Bulk Disposable Medical Tubing Market

Bulk Disposable Medical Tubing Market by Material (Plastic, Rubber, Specialty Polymers), Structure (Single-Lumen, Multi-Lumen, Co-Extruded, Braided), and Region – Bulk Disposable Market Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

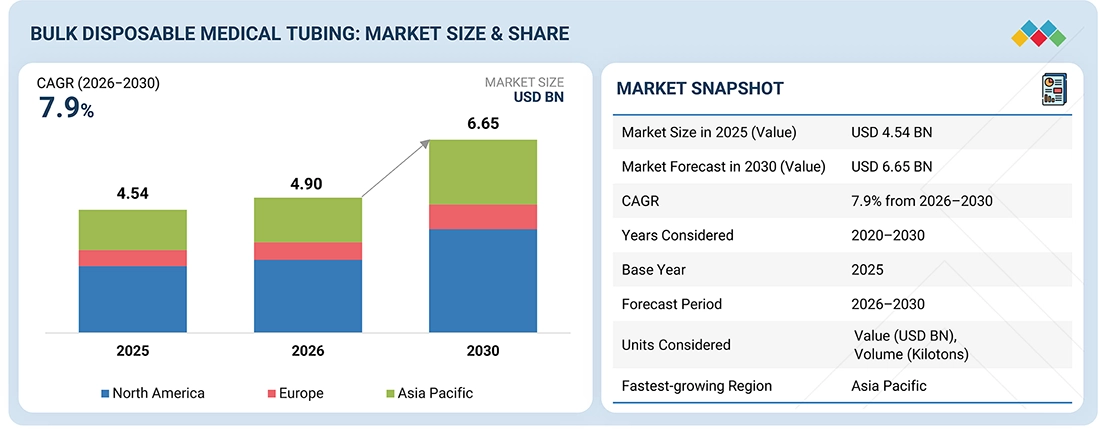

The bulk disposable tubing market is projected to grow from USD 4.90 billion in 2026 to USD 6.65 billion by 2030 at a compound annual growth rate (CAGR) of 7.9% during the forecast period. This market covers disposable medical tubing used in high-volume procedures, such as infusion therapy, dialysis, respiratory care, and drug delivery via IV. A significant factor driving market growth is the increasing demand for sterile, single-use components, which help minimize the risk of infections. This demand is further fueled by the expansion of hospitals and a rise in outpatient treatments. Additionally, trends such as the conversion to PVC-free materials, rapid-scale manufacturing by original equipment manufacturers (OEMs), and more stringent health and safety regulations are also contributing to market growth.

KEY TAKEAWAYS

-

By RegionNorth America dominated the bulk disposable medical tubing market, with a share of 34%, in terms of value, in 2025.

-

By MaterialBy material, the specialty polymers segment is projected to grow at the highest CAGR of 8.40% in the bulk disposable medical tubing market during the forecast period.

-

By StructureBy structure, the single-lumen segment is estimated to account for the largest share (35%) of the bulk medical tubing market, in terms of value, in 2026.

