductor ecosystem with large investments in new fabs throughout China, Taiwan, South Korea, and Japan, equipment suppliers and component manufacturers are giving PEEK a try to enhance reliability and minimize downtimes. PEEK’s ability to maintain dimensional accuracy through multiple thermal cycles and its low outgassing make it a good choice for cleanroom environments, where the risk of contamination that can ruin wafers worth thousands of dollars each is reduced. In addition, the region's transition to more sophisticated nodes, among them sub-10 nm technologies, is pushing for the development of ultra-pure, high-performance materials, thereby reinforcing PEEK's position in the future semiconductor equipment market. This increased dependence on PEEK is a significant area of opportunity in the overall Asia Pacific PEEK market.

Challenge: Strong competition from other advanced polymers

The PEEK market in the Asia Pacific region faces strong competition from other advanced polymers. There are high-performance alternatives with lower cost and competitive properties. PPS (polyphenylene sulfide), PEI (polyetherimide), PAI (polyamide-imide), and high-temperature nylons are the materials that contribute the most to the market and are well-recognized for their applications in automotive, electronics, and industries where quality thermal stability, chemical resistance, and mechanical strength are needed with great durability for high-performance specifications or requirements. It is common for these polymers to be 30-60% less expensive than PEEK, making them very appealing to manufacturers looking to cut costs, especially in high-volume segments. In applications such as automotive electronics, EV components, and consumer devices, engineers mostly choose these alternatives unless the application clearly states that it requires PEEK's extreme temperature resistance or fatigue performance. Also, Asia Pacific has a strong local manufacturing base for the production of PPS, PEI, and high-temperature nylons, allowing them to be more widely available and cost-competitive than PEEK. This scenario has led to PEEK being used only for highly specialized applications by many OEMs, while competing polymers are used for mainstream requirements, thus creating a situation of persistent competitive pressure in the region.

ASIA PACIFIC PEEK MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

High-precision connectors and insulating components in smartphones and semiconductor equipment | High dielectric strength for stable electrical performance | Dimensional stability during high-temperature soldering | Improved device miniaturization and heat resistance |

|

PEEK used in EV battery insulation, high-voltage connectors, and thermal management modules | High heat resistance improves safety in battery packs | Lightweight components support range improvement | Enhanced durability in high-frequency charging cycles |

|

PEEK components in aircraft interior systems, brackets, and cable insulation | Significant weight reduction compared to metal parts | Flame resistance and low smoke/toxic emissions | Improved fuel efficiency and easier manufacturability |

|

PEEK spinal cages and orthopedic implants | Biocompatibility and radiolucency (transparent in X-rays) | Bone-like modulus reduces stress shielding | High fatigue resistance for long-term implant stability |

|

PEEK used in high-wear seals, valve seats, and pump components | Excellent chemical resistance for harsh process environments | Long service intervals due to low wear | Stable mechanical properties under continuous heat exposure |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The PEEK market ecosystem in the Asia Pacific region is shaped by a well-defined value chain that spans specialized resin producers, raw material suppliers, distributors, and end-use industries with advanced performance requirements. At the core of the ecosystem are polyether ether ketone (PEEK) manufacturers such as Mitsubishi Chemical Group, ZYPEEK, and other regional producers that provide high-performance PEEK grades for engineering and industrial applications. Supporting them are raw material suppliers such as Wanlong Chemical and OYI Chemical, which ensure a reliable supply of monomers, intermediates, and additives essential for PEEK synthesis. Distribution partners, including companies such as CoPEEK and Conventus Polymers, play a critical role in bridging manufacturers with diverse downstream industries by offering technical support, logistics, and localized inventory. The ecosystem is completed by end users such as Toshiba Machine and Farsoon Technologies, which incorporate PEEK into components for electronics, additive manufacturing, industrial machinery, and high-precision equipment. Together, this interconnected network enables the rapid adoption of PEEK across Asia Pacific, supports innovation in advanced applications, and strengthens the region’s position as a growing hub for high-performance polymer technologies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific PEEK Market, By Reinforcement Type

The glass-filled PEEK is the fastest-growing segment in the Asia Pacific PEEK market, due to its excellent combination of mechanical strength, dimensional stability, and cost-effectiveness compared to other reinforced grades. The rapid development in electronics, automotive, and industrial machinery in countries such as China, Japan, South Korea, and India is driving the use of glass-filled PEEK in high-performance components. High-content glass grades typically contain 30%-50% glass fibers and provide substantial increases in stiffness (up to 3x), tensile strength, and creep resistance, making them ideal for substituting metal with plastic in extreme conditions. The boom in semiconductor and electronics manufacturing is paving the way for the use of glass-filled PEEK in applications such as connectors, IC sockets, insulation parts, and structural components that require high thermal and mechanical performance stability under high thermal and mechanical stress. The segment also benefits from the growing popularity of electric vehicles (EVs). Car manufacturers that produce EVs in China and Japan are using glass-filled PEEK in battery management systems, under-the-hood components, and lightweight structural parts because of its high thermal resistance and good insulation properties. Moreover, 3D printing system manufacturers in the region, such as Farsoon Technologies, are using glass-filled PEEK filaments to produce strong, accurate parts for prototyping and final use, among other applications.

