Botulinum Toxins Market Size, Growth, Share & Trends Analysis

Botulinum Toxins Market by Product (Botox, Dysport, Jeuveau, Myobloc), Application (Cosmetic (Wrinkle Removal, Contouring, Skin rejuvenation), Therapeutic (OAB, Migraine, Spasm, Pain)), Volume, End User (Clinics, Center), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global botulinum toxins market is expanding rapidly, driven by the dual impact of aesthetic demand and therapeutic diversification. Valued at over USD 8.92 billion in 2025, it is projected to grow at a CAGR exceeding 12.0% by 2030, reaching a value of USD 15.72 billion by 2030. The market growth is driven by rising disposable incomes, greater acceptance of minimally invasive cosmetic procedures, and expanding therapeutic indications. While Botox (Allergan/AbbVie) remains the leading brand, the market has seen increasing competition from Revance, Ipsen, Medytox, Daewoong, Evolus, Hugel, and Asian biosimilars, reshaping the overall landscape. The future outlook will likely be shaped by both aesthetic trends and rapidly growing therapeutic areas such as chronic migraine, cervical dystonia, spasticity, overactive bladder, and depression.

KEY TAKEAWAYS

- The North America Botulinum Toxins market accounted for 40.2% revenue share in 2024

- By type, the type A segment is expected to register highest CAGR of 12.0%

- By application, the cosmetic segment is expected to register the highest CAGR of 14.1%.

- By brand, the Botox segment is expected to dominate the market, growing at the highest CAGR of 13.8%.

- By age group, the 35-50 years old segment accounted for 41.7% revenue share in 2024.

- By end user, the dermatology clinics & hospitals segment accounted for 46.2% revenue share in 2024.

- Companies AbbVie Inc. (US), Ipsen Biopharmaceuticals, Inc. (France), and Galderma (Switzerland) were identified as some of the star players in the botulinum toxins market (global), given their strong market share and product footprint

- Companies Microgen (Russia), JDBIO Co., Ltd. (South Korea), and Atrazist Aray Co. (Iran), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The market is shaped by a set of interconnected trends that are redefining competitive dynamics. The first major trend is the global shift from invasive surgeries to minimally invasive and non-surgical aesthetics, with botulinum toxins emerging as the entry-level choice for younger demographics. Millennials and Gen Z are driving early adoption, often using toxins preventively to delay visible signs of aging. This trend is not restricted to developed nations; in emerging economies, the combination of rising disposable incomes and heightened exposure to Western urban lifestyles is unveiling new demographic groups that are increasingly demanding these cosmetic treatments. On the therapeutic side, botulinum toxins have gained credibility through neurological applications in chronic migraine, spasticity, cervical dystonia, and bladder dysfunction, which have moved into reimbursed care in key regions. In parallel, the rise of biosimilars manufactured in South Korea and China is disrupting pricing models, forcing premium players to differentiate through innovation. Product innovation itself is another defining trend, with companies investing in long-acting formulations, faster onset toxins, and liquid-stable delivery formats that reduce clinical preparation complexity. Finally, digital transformation and direct-to-consumer outreach are shifting purchasing dynamics, with aesthetic chains and online-enabled clinic platforms becoming central to patient acquisition and retention.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The expansion of botulinum toxins has disrupted dermatology clinics, med spas, neurology specialists, and rehabilitation centers, which form the core demand. Customers are experiencing significant margin pressures as biosimilars lower procedure prices and patient expectations for safety, efficacy, and convenience continue to increase. Therapeutic applications are shifting purchasing power toward insurers and payers, changing traditional provider-driven decision-making. Consolidation is also transforming the aesthetic delivery market, especially in North America and Europe, where chains of med spas and dermatology networks are reducing fragmentation and increasing bargaining leverage against suppliers. On the consumer side, patients are becoming more informed and outcome-driven, forcing providers to adopt bundled care packages and loyalty-driven service models rather than relying on episodic treatments. Collectively, these disruptions mean that customer businesses are navigating more complex procurement choices and must constantly balance affordability, safety, and differentiated patient experience.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Aesthetic consciousness among adults

