Carbon Credit Validation Verification and Certification Market

Carbon Credit Validation, Verification, and Certification Market by Type (Voluntary, Compliance), Service (Validation, Verification, Certification), Application (Energy & Utilities, Agriculture & Forestry, Industrial) & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global carbon credit validation, verification, and certification market is on a trajectory to reach USD 0.45 billion in 2030, a notable increase from USD 0.16 billion in 2025, with a CAGR of 22.6%. The future prospects of the global market are highly promising, driven by escalating regulatory demands and heightened corporate and public awareness of climate change.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is the fastest-growing region in the carbon credit validation, verification, and certification market, registering a CAGR of 25.1% during the forecast period.

-

BY TYPEThe voluntary segment, by service, holds 96.8% of the market in 2024.

-

BY APPLICATIONEnergy & utilities dominated the market, registering 45.3% share in 2024.

-

COMPETITIVE LANDSCAPEKey players in the global carbon credit validation, verification, and certification market are VERRA (US), Gold Standard (Switzerland), and DNV GL (Norway). They have employed various strategies to increase their market share in the global carbon credit validation, verification, and certification market.

-

COMPETITIVE LANDSCAPEThe strong product ecosystem and global market penetration of GRN Energy (US) and CarbonClear (Denmark) have made them influential startups/SMEs/emerging leaders in the market.

Drivers of the carbon credit validation, verification, and certification market include tighter emissions disclosure rules, expanding government-backed carbon pricing and Article 6 mechanisms, and growing corporate demand for high-integrity credits, while challenges remain around evolving methodologies, registry interoperability, and uneven climate policy implementation.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The carbon credit validation, verification, and certification market is reshaped by several pivotal trends and disruptions that directly affect customer business models and decision-making. A major trend is the rapid adoption of digital monitoring, reporting, and verification (digital MRV) technologies, including satellite data and automated analytics, which are increasing transparency and reducing costs while enabling more frequent, real-time verification of emission reductions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing scrutiny on carbon credit integrity

-

Expansion of climate disclosure and reporting requirements

Level

-

Decline in new carbon credit project registrations

-

High cost sensitivity among project developers

Level

-

Emergence of Article 6 and new compliance mechanisms

-

Growth in nature-based and removal projects

Level

-

Reputational risk from low-quality or controversial projects

-

Capacity constraints and accreditation bottlenecks

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing scrutiny on carbon credit integrity

Growing concerns around greenwashing and credit quality are forcing project developers and buyers to rely more heavily on independent validation and verification. Corporates, financial institutions, and governments are demanding higher assurance levels, directly increasing the relevance and necessity of VVC services across both voluntary and compliance markets.

Restraint: Decline in new carbon credit project registrations

The slowdown in new project development since 2023—particularly in compliance mechanisms such as CDM—has reduced demand for initial validation services. Market uncertainty and evolving policy frameworks have caused developers to delay or cancel new projects, limiting near-term market expansion.

Opportunity: Emergence of Article 6 and new compliance mechanisms

Although still at an early stage, Article 6 frameworks are expected to generate fresh demand for validation and verification services once operational. Over the medium term, these mechanisms could replace legacy CDM demand and create new revenue opportunities for accredited VVC providers.

Challenge: Reputational risk from low-quality or controversial projects

Past controversies around over-credited or poorly verified projects have increased reputational risks for VVC providers. Ensuring consistent audit quality while managing commercial pressure from developers remains a significant challenge.

CARBON CREDIT VALIDATION VERIFICATION AND CERTIFICATION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Verra partnered with the Forest Carbon Partnership Facility (FCPF) to develop a jurisdictional REDD+ carbon crediting framework that enables countries to generate high-quality carbon credits at the national and sub-national level, aligned with UNFCCC and Paris Agreement requirements. | Enables large-scale, high-integrity carbon credit generation; ensures robust monitoring, reporting, and verification (MRV) at the jurisdictional level; improves data consistency and transparency; supports national climate targets; and facilitates integration of diverse land-use practices into internationally recognized carbon markets. |

