Butyraldehyde Market

Butyraldehyde Market by Product Type (N-Butyraldehyde, Isobutyraldehyde), Application (Chemical Intermediates, Rubber Accelerators, Synthetic Resins, Plasticizers, Other Applications), End-use Industry (Automotive, Construction, Medical, Agriculture, Food & Beverage, Cosmetics, Other End-use Industries), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The butyraldehyde market is projected to reach USD 6.96 billion by 2030 from USD 5.49 billion in 2025, at a CAGR of 4.8% during the forecast period. The butyraldehyde market is largely influenced by its role as a chemical intermediate in the manufacture of 2-ethylhexanol (2-EH) and n-butanol, which are used to produce plasticizers, resins, coatings, and solvents, all of which have a variety of end-use industries.

KEY TAKEAWAYS

-

BY PRODUCT TYPEThe butyraldehyde market comprises N-Butyraldehyde and Isobutyraldehyde

-

BY APPLICATIONKey applications include chemical intermediate, rubber accelerator, synthetic resins, plasticizers, and others

-

BY END-USE INDUSTRIESKey end-use industries include automotive, construction, medical, agriculture, food & beverages, cosmetics, and other end-use industries.

-

BY REGIONThe butyraldehyde market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific is the largest market for butyraldehyde. Growing urbanization and infrastructure development, specifically in the Asia Pacific region, lead to an increasing demand for paints, adhesives, and synthetic materials from which butyraldehyde is sourced.

-

COMPETITIVE LANDSCAPEThe butyraldehyde market is shaped by the strong presence of global chemical giants such as BASF, Mitsubishi Chemical Group Corporation, and SABIC. These players are focusing on expanding production capacities, strengthening downstream integration, and developing advanced derivative applications to cater to the rising demand in plastics, coatings, and agrochemicals.

The increasing demand for butyraldehyde from end-use industries such as construction, automotive, and agriculture is driving the growth of the butyraldehyde market. Growing urbanization and infrastructure development, specifically in the Asia Pacific region, leads to an increasing demand in paints, adhesives, and synthetic materials from which butyraldehyde is sourced.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses, which in turn impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of butyraldehyde suppliers, which in turn impacts the revenues of butyraldehyde manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand from construction industry

-

Rising demand from automotive industry

Level

-

Volatile raw material prices

-

Stringent environment regulations

Level

-

Expansion in emerging economies

-

Shift toward sustainable production methods

Level

-

Supply chain disruptions

-

Competition from alternative chemicals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand from construction industry

The growth of the construction industry is a significant factor driving the butyraldehyde market, primarily because it is a key material in the production of polyvinyl butyral (PVB). PVB is used to create laminated safety glass, which is known for its strength, sound insulation, and UV protection. Safety glass plays an important role in both residential and commercial buildings; it is commonly used in windows, facades, and skylights, making it the most prevalent type of glass found in construction projects.

Restraint: Volatile raw material prices

Fluctuating raw material prices represent a major restraint to the butyraldehyde market, and this is primarily because butyraldehyde production, and indeed a large portion of synthetic organic chemistry, relies on petrochemical feedstocks, such as propylene and synthesis gas (a mixture of hydrogen and carbon monoxide). Each of these inputs is subject to, not only crude oil and natural gas prices, but these prices are affected by worldwide geopolitical tensions, supply chain interruptions, and energy policy changes, as well. Rising prices of raw materials stem from crude oil and natural gas prices; so if those prices increase unpredictably, then production costs for butyraldehyde increase, and producers have issues with production costs and profits, and do not have the flexibility to be competitive with their pricing.

Opportunity: Expansion in emerging economies

Expansion in emerging economies is a major opportunity for the growth of the butyraldehyde market. These countries are rapidly industrializing and urbanizing their economies, and all the end-use markets for butyraldehyde are growing. For example, countries such as India, China, Brazil, Indonesia, and Vietnam are exhibiting substantial increases in the construction, automotive, and agriculture, which are reliant on derivatives of butyraldehyde such as plasticizers, resins, and agrochemicals. Because of these changes in population, infrastructure spending, purchasing power, and the growth of the middle class, there has been an increase in demand for many types of materials such as flexible PVC, coatings, adhesives, and crop protection chemicals that all utilize butyraldehyde.

Challenge: Supply chain disruptions

Competition from alternative chemicals is a significant challenge for the butyraldehyde market due to changing industry preferences, changing environmental regulations, and advances in material science. However, there is an increasing tension around the environmental and health impacts of petrochemical solutions, and consumers are demanding greener, safer alternatives. For example, in sectors like plasticizers, there is a larger shift toward using phthalate-free plasticizers and bio-plasticizers that have the potential to perform similarly to traditional plasticizers while having a lower environmental impact.

