Asia Pacific Point-Of-Use Water Treatment Systems Market

Asia Pacific Point-Of-Use Water Treatment Systems Market by Device (Tabletop Pitchers, Countertop Units, Free-Standing Water Purifiers), Technology, Application, Sales Channel (Direct Sales, Distributor), and Region – Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

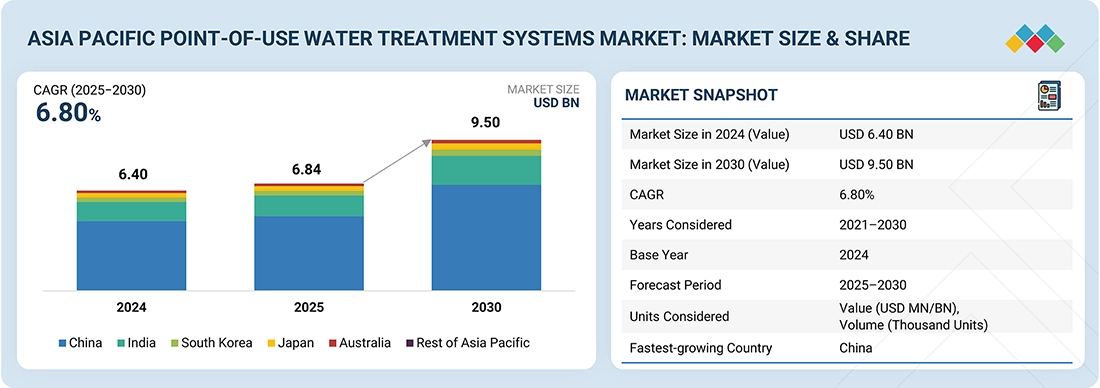

The Asia Pacific point-of-use water treatment systems market is expected to expand from USD 6.84 billion in 2025 to USD 9.50 billion by 2030, with a CAGR of 6.8% during the forecast period. Driven by rapid urbanization, this will lead to an increase in the region's population living in towns and cities, from approximately 2.5 billion people in 2023 to 3.4 billion by 2050. This will put additional pressure on municipal water supply and distribution networks. According to UNDP, UN, or persistent gaps in safely managed drinking water create a critical need for household-level solutions, as only about 60% of rural Asia Pacific populations currently have access to safely managed water (Source: WHO/UNICEF JMP, 2024). Water quality challenges include microbial contamination, heavy metals, or high dissolved solids; thus, point-of-use systems such as reverse osmosis, UV, ultra-filtration, and activated carbon units are encouraged. In addition to rising awareness of health risks, the middle-class households in developing economies also had an increase in disposable income to boost their willingness to invest in a better safe drinking water solution. This movement, combined with technological innovations, compact designs, and smart IoT-enabled monitoring, has driven the relentless growth of point-of-use water treatment adoption across the region.

KEY TAKEAWAYS

-

By CountryChina dominated the point-of-use water treatment systems market, with a 49.3% share in 2024.

-

By DeviceBy device, the whole house water treatment segment is expected to register the highest CAGR of 7.34% from 2025 to 2030, in terms of value.

-

By Sales ChannelBy sales channel, the direct sales segment is expected to register the highest CAGR (7.47%) from 2025 to 2030, in terms of value.

-

By TechnologyBy technology, reverse osmosis systems segment is expected to dominate the market, at the highest CAGR (8.11%).

