Automotive Battery Recycling Market

Automotive Battery Recycling Market by Chemistry (Lead Acid, Nickel, Lithium), and Region (Asia Pacific, Europe, North America, South America, and Middle East & Africa) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

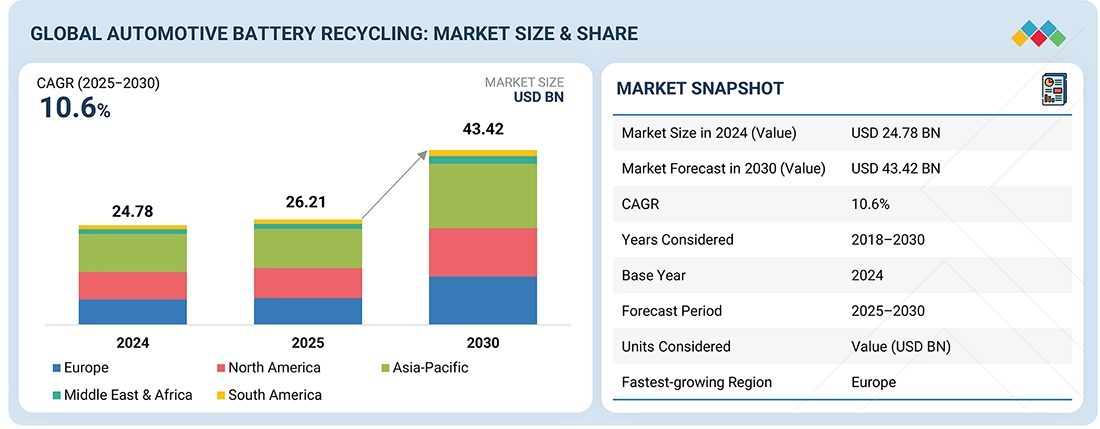

The global automotive battery recycling market is projected to grow from USD 26.21 billion in 2025 to USD 43.42 billion by 2030, at a CAGR of 10.6% during the forecast period. Lithium-ion batteries are widely used in the automotive industry. Valuable metals, including lithium, cobalt, nickel, and other rare earth elements, are found in automotive batteries. These minerals can be recovered through recycling, which lowers the demand for new mining operations and preserves natural resources.

KEY TAKEAWAYS

-

BY REGIONEurope is expected to register the highest CAGR of 12.5% during the forecast period.

-

BY CHEMISTRYBy chemistry, the lithium-based battery segment is estimated to account for a 47.3% share of the overall market in 2024.