Asia Pacific PEEK Market, By End-Use Industry

The electrical & electronics sector is the fastest-growing end user in the Asia Pacific PEEK market. The market is driven by the rapid development of semiconductor manufacturing, consumer electronics production, and high-performance electrical systems in the region. Asia Pacific accounts for a significant share of global electronics output. Companies in China, South Korea, Japan, and Taiwan are supplying the entire world with chips, smartphones, PCs, wearables, and advanced electronic components. The strength of this industrial sector directly drives demand for PEEK. The key factor for growth is the massive increase in semiconductor manufacturing investments, driven by China's commitment to chip self-sufficiency and the ongoing capacity expansions in Taiwan and South Korea, among others. The use of PEEK is very common in wafer-handling tools, connectors, IC test sockets, insulating parts, and high-precision components that must withstand temperatures, chemicals, and plasma in semiconductor production equipment. Another factor contributing to the growth is the consumer electronics boom. The major EMOs in the region involved in smartphones, 5G devices, and high-density circuit board manufacturing are pushing for PEEK applications in micro-connectors, sensors, thermal management components, and miniaturized insulating structures because of the material's ability to perform reliably in compact designs. The need for lightweight, high-temperature, electrically stable polymers in electric vehicles, 5G infrastructure, and IoT devices has already pushed the demand higher and further supported the growth of the PEEK market.

REGION

China is estimated to account for the largest market during the forecast period

China is estimated to account for the largest share of the Asia Pacific PEEK market due to its exceptional manufacturing capabilities, rapid industrial modernization, and continuous growth of high-tech sectors. China has the largest market for electrical and electronic devices, domestic appliances, electric vehicles, and industrial machines, all of which require substantial quantities of high-performance materials, such as PEEK, with outstanding thermal, mechanical, and chemical stability. The country’s goal of becoming self-sufficient in semiconductors and advanced materials is a major driver of increased domestic demand for PEEK in areas such as wafer-processing equipment, test sockets, connectors, and precision insulation components. Moreover, China has the biggest market for automobiles and EVs, which creates a massive demand for polymers that are light and capable of withstanding high temperatures for battery systems, electrical components, and under-the-hood applications. The establishment of manufacturing hubs for EV batteries and the increasing use of PEEK in thermal management and high-voltage insulation are other factors that help secure its position. China is also investing in its aerospace, healthcare device, and oil & gas industries, all of which are using PEEK for its corrosion resistance and reliability in harsh environments.

ASIA PACIFIC PEEK MARKET: COMPANY EVALUATION MATRIX

In the Asia Pacific PEEK market matrix, Jilin Joinature Polymer Co., Ltd. (Star) leads with a strong market share and extensive product footprint. Toray Plastic Precision Co., Ltd. (Emerging Leader) demonstrates substantial product innovations compared to its competitors. While Jilin Joinature Polymer Co., Ltd. dominates through scale and diversified portfolio, Toray Plastics’ PEEK shows significant potential to move toward the leaders’ quadrant as demand for PEEK continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Jilin Joinature Polymer Co., Ltd. (China)

- Junhua (China)

- Mitsubishi Chemical Group (Japan)

- SurloIndia (India)

- J.K. Overseas (India)

- Toray Plastic Precision Co., Ltd. (China)

- Zibo Bainaisi Chemical Co., Ltd (China)

- PEEKChina (China)

- Zhejiang Pfluon Technology Co., Ltd. (China)

- Perfect Polymers (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.53 BN |

| Market Forecast in 2030 | USD 0.85 BN |

| CAGR (2025–2030) | 8.6% |

| Years considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Kiloton) |

| Report Coverage | The report defines, segments, and projects the Asia Pacific PEEK market size based on reinforcement type, processing method, end-use industry, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as new product development, agreements, acquisitions, and expansions that they undertake in the market. |

| Segments Covered |

|

| Regional Scope | China, Japan, India, South Korea, Australia & New Zealand, and Rest of Asia Pacific |

WHAT IS IN IT FOR YOU: ASIA PACIFIC PEEK MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Electronics & Semiconductor Manufacturers (IC sockets, connectors, wafer tools, chip equipment parts) |

|

|

| Automotive & EV OEMs/Tier-1 Suppliers (Battery systems, HV insulation, power electronics housings) |

|

|

| Aerospace & Defense Companies (Brackets, ducts, cable insulation, lightweight structures) |

|

|

| Medical Device Manufacturers (Implants, tool handles, imaging equipment components) |

|

|

| Industrial Equipment & Machinery Manufacturers (Gears, bearings, compressor parts) |

|

|

| 3D Printing/Additive Manufacturing Companies |

|

|

RECENT DEVELOPMENTS

- May 2022 : Zhongyan Co., Ltd. developed an ultra-pure PEEK material designed to replace traditional insulation coatings used in enameled wire. Enameled wire production is complex because it requires precise control of raw materials, processing conditions, equipment, and the manufacturing environment to meet strict performance standards. The new PEEK solution aims to overcome these challenges by offering a more stable, high-performance insulation option.