-

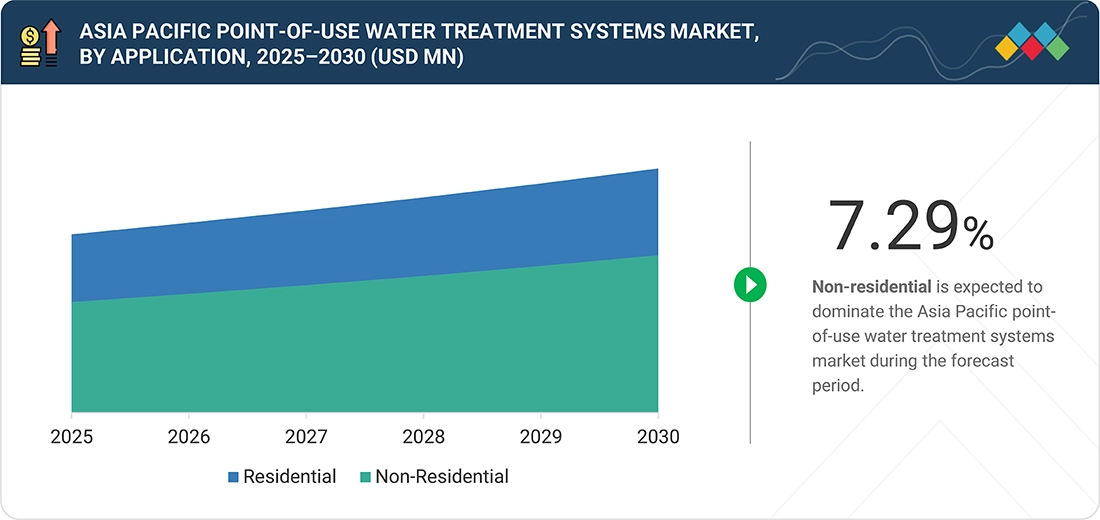

By ApplicationBy application, the non-residential segment is projected to grow at the fastest rate from 2025 to 2030.

-

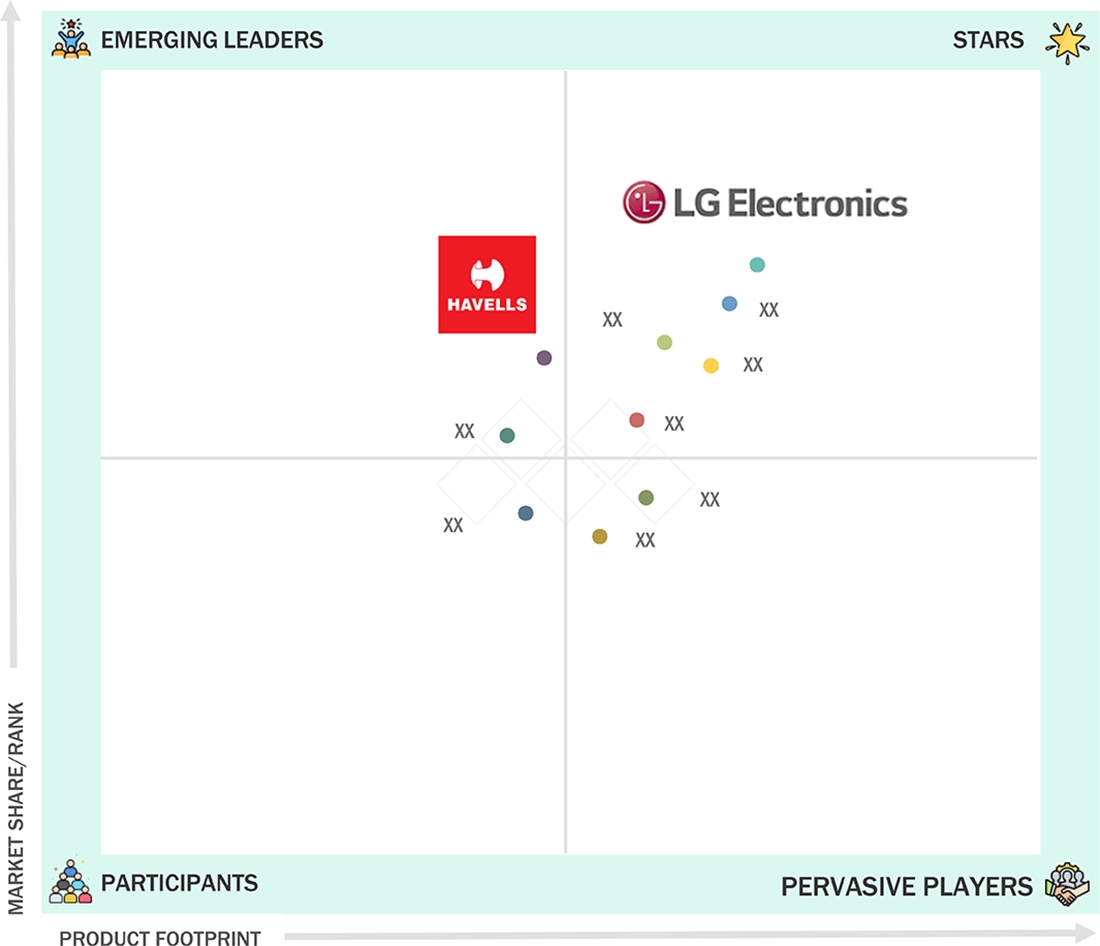

Competitive Landscape - Key PlayersEureka Forbes, Panasonic Holdings Corporation, LG Electronics, Toray Industries, Inc., and COWAY CO., LTD. were identified as star players in the point-of-use water treatment systems market, as they have focused on innovation, have broad industry coverage, and possess strong operational & financial strength.

