Battery Passport Market Size, Share & Analysis

Battery Passport Market by Industry (Automotive, Energy & Utility, Off-Highway/Industrial), Battery Type (Lithium-ion, Lead-acid, Sodium-ion), Technology (Blockchain, Cloud, IoT & AI-integrated), End User, Business Model, Region - Global Forecast to 2035

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The battery passport market is projected to reach USD 2.35 billion by 2035, growing from USD 0.15 billion in 2025, at a CAGR of CAGR of 32.1% during the forecast period from 2025 to 2035. The market is rapidly reshaping global battery supply networks as escalating regulatory pressure, accelerating EV production, and expanding cross-border material movement increase the need for authenticated, connected, and auditable lifecycle data.

KEY TAKEAWAYS

-

By RegionThe European battery passport market accounted for a market share of over 50–55% in 2024.

-

By Battery TypeBy battery type, the sodium-ion segment is expected to record the highest CAGR of 77.1% during the forecast period.

-

By TechnologyBy technology, the IoT & AI-integrated battery passport segment will grow at the fastest rate from 2025 to 2035.

-

By IndustryBy industry, the automotive segment is expected to dominate the market during the forecast period.

-

Competitive LandscapeCompanies such as Minespider GmbH, AVL, Siemens, and Circulor were identified as key players in the global battery passport market due to their strong business networks and strategic growth, which have helped these companies establish their market positions. BloqSens AG and Spherity GmbH, among others, have distinguished themselves among start-ups and SMEs by an innovative portfolio and a robust potential to build strong business strategies.

The battery passport is emerging as a strategic data infrastructure as regulators enforce authenticated lifecycle reporting and OEMs scale digital traceability across global supply chains. Secure identifiers, standardized data schemas, and ledger-backed tracking are being integrated into manufacturing, quality, and recycling systems to enhance efficiency and transparency. IoT-driven inputs enable continuous monitoring of material origins, state of health, and cross-border movements, thereby strengthening compliance and procurement controls. Europe is driving early adoption through strict regulatory milestones, with North America and Asia upgrading systems to align with cross-regional requirements.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Battery passport systems are evolving from compliance tools to strategic data assets, driven by digitization, AI-based traceability, and supply chain transparency mandates. These developments disrupt traditional reporting by enabling real-time lifecycle visibility, carbon tracking, and circular economy validation. The shift transforms compliance into a value-generating function across manufacturing, mobility, and recycling ecosystems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Battery supply chain transparency and sustainability

-

Regulatory enforcement and compliance mandates

Level

-

High CapEx and OpEx for compliance

Level

-

Circular economy

-

Battery-as-a-Service enablement

Level

-

Transition and implementation challenges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Battery supply chain transparency and sustainability

The battery passport is becoming a core compliance tool, utilizing secure digital identifiers to track raw materials such as cobalt, lithium, and nickel throughout the extraction, processing, manufacturing, use, and end-of-life stages. Embedded sensors collect performance and movement data, which is then fed into encrypted systems, enabling reliable verification against sustainability frameworks such as RMAP and CFSI. This strengthens transparency, operational control, and supplier accountability across multi-tier chains.

Restraint: High CapEx and OpEx for compliance

Deploying battery passport systems requires substantial IT and integration expenditures, including blockchain registries, secure cloud infrastructure, and alignment with global data standards. Large OEMs can integrate these requirements into broader digital programs, while smaller suppliers face higher relative costs due to limited readiness. Continuous audits, data governance workflows, and cybersecurity compliance further raise operational expenditure.

Opportunity: Circular economy

The battery passport supports closed-loop models by maintaining verified material histories, which strengthen collection, recycling, and mineral recovery processes. Initiatives such as Northvolt’s program and GBA pilots show how lifecycle data improves recovery rates and reduces waste. This structured approach reduces reliance on primary extraction and reinforces extended producer responsibility frameworks.

