Automotive Conformal Coatings Market

Automotive Conformal Coatings Market by Material (Acrylic, Silicone, Epoxy, Polyurethane, Parylene), Component (ECU, PCB, Sensor, Battery Casing, LED, Infotainment System), Application Method, Vehicle Type, EV, Region – Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The automotive conformal coatings market is projected to reach USD 2.59 billion by 2032 from USD 2.08 billion in 2025, at a CAGR of 3.2%. The automotive conformal coatings market is increasingly driven by architecture-level changes in vehicle electronics, where higher power density, tighter PCB layouts, and centralized ECUs demand enhanced protection against thermal, electrical, and environmental stress. The shift toward electrified powertrains and high-voltage systems is driving the need for coatings with enhanced dielectric strength and thermal stability to ensure reliability in inverters, onboard chargers, and battery management units. Automakers are also standardizing conformal coatings across ECUs and sensors to support ADAS, connectivity, and software-defined vehicle functions, without requiring redesign of the hardware. In Europe, stringent functional safety and durability regulations are accelerating the adoption of high-performance and precision-applied coatings, while North America’s growth is supported by compute-heavy ECUs, high-load EV electronics, and long warranty expectations. Asia-Pacific expansion is fueled by high-volume electronics manufacturing, harsh operating environments, and cost-optimized coating integration, making conformal coatings a critical enabler of reliable, scalable automotive electronics across regions.

KEY TAKEAWAYS

-

BY COMPONENTBy Component, PCBs are expected to register the highest CAGR of 3.9%.

-

BY VEHICLE TYPEBy vehicle type, the heavy commercial vehicles segment is expected to grow at the fastest rate from 2025 to 2032.

-

BY MATERIALThe acrylic segment is expected to dominate the market.

-

By EV TypeBy EV type, the BEV segment is expected to lead the market during the forecast period.

-

BY REGIONAsia Pacific is expected to lead the market, with a 61% share in 2025.

-

COMPETITIVE LANDSCAPE: KEY PLAYERSKey players such as Dow, Henkel AG & CO. KGAA, H.B. Fuller, and Shin-etsu Chemical Co. Ltd are advancing high-performance acrylic, silicone, and specialty conformal coating chemistries, along with precision selective-coating and vapor-deposition technologies, to enhance the reliability, thermal stability, and durability of automotive electronics. Their innovation efforts focus on protecting ECUs, PCBs, power electronics, sensors, and LED systems used in electric, connected, and autonomous vehicles, enabling higher electronics density, longer service life, and improved functional safety across modern automotive platforms.

-

COMPETITIVE LANDSCAPE: STARTUPSSA (Switzerland), Peters Group (Germany), CSL Silicones Inc. (Canada), and emerging US players are focused on high-reliability silicone and specialty conformal coatings optimized for automotive ECUs, PCBs, sensors, and power electronics. Their developments emphasize high-temperature resistance, chemical durability, precise selective coating, and low-stress curing, supporting higher electronic density and long-life performance in EV, ADAS, and connected vehicle applications.

The growth of this market is primarily driven by the increasing use of automotive electronics in vehicles and various technological advancements in the application methods of conformal coatings.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in demand and emerging technology shifts in the automotive conformal coatings market are pushing OEMs and Tier-I suppliers toward more advanced protection solutions for high-density, software-driven vehicle electronics. The transition from ICE electronics to electric, hybrid, connected, and autonomous vehicle platforms is accelerating the use of compact, high-voltage, and high-frequency electronic architectures, increasing exposure to thermal stress, moisture ingress, and signal-integrity risks. This shift is driving adoption of selective coating, vapor deposition, and parylene-based solutions, alongside materials optimized for miniaturization, lightweighting, and automated application. As advanced safety systems, V2X connectivity, and OTA-enabled ECUs become standard, coating performance is no longer a passive requirement but a critical enabler of electronics reliability and lifecycle durability. These evolving requirements are reshaping material selection, application methods, and process automation across the value chain, unlocking new revenue opportunities for suppliers offering high-performance, EV-ready, and precision-applied conformal coating technologies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing adoption of electronics in vehicles

-

Growing popularity of electric vehicles

Level

-

Size reduction and consolidation of component

-

Costly removal and repair of conformal coatings

Level

-

Innovations in autonomous and connected mobility

-

Technological advancements in conformal coatings

Level

-

Lack of technical knowledge

-

Stringent government regulations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing adoption of electronics in vehicles