-

Competitive Landscape- StartupsEnagic International, DrinkPrime, Bepure, among others, have distinguished themselves among startups and SMEs due to their strong product portfolios and effective business strategies.

The Asia Pacific point-of-use water treatment systems market is witnessing significant growth driven by persistent gaps in access to safely managed drinking water. According to the WHO/UNICEF, over 2.1 billion people globally still lack access to reliably safe and available water at home, with only around 64% of residents in Asia Pacific having “safely managed” water. Millions rely on self-supply sources such as wells, boreholes, or rainwater, which often carry microbial or chemical contamination (Source: UNICEF, Nature). Rising urbanization, population growth, and intermittent public water supply further amplify the need for household-level water treatment. Manufacturers can capitalize on this opportunity by offering affordable, region-specific solutions, partnering with government and NGO programs, emphasizing certified safety and efficacy, and providing easy-to-maintain and modular products tailored to the diverse water-quality challenges across the region.

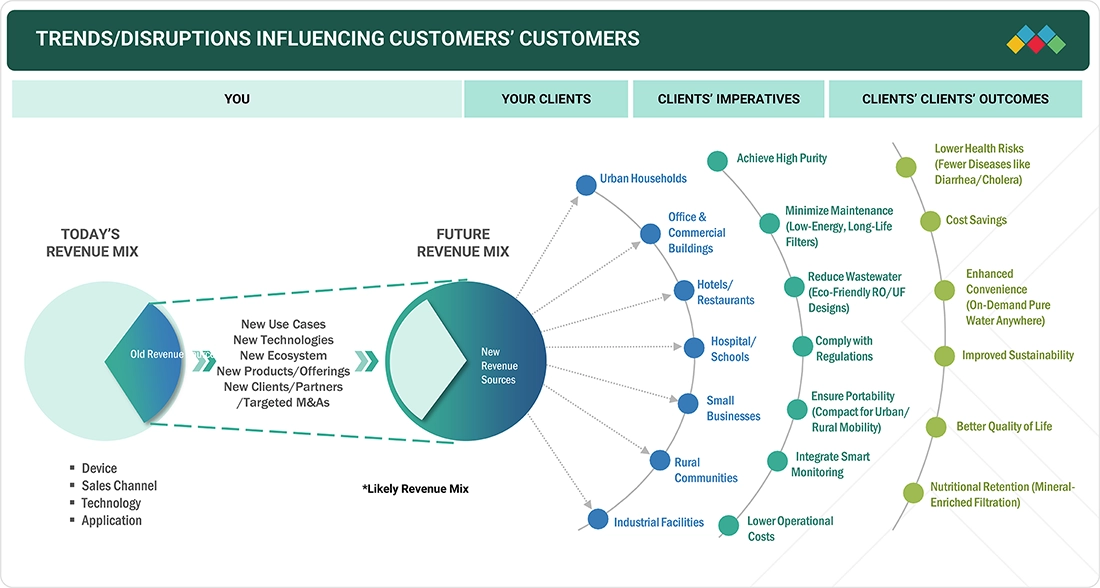

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The influence on end-use sectors in the Asia Pacific point-of-use water treatment systems market is shaped by growing concerns over water safety, inconsistent water quality, and the need for reliable household-level purification. Key end-use segments include residential households, small commercial establishments, healthcare facilities, educational institutions, and rural communities dependent on self-supplied water sources. The demand is driven by rising awareness of waterborne diseases, urbanization pressures, and government efforts to improve drinking water standards. Variations in municipal water quality, seasonal contamination, and expansion of rural water-access programs directly affect the adoption of point-of-use systems, thereby influencing the revenues of purifier manufacturers and filtration component suppliers. Collectively, these trends shape market growth, technology investments, and product innovation across the region.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising health awareness and water contamination concerns