Challenge: Transition and implementation challenges

Shifting to digital traceability demands coordinated upgrades in ERP, MES, and recycler systems to achieve interoperability across cloud and blockchain-linked architectures. Many smaller players lack technical depth, making it challenging to align with standardized data schemas and secure API workflows. Differences in regional rules and certification schedules add complexity, increasing the risk of fragmented implementation without industry-wide coordination.

battery-passport-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implements battery passports for EV models with QR-linked lifecycle data covering chemistry, carbon footprint, sourcing, and in-use parameters | Lower compliance exposure | Stronger asset valuation | Clearer sustainability reporting |

|

Applies digital passports with blockchain-backed material tracing for lithium, nickel, and cobalt across supplier tiers | Higher sourcing assurance | Faster audit cycles | Improved ESG validation |

|

Runs integrated traceability systems capturing material origin, production steps, carbon intensity, and recycling inputs for passport fields | Reliable upstream data | Improved lifecycle oversight | Stronger circular supply-chain control |

|

Supplies recycled-content and recovery-rate data aligned to passport reporting formats for OEMs | Verified recycled input | Easier OEM compliance preparation | Stronger circularity metrics |

|

Configures data export and lifecycle telemetry pathways to support passport obligations for battery modules delivered into EU market | Streamlined conformity readiness | Better lifecycle analytics | Improved recycling coordination |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis highlights various players in the battery passport market ecosystem, primarily represented by raw material suppliers & miners, digital passport & traceability providers, battery manufacturers, OEMs, technology & AI providers, recyclers & second-life operators, auditors & certification agencies, and regulatory authorities & governance organizations. Some major digital passport & traceability providers include Circulor (UK), Minespider (Switzerland), Everledger (UK), Optel Group (Canada), Circularise (Netherlands), and AVL (Austria).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Battery Passport Market, By Industry

The automotive industry dominates battery passport deployment, with EV powertrains offering a range of battery capacities, from 40 kWh in compact models to 100 kWh in premium vehicles. Digital passports capture granular metrics, including cell-level state-of-charge, cycle count, degradation patterns, and thermal profiles, enabling predictive maintenance, optimized recycling flows, and precise second-life repurposing. OEMs leverage these datasets to quantify residual battery value and validate material provenance against EU 2023/1542 reporting standards. By integrating with PLM and ERP systems, passports transform raw operational data into actionable intelligence, reducing compliance overhead and enabling strategic sourcing decisions for critical metals such as cobalt, nickel, and lithium.

Battery Passport Market, By Battery Type

Lithium-ion batteries account for the majority of passported units; however, the technical focus is shifting toward variant chemistries, such as NMC, LFP, and LFP-NMC hybrids, due to their differing energy density, degradation rates, and recyclability profiles. Passports now encode cell-level metadata, including voltage uniformity, thermal stability, and material batch identifiers, allowing OEMs and recyclers to model degradation curves, optimize battery pack disassembly, and forecast material recovery yields. Standardization of machine-readable formats such as JSON, EPCIS, and GS1 across suppliers ensures interoperability, enabling consistent lifecycle assessment, carbon intensity calculation, and traceability across multi-tiered supply chains.

Battery Passport Market, By Technology

Blockchain serves as the technical backbone, and advanced implementations are integrating smart contracts and distributed analytics to automate compliance verification, material transfer logging, and cross-border lifecycle tracking. Platforms by Circulor and Minespider extend beyond provenance, capturing real-time sensor feeds, including BMS telemetry, temperature, and cycle count, while embedding audit-ready, cryptographically signed datasets. This reduces reconciliation costs between OEMs, battery assemblers, and recyclers, thereby supporting scenario modeling for circular economy interventions such as end-of-life repurposing or targeted cathode material recovery.

Battery Passport Market, By Business Model

SaaS-based battery passport platforms now offer modular microservices for lifecycle analytics, regulatory reporting, fleet monitoring, and resale evaluation, enabling stakeholders to tailor their adoption by battery chemistry, region, and application. APIs integrate directly with OEM telematics and BMS to deliver real-time SOC, SOH, and thermal anomaly detection. For recyclers, predictive recovery dashboards estimate material yield and optimize logistics for mixed chemistries. SaaS monetization captures recurring revenue from both licensing and advanced analytics services while enabling continuous alignment with evolving EU compliance, ESG reporting, and circular economy targets.

