Bio-polypropylene Market

Bio-polypropylene Market by Source (Edible and Non Edible Oil, Starch), End-Use Industry (Construction, Automotive, Consumer Goods, Packaging), Application (Injection Molding, Textiles, Films), & Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The bio-polypropylene market is estimated at USD 32,480 thousand in 2024 and is projected to reach USD 1,16,028 thousand by 2029, at a CAGR of 29.0% from 2024 to 2029. The global bio-polypropylene markets is growing at a rapid pace due to the environmental consciousness, regulatory actions, and technological innovation. Growing societal concerns over climate change and pollution has prompted consumers and industries to look for sustainable substitutes for conventional plastics driving the demand for bio-polypropylene, which is produced from earlier-generation agricultural commodities such as corn and sugarcane. Plastic pollution abatement is high on the agenda of governments around the world, and accordingly tough control measures are being introduced to curb plastic waste. The development of automotive and packaging industries is moving to lightweight, eco-friendly materials, which in turn drives the market of bio-polypropylene. Technical development has enhanced bio-polypropylene production process along with their characteristics. Hence bio-polypropylene can be used as a potential surrogate for conventional polypropylene in packaging, textiles and automotive components.

KEY TAKEAWAYS

-

BY SOURCEThe starch segment is forecast to have the highest CAGR in the bio-polypropylene market, owing to its high abundance, low cost and fit with sustainability targets. Originating from highly cultivated species like corn, potato and wheat, starch is readily available at a low cost, so it is quite appealing to manufacturers who want to reduce their production cost and use eco-friendly materials. Starch-based bio-polypropylene is one of the promising alternatives to reduce plastic pollution due to growing environmental concerns and increased interest among consumers in bio-based products. Its flexibility can be applied to many industrial sectors, such as food packaging, automotive, and consumer goods, thus contributing to its current high market attractiveness. Moreover, the development of processing technologies has facilitated the large-scale and efficient production of starch-based bio-polypropylene which has enhanced the competitiveness of bio-polypropylene in comparison to conventional cellulosic polypropylene. As the commitment to sustainability measures by industries grows and regulatory pressures increases', the use of bio-based products is expected to increase substantially. This places the starch segment as a major promoter of growth in the bio-polypropylene market, which acts as a catalyst for innovation and a sustainable alternative to conventional biobased products

-

BY APPLICATIONFilms segment is to grow at the highest CAGR of the bio-polypropylene market by application owing to the increased demand for sustainable packaging solutions due to the rise in environmental consciousness among consumers as well as commercial establishments, primarily within the food and beverage sectors which is one of the largest customers of flexible packaging. Bio-polypropylene films are an attractive alternative because they have superior mechanical properties, high tensile strength, flexibility, and resistance to moisture and contaminants. These features make them well suited for food wraps, pouches, and other packaging formats where durability and product protection are required. The customization potential of bio-polypropylene films, such as varying thickness, transparency, and printability, increases their versatility, allowing manufacturers to approach diverse market requirements and consumer preferences. As international regulatory pressures mount over plastic waste, the call to ban single-use plastics and to encourage biodegradability pushes companies to seek bio-based alternatives to lower their environmental impact. Advances in production technologies are also crucial in upgrading the efficiency and scalability of manufacturing bio-polypropylene film to catch up with classical, petroleum-based plastics. These advances do not only reduce the production costs but also enhance the overall sustainability profile of bio-polypropylene films.

