Asia Pacific Testing, Inspection, and Certification (TIC) Market

Asia Pacific Testing, Inspection, and Certification (TIC) Market by Consumer Good & Retail, Construction & Infrastructure, Medical & Life Science, Automotive, Aerospace, Testing, Inspection, Certification, In-house, Outsourced – Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Asia Pacific testing, inspection, and certification (TIC) market is projected to grow from USD 88.90 billion in 2025 to USD 110.45 billion by 2030, at a CAGR of 4.4%. Growth is driven by the strong manufacturing base related to electronics, automotive, EVs, semiconductors, and consumer goods, alongside strict national regulations, such as CCC, BIS, PSE, and KC. Expanding digitalization—through AI-enabled inspection, automation, IoT-based monitoring, and remote auditing—is improving compliance efficiency. Rising emphasis on safety, quality, sustainability, and export readiness continues to accelerate TIC demand across the region.

KEY TAKEAWAYS

-

By COUNTRYChina is estimated to hold ~48.2% of the Asia Pacific TIC market in 2025.

-

BY SERVICE TYPECertification services segment is estimated to grow the fastest, recording a CAGR of 5.7% from 2025 to 2030.

-

BY SOURCE TYPEOutsourced services segment is estimated to witness the highest growth rate during the forecast period.

-

BY APPLICATIONConsumer goods & retail is estimated to account for ~14.2% of the Asia Pacific TIC market in 2025.

-

COMPETITIVE LANDSCAPEMajor players, such as SGS, Bureau Veritas, Intertek, TÜV SÜD, and TÜV Rheinland, dominate the Asia Pacific TIC market, leveraging extensive regional lab networks, strong cross-border compliance capabilities, and digital inspection solutions. Leading firms are increasingly adopting AI-driven testing, remote audits, and sustainability certification to strengthen their competitive positioning across Asia Pacific.

-

COMPETITIVE LANDSCAPESMEs and startups, such as CEPREI, QIMA Asia, and TIRT Labs, and emerging electronics-testing firms in China, India, and South Korea are gaining traction in the Asia Pacific TIC market, driven by their specialized capabilities in materials testing, product safety checks, and fast, cost-effective compliance services.

The Asia Pacific TIC market is witnessing robust growth, due to the expanding electronics, automotive, EV, semiconductor, and consumer goods manufacturing base. The mounting demand for product safety, export certification, and regulatory compliance—across standards such as CCC, BIS, PSE, and KC—is reshaping how companies manage quality and risk. New developments, including digital inspection tools, AI-enabled testing, and remote auditing solutions, are increasing efficiency and transparency. Additionally, growing investments in ESG verification, sustainability certification, and industry-specific testing capabilities are strengthening the role of third-party TIC providers and accelerating the market’s upward trajectory across Asia Pacific.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business in the Asia Pacific TIC market stems from rising compliance demands, expanding industrial activity, and rapidly evolving technology ecosystems. Electronics, semiconductor, automotive, healthcare, and consumer goods companies are the primary users of TIC services, with export readiness and product safety as key focus areas. Shifts toward digital inspection, AI-enabled testing, remote auditing, and green certification directly influence operational efficiency and risk reduction for end users. These changes drive the need for advanced TIC capabilities, particularly in EV batteries, semiconductor reliability, medical devices, and 5G/6G equipment, shaping the region’s long-term growth trajectory.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of electronics, semiconductor, and EV manufacturing across China, India, Japan, and South Korea

-

Rise in exports requiring mandatory certifications for US, EU, and Middle Eastern markets

Level

-

Fragmented regulatory systems

-

Limited harmonization, duplicated testing, and high costs

Level

-

Accelerated adoption of EVs, batteries, renewable energy, and hydrogen technologies

-

Rapid digitalization and smart factory upgrades (Industry 4.0)

Level

-

Supply-chain disruptions and rising geopolitical tensions affecting cross-border certification and component sourcing

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expansion of electronics, semiconductor, and EV manufacturing across China, India, Japan, and South Korea

The Asia Pacific TIC market is primarily driven by the expansion of electronics, semiconductor, and EV manufacturing across China, India, Japan, and South Korea. These industries require extensive product testing, certification, and regulatory compliance to meet domestic and export standards. As production volumes rise and technologies become more complex, manufacturers increasingly depend on third-party TIC services to ensure reliability, safety, and global market access. This sustained industrial growth continues to strengthen demand for advanced TIC capabilities across the region.