REGION

During the forecast period, Europe is expected to be the largest regional market for battery passports globally.

Europe is the largest and most advanced market for battery-passport deployment, anchored by Regulation (EU) 2023/1542 and its requirements for machine-readable passports and interoperable data structures. Initiatives and consortia such as Battery Pass, CIRPASS/CIRPASS-2, and Catena-X are shaping Europe’s position as the largest market for battery passport deployment. They are aligning schemas, secure identifiers, and standardized APIs that connect BMS telemetry, MES/ERP data, and conformity records. Their pilots in Germany and the expansion of Catena-X hubs in France and Sweden are validating cross-party consent models, data exchange gateways, and analytics for cycle and thermal history. With Regulation (EU) 2023/1542 nearing phased enforcement, Europe’s coordinated regulatory and technical ecosystem offers the fastest pathway to implementing high-resolution, standards-driven battery passports.

battery-passport-market: COMPANY EVALUATION MATRIX

The figure illustrates the competitive landscape of the global battery passport market, positioning key players based on their market share and product footprint. In the trailer telematics market matrix, Minespider GmbH (Star) leads with a strong market presence, strategic growth, strong business networks, and a broad product portfolio. This reinforces the company's position as a leader and ability to meet evolving market demands for efficient and compact equipment, enhancing its brand recognition and customer trust.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Minespider GmbH (US)

- AVL (Austria)

- Siemens (Germany)

- Circulor GmbH (Germany)

- Optel Group (Canada)

- iPoint-systems GmbH

- DENSO Corporation (Japan)

- RCS Global (UK)

- Circularise (Netherlands)

- ChargeZone (India)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 0.15 BN |

| Market Forecast in 2035 (Value) | USD 2.35 BN |

| Growth Rate | CAGR of 32.1% from 2025–2035 |

| Years Considered | 2023–2035 |

| Base Year | 2024 |

| Forecast Period | 2025–2035 |

| Unit Considered | Value (USD MN/BN) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, Europe, North America |

| Drivers | Battery supply chain transparency and sustainability |

| Restraint | High CapEx and OpEx for compliance |

WHAT IS IN IT FOR YOU: battery-passport-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Battery Manufacturer (Cell, Module, Pack) |

|

|

| BMS & Telematics Provider |

|

|

RECENT DEVELOPMENTS

- May 2025 : Minespider and TETHYS signed a Memorandum of Understanding (MoU) to collaborate on next-generation digital traceability solutions. This collaboration will focus on advancing battery passports, digital product passports, critical raw materials traceability, and ESG data systems across mines in Turkey and Central Asia. It will help mining projects to strengthen their positions in international markets, comply with regulations, and export their minerals to European markets and beyond.

- May 2025 : Acculon Energy partnered with Circulor and Rockwell Automation to enhance supply chain transparency in the energy storage sector. This partnership solidifies Acculon’s commitment to responsible sourcing and sustainability through Circulor’s pioneering traceability and digital battery passport solutions, as well as Rockwell’s state-of-the-art manufacturing expertise, to accelerate compliance with existing and emerging regulatory standards.

- January 2025 : AVL introduced its digital battery passport. This cloud-based solution aims to facilitate transparency and reporting at every stage of a battery’s lifecycle.

- October 2024 : In a major step toward establishing Canada as the global leader in sustainable and traceable battery supply chains, Optel, Delphi, Norda Stelo, and the Battery Metals Association of Canada (BMAC) implemented a new initiative to demonstrate the superior lifecycle GHG and ESG performance of Canadian-made NMC batteries. This project is supported by Natural Resources Canada’s (NRCan) Global Partnership Initiative (GPI) with grant funding spread over three years. It aims to secure Canada’s position as the reputed provider of sustainably sourced minerals and batteries.

- August 2024 : Siemens joined the Global Battery Alliance, a collaboration platform that brings together leading international organizations, NGOs, industry actors, academics, and multiple governments to align in a pre-competitive approach, driving systemic change along the entire battery manufacturing value chain.

