Biomethane Market

Biomethane Market by Feedstock (Energy Crops, Agriculture Residues & Animal Manure, Municipal Waste), Production Process (Anaerobic Digestion, Thermal Gasification), End-use (Transportation, Power Generation, Industrial) Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

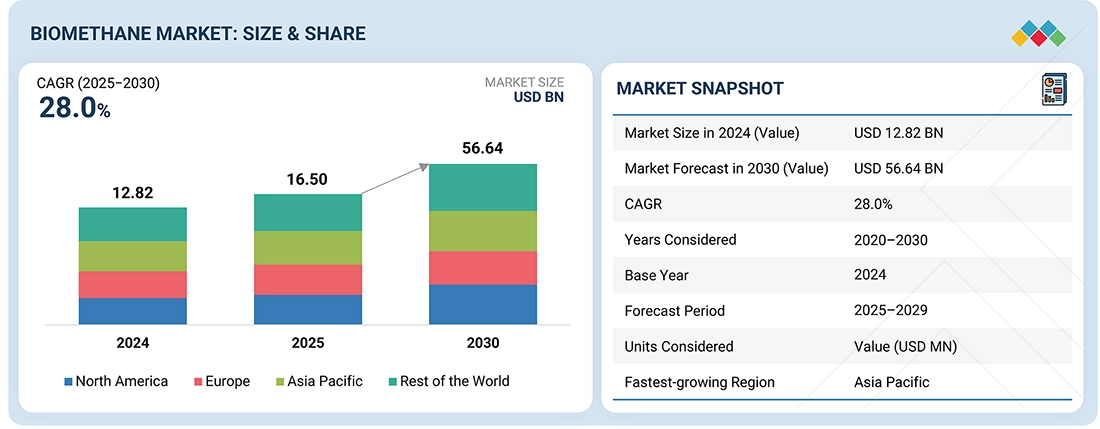

The biomethane market is expected to grow from an estimated USD 16.50 billion in 2025 to USD 56.64 billion by 2030, at a CAGR of 28.0% during the forecast period. The biomethane market is driven by decarbonization goals, methane emission reduction mandates, sustainable waste management needs, renewable gas incentives, and biomethane’s compatibility with existing gas infrastructure across transportation and industrial applications.

KEY TAKEAWAYS

-

BY REGIONEurope is estimated to account for the largest share of 41.3% in the global biomethane market for in 2024.

-

BY FEEDSTOCKBy feedstock, the others (Industrial Waste, Sewage Sludge, Wastewater, and Others) segment is projected to register the highest CAGR of 36.2% during the forecast period.

-

BY END-USE APPLICATIONBy end-use application, the transportation segment is expected to account for the largest share of the overall biomethane market in 2024.

-

COMPETITIVE LANDSCAPEMajor players in the biomethane market are adopting both organic and inorganic strategies, including partnerships and agreements, to expand their market presence. Companies such as Shell Biogas, Gasum Ltd., and BP p.l.c. are actively forming collaborations to meet the growing demand in the biomethane market.

-

COMPETITIVE LANDSCAPEThe strong product ecosystem and global market penetration of Raízen, Anaergia, and Waga Energy position them among the most influential startups and SMEs in the biomethane landscape.

