Carbon Capture Materials Market

Carbon Capture Materials Market by Material (Liquid Solvents, Solid Solvents, Membranes), Process (Absorption, Adsorption), Technique (Pre-Combustion, Post combustion, Oxyfuel combustion, Direct air capture), End-Use Industry (Power Generation, Oil & Gas, Chemical & Petrochemical, Metal & Mining, Industrial, and Other End-use Industries) & Region - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The carbon capture materials market is projected to grow from USD 66.90 billion in 2025 to USD 99.09 billion by 2030, at a CAGR of 8.2% during the forecast period. Key factors driving the carbon capture materials market include stringent climate policies, rising corporate sustainability commitments, and technological advancements. Stringent government regulations compel industries to reduce greenhouse gas emissions, driving demand for efficient carbon capture materials. Corporations aiming to meet net-zero targets increasingly prioritize sustainable materials and carbon reduction, boosting market adoption.

KEY TAKEAWAYS

-

BY MATERIALCarbon capture materials include liquid solvents, solid solvents, and membranes, each playing a critical role in CO2 separation. Liquid solvents such as amines are the most widely used, offering mature large-scale applications, but face challenges of high energy demand and solvent degradation. Solid solvents, including functionalized porous materials, zeolites, and MOFs, are gaining attention for their high selectivity, stability, and lower regeneration energy needs. Membranes are emerging as cost-efficient alternatives due to their compact design, low operational costs, and scalability potential, particularly in gas separation and industrial decarbonization.

-

BY PROCESSCarbon capture processes are primarily divided into absorption and adsorption. Absorption dominates, with amine-based solutions widely deployed in large-scale facilities for capturing CO2 from power and industrial flue gases. However, issues such as corrosion, energy intensity, and solvent loss are driving innovation toward advanced solvent systems. Adsorption, which uses solid materials with high surface area, is witnessing rapid research interest due to its ability to operate at lower regeneration costs and provide high CO2 selectivity. Advances in engineered sorbents and hybrid materials are positioning adsorption as a strong contender for next-generation carbon capture.

-

BY TECHNIQUEThe market is segmented into post-combustion, pre-combustion, oxyfuel combustion, and direct air capture (DAC). Post-combustion capture leads due to its compatibility with existing industrial and power generation infrastructure. Pre-combustion is gaining adoption in integrated gasification combined cycle (IGCC) plants, while oxyfuel combustion is applied in niche high-purity CO2 streams. Direct Air Capture, though still at a nascent stage, is attracting heavy investment and partnerships due to its potential for large-scale negative emissions, with advancements in both solid sorbents and liquid solvent-based DAC systems.

-

BY END-USE INDUSTRYKey end-use industries include oil & gas, power generation, chemical & petrochemical, metal & mining, industrial, and others. Oil & gas continues to drive demand through enhanced oil recovery (EOR) and decarbonization mandates. Power generation is adopting carbon capture to retrofit coal and gas plants to meet emission reduction goals. The chemical and petrochemical sector uses CO2 capture for ammonia, hydrogen, and methanol production. Metal and mining industries are exploring capture for steel and cement plants, some of the hardest-to-abate sectors. Broader industrial uses and emerging applications in waste-to-energy and bioenergy with carbon capture and storage (BECCS) are further shaping the market.

-

COMPETITIVE LANDSCAPEThe carbon capture materials market is shaped by agreements, partnerships, capacity expansions, and partnerships among global leaders. Key players include Ecolab (US), BASF (Germany), DOW (US), MITSUBISHI HEAVY INDUSTRIES, LTD (Japan), Solvay (Belgium), Air Products and Chemicals, Inc. (US), Tosoh Corporation (Japan), Honeywell International Inc. (US), and Zeochem (Switzerland).

Carbon utilization, converting captured CO2 into fuels, chemicals, or construction materials, is a growing driver for the carbon capture materials market. This creates revenue streams, making CCS economically attractive and increasing demand for efficient capture materials like sorbents and membranes. The opportunity lies in supplying materials for CO2-to-product processes, such as synthetic fuels or concrete, which are gaining traction in Europe and Asia Pacific. Utilization reduces storage costs and supports circular economy models, encouraging industries to invest in capture technologies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The carbon capture materials market is experiencing rapid change, with several disruptive trends shaping how end users, ranging from energy producers to cement, steel, and chemical manufacturers approach carbon management. A major trend is the move toward next-generation materials such as MOFs, hybrid sorbents, and nanoporous polymers, which provide significantly higher selectivity and lower energy needs than traditional amine-based solvents. This disruption directly affects customer business models, as industrial emitters can now consider capture systems that are more cost-effective and less complex to operate. Another emerging disruption is the integration of carbon capture with utilization pathways (CCUS). Customers are increasingly looking for materials that not only capture CO2 but also support downstream valorization, such as synthetic fuels, methanol, or carbonates. This trend shifts carbon capture from a compliance cost into a potential revenue source for businesses. Consequently, companies are investing in pilot plants and forming partnerships with material developers to access scalable, utilization-ready capture materials.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising decarbonization pressure in energy-intensive industries

