C5ISR Market Size, Share and Trends

C5ISR Market by Solution (Hardware, Software, and Services), End User (Army, Navy, Airforce, and Government & Law Enforcement), Installation (New Installations, and Upgrades) and Region - Global Forecast to 2029

OVERVIEW

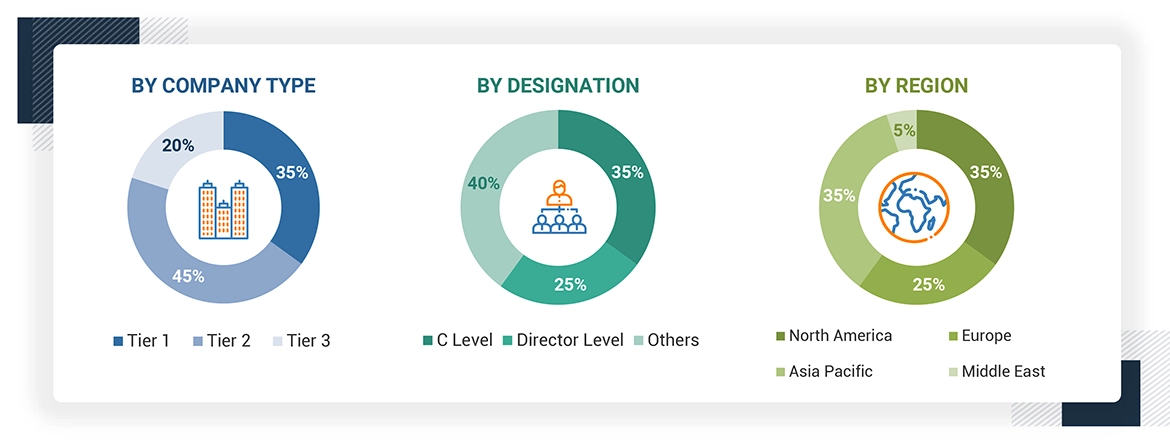

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The C5ISR market is projected to reach USD 19,280.8 million by 2029, from USD 10,720.1 million in 2024, at a CAGR of 12.5%. The C5ISR market is expanding rapidly due to rising global security demands, modernization programs, and the adoption of advanced technologies such as AI, big data, and cloud computing. Growing asymmetric threats and multi-domain operational needs are driving investment in integrated hardware and software systems across land, air, sea, and cyber domains.

KEY TAKEAWAYS

-

By RegionThe North America C5ISR market accounted for a 94.7% revenue share in 2024.

-

By SolutionBy Solution, the Software segment is expected to register the highest CAGR of 19.0%.

-

By End UserBy End User, the Army segment is expected to dominate the market during the forecast period (2025-2030)

-

By InstallationBy Installation, the New Installatinon segment is expected to be the fastest growing segment, with a CAGR of 12.6%

-

CL- KeyLockheed Martin, General Dynamics and Airbus were identified as some of the star players in the Aircraft Platform Market, given their strong market share and product footprint.

-

CL- SME & StartupsManTech International, MAG Aerospace, and Sigma Defense Systems among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The aerospace materials market is witnessing steady growth, driven by the rising demand for lightweight, high-performance materials such as aluminum alloys, titanium, and advanced composites to enhance fuel efficiency, reduce emissions, and meet stringent safety standards. New deals and developments, including strategic partnerships between OEMs and material suppliers, investments in recycling technologies, and innovations in high-strength alloys and sustainable composites, are reshaping the industry landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The shift in the C5ISR market shows a clear transition from legacy surveillance systems toward new revenue sources driven by AI-enabled battle management, unmanned ISR platforms, and advanced EO/IR and software-defined capabilities. Future revenue growth will be shaped by connected battle management systems and 5G-enabled situational awareness, with armed forces and defense contractors emerging as the primary beneficiaries of this technological evolution.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Evolving Cybersecurity Threats

-

Need for enhanced situational awareness to support decision making in emergency response

Level

-

Regulatory Constraints related to technology tranfer

-

High development and sustainment costs

Level

-

Technological advancements

-

Increasing need for interoperability between military devices/technologies

Level

-

Data storage and transmission limitations

-

Integration challenges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Evolving Cybersecurity Threats

As defense networks become more interconnected, cyber threats such as ransomware and state-sponsored intrusions are intensifying, pushing militaries to strengthen cybersecurity within C5ISR systems. This is driving demand for advanced threat detection, response mechanisms, and real-time analytics to protect critical infrastructure. As a result, integrated cybersecurity-focused C5ISR capabilities are expected to grow significantly.