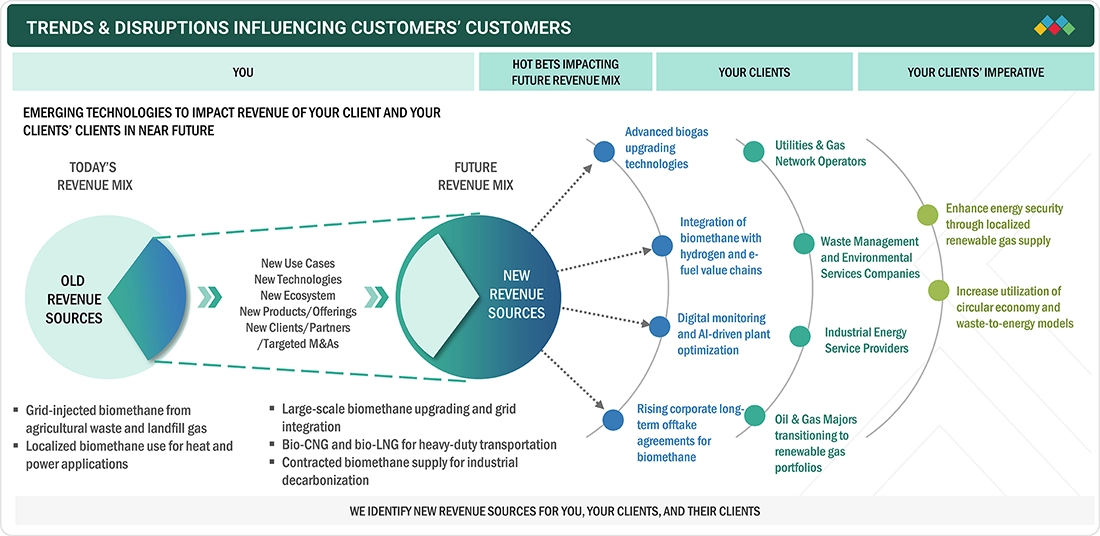

The biomethane market is offering significant opportunities with the massive installation of waste-to-gas projects in emerging regions, large-scale introduction of biomethane in natural gas grids, and the slow but steady acceptance of biomethane as a fuel for heavy-duty vehicles. The employment of high-end upgrading technologies, digital plant optimization, and real-time monitoring systems is slowly turning the process into an efficient and reliable one. New techniques, such as biological methanation, co-digestion tactics, and modular production units, are not only augmenting capacity but also making the feedstock more versatile. On the other hand, the emphasis on the circular economy approach, the necessity of energy security, and the demand for lower methane emissions are driving the market.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The leading players in the biomethane market are Shell Biogas (UK), Air Liquide (France), and BP p.l.c. (UK). These companies are recognized for their dominant market presence, financial strength, and years of experience in the energy and gas sectors. They provide comprehensive biomethane solutions, encompassing production, upgrading, distribution, and end-use applications. These players have already positioned themselves to expand the deployment of renewable gas with their high-tech, large-scale project experience and well-established global networks.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Turning organic waste into low-cost renewable gas

-

Increasing biomethane output through advanced processing technologies

Level

-

Limited sustainable feedstock availability

-

Competition from alternative low-carbon and renewable gases

Level

-

Rapid scale-up via grid injection & national targets

-

Growth in heavy-duty transport & CNG/LNG/LBG market (road, shipping, buses)

Level

-

High CAPEX /uncertain project economics

-

Gas network and injection constraints

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Turning organic waste into low-cost renewable gas

Biomethane production is increasingly relying on agricultural residues, municipal organic waste, and wastewater sludge as feedstocks, converting low- or negative-cost waste streams into a renewable gas. According to the International Energy Agency (IEA), using waste-based inputs can reduce feedstock costs by 30–50% compared to energy crops, while diverting 60–90% of organic waste from landfills and open dumping, thereby significantly improving environmental outcomes. Countries are increasingly embracing the circular economy case for biogas and biomethane, as organic waste and residues are being revalorized into a low-cost renewable gas stream that reduces landfill emissions and creates local economic value.

Restraint: Limited sustainable feedstock availability

Regional disparities in the availability of sustainable feedstocks, such as agricultural residues, municipal organic waste, and wastewater, constitute a major constraint on scaling up biomethane production. While biomethane has substantial theoretical potential globally, the practical availability of sustainably sourced organic feedstock remains a significant constraint on near- to medium-term market growth. Recent benchmarks indicate that only a small fraction of the available sustainable biomass is currently utilized in Europe. For example, approximately 20% of the identified feedstock potential is being utilized today, suggesting that most resources remain untapped, but also indicating that utilization is uneven and dependent on local conditions. Even though studies estimate that the EU alone could sustainably produce up to ~41 bcm of biomethane by 2030 and ~151 bcm by 2050 under strict sustainability criteria focused on residues and wastes, realizing this potential will require careful management of feedstock supply chains and competition for residues like manure and crop residues.