Level

-

Economic, regulatory, and societal constraints

Level

-

New use cases of botulinum toxins in therapeutics

Level

-

Pricing constraints and shortage of skilled professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Aesthetic consciousness among adults

The most significant growth driver remains the increasing preference for aesthetic procedures among adults and working professionals of all ages. Social media influencers, long careers, and the normalization of cosmetic enhancements are encouraging adoption among both men and women. For example, according to the American Society of Plastic Surgeons and the International Society of Aesthetic Plastic Surgery (ISAPS), more young adults, especially Millennials and Generation Z, are using botulinum toxins not only to remove wrinkles but also as a preventive measure. This trend, called "prejuvenation," is fueled by increased awareness of aesthetics and easy access to information about these treatments. Furthermore, botulinum toxins are no longer limited to cosmetic use but are now a key part of therapeutic treatments. FDA and EMA approvals in neurology and urology are validating wider clinical acceptance, while new trials in psychiatry and pain management highlight promising growth areas. This dual role as both a lifestyle and healthcare solution reduces risks and provides a solid base for ongoing demand.

Restraint: Economic, regulatory, and societal constraints

Despite strong demand drivers, several barriers hinder the full potential of the botulinum toxin market. High treatment costs and limited reimbursement keep aesthetic procedures out of reach for many, especially in emerging markets. Regulatory scrutiny adds further complexity, as approval requirements for therapeutic uses vary greatly across regions, slowing global expansion. Concerns over adverse effects — such as muscle weakness, allergic reactions, or toxin spread — discourage risk-sensitive consumers, particularly when treatments are performed by unqualified practitioners. Regulatory challenges also exist, as countries have different approval processes and restrictions for both aesthetic and medical uses of botulinum toxins. Additionally, cultural stigma surrounding cosmetic procedures in some societies continues to limit openness about their use, indirectly restraining demand in more conservative communities..

Opportunity: New use cases of botulinum toxins in therapeutics

Opportunities for the market include expanding therapeutic applications beyond traditional neurology and urology into areas such as depression, anxiety, chronic pain, and inflammatory conditions. As clinical evidence continues to grow, these new use cases could lead to multi-billion-dollar therapeutic markets that surpass today’s aesthetic revenue streams. Another opportunity involves next-generation product development, with companies working on liquid-stable formulations and ultra-long-acting toxins that could decrease injection frequency and improve patient convenience. Price-disruptive biosimilars also offer chances for volume-driven growth in emerging markets, especially in Asia-Pacific and Latin America, where rising middle-class populations are increasingly seeking affordable aesthetic and medical treatments.

Challenge: Pricing constraints and shortage of skilled professionals

The industry faces systemic challenges that could hinder growth if not addressed strategically. Pricing pressures are intensifying as biosimilar competition grows and therapeutic adoption comes under payer scrutiny. Premium brands are increasingly required to demonstrate differentiation through durability, safety, or unique indications to justify higher prices. This situation forces manufacturers to find a careful balance between making their products affordable and ensuring profitability, especially in cost-sensitive markets or regions with strict price limits from public healthcare programs. At the same time, a shortage of skilled injectors remains a bottleneck. In many markets, untrained or underqualified practitioners increase the risks of misuse, complications, and poor patient experiences, which can damage brand reputations. Addressing training, certification, and quality control will be essential for manufacturers looking to expand adoption responsibly.

Botulinum Toxins Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers Botox, Dysport, and Jeuveau injections for wrinkle reduction, facial contouring, and skin rejuvenation | Large footprint across states (over 40+ clinics) enables standardized patient experience. |

|

Offers fine-line smoothing, facial rejuvenation with neurotoxin injectables and preventative aging, self-care trend | Cost-effective therapy and attracts younger demographics (millennials/Gen Z) seeking “affordable luxury.” |

|

Providing toxin treatments in a spa-like setting at more affordable pricing compared to dermatology clinics. | Attracts cost-conscious consumers seeking non-surgical beauty solutions. Strengthens brand identity as an affordable luxury provider. |