-

BY END USE INDUSTRYThe bio-polypropylene packaging segment is set to demonstrate the highest CAGR among all other end-use industries owing to the increasing need for bio-compatible and green materials. Bio-polypropylene, obtained from renewable resources including sugarcane, corn and other biomass, is a promising alternative to conventional oil-based polypropylene. The material’s lightweight, durability, and recyclability make it ideal for various packaging applications, including food containers, films, caps, and flexible packaging. The food and beverage sector is a key consumer, as companies extensively use bio-based materials to match what consumers are asking for in products designed for sustainability and to meet strict environmental standards. Bio-polypropylene, in addition, as an ideal material to resist moisture, has a barrier property, can guarantee the freshness and safety of packed products, and that is very important for the fields of food and beverages. In addition, bio-polypropylene compatibility with current manufacturing techniques allows for easy integration with minimal modifications in infrastructure. Technological progress for bio-polypropylene production such as better polymerization methods and improved material properties is fostering its use in packaging. Furthermore, government-provided incentives and subsidies for bio-based material, combined with corporate sustainability, are creating demand for bio-polypropylene in this field.

-

BY REGIONThe bio-polypropylene market has been studied in North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific is currently undergoing a period of accelerated economic expansion, that is, in the case of, China and India, which is creating a considerable market for bio-based materials in several sectors such as automotive, packaging, and construction. Consumer and business awareness of the environmental sustainability are increasing, resulting in a trend toward eco-friendly materials. This tendency is corroborated by the use of bio-degradable plastic use made by the government, as well as the stringent regulations imposed on conventional plastics, generating an encouraging climate for bio-polypropylene implementations

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Braskem (Brazil), Lyondellbasell Industries N.V. (Netherlands), Mitsui Chemicals, Inc (Japan) have entered into a number of agreements and partnerships to cater to the growing demand for Bio-Polypropylene across innovative applications.

A number of interactive factors are leading to the increasing use of bio-polypropylene and this trend is expected to continue in the future. As environmental consciousness grows and market trends lean toward sustainability, consumers and businesses are increasingly looking for the environmentally conscious version of the traditional plastic. Bio-polypropylene produced with sustainable feedstocks such as corn or sugarcane featuring carbon footprint reduction and biodegradability has begun to be highly desired by environmentally-minded consumers. Furthermore, the proliferation of plastic pollution and the rising government regulation to restrict plastic pollution and promote bio-based substitutes are prompting industry to use bio-based options. This has been extended by technological development which enhances the characteristics of bio-polypropylene along with its corresponding performance, to gain competitiveness over conventional polypropylene both in performance and cost effectiveness. The rise in market demands for critical industries, particularly from the packaging and automotive industry, for lightweight and sustainable materials is significantly boosting market growth

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The bio-polypropylene market is going through a period of notable changes instigated by trends and disruptions which are changing the business environment for different sectors. One of the major trends is the increasing demand for sustainable materials, with both customers becoming more eco-friendly-minded, as well as companies adopting bio-based ones as a way of minimizing the carbon footprint and supporting a circular economy. The change in consumer demand towards functional yet sustainable offerings is pushing brands to take eco-friendly steps to retain customers, for companies such as Orkla, both the need for sustainability objectives and the necessity to innovate in product development are of increasing importance. Through the use of bio-polypropylene, Orkla is better able to exert its "green" brand image as a sustainability leader, thereby attracting environmentally minded customers. In a similar way, Mazda also aims to be lightweight for its benefit in fuel economy while protecting the integrity of its body structure in the vehicles that it provides. Utilization of bio-polypropylene can result in substantial cost reductions in manufacturing and fuel consumption and, at the same time, improve the robustness and operation ability of automotive parts.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing consumer preference for sustainable and eco-friendly products in consumer goods industry

-

Expansion of key polypropylene manufacturers in bio-polypropylene market

Level

-

High production costs compared to conventional polypropylene

-

Competition from alternative bioplastics

Level

-

Growing demand in the packaging industry

-

Expansion of production capacities by companies to meet growing demand for sustainable materials

Level

-

Slower development of production technologies for bio polypropylene

-

Limited availability of raw materials

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing consumer preference for sustainable and eco-friendly products in consumer goods industry