Opportunity: Rapid scale-up via grid injection & national targets

Governments are increasingly using binding blending mandates and grid-injection targets to accelerate biomethane deployment, creating a clear and scalable demand pathway. In Europe, REPowerEU sets a target of 35 bcm of biomethane by 2030, while the IEA projects that renewable gases could reach a ~10% blend in European gas grids by 2040. Country-level ambitions reinforce this momentum: Germany could inject ~100 TWh per year by 2030, equivalent to about one-fifth of the gas volumes it previously imported from Russia; France’s Energy Transition for Green Growth Law (LTECV) targets 10% renewable gases in natural gas consumption by 2030.

Challenge: High CAPEX/ uncertain project economics

Biomethane plants require significant capital for digestion systems, upgrading units, grid injection infrastructure, and often liquefaction or compression, while returns depend on a stable feedstock supply and long-term offtake pricing. Cost dispersion across projects is wide due to differences in feedstock type, logistics distance, plant scale, and grid connection requirements, making replication difficult. In markets where support schemes are revised frequently or lack long-term guarantees, developers face difficulty achieving financial close, as lenders factor in policy and price risk, which pushes up financing costs and weakens project returns. Estimates from technical assessments show that initial plant construction and upgrading investments typically range from approximately USD 2.2 million to USD 5.5 million for modest units.

BIOMETHANE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The Landfill of Steuben County, New York, in the past, was a significant source of methane emissions. Unfortunately, there was no gas recovery and valorization system in place. The landfill gas escape occurred without the necessary infrastructure for capturing and utilizing it, thereby contributing to global warming and the loss of a renewable energy source. The local governments did not have a reliable renewable fuel supply for the energy grids in the area. | The Steuben County Landfill biomethane project offered environmental, economic, and energy system benefits. The substantial methane emission reduction resulting from the gas capturing and upgrading process not only directly cuts down on greenhouse gas impacts but also aids in achieving regional climate goals. The landfill gas converted into pipeline-quality biomethane is a new and steady source of renewable energy for local use, thereby increasing energy security. The project is a public-private partnership at its best, as it has allowed for the incineration of waste in a cost-effective manner while generating long-term economic value. Moreover, advanced technology for upgrading is used in the project, thereby revealing a model that is not only scalable but also replicable among landfills in need of accelerating the gas production from renewable sources. |

|

AstraZeneca aimed to significantly reduce greenhouse gas emissions from its US operations, but faced difficulties obtaining the low-carbon fuel supplies necessary for large-scale use. The use of traditional energy sources and fossil gas was a challenge for the company in achieving its sustainability targets and reducing its Scope 1/2 emissions in the long run. | The AstraZeneca–Vanguard Renewables biomethane project delivers strong environmental, operational, and strategic benefits. By securing a long-term supply of renewable natural gas, AstraZeneca significantly reduces Scope 1 and 2 emissions while advancing its corporate net-zero commitments. The project converts organic waste into clean energy, diverting waste from landfills and lowering methane emissions. It provides a stable, large-scale low-carbon fuel solution without requiring changes to existing infrastructure. Additionally, the partnership demonstrates how on-farm anaerobic digestion can be scaled to support corporate decarbonization goals while creating value for agricultural communities and strengthening circular economy practices. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The biomethane market ecosystem is a complex web of stakeholders at multiple levels who collectively turn organic waste into sustainable gas and offer it to consumers. The foundation of biomethane production is the feedstock consisting of agricultural residues, animal manure, municipal waste, and industrial organic waste provided by suppliers. The players involved in feedstock collection and pre-treatment carry out waste aggregation, sorting, and conditioning to ensure that the quality of input is consistent. Biogas production operators transform prepared feedstocks into biogas through the process of anaerobic digestion or advanced conversion techniques. Biogas upgrading and purification providers prepare raw biogas for pipeline-quality biomethane by removing CO2, impurities, and moisture. The stakeholders in compression and liquefaction facilitate the storage and transport of biomethane for mobility and remote applications. The distribution and grid-injection entities are responsible for integrating the natural gas networks, ensuring the compliance and reliability of the system. Lastly, the end users—comprising the transportation, industrial sector, and power consumers—apply biomethane as a low-carbon alternative, thus completing a circular and sustainable energy ecosystem.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Biomethane market, by feedstock

By feedstock, municipal waste occupies the top position in the biomethane market and is increasing steadily due to urbanization and the accumulation of organic municipal waste. The combination of municipal solid waste, food waste, and wastewater sludge provides a systematic and large-scale feedstock supply, particularly in densely populated areas. Furthermore, strong governmental backing for waste-to-energy initiatives, landfill diversion targets, and stricter disposal regulations further facilitates the acceptance of biomethane from waste. The practice of converting municipal waste into biomethane not only helps cities reduce methane emissions but also enhances waste management effectiveness and supplies local energy with renewable gas.