Butyraldehyde Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integration of butyraldehyde-derived coatings and adhesives in body panels, interiors, and exterior finishes | Superior surface durability, scratch and chemical resistance, premium finish quality, and longer component life |

|

Use of butyraldehyde-based plasticizers in flexible PVC for wiring harnesses, seals, and interior components | Enhanced flexibility and safety in wiring, extended durability of seals, and reduced material degradation under heat and stress |

|

Application of butyraldehyde-based coatings, adhesives, and protective resins in large-scale infrastructure projects | Increased weather resistance, lower lifecycle costs, improved environmental compliance, and extended structure lifespan |

|

Use of butyraldehyde-derived plasticizers and resins in high-performance concrete admixtures and sealants | Enhanced workability of concrete, longer durability of structures, reduced maintenance costs, and improved sustainability in building materials |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The butyraldehyde market has a complex ecosystem, including manufacturers, raw material suppliers, distributors, governments, and end-user industries. Prominent companies in this market include well-established, financially stable manufacturers of butyraldehyde. These companies have been operating in the market for several years and possess diversified product portfolios and strong global sales and marketing networks.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Butyraldehyde Market, by Product Type

N-Butyraldehyde is the largest product type in the butyraldehyde market due to its extensive use as an important intermediate in the production of various high-volume chemicals. It is primarily manufactured for the production of 2-ethylhexanol (2-EH) and n-butanol, which are essential building blocks for creating plasticizers, solvents, and resins. These materials are utilized across multiple industries, including construction, automotive coatings and paints, and consumer goods. The high demand for n-butyraldehyde stems from the increasing need for 2-EH and its derivatives. This demand is largely driven by the use of dioctyl phthalate (DOP), a common plasticizer found in flexible PVC products.

Butyraldehyde Market, by Application

The chemical intermediate segment is the fastest-growing application in the butyraldehyde market, primarily because of its fundamental use in the manufacture of a significant number of industrial chemicals. The continuing demand for flexible polyvinyl chloride (PVC) products, coatings, and adhesives has often been associated closely with the proliferation of these derivatives, fueling the same downstream consumption of butyraldehyde as their current demand will also require consumption of butyraldehyde as a chemical intermediate. At the same time, the growing investment in chemical manufacturing, especially in developing countries, is reinforcing production capacities and applications of butyrylhyde-based intermediates.

Butyraldehyde Market, by End-use Industry

As construction activity rises globally, especially in developing economies like China, India, and Southeast Asia, many governments are investing heavily in the sector. They are seeking cost-effective, durable, and high-performance materials that are economically manageable to replace or maintain. The demand for advanced, flexible materials is increasing due to urbanization, population growth, and enhanced government initiatives in infrastructure. Additionally, the trend toward sustainable and energy-efficient buildings is driving the use of various coatings and materials, many of which are produced using butyraldehyde or products derived from butyraldehyde.

REGION

Asia Pacific to be fastest-growing region in global butyraldehyde market during forecast period

The rapid growth in countries such as China, India, Japan, and Korea is driving an increasing demand for products derived from butyraldehyde, including plasticizers, coatings, adhesives, and resins. The Asia Pacific region has emerged as a major hub for chemical manufacturing, benefiting from abundant raw materials, competitive labor, and government policies that promote foreign direct investment. Concurrently, the rising demand for agrochemicals, fueled by the need to support a growing population, is also contributing to the increased consumption of butyraldehyde.

Butyraldehyde Market: COMPANY EVALUATION MATRIX

In the butyraldehyde market matrix, Oxea (Star) stands out as a leading player with a strong product footprint and extensive downstream integration, particularly in oxo-alcohols and plasticizer intermediates that are widely used across construction, automotive, and coatings industries. Perstorp (Emerging Leader) is steadily gaining momentum by focusing on specialty applications and sustainable process innovations, strengthening its position in niche butyraldehyde derivatives. While Oxea dominates the market with scale and breadth, Perstorp demonstrates high growth potential and is well-positioned to advance further toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.22 Billion |

| Market Forecast in 2030 (Value) | USD 6.96 Billion |

| Growth Rate | CAGR of 4.8% from 2025-2030 |

| Years Considered | 2022–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Product Type: N-Butyraldehyde and Isobutyraldehyde By Application: Chemical Intermediate, Rubber Accelerator, Synthetic Resins, Plasticizers, and Others By End-use Industry: Automotive, Construction, Medical, Agriculture, Food & Beverages, Cosmetics, a |

| Regions Covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Butyraldehyde Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Construction Chemical Manufacturer | • Profiling of regional demand for butyraldehyde derivatives (e.g., plasticizers, resins, coatings) • Analysis of raw material supply chains (propylene, oxo-alcohols) • Competitive benchmarking of major suppliers in APAC & EU markets | • Identified cost-effective sourcing clusters for large-scale construction projects • Revealed shifts from conventional solvents to eco-friendly derivatives • Enabled targeting of sustainable building material opportunities |

