Battery as a Service Market

Battery as a Service Market by Leasing Type (Subscription, Pay-per-use), Usage (Private, Commercial), Vehicle Type (Two-wheelers, Three-wheelers, Passenger Cars, Commercial Vehicles), Battery Capacity, and Region - Global Forecast to 2035

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Battery-as-a-Service market is projected to reach USD 14.45 billion by 2035 from USD 0.66 billion in 2024, growing at a CAGR of 32.4%. Growth is driven by the leasing model's ability to cut the initial EV purchase cost by 30-40%, making EVs significantly more affordable across all segments. The model also transfers responsibility for battery lifecycle management from the consumer to the service provider, reducing concerns around long-term performance degradation and replacement costs. Additionally, second-life battery utilization in stationary energy storage supports circular economy goals, strengthening the sustainability and profitability of BaaS platforms.

KEY TAKEAWAYS

-

BY LEASING TYPEIn the battery as a sevice market by leasing type, subscription dominates in mature markets for predictable costs, while pay-per-use gains traction with commercial fleets requiring scalable battery access.

-

BY USAGEIn the battery as a sevice market by usage, commercial fleets lead adoption due to delivery and ride-hailing needs, while private users prefer predictable costs and battery upgrade flexibility.

-

BY VEHICLE TYPEThe growth for electric three-wheelers is being drive by demand for last-mile delivery and public transport, while passenger cars benefit from flexible ownership and leasing models.

-

BY BATTERY CAPACITYSmaller batteries are popular in two- and three-wheelers, mid-range capacities drive passenger EV adoption, and high-capacity batteries support commercial EV fleets and long-range vehicles.

-

BY REGIONAsia Pacific leads in volume adoption, Europe is the fastest-growing due to regulatory support and fleet electrification, and North America focuses on passenger EV adoption.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including service launches, collaborations, and regional expansions. For instance, Hyundai Motor Company launched a new EV subscription service in South Korea in July 2024, Mahindra Last Mile Mobility collaborated with VidyutTech to introduce a Battery-as-a-Service program in December 2024, and VinFast launched a battery subscription model for its VF5 in the Philippines in August 2024.

Rising electrification of commercial fleets is accelerating the shift toward leasing-based battery models. Fleet operators in logistics, public transport, and ride-hailing are adopting subscription plans to reduce capital costs and mitigate battery degradation risks. Pay-per-use and distance-based models are also gaining traction in price-sensitive markets like India, aligning costs with actual vehicle utilization and improving total cost of ownership economics.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the Battery-as-a-Service market, current revenue mainly comes from direct EV sales where battery costs are included. The future mix is expected to shift toward pay-per-use plans, subscription-based services, and battery leasing or renting models. Growth will be influenced by advancements in battery health tracking, predictive maintenance, and lifecycle-based pricing that improve fleet uptime and reduce ownership costs.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Ease of EV ownership with battery leasing

-

Integration of battery swapping service into battery leasing model

Level

-

Limited scope in North America and Europe for two- and three-wheelers

-

Limited scope in private vehicles segment

Level

-

Incresing relianc on micro-mobility

-

Second-lie battery shortage

Level

-

Dependency on battery asset companies

-

Shortage of lithium for use in EV batteries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Ease of EV ownership with battery leasing

Battery leasing lowers upfront costs and reduces concerns around battery degradation. NIO’s BaaS model cuts vehicle prices by up to 40% with flexible monthly plans. VinFast’s subscription model in Vietnam similarly separates vehicle and battery ownership, boosting affordability and EV adoption in cost-sensitive markets.

Restraint: Limited scope in North America and Europe for two- and three-wheelers

Battery-as-a-Service has limited potential in North America and Europe due to low penetration of electric two- and three-wheelers. Strong consumer preference for full ownership and high financing availability reduce interest in battery leasing. The lack of large fleet or shared mobility segments further restricts recurring leasing adoption.

Opportunity: Increasing reliance on micro-mobility

Rising adoption of electric two- and three-wheelers in Asia and parts of Europe is expanding the base for battery leasing. Startups in Asia offer monthly rental plans for delivery and ride-hailing fleets. These high-use vehicles gain from lower upfront costs and predictable energy expenses, strengthening the case for leasing-based Battery-as-a-Service in micro-mobility markets.

Challenge: Dependncy on battery asset companies

Battery leasing models rely on asset management companies to finance and maintain large battery inventories. Limited availability of such players restricts scalability and raises operational costs for OEMs. High capital intensity of battery lifecycle management increases financing risks, forcing OEMs to depend on third-party partners and slowing independent expansion.