-

Stringent climate policies, carbon pricing mechanisms, and net-zero targets

Level

-

High energy requirement and cost burden in large-scale material regeneration

Level

-

Development of bio-derived and circular carbon capture materials

Level

-

Integration of capture systems with utilization and mineralization technologies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Stringent climate policies, carbon pricing mechanisms, and net-zero targets

Stringent climate policies, carbon pricing mechanisms, and net-zero targets are among the most significant drivers accelerating the adoption of carbon capture materials in the global market. Governments, industries, and international bodies have recognized the urgent need to mitigate climate change by reducing carbon dioxide emissions. This has led to the establishment of strict regulatory frameworks aimed at curbing greenhouse gas emissions across various sectors, especially heavy industries such as power generation, cement, and oil and gas. These policies compel companies to adopt carbon capture technologies to comply with emission limits, creating strong demand for advanced carbon capture materials that can effectively absorb, separate, or store CO2. Carbon pricing mechanisms, such as carbon taxes and cap-and-trade systems, further incentivize emission reductions by putting a tangible cost on carbon emissions. This economic driver encourages industries to invest in carbon capture solutions to lower their carbon liability and improve financial performance. By assigning monetary value to emissions, carbon pricing makes the deployment of carbon capture materials and technologies more attractive financially, fostering innovation and scaling efforts that bring down costs. Net-zero targets, which represent ambitious pledges by governments and corporations to achieve carbon neutrality by mid-century, are pushing industries to adopt carbon capture as part of their decarbonization strategies.

Restraint: High energy requirement and cost burden in large-scale material regeneration

The carbon capture materials market faces significant restraints primarily due to the high energy penalty and the substantial cost burden associated with large-scale material regeneration. The energy penalty refers to the additional energy consumption required for capturing and regenerating carbon capture materials, particularly solvents and adsorbents, during the capture process. This extra energy intake can be quite substantial, frequently increasing the overall energy requirements of the facility by 10% to 40%, depending on the technology and material used. This energy often comes from burning additional fossil fuels, which inadvertently generates more emissions, somewhat offsetting the intended benefits of carbon capture. The energy penalty is especially pronounced in post-combustion capture processes, where solvents like amines require significant heat for regeneration to release the absorbed CO2 for compression and storage. This elevated energy demand translates into higher operational costs, making carbon capture less economically attractive, especially for industries with thin profit margins. The capital costs for setting up the capture facilities, including necessary infrastructure for solvent regeneration and CO2 compression, combined with ongoing expenditure for energy, limit the scalability and widespread deployment of carbon capture systems. Large-scale material regeneration facilities need to be robust and able to maintain chemical stability over many cycles, which often requires expensive maintenance and replacement of capture materials due to degradation.

Opportunity: Development of bio-derived and circular carbon capture materials

The innovation of bio-derived and circular carbon capture materials represents a significant opportunity in the carbon capture materials market, driven by the pressing need for sustainable and environmentally friendly solutions. Bio-derived materials leverage renewable biomass resources like agricultural residues, wood fibers, algae, and other organic waste streams to create carbon capture products that not only absorb CO2 efficiently but also contribute to carbon sequestration by locking carbon within their structure for extended periods. Unlike traditional synthetic materials, bio-based options offer the dual advantage of reducing dependence on fossil-based raw materials and promoting a circular carbon economy by recycling atmospheric carbon into useful products. One of the strongest benefits of bio-derived materials is their potential for carbon storage embedded in long-lasting products such as bio-based construction materials, insulation, and composites. These materials sequester carbon for years or decades, effectively removing CO2 from the atmosphere while simultaneously replacing more carbon-intensive materials like concrete or steel. Using bio-based feedstocks also addresses environmental concerns related to waste management, such as reducing open burning or landfill disposal of agricultural residues, which otherwise emit greenhouse gases. Circular carbon capture materials extend this principle by promoting reuse, recycling, and regeneration of capture materials, improving resource efficiency, and reducing the environmental footprint.