| Automotive OEM & Component Supplier | • Demand mapping for butyraldehyde-based coatings, sealants, and fuel additives • Cost-benefit analysis of butyraldehyde in lightweight material processing • Forecasting adoption of bio-based butyraldehyde for EV components | • Supported transition toward greener automotive coatings • Pinpointed substitution opportunities in fuel and lubricant additives • Strengthened competitive positioning in EV value chains |

| Medical & Pharmaceutical Manufacturer | • Assessment of butyraldehyde as a precursor in pharma intermediates and specialty drugs • Mapping regulatory requirements (FDA, EMA) for butyraldehyde derivatives • Market sizing of medical adhesives & specialty resins | • Highlighted high-margin opportunities in specialty pharma intermediates • Uncovered compliance-driven differentiation in regulated markets • Enabled innovation pipeline for advanced medical adhesives |

| Specialty Chemical Producer | • Comparative study of N-Butyraldehyde vs. Isobutyraldehyde derivatives • Technology assessment of oxo-alcohol downstream applications • End-user demand mapping across consumer goods & paints | • Identified emerging revenue streams in coatings & adhesives • Provided roadmap for shifting to sustainable, bio-based feedstocks • Strengthened partnerships with fast-growing consumer industries |

RECENT DEVELOPMENTS

- August 2023 : Perstorp inaugurated its new greenfield facility in Sayakha, Gujarat, in August. This marks the company's first major investment in India and signifies an expanding presence in the rapidly growing Asian market. This strategic investment enhances Perstorp's ability to meet the rising regional demand for critical intermediates, including butyraldehyde and its derivatives, across various end-use markets.

Table of Contents

Methodology

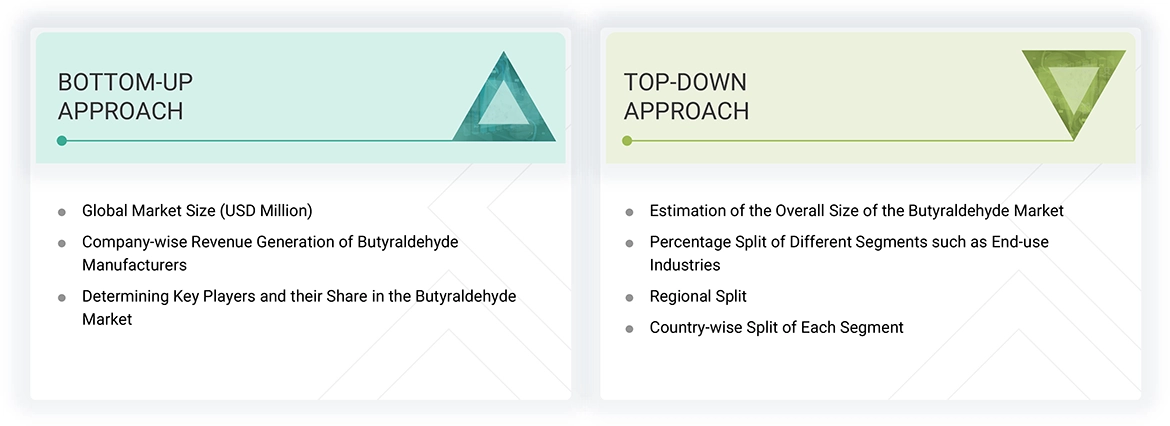

The study involves two main activities to estimate the current market size for butyraldehyde. Extensive secondary research was conducted to gather information on the overall, related, and parent markets. The next step was to validate these findings, assumptions, and estimates with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to determine the total market size. Then, market segmentation and data triangulation were applied to estimate the sizes of segments and subsegments.

Secondary Research

Secondary sources used for this research include financial statements of companies offering butyraldehyde and information from various trade, business, and professional associations. Secondary research has been utilized to gather critical information about the value chain, the total pool of key players, market classification, and segmentation based on industry trends at the most detailed level, including regional markets. The secondary data was collected and analyzed to determine the overall size of the butyraldehyde market, which primary respondents validated.