The rising penetration of safety, comfort, and emission-control features is sharply increasing the electronic content per vehicle, with sensor counts surpassing 200 per car. These sensors and control modules operate in thermally stressed, contamination-prone environments, making conformal coatings essential to maintaining signal accuracy and long-term reliability. At the same time, ECUs are evolving from single-function controllers to high-performance units that manage braking, powertrain, thermal systems, and vehicle security. In EVs, where ECU density, voltage exposure, and replacement costs are significantly higher than in ICE vehicles, conformal coatings play a critical role in protecting high-value electronics, reducing failure risk, and supporting extended warranty requirements—directly accelerating market adoption.

Restraint: Size reduction and consolidation of the component

Rapid miniaturization of automotive electronics is structurally reducing the amount of conformal coating per vehicle. The shift toward HDI PCBs places components closer together, enabling smaller boards with lower coating surface area despite rising electronic complexity. In parallel, OEMs and Tier-1 suppliers are consolidating multiple ECUs into centralized, high-compute domain or zonal controllers. This architecture replaces several mid-density boards with a single high-power PCB, improving packaging efficiency while reducing total coating volume. As a result, while electronic content per vehicle continues to rise, coating demand is increasingly decoupled from unit growth, acting as a moderating restraint on overall market expansion.

Opportunity: Innovation in autonomous and connected mobility

Automotive electronics are transitioning from a support function to a core cost driver, with their share of vehicle value projected to approach half by 2030. The rapid penetration of connected-car features, including sensor fusion, V2X communication, real-time diagnostics, and cloud-linked control systems, is sharply increasing the density and criticality of onboard electronics. As OEMs move toward Level 2+ and Level 3 autonomy, the reliability of ECUs, sensors, and communication modules becomes non-negotiable, particularly under thermal, moisture, and vibration stress. This creates a structural opportunity for conformal coatings as an enabling technology that safeguards high-value electronics as the industry shifts from connectivity-led vehicles to fully autonomous platforms.

Challenge: Lack of technical knowledge

Conformal coatings are critical for protecting automotive electronics from moisture, heat, corrosion, chemicals, and electrical failure, but their effectiveness depends on material selection and application quality. Silicone coatings are preferred over acrylic in vehicles due to higher thermal stability and superior moisture resistance. Challenges arise from improper surface preparation, insufficient coverage, trapped air bubbles, or uneven thickness, all of which can compromise protection and lead to PCB failure, highlighting the need for precise process control.

AUTOMOTIVE CONFORMAL COATINGS MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Specification and validation of conformal coatings for ECUs, PCBs, sensors, battery packs, power electronics, lighting modules, and infotainment systems across ICE, HEV, and BEV platforms | Improves electronic reliability under thermal, moisture, and vibration stress | Reduces field failures and recalls | Supports higher electronics density required for ADAS, electrification, and software-defined vehicles |

|

Application of acrylic, silicone, epoxy, or parylene coatings on high-density PCBs and miniaturized electronic assemblies used in ADAS, body electronics, and EV power management systems | Enables miniaturization, improves insulation and corrosion resistance | Supports high-voltage and high-frequency electronics | Increases yield in harsh automotive environments |

|

Integration of selective, spray, or vapor-phase conformal coating processes within ECU, sensor, and power-module assembly lines to meet OEM durability and lifetime performance requirements | Enhances product robustness and extends component lifecycle | Ensures compliance with OEM quality standards | Lowers warranty exposure for safety-critical electronics |

|

Development of application-specific coating chemistries optimized for under-hood temperatures, high-voltage EV systems, LED optics, and automated selective-coating equipment | Creates differentiation through high-performance materials | Secures long-term supply agreements with OEMs and Tier-1s | Captures EV-driven demand growth | Strengthens positioning in premium and safety-critical automotive electronics |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The automotive conformal coatings market features the latest technologies, diversified portfolios, and strong global distribution networks. The major players in the global automotive conformal coatings market include Dow (US), Henkel AG & CO. KGAA (Germany), H.B. Fuller (US), and Shin-Etsu Chemical Co. Ltd. (Japan).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Automotive Conformal Coatings Market, By Component

ECUs represent the dominant segment in the automotive conformal coatings market due to their rapid proliferation, rising compute density, and harsh operating environments. Modern vehicles integrate centralized and domain ECUs for powertrain control, ADAS, thermal management, and body electronics, many of which are mounted in engine bays or near high-voltage systems, exposing them to sustained heat, vibration, and moisture. The shift toward EV and software-defined vehicle architectures further increases ECU value and failure risk, as battery management, inverter control, and vehicle-domain controllers rely on uninterrupted electronic performance. As ECU consolidation raises functional criticality per unit, OEMs increasingly mandate conformal coatings to ensure thermal stability, long-term reliability, and functional safety compliance, reinforcing ECU dominance in conformal coating demand.