-

Rapid urbanization and industrialization

Level

-

High initial and maintenance costs

-

Dependence on skilled installation and upkeep

Level

-

Expanding access in rural and peri-urban Asia Pacific

-

Adoption of smart and IoT-enabled systems

Level

-

Environmental and disposal issues

-

Varying water quality and infrastructure gaps

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising health awareness and water contamination concerns

The Asia Pacific point-of-use water treatment systems market is witnessing significant growth, driven by rising health awareness and increasing concerns over water contamination. In the region, millions still lack access to safely managed drinking water, while inadequate wastewater treatment exacerbates the risks of microbial, chemical, and heavy-metal contamination. In 2022, only 61.7% of domestic wastewater in China and 20.7% in India was safely treated, compared to 91.7% in Japan and 99.1% in South Korea, indicating significant disparities in sanitation infrastructure across the region. Taken together, these gaps in access, along with population growth, rapid urbanization, and industrial and agricultural pollution, continue to foster public skepticism about the quality of municipal water supplies. Consumers are increasingly turning to reverse osmosis, UV, filtration, and hybrid point-of-use solutions to ensure safe, on-site purification at the household, office, and small business levels. These immediate protections against diarrhea, cholera, typhoid, and other waterborne diseases, and the long-term exposure to arsenic, lead, and other pollutants, greatly enhance their value proposition. As public trust in centralized water supply remains inconsistent in many Asia Pacific countries, point-of-use technologies are emerging as an essential rather than an optional solution, creating a strong growth opportunity for the regional market.

Restraint: High initial and maintenance costs

Substantial initial and recurring maintenance expenses remain considerable obstacles to the implementation of point-of-use water purification systems throughout the Asia Pacific, especially for low-income and rural families. The Asian Development Bank (2024) reports that roughly 1.6 billion individuals in Asia Pacific, constituting about 38% of the population, subsist on less than USD 5.50 daily (2017 PPP), rendering even fundamental reverse osmosis or UV systems, generally priced between USD 150 and 400 upfront, financially inaccessible for the majority of families. Access disparities exacerbate the challenge: the World Health Organization and UNICEF (JMP 2024) report that only 60% of the regional population has safely managed drinking water at home, with the poorest quintile being five times less likely to utilize improved on-premises sources compared to the wealthiest quintile. Recurring expenses, including replacement filters for widely used reverse osmosis systems priced at USD 30–80 yearly, may account for 4–10% of monthly income for households earning less than USD 200. High lifecycle costs cause 25–35% of installed household purifiers to remain unused or poorly maintained in low-income areas, forcing many families to continue using untreated or boiled water despite ongoing contamination risks, according to government data from Indonesia's Ministry of Health and India's Jal Jeevan Mission (2024).

Opportunity: Expanding access in rural and peri-urban Asia Pacific

Untapped rural and peri-urban markets in the Asia-Pacific region provide substantial development potential for point-of-use (POU) water treatment systems, as centralized water infrastructure frequently underperforms and pollution hazards persist. The Asian Development Bank's Asian Water Development Outlook 2025 indicates that around 1.5 billion individuals in rural regions and 600 million in urban and peri-urban areas lack sufficient water supply and sanitation, with rural households being only half as likely to have access to potable water nearby compared to their urban counterparts. In emerging countries, these disparities result in around 700 million individuals in China consuming water that fails to meet WHO guidelines, disproportionately affecting semi-urban and rural populations. Significant differences are evident in the region: in Mongolia, rural access to safe water is under 13%, contrasted with 51% in urban areas, whilst Cambodia's rural safe water coverage stands at 63.3%, necessitating expedited annual growth to achieve the 2030 SDG 6 objectives. Peri-urban regions, dependent on outdated community systems, experience significant non-revenue water losses (30–55%) and seasonal deficits. Government initiatives, including Bhutan’s Water Flagship and ADB’s rural rehabilitation programs, underscore the potential for scalable, cost-effective interventions to enhance health, economic inclusion, and quality of life.