Restraint: Fragmented regulatory systems

A key restraint in the Asia Pacific TIC market is the highly fragmented regulatory landscape across countries, with diverse standards, such as CCC in China, BIS in India, PSE in Japan, KC in South Korea, SAA in Australia, and multiple ASEAN-specific frameworks. This lack of harmonization often results in duplicated testing, longer certification timelines, and higher compliance costs for manufacturers. Navigating multiple certification pathways increases operational complexity and slows market entry for companies operating across Asia Pacific's multi-country supply chains.

Opportunity: Accelerated adoption of EVs, batteries, renewable energy, and hydrogen technologies

Significant opportunities in the Asia Pacific TIC market stem from the accelerated adoption of electric vehicles, advanced batteries, renewable energy systems, hydrogen technologies, and next-generation mobility solutions. These emerging sectors require extensive safety validation, performance testing, and regulatory certification, opening strong growth avenues for TIC providers. As governments across Asia Pacific invest heavily in green technologies and clean energy programs, demand for specialized TIC services—from EV battery testing to renewable energy compliance—continues to rise rapidly.

Challenge: Supply-chain disruptions and rising geopolitical tensions affecting cross-border certification and component sourcing

The Asia Pacific TIC market faces growing challenges from supply-chain disruptions and rising geopolitical tensions, which impact cross-border certification processes and component sourcing. Delays in semiconductor supply, tightening export controls, and fluctuating trade policies create bottlenecks for manufacturers seeking timely approvals. These uncertainties increase compliance risks, extend testing timelines, and add complexity to global certification pathways, making it harder for companies in Asia Pacific to maintain consistent production and market readiness.

ASIA PACIFIC TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Uses independent TIC labs for electrical safety, EMC, RF/5G/6G testing, battery safety validation, and global certification (IEC, KC, FCC, CE) for smartphones and consumer electronics manufactured in South Korea and Vietnam | Ensures global market access | Reduces product failure risk | Accelerates launch timelines for high-volume electronics |

|

Engages TIC providers for EV battery testing (UL/IEC standards), charging system safety, automotive component validation, and homologation for export markets across Europe, LATAM, and Asia | Guarantees compliance with global EV regulations | Supports export expansion | Enhances battery safety credibility |

|

Works with TIC agencies for crash testing, ADAS validation, engine/emission compliance (BS-VI), and safety certification for domestic and export vehicles | Ensures regulatory conformance | Improves vehicle reliability | Strengthens acceptance in international markets |

|

Utilizes third-party TIC labs for hybrid/EV powertrain testing, EMC validation, and functional safety (ISO 26262) certification across Asia Pacific production hubs | Enhances safety compliance | Reduces recall risks | Supports certification of advanced mobility platforms |

|

Partners with TIC firms for semiconductor reliability tests, PCB inspections, cleanroom audits, and global certification for computing and telecom hardware | Improves manufacturing yield | Strengthens supply-chain reliability | Ensures compliance with OEM and regulatory standards |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Asia Pacific TIC ecosystem is shaped by diverse national TIC regulatory bodies, such as CNCA, BIS, KATS, FSSAI, SIRIM, and ACCC, which enforce stringent safety and quality standards across industries. TIC service providers, including SGS, Intertek, TÜV SÜD, Bureau Veritas, Eurofins, DNV, and ALS, operate extensive regional networks to support compliance needs. Major end users, such as Samsung, Toyota, LG, Yili, Hitachi, and Hyundai, drive strong demand for testing, inspection, and certification services across electronics, automotive, food, and industrial sectors.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Asia Pacific Testing, Inspection, and Certification (TIC) Market, By Service Type

As of 2025, the testing services segment is expected to hold the largest share of the Asia Pacific TIC market, driven by strong demand from electronics, automotive, EV battery, and industrial manufacturing sectors that require extensive safety, reliability, and performance validation. Testing remains the foundation of compliance for domestic and export markets across China, India, Japan, and South Korea.