Automotive Conformal Coatings Market, By Material Type

Silicone conformal coatings hold a critical position in the automotive conformal coatings market due to their exceptional thermal stability and environmental resilience, making them the preferred choice for under-the-hood electronics, power electronics, and LED modules. Their ability to maintain electrical insulation and mechanical integrity across extreme temperature cycles supports reliable operation in EV inverters, battery control units, and high-heat PCBs. Silicone’s resistance to moisture, chemicals, and corrosion further strengthens its adoption in harsh automotive environments. However, difficult reworkability and the need for thicker coating layers limit its use in ultra-miniaturized electronics such as MEMS and dense IoT-grade assemblies, confining its dominance to high-stress automotive applications rather than compact modules.

Automotive Conformal Coatings Market, by Vehicle Type

Passenger cars dominate the automotive conformal coatings market, primarily due to their high production volumes and the deepest penetration of electronics per vehicle. Unlike commercial vehicles, passenger cars increasingly integrate multiple ECUs, high-density PCBs, ADAS sensors, infotainment modules, digital instrument clusters, LED lighting, and body-control electronics across even mid-priced models, significantly expanding the coated surface area per unit. The rapid shift toward electrified and software-defined passenger platforms further amplifies coating demand, as battery management systems, power electronics, and centralized compute units require robust protection against moisture, thermal cycling, and voltage stress. In addition, passenger cars are exposed to diverse operating environments urban humidity, dust, temperature extremes, and vibration, necessitating conformal coatings to ensure long-term electronic reliability and warranty compliance. OEM focuses on lifecycle durability, reduced field failures, and regulatory safety validation, making conformal coating a standardized, non-negotiable process in passenger car electronics manufacturing, reinforcing this segment’s dominance by vehicle type.

Automotive Conformal Coatings Market, By Application

Selective coating dominates the automotive conformal coatings market by application because it aligns most effectively with the high-density, mixed-technology electronics used in modern vehicles. Automotive PCBs increasingly combine sensitive connectors, test points, sensors, and heat-dissipating components that must remain uncoated, making full-coverage methods such as dipping or vapor deposition impractical. Selective coating enables precise, programmable deposition only where protection is required, ensuring consistent film thickness while avoiding masking-related rework and yield losses common in spray and brush processes. As OEMs transition to centralized ECUs, HDI boards, and automated electronics assembly, selective coating integrates seamlessly with inline manufacturing, enabling higher throughput, reduced material waste, and improved process repeatability. Compared to dipping and spray coating, it reduces contamination risk and improves reliability in harsh automotive environments, making it the preferred method for large-scale production of passenger vehicle and EV electronics.

REGION

Asia Pacific is expected to be the largest region in the global automotive conformal coatings market during the forecast period.

Asia Pacific remains the largest automotive conformal coatings market, driven by its dominance in passenger car and EV production, particularly in China, Japan, South Korea, and increasingly India. The region is driving the global deployment of electronics-intensive vehicles, in which compact and mid-size passenger cars feature high ECU counts for powertrain control, ADAS, body electronics, and infotainment, directly increasing coating demand per vehicle. China anchors regional demand through large-scale BEV manufacturing by OEMs such as BYD, SAIC, Geely, and Tesla, where battery management systems, inverters, and high-density PCBs require selective and high-reliability conformal coatings. Japan and South Korea contribute through advanced electronics architectures adopted by Toyota, Honda, Hyundai, and Kia, emphasizing durability, long vehicle lifecycles, and high under-the-hood reliability standards. India is emerging as a volume-driven growth market as safety regulations and feature penetration push conformal coatings into mid-priced passenger cars. The presence of global OEM manufacturing hubs alongside strong regional electronics and materials suppliers ensures sustained investment in localized coating capacity, reinforcing Asia Pacific’s leadership through 2032.

