Central Lab Services/Clinical Trial Lab Services Market Size, Growth, Share & Trends Analysis

Central Lab Services/Clinical Trial Lab Services Market by Phase (Phase I, II, III), Service Type (Safety Testing, Immunology), Therapeutic Area (Oncology), Modality (Small Molecules, Vaccine), End user (Pharma & CROs) & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global central lab services/clinical trial lab services market is projected to reach USD 8.18 billion by 2030 from USD 5.97 billion in 2025, at a CAGR of 6.5% during the forecast period. The increasing prevalence of rare diseases such as Huntington's disease and cystic fibrosis drives market growth. Additionally, increased government investment in R&D and technological advancements are expected to impact market growth. The increasing number of pharmaceutical companies globally also poses an opportunistic factor for market growth.

KEY TAKEAWAYS

-

BY PHASEThe central lab services/clinical trial lab services market is segmented into phases I, II, III, and IV based on the trial phase. Among these, phase III dominates the market share in 2024, owing to its broad representation in clinical trials, which ensures treatments are effective across various demographics. Central labs play a crucial role in phase III trials by offering extensive testing services, including biomarker analysis, genomic testing, and thorough screening. This aids in gathering reliable and precise data from multiple trial sites. Given that phase III trials involve a larger participant pool to evaluate trial efficacy and serve as the last step before seeking regulatory approval, the accuracy of the collected data is essential. The demand for regulatory compliance, data integrity, and large-scale testing underscores the heavy dependence on central lab services during this phase, positioning it as the leading market segment. Consequently, the rising demand for these clinical trials has driven growth in the central lab services/clinical trial lab services market.

-

BY SERVICE TYPEThe central lab services/clinical trial lab services market is categorized by service type into safety testing, immunology, genetic testing, coagulation testing, pathology testing, biomarkers, companion diagnostics, and additional tests. In 2024, the safety testing category held the largest market share within the central lab services/clinical trial lab services market. Safety testing in clinical trials includes routine hematology and biochemistry panels, conducted using cutting-edge technology that supports high sample throughput and cost efficiency.

-

BY THERAPEUTIC AREAThe central lab services/clinical trial lab services market is divided into therapeutic areas, including oncology, infectious diseases, neurology, cardiology, and other fields. The oncology segment claims the largest share of this market, driven by the growing number of cancer patients. Oncology clinical trials often demand advanced diagnostic testing, such as biomarker testing, genomic testing, and tumor profiling, to evaluate the efficacy and safety of new cancer therapies. Central labs are vital in delivering these services, ensuring consistent, reliable, and regulatory-compliant results across multiple sites. With the increasing emphasis on precision medicine, the demand for specialized and high-quality lab testing in oncology is notable, positioning this segment as the largest and most essential in the central lab services market.

-

BY MODALITYThe modality segment of the Central Lab Services/Clinical Trial Lab Services Market includes small molecules, gene therapy, biologics, and medical devices & IVD devices. Among these, gene therapy leads due to its expanding clinical pipeline, complex analytical requirements, and stringent regulatory demands that necessitate specialized centralized testing. Small molecules maintain a steady share owing to their large trial volume, while biologics are rapidly growing with increased biomarker and immunogenicity testing. Medical devices and IVD devices contribute through performance and safety validation studies. Overall, the advanced testing complexity of gene therapy makes it the key growth driver in this segment.

-

BY END USERThe central lab services/clinical trial lab services market is segmented by end users into pharmaceutical & biopharmaceutical companies, CROs, medical device companies, and other end users. The pharmaceutical & biopharmaceutical companies segment held the largest market share in 2024, driven by increased funding programs for conducting clinical trials. Central labs offer specialized testing services, including genetic testing, biomarker analysis, and immunology testing, which are essential for evaluating drug efficacy and safety. These companies also gain from the scalability and cost-effectiveness of central lab services, which reduce the need for onsite labs and streamline trial processes. This comprehensive support across various drug development stages, from pre-clinical to post-marketing, establishes pharmaceutical and biopharmaceutical companies as the primary users of clinical trial lab services.