|

Gold Standard introduced a methodology for decentralized organic waste processing, developed by Lomi in consultation with Carbonomics, enabling the generation of carbon credits from home and commercial food waste treatment that avoids landfill disposal and associated methane emissions. | Reduces methane emissions by diverting organic waste from landfills; eliminates transport-related emissions; enables decentralized, scalable carbon credit generation; supports circular economy models by converting waste into valuable by-products such as fertilizers; and strengthens alignment with sustainable development and climate mitigation goals. |

|

ACR’s GreenTrees reforestation project focuses on restoring degraded lands in the Mississippi Alluvial Valley by partnering with private landowners to plant trees on marginal agricultural land, enabling large-scale carbon sequestration and the issuance of high-quality carbon credits through reforestation. | Restores biodiversity and critical wildlife habitats; enhances carbon sequestration capacity at scale; improves water quality and ecosystem resilience; generates verified, high-integrity carbon credits; and delivers long-term economic benefits to local communities through land restoration incentives. |

|

SCS Global Services certified Fresh Del Monte Produce Inc.’s New Del Monte Zero pineapples as carbon neutral, following a comprehensive assessment of emissions across cultivation, transportation, distribution, and commercialization, supported by conservation and reforestation initiatives across Del Monte’s Costa Rica operations. | Enables verified carbon-neutral product claims; ensures end-to-end supply-chain emissions accountability; supports market access in North America and Europe; strengthens ESG credibility; and sets a sustainability benchmark for carbon-neutral practices in the global fresh produce industry. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The key stakeholders involved in the global carbon credit validation, verification, and certification market are project developers, verification bodies, third-party verifiers, and end users.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Carbon credit validation, verification, and certification market, by service

The service segment of the carbon credit validation, verification, and certification market plays a critical role in ensuring the credibility, transparency, and regulatory acceptance of carbon credits across both voluntary and compliance markets. Validation services support project feasibility and methodological alignment at the design stage, while verification services drive recurring demand by confirming actual emission reductions over time, and certification services enable the formal issuance and traceability of credits.

Carbon credit validation, verification, and certification market, by type

The voluntary segment by type held the largest market share in 2024 largely because corporations and investors are increasingly turning to voluntary carbon credits to meet net-zero pledges, improve ESG disclosures, and enhance brand reputation, especially in regions where compliance markets are limited or evolving. Growing emphasis on high-integrity, co-benefit credits that deliver environmental and social value has driven demand for voluntary offsets backed by rigorous third-party validation and verification.

Carbon credit validation, verification, and certification market, by application

Energy and Utilities held the largest global market share in 2024 in the carbon credit validation, verification, and certification market due to the sector’s central role in regulated emissions, large-scale decarbonization investment, and measurable abatement potential. Power generation and utility operators are among the highest greenhouse gas emitters and are therefore subject to stringent emissions reporting, compliance obligations, and ongoing regulatory oversight, all of which require rigorous third-party validation and verification.

REGION

Asia Pacific is expected to dominate relay market during forecast period with highest CAGR

Asia Pacific is projected to be the fastest-growing region in the carbon credit validation, verification, and certification market during the forecast period. It is witnessing significant growth, primarily driven by heightened awareness and commitment to reducing carbon emissions. The market is growing, as countries in this region implement stricter environmental regulations and engage in international climate agreements.

CARBON CREDIT VALIDATION VERIFICATION AND CERTIFICATION MARKET: COMPANY EVALUATION MATRIX

VERRA, is leading the carbon credit validation, verification and certification market, and is classified under the “Star” category due to its strong service/product portfolio. Vendors in the “stars” category generally receive high scores for most evaluation criteria. These players have established product portfolios and a broad market presence. They also devise effective business strategies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- VERRA (US)

- Gold Standard (Switzerland)

- ACR (American Carbon Registry) (US)

- Climate Action Reserve (US)

- SGS Société Générale de Surveillance SA. (Switzerland),

- DNV GL (Norway)

- TUV SUD (Germany)

- Intertek Group plc (UK)

- Bureau Veritas (France)

- The ERM International Group Limited (UK)

- SCS Global Services (US)

- Climate Impact Partners (UK)

- RINA S.p.A. (Italy)

- Aenor (Spain)

- Cotecna (Switzerland)

- Carbon Check (India)

- Center for Resource Solutions (US)

- Carbon Credit Capital, LLC (US)

- Control Union (Netherlands)

- Aster Global Environmental Solutions, Inc. (US)