Restraint: Regulatory Constraints related to technology tranfer

Regulatory constraints around defense technology transfer remain a major barrier for C5ISR manufacturers, who must comply with stringent export controls, licensing rules, and anti-proliferation requirements. Many countries restrict the export of sensitive C5ISR systems, limiting market access and subjecting technologies to extensive risk assessments. Ongoing geopolitical disputes, such as the US–China trade tensions and accusations of forced technology transfer, have further tightened regulations and increased tariffs on critical defense components, adding complexity for global suppliers.

Opportunity:Technological advancements

Technological advancements are creating strong growth opportunities in the C5ISR market, as emerging capabilities in AI, machine learning, and edge computing enhance real-time data processing, threat detection, and multi-domain interoperability. Secure cloud-based architectures and next-generation communications are expanding the scope of C5ISR applications, enabling faster decision-making and seamless information-sharing across forces. As security threats intensify, governments are increasing investments in advanced, scalable C5ISR technologies, driving sustained long-term demand and innovation in the sector.

Challenge: Data storage and transmission limitations

C5ISR systems generate massive volumes of real-time data from sensors and communication networks, often exceeding the capacity of existing storage and transmission infrastructures. Bandwidth constraints and slow data retrieval create bottlenecks that undermine mission-critical decision-making, especially in fast-moving operational environments. As imaging, surveillance, and cloud-based analytics grow more advanced, there is rising demand for next-generation data compression, edge computing, and secure high-speed networks to overcome these limitations and maintain C5ISR system performance.

C5ISR MARKET SIZE, SHARE AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Modernization of network infrastructure through the NetModX program to test and refine advanced C5ISR systems in realistic operational environments. | Accelerates technology validation, enhances operational readiness, and ensures solutions align with real battlefield requirements. |

|

Deployment of the Sigma Defense ISR solution using the Stingray Tactical Relay to enable real-time integration and sharing of ISR data at the tactical edge. | Improves timely decision-making, strengthens sensor-to-shooter connectivity, and enhances overall mission effectiveness. |

|

Development of new firmware and the MIG server to enable interoperability between Iridium SBD devices and JBC-P systems. | Restores seamless communication, improves C2 and situational awareness messaging, and ensures reliable connectivity across networks. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The C5ISR ecosystem is driven by close coordination between research bodies, major defense integrators, and military end users. Organizations such as NASA, DSTL, and DARPA fuel technological innovation, while leading solution providers including Lockheed Martin, Northrop Grumman, BAE Systems, RTX, and Leonardo translate these advances into deployable C5ISR capabilities. These systems are ultimately adopted by armed forces and national security agencies across the US, UK, Canada, and allied nations, enabling enhanced mission readiness and multi-domain operational effectiveness.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

C5ISR Market, By Solution

In 2024, the software segment emerged as the fastest-growing area of the C5ISR market, supported by rising adoption of cyber warfare tools, AI-enabled analytics, and mission-management applications. Software is expanding rapidly as defense organizations prioritize real-time data processing, secure network operations, and advanced decision-support capabilities across multi-domain environments.

C5ISR Market, By End User

As of 2024, the Army remained the largest end-user segment in the C5ISR market, reflecting sustained investment in battlefield communication systems, surveillance platforms, and integrated command-and-control capabilities. Its dominant share underscores the continued need for robust C5ISR solutions to support ground-based operations, enhance situational awareness, and enable effective decision-making across diverse mission scenarios.

C5ISR Market, By Installation

In 2024, new installations represented the fastest-growing installation segment, militaries modernize their infrastructure with next-generation communication networks and sensor-integration platforms. The demand for new C5ISR deployments highlights the global shift toward upgraded, high-performance systems capable of meeting evolving operational and multi-domain intelligence requirements.

REGION

North America to be fastest-growing region in global aerospace materials market during forecast period

Europe is the fastest-growing region driven by rising security concerns, advancing defense technologies, and the push for stronger interoperability among NATO members seeking seamless communication and data-sharing capabilities. Countries across the region are rapidly integrating C5ISR systems to enhance situational awareness, improve response times, and support joint operations in complex environments. Continued initiatives such as the European Defence Fund are further accelerating innovation and deployment across the continent.