-

BY REGIONThe global central lab services/clinical trial lab services market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is witnessing strong growth due to increasing number of clinical trials and growing prevalence of rare diseases

-

COMPETITIVE LANDSCAPEThe global central lab services/clinical trial lab services market is steadily growing, driven by strategic partnerships and strong R&D investments. Key players like Thermo Fisher Scientific Inc. (US), IQVIA (US), ICON plc (Ireland), Charles River Laboratories (US), Labcorp (US) , and others leverage diverse product portfolios and innovation to expand globally through collaborations, acquisitions, and new product launches.

The global central lab services/clinical trial lab services market is forecasted to grow significantly by 2030 from its 2025 value, with a steady compound annual growth rate during the forecast period. The rising occurrence of rare diseases, including Huntington's disease and cystic fibrosis, is a key driver of this expansion. Furthermore, enhanced government funding in research and development, along with technological progress, are anticipated to boost market growth. The growing presence of pharmaceutical companies worldwide also presents a favorable opportunity for further market development.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on the central lab services/clinical trial lab services market stems from evolving healthcare needs and advancements in clinical trial lab solutions. Pharmaceutical & biopharmaceutical companies, CROs, Medical device companies and other end users form the core customer base, addressing verious modality such as small molecules, biologics, vaccines, cell & gene therapy, and medical devices & IVD devices. These trends shape customer decisions and attract investments in innovative solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising investments in research & development

-

Favorable government initiatives

Level

-

Shortage of skilled professionals

-

High costs associated with clinical trials

Level

-

Decentralized and virtual clinical trials

-

Emerging markets worldwide

Level

-

Limited patient diversity

-

Cybersecurity and intellectual property concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Rising investments in research & development

The R&D investments carried out in central lab clinical trials mainly focus on improving the use, efficiency, and accuracy of clinical trial services. It also lessens the timeline required for the trial to take place and ensures regulatory compliance. With advancements in genetics, proteomics, and precision medicine, there is an increased need for advanced lab services to process complicated data and offer insights much faster. Central labs are on the lookout for evolving their capabilities, utilizing new technologies such as next-generation sequencing and artificial intelligence to enhance data interpretation and decision-making in clinical trials. According to an IQVIA report in 2024, clinical development productivity rose in 2023 due to an improvement in the composite success rate, which increased to 10.8%, the highest since 2018. 69 novel active substances (NASs) were launched globally, six more than the previous year, including 24 first-in-class launches in the US. Therefore, the R&D investments in central lab services are expected to continue rising, promoting advancements in clinical research and drug development.

Restraint: Shortage of skilled professionals

There is a huge demand for skilled professionals, regulatory management expertise, and other trained healthcare professionals to handle the clinical trial testing associated with central labs. According to WebFX, in 2022, there were approximately 342,900 clinical lab technicians and technologists in the US. The deficit of skilled professionals required in clinical trials is prominent due to rising diagnostic needs, early workforce retirements, and limited training programs. Additionally, the rising demand for clinical trial designs, such as adaptive trials, requires professionals to have advanced knowledge and technical skills, which are in limited supply. The increasing difficulties in the regulatory requirements and the need for data integrity add to the skill set required for clinical trial professionals. The need for education, automation, and innovative solutions is crucial to addressing this issue. In addition, an increasing number of clinical trials and a growing demand for new testing also demand an increase in skilled professionals for central lab clinical trial testing services, a shortage of which can lead to reduced market growth.

Opportunity: Decentralized and virtual clinical trials

Decentralized and virtual clinical trials are growing in the central lab services/clinical trial lab services market. Several well-established companies provide virtual clinical trials. IQIVA (US) offers decentralized clinical trials that provide flexible, customized clinical services and technologies that engage patients in their desired locations. IQIVA has around 500 active decentralized clinical trial facilities across more than 75 countries and 30 therapeutic areas. This model is increasingly adopted by sponsors seeking higher patient engagement and accessibility. Decentralized and virtual clinical trials help significantly enhance central lab services by allowing broader patient participation and real-time data collection. These trials help reduce the location barriers, allowing central labs to process a broader range of patients and extensive datasets. Virtual trials rely on digitalized tools, such as remote monitoring and AI analytics, to improve efficiency and accuracy. This increased patient participation to collect more data strengthens clinical trial lab services by accelerating decision-making, optimizing workflows, and further enhancing collaboration between labs and research teams. These advancements will lead to faster approval of clinical trials and improved patient outcomes.