Battery as a Service Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers flexible battery leasing with Power Swap stations, allowing users to choose battery capacities and upgrade options. | Reduces EV upfront cost, mitigates battery degradation concerns, and provides access to the latest battery technology. |

|

Introduced a lifetime battery warranty with free maintenance and replacement if capacity drops below 70%. | Ensures long-term battery reliability and reduces ownership costs. |

|

Launched the Windsor EV with a BaaS model, offering reduced vehicle price. | Lowers initial EV investment and provides cost-effective battery usage for high-mileage drivers. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Battery as a Service market ecosystem consists of battery manufacturers (CATL, Panasonic), OEMs (NIO, VinFast, XPeng), battery asset management companies (Aulton, LithiON, Sun Mobility), and financial institutions (Bajaj Finserv, Hero FinCorp, Vidyut, Ecofy). Battery manufacturers supply lithium-ion packs, while asset managers oversee leasing, maintenance, and lifecycle optimization. OEMs integrate BaaS into EV ownership models, and financial partners enable battery financing and subscription plans.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Battery as a Service Market, By Battery Capacity

The 51-100 KWh segment is projected to lead the Battery-as-a-Service market over the forecast period. Growth is driven by rising demand for high-range EVs, improved battery lifecycle management, and increasing adoption of battery leasing and rental models that reduce upfront costs and provide flexible capacity upgrades.

Battery as a Service Market, By Vehicle Type

The passenger cars segment by value is expected to dominate the market in 2024 and continue over the forecast period. This is due to growing urban EV adoption, government incentives for personal EV ownership, and rising consumer preference for subscription-based battery models that reduce upfront costs. Premium and mid-range EV models with battery leasing options further boost this segment.

Battery as a Service Market, By Leasing Type

The subscription segment is estimated to lead the market, driven by consumer demand for predictable monthly costs, flexibility to upgrade battery capacity, and reduced financial burden compared to outright battery purchase. Automakers are increasingly bundling subscriptions with vehicle sales to enhance customer loyalty and recurring revenue streams.

Battery as a Service Market, By Usage

The commercial vehicle segment is projected to grow fastest over the forecast period, driven by the electrification of delivery fleets, ride-hailing, and public transport requiring regular battery maintenance. Growth is further supported by the need for cost efficiency, minimized operational downtime, and flexible battery scalability. Companies such as Sun Mobility and Battery Smart are capitalizing on this by offering integrated battery leasing and swapping solutions for commercial fleet operations.

REGION

Asia Pacific to be the largest market for battery as a service business model

Asia Pacific is projected to dominate the Battery-as-a-Service market as automakers and energy providers form joint ventures to deploy flexible leasing models. Large-scale electrification of two- and three-wheelers in India, Indonesia, and Vietnam is creating a strong recurring demand base for leased batteries. Governments in the region are also supporting BaaS adoption through incentives for battery financing and localized energy storage partnerships. Fintech players like Grab Financial are enabling digital battery financing and seamless payment solutions, making BaaS models more accessible.

Battery as a Service Market: COMPANY EVALUATION MATRIX

In the Battery-as-a-Service market matrix, NIO (Star) leads with a strong market share in passenger cars and proven execution of large-scale leasing programs integrated into its EV ecosystem. Its mature subscription model and extensive charging infrastructure position it as the benchmark for battery ownership flexibility. Mahindra and Mahindra (Emerging Leader) is gaining traction through pilot leasing initiatives for electric three-wheelers and light commercial vehicles in India, supported by collaborations with financing and energy partners. While NIO sets the standard through operational maturity and customer reach, Mahindra and Mahindra shows strong potential to move toward the leaders' quadrant as its localized leasing ecosystem expands.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.66 Billion |

| Market Forecast in 2030 (Value) | USD 14.45 Billion |

| Growth Rate | CAGR of 32.4% from 2024-2035 |

| Years Considered | 2020-2035 |

| Base Year | 2023 |

| Forecast Period | 2024-2035 |

| Units Considered | Value (USD Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe |

WHAT IS IN IT FOR YOU: Battery as a Service Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Two-wheeler OEM | Analysis of battery subscription models, adoption trends, and market dynamics |

|

| Battery Leasing Company | Evaluation of pricing structures, operational models, and regional feasibility |

|

RECENT DEVELOPMENTS

- October 2025 : U Power (China) signed an MoU with NV Gotion (China) to co-develop EV battery modules, swapping infrastructure, and leasing solutions in Southeast Asia, starting with Thailand, to expand regional battery-swapping operations.

- October 2025 : Foton Motor (China) and Eve Energy (China) formed a joint venture to provide battery leasing for electric trucks, aimed at lowering upfront costs and boosting sales of Foton’s battery electric vehicles in China.

- July 2025 : Nio (China) and CATL (China) formed a new joint venture, Weineng Battery Technology (China), to expand their Battery-as-a-Service operations covering battery leasing, recycling, and swap infrastructure to enhance lifecycle management and grid efficiency.

- March 2025 : Nuvve (United States) launched a Battery-as-a-Service offering to help utilities and cooperatives deploy battery storage without upfront costs, improving grid resilience and managing peak demand.

- January 2025 : JSW MG Motor India partnered with Kotak Mahindra Prime (India) to provide financing solutions for its battery as a service program. The initiative aims to lower upfront costs for EV ownership and boost EV sales.