The bio-polypropylene market is expanding in a fast pace, and it is, above all, due of the growing consumer interest for biopolymers within the consumer goods sector. Due to environmental issues such as plastic pollution and climate change increase's, consumers are starting to take environmental considerations into account and evaluate the materials embedded in products they purchase. This trend is pushing the manufacturers to find alternatives to the traditional based products and bio-polypropylene is a promising alternative. Bio- polypropylene, which comes from renewable resources such as corns and sugarcane, has a less dependence on fossil and also has a minimal carbon emission ratio than ordinary plastics. On top of the bio-based functionality of comonomers, due to the structural ability of bio-polypropylene, the material is applicable for a number of applications in the packaging, textile, and automotive sectors. Since consumers are willing to pay more in products that are ecologically friendly, the use of bio-polypropylene is set to rise further, making it a core element of sustainable living in the consumer products industry. Companies are adopting to renewable products in order to provide customers with eco-friendly products

Restraint: Competition from alternative bioplastics

Competition with other forms of bioplastics is a major threat which hinders the future market growth of the bio-polypropylene market. From the increasing need of green materials, numerous companies are therefore producing different types of bioplastics which can be substitutes to the conventional plastics. The consequence of this has led to the availability to manufacturers of so many alternative polymers of greater practical value such as polylactic acid (PLA), polyhydroxyalkanoates (PHA) and other bio-based polymers that displace bio-polypropylene because of the strong competition. Other bioplastics have their own features such as biodegradability or other features in specific application, which usually attract consumers and manufacturers. Examples include a large amount of packaging materials, such as PLA, which are being released to the market due to their composability and low environmental pollution. Likewise, PHA is also gaining a solid place in the market owing to its ability to undergo degradation process in marine environment which will be adapted by the companies who are in a state to mitigate the plastic pollution. These alternatives remain as potential substitutes that may erode the market for bio-polypropylene over time

Opportunity: Growing demand in packaging Industry

Due to an ever-growing need of the packaging industry the market for bio-polypropylene is growing. Going green has become the new trend and the demand for environment friendly packaging products has emerged. Bio-polypropylene derived from renewable resources is eco-friendly compared with traditional petroleum-based plastics which can be used in a variety of packaging applications. It is primarily employed in the food industry in the packaging of chips, drinks, fruit, vegetable and other foodstuffs, as this material is both strong and flexible and can be used to protect the vast majority of foodstuffs from a variety of forces. Elevated awareness of environmental consequences has led to consumers’ greater awareness of their material choices, and manufacturers have to consider the rise of bio-based materials which reflects this culture. Countries such as Europe and North America include programmes that encourage the use of bio-based products as part of business activity. In addition, the versatility property of bio-polypropylene allows it to be determined in various forms, such as films, flasks, and various packaging types. As several of the industries are researching and implementing novel applications of bio-polypropylene in their products, the market is anticipated to expand considerably because of the increasing demand of eco-friendly packaging

Challenge: Slower development of production technologies for bio-polypropylene

The slower development of production technologies is a major challenge for the bio-polypropylene market. There is a growing demand for sustainable materials especially from Industries such as packaging, consumer goods and automotive Industry, yet the pace at which bio-polypropylene can be produced and commercialized is slower. Companies such as Neste and LyondellBasell are working to develop bio-naphtha from non-food oils and used fats, yet the scale of production is short. The production of bio-polypropylene involves complex conversion technologies which are in nascent phase and still improving. Technologies such as fermentation, gasification are being explored and developed in order to make them commercially available. One of the main difficulties for bio-polypropylene manufacturers is to reach the cost competitive level of fossil fuel derived polypropylene. Bio-polypropylene production is associated with greater capital and operational costs, as the sourcing of renewable feedstocks is complex and the technologies for bio-based manufacturing are also complex. Because these high costs are incurred, bio-polypropylene cannot compete with the cheaper prices of fossil-based polypropylene which advantageously uses existing infrastructure and cost efficiencies. Due to the presence of alternative sources to bio-polypropylene clubbed with slower development of production technologies for bio-polypropylene stands as a challenge to the bio-polypropylene market

