BOPET Films Market

BOPET Films Market by Thickness (Thin and Thick), Application (Packaging, Electrical & Electronics, Imaging), End-use Industry (Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, and Electrical & Electronics), and Region - Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The BOPET films market size is expected to reach USD 13.22 billion by 2029 from USD 10.49 billion in 2024 at a CAGR of 4.7% during the forecast period. The UN estimates the world population will reach 8.6 billion by 2030, 9.8 billion by 2050, and 11.2 billion by 2100, creating huge food demand that impacts the BOPET films market. Increasing populations necessitate efficient, secure, and ecological packaging to preserve food supplies and minimize waste. Furthermore, the need for convenience foods, e-commerce, urbanization, and increasing disposable incomes will propel the use of BOPET films in packaging. Global B2B e-commerce sales are projected to attain USD 36 trillion by 2026, while B2C revenue is anticipated to reach USD 5.5 trillion by 2027, exhibiting a CAGR of 14.4% (ITC). BOPET films, characterized by superior barrier qualities, strength, and printability, address the changing demands of packaging, bolstered by biodegradable materials, improved recycling techniques, and environmentally sustainable production methods.

KEY TAKEAWAYS

-

BY THICKNESSBased on thickness, the BOPET films market is segmented into thin and thick films, with thin films witnessing faster growth due to their versatility, cost-effectiveness, and widespread use in packaging, labeling, and industrial applications, while thick films cater to specialized and high-strength requirements.

-

BY APPLICATIONBased on application, the BOPET films market is segmented into Packaging, Electrical & Electronics, Imaging, and Other Industrial applications. Packaging is fueled by increasing demand for high-barrier, durable, and sustainable materials in food, beverage, pharmaceutical, and personal care sectors.

-

BY END-USE INDUSTRYKey end-use industries for BOPET films include Food & Beverages, Electrical & Electronics, Personal Care & Cosmetics, Pharmaceuticals & Medical, and Other End-use Industries. Food & Beverages is the fastest-growing segment, driven by rising demand for safe, durable, and high-barrier packaging solutions, along with increasing e-commerce, convenience food consumption, and sustainability requirements across consumer and industrial applications.

-

BY REGIONThe BOPET films market is segmented regionally into Asia Pacific, North America, Europe, South America, and the Middle East & Africa. Asia Pacific is the fastest-growing region, driven by rapid urbanization, rising disposable incomes, expanding e-commerce, and increasing demand for high-performance and sustainable packaging solutions across food, beverage, pharmaceutical, and personal care industries.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Toray Industries, Inc., UFlex Limited, Polyplex, SRF Limited, and Jindal Poly Films Limited entered into a number of agreements, partnerships, product launches, and expansions to cater to the growing demand for BOPET films across innovative applications.

The global BOPET films market is witnessing consistent expansion, propelled by its diverse applications across various sectors. BOPET films are extensively utilized in the packaging of food and beverages, pharmaceuticals, personal care items, and electronics owing to their superior barrier qualities, durability, and printability. Their durability, chemical resistance, and recyclability render them optimal for sustainable packaging solutions, corresponding with the rising need for eco-friendly, high-performance materials in both consumer and industrial applications.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The influence on customers' businesses in the BOPET films market stems from evolving consumer preferences and industry trends. Major sectors encompass food and beverage, pharmaceuticals, personal care, electrical and electronics, along with various industrial applications, whereas intended uses include packaging, labeling, insulation, and imaging. Fluctuations in end-user demand directly influence revenues for manufacturers and suppliers, hence determining the overall growth and sales dynamics of the BOPET films market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising e-commerce industry

-

Increasing demand for flexible packaging

Level

-

Fluctuations in raw material prices

-

Increasing competition from alternative packaging

Level

-

Innovation in BOPET films

-

Rise of smart packaging solutions

Level

-

Supply chain disruptions and trade restrictions

-

Absence of a recycling infrastructure

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising e-commerce industry

The e-commerce industry has grown a lot, which has led to a rise in the need for packaging. BOPET films are very strong and keep moisture, oxygen, and other impurities out, making sure that products are safe all the way through the supply chain. Because they are so durable, they are great for e-commerce because they don't get damaged as easily. Thin BOPET films make packages lighter, which lowers the cost of shipping and greenhouse gases. Transparent films make products easier to see, while metallized ones protect them from damage. They also offer high-quality printing and branding, which are important for getting customers' attention. BOPET films are environmentally friendly because they can be recycled. The growth of Amazon, Alibaba, and Flipkart has increased demand, and this trend is likely to continue as e-commerce grows.