Primary Research

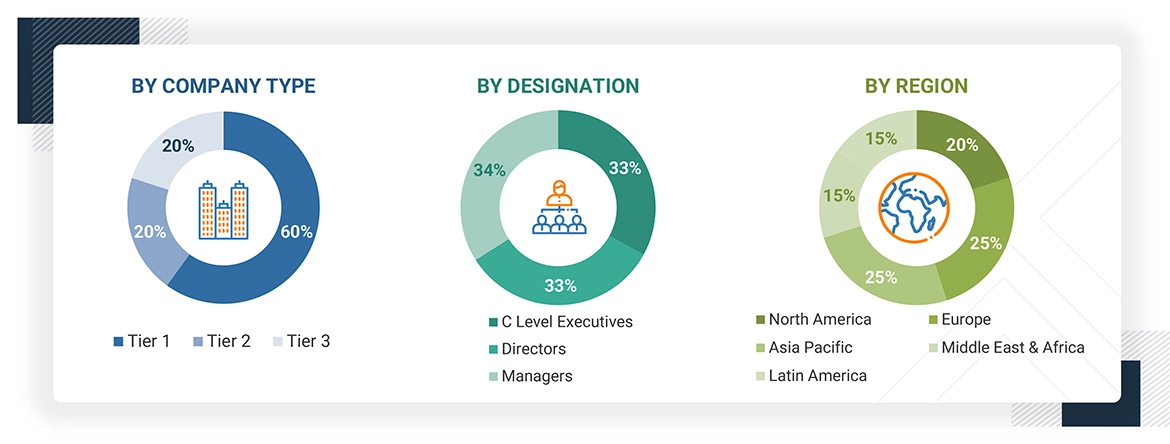

Extensive primary research was performed after gathering information on the butyraldehyde market through secondary research. Several interviews were conducted with market experts from both the demand and supply sides across key countries in North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Data was collected via questionnaires, emails, and phone calls. From the supply side, sources included industry professionals such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors of business development, marketing, product development/innovation teams, and other key executives from vendors, material providers, distributors, and opinion leaders in the butyraldehyde industry. These interviews provided insights into market statistics, revenue data from products and services, market segmentation, market size estimates, forecasts, and data triangulation. They also helped identify trends related to product types, applications, end-use industries, and regions. Stakeholders from the demand side, including CIOs, CTOs, CSOs, and installation teams from end-user companies seeking butyraldehyde, were interviewed to gain their perspectives on suppliers, product offerings, component providers, current usage, and future outlooks, which influence the overall market.

Breakup of Primary Research

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the butyraldehyde market includes the following details. The market sizing was conducted from the demand side. The market expanded based on the demand for butyraldehyde in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the butyraldehyde industry for each application. For each end-use, all possible segments of the butyraldehyde market were integrated and mapped.

Data Triangulation

After determining the overall size from the market size estimation process described above, the total market was divided into various segments and subsegments. The data triangulation and market breakdown methods outlined below were applied, where applicable, to complete the overall market analysis and determine precise statistics for different market segments and subsegments. The data was triangulated by examining various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Butyraldehyde, also called butanal, is a colorless, flammable liquid aldehyde with the chemical formula C4H8O. It is an important intermediate in organic synthesis and serves as a core building block in many industrial processes. Made mainly through propylene hydroformylation (oxo process), butyraldehyde has a strong odor and is highly reactive due to its aldehyde group. Its versatility is important as a precursor for producing chemicals like 2-ethylhexanol, n-butanol, trimethylolpropane, and various plasticizers and resins. These derivatives are key components in products such as coatings, adhesives, lubricants, and solvents. Butyraldehyde plays a crucial role in supply chain integration in the global chemical industry, especially in petrochemical and specialty chemical markets. Its demand is closely linked to economic trends and sectors like automotive, construction, and consumer goods.

Stakeholders

- Butyraldehyde manufacturers

- Butyraldehyde distributors and suppliers

- End-use industries

- Universities, governments, and research organizations

- Associations and industrial bodies

- R&D institutes

- Environmental support agencies

- Investment banks and private equity firms

- Research and consulting firms

Report Objectives

- To define, describe, and forecast the butyraldehyde market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global butyraldehyde market based on product type, application, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What primary factor is propelling the growth of the butyraldehyde market?

Increasing demand from the construction industry is the primary factor propelling the butyraldehyde market.

How is the butyraldehyde market segmented?

This report segments the butyraldehyde market based on product type, application, end-use industry, and region.

What are the major challenges in the butyraldehyde market?

Supply chain disruptions and competition from alternative chemicals are the major challenges in the butyraldehyde market.

What are the major opportunities in the butyraldehyde market?

Expansion in emerging economies and a shift toward sustainable production methods are the major opportunities in the butyraldehyde market.

Which region has the largest demand?

Asia Pacific stands out as having the highest demand for butyraldehyde.

Who are the major manufacturers of butyraldehyde?

BASF (Germany), Mitsubishi Chemical Group Corporation (Japan), SABIC (Saudi Arabia), Eastman Chemical Company (US), KH Neochem Co., Ltd. (Japan), Perstorp (Sweden), OXEA GmbH (Germany), Grupa Azoty (Poland), LG Chem (South Korea), and Aurochemicals (US).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Butyraldehyde Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Butyraldehyde Market