Bio-polypropylene Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of bio-PP in automotive interior components (dashboards, trims, panels). | Reduces carbon footprint by up to 70% compared to fossil PP, enables OEM sustainability targets. |

|

Bio-based polypropylene in food-grade packaging (containers, trays, caps). | Compliant with food safety regulations, recyclable, reduces reliance on virgin fossil feedstock. |

|

Green polypropylene used in cosmetics and personal care packaging. | Bio-based branding appeal, lightweight design, improves shelf sustainability score. |

|

Supply of renewable polypropylene feedstock for consumer goods and industrial packaging applications. | Drop-in compatibility with existing infrastructure, circularity enabled, lower lifecycle emissions. |

|

Integration of bio-PP in lightweight automotive seating and structural parts. | Contributes to vehicle weight reduction, enhances recyclability, supports EU decarbonization mandates. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Raw material manufacturers, including Neste, Cargill, and Avebe supply the necessary raw materials such as edible and non-edible oils and starch, which form the backbone of the bio-polypropylene industry. These raw materials are vital for manufacturers of bio-polypropylenes, such as Braskem, Mitsui Chemicals, Inc., and SABIC, which transform them into bio-polypropylenes using advanced manufacturing processes. Major end-use companies include Orkla, a leading supplier of customer goods to the grocery, specialized retail, pharmacy, and bakery sectors in the Nordic region will be buying bio-polypropylene products from PACCOR. Mazda can effectively replace conventional PP in bumpers, body panels, and interior components applications, and Bonnysa will be using new packaging solutions for its grated tomato product.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Bio-polypropylene Market, By Source

Starch-based bio-polypropylene is anticipated to demonstrate the highest CAGR in the bio-polypropylene market due to its alignment with the growing consumer demand for eco-friendly and easy-to-decompose materials. With increasing environmental pressures, there is a major trend toward eco-friendly packaging in many different sectors including food and beverages, cosmetics, and pharmaceuticals. Starch-based bio-polypropylene provides a biodegradable solution fulfilling these sustainability requirements while also offering the necessary properties such as moisture resistance, which are crucial to maintain the product quality. Further advances in manufacturing technologies have also ensured feasibility and affordability of producing starch-based bioplastic and hence, have increased their attractiveness to manufacturers. Support for regulatory use of biodegradables consolidates demand, as governments enact regulations to cut down plastic waste. The broad application range of starch-based bio-polypropylene lends itself to use in a range of applications, which makes starch-based bio-polypropylene a choice of interest to industry seeking to improve their sustainability profile

REGION

Asia Pacific to be fastest-growing region in global Bio-Polypropylene market during forecast period

Asia-Pacific market is the fastest growing region for bio-polypropylene, owing to the economic development, industrialization, as well as the growing awareness on sustainability. The high demand of major economies, including China, India, and Japan, across various sectors such as packaging, automotive, consumer goods is pushing their bio-based material usage. Due to the rapid urbanisation and increasing population, the consumption of packing materials is increasing, and bio-polypropylene is an alternative green solution over traditional plastics. Governmental programmes encouraging the application of renewable and biodegradable materials are driving the shift to bio-polypropylene. Countries have developed the policies to promote bio-based production and reduce dependence on fossil-fuel-based polymers. Asia-Pacific’s robust agricultural economy allows the region to consistently provide the feedstocks, in the form of sugarcane, corn and other biomass, which supports a large-scale production of bio-polypropylene. The technological progress in polymerization techniques and the scaling up of biopolymer production infrastructure is pushing the production capacity and cost-efficiency. Bio-polypropylene manufacturing is becoming more and more widespread in the automotive and packaging sectors in Asia-pacific, in response to consumer desire for environmentally friendly products as well as environmental regulation requirements