Biomethane market, by production process

Thermal gasification is expected to be the fastest-growing segment in the biomethane market, by production process, due to the wide range of dry and lignocellulosic feedstocks' conversion into renewable gas. It effectively utilizes forestry residues, industrial waste, and other difficult-to-process materials that are not readily biodegradable. Along with the demand for advanced waste-to-energy solutions, technological improvements and increasing investments in low-carbon fuels are contributing to the rapid adoption and strong growth during the forecast period.

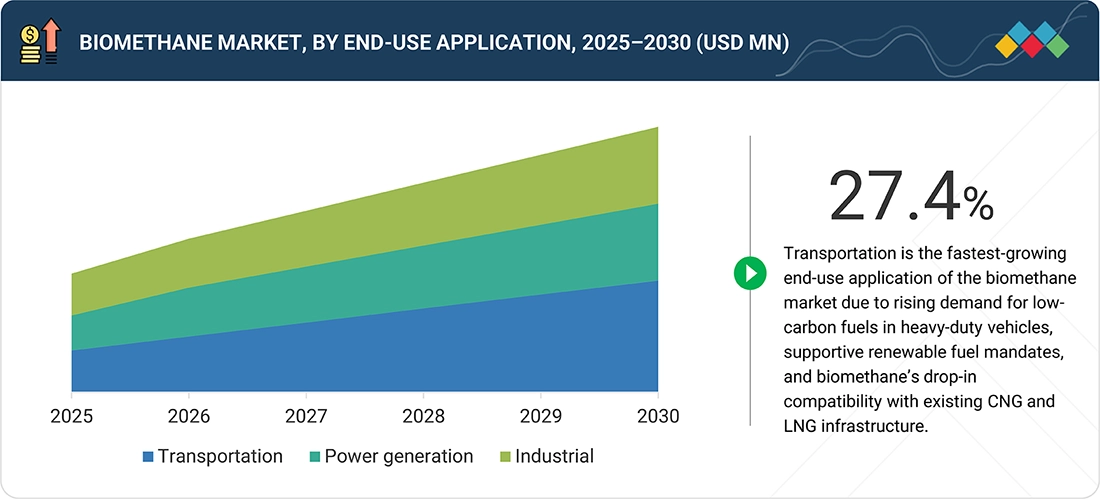

Biomethane market, by end-use application

Based on end-use application, the transportation segment is estimated to account for the largest share in the overall biomethane market. Biomethane can be used just as a compressed or liquefied renewable natural gas. Hence, it does not require any modifications to the existing engines. Government mandates for renewable fuels, carbon credit mechanisms, and the increasing installation of infrastructure for CNG and LNG are among the factors that are driving the market. In addition, the use of biomethane in transportation is much more profitable.