C5ISR MARKET SIZE, SHARE AND TRENDS: COMPANY EVALUATION MATRIX

In the C5ISR market, Lockheed Martin (Star) holds a leading position supported by its broad C5ISR portfolio, strong integration capabilities, and long-standing presence across major defense programs. The company’s extensive deployment base and advanced solutions in communications, surveillance, and battle management reinforce its dominance. Northrop Grumman (Emerging Leader) is rapidly strengthening its position through innovation in next-generation ISR platforms, sensor fusion technologies, and autonomous data-processing systems. While Lockheed Martin leads through scale and system integration expertise, Northrop Grumman demonstrates strong potential to move toward the leaders’ quadrant as demand for advanced multi-domain C5ISR capabilities continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Lockheed Martin Corporation (US)

- RTX (US)

- General Dynamics Corporation (US)

- BAE Systems (UK)

- Leonardo S.p.A (Italy)

- Thales (France)

- Northrop Grumman (US)

- Elbit Systems Ltd (Israel)

- Rheinmetall AG (Germany)

- L3Harris Technologies Inc (US)

- Saab AB (Sweden)

- Airbus (Netherlands)

- Indra Sistemas S.A (Spain)

- CACI International Inc (US)

- Leidos (US)

- Serco Group plc (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 10,720.1 Million |

| Market Forecast in 2029 (Value) | USD 19,280.8 Million |

| Growth Rate | CAGR of 8.4% from 2025-2030 |

| Years Considered | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East |

WHAT IS IN IT FOR YOU: C5ISR MARKET SIZE, SHARE AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Aircraft OEM |

|

|

| Composite Material Manufacturer |

|

|

| Engine Manufacturer |

|

|

| Raw Material Supplier |

|

|

| Defense Contractor |

|

|

RECENT DEVELOPMENTS

- September 2024 : Airbus (France) and Rohde & Schwarz (Germany) signed a Memorandum of Understanding to improve the technological connectivity offering for the Royal Navy. This strategic collaboration aims to provide the Royal Navy with enhanced communication resilience by leveraging the latest technologies and expertise from both companies.

- September 2024 : Airbus finalized the acquisition of Infodas, a german company that provides cybersecurity and IT solutions in the public sector including for defense and critical infrastructures.

- July 2024 : CACI International Inc (US) secured a five-year task order worth up to USD 414 million to provide the U.S. Army Combat Capabilities Development Command (DEVCOM) with expertise and support for unmanned systems as part of the Command, Control, Communications, Computers, Cyber, Intelligence, Surveillance, and Reconnaissance (C5ISR) Center's efforts to address evolving threats.

Table of Contents

Methodology

This research study involved the substantial use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information on the C5ISR market. Primary sources included experts from core and related industries, suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information as well as assess prospects for the growth of the market during the forecast period.

Secondary Research

The market size of companies offering C5ISR solutions was arrived at based on the secondary data available through paid and unpaid sources, as well as by analyzing the product portfolios of major companies and rating them based on their performance and quality.

In the secondary research process, various secondary sources were referred to identify and collect information for this study. These included government sources; corporate filings such as annual reports, press releases, and investor presentations; white papers, journals, and certified publications; and articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s value and supply chain and identify the key players by various products, market classifications, and segmentation according to their offerings and industry trends related to the solution, end user, installation, and region, and key developments from both the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included various industry experts, such as vice presidents (VPs), directors from business development, marketing, product development/innovation teams, and related key executives from components vendors, C5ISR solutions providers, and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from products, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped us understand the various trends related to applications, solutions, systems, and regions. Stakeholders from the demand side, such as CIOs (Chief Information Officer), CTOs (Chief Technology Officer), and installation teams of customers/end users of C5ISR solutions, were interviewed to understand the buyer’s perspective on suppliers, products, component providers, their current use of C5ISR solutions, and the outlook of their businesses.