Challenge: Limited patient diversity

The limitation in patient diversity in the central lab clinical trials has significant challenges for the central lab services and clinical trial lab services market. A diverse representation is important for effective treatments across various geographic locations, as larger participation is needed for the phase tests. Logistical barriers, such as trial sites being far from underserved communities, prevent participation. Additional obstacles such as time commitments, complex procedures, lack of transportation, and the need for better technology literacy in digital trials add further complications. Mistrust in the healthcare system, especially among minority groups due to historical unethical practices, makes recruitment harder, compounded by a lack of diversity among researchers. Socioeconomic factors, such as financial background and limited healthcare access, also hinder enrollment, particularly when there are out-of-pocket costs. Language also adds to the complication in participation, as those with limited proficiency may struggle to understand trial details.

Central Lab Services Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides comprehensive central laboratory services supporting clinical trials through global testing capabilities, standardized processes, and advanced analytical technologies. | Ensures high-quality data generation, accelerates study timelines, enhances regulatory compliance, and improves trial efficiency across therapeutic areas. |

|

Offers integrated central lab services combining data analytics, clinical operations, and laboratory expertise to support multi-phase global clinical trials. | Delivers faster decision-making through real-time data integration, improves operational visibility, reduces trial delays, and enhances overall study performance. |

|

|

Provides global central laboratory services for drug development, offering end-to-end testing, biomarker analysis, and logistics management across all trial phases. | Enhances data reliability and scientific accuracy, supports global trial harmonization, improves turnaround time, and optimizes patient sample management. |

|

Delivers centralized lab testing and bioanalytical services enabling efficient sample management, standardized workflows, and comprehensive global trial support. | Ensures consistent data quality, accelerates drug development timelines, supports regulatory submissions, and enhances overall trial success rates. |

|

Provides full-service central laboratory and preclinical testing solutions supporting drug development from early research through late-stage clinical trials. | Improves trial predictability, strengthens translational research continuity, ensures accurate biomarker evaluation, and facilitates faster path-to-market for new therapies. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem market map of central lab services/clinical trial lab services outlines the key elements present in this market, including the services used in the phase, service type, therapeutic area, modality, and end users. It encompasses various types of central lab services/clinical trial lab services utilized by industries. The service provider category includes a range of clinical trial service providers such as organizations involved in research, product development, optimization, and launch. Prominent service providers in the market are Thermo Fisher Scientific Inc. (US), IQVIA (US), ICON plc (Ireland), Charles River Laboratories (US), Labcorp (US), among others. Research and product development include in-house research facilities, contract research organizations, and contract development that play a key role in outsourcing services. End users adopt central lab services/clinical trial lab services during various stages of development. These end users are the key stakeholders in the central lab services/clinical trial lab services market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Central Lab Services/Clinical Trial Lab Services Market, By Phase

On the basis of phase, the central lab services/clinical trial lab services market is divided into phase I, phase II, phase III, and phase IV. Among these, phase III holds the largest market share in 2024 due to the diverse representation in the clinical trials that will ensure treatments are effective for different demographics. Central labs are important during the phase III trials, as they provide comprehensive testing services, which include biomarker analysis, genomic testing, and a high level of screening. This helps in collecting consistent, accurate data from multiple trial sites. In this trial, a larger number of participants are required to understand the trial effectively. As Phase III trials are the final step before seeking regulatory approval, the quality of data collected is paramount. The need for regulatory compliance, data integrity, and rapid, large-scale testing drives the significant reliance on central lab services in this phase, making it the largest segment in the market. Consequently, the increasing need for these clinical trials has contributed to the segmental growth in the central lab services/clinical trial lab services market.

Central Lab Services/Clinical Trial Lab Services Market, By Service Type

Based on service type, the central lab services/clinical trial lab services market is divided into safety testing, immunology, genetic testing, coagulation testing, pathology testing , biomarkers, companion diagnostics, and other tests. Among these, in 2024, the safety testing segment accounted for the highest market share in the central lab services/clinical trial lab services market. Safety testing in clinical trials involves routine hematology and biochemistry panels, which are carried out using advanced technology that enables high sample throughput and cost efficiency.

