Calcium Acetate Market

Calcium Acetate Market by Function, Form (Powder, Granules, Solution), Application (Resins, Pharmaceutical Ingredients, Paints & Coatings, Detergents & Cleaning Agents, Food & Beverage Additives), End-use Industry, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The calcium acetate market is projected to grow from USD 0.14 billion in 2025 to USD 0.16 billion by 2030, at a CAGR of 4.0% during the forecast period. Calcium acetate market growth is mainly driven by the demand in pharmaceutical and nutraceutical applications. There is an increased demand for processed and fortified food, where calcium acetate is used as an acidity regulator and preservative.

KEY TAKEAWAYS

-

By RegionAsia Pacific is expected to be the fastest-growing market with a CAGR of 5.3% during the forecast period.

-

By End-Use IndustryThe pharmaceutical end-use industry is estimated to account for the largest share of 34.6% in the overall calcium acetate market in 2025.

-

By FormThe solution segment is projected to register the highest CAGR of 4.5% during the forecast period.

-

By FunctionBy function, the firming agent segment is projected to witness the highest CAGR during the forecast period.

-

By ApplicationThe pharmaceutical ingredients segment is estimated to be the largest application of calcium acetate during the forecast period.

-

COMPETITIVE LANDSCAPE- KEY PLAYERSCompanies such as Dr. Paul Lohmann GmbH & Co. KGAA, Kerry Group, and Jiangsu Kolod Food Ingredients Co., Ltd., among others, were identified as some of the star players in the calcium acetate market globally, given their strong market share and product footprint

-

COMPETITIVE LANDSCAPE- STARTUPSFoodchem International Corporation, Sinofi Ingredients, and JJ Chemical, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The expansion of the calcium acetate market is driven by the demand for mineral fortification in food & beverage products as consumers increasingly concentrate on bone health and preventive nutrition. Calcium acetate is increasingly used for pH control, preservation, and calcium supplementation.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Some notable trends and disruptions in the calcium acetate market include the trend toward high-purity, application-oriented grades and an increasing focus on regulatory compliance and traceability, particularly in pharmaceutical and food applications. Demand is shifting from commodities toward pharmacopeia-grade materials and custom formulations that provide consistent performance with clean-label positioning. Another significant trend is the increasing use of calcium acetate in multifunctional formulations, where it serves as a firming agent, regulates pH, and provides mineral fortification.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising burden of chronic kidney disease and demand for phosphate binder

-

Multifunctionality in food preservation and acid regulation

Level

-

Safety concerns and competitive shift to non-calcium binders

-

Price sensitivity and commodity competition in food/industrial segments

Level

-

Expansion in emerging dialysis markets

-

Circular economy and sustainable feedstocks

Level

-

Regulatory compliance and quality standards

-

Raw material price volatility

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising burden of chronic kidney disease and demand for phosphate binder

The rise in demand for therapeutics to treat phosphate is a major driver of the global calcium acetate market. Chronic kidney disease (CKD) is one of the main causes of the demand for phosphate-lowering therapies. Kidney function decreases in CKD, and the daily intake of phosphate is not easily removed by the kidneys, leading to high blood phosphate levels. Hyperphosphatemia is an independent risk factor for cardiovascular morbidity and mortality among patients with late-stage renal diseases. Calcium acetate has been the primary phosphate binder, as it is absorbed in the gut and thus goes straight to the intestine, where it makes phosphate insoluble by combining with it.

Restraint: Safety concerns and competitive shift to non-calcium binders

Calcium overload, leading to cardiovascular side effects, is a major factor limiting the use of calcium acetate in the pharmaceutical sector. Most systemic accumulations of calcium are caused by the use of calcium-based phosphate binders, which can lead to the adverse condition known as hypercalcemia, characterized by an increased risk of vascular calcification. Such health conditions become severe for patients with chronic kidney disease (CKD) and co-existing cardiovascular complications. Due to this, the available clinical guidelines in most regions recommend that calcium-based binders be restricted in patients with pre-existing hypercalcemia or clinical signs of arterial calcification. Non-calcium binders such as sevelamer and lanthanum carbonate are the first options, which have better safety profiles regarding calcium balance.

Opportunity: Expansion in emerging dialysis markets

Emerging markets, particularly in the Asia Pacific and Latin American regions, present a significant opportunity for growth of the calcium acetate market. These markets are currently witnessing a rapid increase in the prevalence of CKD, driven by aging populations and rising incidences of diabetes and hypertension. CKD prevalence in China alone accounts for tens of millions of individuals, with a significant proportion of this subset progressing to end-stage disease requiring dialysis. In many of these markets, cost remains a primary factor in determining treatment choice. Cheaper calcium-based phosphate binders, such as calcium acetate and calcium carbonate, are preferred over newer, non-calcium-based treatments.