Bio-polypropylene Market: COMPANY EVALUATION MATRIX

In the bio-polypropylene market matrix, Braskem (Star) leads with a strong market share and extensive product footprint, Due to its innovative leadership in the industrial production of bio-based polymers and its use of unique technology to transform bioethanol into sustainable polypropylene. Orlen Group (Emerging Leader) is gaining visibility due to its strong commitment to sustainability and significant investments in expanding bio-based petrochemical production capacity. While Braskem dominates through scale and a diverse portfolio, Orlen Group shows significant potential to move toward the leaders’ quadrant as demand for bio-polypropylene continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 32,480.0 Thousand |

| Market Forecast in 2030 (Value) | USD 116,028.5 Thousand |

| Growth Rate | CAGR of 29.0% from 2025-2030 |

| Years Considered | 2022-2029 |

| Base Year | 2024 |

| Forecast Period | 2025-2029 |

| Units Considered | Value (USD Thousand), Volume (Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Source (Edible and Non Edible Oil, Starch,Others) I By End-Use Industry (Construction, Automotive, Consumer Goods, Packaging) I By Application (Injection Molding, Textiles, Films,Others) |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Bio-polypropylene Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| FMCG Packaging Major |

|

|

| Automotive Tier-1 Supplier |

|

|

| Bio-Polymer Producer |

|

|

| Sustainable Packaging Startup |

|

|

| Petrochemical Company Diversifying into Bio-Based Materials |

|

|

RECENT DEVELOPMENTS

- Jan 2025 : INEOS bio-based high-density polyethylene (HDPE) has been used to manufacture the world's first fully sustainable gas pipeline, installed by French gas utility operator GRDF in Clermont-Ferrand. This pioneering pipeline is produced from wood processing residues, with a much lower carbon footprint than traditional fossil-based polymers and is ISCC certified.

- December 2023 : LyondellBasell and Pigeon Singapore collaborate to incorporate CirculenRenew polymers in nursing bottles, as part of Pigeon’s transitioning away from using 100% virgin polypropylene resins

- November 2023 : SABIC and CJ CheilJedang have collaborated to develop the world's first renewable polypropylene bowls for instant rice, containing 25% certified renewable content. The bowls are part of CJ's Hetbahn brand and use SABIC's TRUCIRCLE portfolio of certified renewable polymers derived from second-generation feedstocks that do not compete with food production

- August 2023 : Neste, LyondellBasell, Biofibre, and Naftex have collaborated to create bio-based polymers reinforced with natural fibre for use in the construction sector. This partnership is meant to develop sustainable materials that can replace the traditional fossil-based plastics in construction applications

- September 2023 : SABIC along with three other companies collaborates for producing mono-PP thin-wall containers with in-mould labelling in an integrated single-step injection moulding process