AUTOMOTIVE CONFORMAL COATINGS MARKET: COMPANY EVALUATION MATRIX

In the automotive conformal coatings market matrix, Henkel AG & Co. KGaA (Star) leads with a strong global manufacturing footprint, broad acrylic and silicone coating portfolios, and deep integration with Tier-I automotive electronic suppliers across ECUs, PCBs, sensors, and power electronics. Its early alignment with EV and ADAS reliability standards and automated selective-coating processes reinforces its leadership across major automotive regions. Dymax (Emerging Leader) is rapidly gaining share by scaling high-performance silicone and specialty coatings optimized for high-temperature EV and under-hood electronics, supported by strong relationships with Japanese and Korean OEMs and expanding penetration into Europe and North America through EV-focused electronics programs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Dow

- Henkel AG & CO. KGAA

- Chase Corporation

- H.B. Fuller

- Shin-etsu Chemical Co., Ltd.

- ALTANA AG

- Electrolube

- Dymax

- CHT Group

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 2.08 BN |

| Market Size in 2032 (Value) | USD 2.59 BN |

| Growth Rate | CAGR of 3.2% from 2025 to 2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD MN/BN), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, North America, Rest of the world |

WHAT IS IN IT FOR YOU: AUTOMOTIVE CONFORMAL COATINGS MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| OEMs and Tier-I suppliers are evaluating next-generation electronic architectures for ICE, HEV, and BEV platforms with higher ECU density and compact PCBs | Component-level assessment of conformal coating requirements for ECUs, HDI PCBs, sensors, and LED modules across under-hood, chassis, and cabin zones | Component-level assessment of conformal coating requirements for ECUs, HDI PCBs, sensors, and LED modules across under-hood, chassis, and cabin zones |

RECENT DEVELOPMENTS

- December 2025 : Henkel introduced the Bergquist TGF-10000, a new high-performance thermal gap filler engineered for ultra-demanding electronics applications that require exceptional heat dissipation and mechanical compliance. The material delivers very high thermal conductivity and robust performance under thermal cycling and stress, making it suitable for advanced power electronics used in electric vehicles, renewable energy inverters, and industrial systems.

- October 2025 : Dymax announced the release of its new 9773 ruggedized adhesive, formulated to meet the NASA/ASTM E595 low-outgassing standard, making it suitable for demanding environments where volatile emissions must be minimized. The material delivers robust adhesion and environmental resistance, making it suitable for applications in electronics, aerospace, and other high-performance industries that require reliable bonding with stringent outgassing specifications.

- August 2025 : ALTANA announced that its specialty chemicals division BYK has established a new company, “BYK do Brasil,” headquartered in São Paulo, to strengthen its presence and customer proximity in the South American market. This strategic move reflects BYK’s focus on tapping into the economic growth dynamics of key industries such as paints/coatings, plastics, and cosmetics in the region, enabling faster response times, closer cooperation with partners and customers, and deeper market development.

- July 2025 : Henkel completed the acquisition of Nordbak, a South African manufacturer of industrial adhesives, sealants, and coating solutions, to strengthen its Adhesive Technologies footprint in Africa. The transaction enhances Henkel’s local production capabilities, broadens its product portfolio for regional customers, and supports tailored solutions across automotive, construction, packaging, and industrial applications.

- May 2025 : H.B. Fuller is expanding its manufacturing capabilities across the IMEA region (India, the Middle East, and Africa), emphasizing localized production, technical service, and application expertise to better serve regional customers. It outlines how investments in plants, labs, and supply-chain infrastructure enable faster delivery, customized adhesive solutions, and stronger support for industries such as automotive, construction, electronics, hygiene, and packaging across high-growth IMEA markets.

- May 2025 : CHT showcased its latest sustainable, high-performance products and solutions at the European Coatings Show 2025 in Nuremberg, highlighting innovations across coatings, paints, inks, and specialty applications. The company presented advanced solutions focused on sustainability, performance enhancement, and regulatory compliance, reinforcing CHT’s position as a technology partner for the global coatings and materials industry.

Table of Contents

Methodology

The study involves 4 main activities to estimate the current size of the automotive conformal coatings market. Exhaustive secondary research was done to collect information on the market, such as the conformal material, upcoming technologies, and component coated with these coating. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. A mix of bottom-up and top-down approach was employed to estimate the market size for different segments considered under this study.

Secondary Research

The secondary sources referred for this research study include automotive organizations such as the European Automobile Manufacturers’ Association, The Institute for Advanced Composites Manufacturing Innovation, corporate filings (such as annual reports, investor presentations, and financial statements), Factiva, CrunchBase, Bloomberg and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by multiple industry experts.