-

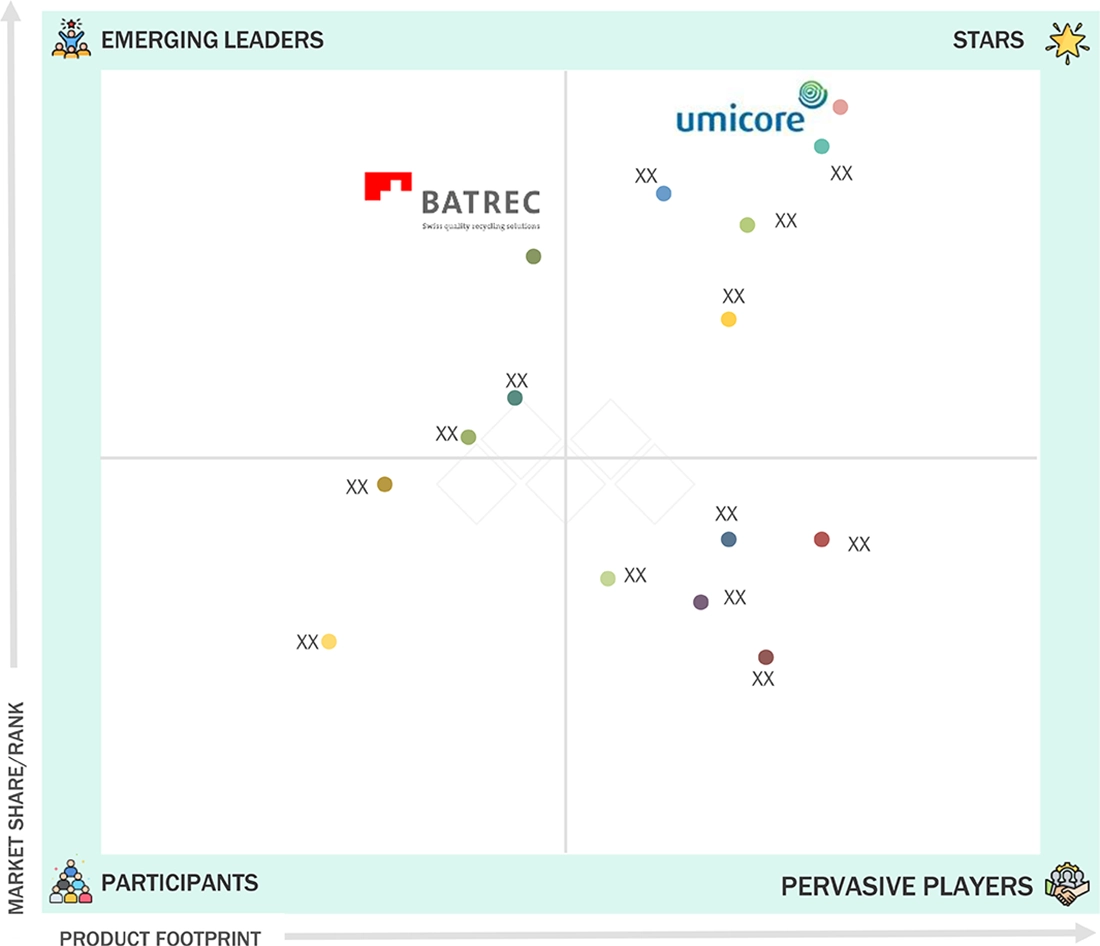

Competitive Landscape - Key PlayersUmicore, Call2Recycle, Inc., and Cirba Solutions were identified as some of the star players in the global automotive battery recycling market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsBatrec Industries AG, Duesenfeld GmbH, Euro Dieuze Industrie (E.D.I.), and others have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The automotive battery recycling market is expected to grow as global electric vehicle production increases. Moreover, the increasing number of end-of-life EV and hybrid battery production is expected to support the market growth. The large amount of waste generated by gigafactories and the initial wave of retired automotive lithium-ion batteries creates a steady stream of recyclable materials. Governments in North America, Europe, and Asia Pacific have imposed strict regulations on the disposal, recovery efficiencies, and the percentage of recycled materials for battery production that OEMs and recyclers must follow to create functional systems for closed-loop battery recycling.