Note: Tiers of companies are based on their revenue in 2023. Tier 1: company revenue greater than USD 1 billion; tier 2: company revenue between USD 100 million and USD 1 billion; and tier 3: company revenue less than USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

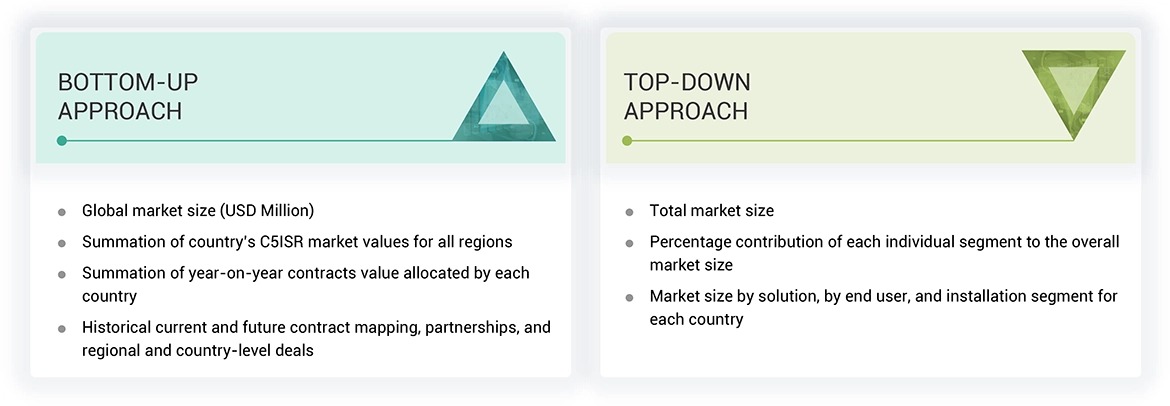

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the C5ISR market. The research methodology used to estimate the market size includes the following details.

Key players in the C5ISR market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews with leaders such as directors, engineers, marketing executives, and other stakeholders of leading companies operating in the C5ISR market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the C5ISR market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

C5ISR Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for C5ISR solutions segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was also validated using both top-down and bottom-up approaches.

Market Definition

C5ISR is an acronym for Command, Control, Computers, Communications, Cyber, Intelligence, Surveillance, and Reconnaissance. It is an integrated framework used primarily by military and defense organizations to manage and utilize a wide range of technologies and operations. Here's a breakdown of each component:

- Command: The exercise of authority and direction by a designated commander over assigned and attached forces in the accomplishment of a mission.

- Control: The process through which commanders ensure that commands are executed correctly and efficiently.

- Communications: The systems and methods used for transmitting information between different parts of a military organization.

- Computers: The hardware and software used to support command and control, communications, and intelligence operations.

- Cyber: The protection, defense, and exploitation of cyberspace to ensure information superiority and network security.

- Intelligence: The gathering, analysis, and dissemination of information that supports decision-making and strategic planning.

- Surveillance: The monitoring of activities, behavior, and information for intelligence gathering and security.

- Reconnaissance: The mission of obtaining information about an enemy or potential enemy, or about the terrain and weather conditions of an area.

The C5ISR market encompasses a wide range of technologies and systems that provide critical information and situational awareness to military and defense operations.

Key Stakeholders

- C5ISR Solution Providers

- Original Equipment Manufacturers (OEMs)

- Defense Procurement Agencies

- Regulatory Bodies

- System/Component Manufacturers

- System Integrators

- Software Developers

Report Objectives

- To define, describe, segment, and forecast the size of the C5ISR market based on solution, end user, installation, and region

- To forecast the size of market segments with respect to five regions, namely North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market shares and core competencies2

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis ,and revenue analysis of key players

- To analyze the degree of competition in the market by identifying key growth strategies, such as product launches, contracts, agreements, and partnerships, adopted by leading market players

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

- 5G: 5G technology means 5th generation of mobile network. It is a promising a significant advancement over its predecessors. It deliver fast speed, low latency, and increased connectivity compared to 3G and 4G. These quality of 5G is advantageous for military. This is because military need rapid data exchange and real-time communication . Also 5G enhances command and control by providing secure, and trusted communication networks that help complex operations. It aids in huge data sharing and give the military computer systems ability to exchange and make use of information between systems. This improves situational awareness and decision-making.

- Electronic warfare: Electronic warfare (EW) means the planned use of electromagnetic energy to gain advantage in military operations. It enhances the C5ISR capabilities by integrating electronic mechanisms into the framework of military operations. EW encompasses three components, including Electronic Attack (EA), Electronic Protection (EP), and Electronic Support (ES). They all play an important role in new age warfare by manipulating the electromagnetic spectrum to disrupt, deceive, or protect against enemy systems.

- Need for enhanced situational awareness to support decision-making in emergency response

- Rise in terrorism necessitating advanced C5ISR solutions

- Evolving cybersecurity threats

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the C5ISR Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in C5ISR Market