REGION

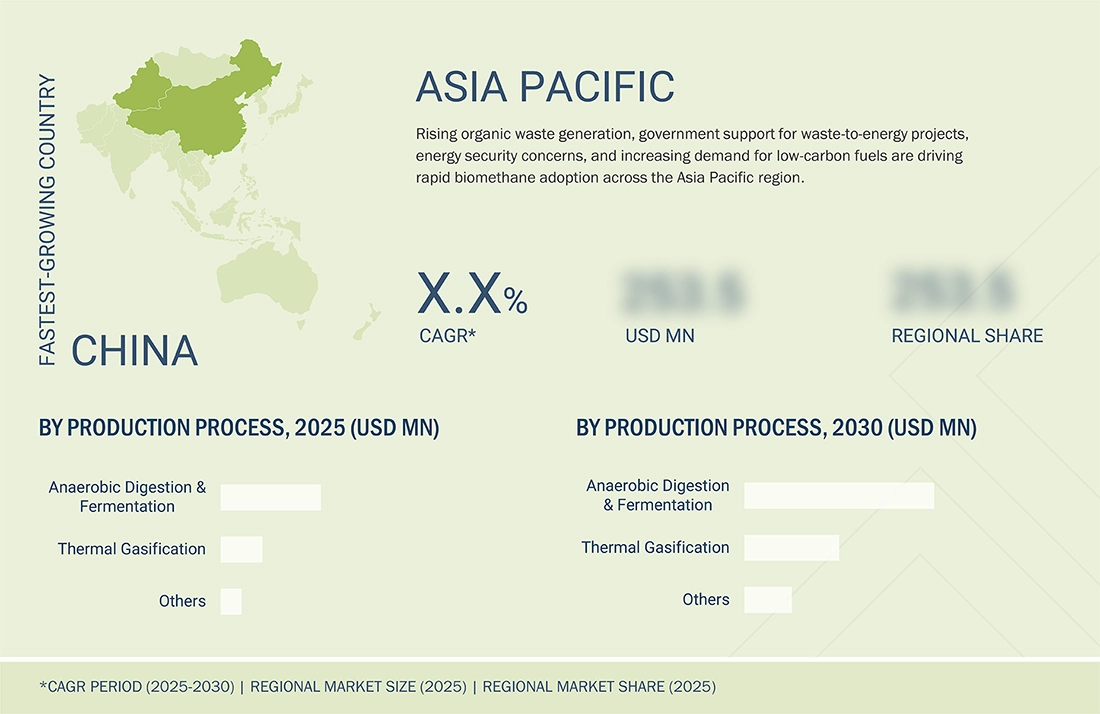

Asia Pacific is expected to dominate relay market during forecast period with highest CAGR

Asia Pacific is projected to be the fastest-growing biomethane market during the forecast period. The market in the region is driven by rapid urbanization, higher energy demands, and increasingly stringent regulations on managing organic waste. The agriculture sector is growing, and the amounts of waste from municipalities and industries are also increasing, thus creating a solid base of feedstock. Government backing, waste-to-energy schemes, and continuously increasing interest in low-carbon fuels for transport and industrial applications are among the factors that are promoting the uptake of biomethane in the region.