Table of Contents

Methodology

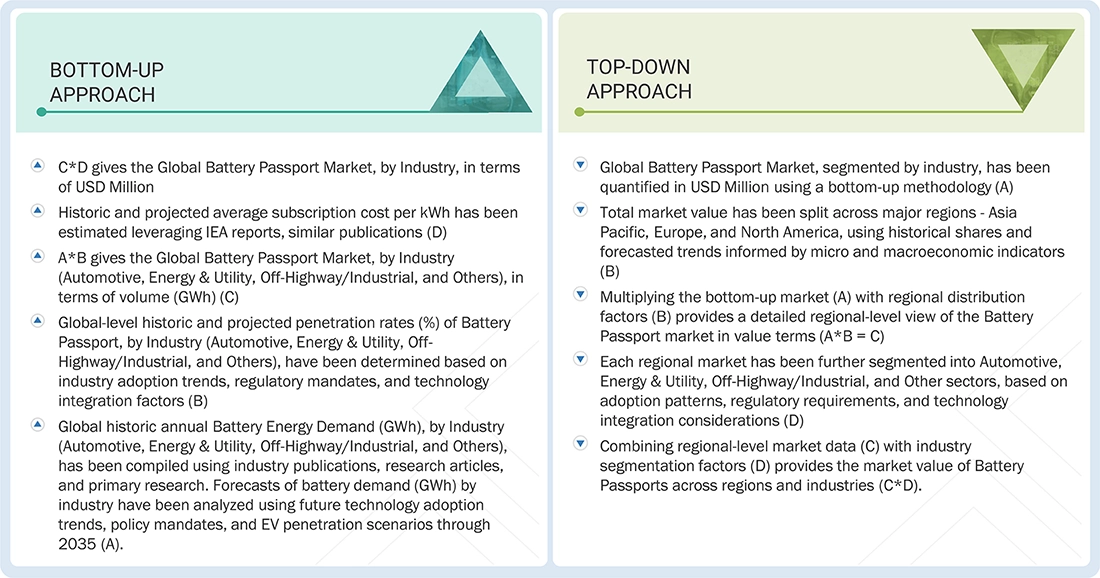

The study involved four major activities in estimating the current size of the battery passport market. Exhaustive secondary research was conducted to gather information on the market, its peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

The battery passport market is directly dependent on vehicle production. Battery passport sales/registration volume was derived through secondary sources, including corporate filings (such as annual reports, investor presentations, and financial statements), paid repositories, relevant associations (like IEA, Avicenne Energy), and industry production statistics. The EU’s plans regarding the adoption of battery passport data were compiled and analyzed, and industry trends were considered to inform the forecast, which was subsequently validated through primary research.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included industry experts, such as CXOs, vice presidents, directors from business development, marketing, and product development/innovation teams, and related key executives from key companies. Various system integrators, industry associations, independent consultants/industry veterans, as well as key opinion leaders, were also interviewed.

Primary interviews were conducted to gather insights, including battery passport sales and registrations, market forecasts, future technology trends, and upcoming technologies in the industry. Data triangulation was carried out using the information gathered from secondary research and model mapping to triangulate all these points. Stakeholders from the demand and supply sides were interviewed to understand their views on the aforementioned points.