Asia Pacific Testing, Inspection, and Certification (TIC) Market, By Source Type

In-house TIC activities account for the largest share of the Asia Pacific TIC market, supported by large-scale manufacturing hubs—particularly in electronics, automotive, and industrial equipment—where companies maintain captive testing facilities for rapid product validation and process control.

Asia Pacific Testing, Inspection, and Certification (TIC) Market, By Application

As of 2025, Consumer Goods & Retail holds the largest share of the Asia Pacific TIC market, supported by the region’s massive electronics, household goods, textiles, and packaged products manufacturing base. Strong export activity and rising consumer safety regulations across China, India, Japan, and Southeast Asia continue to reinforce its leadership.

REGION

Vietnam to record highest CAGR in Asia Pacific TIC market during forecast period

Strong industrial expansion across electronics, semiconductors, automotive, EVs, and consumer goods drives the Asia Pacific TIC market. The market growth is supported by rising regulatory compliance requirements and increasing export-oriented production. Vietnam is the fastest-growing market, owing to the rapid industrialization, growing foreign investment, and increasing certification needs for export-focused manufacturing.

ASIA PACIFIC TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: COMPANY EVALUATION MATRIX

The competitive landscape of the Asia Pacific TIC market shows a diverse mix of players spread across four strategic quadrants based on market share and service footprint. Global leaders, such as SGS, appear in the “Stars” quadrant, reflecting their strong regional presence and broad service portfolios. ALS and several regional firms occupy the “Emerging Leaders” quadrant, indicating growing capabilities and rising market influence. Smaller and niche providers are positioned in the “Participants” quadrant, offering focused or localized services, while companies in the “Pervasive Players” quadrant demonstrate wide service reach with moderate market share. This distribution highlights a dynamic ecosystem where global TIC leaders coexist with fast-growing regional specialists.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- SGS SA (Switzerland)

- Bureau Veritas (France)

- Intertek Group plc (UK)

- TÜV SÜD (Germany)

- TÜV Rheinland (Germany)

- DEKRA SE (Germany)

- DNV (Norway)

- ALS Limited (Australia)

- Eurofins Scientific (Luxembourg)

- TÜV NORD GROUP (Germany)

- Applus+ (Spain)

- MISTRAS Group (US)

- Element Materials Technology (UK)

- UL LLC (US)

- Lloyd’s Register (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 88.90 Billion |

| Market Forecast in 2030 (Value) | USD 110.45 Billion |

| Growth Rate | CAGR of 4.4% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Countries Covered | China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Vietnam, Taiwan, Hong Kong, Bangladesh, the Philippines, Rest of Asia Pacific |

WHAT IS IN IT FOR YOU: asia-pacific-testing-inspection-certification-tic-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Electronics & Semiconductor Manufacturer | End-to-end benchmarking of APAC compliance requirements for EMC, wireless, reliability, and safety testing across China (CCC), Japan (PSE), Korea (KC), and Taiwan (BSMI). Mapping of accredited labs, certification bodies, and regional approval timelines. |

|

| Automotive & EV OEM | Detailed assessment of EV battery safety, charging system validation, ADAS testing, and vehicle homologation standards across APAC. Competitive benchmarking of TIC providers offering EV, mobility, and autonomous-vehicle compliance services. |

|

| Medical Device & Pharma Manufacturer | Comprehensive mapping of regional approval frameworks (ISO 13485, CDSCO, NMPA, PMDA, TGA) and performance/clinical testing needs for devices and diagnostics. Identification of APAC labs specializing in biocompatibility, sterilization validation, and pharmaceutical testing. |

|

| Consumer Goods & Retail Exporter | Comparative analysis of mandatory product safety requirements in China, India, Japan, Korea, and ASEAN for electronics, toys, textiles, cosmetics, and home appliances. Development of supplier audit frameworks and risk-scoring models. |

|

RECENT DEVELOPMENTS

- June 2025 : TÜV SÜD was listed as a certified body under the Textile Exchange for sustainable-textile certification in Bangladesh, India, and Vietnam, expanding its certified-body status in the Asia Pacific. This enables TÜV SÜD to offer Recycled Claim Standard (RCS)/Global Recycled Standard (GRS) certifications across major textile manufacturing hubs—targeting the growing sustainability and compliance demand in textile supply chains across Asia.