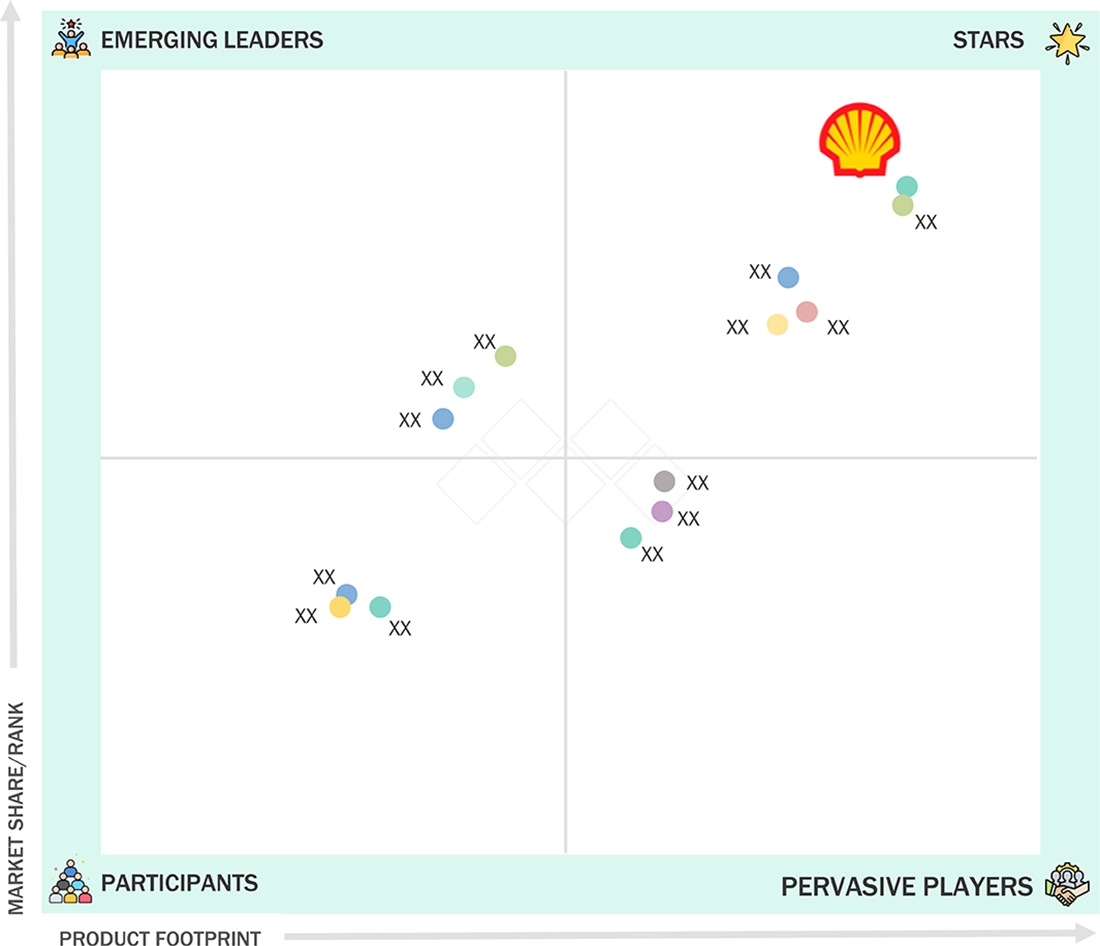

BIOMETHANE MARKET: COMPANY EVALUATION MATRIX

Shell Biogas is considered a Star player in the biomethane market because of its solid project portfolio and emphasis on renewable gas. The company is vigorously increasing biomethane production by means of waste-based projects and alliances and is tapping into the existing gas and energy infrastructure. Shell Biogas utilizes its vast knowledge in energy markets, project development, and downstream integration to provide large-scale biomethane solutions for transport and industrial use.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Shell Biogas (UK)

- Gasum Ltd. (Finland)

- Air Liquide (France)

- BP p.l.c. (UK)

- OPAL Fuels (US)

- Chevron Corporation (US)

- TotalEnergies (France)

- Veolia (France)

- Raízen (Brazil)

- Anaergia (Canada)

- EnviTec Biogas AG (Germany)

- Kinder Morgan (US)

- Ameresco (US)

- ENGIE (France)

- E.ON SE (Germany)

- Verbio SE (Germany)

- Waga Energy (France)

- Vanguard Renewables (US)

- Gothenburg Energy (Sweden)

- WELTEC BIOPOWER GmbH (Germany)

- PlanET Biogas Group (Germany)

- ETW Energietechnik GmbH (Germany)

- Clean Energy Fuels (US)

- EQTEC PLC (Ireland)

- GENeco (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 12.82 Billion |

| Market Forecast in 2029 (Value) | USD 56.64 Billion |

| Growth Rate | 28.0% |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion); Volume (BCM) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe, Asia Pacific, North America, South America, Rest of the World |