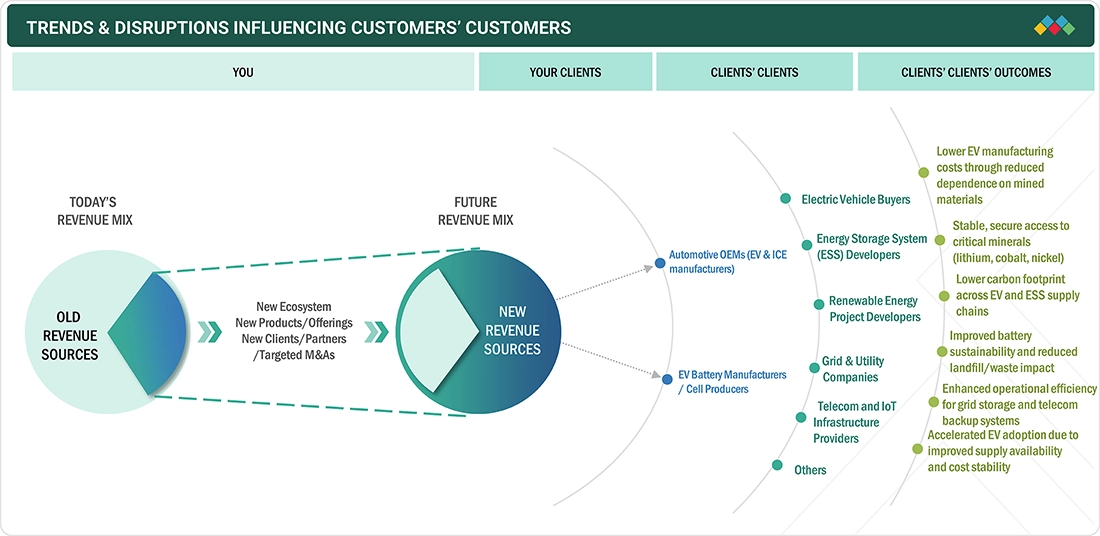

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses arises from evolving customer trends or market disruptions. Increasing deployment of lead-acid, lithium-ion, and nickel-based batteries across passenger and commercial vehicles is significantly expanding the volume of end-of-life automotive batteries entering the supply chain. These megatrends are expected to drive growth and increase the revenue of the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Accelerating global electric vehicle (EV) production and sales

-

Declining Li-ion battery prices

Level

-

Safety and environmental risks associated with transporting, handling, and storing end-of-life automotive batteries

Level

-

Rising demand for recycled battery-grade materials

Level

-

High recycling costs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Accelerating global electric vehicle (EV) production and sales

The growth of the electric vehicles market is leading to a rise in the number of end-of-life automotive batteries, which in turn makes the recycling solutions more efficient. The trend toward electrification and OEMs' increasing production of electric vehicles is resulting in an increase in the number of lithium-ion and lead-acid batteries that are no longer usable and consequently thrown away. This situation is driving recyclers to increase their capacity and to invest in more sophisticated technologies for the extraction of precious materials and, consequently, the support of the circular supply chain.

Restraint: Safety and environmental risks associated with transporting, handling, and storing end-of-life automotive batteries

One of the unresolved issues the recycling sector faces is the treatment of used car batteries, mainly high-voltage lithium-ion packs, which are the most challenging to recycle. There is a chance that, if not properly managed, these batteries could transfer heat, spill their contents, or ignite. The problem becomes even more complicated and costly due to the rigid laws that accompany the need for specialized logistics, trained personnel, and controlled storage. Therefore, the question of safety has become a major factor that slows down the battery collection and recycling process.

Opportunity: Rising demand for recycled battery-grade materials

Automotive companies, including Ford and Volkswagen, along with globally recognized battery manufacturers such as LG Chem and Panasonic, have begun sourcing recycled materials to meet their sustainability goals while minimizing the use of mined resources. This change is resulting in a great demand for high-quality recycled lithium, nickel, cobalt, and other necessary minerals. However, the role of recyclers as a provider of battery-grade materials is not the only one; OEMs are also reducing their carbon emissions and securing stable prices for their raw materials through the closed-loop manufacturing movement.

Challenge: High recycling costs

Despite the increasing demand for recycling, the costs associated with recovering materials from car batteries remain high. The complicated design of batteries, labor-intensive disassembly, and the application of either hydrometallurgical or pyrometallurgical processes entail high operational costs. In numerous situations, the value obtained from certain types of lithium-ion, e.g., LFP, cannot even cover these costs.

AUTOMOTIVE BATTERY RECYCLING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The company regularly conducts large-scale battery collection and recycling programs throughout North America, providing help to automotive OEMs, dealers, and fleet operators in acquiring safe and secure ways for the collection and disposal of used lead-acid and lithium-ion batteries. It is through logistics, compliance, and certified recycling processes that the company makes battery take-back programs a lot easier. | The entire process of battery recycling and safe management is enhanced, the risk of landfill disposal is reduced, and OEMs remain legally compliant. Battery materials are thus reliably recovered, and the environmental impact across the automotive value chain is significantly reduced; in other words, more sustainability potential is unlocked. |

|

It offers comprehensive lithium-ion and lead-acid battery recycling services for electric and hybrid vehicles. The services available include the collection of battery packs, disassembly, separation of materials, and the use of advanced hydrometallurgical techniques for recovering high-value metals in demand by EV battery manufacturers. | The process of accepting these critical materials, such as lithium, nickel, and cobalt, supports the circular economy and enables their reuse in new battery production. It helps to comply with OEM safety standards by following proper handling practices, and it also reduces environmental impact and ensures a steady domestic supply of battery-grade materials. |