- Ancer Climate, LLC (US)

- The CarbonTtrust (UK)

- First Environment Inc. (US)

- OurOffset Nonprofit LLC (Hungary)

- Sustain CERT (Luxembourg)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.17 Billion |

| Market Forecast in 2030 (Value) | USD 0.45 Billion |

| Growth Rate | 22.6% |

| Years Considered | 2025–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | Europe, Asia Pacific, North America, Rest of World |

WHAT IS IN IT FOR YOU: CARBON CREDIT VALIDATION VERIFICATION AND CERTIFICATION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| End-user focused analysis beyond standard segmentation | ||

| Competitive benchmarking of top players |

RECENT DEVELOPMENTS

- January 2025 : SGS acquired Aster Global Environmental Solutions, Inc., an industry-leading company focused on validation and verification of greenhouse gas (GHG) emissions and offsets, as well as forestry, ecosystem, and corporate and social responsibility services

- January 2025 : TÜV SÜD expands its biogenic carbon content (BCC) testing and verification services. By offering these innovative services, the testing, inspection, and certification (TIC) company enables businesses to build more sustainability into their products while complying with statutory requirements and to carve out a market position at the forefront of environmental protection.

Table of Contents

Methodology

This study encompassed significant efforts to determine the current size of the carbon credit validation, verification, and certification market. It commenced with a thorough secondary research process to gather data on the market, related markets, and the broader industry. Subsequently, these findings, assumptions, and market size calculations were rigorously validated by consulting industry experts across the entire supply chain through primary research. The total market size was assessed through analyses specific to each country. Following that, the market was further dissected, and the data was cross-referenced to estimate the size of various segments and sub-segments within the market.

Secondary Research

In this research study, a wide range of secondary sources were utilized, including directories, databases, and reputable references such as Hoover's, Bloomberg BusinessWeek, Factiva, World Bank, International Monetary Fund (IMF), the US Department of Energy (DOE), and the International Energy Agency (IEA). These sources played a crucial role in gathering valuable data for a comprehensive analysis of the global carbon credit validation, verification, and certification market, covering technical, market-oriented, and commercial aspects. Additional secondary sources included annual reports, press releases, investor presentations, whitepapers, authoritative publications, articles authored by well-respected experts, information from industry associations, trade directories, and various database resources.

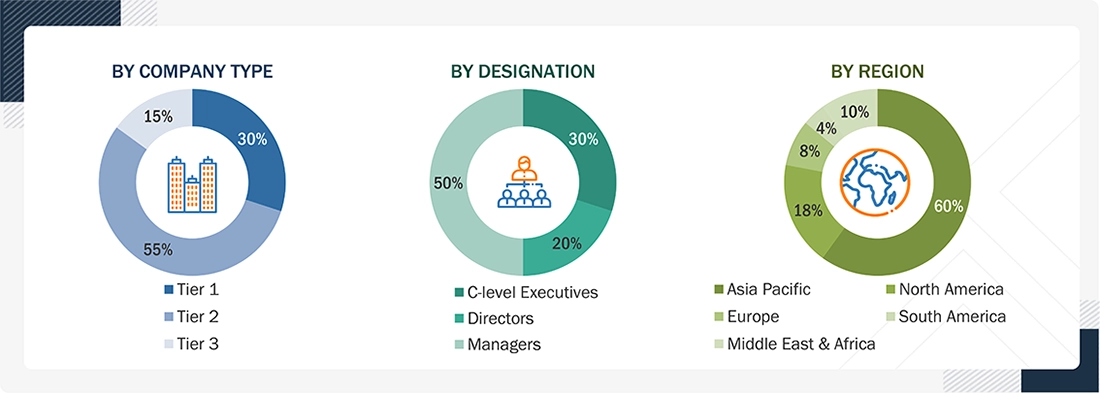

Primary Research

The carbon credit validation, verification, certification market involves a range of stakeholders, including project developers, certification bodies, auditors/third-party verifiers, and end users within the supply chain. To gather qualitative and quantitative insights, various primary sources from both the supply and demand sides of the market were interviewed. The following breakdown presents the primary respondents involved in the research study.

Note: “Others” include sales managers, engineers, and regional managers.