Restraints: Increasing competition from alternative packaging

BOPET films see growing competition from other packaging materials such as BOPP, PVC, and biodegradable films. The cost advantages of BOPP, which are less expensive to produce with comparable moisture and oxygen barrier properties, make BOPP preferable for food packaging in flexible applications such as snack and confectionery products. The excellent optical clarity, sealing properties, and rigidity properties of PVC films are leveraged for pharmaceutical and food packaging, which restricts the use of BOPET films in these applications. BOPP provides superior printability and heat-sealing capabilities for branding and efficient high-speed processing. Moreover, the escalating demand for eco-friendly packaging has augmented the utilization of biodegradable and compostable films, regarded as more sustainable alternatives to BOPET.

Opportunity: Innovation in BOPET films

The BOPET film market is going through a spate of developments with improvements in PET chip technology. These have enhanced the mechanical, optical, and barrier properties of BOPET films to render them stronger, clearer, and more efficient. The development of stronger and dimensionally more stable PET chips has significantly enhanced the strength, toughness, and reliability of BOPET films to render them suitable for use in high-performance applications in industries. This trend towards lightweight, high-performance sheets reduces environmental impact and generates new prospects in packaging, electronics, and insulation applications. The exceptional electrical insulation properties of novel BOPET films are driving their application in capacitors, insulation tapes, and motor insulation, thereby improving safety and efficiency in electrical and electronic devices.

Challenges: Absence of a recycling infrastructure

Even though BOPET films can be recycled, their environmental benefits are limited because many places don't have recycling centers. Materials with established recycling routes, including aluminum, glass, and paper, are much easier for recycling systems to process than BOPET films. Most cities and waste facilities do not have the capacity to accept flexible packaging and the waste often ends up in a landfill or incinerated, particularly in developing countries with unestablished infrastructure. Recycled BOPET is further challenged by contamination from adhesives, coatings, inks, and other multilayered structures used in packaging (such as laminations with PE or aluminum foil), which adversely affected the quality of the recycled BOPET and limited market value and applications.

BOPET Films Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Developed a soft-touch BOPET film (FLEXPET F-STF) with a velvety, luxurious surface while maintaining strong mechanical properties. This is used in luxury brand packaging, decorative packaging, labels, graphic advertising, high-end stationery etc. | The film exhibits exceptional scratch, heat, scuff resistance; the surface is “self-healing” from most scuffing. Also, the combination of low gloss & high haze (>90%) but still good clarity helps for premium graphics, reverse printing etc. It reduces material cost because it can be thinner than prior matte/low-quality alternatives, and gives higher yield |

|

Developed a pharma-grade PET blister film containing 30% post-consumer recycled (PCR) monomers. When paired with TekniPlex’s polyester lidding (Teknilid® Push), the system is designed to be fully recyclable in the polyester recycling stream. | Enables compliance with sustainability and regulatory goals, maintains pharmaceutical-grade quality, and supports circularity by using recyclable mono-material structures. |

|

Uses BOPET films in pouches and laminated wraps for detergents and household care products. | Offers chemical resistance, high strength, and stability, ensuring safe containment of active ingredients. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The market for BOPET films includes raw material suppliers, manufacturers, distribution companies, and end users, each with an important role to play in the growth of the industry. Raw material suppliers offer major ingredients such as polyethylene terephthalate (PET) resins and additives, whose price variations affect the cost of production. Manufacturers make BOPET films of various grades to meet the requirements of many end-user sectors without sacrificing on regulatory compliance. Distributors allow market access with a proper supply chain that satisfies the converters, packaging companies, and direct buyers. End-users in different sectors like packaging, electronics, and automotive drive the demand based on factors like sustainability, barrier resistance, and longevity.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

BOPET Films Market, By Thickness

In 2023, the thin film segment led the BOPET films market and is projected to maintain its dominance through 2025, owing to its adaptability, cost-effectiveness, superior barrier qualities, and high strength-to-weight ratio. Thin BOPET films, extensively utilized in packaging, labeling, and industrial applications, provide durability, printability, and versatility across the food, beverage, pharmaceutical, and personal care industries. Improvements in coating, metallization, and biodegradable alternatives augment performance, establishing thin films as the preferable option for sustainable, high-performance packaging solutions, hence solidifying their dominant status in the BOPET films market alongside thicker and specialty film sectors.