- January 2025 : SGS acquired Independent Metallurgical Operations Pty Ltd (IMO) in Australia. This acquisition expands SGS’s metallurgical testing and consulting footprint in the Australian mining and metals sector—strengthening its presence in Asia Pacific’s resource-intensive economies and enhancing its end-to-end TIC offering for raw materials and industrial clients.

- December 2024 : Bureau Veritas completed the acquisition of The APP Group, an Australian infrastructure asset-management & IV/IC firm. This enhances Bureau Veritas’s buildings, infrastructure, and construction-verification capabilities within Australia and broader Asia Pacific. It reinforces TIC demand from infrastructure investments and broadens the company’s project-based inspection and certification services across Asia Pacific's growing construction sector.

Table of Contents

Methodology

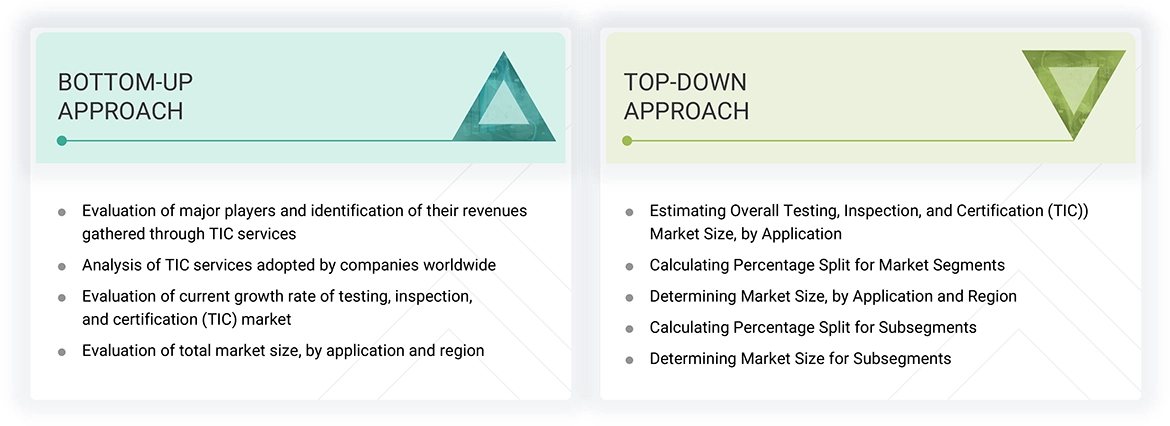

The study involved four major activities in estimating the current size of the Asia Pacific testing, inspection, and certification (TIC) market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the supply chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Secondary and primary sources have been used to identify and collect information for an extensive technical and commercial study of the Asia Pacific testing, inspection, and certification (TIC) market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the Asia Pacific testing, inspection, and certification (TIC) market through secondary research. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the Asia Pacific testing, inspection, and certification (TIC) market.

- More than 40 companies offering testing, inspection, and certification (TIC) services have been identified, and their services have been mapped based on certification service type, application, and region.

- The Asia Pacific testing, inspection, and certification (TIC) market size has been derived through the data sanity method. The revenues of Asia Pacific testing, inspection, and certification (TIC) service providers have been analyzed through annual reports and press releases and summed up to derive the overall market size.

- For each company, a percentage has been assigned to the overall revenue to derive the revenues from the Asia Pacific testing, inspection, and certification (TIC) segment.

- Each company's percentage has been assigned after analyzing various factors, including service offerings, geographic presence, initiatives, and recent developments/strategies adopted for growth in the Asia Pacific testing, inspection, and certification (TIC) market.

