Chromic Materials Market

Chromic Materials Market by Technology (Photochromism, Thermochromism, Electrochromism, Others), Material, Application (Smart Windows, Smart Fabrics, Others), End-use Industry, Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The chromic materials market is projected to reach USD 6.37 billion by 2030 from USD 4.64 billion in 2025, at a CAGR of 6.5% from 2025 to 2030. The global chromic materials market is growing due to rising demand for smart, energy-efficient, and responsive technologies across construction, automotive, textiles, and packaging sectors. Increasing focus on sustainability and advanced material innovation further accelerates adoption worldwide.

KEY TAKEAWAYS

-

BY TYPEThe chromic materials market by type includes transparent, and colored state. Colored state materials lead the chromic materials market due to their versatile applications in smart windows, displays, and decorative coatings. These materials can switch between different colors or transparency levels, offering both aesthetic appeal and functional benefits such as glare reduction and energy savings.

-

BY TECHNOLOGYThe chromic materials market by material type includes photochromism, thermochromism, electrochromism, piezochromism, gasochromism, and other technologies. Thermochromism as technology type dominates the chromic material market.

-

BY MATERIAL TYPEThe chromic materials market by material type includes tungsten oxide, vandium dioxide, liquid crystal polymers, carbazoles, methoxy biphenyls, indium tin oxide, and other materials. Tungsten oxide is the leading raw material in the chromic materials market due to its excellent electrochromic properties, stability, and efficiency in modulating light and heat. It is widely used in smart windows, which dominate the market, and finds applications in displays and energy-saving devices. Its strong performance, durability, and adaptability make it the preferred choice for both commercial and residential electrochromic systems, particularly in regions with growing demand for energy-efficient and sustainable building solutions

-

BY APPLICATIONThe chromic materials market by application includes smart windows, smart fabrics, smart label indicators, displays, ophthalmic lenses and other applications. Smart windows, which adjust their transparency or color using electrochromic, thermochromic, or photochromic materials, are the leading application in the chromic materials market. Driven by energy efficiency, occupant comfort, and sustainability, they reduce heating, cooling, and lighting costs while controlling glare. Electrochromic windows dominate due to precise controllability, with strong adoption in North America, Europe, and Asia-Pacific, where green building and smart architecture initiatives are expanding rapidly.

-

BY REGIONAsia Pacific is expected to grow fastest, with a CAGR of 7.1%, driven by increasing urbanization, infrastructure development, and a strong focus on energy-efficient buildings. Countries like China, Japan, and South Korea are leading in the adoption of smart windows and electrochromic systems, supported by government incentives for green construction and sustainable technologies. Rising demand in automotive glazing, commercial buildings, and high-end residential projects is further boosting the market, making APAC a key growth region in the global chromic materials landscape

-

COMPETITIVE LANDSCAPEThe market is driven by strategic collaborations, new product launch, capacity expansions, and technological innovations from leading players such as Merck KGaA (Germany), Milliken & Company (US), Tokuyama Corporation (Japan), Flint Group (UK), Nova by Saint-Gobain (US), SpotSee (US), Matsui International Company (Japan), QCR Solutions Corp. (US), Chromatic Technologies Inc. (US), Olikrom Industry (France), Kolortek Co., Ltd. (China), New Prismatic Enterprise Co., Ltd. (Taiwan), GEM’INNOV (France), Hali Pigment Co., Ltd. (China) Vivimed Labs Limited (India), and Smarol Industry Co., Ltd. (China) .These companies are heavily investing in new technologies.

The global chromic materials market is expanding rapidly, driven by the growing adoption of smart and energy-efficient solutions in buildings, automobiles, textiles, and packaging. Asia-Pacific leads with smart infrastructure and manufacturing growth, while North America and Europe are advancing through sustainability initiatives and smart material innovations

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of chromic materials suppliers, which, in turn, impacts the revenues of chromic materials manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising adoption in automotive and aerospace sectors.