Challenge: Regulatory compliance and quality standards

Regulatory compliance remains one of the most complex and expensive challenges for calcium acetate manufacturers, especially in the pharmaceutical and food sectors. Calcium acetate must conform to very strict standards in terms of pharmacopeia specifications such as USP, EP, BP, and JP when used as a phosphate binder or excipient. These specifications typically set limits for heavy metals, residual solvents, microbial load, and elemental impurities at very low levels, in conformity with the ICH Q3D guidelines. These specifications require the implementation of very extensive purification procedures, validated analytical methods, and continuous quality monitoring, which greatly increases the cost of manufacturing.

CALCIUM ACETATE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Used as a firming agent, acidity regulator, and calcium fortifier in processed foods, dairy alternatives, and nutrition products | Improved texture and shelf stability, enhanced calcium content, clean-label compliance, and support for nutritional fortification initiatives |

|

Utilized in pharmaceutical formulations, including phosphate binders and calcium supplementation products | High bioavailability, controlled calcium delivery, compliance with pharmacopeial standards (USP/EP), and reliable performance in regulated drug formulations |

|

Applied as an acidity regulator and stabilizer in beverages, flavored drinks, and functional nutrition offerings | Improved pH stability, consistent taste profile, extended product shelf life, and alignment with food safety and regulatory requirements |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The calcium acetate market ecosystem encompasses suppliers of upstream raw materials-calcium carbonate and acetic acid-to chemical manufacturers producing industrial, food, and pharmaceutical grades through controlled methods of synthesis and purification. Midstream players, including excipient manufacturers and distributors, tailor quality, particle characteristics, and regulatory compliance to suit the end-use requirements. Pharmaceutical, food & beverage, and selected industrial applications steer downstream demand, supported by regulatory authorities, certification bodies, and logistics partners.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Calcium Acetate Market, By Function

The firming agent segment accounts for the largest share of the calcium acetate market. The rising consumption of processed, ready-made, and convenience foods has increased the demand for firming agents that maintain the texture, structure, and shelf stability of fruits, vegetables, dairy alternatives, and meat analogues. Calcium acetate is increasingly preferred for its functional provision of firming, along with clean label, pH control, and mineral fortification attributes that are coherent with the evolving food safety and labeling regulations. Besides, growth in export-oriented food processing and cold-chain distribution is prompting manufacturers to adopt firming solutions that can ensure product quality during prolonged storage and transportation.

Calcium Acetate Market, By Application

The pharmaceutical ingredients segment is the fastest-growing application of calcium acetate. The increased clinical need, regulatory scrutiny, and additional therapeutic applications have all contributed to the widespread use of calcium acetate as a phosphate binder among patients with chronic kidney disease (CKD). One of the key reasons for the rising global consumption of pharmaceuticals is the increasing incidence of CKD. As drug manufacturers focus on quality, traceability, and regulatory compliance in their production, there is a growing demand for high-purity calcium salts.

Calcium Acetate Market, By Form

By form, the powder segment is estimated to account for the largest share of the calcium acetate market due to its versatility, ease of handling, and compatibility across different applications. The powdered form of calcium acetate exhibits excellent flowability, uniform blending, and accurate dosing, making it a favored ingredient in pharmaceutical and nutraceutical formulations, such as tablets, capsules, and sachets. It offers improved storage stability, transportation efficiency, and a longer shelf life compared to liquids or solutions.

Calcium Acetate Market, By End-use Industry

The food & beverage industry is the second-largest consumer of calcium acetate. Calcium acetate is used as a firming agent, acidity regulator, and preservative in various processed and packaged foods. It is used in fruits and vegetables, bakery products, dairy and dairy alternatives, and ready-to-eat meals for textural maintenance, pH control, and shelf-life extension. The rising emphasis on food safety, clean-label ingredients, and mineral fortification is further augmenting calcium acetate adoption.

REGION

Asia Pacific to be fastest-growing calcium acetate market during forecast period

The Asia Pacific is the fastest-growing calcium acetate market, driven by the rapid growth in pharmaceuticals, food processing, and industrialization in key economies such as China, India, and Southeast Asia. With rising healthcare spending, increasing production of generic drugs, and a growing number of lifestyle-related diseases, the region is experiencing strong growth in the manufacture of pharmaceutical products, driving demand for pharmacopeia-grade calcium acetate.