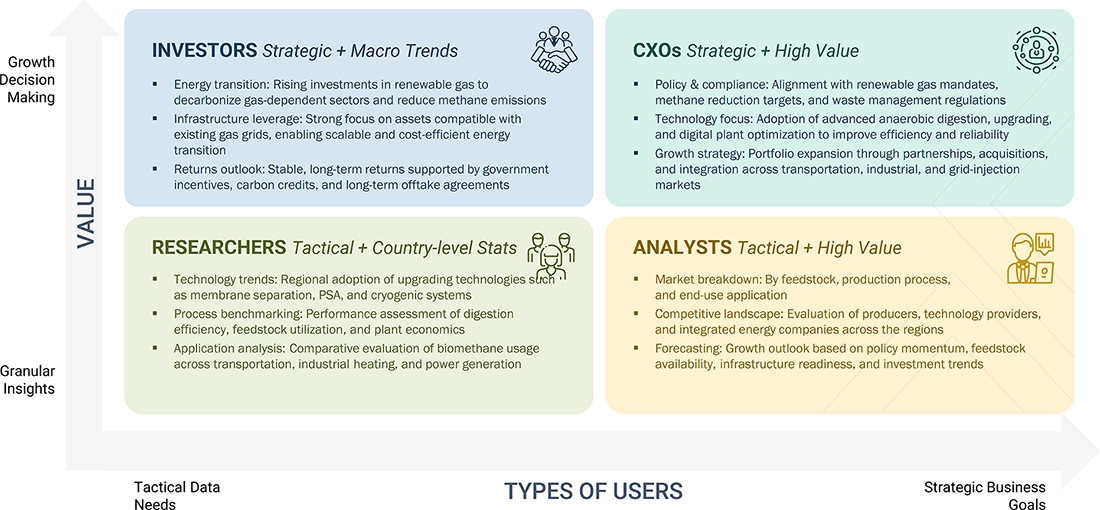

WHAT IS IN IT FOR YOU: BIOMETHANE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Biomethane Project List Across the European Region |

|

|

RECENT DEVELOPMENTS

- September 2025 : Shell Biogas and Hapag-Lloyd entered into a long-term partnership for the provision of liquefied biogas, which the shipping company will use to implement its decarbonization plan. The agreement, which is an extension of their earlier partnership in 2023, allows Hapag-Lloyd's vessels running on LNG dual fuel to switch to renewable marine fuel without modification of the equipment. Currently, Shell provides liquefied biogas at 22 locations worldwide for bunkering, making a significant contribution to the competition for renewable fuel availability. The ISCC EU-certified biomethane results in tremendous lifecycle GHG reductions, which is a big help in decarbonizing fleet operations and customer supply chains.

- August 2025 : Gasum entered into a deal with Wasaline to provide the ferry Aurora Botnia, which is at the same time and daily between Finland and Sweden, with 100% liquefied biogas (bio-LNG), thereby establishing the first entirely carbon-neutral shipping route across the Baltic Sea. The change is possible due to FuelEU Maritime compliance pooling involving Stena Line. The use of waste-based bio-LNG with approximately 90% lower lifecycle GHG emissions than that of fossil fuels is the main point of the deal that will lead the maritime sector to new carbon-free times, and at the same time, enable Wasaline to provide non-polluting transport for both passengers and cargo without any surcharges

- April 2024 : Air Liquide is expanding its biomethane operations in the US by establishing two new units in Pennsylvania and Michigan. The two plants will implement manure-based anaerobic digestion to produce biogas, which will then be upgraded using Air Liquide’s proprietary membrane technology into RNG for grid injection. The projects have a total output of 74 GWh every year, promoting circular waste management by sending digestate back to farms. These developments have made Air Liquide’s global biomethane portfolio more robust, now with 26 operating units that produce around 1.8 TWh annually.