Challenge: Varying water quality and infrastructure gaps

Point-of-use water treatment systems are heavily impacted by the unstable municipal water supply, as well as the variation in water quality in different countries and localities within Asia Pacific. Many urban centers are subjected to an intermittent supply, whereas the rural and peri-urban areas are usually dependent on inadequately maintained pipelines, shallow wells, or community schemes. The levels of contaminants, such as microbial pathogens, heavy metals, and industrial pollutants, vary drastically from region to region, making it challenging to establish a standard for POU technologies and to determine which filtration or purification methods are suitable. These differences demand solutions that are specifically designed for the local water conditions, thus raising the cost and the complexity of operations. Consequently, point-of-use devices should be versatile, trustworthy, and capable of processing various water profiles so as to be able to provide safe drinking water in Asia-Pacific regions with different types of infrastructures (Source: WHO, ADB 2024).

ASIA PACIFIC POINT-OF-USE WATER TREATMENT SYSTEMS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Eureka Forbes supplied Aquaguard commercial water purifiers to major hotel chains in India, including Taj Hotels, Oberoi Hotels, and Leela Kempinski, for installation in guest rooms and public areas across multiple properties in Mumbai and Delhi, ensuring safe drinking water for both guests and staff. | Enhanced employee and guest health by addressing urban water contamination issues, reduced reliance on bottled water, leading to cost savings and improved sustainability. |

|

Kent RO Systems installed high-capacity RO water purifiers in the offices of major IT firms like Infosys and Wipro in Bangalore's tech parks, providing purified water to over 1,000 employees per facility via centralized dispensing units. | Cost-effective purification in areas with high microbial contamination, supporting compliance with health standards and boosting productivity through reliable water access. |

|

Panasonic deployed countertop alkaline ionizer POU purifiers (TK-AS series) in hospitality venues such as Hilton Tokyo and various ryokan in Kyoto, Japan, for immediate purified and pH-balanced water in restaurants, lobbies, and guest suites. | Space-efficient solutions that reduce downtime from waterborne illnesses, integrate smart monitoring for maintenance efficiency, and enhance guest experience in urban environments. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

An ecosystem map for the Asia Pacific point-of-use water treatment systems market reflects a well-connected value chain that supports safe and reliable drinking water across the region. It begins with suppliers of key filtration media, activated carbon, ion-exchange resins, membrane elements, and UV purification components, feeding into manufacturers of reverse osmosis purifiers, UV systems, gravity filters, and multi-stage treatment units. This network is supported by distributors, retailers, and service providers responsible for installation, maintenance, and cartridge replacement. The ecosystem extends to diverse end-use segments, including households, healthcare facilities, small commercial establishments, schools, and rural communities that rely on self-supplied or inconsistent water sources. Government water authorities, public-health programs, and NGOs further influence standards, awareness, and adoption, creating an integrated environment that drives market growth and ensures wider access to safe drinking water.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Point-of-use Water Treatment Systems Market, by Sales Channel

In 2024, distributors held the largest share of the Asia Pacific point-of-use water treatment systems market in the sales channel category, driven by their extensive reach, robust regional networks, and ability to cater to diverse customer needs in both urban and rural areas. Distributors played a crucial role in enhancing product accessibility, particularly in markets with significant water quality disparities, where localized product recommendations are essential. Their collaborations with prominent brands facilitated expedited product penetration, optimized inventory management, and enhanced after-sales assistance. The emergence of third-party retail chains, multi-brand stores, and specialized water treatment retailers has further bolstered distributor-led sales. Consequently, distributors continued to be the favored channel for both premium and mass-market POU systems throughout the Asia Pacific area.

Asia Pacific Point-of-use Water Treatment Systems Market, by Device

In 2024, free-standing water purifiers dominated the Asia Pacific point-of-use water treatment systems market by device type, driven by rising consumer preference for convenient, plug-and-play purification solutions. Their ability to integrate RO, UV, UF, and activated carbon technologies within a single compact unit made them highly suitable for diverse household water conditions across the region. Free-standing purifiers also gained traction due to their aesthetic designs, digital indicators, larger storage capacities, and ease of installation without the need for plumbing modifications. Growing demand from urban apartments, rented homes, and small commercial establishments further accelerated adoption. Additionally, strong retail visibility, rapid product innovation, and widespread distributor support reinforced their leadership position in the overall device segment.