The companies are divided into tiers based on their 2021 total revenue: Tier 1: >USD 1 billion; Tier 2: USD 500 million–1 billion; and Tier 3: <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

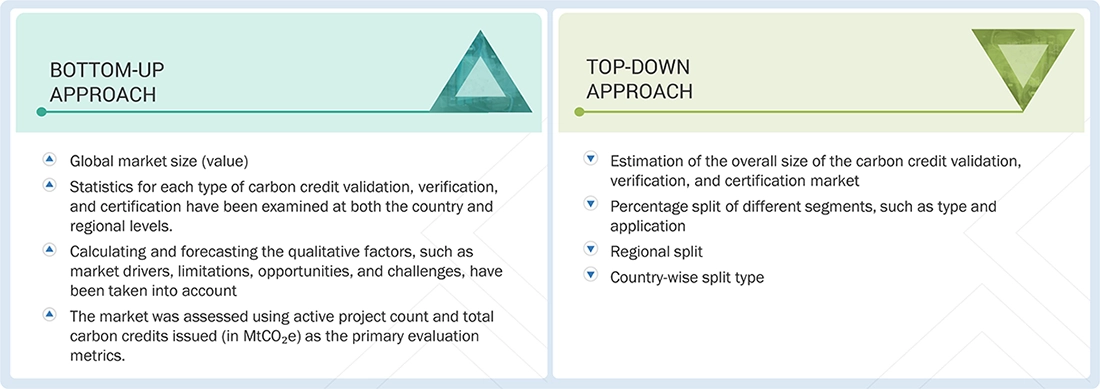

Market Size Estimation

The estimation and validation of the carbon credit validation, verification, and certification market size have been conducted using a bottom-up and top-down approach. This approach was rigorously employed to ascertain the dimensions of multiple subsegments within the market. The research process comprises the following key stages.

- In this method, the statistics for each type of carbon credit validation, verification, and certification have been examined at both the country and regional levels.

- Thorough secondary and primary research has been conducted to gain a comprehensive understanding of the global market landscape for various segments of the carbon credit validation, verification, and certification market.

- When calculating and forecasting the market size, qualitative factors such as market drivers, limitations, opportunities, and challenges have been taken into account.

Global Carbon Credit Validation, Verification, and Certification Market Size: Bottom-Up Approach and Top-Down Approach

Data Triangulation

The process of determining the overall market size involved the methodologies described earlier, followed by segmenting the market into multiple segments and subsegments. To finalize the comprehensive market analysis and obtain precise statistics for each market segment and subsegment, data triangulation and market segmentation techniques were applied, as appropriate. Data triangulation was achieved by examining various factors and trends from both demand and supply perspectives within the carbon credit validation, verification, and certification market.

Market Definition

The carbon credit validation, verification, and certification market encompasses the processes and services that ensure the integrity and credibility of carbon credits used in emissions trading and offset programs. This market includes validating carbon-reduction projects, verifying actual emissions reductions achieved, and certifying these reductions by accredited bodies. These activities provide assurance to buyers and stakeholders that the carbon credits are legitimate, quantifiable, and compliant with established standards and regulations, thereby facilitating transparent and reliable carbon trading and contributing to global climate change mitigation efforts.

Key Stakeholders

- Government & research organizations

- Institutional investors

- Investors/shareholders

- Environmental research institutes

- Project developers

- State and national regulatory authorities

- Manufacturing industry

- Energy efficiency consultancies

- Certification bodies

Report Objectives

- To describe and forecast the carbon credit validation, verification, and certification market, in terms of value, by type, application, and region.

- To forecast the market for various segments, in terms of value, with regard to four regions: North America, Europe, Asia Pacific, and Rest of the World, along with their key countries

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the market’s growth

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To study the complete supply chain and allied industry segments and perform a supply chain analysis of the carbon credit validation, verification, and certification landscape

- To strategically analyze the regulatory landscape, tariffs, standards, patents, Porter’s five forces, import and export scenarios, trade values, and case studies pertaining to the market under study

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the carbon credit validation, verification, and certification market

- To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments such as agreements, partnerships, product launches, acquisitions, contracts, expansions, and investments in the carbon credit validation, verification, and certification market

Available customizations:

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

-

Detailed analyses and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Carbon Credit Validation, Verification, and Certification Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Carbon Credit Validation, Verification, and Certification Market