|

Positioning botulinum toxin not just as a medical treatment but as part of a self-care and lifestyle service. | Expands clinic portfolio with a high-demand, high-margin service and differentiates Refresh as a “beauty + wellness destination.” |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The botulinum toxins market is supported by a layered ecosystem comprising manufacturers, distributors, end users, and regulators. Leading manufacturers include AbbVie, Ipsen, Revance, Medytox, Daewoong, Hugel, and Evolus, while Chinese institutions such as Lanzhou Institute are driving regional biosimilar penetration. Distribution networks are divided among global pharmaceutical distributors, aesthetic-focused MedSpa chains, and local resellers that expand penetration in emerging markets. End users include hospitals, neurology and rehabilitation centers, dermatology practices, and independent MedSpa operators. Regulators such as the USFDA, EMA, NMPA, and PMDA play a crucial role, while insurers and public health systems are gaining influence in therapeutic adoption pathways. This interconnected ecosystem ensures market continuity but also drives competitive pressure and pricing challenges at every level.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Botulinum Toxins Market, By Type

Within the botulinum toxins market, Type A toxins lead due to their proven safety, effectiveness, and regulatory approvals across many therapeutic and aesthetic applications. Brands such as Botox, Dysport, Xeomin, and Jeuveau continue to grow their market share by leveraging solid clinical validation and widespread practitioner familiarity. The trend within Type A is shifting toward differentiation by formulation, with companies developing long-lasting and liquid-stable toxins to extend treatment effectiveness and make administration easier. Although less common, Type B toxins are gaining renewed interest for patients who develop resistance or antibodies to Type A products. However, the limited number of brands and narrower approval base have kept Type B use confined to niche therapeutic cases. Over the forecast period, Type A is expected to further solidify its dominance, while Type B may see selective growth among resistant patient populations..

Botulinum toxins Market, By Application

In terms of end-use applications, the trend is toward premiumization through innovation, with long-acting formulations and aesthetic-specific products differentiating offerings. Conversely, biosimilar toxins mostly produced in South Korea and China are reshaping the market by introducing aggressive pricing strategies. Aesthetic applications remain the main focus, making up the largest share, driven by younger consumers seeking preventive treatments and older populations pursuing rejuvenation. The aesthetic trend is shifting from one-time treatments to preventive maintenance and combination therapies, where toxins are paired with fillers, lasers, or skin boosters to improve results. On the therapeutic side, botulinum toxins are becoming more mainstream for treating neurological conditions such as spasticity, chronic migraines, cervical dystonia, and blepharospasm, with increasing inclusion in reimbursement lists in North America and Europe. New applications in urology (overactive bladder), gastroenterology, and psychiatry (depression and anxiety) are in clinical trials and represent the biggest future trend, as they could significantly expand the therapeutic use of botulinum toxins..

Botulinum toxins Market, By End user

End user adoption patterns mirror broader healthcare and aesthetic delivery trends. Hospitals and specialty clinics continue to dominate therapeutic applications, supported by neurologists, urologists, and pain specialists who integrate into structured treatment plans. The trend in this segment leans toward payer-driven adoption, where insurance coverage and clinical guidelines increasingly determine usage levels. In the botulinum toxins market, dermatology clinics and medspas represent the largest and fastest-growing demand segments. Medspas are fueling procedural volumes in North America and Asia-Pacific, with younger consumers preferring less clinical, more lifestyle-oriented service environments. A notable trend is the consolidation of medspa chains, creating institutional buyers with greater bargaining power. Lastly, rehabilitation and physiotherapy centers constitute a small but rising segment, especially in Europe, where indications related to spasticity and mobility are expanding therapeutic demanded

REGION

North America is expected to hold a significant market share in global botulinum toxins market

Regional growth patterns show clear differences. North America remains the largest and most developed market, supported by strong infrastructure, brand loyalty to AbbVie’s Botox, and high disposable incomes. However, consolidation among medspas and dermatology groups is shifting demand patterns and increasing negotiations with manufacturers. The Asia Pacific is the fastest-growing region, driven by South Korea’s leadership in aesthetics, China’s rapid biosimilar growth, and medical tourism centers in Thailand and Singapore. Europe shows steady adoption of therapies, although fragmented reimbursement systems lead to uneven demand. Meanwhile, Latin America and the Middle East are emerging as high-growth markets, especially Brazil and the Gulf states, where aesthetic awareness is rising and private clinics dominate service delivery.