BOPET Films Market, By Application

In 2023, the packaging was the leading application of the BOPET films market due to increased printed and unprinted demand for high durability, high-barrier, and sustainable packaging in food, beverage, nutraceutical, personal care, and pharmaceutical products. Thin, metallized BOPET films have seen much of this increase in demand as part of the overall films category due to their impressive strength, moisture, and oxygen barrier properties, printability, and the ability to heighten product visibility and branding. A continuing rise in demand from e-commerce, convenience foods, urbanization, and film innovations, adding biodegradable and recyclable films, sustaining overall supply and consumption efforts, has provided the packaging application with the leading position of all applications in the BOPET films market.

BOPET Films Market, By End-use Industry

In 2023, the Food & Beverage sector was the largest end-use market for BOPET films. This was because they are very strong, stable in heat, and meet food safety standards (EC 10/2011, REACH, US FDA). BOPET films maximize shelf life by preventing gas, odor, and moisture from permeating, while the clarity of the film allows consumers to see the product. Lightweight, robust, flexible, and recyclable, they are optimal for pouches, lidding, and soft drink containers. The increasing demand for sustainable, convenient packaging and advancements in coating and metallization technologies have broadened their applicability in high-barrier contexts such as vacuum-packed and modified atmosphere packaging (MAP).

REGION

Asia Pacific to be the fastest-growing region in the global BOPET films market during the forecast period

The Asia-Pacific region is the fastest-growing market for BOPET film. This is because more people are moving to cities, incomes are rising, and people want more convenient food and drinks. Demand for durable, high-barrier packaging is increasing due to busy lifestyles, leading to the introduction of BOPET-based flexible packaging solutions such as stand-up and flat pouches. The region is advancing in sustainability and technology as producers launch green BOPET films, bio-based plastics, and packaging with high recycled content. Technologies such as epoxy silane-free laminating adhesives and nano-coated multi-layer barrier films improve safety, recyclability, and shelf life. The major players such as UFlex Limited, Jindal Poly Films, SRF Limited, Toray Industries, Polyplex, and Jiangsu Shuangxing Color Plastic New Material Co., Ltd. are increasing manufacturing and diversifying product portfolios to keep up with increasing demand.

BOPET Films Market: COMPANY EVALUATION MATRIX

Toray Industries, Inc. (Star) is at the forefront of the BOPET films industry due to its strong global presence, product portfolio, and focus on R&D competence, allowing extensive penetration into various food & beverage, pharmaceuticals, personal care, and industrial applications. Mitsubishi Polyester Film GmbH (Emerging Leader) is making a name for itself in the BOPET industry by introducing innovative BOPET solutions, focusing on unique high-performance sustainable and customized film products for packaging, electrical, and specialty industrial applications, while increasing its footprint in the leader quadrant via quality, reliability, and customer-focused approaches.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 10.02 BN |

| Market Forecast in 2029 (Value) | USD 13.22 BN |

| CAGR | 4.7% |

| Years Considered | 2022–2029 |

| Base Year | 2023 |

| Forecast Period | 2024–2029 |

| Units Considered | Value (USD Million), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: BOPET Films Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| U.S.-based BOPET Films Manufacturer |

|

|

| BOPET Thin Film Manufacturers |

|

|

| BOPET Thick Film Manufacturers |

|

|

RECENT DEVELOPMENTS

- December 2024 : UFlex Limited invested USD 200 million in Egypt to enhance backward integration and market reach. It is allocating USD 70 million for a PET chips facility, a key raw material for BOPET films used in flexible packaging.

- November 2024 : Polyplex is expanding its Decatur, Alabama, facility with a 50,000-tonne BOPET film line and increasing resin capacity to 86,000 tonnes, reducing PET film lead times in the US

- February 2024 : Mitsubishi Polyester Film GmbH is constructing a new PET film plant in Wiesbaden, Germany, with a capacity of 27,000 tons of HOSTAPHAN films.

- December 2022 : Toray Industries, Inc. developed an eco-friendly PET film designed for superior adhesion and applicability with water-based and solvent-free coatings

- April 2022 : Jindal PolyPack, a subsidiary of Jindal Poly Films Limited, acquired a 100% stake in SMI Coated Products.