Table of Contents

Methodology

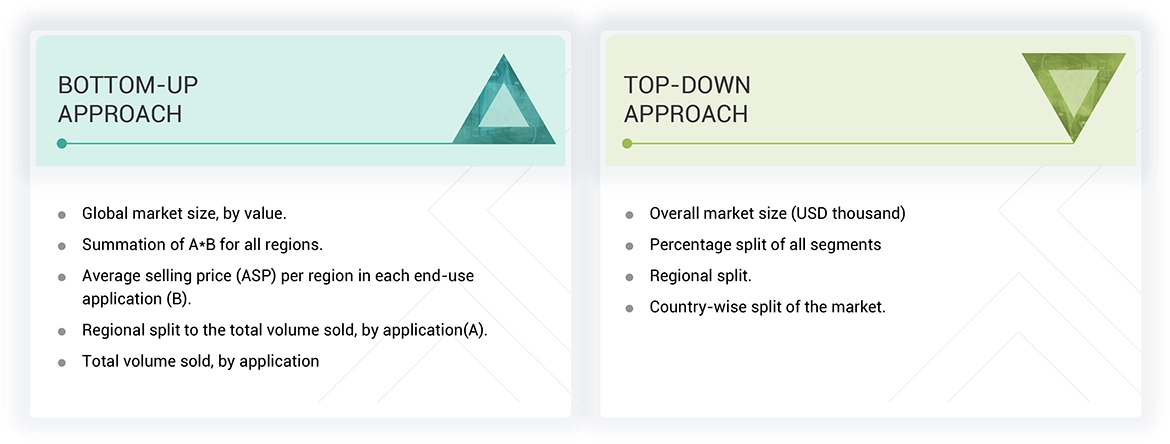

The study involves two major activities in estimating the current market size for the bio-polypropylene market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering bio-polypropylene and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the bio-polypropylene market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the bio-polypropylene market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from bio-polypropylene industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to by source, end-use Industry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and production teams of the customer/end users who are using bio-polypropylene, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of bio-polypropylene and future outlook of their business which will affect the overall market.

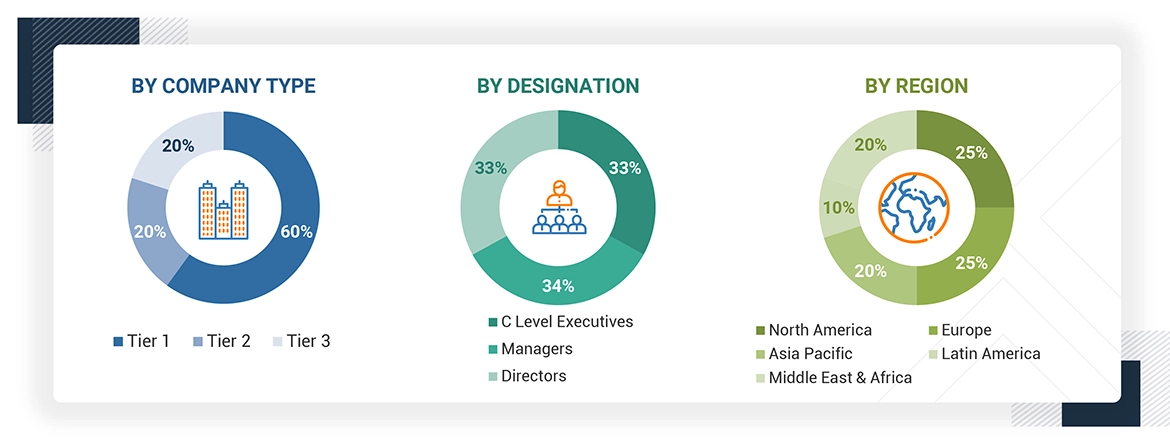

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the bio-polypropylene market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in bio-polypropylene in different end-use applications at a regional level. Such procurements provide information on the demand aspects of the bio-polypropylene industry for each application. For each application, all possible segments of the bio-polypropylene market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Bio-polypropylene is fully or partially produced from bio-based feedstock. Bio-based polypropylene can be made entirely or partially from biomass and is non-biodegradable. Bio-polypropylene serves as an eco-friendly alternative to conventional polypropylene. It can be synthesized from a variety of renewable resources, including both edible and non-edible oils such as vegetable oils, used cooking oil, hydrogenated vegetable oils, and animal fats. Additionally, starch sources like corn starch, potato starch, and cassava starch are utilized in its production. Other feedstocks include agricultural residues, non-food biomass such as switchgrass and miscanthus, cellulosic biomass, lignin, and sugarcane.

Stakeholders

- Bio-polypropylene manufacturers

- Raw material suppliers

- Distributors and suppliers

- Industry associations

- Universities, governments & research organizations

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environmental support agencies

- Investment banks and private equity firms

Report Objectives

- To define, describe, and forecast the bio-polypropylene market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global bio-polypropylene market by source, application, end-use Industry and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, and analyze the significant region-specific trends

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Bio-polypropylene Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Bio-polypropylene Market