Botulinum Toxins Market: COMPANY EVALUATION MATRIX

The competitive landscape for the global botulinum toxins market can be segmented into market leaders and niche innovators/emerging players. Leaders such as AbbVie, Ipsen, and Revance hold significant market share and continue to push innovation, with AbbVie maintaining dominance through brand strength and a wide range of indications. Challengers such as Medytox, Daewoong, Hugel, and Evolus are growing quickly, often using regional strengths and biosimilar pipelines to challenge the leader's dominance. Niche innovators like Revance focus on unique formulations, such as long-acting toxins, to clearly differentiate themselves from competitors. Value-driven companies, especially Chinese and Korean biosimilar manufacturers, are transforming the market by offering low-cost products that improve access in price-sensitive areas. This landscape shows a market where innovation, regulatory approval, and pricing strategies will shape long-term leadership roles..

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 8.11 Billion |

| Market Forecast in 2030 (value) | USD 15.72 Billion |

| Growth Rate | 12.0% |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Procedure) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Product Type: Type A, Type B; Product: Botox, Dysport, Jeaveau, Xeomin, Myobloc, Other Products; Age Group: 17 years or younger, 18–34 Years Old, 35–50 Years Old, 51–64 Years Old, 65 Years Or Older; Application: Aesthetics, Therapeutics, Other Application |

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Botulinum Toxins Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Medical Aesthetic Company |

|

|

| Medical Aesthetic Manufacturer |

|

|

RECENT DEVELOPMENTS

- February 2025 : Daewoong Pharmaceutical Co., Ltd. (South Korea) launched NABOTA, its high-purity botulinum toxins product, in Saudi Arabia after receiving approval from the Saudi Food and Drug Authority (SFDA). This expansion aims to strengthen Daewoong's presence in the Middle East.

- January 2025 : Hugel, Inc. (South Korea) secured approval for Botulax in the United Arab Emirates, covering both aesthetic and therapeutic indications, including eyelid spasm and upper extremity muscle spasticity.

- October 2024 : AbbVie, Inc. (US) received approval for Botox Cosmetic (onabotulinumtoxinA) to treat moderate to severe vertical platysma bands (neck lines), expanding its aesthetic indications in the US.