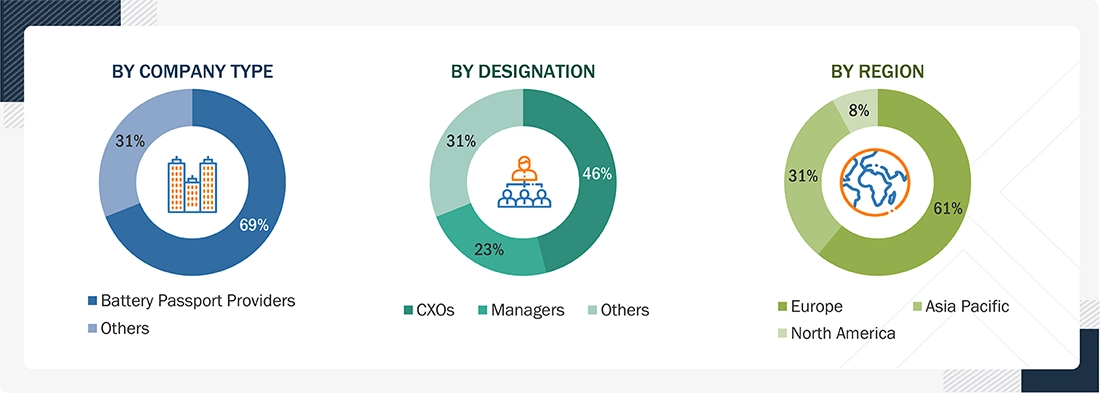

Primary interviews were conducted with market experts from both the demand (battery passport manufacturers) and supply (OEMs, battery swapping service providers, etc.) sides across three major regions: North America, Europe, and Asia Pacific. Approximately 69% and 31% of primary interviews were conducted with battery passport service providers and others, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. During the canvassing of primaries, various departments within organizations, including sales, marketing, operations, R&D, and aftermarket, were covered to provide a holistic perspective in the report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with the in-house subject matter expert opinions, led to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the battery passport market and other dependent submarkets, as mentioned below:

- Key players in the market were identified through secondary research, and their global market shares were determined through a combination of primary and secondary research.

- The research methodology included a study of annual and quarterly financial reports and regulatory filings of major market players (public), as well as interviews with industry experts for detailed market insights.

- All industry-level penetration rates, percentage shares, splits, and breakdowns for the market were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

- Qualitative aspects, including market drivers, restraints, opportunities, and challenges, were taken into consideration when calculating and forecasting the market size.

Battery Passport Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes explained above, the market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The backscatter X-ray devices market involves the development of non-intrusive inspection systems that use low-energy X-rays to detect concealed threats in vehicles, cargo, baggage, and on-person scenarios. These systems provide real-time imaging, which is crucial for border security and law enforcement, enabling the identification of substances such as explosives and narcotics. Backscatter technologies utilize advanced detector arrays, X-ray modules, and automated algorithms for efficient screening, which are deployed at customs, airports, and military bases. The market growth is driven by rising cross-border trade, increasing smuggling, and stricter security regulations. Innovations such as AI-assisted image analysis and portable units enhance detection and operational efficiency, making backscatter X-ray devices essential for reliable security inspections worldwide.

Key Stakeholders

- Global battery passport companies

- Battery manufacturers

- EV manufacturers

- Battery recyclers

- Energy storage system integrators

- Utility operators

- Fleet operators

- Battery technology providers

Report Objectives

-

To define, describe, segment, and forecast the size of the battery passport market in terms of value (USD million) based on

- Industry (automotive, energy & utility, off-highway/industrial, other industries)

- Battery type (lithium-ion, lead-acid, sodium-ion, other batteries)

- Technology (blockchain-based battery passport, cloud-based battery passport, IoT & AI-integrated battery passport, other technologies)

- Region (Asia Pacific, Europe, North America)

- To analyze the battery passport market qualitatively based on compliance (EU Battery Regulation-compliant batteries, batteries under pilot schemes, non-compliant/legacy batteries), end user (compliance end users, operational end users), and business model (software-as-a-service platform, white-label solution, on-demand deployment, subscription, licensing, pay-per-use)

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze the market, including macroeconomic outlook, trends/disruptions impacting buyers, case studies, patent analysis, supply chain analysis, market ecosystem, regulatory analysis, impact of AI/Gen AI, brand comparison, and technology trends

- To understand the competition in the battery passport market and position players as stars, emerging leaders, pervasive players, and participants based on their product portfolios and business strategies

- To analyze the ranking of leading market players and evaluate the competitive leadership mapping

- To strategically analyze key player strategies/right to win and company revenues

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To provide an analysis of recent developments, such as joint ventures, mergers & acquisitions, product launches/developments, and other activities carried out by key market players

Customization Options:

With the given market data, MarketsandMarkets offers customizations tailored to the company’s specific needs.

- Battery Passport Market, By Battery Type, at Country Level (For Countries Covered in Report)

- Battery Passport Market, By Industry, at Country Level (For Countries Covered in Report)

Company Information

- Profiling of Up to Five Additional Market Players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Battery Passport Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Battery Passport Market