-

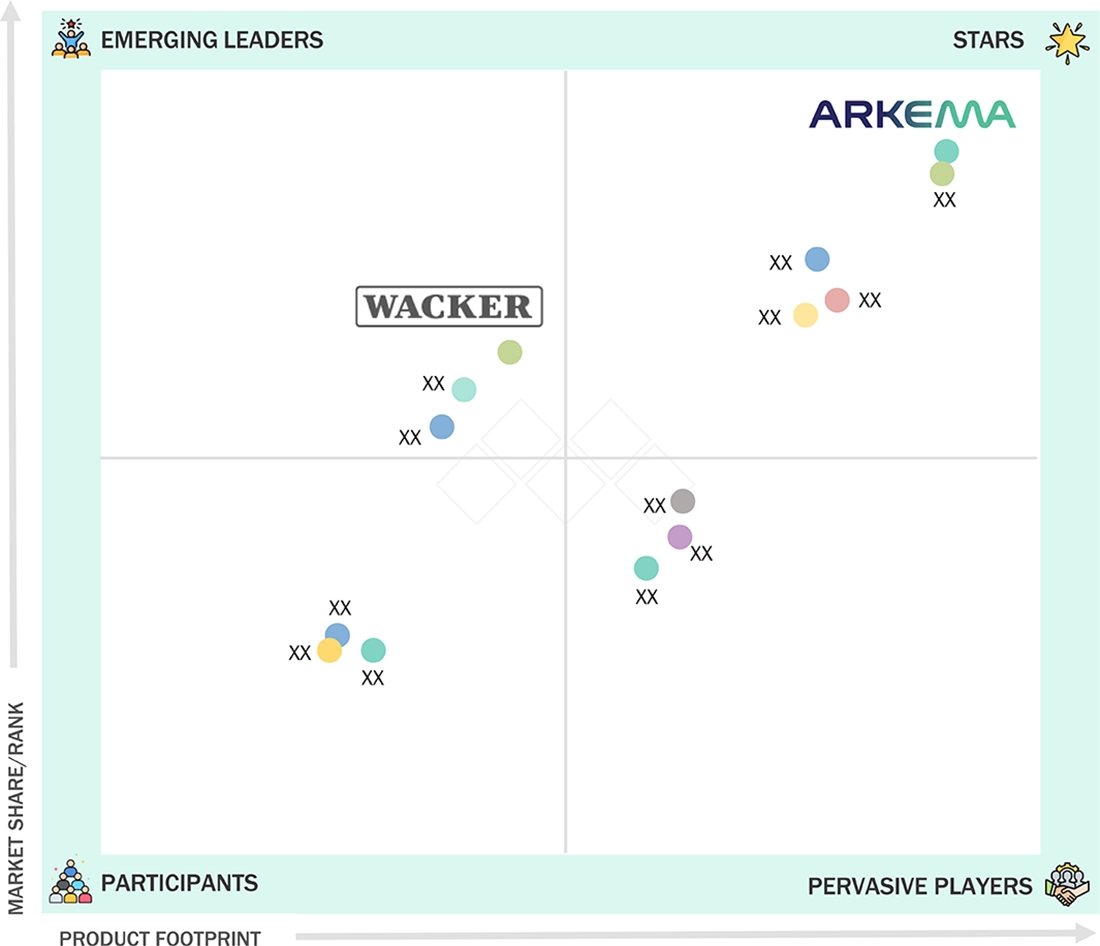

Competitive Landscape - Key PlayersArkema, Dow, and Elkem ASA were identified as star players in the bulk disposable medical tubing market, given their strong market share and product footprint.

-

Competitive Landscape - Startups/SMEsjMedtech, Cubit Medisurge, and Ami Polymer have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The bulk medical tubing market is steadily advancing, driven by an increasing demand for less-invasive devices, the opening of new hospital facilities, and the growth of home healthcare practices. All of these factors require high-quality, biocompatible tubing. The market is also evolving due to new agreements and developments, such as strategic partnerships between original equipment manufacturers (OEMs) and material suppliers. Additionally, there is significant investment in research and development, advancements in technology, and the creation of strong alloys and eco-friendly composites.

