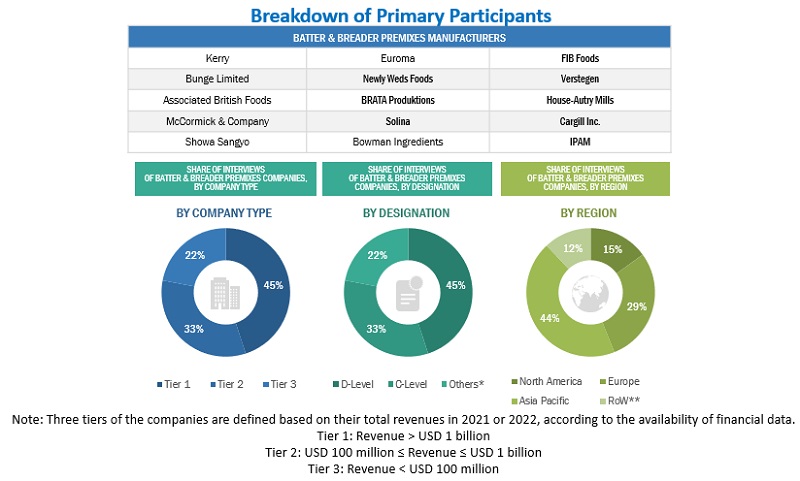

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the batter & breader premixes market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases were referred to, to identify and collect information. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the batter & breader premixes market.

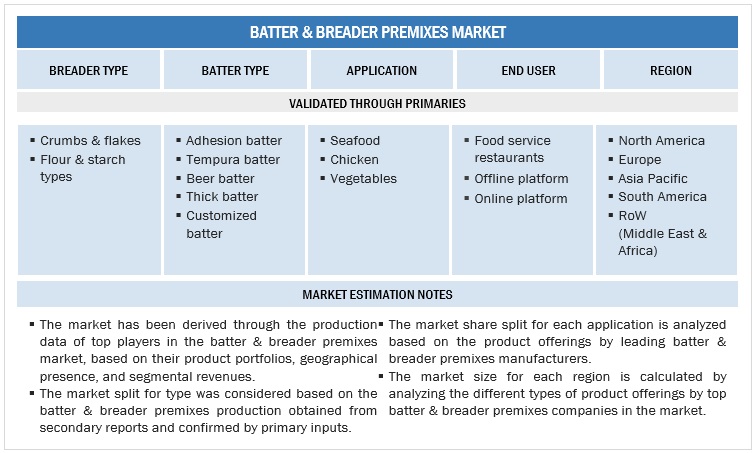

After the complete market engineering (which included calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and to verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, key players, and competitive landscape of batter & breader premixes supplied by different market players, key market dynamics such as drivers, restraints, opportunities, industry trends, and key player strategies.

In the complete market engineering process, top-down and bottom-up approaches were extensively used along with several data triangulation methods to conduct market estimation and forecasting for the overall segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

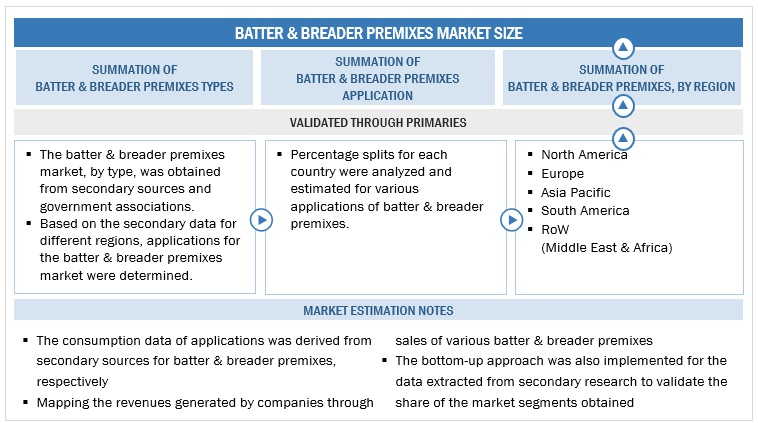

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

-

The key players in the industry and markets were identified through extensive secondary research.

-

The industry’s supply chain and market size were determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

-

The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for key opinions from leaders such as CEOs, directors, and marketing executives.

Market size estimation: Top-Down approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the segmentation) through percentage splits from secondary and primary research. For the calculation of each specific market segment, the most appropriate immediate parent market size was used to implement the top-down approach. The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up procedure. With the data triangulation procedure and validation of data through primary, the overall parent market size and each market size were determined and confirmed. The data triangulation procedure in this study is explained in the next section.

To know about the assumptions considered for the study, Request for Free Sample Report

Market size estimation methodology: Bottom-up approach

In the bottom-up approach, each country's market size for batter & breader premixes and the types was arrived at through secondary sources, such as annual reports, investor presentations, journals, and government publications. The bottom-up procedure was also implemented on the data extracted from secondary research to validate the market segment sizes obtained.

The penetration rate of each type of batter & breader premixes in each country was calculated from secondary sources. Country-level data for batter & breader premixes were estimated based on the adoption rate of each type of batter & breader premixes within each food application. The origin of each product type was tracked via product mapping and studied for its penetration level to estimate the market size at a regional level. Each product type was studied for its commercially available form. The market size arrived at was further validated by primary respondents.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, there are three approaches: first is the top-down approach, second is the bottom-up approach, with the third is expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Market Definition

Batter & breader premixes are primarily used as a coating for deep-fried food products. These premixes enhance the appearance of food products and contribute to their crispy texture. Batter & breader products are suitable for seafood, chicken, and other high-value products. These premixes mainly help in retaining moisture in the final product.

The major types of batter premixes considered for the study include tempura batter, adhesion batter, beer batter, thick batter, and customized batter, while the major types of breader premixes include crumbs & flakes and flour & starch.

Key Stakeholders

-

Food product suppliers and manufacturers

-

Food product importers and exporters

-

Food product traders and distributors

-

Government and research organizations

-

Associations and industry bodies

-

World Health Organization (WHO)

-

Food and Drug Administration (FDA)

-

Institute of Food and Agricultural Sciences (IFAS)

-

Global Food & Beverage Association (GFBA)

-

National Food Safety and Quality Service (SENASA)

-

Canadian Food Inspection Agency (CFIA)

-

Center for Professional Advancement (CfPA)

Report Objectives

Market Intelligence

-

To define, segment, and estimate the size of the batter & breader premixes market with respect to its type, application, and region

-

To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

-

To analyze the complete supply chain and the influence of all key stakeholders, such as manufacturers, suppliers, and end users

-

To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To profile the key players and comprehensively analyze their core competencies

-

To analyze the competitive developments, such as new product launches, acquisitions, investments, expansions, and partnerships, in the batter & breader premixes market

Competitive Intelligence

-

Profiling the key players in the batter & breader premixes market and comprehensively analyzing their market positions and core competencies

-

Providing a comparative analysis of the market leaders based on the following:

-

Product offerings

-

Business strategies

-

Strengths, weaknesses, opportunities, and threats

-

Key financials

-

Understanding the competitive landscape and identifying the major growth strategies adopted by the players across the key regions

-

Providing insights on the key investments in product innovations and patent registrations

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

-

Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

-

Further breakdown of the Rest of European batter & breader premixes market, by key country

-

Further breakdown of the Rest of the South American batter & breader premixes market, by key country

-

Further breakdown of the Rest of Asia Pacific batter & breader premixes market, by key country

Company Information

-

Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Batter & Breader Premixes Market