Asia Pacific Point-of-use Water Treatment Systems Market, by Technology

In the Asia Pacific point-of-use water treatment systems market, reverse osmosis technology holds the largest share, reflecting its widespread adoption across residential and commercial segments. Reverse osmosis systems are favored for their superior contaminant removal capabilities, including dissolved solids, heavy metals, and pathogens, making them ideal for regions with variable water quality. The technology’s dominance is reinforced by rising awareness of safe drinking water, increasing urbanization, and government initiatives promoting clean water access, particularly in countries like China, where regulations support the adoption of point-of-use water treatment systems. In 2024, reverse osmosis systems accounted for the largest share within the technology segment, outperforming alternatives such as ultrafiltration, activated carbon, and others. The market growth is further accelerated by innovations in compact, energy-efficient reverse osmosis units with smart monitoring features, catering to the evolving needs of households and businesses across the region.

Asia Pacific Point-of-use Water Treatment Systems Market, by Application

In 2024, residential usage constituted the largest segment of the Asia Pacific point-of-use water treatment systems market, led by ongoing deficiencies in water safety and supply quality at the domestic level. In India, merely 6% of urban homes obtain potable tap water directly from municipal providers, whilst 62% depend on filtering systems, reverse osmosis, or boiling to guarantee water safety. In China, despite rural tap-water coverage attaining 90% in 2023, issues about quality and reliability remain, leading numerous homes to utilize point-of-use purifiers (Source: State Council Information Office of China, 2024). Increasing disposable incomes, heightened health consciousness, and expanded access via retail and e-commerce channels have further expedited residential adoption, facilitating convenient and safe water solutions directly at home.

ASIA PACIFIC POINT-OF-USE WATER TREATMENT SYSTEMS MARKET: COMPANY EVALUATION MATRIX

LG Electronics (Star) leads the Asia Pacific point-of-use water treatment systems market through its strong regional presence, advanced reverse osmosis and UV-UF purification technologies, and integration of smart IoT features that drive adoption across urban households and commercial spaces. Havells India Limited (Emerging Leader) is rapidly expanding its footprint by offering cost-efficient, energy-saving reverse osmosis, UV, UF, and activated carbon systems tailored to diverse water quality needs, enabling the company to capture the rising demand for affordable, reliable, and high-performance point-of-use solutions across residential and small business segments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Eureka Forbes

- Panasonic Holdings Corporation

- LG Electronics

- Toray Industries, Inc.

- COWAY CO.,LTD.

- Havells India Limited

- Kent RO Systems Ltd.

- Enagic International

- DrinkPrime

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.40 BN |

| Market Size in 2030 (Value) | USD 9.50 BN |

| CAGR | 6.8% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD MN) Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | China, India, Japan, South Korea, Australia, Rest of Asia Pacific |

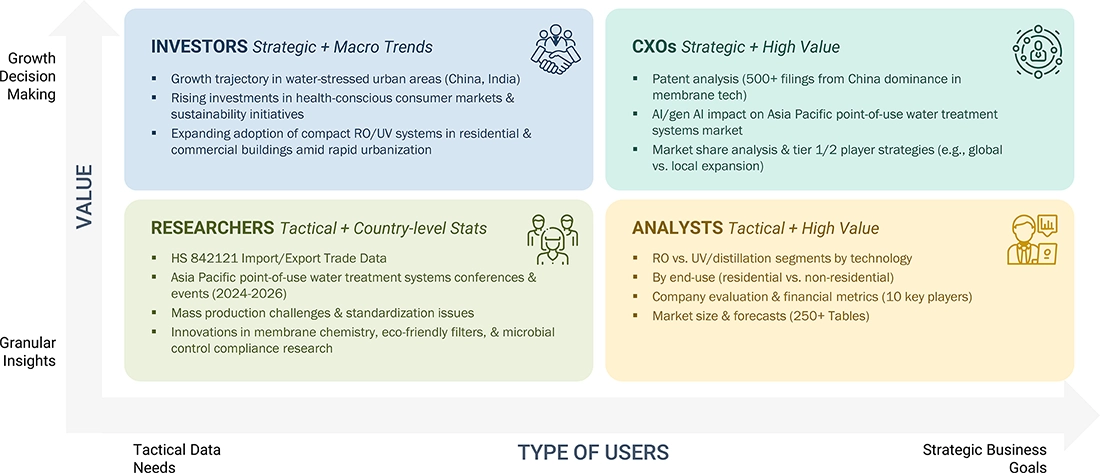

WHAT IS IN IT FOR YOU: ASIA PACIFIC POINT-OF-USE WATER TREATMENT SYSTEMS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| China-based point-of-use (POU) water treatment systems market |

