Cloud AI Market Size, Share, Growth & Latest Trends

Cloud AI Market by Cloud AI Infrastructure (Compute, Storage, Network), AI & ML Platforms (Auto ML), MLOps and Lifecycle Management (AI Workflow Orchestration), AIaaS, Technology (Generative AI and Other AI) - Global Forecast to 2029

OVERVIEW

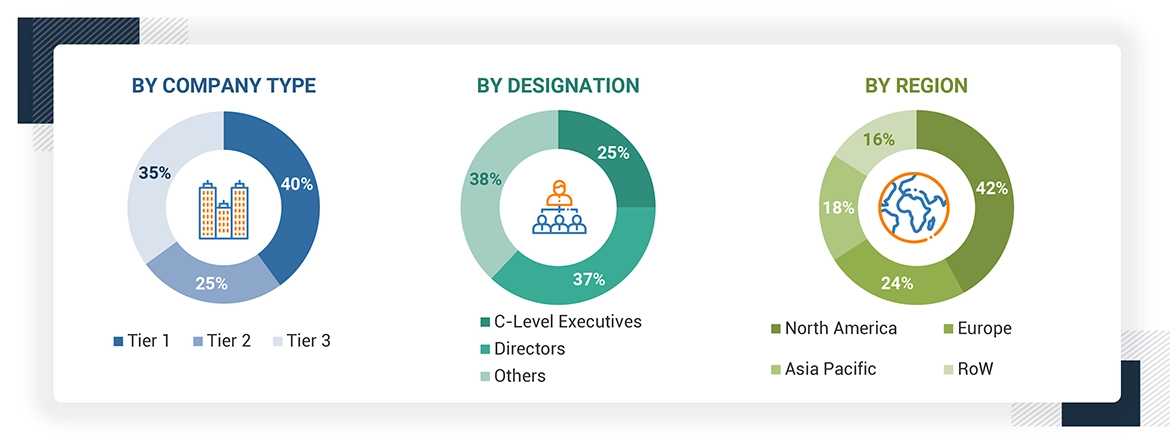

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global cloud AI market is expected to grow substantially, projected to rise from USD 80,307.6 million in 2024 to USD 327,159.1 million by 2029, reflecting a CAGR of 32.4%. This surge is driven by increasing enterprise adoption of AI-powered, cloud-native solutions across critical business functions. Cloud AI platforms are increasingly deployed in BFSI, healthcare, retail, and large enterprises, where real-time data processing, predictive analytics, and intelligent automation are essential for operational efficiency and strategic decision-making. Key growth drivers include: Accelerating AI adoption across industries for process automation, personalized services, and data-driven insights | Rising deployment in BFSI, healthcare, retail, and enterprise operations, where scalable AI solutions improve efficiency, compliance, and customer experience | Growing preference for AI-as-a-Service (AIaaS), modular AI platforms, and cloud-native architectures that support hybrid deployments and integration with emerging technologies

KEY TAKEAWAYS

-

BY REGIONThe North America student information system market accounted for a 43.3% revenue share in 2024.

-

BY OFFERINGBy offering, the AI as a Services segment is expected to register the highest CAGR of 38.1%.

-

BY TECHNOLOGY TYPEBy technology type, generative AI segment is projected to grow at highest CAGR.

-

BY HOSTING TYPEBy hosting type, the managed hosting segment is expected to dominate the market.

-

BY ORGANIZATION SIZEBy organization size, large enterprises segment will hold the largest market share.

-

BY BUSINESS FUNCTIONBy business function, the sales segment is expected to dominate the cloud AI market.

-

BY VERTICALBy vertical, the healthcare & life sciences segment is projected to grow the at the fastest rate of 39.7% during the forecast period.

-

COMPETITIVE LANDSCAPECompany AWS, Google, and Microsoft were identified as some of the star players in the system integration system market (global), given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPECompanies Salesforce, SAP, and Alibaba Cloud, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The surge in digital transformation, AI-driven workflows, and real-time decision-making is intensifying the need for flexible, scalable, and intelligent cloud AI solutions. At the core of this evolution, cloud AI platforms are becoming foundational to modern business operations by offering: Centralized AI model management and data processing across critical functions such as operations, finance, marketing, and supply chain | Real-time analytics, predictive insights, and intelligent automation that empower organizations to make data-driven decisions, optimize workflows, and enhance operational efficiency | Seamless integration with emerging technologies such as IoT, 5G, and blockchain, enabling faster, smarter, and secure business processes As enterprises prioritize model governance, data privacy, and interoperability, cloud AI vendors are investing in next-generation AI infrastructure, unified data lakes, and metadata-driven frameworks to support enterprise-wide intelligence and scalable innovation.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Rising demand for AI-driven automation and real-time data insights is creating mounting pressure on enterprises to optimize operations and enhance decision-making. Cloud AI solutions, supported by generative AI, machine learning, and intelligent automation across marketing, sales, finance, and operations, help organizations improve efficiency, reduce operational bottlenecks, and enable predictive, data-driven decisions. These platforms lower manual effort, enhance process visibility, and support scalable growth. Changes in AI technology adoption, regulatory frameworks, or workforce dynamics directly influence these outcomes and drive growth for Cloud AI providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing advancements in generative AI and intelligent automation