Challenge: Integration of capture systems with utilization and mineralization technologies

The carbon capture materials market faces significant challenges related to supply chain reliability and plant-retrofit compatibility constraints, which hinder the widespread adoption and scalability of carbon capture technologies. Supply chain reliability is critical as the deployment of carbon capture materials and technologies requires a steady and consistent flow of high-quality raw materials, specialized components, and advanced manufacturing capabilities. Any disruptions or delays in this complex supply network can cause project postponements, inflate costs, and reduce the overall efficiency of carbon capture systems. The supply chain often involves multiple stages, including sourcing of raw materials like solvents and adsorbents, transport, manufacturing, and assembly, each vulnerable to logistical, geopolitical, and regulatory risks. Ensuring sustainability and environmental standards within the supply chain also adds layers of complexity, as green sourcing and low-carbon footprint materials gain importance. Plant-retrofit compatibility presents another substantial hurdle. Many carbon capture projects target existing industrial plants, power stations, and refineries that were not originally designed to incorporate carbon capture equipment. Integrating new carbon capture materials and systems into these established infrastructures can be technically challenging due to spatial constraints, the need to maintain uninterrupted operations, and compatibility with existing processes. Retrofit projects require custom engineering solutions that can accommodate diverse plant layouts and operational parameters, often leading to increased upfront costs, extended downtime, and more complex project management.

Carbon Capture Materials Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development of amine-based solvent technologies for post-combustion CO2 capture in industrial and power sectors | Offers high CO2 capture efficiency with reduced regeneration energy, lowering operational costs and emissions |

|

Provides modular, cost-effective CO2 capture systems (CycloneCC) designed for mid-sized emitters in cement, steel, and chemical industries | Reduces footprint, CAPEX, and OPEX by up to 50% compared to traditional systems, with fast installation timelines |

|

Builds integrated oxy-fuel combustion and CO2 purification units for hydrogen and ammonia plants | Improves carbon intensity of hydrogen and ammonia production, enabling blue hydrogen pathways |

|

Commercialization of CANSOLV CO2 Capture System based on regenerable solvent absorption technology | Delivers high-purity CO2 capture with low energy consumption, suitable for flue gas and sulfur processing facilities |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis of the carbon capture materials market offers a detailed overview of the network of stakeholders that influence the production, distribution, and use of carbon capture materials across different industries. This analysis covers the entire value chain, starting with raw material suppliers and moving through manufacturers and distributors of carbon capture materials to the various end-use industries that depend on these materials for essential applications. Major participants in the ecosystem include chemical producers specializing in solvents and sorbent compounds, logistics and distribution partners supporting global supply, and end-use industries such as power generation, metal & mining, oil & gas, chemical & petrochemical, and industrial. By mapping out the roles and interactions of each entity, ecosystem analysis provides strategic insights into supply chain operations, market dependencies, competitive positions, and emerging opportunities within the carbon capture materials market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Carbon Capture Materials Market, by Process

Absorption technologies are expected to capture the largest market share in the carbon capture materials market during the forecast period. This is primarily due to their maturity, effectiveness, and broad industrial applicability. Absorption, especially chemical absorption, is a well-established method for capturing CO2, achieving high capture rates that often exceed 90% The process typically employs solvents such as amine-based solutions, including monoethanolamine (MEA), which chemically bind to CO2, efficiently separating it from flue gases generated by industries like power generation, cement production, steel manufacturing, oil and gas, and chemicals. This versatility across various sectors makes absorption a preferred and reliable choice. Furthermore, absorption technologies benefit from numerous government initiatives, policies, and investments aimed at reducing greenhouse gas emissions and addressing climate change. Many countries are actively promoting carbon capture through subsidies, tax credits, and funding for pilot and commercial projects, creating favorable market conditions for absorption technologies. Additionally, the ability to reuse solvents and integrate absorption processes with existing industrial operations enhances their economic appeal.