|

The main focus of this company is the disposal of electric vehicle and hybrid batteries at the end of their life through their sophisticated refining techniques. They have developed a method to extract valuable metals such as nickel, cobalt, and lithium from used automotive batteries and sell them in their purest forms to battery makers and car parts suppliers. | It helps maintain the efficiency of raw materials and reduces the need for imported minerals, thereby strengthening the region's battery manufacturing capability. Furthermore, it enables car manufacturers to meet the requirements of extended producer responsibility (EPR) legislation and also contributes to the overall reduction of waste by using their advanced recycling methods that recover a high percentage of the materials. |

|

Umicore operates advanced battery recycling plants in various locations across Europe, specializing in the dismantling of lithium-ion and hybrid batteries that have been spent by car manufacturers, electric vehicle (EV) fleets, and battery producers. The company employs unique technologies in high-temperature smelting and hydrometallurgy to extract pure metals of high quality and in quantities typical for industrial scale. | Moreover, Umicore is returning to the European battery cathode plants the superior battery-grade materials, thus, strengthening the local supply channels. It has also lessened the need for new mining, diminished carbon emissions that are associated with the extraction of raw materials, and has aided the carmakers in the establishment of the recycling systems that are in line with the European Union (EU) Battery Regulation and are hence, closed-looped. |

|

The world's largest and most advanced EV battery maker, CATL operates a large-scale battery recycling and materials recovery business in China, which is perfectly integrated with its battery production ecosystem. The company has set up the entire process, starting from the collection of the used EV batteries through their safe disassembling and chemical extraction to the reintegration of lithium, nickel, and cobalt thus recovered into the production of new batteries. | The company fully supports the country's efforts towards a sustainable and circular economy. Its activities contribute to a significant reduction in the demand for imported raw materials as well as to a steady supply of high-purity recycled minerals. It also has a positive impact on the production cost of EV batteries, contributing to the security of the supply chain and helping car manufacturers meet carbon reduction and material recovery regulatory targets. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The global automotive battery recycling ecosystem consists of raw material suppliers (e.g., Battery Systems Inc., Interstate Batteries, and others), producers (e.g., Umicore, CATL, Call2Recycle, and others), distributors (e.g., Brenntag N.V., Riverland Trading), and end users (e.g., Automotive Cells Company, Mercedes-Benz Group, and others).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