Table of Contents

Methodology

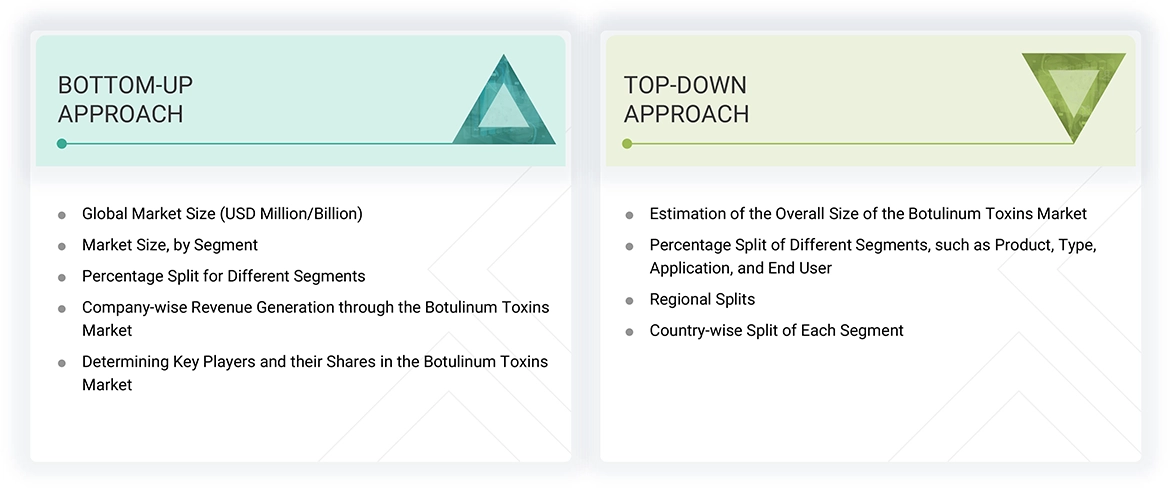

This study balanced primary and secondary research for the botulinum toxins market by analyzing various market variables affecting small, medium, and large businesses. The next step involved conducting primary research with industry experts along the value chain to validate the findings, assumptions, and market sizing. Multiple methodologies were employed to estimate the overall market size, including both top-down and bottom-up approaches.

The study encompasses significant market segments, evolving trends, regulatory frameworks, and competitive dynamics. It also examines leading market players and the strategies they employ in this sector. In conclusion, the total market size was estimated using a combination of top-down and bottom-up approaches, and data triangulation, to finalize the market size. Primary research was conducted throughout the study to validate and test each hypothesis.

Secondary Research

During the study, secondary research utilized a range of sources, including directories and databases like Bloomberg Businessweek, D&B Hoovers, and Factiva. Additional materials included white papers, annual reports, SEC filings, and investor presentations. This research approach was adopted to collect and analyze data that provides comprehensive, technical, and market-focused insights into the botulinum toxins market. The findings offer insights into key players and market segmentation based on recent industry trends, as well as significant developments within the market. A database comprising leading industry figures was also created as part of this secondary research.

Primary Research

Primary research involved activities designed to gather both qualitative and quantitative data. A variety of individuals from both the supply and demand sides were questioned during this phase. On the supply side, key figures such as CEOs, vice presidents, directors of marketing and sales, directors of technology and innovation, and other important leaders were interviewed by industry experts. On the demand side, primary sources included academic institutions and research organizations. This research aimed to validate market segmentation, identify prominent market participants, and gain insights into significant industry trends and market dynamics through a real-world primary study.

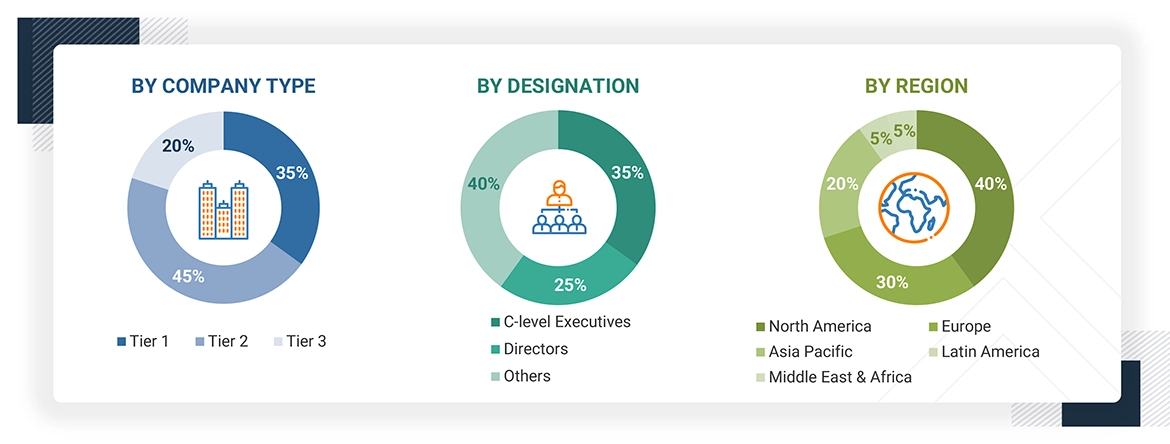

A breakdown of the primary respondents is provided below:

Note 1: Others include distributors, suppliers, product managers, business development managers, marketing managers, and sales managers.

