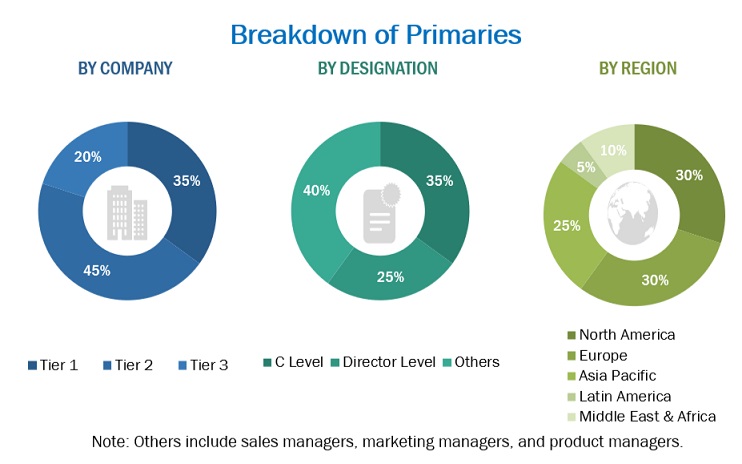

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect valuable information for a technical, market-oriented, and commercial study of the automation testing market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering automation testing solutions and services to different verticals has been estimated and projected based on the secondary data made available through paid and unpaid sources, as well as by analyzing their product portfolios in the ecosystem of the automation testing market. It also involved rating company products based on their performance and quality. In the secondary research process, various sources such as the International Journal of Computer Science Engineering (IJCSE), International Journal of Computer Applications Technology and Research (IJCSE), and International Research Journal of Engineering and Technology (IRJET) have been referred to for identifying and collecting information for this study on the automation testing market. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles by recognized authors, directories, and databases. Secondary research has been mainly used to obtain key information about the supply chain of the market, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives that have been further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from automation testing solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using automation testing solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of automation testing solutions which would impact the overall automation testing market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

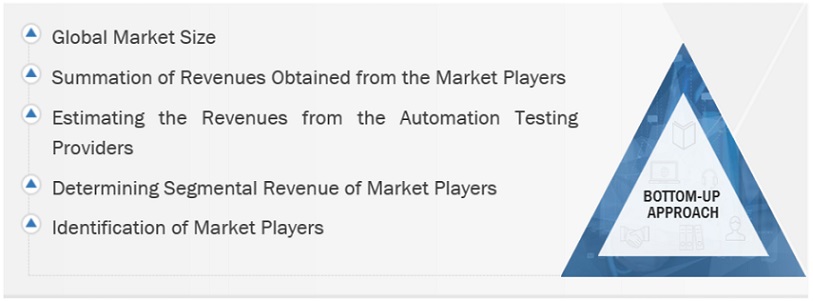

Multiple approaches were adopted to estimate and forecast the size of the automation testing market. The first approach involves estimating market size by summing up the revenue companies generate by selling automation testing offerings.

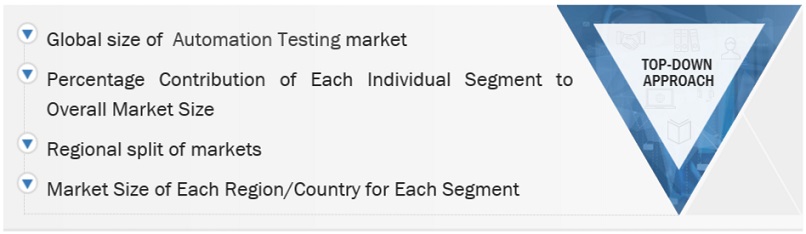

Both top-down and bottom-up approaches were used to estimate and validate the total size of the automation testing market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

-

Key players in the market have been identified through extensive secondary research.

-

In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After arriving at the overall market size, the automation testing market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

The automation testing market refers to the industry and ecosystem that involves the development, deployment, and utilization of automated tools, frameworks, and technologies to conduct software testing processes. Automation testing aims to streamline and enhance the efficiency of testing activities by automating the execution of test cases, reducing manual intervention, and providing rapid and repetitive testing capabilities. This market encompasses a wide range of tools and solutions designed to validate the functionality, performance, security, and reliability of software applications throughout the software development lifecycle. Key components of the automation testing market include test automation tools, frameworks, scripting languages, and associated services. The market addresses the growing need for organizations to accelerate their software development cycles, improve software quality, and adapt to the challenges posed by complex and dynamic software environments.

Key Stakeholders

-

Automation Testing Tool Providers

-

IT Departments

-

Test Automation Engineers

-

QA and Testing Teams

-

IT Managers and Decision-Makers

-

Government Agencies

-

Investment Firms

-

Automation testing Alliances/Groups

Report Objectives

-

To determine, segment, and forecast the automation testing market by offering, vertical, end-point interface, and region in terms of value

-

To forecast the size of the market segments concerning 5 main areas: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

-

To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

-

To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

-

To strategically analyze the macro and micro-markets with respect to individual growth trends, prospects, and contributions to the total market

-

To analyze the industry trends, pricing data, patents, and innovations related to the market

-

To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

-

To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

-

To track and analyze competitive developments, such as mergers & and acquisitions, product launches and developments, partnerships, agreements, collaborations, business expansions, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Country-wise information

-

Analysis for additional countries (up to five)

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Automation Testing Market