Carbon Capture Materials Market, by Material

Membranes (polymeric membranes) are projected to dominate the materials segment of the carbon capture materials market during the forecast period due to their unique combination of efficiency, cost-effectiveness, and adaptability. These membranes are made from polymeric materials such as polysulfone, polyimide, polyethylene, and polyvinylidene fluoride, which offer excellent gas separation performance under various industrial conditions. Their ability to selectively allow CO2 to pass through while blocking other gases makes them highly effective for carbon capture applications. A major driver of market share for polymeric membranes is their scalability and ease of fabrication. They can be manufactured in large quantities and customized into various forms like hollow fiber modules, boosting surface area and separation efficiency. This structural flexibility enables their integration into existing industrial processes across sectors like power generation, oil & gas, and chemicals. Polymeric membranes also provide an energy-efficient alternative to traditional carbon capture methods like absorption, reducing operational costs significantly. Their mechanical flexibility and chemical resistance allow for durability and longevity, contributing to lower maintenance expenses. Advances in polymer science continually improve these membranes' selectivity and permeability, enhancing performance even in harsh environments.

Carbon Capture Materials Market, by Technique

Post-combustion technique is expected to account for the largest share of the carbon capture materials market in terms of value during the forecast period due to its retrofit-friendly nature, technological maturity, and wide industrial applicability. This technique captures carbon dioxide after fossil fuels are burned, making it highly suitable for integration into existing power plants and industrial facilities without requiring a complete overhaul or replacement of infrastructure. One key qualitative reason for its dominance is that post-combustion capture can be deployed on already operational coal and natural gas power plants, which constitute a major share of global electricity generation. Its retrofit compatibility helps industries comply with stricter emission regulations without disrupting ongoing activities. The availability of advanced solvents and evolving membrane technologies also supports enhanced efficiency and reduced energy consumption, addressing traditional cost and operational challenges. Moreover, the widespread adoption is driven by global policy frameworks, funding incentives, and increasing corporate commitments to reduce carbon footprints. Post-combustion technology plays a critical role in sectors like power generation, cement, steel, and refining, where emissions are significant and hard to eliminate by other means. The scalability of projects and growing deployment in regions like North America, Europe, and Asia Pacific further accelerate market growth.

Carbon Capture Materials Market, by End-use Industry

Power generation is expected to hold the largest share of the carbon capture materials market in terms of value during the forecast period due to its high CO2 emissions, regulatory pressure, and critical role in global energy supply. Power plants, especially those using coal and natural gas, are among the largest emitters of carbon dioxide worldwide. Post-combustion carbon capture technologies, which are well-suited for retrofitting existing thermal power plants, make the power generation sector a prime candidate for carbon capture adoption. These technologies enable power plants to continue operating while significantly reducing their carbon footprint, supporting a transition to cleaner energy without disruptive shutdowns. Moreover, governments globally are imposing stricter emission regulations and incentivizing the deployment of carbon capture and storage (CCS) technologies in power generation through subsidies, tax credits, and funding for large-scale demonstration projects. The economic and policy landscape encourages power producers to invest in carbon capture solutions to avoid hefty fines and align with net-zero commitments.

REGION

Asia Pacific to be largest and fastest-growing region in global carbon capture materials market during forecast period

Asia Pacific is poised to capture the largest share of the carbon capture materials market due to a confluence of economic, industrial, and policy-driven factors. As the world’s manufacturing hub, countries like China, India, Japan, and South Korea generate substantial CO2 emissions from coal-heavy power generation, cement production, and steel manufacturing, necessitating robust carbon capture and storage (CCS) solutions to meet global climate goals. China, the largest emitter, has aggressively invested in CCS, with projects like the Sinopec Qilu Petrochemical CCUS facility aiming to capture over 1 million tons of CO2 annually. Rapid industrialization and urbanization in the region amplify the demand for decarbonization technologies, particularly in hard-to-abate sectors. Additionally, the region’s focus on blue hydrogen production, especially in Japan and South Korea, integrates CCS to produce low-carbon fuels, boosting market growth.

Carbon Capture Materials Market: COMPANY EVALUATION MATRIX

The carbon capture materials market is characterized by a mix of stars, emerging leaders, participants, and pervasive players. The chart highlights BASF as a strong market leader in terms of both market share and product footprint, occupying the "Stars" quadrant. the world's largest chemical producer, with a strategic focus on the carbon capture materials market through its chemicals segment. BASF manufactures amine-based solvents, specializing in gas treatment solutions, designed for efficient post-combustion CO2 capture from flue gases. This portfolio supports global decarbonization efforts by offering low-energy, high-purity technologies proven in pilot projects, such as the Niederaussem power plant collaboration. The company operates six business segments: Chemicals, Materials, Industrial Solutions, Nutrition & Care, Surface Technologies, and Agricultural Solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 66.90 Billion |