- For the CAGR, the market trend analysis of Asia Pacific testing, inspection, and certification (TIC) was conducted by understanding the industry penetration rate and the demand for the supply of testing, inspection, and certification (TIC) services in different sectors.

- Estimates at every level were verified and validated by discussing with key opinion leaders, including CXOs, directors, operation managers, and domain experts in MarketsandMarkets.

- Various paid and unpaid information sources, such as annual reports, press releases, white papers, and databases, have been studied.

The top-down approach has been used to estimate and validate the total size of the Testing, inspection, and certification (TIC) market.

- The report focused on top-line investments and expenditures in the ecosystems of various industries. The Asia Pacific testing, inspection, and certification (TIC) market has been further segmented based on sourcing type, service type, and application.

- Further information has been derived from the market revenue generated by the key Asia Pacific testing, inspection, and certification (TIC) service providers.

- Multiple on-field discussions have been carried out with key opinion leaders from each major company involved in providing testing, inspection, and certification (TIC) services.

- The geographic splits have been estimated using secondary sources based on various factors such as the number of players in a specific country, region, and major applications.

Asia Pacific Testing, Inspection, and Certification (TIC) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the Asia Pacific testing, inspection, and certification (TIC) market.

Market Definition

The Asia Pacific testing, inspection, and certification (TIC) market comprises organizations and service providers engaged in evaluating the quality, safety, compliance, and performance of products, processes, and systems across various industries. These services are delivered by testing laboratories, inspection agencies, certification bodies, and conformity assessment entities, which conduct evaluations, inspections, and audits to ensure adherence to regulatory standards, industry requirements, and customer specifications. TIC services are instrumental in verifying product quality and safety, supporting regulatory compliance, facilitating trade, and strengthening consumer confidence.

The scope of TIC services includes testing, inspection, certification, and others such as verification, validation, auditing, consulting, technical assistance, training, environmental quality assessment, safety and health evaluation, asset integrity management, and project management. These services are applicable across industries and ensure that products, services, and processes align with national and international standards. The growing emphasis on quality assurance and regulatory compliance has driven the demand for TIC services, reinforcing the need for rigorous assessment frameworks to uphold safety and performance standards in global markets.

Key Stakeholders

- Raw material and testing equipment suppliers

- Research organizations

- Original equipment manufacturers (OEMs)

- Technology standards organizations, forums, alliances, and associations

- Technology investors

- Analysts and strategic business planners

- Government bodies, venture capitalists, and private equity firms

- End users who want to know more about Asia Pacific testing, inspection, and certification services and the latest standards in the market

Report Objectives

- To define, describe, and forecast the size of the Asia Pacific testing, inspection, and certification (TIC) market By Source, service type, application, and region in terms of value

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To understand and analyze the impact of evolving technologies on the overall value chain of the Asia Pacific testing, inspection, and certification market and upcoming trends in the ecosystem

- To provide a detailed overview of the Asia Pacific testing, inspection, and certification (TIC) market industry trends, technology trends, use cases, regulatory landscape, and Porter’s five forces.

- To strategically analyze micromarkets for individual growth trends, prospects, and contributions to the total market

- To provide ecosystem analysis, trends/disruptions impacting customer business, technology analysis, pricing analysis, key stakeholders & buying criteria, case study analysis, trade analysis, patent analysis, key conferences & events, Gen AI/ AI impact, and regulations related to the Asia Pacific testing, inspection, and certification (TIC) market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detailing the competitive landscape for market players.

- To strategically profile key players and comprehensively analyze their market rankings, core competencies, company valuation and financial metrics, and product/brand comparison, along with detailing the competitive landscape for the market leaders

- To analyze the competitive developments, such as acquisitions, product launches, expansions, agreements, partnerships, and collaboration carried out by market players

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of service portfolio

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company‘s specific needs. The following customization options are available for the report.

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Asia Pacific Testing, Inspection, and Certification (TIC) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Asia Pacific Testing, Inspection, and Certification (TIC) Market