-

Growing demand for smart materials across industries

Level

-

Limited durability of chromic materials

-

High production costs

Level

-

Rising demand for energy-efficient building solutions

-

Expansion of applications in automotive safety features

Level

-

Complex regulatory and certification processes

-

Limited availability of raw materials

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising adoption in automotive and aerospace sectors.

Growing demand from the automotive and aerospace industries for chromic materials is a key market driver since these materials are capable of changing optical properties based on external stimuli such as light, heat, or electricity. In the automotive sector, electrochromic materials are increasingly employed in self-dimming rearview mirrors, which automatically reduce glare from vehicles being followed at night, enhancing driver visibility and safety. These mirrors have become a mandatory safety feature in most modern cars, backed by statistics from the Automotive Safety Council for decreased glare-related accidents. Premier suppliers such as Magna International and Gentex Corporation are at the cutting-edge of this technology, supplying electrochromic systems to leading automobile manufacturers like Tesla, BMW, and Ford. Electrochromic sunroofs and windows have an increased demand because they can enhance in-cabin comfort, control temperature and improve vehicle appearance. In the aerospace sector, chromic materials are redefining the passenger and pilot experience. Electrochromic windows, installed in aircraft like the Boeing 787 Dreamliner, allow passengers to control window tint levels electronically, replacing physical shades with reduced cabin heat and improved energy efficiency

Restraints: Limited durability of chromic materials

The longevity of chromic materials, particularly for outdoor or high-exposure use, is another significant restraint to the market. Chromic materials exhibit reversible property change with light, heat, or electricity exposure, but over time, their ability to do so can be lost due to chronic exposure to erosive ambient conditions such as UV, temperature, and humidity. For example, photochromic devices used in self-darkening windows or glasses may start to lose efficacy in color change after prolonged exposure to sunlight or extremely severe temperatures. Similarly, electrochromic windows used in buildings and cars may be prone to performance degradation after decades of use. Electrochromic windows, a next-generation technology in energy-efficient structures, have faced challenges with long-term reliability and durability. Such materials could lose their color-changing properties after a number of years, especially when being cycled repeatedly. Long-lasting and reliable products are generally desired by consumers and companies, and the issue of durability becomes a major barrier to the large-scale application of chromic materials. Such a lack of long-term durability also leads to additional maintenance costs and can result in the need for product replacement, deterring industries from adopting chromic materials, particularly for construction, automotive, and aerospace uses, where strength is of prime concern

Opportunity:Rising demand for energy-efficient building solutions

The increasing need for energy-saving building solutions is a significant potential opportunity for the market of chromic materials. Since there is an increased focus on sustainability across the globe, governments and companies are focusing on technology that saves energy and reduces carbon emissions. Chromic materials that change their properties or color on exposure to external stimuli such as light, heat, or electric fields are finding wider applications in smart windows, adaptive facades, and smart coatings. Such materials help control the temperature of a building through the regulation of solar heat gain and daylighting, thereby reducing the burden on artificial lighting, cooling, and heating systems. With green building ratings like LEED and BREEAM becoming more widely accepted, the use of chromic materials offers developers a novel method for the attainment of extremely high energy efficiency standards. The quick acceleration in urbanization, combined with buyer pressure to construct green and tech-enabled buildings, will drive fast growth of the business. Companies investing in R&D and designing future-generation chromic materials have the potential to gain significantly as the smart building technology moves away from niche applications and into standard building processes on houses, businesses, and industrial buildings around the world

Challenge: Complex regulatory and certification processes

Complex regulatory and certification processes pose a major challenge to the chromic materials market. Chromic materials, due to their chemical nature and broad application range, have to meet a multitude of strict and constantly evolving safety, health, and environmental regulations for every region. Organizations like the European Union's REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) mandate producers to submit detailed information about the safety, environmental footprint, and use of chromic materials. This can include expensive and time-consuming testing, third-party analysis, and constant reporting to maintain compliance. Apart from regulatory compliance, product certification is also needed to check particular performance claims, e.g., energy efficiency for intelligent windows or chemical resistance for coatings. Obtaining these certificates generally involves independent lab testing to meet strict standards, elaborate documentation, and official permits, all which increase operational costs and lengthen time to market. In addition, the constant redefinition of regulations, such as the planned move from approval to flat prohibition on certain chromic compounds, also adds to the complexity. Companies are compelled to constantly reformulate products, reorder supply chains, and sometimes invest in substitute technologies, always keeping up-to-date with the latest regulations. This is most burdensome for SMEs, who may not have the resources to cope with the recurring regulatory changes and multiple certification processes. In general, the regulation and certification context has the potential to limit innovation, slow the commercialization of new chromic technologies, and limit the expansion of the market by ensuring that new entrants and innovative products find it harder to progress