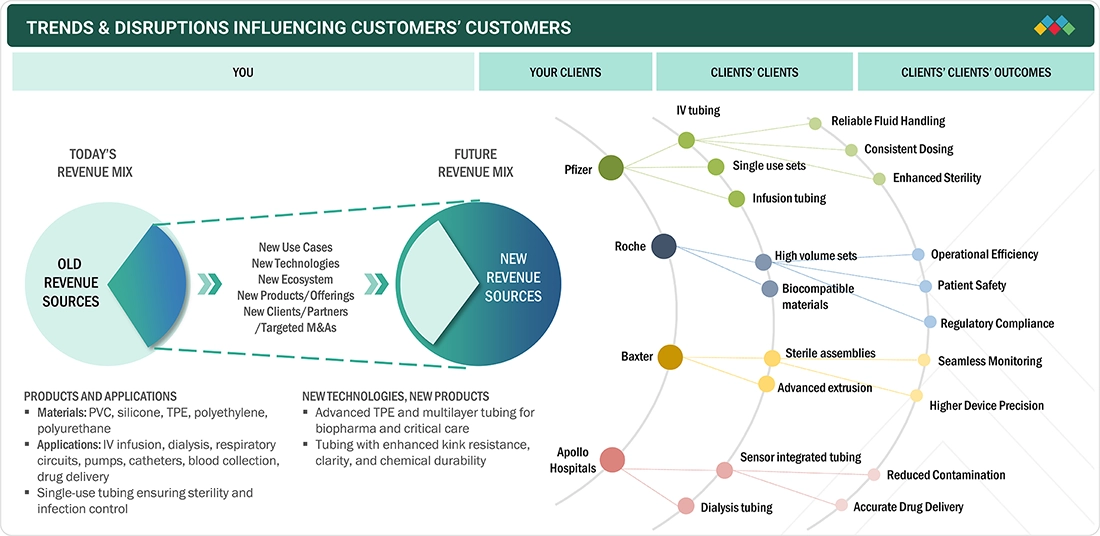

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The disposable medical tubing market is consistently growing due to an increase in procedure volumes, stricter infection control policies, and a greater reliance on single-use consumables across different healthcare settings like hospitals, clinics, and home care. In addition, the creation of new medical hospitals in the Asia Pacific region has played a significant role in boosting the demand for medical tubing, which has now shifted to high-quality, biocompatible, and cost-effective tubing. Additionally, the bulk disposable tubing market is evolving through the partnerships of OEMs and suppliers, the technological advancements in extrusion and sterilization, and the launch of PVC-free materials and sustainable polymer alternatives.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid expansion of point-of-care and emergency treatment centers

-

Rise in infection-control audits and sterility compliance

Level

-

Volatile raw material prices

-

Limited recyclability of single-use tubing

Level

-

Growth of mobile health units and temporary clinics

-

Adoption of closed-loop fluid management systems

Level

-

Maintaining sterility and consistent quality at extremely high production speeds

-

Competition from low-cost regional manufacturers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rise in infection-control audits and sterility compliance

A significant growth in the bulk disposable medical tubing market can be attributed to the rising number of infection-control audits and stricter compliance with sterility standards. Healthcare institutions—including hospitals, ambulatory care, and emergency care units—are under constant pressure from governmental regulatory bodies, accreditation agencies, and internal quality control teams to reduce healthcare-associated infections (HAIs). As a result, the shift from reusable tubing, which can become contaminated due to improper reprocessing, to single-use pre-sterilized tubing has been substantial. This transition ensures patient safety and eliminates the risk of infection transfer. The demand for high-volume disposable tubing is driven by mandatory sterility procedures for manufacturing intravenous (IV), enteral, dialysis, respiratory, and surgical suction systems, as well as their application in hospitals. Additionally, routine infection-control audits encourage hospitals to maintain larger stocks of single-use supplies, facilitating quicker patient turnover. Global standards, such as ISO 80369 for connector safety, along with hygiene programs at the facility level, play a crucial role in the widespread acceptance of disposable sets, which help minimize human errors in sterilization. With infection prevention teams advocating for safer workflows, original equipment manufacturers (OEMs) are producing tubing that offers higher levels of sterility assurance. This, in turn, improves compliance and fosters ongoing market growth for disposable medical tubing across all care settings.

Restraint: Volatile raw material prices

Volatility in the prices of raw materials poses a significant challenge for the bulk disposable medical tubing market. Manufacturers of these products rely heavily on medical-grade polymers, the prices of which fluctuate due to global oil prices, supply chain disruptions, and petrochemical production cycles. Key raw materials for bulk disposable medical tubing include PVC, silicone, thermoplastic elastomers (TPE), and polyurethane. When there is a sudden increase in resin prices, production costs rise accordingly. This is particularly impactful in areas with high-volume disposable tubing, such as IV sets, oxygen lines, feeding systems, and dialysis circuits, where profit margins are already thin. Smaller and mid-sized manufacturers are the most affected, as they often lack long-term supply contracts and struggle to absorb cost fluctuations without raising product prices. These price fluctuations complicate inventory planning, procurement strategies, and budgeting for OEMs and healthcare providers. Additionally, the growing demand for PVC-free and specialty polymers, compounded by geopolitical uncertainties and intermittent shortages of medical-grade raw materials, further exacerbates price instability. Such volatility not only hinders capacity expansion but also reduces the likelihood of investments in new extrusion lines or advanced material research and development. Ultimately, this boosts the overall growth and competitiveness of the bulk disposable medical tubing market.