Central Lab Services/Clinical Trial Lab Services Market, By Therapeutic Area

Based on theraprutic area, the central lab services/clinical trial lab services market is segmented into oncology, infectious diseases, neurology, cardiology, and other therapeutic areas. The oncology segment holds for the largest market share in central lab services/clinical trial lab services market due to increasing number of cancer patients. Oncology clinical trials often require modern diagnostic testing, including biomarker testing, genomic testing, and tumor profiling, to assess the effectiveness and safety of new cancer therapies in clinical trials. Central labs are important in providing these services, ensuring that testing is viable, consistent, and compliant with regulatory standards across multiple sites. With the rising focus on precision medicine, the need for specialized and high-quality lab testing in oncology is significant, making the oncology segment the largest and most critical in the central lab services market.

Central Lab Services/Clinical Trial Lab Services Market, By Modality

Gene therapy is leading the modality segment of the Central Lab Services/Clinical Trial Lab Services Market due to the rapid expansion of its clinical pipeline and the complexity of testing requirements associated with these advanced therapies. Unlike traditional small molecules or biologics, gene therapy trials require highly specialized bioanalytical and molecular testing such as vector biodistribution, viral shedding, transgene expression, and immunogenicity studies, which demand advanced technologies and stringent quality standards. The growing number of gene therapy programs across multiple therapeutic areas, coupled with the need for standardized data, regulatory compliance, and centralized quality control, has increased the reliance on specialized central lab partners. Moreover, the high analytical intensity and customized testing protocols involved in these studies contribute to higher service demand and spending, making gene therapy the leading modality within the Central Lab Services/Clinical Trial Lab Services Market.

Central Lab Services/Clinical Trial Lab Services Market, By End User

Based on end users, the central lab services/clinical trial lab services market has been classified into pharmaceutical & biopharmaceutical companies, CROS, medical device companies, and other end users. The pharmaceutical & biopharmaceutical companies segment accounted for the largest market share in 2024 due to rising funding programs to conduct clinical trials. The central labs provide special testing services such as genetic testing, biomarker analysis, and immunology testing, which are important for assessing drug efficacy and safety. These companies also benefit from the scalability and cost-effectiveness of the central lab services as they reduce the need for onsite labs and streamline trial processes. This comprehensive support in various phases of drug development, from pre-clinical to post-marketing, makes pharmaceutical and biopharmaceutical companies the dominant consumers of clinical trial lab services.

REGION

Asia Pacific is the fastest growing region in the central lab services/clinical trial lab services market

The Asia Pacific is the fastest-growing regional market due to the rapid expansion of central lab services/clinical trial lab services companies across key countries such as China, Japan, and India. As the players in this region are continuously investing in R&D and launching new drugs for diseases globally, the market is continuously increasing. Additionally, the increasing population has increased the demand for clinical trials. As this population is more prone to having rare diseases and other chronic diseases, such as chronic granulomatous disease, there is an increasing chance of new drug discoveries, which can require central lab clinical trials. China will be experiencing rapid growth of biopharmaceutical companies as it attracts global attention, which will lead to investments in this region. A diverse population has made the region an attractive location for clinical trials, offering comprehensive data on drug efficacy across different demographics. These significant factors are contributing to the Asia Pacific central lab services/clinical trial lab services market during the forecast period.

Central Lab Services Market: COMPANY EVALUATION MATRIX

Thermo Fisher Scientific is the top provider of scientific services globally for hospitals, clinical diagnostic labs, universities, research institutes, government agencies, pharmaceutical & biotech firms, and the environmental, industrial, R&D, quality, and process control sectors. It offers new technologies and pharma services through its Thermo Scientific, Applied Biosystems, Invitrogen, Fisher Scientific, Unity Lab Services, Patheon, and PPD brands. The company operates through four business segments: laboratory products and biopharma services, life sciences solutions, specialty diagnostics, and analytical instruments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 5.64 Billion |

| Revenue Forecast in 2030 | USD 8.18 Billion |

| Growth Rate | CAGR of 6.5% from 2025-2030 |

| Actual data | 2023-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America and the Middle East & Africa |