chromic-materials-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use photochromic or electrochromic materials that automatically adjust light transmission and tint levels to improve building energy performance and comfort. | Enhanced occupant comfort and natural light control. |

|

Integrate thermochromic or photochromic pigments into textiles that change color with temperature or light, enabling functional and aesthetic enhancements in garments. | Real-time body temperature indication. |

|

Apply thermochromic coatings for automotive interiors, seats, or medical devices that visually indicate temperature changes or system activation | Enhanced user safety and comfort. |

|

Use thermochromic or photochromic inks in packaging to indicate freshness, tampering, or temperature exposure in pharma and food products | Ensures product safety and integrity |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The chromic material ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material supplies, equipment suppliers, manufacturers, distributors, and end users. The raw material suppliers provide tungsten oxide, liquid crystal polymer and others to chromic material manufacturers. The distributors and suppliers establish contact between the manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Chromic Materials Market, By Technology

Thermochromism accounts for the largest market share, based on technology, in the chromic materials market due to its application in various industries. Thermochromic materials change color upon a change in temperature and have widespread applications in smart windows, apparel, package structures, and consumer products for functional as well as esthetic uses. They improve energy efficiency and user experience; they also offer visual indications, thereby making them very modern and sustainable. In addition, advancements and innovations in the thermochromic technology have made them more durable and sensitive in markets such as automotive, construction, and healthcare. All these factors are significantly driving the market. The automotive industry also drives the strong development of the thermochromism technology to smart rearview mirrors, temperature-sensitive coatings, and adaptive sunroofs. Moreover, advances in materials science have improved the durability, sensitivity, and color range of thermochromic materials, enabling their use for functionality and appearance. The medical sector has also begun to use thermochromic indicators for temperature-sensitive drugs and medical devices, expanding the field of applications. Cost-effectiveness relative to other chromic technologies further strengthens thermochromism's place in the market by enabling easier incorporation into mass-produced consumer and industrial products. Greater focus on sustainability and energy conservation across the globe is well aligned with the uses of thermochromics, especially in building and automotive applications

Chromic Materials Market, By Application

The displays segment is the fastest-growing application in the chromic materials market, in terms of value, due to the increasing demand for advanced, interactive, and energy-efficient display technologies. Chromic materials improve display performance by enabling color change, adaptive brightness, and improved visual effects upon response to environmental stimuli. As smart devices, e-readers, wearable electronics, and flexible displays increase in use, manufacturers are investing significantly in chromic technologies to deliver state-of-the-art features. The growing utilization of augmented reality (AR) and virtual reality (VR) devices is also paving the way for new applications of chromic materials, as these technologies require high-performing displays with dynamic characteristics to change and enhance visual experiences. The automotive sector is also one of the significant drivers of the demand for chromic materials, with the increasing utilization of heads-up displays (HUDs) and smart displays that utilize chromic materials to enable more flexibility and reduce glare. As sustainability has taken center stage, chromic displays that reduce energy consumption are gaining popularity in consumer electronics as well as business markets. The strong thrust toward lightweight, flexible, and interactive display products worldwide is expected to further drive the growth of this segment. Thus, the displays segment is the highest-growing application of chromic materials in terms of value during the forecast period

REGION

Asia Pacific to be fastest-growing region in global chromic materials market during forecast period