Opportunity: Growth of mobile health units and temporary clinics

The rise of mobile health units and temporary clinics presents a significant opportunity for the bulk disposable medical tubing market. These facilities require large quantities of portable, sterile, and easy-to-deploy medical consumables. Mobile clinics are being deployed for vaccination campaigns, maternal care, emergency responses, chronic disease monitoring, and rural healthcare outreach. As a result, they need to be well-stocked with IV tubing, oxygen and suction lines, enteral feeding tubes, and disposable catheter sets, as these are essential supplies for quick and efficient patient care. Disposable tubing is also a fundamental necessity for temporary field hospitals, which may be established during disease outbreaks, natural disasters, or mass-casualty incidents. By using disposable tubing, hospitals can avoid the complications of setting up complex sterilization systems while still maintaining a consistent level of infection control, even in resource-limited settings. As governments and NGOs in the Asia Pacific (APAC) region and emerging markets invest more in mobile healthcare to improve access to care, the demand for low-cost, durable, and pre-sterilized tubing is rapidly increasing. Additionally, the global pandemic preparedness initiative and the shift towards decentralized care models are promoting the faster adoption of disposables. This trend creates long-term growth potential for manufacturers who provide compact, easy-to-transport packaging, universal connectors, and multi-purpose disposable tubing systems designed for mobile medical operations.

Challenge: Maintaining sterility and consistent quality at extremely high production speeds

The production of bulk disposable medical tubing presents significant challenges, particularly in maintaining sterility and consistent quality at high production speeds. Manufacturers face constant pressure to meet the demands of hospitals, original equipment manufacturers (OEMs), and emergency care facilities. High-volume extrusion and assembly lines must operate quickly while still adhering to critical parameters, such as wall thickness, lumen size, and tensile strength. As production speeds increase, maintaining these precision levels becomes more challenging. Even a slight change in temperature, pressure, or material flow can lead to defects that compromise either sterility or the product's final performance. Additionally, the requirement for advanced cleanroom environments to control contamination, along with thorough inspections by ISO and GMP certifying bodies, adds complexity to the sterile manufacturing process during high-speed production. Creating and sustaining sterile conditions necessitates stringent contamination-control protocols and frequent validation under these standards. Automated inspection systems, which utilize vision-based and laser measurement technologies, aid in defect detection. However, integrating these systems into the manufacturing process without slowing down output remains a technical and financial challenge. As OEMs seek quicker delivery times and larger batch sizes, manufacturers find themselves in a dilemma: balancing speed with quality assurance. This necessitates investment in sophisticated equipment, skilled labor, and robust process controls—all of which significantly increase operational costs and complicate scalability for small and mid-sized companies.

BULK DISPOSABLE MEDICAL TUBING MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Supply specialty fluoropolymers and medical-grade resins for chemically resistant, low-friction, and sterilizable medical tubing and devices | High chemical resistance | Long shelf life | Reliable sterilization | Strong drug compatibility. |

|

Provide medical-grade elastomers and polymers for IV sets, infusion tubing, and flexible connectors with OEM formulation support | High clarity | PVC-free options | Efficient extrusion | Strong regulatory compliance |

|

Offer medical-grade silicones for coatings, catheters, and tubing to improve softness, durability, and surface performance | Enhanced biocompatibility | Reduced friction | Patient comfort | Sterilization stability |

|

Manufacture specialty polymers for tubing, barrier resins, and anti-kink, antimicrobial medical components | Superior kink resistance | Better fluid transfer | Reliable sealing | Quick custom prototyping |