- March 2022 : Zhongyan Co., Ltd. developed an ultra-pure PEEK material designed to replace traditional coatings used on enameled wire. Because enameled wire production is highly sensitive to raw material quality, process conditions, equipment, and manufacturing environment, creating products that meet strict standards is challenging. The new PEEK material aims to overcome these limitations and improve overall performance.

Table of Contents

Methodology

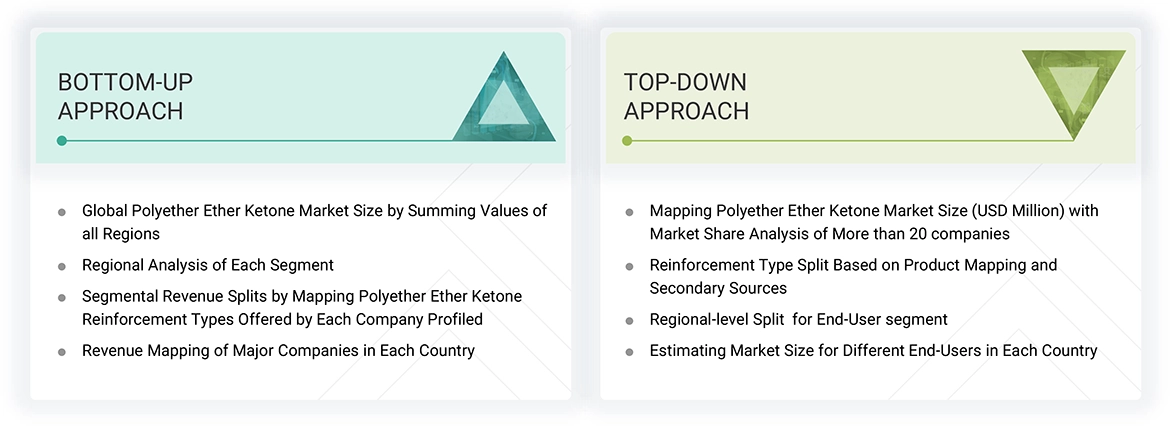

The research encompassed four primary actions in assessing the present market size of Asia Pacific PEEK market. Comprehensive secondary research was conducted to gather information on the market, the peer market, and the parent market. The subsequent stage involved corroborating these findings, assumptions, and dimensions with industry specialists throughout the Asia Pacific PEEK value chain via primary research. The total market size is ascertained using both top-down and bottom-up methodologies. Subsequently, market segmentation analysis and data triangulation were employed to determine the dimensions of the market segments and sub-segments.

Secondary Research

The research approach employed to assess and project the access control market is initiated by collecting revenue data from prominent suppliers using secondary research. During the secondary research, sources such as D&B Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines were utilized to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations; white papers; accredited periodicals; writings by esteemed authors; announcements from regulatory agencies; trade directories; and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

The Asia Pacific PEEK market comprises several stakeholders in the supply chain, such as manufacturers, suppliers, traders, associations, and regulatory organizations. The demand side of this market is characterized by the development of electrical & electronics, automotive, oil & gas, medical, aerospace, and other applications. Advancements in technology characterize the supply side. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Asia Pacific PEEK market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the Asia Pacific PEEK market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Asia Pacific PEEK Market Size: Bottom-Up and Top-Down Approaches

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

Polyether ether ketone is a high-performance, semi-crystalline thermoplastic polymer known for its excellent mechanical strength, thermal stability, chemical resistance, and flame retardancy. It is widely utilized in demanding engineering applications due to its ability to maintain performance under extreme conditions. PEEK is available in several reinforcement types, including unfilled polyether ether ketone, glass-filled polyether ether ketone for improved rigidity and dimensional stability, and carbon-filled polyether ether ketone for enhanced strength, stiffness, and thermal conductivity. The polymer is processed through advanced methods such as injection molding and extrusion, which allow for the production of complex components with high precision. Owing to its superior properties, PEEK finds extensive applications across various end-use industries, including electrical and electronics, aerospace, automotive, oil and gas, and medical. These industries leverage PEEK’s performance benefits for parts such as insulators, connectors, engine components, implants, and seals, making it a critical material in high-reliability environments.

Stakeholders

- Polyether ether ketone manufacturers

- Polyether ether ketone suppliers

- Polyether ether ketone traders, distributors, and suppliers

- Investment banks and private equity firms

- Raw material suppliers

- Government and research organizations

- Consulting companies/consultants in the chemicals and materials sectors

- Industry associations

- Contract Manufacturing Organizations (CMOs)

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

- To define, describe, and forecast the size of the Asia Pacific PEEK market in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the Asia Pacific PEEK market

- To analyze recent developments and competitive strategies, such as agreements, partnerships, product launches, and joint ventures, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific PEEK Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific PEEK Market