Note 2: Companies are categorized into tiers based on their total revenue. As of 2024, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

This report provides an analysis of the global botulinum toxins market size by reviewing the revenue shares of prominent companies. Key players with significant market shares were identified through secondary research, and their revenue from botulinum toxin sales was calculated and subsequently validated through primary research. The secondary research included an analysis of annual and financial reports from leading market participants. Meanwhile, the primary research involved in-depth interviews with key thought leaders, such as directors, CEOs, and marketing executives.

Segmental revenues were determined based on the revenue mapping of service and product providers to calculate the global market value. The process involved the following steps:

- Generating a list of key players that operate in the botulinum toxins market at the regional or global levels.

- Mapping the products of manufacturers of botulinum toxins and related product lines at the regional level.

- Mapping the revenues of listed players from botulinum toxins and related products.

- Mapping the revenues of major players to cover at least ~90% of the global market share as of 2024.

- Extrapolating the mapped revenues of players to arrive at the global market value for the respective segment.

- Summing up the market value for all segments and subsegments to achieve the actual value of the global botulinum toxins market.

Data Triangulation

After estimating the overall market size, the botulinum toxins market was divided into segments and subsegments. The overall market engineering process was finalized using data triangulation and market segmentation techniques to obtain accurate statistics for all segments and subsegments. This triangulation involved studying and analyzing various trends and factors from both the demand and supply sides. Furthermore, the botulinum toxins market data were verified and validated using both top-down and bottom-up approaches.

Market Definition

Botulinum toxins are neurotoxic proteins produced by the bacterium Clostridium botulinum. They block signaling between nerves and muscles, resulting in temporary muscle relaxation. This substance is used in both aesthetic procedures and therapeutic treatments. Additionally, it is regulated as a prescription biologic in most markets.

Stakeholders

- Medical Aesthetic Clinics

- Cosmetic Product Manufacturers

- Aesthetic Device Manufacturers

- Pharmaceutical Companies

- Hospitals and Surgical Centers

- Aesthetic Product Retailers

- Medical Spas and Beauty Spas

- Cosmetologists and Plastic Surgeons

- Media and Influencers

- Medical Aesthetics Device Distributors and Suppliers

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the size of the botulinum toxins market based on product, type, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global botulinum toxins market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the global botulinum toxins market

- To analyze key growth opportunities in the global botulinum toxins market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions: North America (US and Canada), Europe (Germany, France, the UK, Spain, Italy, and the RoE), Asia Pacific (Japan, China, India, Australia, South Korea, and the RoAPAC), Latin America (Brazil, Mexico, RoLA), and the Middle East & Africa (GCC Countries and RoMEA)

- To profile the key players in the botulinum toxins market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global botulinum toxins market, such as product launches, agreements, expansions, and mergers & acquisitions

Key Questions Addressed by the Report

What is the projected market value of the botulinum toxins market?

The global market for botulinum toxins is projected to reach USD 17.3 billion by 2030.

What is the estimated CAGR of the botulinum toxins market for the next five years?

The market is projected to grow at a CAGR of 14.1% from 2025 to 2030.

Which product segment of the botulinum toxins market will have the highest market share?

The Botox segment is projected to hold the highest market share due to its wider adoption.

What are the major revenue pockets in the botulinum toxins market currently?

Asia Pacific is expected to grow at the highest pace, driven by expanding opportunities in China and India.

Who are the key players operating in the botulinum toxins market?

Key players include AbbVie Inc. (US), Ipsen Biopharmaceuticals Inc. (France), Galderma (Switzerland), Hugel, Inc. (South Korea), Revance Therapeutics, Inc. (US), Evolus, Inc. (US), Medytox, Inc. (South Korea), Merz Pharmaceuticals GmbH (Germany), Supernus Pharmaceuticals, Inc. (US), Daewoong Pharmaceutical Co., Ltd. (South Korea), Huons Co., Ltd. (South Korea), Eisai Co., Ltd. (Japan), and Hugh Source (International) Ltd. (Hong Kong).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Botulinum Toxins Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Botulinum Toxins Market