|

Produce polyolefins for cost-effective, high-volume disposable medical tubing and packaging | Low material cost | Consistent extrusion quality | Scalable production | Dimensional stability |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The bulk disposable medical tubing ecosystem consists of several key participants. Raw material suppliers provide medical-grade polymers, silicones, thermoplastics, and specific additives to high-volume tubing manufacturers. These manufacturers produce cost-effective, sterilization-ready, and biocompatible tubing suitable for end users such as hospitals (such as Apollo Hospitals), home care clinics, diagnostics centers (such as Roche), biomedical research facilities (such as John Hopkins Medicine), and healthcare companies (such as Baxter). Intermediaries, such as distributors, contract development and manufacturing organizations (CDMOs), and medical device original equipment manufacturers (OEMs), also play a crucial role in the large-scale assembly, packaging, and transportation of disposable tubing sets to healthcare facilities worldwide. North America, Europe, and Asia Pacific (APAC) boast strong manufacturing bases that not only ensure competitive pricing but also facilitate compliance with regulations and prompt shipping. Each participant of the ecosystem plays a vital role in the sourcing process, quality mass production, and availability of disposable tubing for essential medical and patient care applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Bulk Disposable Medical Tubing Market, By Structure

By structure, the bulk disposable medical tubing market includes single-lumen, co-extruded, multi-lumen, tapered, bump, and braided segments. Among these segments, the single-lumen tubing segment is projected to account for the largest share during the forecast period due to the extensive use of single-lumen tubing in high-volume disposable products, such as IV sets, oxygen lines, and suction tubing. Co-extruded and multi-lumen tubing caters to more specific needs. Similarly, tapered, bump, and braided tubing is increasingly utilized in niche markets that require greater flexibility or durability.

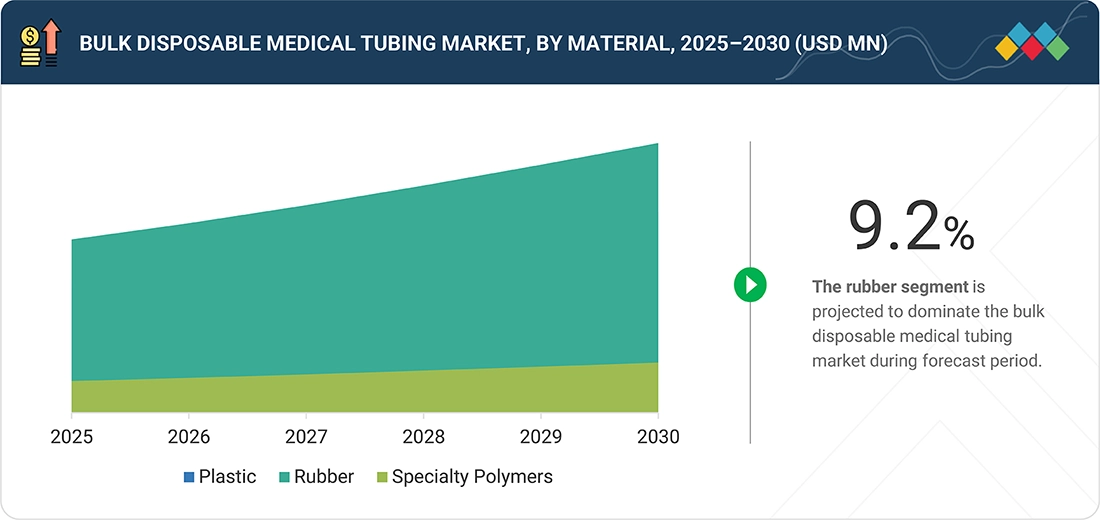

Bulk Disposable Medical Tubing Market, By Material

By structure, the bulk disposable medical tubing market features a variety of materials, including rubber, plastic, specialty polymers, and others. The market for rubber, which covers silicone and thermoplastic elastomers (TPE), is projected to lead the market during the forecast period. Silicone and thermoplastic elastomers (TPE) offer flexibility, biocompatibility, and suitability for critical care applications. Plastic is used for cost-effective disposable products, while specialty polymers and bioabsorbable materials are chosen for more specialized applications, such as drug delivery.