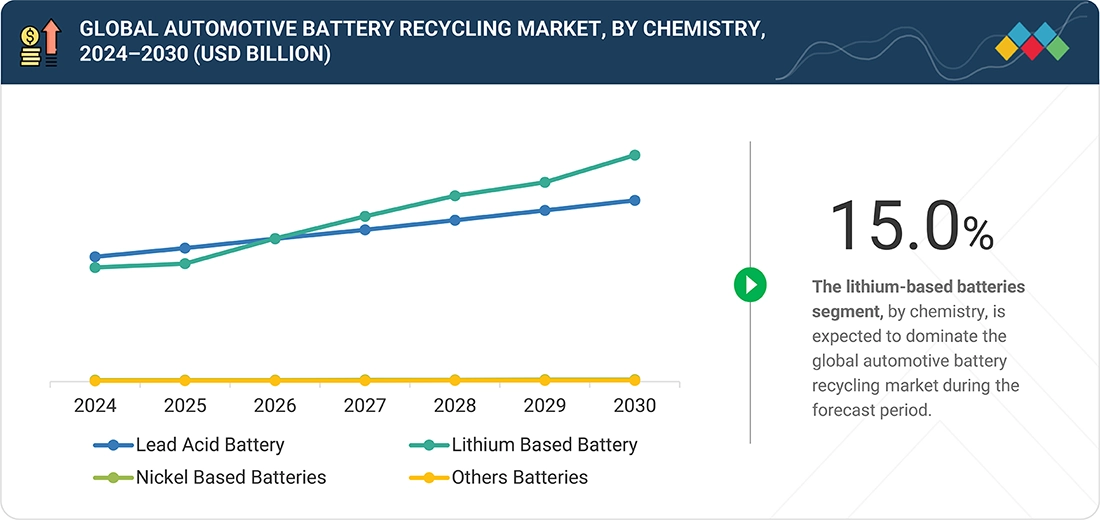

Global Automotive Battery Recycling Market, By Chemistry

The lithium battery segment is projected to grow at the highest rate during the forecast period. This rapid growth is attributed to the increasing prevalence of electric vehicles worldwide, including on-road cars, buses, and motorcycles. The corresponding increase in the volume of lithium-ion automotive battery production debris created during the initial stages of EV manufacturing is significant. As a result of this, the previous and current rounds of lithium-ion EV batteries have increased potential recoverable quantities. In an effort to ensure compliance with new and growing recycling mandates created by governments across North America, Europe, China, and other nations in Asia, vehicle and battery manufacturers, along with recyclers, have been required to develop large-scale, closed-loop recycling systems to meet those mandates.

REGION

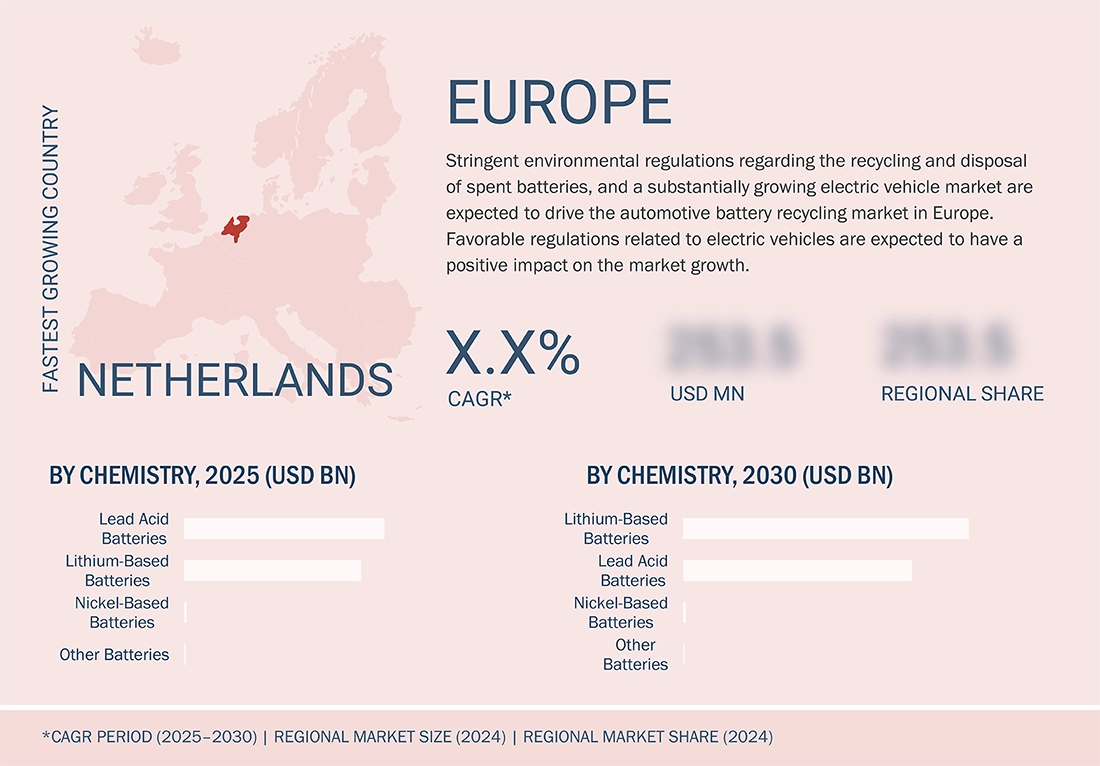

Europe to be fastest-growing region in global automotive battery recycling market during forecast period

Europe is emerging as the fastest-growing region in the global automotive battery recycling market, driven by the rapid growth of the electric vehicle market, as well as regulatory measures by the European Union aimed at encouraging EV adoption and promoting increased investments in advanced recycling technologies. The EU Battery Regulation, which requires that batteries be recovered at a higher efficiency and that there be an increased amount of recycled content in batteries, as well as total traceability throughout the battery value chain, has pushed automakers and recyclers to invest significantly in closed-loop systems. In addition, the ever-increasing availability of end-of-life hybrid and electric vehicle batteries and large amounts of scrap from gigafactories, combined with Europe's efforts to reduce reliance on critical minerals, will lead to a strong, sustainable, and scalable feedstock supply stream for battery recyclers.