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Services Matrix, which provide a detailed comparison of the service portfolio of each company in the market. | Enables identification of services adoption shifts across pharmaceutical & biopharmaceutical companies, CROs, medical device companies, and other end users; highlights efficiency, and compliance trends influencing purchasing decisions. |

| Company Information | Detailed analysis and profiling of additional market players (Up to five) | Provides insights into competitive strategies, innovation focus , and partnerships shaping the central lab services/clinical trial lab services. |

| Geographic Analysis | Further breakdown of the central lab services/clinical trial lab services market into specific countries for the Rest of Europe, the Rest of Asia Pacific, the Rest of Latin America, and the Middle East & Africa | Country level demand mapping for new product launches and localization strategy planning. |

RECENT DEVELOPMENTS

- October 2024 : Thermo Fisher Scientific Inc. (US) PPD expanded its services in Europe, offering advanced solutions for molecules, biomarkers, and novel modalities using technologies such as chromatography, flow cytometry, and molecular genomics.

- July 2024 : IQVIA (US) launched One Home for Sites, a new technology platform providing clinical research sites with a single sign-on and dashboard for managing key systems and tasks across all clinical trials.

- April 2024 : Labcorp (US) acquired select assets from the laboratory business of Providence (US) operated by its California medical groups. This includes ambulatory lab draw stations, an ambulatory laboratory facility, and other equipment.

- September 2023 : ICON plc (Ireland) partnered with BARDA to conduct a clinical trial evaluating next-generation COVID-19 vaccine candidates for improved protection and coverage.

Table of Contents

Methodology

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, investor presentations, SEC filings of companies and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), , Global Burden of Disease Study, and Centers for Medicare and Medicaid Services (CMS) were referred to identify and collect information for the global vaccine storage equipment market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in central lab services/clinical trial lab services market. The primary sources from the demand side include pharmaceutical companies, biotechnology companies, CROs, pharmacies, medical device companies, and research academics and universities. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

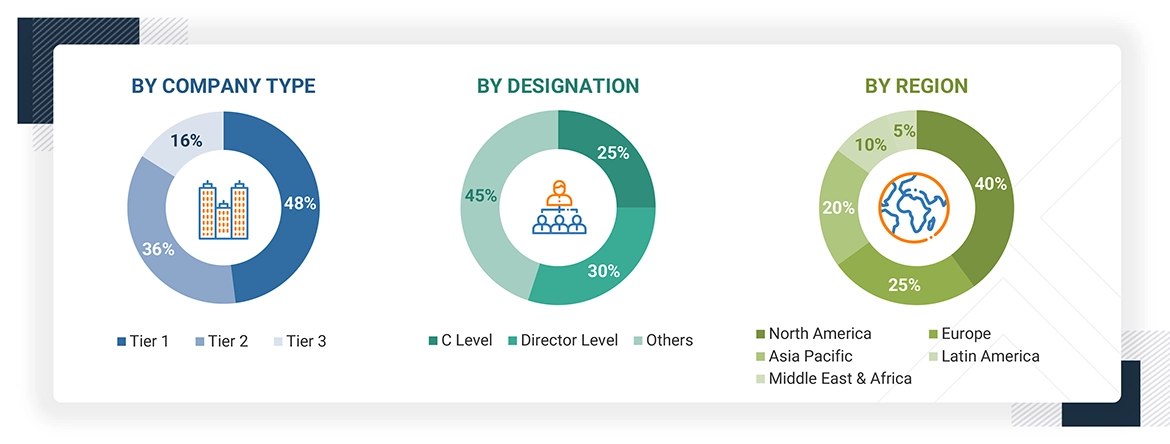

A breakdown of the primary respondents is provided below:

*C-level primaries include CEOs, CFOs, COOs, and VPs.