REGION

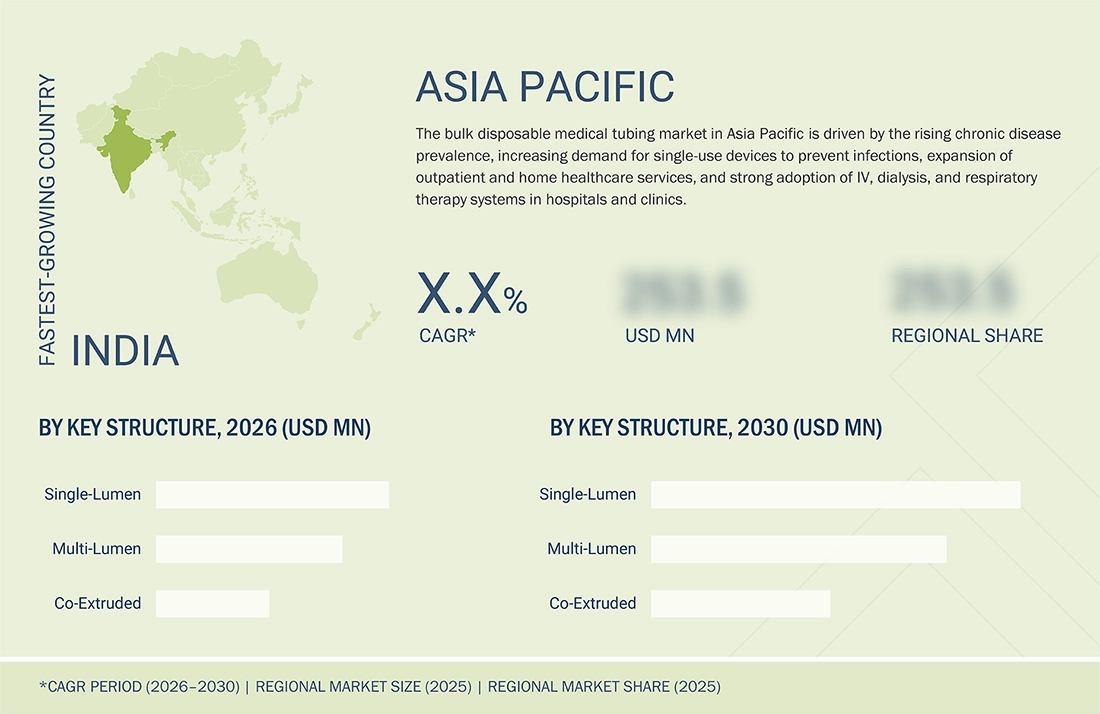

Asia Pacific is projected to be the fastest-growing region in the bulk disposable tubing market during the forecast period

The Asia Pacific region is projected to be the fastest-growing market for bulk disposable medical tubing. This growth is driven by the rapid development of healthcare infrastructure; an increasing prevalence of chronic diseases, such as diabetes and kidney diseases; and a rising demand for less invasive procedures and outpatient surgeries. Additionally, the presence of robust manufacturing hubs in countries like China, India, and Southeast Asia contributes to this market expansion. These countries benefit from low production costs and a high adoption of single-use, sterile tubing solutions.

BULK DISPOSABLE MEDICAL TUBING MARKET: COMPANY EVALUATION MATRIX

Arkema (Star) has risen to the top position in the global bulk disposable medical tubing market mainly due to its cooperation with big OEMs and healthcare providers and to its remarkable specialty polymers, high-performance resins, and engineered additives for medical tubing. On the other hand, Wacker Chemie (Emerging Player) is becoming a strong competitor through its increasing range of silicone-based and elastomeric solutions for disposable applications. The company utilizes its know-how in high-purity silicones and polymer formulations to advance the somewhat not-so-long growth areas of single-use infusion, dialysis, and respiratory care systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- 1. Arkema (France)

- 2. Dow (US)

- 3. Elkem ASA (Norway)

- 4. Kuraray (Japan)

- 5. LyondellBasell (Netherlands)

- 6. Shin-Etsu Chemical (Japan)

- 7. Teknor Apex (US)