AUTOMOTIVE BATTERY RECYCLING MARKET: COMPANY EVALUATION MATRIX

In the global automotive battery recycling market matrix, Umicore (Star) leads with its integrated supply chain to maximize market reach and product diversification. Players under the stars category primarily focus on new service & technology launches, as well as acquiring leading market positions through the provision of broad portfolios, catering to different requirements of customers. They are also focused on innovations and are geographically diversified. They also have broad industry coverage. Apart from that, they have strong operational and financial strength and endeavor to grow organically and inorganically in the market. Batrec Industries AG (Emerging Leader) has a strong potential to build strategies to expand its business and stay on par with the star players. However, emerging leaders have not adopted effective growth strategies for their overall business.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Call2Recycle, Inc. (US)

- Cirba Solutions (US)

- Element Resources (US)

- Umicore (Belgium)

- Contemporary Amperex Technology Co., Limited (China)

- Exide Industries Ltd. (India)

- ACCUREC Recycling GmbH (Germany)

- East Penn Manufacturing Company (US)

- Ecobat (UK)

- Enersys (US)

- Fortum (Finland)

- GEM Co., Ltd. (China)

- Glencore (Switzerland)

- Neometals Ltd. (Australia)

- Sk Tes (Singapore)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 24.78 BN |

| Market Forecast in 2030 (Value) | USD 43.42 BN |

| CAGR (2025–2030) | 10.6% |

| Years Considered | 2018–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, competitive landscape, growth factors, and trends |

| Segments Covered | By Chemistry (Lead Acid, Nickel-Based, Lithium-Based, and Other Chemistries) |

| Regions Covered | Asia Pacific, Europe, North America, South America, and Middle East & Africa |

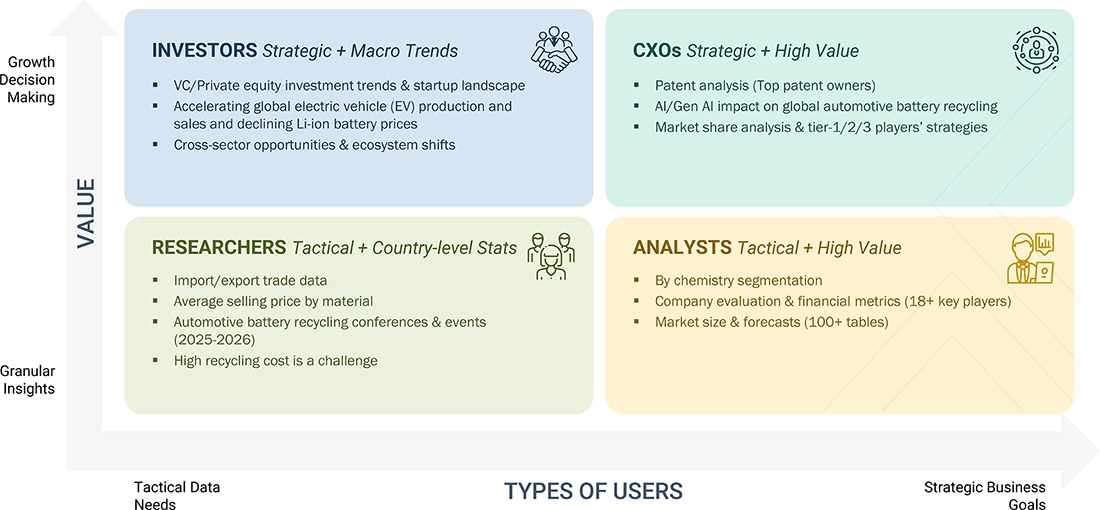

WHAT IS IN IT FOR YOU: AUTOMOTIVE BATTERY RECYCLING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Initially, it is necessary to examine the compliance needs of the EV battery recycling laws for the main regions (EU, North America, Asia Pacific). | Regulatory frameworks were analyzed. EPR responsibilities, battery passport requirements, and hazardous waste shipping regulations were examined, and the standards for recyclers worldwide were established. | Legal readiness was achieved, the risk of non-compliance was reduced, and international recycling activities were enhanced. |