Asia Pacific is expected to be the fastest-growing market for chromic materials during the forecast period, fueled by expanding industrialization and the growing adoption of technology across various industries. China, Japan, South Korea, and India are experiencing high growth in industries such as construction, automotive, electronics, and consumer goods, which are key end users of chromic materials. The booming building sector, spearheaded by intelligent city projects and the need for energy-efficient structures, is stimulating the application of chromic materials in smart windows, adaptive facades, and sophisticated coatings. Further, the region houses several giant global electronics manufacturing companies, China, Japan, and South Korea among them, where the requirement for new display technologies that integrate chromic materials is growing extremely fast. Additionally, the region has the benefit of having a large number of local manufacturers and research entities, which gives rise to technological innovations in the field of materials science and economies of production. Favorable manufacturing costs, as well as strong infrastructure for supplies form additional support for regional as well as foreign firms to enhance their capacities. With the tightening environmental regulations and growing awareness of sustainable materials, the need for chromic materials in the Asia Pacific is anticipated to grow at a high rate

chromic-materials-market: COMPANY EVALUATION MATRIX

In the chromic materials market matrix, Merck KGaA (Star), a US company, leads the market through its high-quality products, which find extensive applications in various applications such as smrt windows, smart fabrics and others.Hali Pigment Co. Ltd. (Emerging Leader) is gaining traction with its technological advancements in chromic materials.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 4.36 Billion |

| Revenue Forecast in 2030 | USD 6.37 Billion |

| Growth Rate | CAGR of 6.5% from 2025-2030 |

| Actual data | 2025–2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Ton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Europe, North America, Asia Pacific, the Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: chromic-materials-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Interest in competitive benchmarking | • Provided a comparison of top chromic materials suppliers by product range, and market presence | • Supported go-to-market strategy and positioning vs competitors) |

| Need to assess future market growth hotspots | • Created a forecast model highlighting demand in APAC and other regions | • Guided client’s investment priorities toward regions with the strongest growth outlook |

| Emerging technologies & materials | Technology mapping | Stay ahead of innovation |

RECENT DEVELOPMENTS

- May 2024 : , Beverage innovator L.A. Libations partnered with Chromatic Technologies Inc. (CTI) to incorporate its chromatic technologies into its strategic portfolio

- March 2023 : Matsui International Company launched a new line of thermochromic microcapsules designed for home decor applications

- January 2021 : SpotSee acquired TMC Hallcrest and LCR Hallcrest, expanding its temperature monitoring solutions

- March 2020 : Chromatic Technologies Inc. (CTI) developed the BPA, BPS, and BPF-free thermochromic technology to meet strict pharma packaging regulations

- January 2020 : Milliken & Company officially completed the acquisition of Borchers Group Limited from The Jordan Company, expecting it to strengthen its position in the chromic materials market by enhancing its portfolio of sustainable and high-performance additives