- 8. The Lubrizol Corporation (US)

- 9. Wacker Chemie (Germany)

- 10. Westlake Chemical (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 4.54 Billion |

| Market Forecast in 2030 (Value) | USD 6.65 Billion |

| Growth Rate | CAGR of 7.9% from 2026–2030 |

| Years Considered | 2020–2030 |

| Base Year | 2025 |

| Forecast Period | 2026–2030 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe |

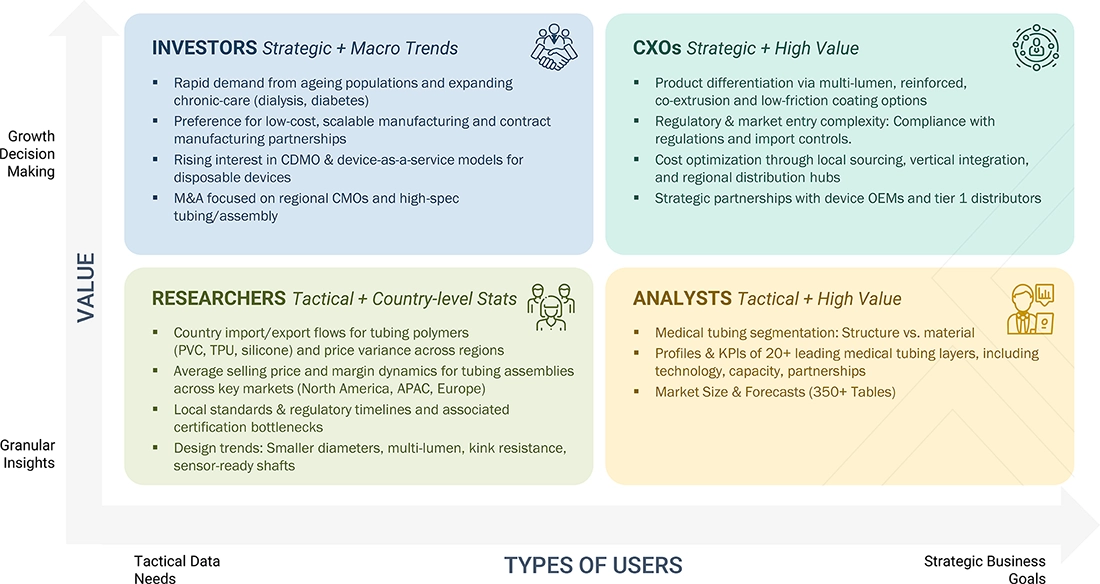

WHAT IS IN IT FOR YOU: BULK DISPOSABLE MEDICAL TUBING MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Medical Device OEM |

|

|

| Hospital & Healthcare System Provider (Global) |

|

|

| Contract Manufacturer/CDMO | Custom tubing reels, cut-to-length assemblies, automated connector bonding, sterile double-bagging, EO/gamma validation support and on-demand production ramps |

|

| Catheter & Cannula Manufacturer | Low-friction inner coatings, tapered tips, reinforced braid options, and coated single-use catheter tubing in standardized reels for downstream assembly |

|

| Drug Delivery & Infusion System Provider | Precision single-lumen tubing for infusion pumps, metered-flow tubing, integrated luer interfaces, and tubing validated for drug compatibility and extractables/leachable |

|

RECENT DEVELOPMENTS

- January 2025 : Arkema and ALBIS partnered to distribute high-performance medical-grade polymers, supporting innovation and efficiency in bulk disposable medical tubing for the healthcare market.

- November 2024 : Lubrizol signed an MoU with Polyhose to set up a medical tubing manufacturing facility near Chennai, India. This was a strategic move to multiply local tubing capacity and support 'Make-in-India' supply.

- November 2024 : Teknor Apex introduced new medical-grade TPE compounds (Medalist® series) optimized for biopharma tubing. The compounds would provide improved clarity, reduced spallation, and pump compatibility for disposable tubing applications.

- May 2024 : Dow announced an MOU with SCGC to convert 200 ktpa of plastic waste into circular products to support the development of PVC-free and recycled polymer solutions applicable to high-volume medical tubing.