Table of Contents

Methodology

The research uses extensive secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the battery as a service market. Primary sources, such as experts from related industries, OEMs, and suppliers, have been interviewed to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

Secondary sources for this research study include government sources [such as country-level automotive associations and organizations, Organization for Economic Co-operation and Development (OECD), World Bank, CDC, and Eurostat], corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements), business magazines and research journals, annual reports, press releases, investor presentations of companies; whitepapers, free and paid automotive databases, certified publications, articles from recognized authors, the International Energy Agency, EV Volumes, Alternative Fuels Data Center (AFDC), the European Alternative Fuels Observatory (EAFO), and other associations/organizations. Secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

After understanding the scenario of the battery as a service market through secondary research, extensive primary research was conducted. Several primary interviews were conducted with market experts from the demand (OEMs) and supply (component manufacturers) sides across Asia Pacific, Europe, and North America. Approximately 53% and 47% of primary interviews were conducted from the demand and supply sides, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. During the primary research process, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions with experienced independent consultants were also conducted to reinforce the findings from primaries. Analyses by these consultants and in-house subject-matter experts led to the findings described in this report.

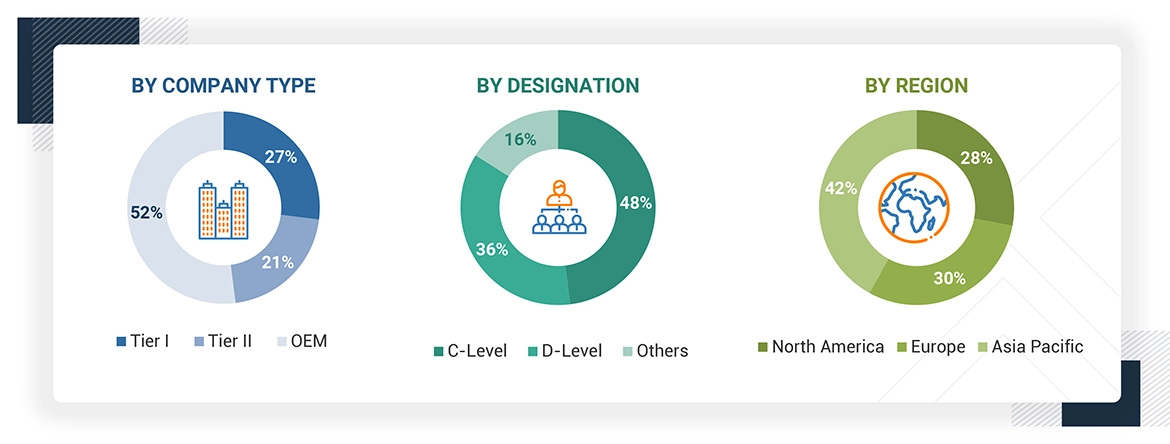

Note: Others include sales, managers, and product managers.

Company tiers are based on the value chain; the company's revenue is not considered.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the battery as a service market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Battery as a Service Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size of the global market through the methodology mentioned above, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and sub-segments, wherever applicable. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand and supply-side participants.

Market Definition

In a battery as a service model, EV owners buy vehicles without the battery. Instead, the battery is offered through a subscription or rental plan, which is paid via a monthly fee or EMI. This fee covers the battery cost divided into small, manageable payments over the subscription period. It reduces upfront costs, offers flexibility for battery upgrades, and ensures affordability for consumers.

Stakeholders

- Automotive OEMs

- Battery Asset Management Companies

- EV Battery Casing Manufacturers

- EV Battery Cell Manufacturers

- EV Battery Component Providers

- EV Battery Manufacturers

- EV Battery Pack Manufacturers

- EV Charging Infrastructure Providers

- Financial Institutions

- Fleet Operators

- Government and Regulatory Bodies

- Research and Consulting Associations

- Technology Companies

- Traders and Distributors of EVs

- Traders, Distributors, and Suppliers of EV Battery Components

Report Objectives

-

To define, segment, and forecast the battery as a service market in terms of volume (thousand units) and value (USD million) from 2020 to 2035, based on the following categories:

- Leasing Type (Subscription and Pay-Per-Use)

- Usage (Private and Commercial)

- Vehicle Type (Two-wheelers, Three-wheelers, Passenger Cars, and Commercial Vehicles)

- Region (Asia Pacific, Europe, and North America)

- To define and segment, the battery as a service market in terms of volume (thousand units) from 2020 to 2035, based on the Battery Capacity (Below 5 kWh, 5–10 kWh, 11–50 kWh, 51–100 kWh, and Above 100 kWh)

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze the market segments for individual growth trends, prospects, and contributions to the total market

-

To study the following dynamics of the market

- Value Chain Analysis

- Ecosystem Analysis

- Technology Analysis

- Investment Scenario

- Pricing Analysis

- Case Study Analysis

- Patent Analysis

- Regulatory Landscape

- Buying Criteria

- Business Models

- Conferences & Events

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze the opportunities for stakeholders and the competitive landscape for market leaders

- To track and analyze competitive developments, such as collaborations, agreements, acquisitions, service launches/developments, expansion, and other activities undertaken by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company's specific needs.

- Additional Company Profiles (Up to Five Companies)

- Additional Countries (Up to Three Countries)

- Detailed Analysis of Battery as a service market, By vehicle range

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Battery as a Service Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Battery as a Service Market