Table of Contents

Methodology

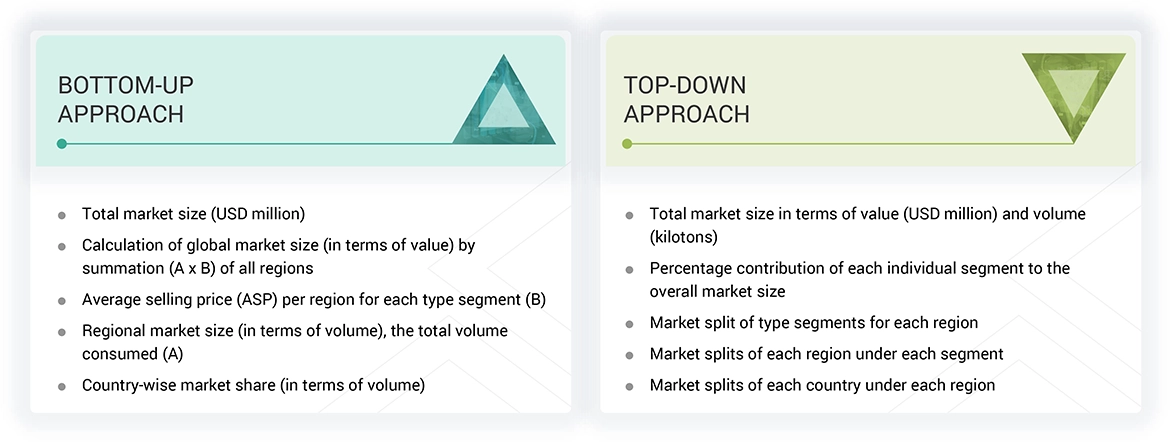

The study involved four major activities for estimating the current size of the global BOPET films market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of BOPET films through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the BOPET films market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

The market for the companies offering BOPET films is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various secondary sources such as Business Standard, Bloomberg, World Bank, and Factiva were referred to, to identify and collect information for this study on the BOPET films market. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of BOPET films vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the BOPET films market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of BOPET films offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies. In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

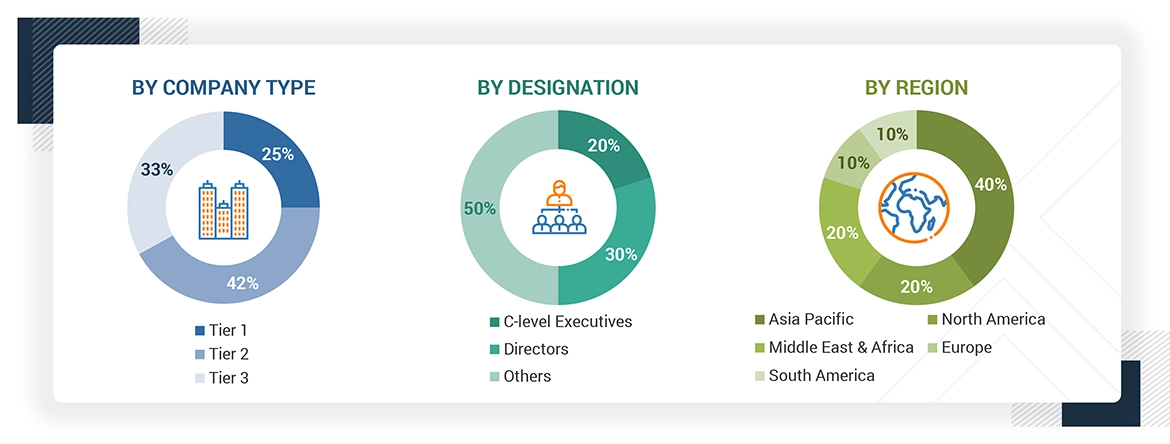

Following is the breakdown of primary respondents—

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the BOPET films market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following:

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

BOPET is a high-performance polyester film produced by biaxially stretching polyethylene terephthalate (PET) in two primary directions, enhancing its mechanical and barrier properties. This film has high tensile strength, chemical and dimensional stability, transparency, reflectivity, excellent gas and aroma barrier properties, and electrical insulation. BOPET films are a crucial element in various industries, including consumer electronics, automotive, green energy, and medical devices. However, their most significant application is in flexible packaging, where they serve as a fundamental component in multi-layer plastic (MLP) structures. Despite accounting for only 5–10% of total packaging material by weight, BOPET films are essential to approximately 25% of packaging structures, contributing to their superior performance and resource efficiency.

Stakeholders

- BOPET films Manufacturers

- Raw Material Suppliers

- Converters & Processors

- Distributors and Traders

- Industry Associations and Regulatory Bodies

- End Users

Report Objectives

- To estimate and forecast the BOPET films market, in terms of value and volume

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market thickness, application, end-use industry, and region

- To forecast the market size along with segments and submarkets, in key regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America along with their key countries

- To strategically analyze micro markets, for individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as acquisitions, product launches, agreements, and expansions in the BOPET films market

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the BOPET Films Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in BOPET Films Market