- February 2022 : Shin-Etsu continued large investments and broadened silicone tubing product lines and processing capabilities for medical applications to strengthen mass-production capacity for silicone tubing.

Table of Contents

Methodology

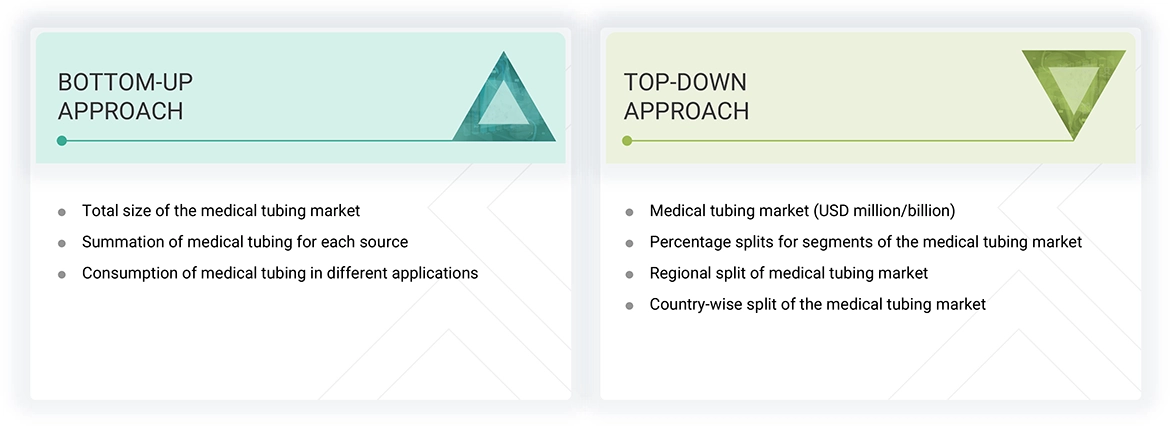

The study involved four major activities for estimating the current size of the bulk disposable medical tubing market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of bulk disposable medical tubing through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the bulk disposable medical tubing market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred, to identify and collect information for this study on the bulk disposable medical tubing market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The bulk disposable medical tubing market comprises several stakeholders in the supply chain, which include raw material suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the bulk disposable medical tubing market. Primary sources from the supply side include associations and institutions involved in the bulk disposable medical tubing market, key opinion leaders, and processing players.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the bulk disposable medical tubing market by material, application, structure, and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders such as directors and marketing executives to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the bulk disposable medical tubing market from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Bulk disposable medical tubing is flexible, hollow tubing used in a range of medical and pharmaceutical uses for the transfer of fluids and gases. Bulk disposable medical tubing is a critical component in healthcare environments for uses including drug delivery, respiratory therapy, catheters, intravenous (IV) therapy, and peristaltic pumps. Bulk disposable medical tubing is produced from materials such as silicone, polyvinyl chloride (PVC), thermoplastic elastomers (TPE), and polyethylene, providing biocompatibility, chemical resistance, and flexibility. The market for bulk disposable medical tubing is growing due to improving healthcare spending, expanding demand for minimally invasive treatments, and technological innovation in medical devices. The growing prevalence of chronic diseases, such as cardiovascular diseases and diabetes, has also fueled demand for bulk disposable medical tubing solutions.

Stakeholders

- Bulk Disposable Medical Tubing Manufacturers

- Raw Material Suppliers

- Regulatory Bodies and Government Agencies

- Distributors and Suppliers

- End-Use Industries

- Associations and Industrial Bodies

- Market Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the size of the bulk disposable medical tubing market in terms of value and volume.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To forecast the market size based on material, application, structure, and region.

- To forecast the market size for the five main regions—North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa (MEA),—along with their key countries.

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders.

- To strategically profile leading players and comprehensively analyze their key developments such as new product launches, expansions, and deals in the bulk disposable medical tubing market.

- To strategically profile key players and comprehensively analyze their market shares and core competencies.

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Bulk Disposable Medical Tubing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Bulk Disposable Medical Tubing Market