| Market Forecast in 2030 (Value) | USD 99.09 Billion |

| Growth Rate | CAGR of 8.2% from 2025-2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Carbon Capture Materials Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Country-level Breakdown | Instead of just regional coverage, the report provides country-specific market data (US (45Q tax credit dynamics), Canada (storage capacity), UK (cluster sequencing), China (industrial decarbonization focus), and the UAE (CCUS for enhanced oil recovery). It includes policy analysis, storage infrastructure, and key project pipelines. | It helps companies identify markets with the strongest regulatory and economic drivers. It is essential for planning investment, locating capture hubs, and navigating local content requirements |

| End-use Industry-specific Deep Dive | A customized focus on key, hard-to-abate sectors such as Metal & Mining, Chemical & Petrochemicals, Power Generation, and Oil & Gas. It includes analysis of flue gas composition, capture readiness, CO2 offtake opportunities (utilization), and CAPEX sensitivity. | Enables material suppliers and technology providers to tailor their solutions (e.g., sorbents resistant to impurities for cement) and engage with end-users facing the most stringent decarbonization pressures |

| Material Customization | Comparative analysis of Liquid Solvents (Amine-based, Alkine-based), Solid Sorbents (Zeolites, Activated Carbon MOFs), and Membranes. Covers key metrics: capture rate, energy penalty for regeneration, degradation rate, tolerance to contaminants (SOx, NOx), and capital intensity. | Allows clients to benchmark material performance against specific project needs (high purity vs. cost-effectiveness), optimize the technology selection process, and identify gaps for R&D investment |

| Competitive Benchmarking | Extended profiling of global leaders (Ecolab, BASF, DOW, MITSUBISHI HEAVY INDUSTRIES, LTD, Solvay, Air Products and Chemicals, Inc., Tosoh Corporation, Honeywell International Inc., and Zeochem) alongside regional players. It includes SWOT, product portfolios, technology focus, mergers & acquisitions, and market positioning. | Provides a clear competitive landscape, helping clients identify potential partnerships, acquisition targets, or risks from disruptive competitors |

RECENT DEVELOPMENTS

- April 2025 : MHI partnered with ExxonMobil for a CCS project in Baytown, Texas, North America, using KS-21 solvents in the Advanced KM CDR Process to capture 2 million tons of CO2 annually from refining operations.

- May 2025 : BASF signed a license agreement with Carbon Cap Applications Technology Co. (CCAT) to provide its OASE blue gas treatment technology for a carbon capture and storage (CCS) project at the Taichung Power Plant Carbon Reduction Technology Park, operated by Taiwan Power Company (Taipower), Taiwan’s largest electricity provider.

- November2024 : BASF and Exterra Carbon Solutions (Exterra) entered into a memorandum of understanding (MoU) to explore opportunities to deploy a commercial-scale carbon capture and storage (CCS) project in Quebec, Canada, using a combination of BASF’s OASE gas treatment technology and Exterra’s Reactive Oxide to Carbonate System (ROC) as part of its integrated carbon storage services.

- November 2024 : Dow reported progress on the Fort Saskatchewan Path2Zero project in Alberta, Canada, and North America. The project involves retrofit and expansion for net-zero ethylene production with CCS via amine solvents

- September 2024 : Honeywell collaborated with Samsung E&A to deploy carbon capture solutions globally, focusing on hard-to-abate power plants in Asia Pacific and other regions.

- September 2023 : Honeywell partnered with SK E&S to implement carbon capture technology in South Korea and Southeast Asia.

Table of Contents

Methodology

The study involved four major activities in estimating the market size of the carbon capture materials market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key carbon capture materials Market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