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = < USD 1.00 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

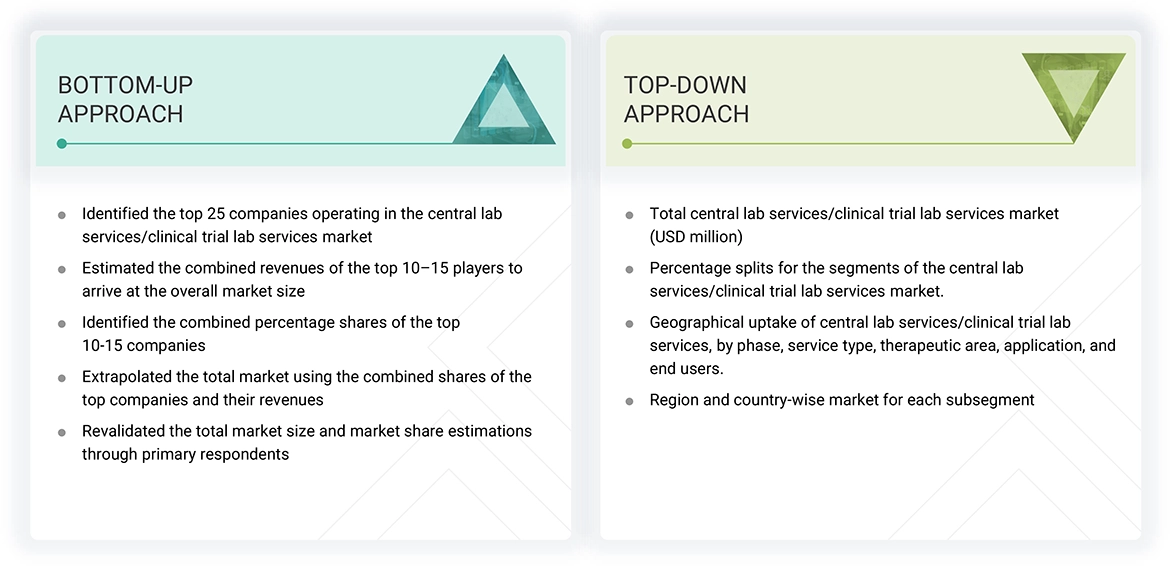

Market Size Estimation

For the global market value, annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs active in the global central lab services/clinical trial lab services market. All the major service providers were identified at the global and/or country/regional level. Revenue mapping for the respective business segments/sub-segments was done for the major players. Also, the global Central lab services/clinical trial lab services market was split into various segments and sub-segments based on:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of central lab services/clinical trial lab service providers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from central lab services/clinical trial lab services (or the nearest reported business unit/product category)

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global central lab services/clinical trial lab services market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation (Bottom Up approach &Top down approach)

Data Triangulation

After arriving at the overall size of the global central lab services/clinical trial lab services market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

The central laboratories services, also known as Clinical Trial Lab Services, refers to a laboratories responsible for the standardized analysis and identification of biological samples collected during clinical trials. These laboratories ensure precision, accuracy, and consistency across multiple trial sites by implementing same testing methods, regulatory compliance, and advanced laboratory techniques in clinical trials. Central labs support the clinical trials by providing essential services such as biomarker testing, safety testing, pharmacokinetics, and efficacy assessments, which are carried out in phases ultimately contributing to reliable and reproducible clinical trial outcomes.

Stakeholders

- Contract Research Organizations (CROs)/Clinical Trial Service Providers

- Pharmaceutical and Biopharmaceutical Companies

- Medical Device Manufacturing Companies

- Academic and Research Institutes

- Venture Capitalists and Investors

- Market Research and Consulting Firms

- Government Associations

- Medical Institutions and Universities

Report Objectives

- To define, describe, segment, and forecast the global central lab services/clinical trial lab services market by phase, service type, therapeutic area, modality, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall central lab services/clinical trial lab services market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions: North America, Europe, the Asia Pacific, Latin America, and Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies2

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business and product excellence

- To study the impact of AI/Gen AI on the market, along with the macroeconomic outlook for each region

Key Questions Addressed by the Report

- Pharmaceutical & Biopharmaceutical Companies

- CROs

- Medical Device Companies

- Other End Users

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Central Lab Services/Clinical Trial Lab Services Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Central Lab Services/Clinical Trial Lab Services Market