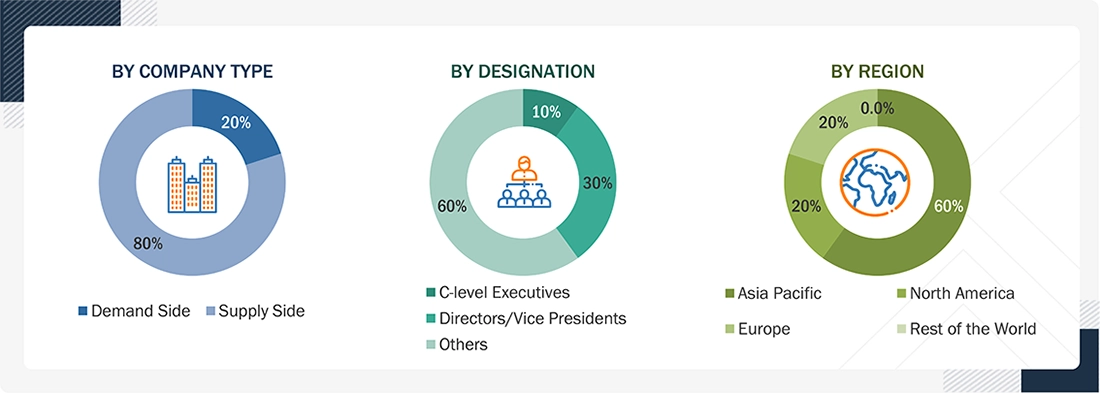

Primary Research

Extensive primary research was conducted after acquiring an understanding of the automotive conformal coatings market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (OEM) and supply-side (automotive conformal coating manufacturers and distributors) players across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 20% of primary interviews from the demand side and 80% from the supply side were conducted. Primary data was collected through questionnaires, mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the automotive conformal coatings market and other dependent submarkets, as mentioned below:

- Key players in the automotive conformal coatings market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of the annual and quarterly financial reports & regulatory filings of major market players as well as interviews with industry experts for detailed market insights.

- All application-level penetration rates, percentage shares, splits, and breakdowns for the automotive conformal coatings market were determined by using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative & qualitative data.

The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to estimate and validate the size of the global market and various other dependent sub-markets of the overall automotive conformal coatings market. The research methodology used to estimate the market size includes the following details.

The bottom-up approach was used to estimate and validate the size of the automotive conformal coatings market, by component and vehicle type, at country and region levels. The country-level production of vehicles for each type (in units) was derived from secondary sources and paid databases and validated through primary interviews. The country-level production of vehicle types (passenger cars, light commercial vehicle, and heavy commercial vehicle) was multiplied by average number of quantity of components (ECU, PCB, sensors, battery casing, LED, and infotainment system), which was derived from secondary sources and validated through primary interviews. Then the average surface area of each component where the conformal coating is required was derived through secondary and primary validation. The average quantity of conformal coating per mm2 surface area for components was derived through secondary and primary validation. Multiplication of the coating quantity with average surface area derived conformal coating quantity per component. Multiplication of average quantity of conformal coating per component multiplied by the total number of components in each vehicle type provided the total quantity of conformal coating per component, and summation of quantities required for components per vehicle provides the quantity of conformal coating per vehicle in liters at country level. To derive the value market, for component and vehicle type segments, ASP of per ml/liter conformal coating has been derived through secondary and primary validation and multiplied with the total quantity per component, which provides conformal coating value by component, and summation of all component values provides conformal coating value by vehicle at country level. The summation of country-level markets led to the regional market, and further summation of the regional markets led to the global automotive conformal coatings market, by vehicle type and component.

To know about the assumptions considered for the study, Request for Free Sample Report