Table of Contents

Methodology

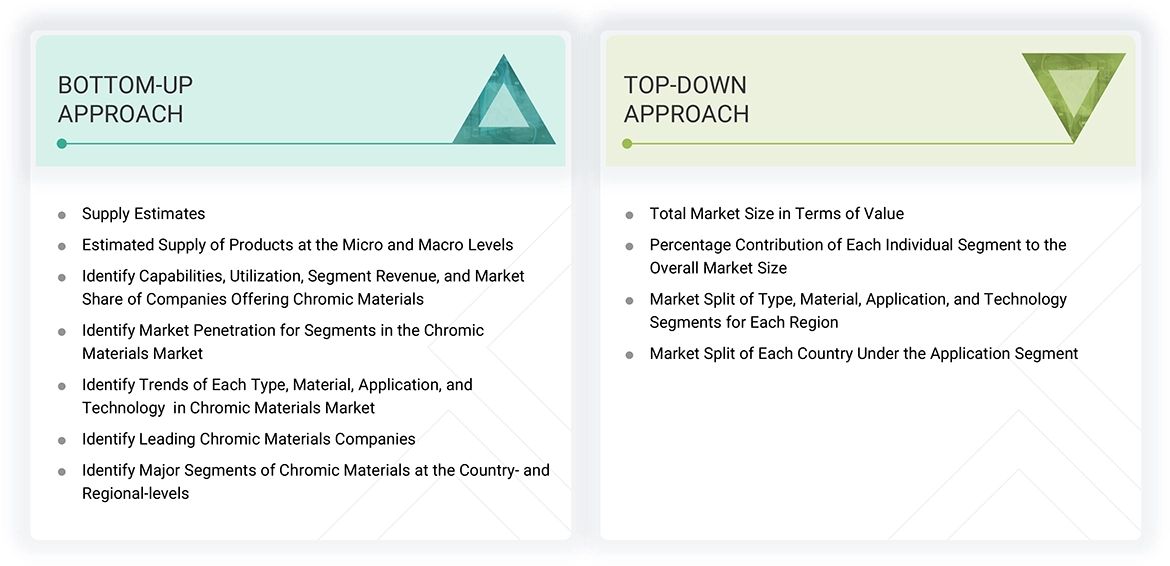

The study involved four major activities in estimating the market size of the chromic materials market. Exhaustive secondary research was undertaken to collect information on the market, the peer market, and the grandparent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases. Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The chromic materials market comprises several stakeholders in the value chain, which include manufacturers and end users. Various primary sources from the supply and demand sides of the chromic materials market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in the industrial sector. The primary sources from the supply side include manufacturers, associations, and institutions involved in the chromic materials industry. Interviews with experts were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, material, application, technology, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of chromic materials and the outlook of their business, which will affect the overall market.

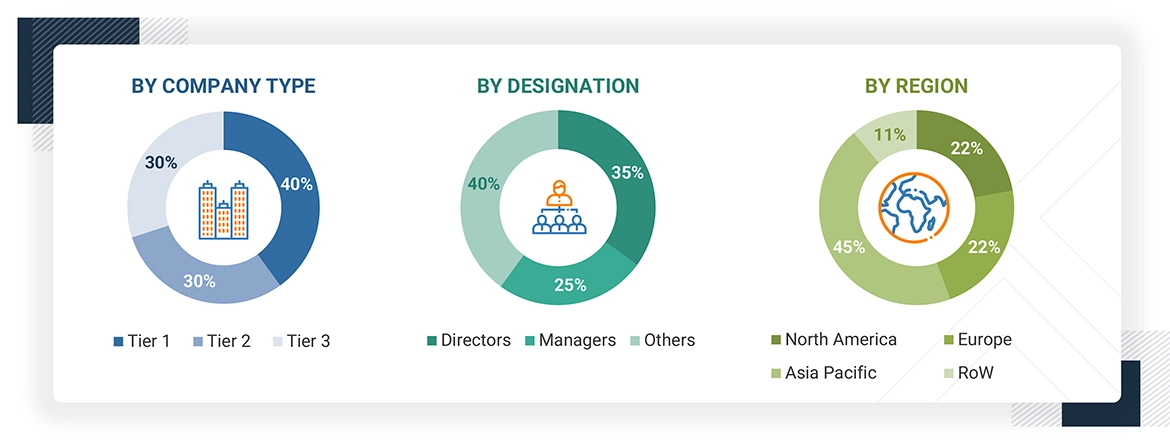

The breakdown of profiles of the expert interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the chromic materials market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Data Triangulation

After arriving at the total market size from the estimation process, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both, the demand and supply sides. Along with this, the market size has been validated by using both, the top-down and bottom-up approaches and interviews with experts. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and interviews with experts. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Chromic materials are materials that display reversible color changes on exposure to some external stimulus like light, temperature, electricity, solvents, or mechanical operations. Some of the examples of such materials are photochromic materials responding to light, thermochromic materials responding to temperature variations, and electrochromic materials responding to electrical currents. Chromic effects find extensive use in areas such as anti-counterfeiting, data storage, fabrics, and building design because they are dynamic and responsive. The versatility of chromic materials is useful for cutting-edge applications in security, energy efficiency, and interactive technologies.

Stakeholders

- Senior Management

- End Users

- Finance/Procurement Department

- R&D Department

- Manufacturers

- Raw Material Suppliers

Report Objectives

- To define, describe, and forecast the size of the chromic materials market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, technology, application, end-use industry, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Chromic Materials Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Chromic Materials Market