|

|

| Reverse osmosis (RO) system–based POU water treatment system manufacturers |

|

|

| Activated carbon–based POU water treatment system manufacturers |

|

|

RECENT DEVELOPMENTS

- October 2024 : The company Kent RO entered into a licensing partnership with BLACK+DECKER, a global home products brand, to co-develop and launch a new range of advanced water purifiers in India, the Black Decker Crest RO Purifier and the Zenith RO Purifier.

- September 2024 : LG expanded its water purifier lineup in India by launching nine new models. These purifiers feature advanced technologies, such as Airtight Stainless Steel Tanks, Mineral Boosters, In-Tank EverFresh UV Plus, Digital Sterilizing Care, and a 7-stage Filtration System.

- May 2023 : Toray Industries, Inc. launched the Torayvino Cassetty 310MX faucet-mounted water purifier. The product will be equipped with a single cartridge.

- April 2022 : LG Electronics in India launched its UF+UV Water Purifier, which offers a heavy metal removal filter that removes 7 Heavy Metals and Virus Clean + Filter.

- October 2021 : LG Electronics transformed its home appliance plant into LG Smart Park, which included digital transformation such as advanced automation, big data, AI, and 5G technologies.

Table of Contents

Methodology

The study involved four major activities to estimate the current size of the Asia Pacific Point-Of-Use Water Treatment Systems market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of Asia Pacific point-of-use water treatment systems through primary research. The top-down and bottom-up approaches were employed to estimate the overall size of the Asia Pacific Point-Of-Use Water Treatment Systems market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments of the market.

Secondary Research

The market for the companies offering point-of-use water treatment systems is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources, such as Business Standard, Bloomberg, World Bank, and Factiva, were referred to identify and collect information for this study on the Asia Pacific Point-Of-Use Water Treatment Systems Market. In the secondary research process, various secondary sources were referred to identify and collect information related to the study. Secondary sources included annual reports, press releases, and investor presentations of point-of-use water treatment systems vendors, forums, certified publications, and white papers. Secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both, the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from several key companies and organizations operating in the Asia Pacific Point-Of-Use Water Treatment Systems Market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of point-of-use water treatment systems offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the Asia Pacific Point-Of-Use Water Treatment Systems Market. These approaches were also used extensively to estimate the size of various dependent market segments. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Market Definition

Point-of-use water treatment systems are devices installed on individual taps or multiple taps to provide high-quality water that is free from contaminants like chlorine, iron, sulfur, and dissolved solids. This purified water is suitable for drinking, cooking, and other uses in both, residential and non-residential settings. These compact filtration or purification devices are placed directly where water is consumed, such as kitchen sinks, faucets, or even portable pitchers, ensuring immediate access to clean and safe water.

Tabletop pitchers, whole-house water treatments, faucet-mounted filters, countertop units, under-the-sink filters, free-standing water purifiers, and other variants are examples of products included in point-of-use water treatment systems. These systems utilize various technologies to enhance effectiveness and user-friendliness, such as reverse osmosis (RO) systems, ultrafiltration systems, and activated carbon filtration.

Stakeholders

- Raw Material Suppliers and Producers

- Regulatory Bodies

- Point-of-use Water Treatment System Distributors/Suppliers

- Environmental Protection Bodies

- Local Governments

- End-use Industries

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the size of the Asia Pacific Point-Of-Use Water Treatment Systems Market based on device, technology, sales channel, application, and region in terms of value and volume

- To provide detailed information on the significant drivers, restraints, opportunities, and challenges influencing the market

- To strategically analyze micromarkets concerning individual growth trends, prospects, and their contribution to the market

- To assess the growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as product launches, collaborations, acquisitions, expansions, and partnerships, in the Asia Pacific Point-Of-Use Water Treatment Systems Market

- To provide the impact of AI on the Asia Pacific Point-Of-Use Water Treatment Systems market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Point-Of-Use Water Treatment Systems Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Point-Of-Use Water Treatment Systems Market