CALCIUM ACETATE MARKET: COMPANY EVALUATION MATRIX

Dr. Paul Lohmann (Star) dominates the calcium acetate market landscape, well-supported by a strong manufacturing experience, a broad customer base, and a diversified calcium acetate portfolio offering applications in pharmaceuticals, food, and industry. Its products find applications across regulated and high-value end uses such as pharmaceuticals, nutraceuticals, and food & beverage. On the other hand, Tengzhou Aolong Chemical Co., Ltd. (Emerging Leader) has been growing steadily due to its economically priced products, flexible production capabilities, and customized grades of calcium acetate suitable for industrial use and food-grade quality, particularly in price-sensitive and fast-growing markets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Dr. Paul Lohmann GmbH & Co. KGAA (Germany)

- Kerry Group (Ireland)

- Jiangsu Kolod Food Ingredients Co., Ltd. (China)

- Jiangsu Aolikai Food Technology Co., Ltd. (China)

- Macco (Canada)

- Fengchen Group Co., Ltd. (China)

- Vasa Pharmachem Pvt. Ltd. (India)

- Tengzhou Aolong Chemical Co., Ltd. (China)

- Shanxi Zhaoyi Chemical Co., Ltd. (China)

- Shandong Aojin Chemical Technology Co., Ltd. (China)

- Freudenberg Sealing Technologies (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 0.14 Billion |

| Market Forecast in 2030 (value) | USD 0.16 Billion |

| Growth Rate | CAGR of 4.0% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, North America, Europe, Middle East & Africa and South America |

WHAT IS IN IT FOR YOU: CALCIUM ACETATE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Pharmaceutical-Grade Calcium Acetate Manufacturer (US/EU) |

|

|

| Food & Beverage Ingredient Supplier |

|

|

| Global FMCG/Beverage Producer |

|

|

| Industrial Chemicals Manufacturer |

|

|

RECENT DEVELOPMENTS

- December 2021 : Kerry Group’s 2021 acquisition of Niacet for approximately USD 1.01 billion (€853 million) significantly strengthened its capabilities in food protection and preservation technologies. Niacet’s long-standing expertise in organic acids particularly acetates and its proprietary drying and granulation technologies enhanced Kerry’s ability to supply high-quality, pharma-grade and food-grade calcium acetate. With Niacet’s strong presence in bakery and pharmaceutical preservation and established operations in the US and the Netherlands serving more than 75 countries, the acquisition expanded Kerry’s global reach, technical depth, and capacity for producing reliable, customizable calcium acetate grades.

Table of Contents

Methodology

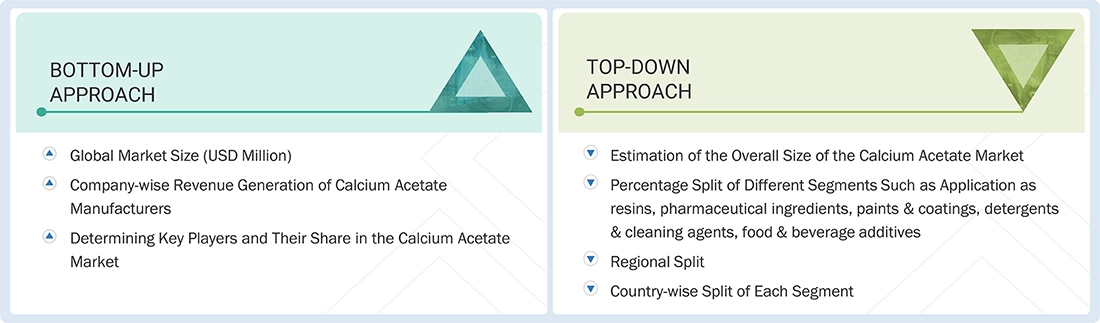

The study involves two major activities in estimating the current market size for the calcium acetate market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering calcium acetate and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the calcium acetate market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the calcium acetate market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from calcium acetate industry vendors; material providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to form, application, function, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking calcium acetate services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of calcium acetate and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the calcium acetate market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on the demand for calcium acetate in different end-use industries at a regional level. Such procurements provide information on the demand aspects of the calcium acetate industry for each end-use industry. For each end-use, all possible segments of the calcium acetate market were integrated and mapped.

Calcium Acetate Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The calcium acetate market includes all global production, distribution, and consumption of calcium acetate, an organic calcium salt of acetic acid, in a variety of forms and grades for use in applications ranging from pharmaceuticals to food & beverage to nutraceuticals and other industrial applications. The market comprises pharmacopeia (USP, EP, BP)-grade, food-grade, and industrial-grade calcium acetate, which is available primarily in powder and granular form.

Key Stakeholders

- Calcium acetateManufacturers

- Calcium acetate Distributors and Suppliers

- End-use Industries

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the calcium acetate market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and forecast the market form, application, function, end-use industry, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, partnerships & collaboration and new product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Available Customizations:

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the calcium acetate market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Calcium Acetate Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Calcium Acetate Market