| Everyone knows that automotive batteries have an end of life. However, they must not be discarded; rather, they should be collected, aggregated, and sent back through reverse logistics networks for recycling, which is the most environmentally friendly option. | Battery return channels, including dealerships, fleets, and dismantlers, have been identified, and cost-efficient logistics flows tailored to EV volumes and regional recycling capacities have been modeled. | Collection and transport costs were reduced, and recyclers were provided with a reliable source of feedstock due to the increased throughput reliability. |

| Recycling technology for electric vehicle and hybrid battery chemistries (Li-ion NMC, LFP, NiMH, lead-acid) have been evaluated. | The evaluation included comparing three methods: pyrometallurgical, hydrometallurgical, and direct-recycling, which are based on their capacity, capital and operating costs, and scalability. | They provided support to investment decisions by making the cost-benefit analysis clearer and by facilitating the raising of precious metals recovery rates. |

| End-of-life and second-life options for EV batteries should be examined prior to recycling. | The second-life application for energy storage systems (ESS) was modeled, and the material flows moving from reuse to recycling were quantified. | The benefits included greater use of the asset, postponed recycling expenses, and improved compatibility with the global circular economy goals. |

RECENT DEVELOPMENTS

- April 2023 : Cirba Solutions signed a Memorandum of Understanding (MoU) with Honda to collect, process, and return recycled battery materials to be used as raw material feedstock for Honda’s battery supply chain for application in future electric vehicle batteries.

- April 2022 : Umicore signed a long-term strategic supply agreement with Automotive Cells Company (ACC) on battery recycling services. The recovered metals are delivered to the ACC pilot plant in Nersac, France, in battery-grade quality at the end of the Umicore recycling process, allowing them to be recirculated into producing new batteries.

- April 2022 : Call2Recycle, Inc. announced its partnership with Li Industries to enhance its battery sorting and recycling using Li Industries’ innovative technology. Both companies will refine their approach to lithium-ion battery processing, with commercialization of their process expected in 2023.

Table of Contents

Methodology

The study involved four major activities in estimating the current market size of automotive battery recycling. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of automotive battery recycling through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The automotive battery recycling market comprises several stakeholders, such as such as battery suppliers, processors, recycling companies, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the automotive battery recycling industry. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom- up approaches were used to estimate and validate the total size of the automotive battery recycling industry. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the automotive battery recycling market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the automotive and non-automotive sources.

Market definition

Automotive battery recycling refers to the process of collecting and reprocessing used batteries to recover valuable materials and reduce environmental impact. It involves the safe and responsible disposal of batteries, followed by the extraction and recycling of materials such as precious metals (e.g., lead, lithium, copper, nickel, cobalt) and other components (e.g., plastic, acid) that can be reused or repurposed. Automotive battery recycling helps conserve natural resources, minimize pollution, and prevent hazardous substances from entering the environment.

Key Stakeholders

- Governments and research organizations

- Battery manufacturers

- Electric vehicle manufacturers

- Mining companies

- Oil companies expanding into alternative energy

- Recycling associations and Industrial bodies

- Automotive battery recycling manufacturers/traders

Report Objectives:

- To analyze and forecast the market size of automotive battery recycling in terms of value

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global automotive battery recycling market on the basis of source, chemistry, and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To strategically analyze the micromarkets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To forecast the size of various market segments based on five major regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their respective key countries

- To track and analyze the competitive developments, such as new technology launches, joint ventures, partnerships, contracts, collaborations, acquisitions, agreements, investments, and expansions, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the automotive battery recycling market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Automotive Battery Recycling Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Automotive Battery Recycling Market