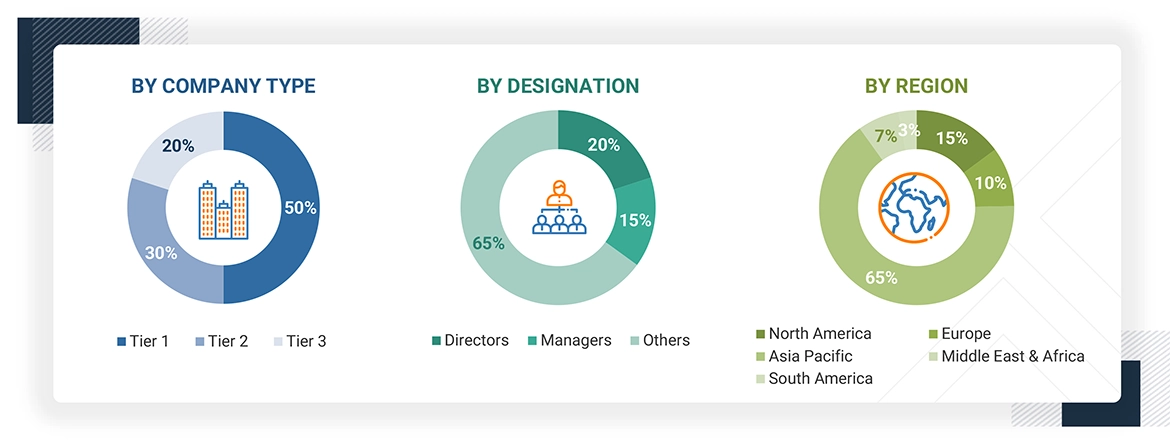

The carbon capture materials Market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the carbon capture materials market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the carbon capture materials Market industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of carbon capture materials market and future outlook of their business which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for the carbon capture materials market. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns based on process, materials, technique and end-use industries, region were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Data Triangulation

After arriving at the total market size from the estimation process above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The carbon capture materials market refers to the industry dedicated to developing, producing, and applying specialized materials that facilitate the separation, absorption, or chemical transformation of carbon dioxide (CO2) from industrial emissions, energy generation processes, and even directly from the atmosphere. These materials form the backbone of carbon capture, utilization, and storage (CCUS) technologies by enabling efficient removal of CO2 from various sources, thereby mitigating greenhouse gas emissions and supporting global decarbonization goals. The market includes a wide range of materials, such as amine-based solvents, alkaline-based substances, zeolites, activated carbon, metal-organic frameworks (MOFs), membranes, cryogenic separation agents, and emerging solid sorbents. Each type of material is designed with specific features such as high CO2 selectivity, thermal stability, recyclability, and cost efficiency, allowing its application across industries such as power generation, cement, steel, fertilizers, chemicals, natural gas processing, and direct air capture (DAC). The growth of this market is driven by the increasing urgency of achieving net-zero emissions, stringent government regulations on carbon emissions, and the rising adoption of CCUS technologies by industries under decarbonization pressure. Technological advancements are enhancing material performance, from solvents that reduce regeneration energy requirements to MOFs and hybrid membranes offering higher capture efficiency at lower costs. The market is also closely linked with downstream sectors where captured carbon is either stored underground or utilized for enhanced oil recovery (EOR), fuel synthesis, or the production of carbon-based chemicals, creating value-added pathways. Overall, the carbon capture materials market is not only a vital component of climate strategies but also a rapidly evolving ecosystem where innovation, supply chain integration, and policy support collectively promote adoption and commercialization on a global scale.

Stakeholders

- Carbon Capture Materials Market Manufacturers

- Carbon Capture Materials Market Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the carbon capture materials, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on process, material, technique, end-use industry, and region

- To forecast the size of the market with respect to major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments, such as partnerships, agreements, joint ventures, collaborations, announcements, awards, and market expansion

- To strategically profile key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major companies in the CCUS market? What key strategies have market players adopted to strengthen their market presence?

Key players include Fluor Corporation (US), Exxon Mobil Corporation (US), Linde plc (UK), Shell Plc. (UK), Mitsubishi Heavy Industries, Ltd. (Japan), JGC Holdings Corporation (Japan), Schlumberger Limited (US), Aker Solutions (Norway), Honeywell International (US), Equinor ASA (Norway), TotalEnergies SE (France), Hitachi Ltd (Japan), Siemens AG (Germany), GE Vernova (US), and Halliburton (US). Their key strategies include technology advancements, acquisitions, and expansions.

What are the drivers and opportunities for the CCUS market?

Increasing R&D activities and growing investments in the CCUS industry are key drivers fueling market growth.

Which region is projected to account for the largest market share?

North America is projected to be the largest market for CCUS due to the presence of major CCUS projects.

What is the projected growth rate of the CCUS market over the next five years?

The CCUS market is projected to grow at a CAGR of 25.0% during the forecast period, in terms of value.

How is the CCUS market aligned for future growth?

The CCUS market is rapidly expanding, driven by increasing demand in the oil & gas sector and growing government initiatives aimed at reducing carbon emissions.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Carbon Capture Materials Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Carbon Capture Materials Market