Table of Contents

Methodology

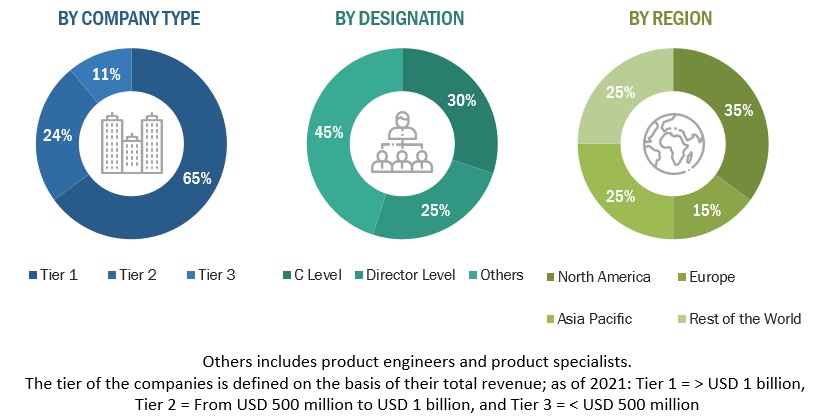

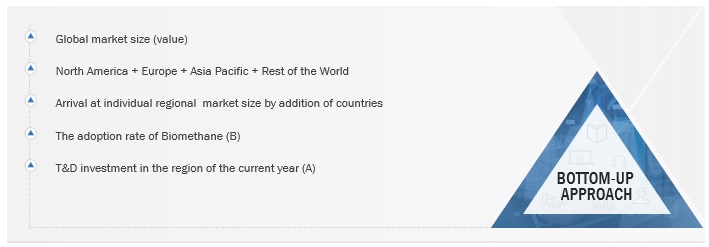

The research encompassed significant efforts to determine the present scale of the biomethane market. Thorough secondary research was conducted to gather data on both peer and parent markets. Subsequently, these findings, assumptions, and sizing were validated through primary research involving industry experts throughout the value chain. A comprehensive approach, combining top-down and bottom-up methodologies, was applied to ascertain the overall market size. Following this, market breakdown and data triangulation techniques were employed to calculate the market size of individual segments and subsegments, ensuring a comprehensive and reliable assessment.

Secondary Research

This research on the biomethane market utilized a comprehensive range of secondary sources, including directories and databases such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy. These sources were instrumental in identifying and gathering information essential for conducting a technical, market-oriented, and commercial study of the market. Other secondary sources encompassed annual reports, press releases, and investor presentations from companies, as well as white papers, certified publications, articles by reputable authors, manufacturer associations, trade directories, and databases.

Primary Research

The biomethane market encompasses various stakeholders, including manufacturers of biomass power generation, providers of manufacturing technology, and technical support providers throughout the supply chain. On the demand side, there is a noticeable increase in the demand for biomass power generation across applications such as generation, transmission, and distribution. On the supply side, there is a growing demand for contracts from the industrial sector, and significant activity in terms of mergers and acquisitions among major players. To gather qualitative and quantitative information, interviews were conducted with numerous primary sources from both the supply and demand sides of the market.

The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the biomethane market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Global Biomethane Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Biomethane Market Size: Top-Down Approach

Data Triangulation

The previously mentioned approaches were used to calculate the total market size before the market was divided into numerous segments and subsegments. Methods of data triangulation and market segmentation were used as needed to complete the thorough market analysis and acquire accurate statistics for each market segment and subsegment. Through an analysis of numerous variables and patterns from the supply and demand sides of the biomethane market ecosystem, data triangulation was achieved.

Market Definition

The biomethane market refers to the industry involved in the production, distribution, and utilization of biomethane, a renewable and sustainable natural gas derived from the anaerobic digestion or fermentation of organic materials such as agricultural residues, municipal solid waste, wastewater, and organic by-products. Biomethane, also known as renewable natural gas (RNG), is a clean energy source that can be seamlessly integrated into existing natural gas infrastructure, used for power generation, heating, and as a transportation fuel. The market encompasses various stakeholders, including biomethane producers, technology providers, and entities involved in the entire supply chain. Key drivers for the market include the global emphasis on reducing greenhouse gas emissions, government initiatives promoting renewable energy, advancements in biomethane production technologies, and a growing awareness of sustainable waste management practices. The market is characterized by a dynamic landscape with increasing investments, partnerships, and technological innovations to further enhance the efficiency and sustainability of biomethane production and utilization.

Key Stakeholders

- Analytics Vendors

- Communication Vendors

- Consulting Companies In The Energy And Power Sector

- Electric Utilities

- Energy & Power Sector Consulting Companies

- Energy Regulators

- Government & Research Organizations

- Government Utility Providers

- Independent Power Producers

Objectives of the Study

- To describe, segment, and forecast the biomethane market based on feedstock, distribution mode, production process, end-use application, end user type and region, in terms of value

- To describe and forecast the market for five key regions: North America, Europe, Asia Pacific, Rest of the World, along with their country-level market sizes, in terms of value

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide the supply chain analysis, trends/disruptions impacting the customer’s business, market map, pricing analysis, and regulatory analysis of the market

- To analyze opportunities for stakeholders and draw a competitive landscape of the market

- To strategically analyze the micromarkets with respect to individual growth trends, upcoming expansions, and their contribution to the overall market

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, Porter’s five forces, and case studies pertaining to the market under study

- To benchmark market players using the company evaluation quadrant, which analyzes market players on broad categories of business and product strategies adopted by them.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Biomethane Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Biomethane Market