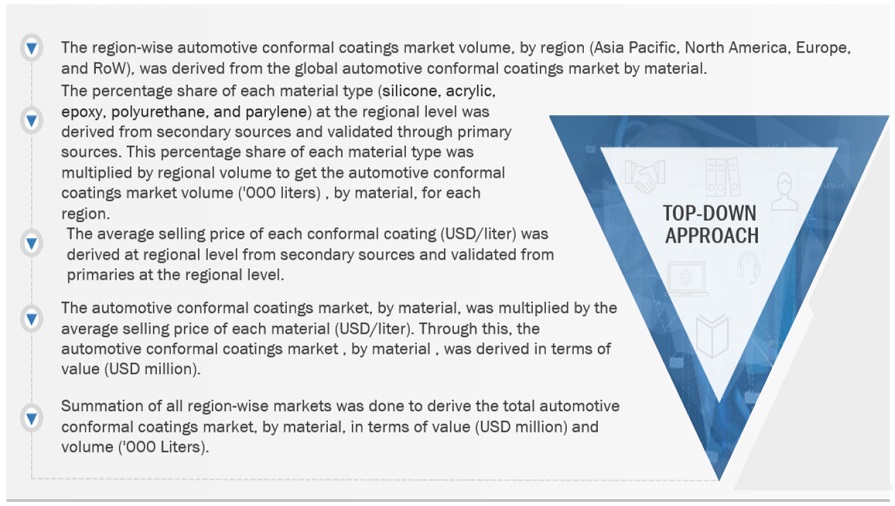

Top-Down Approach

For the material segment, the region-wise automotive conformal coatings market volume, by region (Asia Pacific, North America, Europe, and RoW), was derived from the global automotive conformal coatings market by application method. Further, the percentage share of each material type (silicone, acrylic, epoxy, polyurethane, and parylene) at the regional level was derived from secondary sources and validated through primary sources. This percentage share of each material type was multiplied by regional volume to get the automotive conformal coatings market volume ('000 liters) for each region. For the value market, the average selling price of each conformal coating (USD/liters) was derived at regional level from secondary sources and validated from primaries at the regional level. The automotive conformal coatings market, by material, was then multiplied by the average selling price of each material USD/liters. Through this, the automotive conformal coatings market, by material type, was derived in terms of value (USD million). Summation of all region-wise markets was done to derive the total automotive conformal coatings market, by material, in terms of value (USD million) and volume ('000 Liters).

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. The data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report.

Market Definition

Automotive conformal coatings are specialized protective coatings applied to electronic components and circuitry within vehicles to safeguard them from environmental factors such as moisture, dust, chemicals, and temperature extremes. These coatings are typically thin layers of polymeric film that conform to the contours of the electronics, providing a barrier that enhances the durability and reliability of sensitive components. By preventing corrosion, electrical failures, and physical damage, conformal coatings ensure the optimal performance and longevity of automotive electronics, which are increasingly critical in modern vehicles due to the integration of advanced systems like infotainment, ADAS, and engine control units .

Stakeholders

- Automotive Conformal Coating Suppliers

- Automotive Electronics Manufacturers

- Original Equipment Manufacturers (OEMS)

- Raw Material Suppliers

- Regional Manufacturer Associations and Automobile Associations

- Automotive Conformal Coating Traders, Distributors, and Suppliers

- Automotive Industry as an End-Use Industry

Report Objectives

-

To define, describe, segment, and forecast the size of the automotive conformal coatings market in terms of volume (thousand liters) and value (USD million/billion) from 2019 to 2030

- To define, describe, and forecast the size of the automotive conformal coatings market based on material, component, vehicle type, EV type, application method, and region

- To segment and forecast the size of the automotive conformal coatings market based on material (parylene, silicone, acrylic, epoxy, and polyurethane)

- To segment and forecast the size of the automotive conformal coatings market based on component (ECU, PCB, sensor, battery casing, LED, and infotainment system)

- To segment and forecast the size of the automotive conformal coatings market based on vehicle type (passenger car, light commercial vehicle, and heavy commercial vehicle)

- To segment and forecast the size of the automotive conformal coatings market based on EV type (BEV and HEV/PHEV)

- To segment and forecast the size of the automotive conformal coatings market based on application method (brush coating, dipping, spray coating, selective coating, and vapor deposition)

- To define, describe, and forecast the size of the automotive conformal coatings market based on region (Asia Pacific, Europe, North America, and Rest of the World)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) and conduct patent analysis, case study analysis, value chain analysis, regulatory analysis, and ecosystem analysis

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze recent developments, such as agreements/partnerships/collaborations, mergers and acquisitions, expansions, and product developments of key players in the automotive conformal coatings market

- To understand the dynamics of the key market players and distinguish them into stars, emerging leaders, pervasive players, and participants according to their product portfolio strength and business strategies

- To analyze the opportunities offered by various segments of the market to its stakeholders

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

Country Information

- Application method segment at country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Automotive Conformal Coatings Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Automotive Conformal Coatings Market