-

Rising adoption of cloud-based services and applications

Level

-

Data privacy and security concerns

Level

-

Integration with emerging technologies

-

Expansion into SMEs

Level

-

High costs of AI implementation

-

Complexity of AI integration

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Increasing advancements in generative AI and intelligent automation

The rapid advancements in generative AI (GenAI) and intelligent automation are accelerating the growth of the Cloud AI market. With models like GPT-4.1, Gemini 2.5, and Meta’s Llama 4 Scout now supporting multimodal processing and million-token context windows, enterprises can handle entire policy documents, compliance manuals, or customer data sets in a single pass. This progress enables automation of complex workflows such as claims validation, report generation, and data analysis across industries including healthcare, banking, and insurance. Businesses are increasingly shifting to cloud-based AI platforms that offer: Scalable infrastructure for large-scale model training and deployment | Real-time data analytics and predictive insights | Integration of Mixture-of-Experts (MOE) architectures for efficient task handling This trend aligns with vendor strategies emphasizing cloud-native, AI-optimized environments that enhance innovation, boost operational efficiency, and deliver personalized customer experiences.

Restraint:Data privacy and security concerns

Data privacy and security concerns remain a major restraint in the growth of the Cloud AI market. As AI systems increasingly handle vast volumes of sensitive enterprise and customer data, organizations remain cautious about deploying workloads in shared cloud environments due to: Risks of data breaches, unauthorized access, and insider threats | Compliance challenges with regulations such as GDPR and HIPAA | Limited visibility and control over third-party data management Nearly one-third of enterprises continue to cite data protection issues as a key barrier to wider Cloud AI adoption. Vendors are responding by implementing zero-trust architectures, end-to-end encryption, privacy-preserving AI models, and continuous compliance monitoring to strengthen data governance and ensure secure, trustworthy AI deployments.

Opportunity:Integration with emerging technologies

The integration of emerging technologies presents a major opportunity for the Cloud AI market. As IoT, blockchain, and 5G ecosystems expand, enterprises are generating unprecedented volumes of data that demand intelligent, scalable analysis. Cloud AI platforms enable: Real-time data processing and predictive insights for IoT-driven applications such as smart cities and autonomous systems | Enhanced data integrity and transparency through blockchain-enabled AI workflows | High-speed, low-latency AI processing powered by 5G connectivity This trend aligns with vendor strategies emphasizing cross-technology integration, edge-AI deployment, and secure, cloud-native architectures to accelerate innovation across connected industries.

Challenge:High costs of AI implementation

High implementation costs continue to pose a significant challenge to cloud AI adoption, especially among small and medium-sized enterprises (SMEs). While cloud-based AI reduces dependence on physical infrastructure, organizations still face substantial expenses in: Procuring advanced software and computing resources | Hiring and retaining AI specialists such as data scientists and engineers | Managing recurring costs for model training, maintenance, and compliance AI investments can range from USD 10,000 for small-scale automation to over USD 10 million for enterprise-grade systems, making it difficult for cost-sensitive firms to justify large expenditures. As a result, many businesses delay full-scale implementation or limit adoption to pilot projects. To overcome this challenge, vendors are increasingly focusing on modular deployment models, usage-based pricing, and automation accelerators that reduce upfront costs while enabling measurable ROI from AI integration.

CLOUD AI MARKET SIZE, SIZE, GROWTH & LATEST TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Siemens leverages Microsoft Azure Machine Learning and its Industrial Edge platform to analyze images and videos from the shop floor. Using AI-powered computer vision, the company automates quality inspection, detects defects early, and scales production monitoring across facilities. | Faster detection of product defects and variances | Real-time production adjustments to prevent costly errors | Enhanced collaboration by integrating PLM tools with Microsoft Teams | Empowers workers without PLM access to contribute to product lifecycle improvements |

|

Edger Finance, a Swedish fintech startup, partnered with IBM to pilot generative AI using the Watsonx.ai suite. The project created AI-assisted processes, including a conversational AI assistant, to enhance decision-support tools and deliver personalized investment insights to users. | Improved efficiency in collecting and analyzing investment data | Personalized and relevant information tailored to each investor | Interactive reports enabling better investment decision-making | Demonstrated potential value for corporate clients, recognized with the "Best Enterprise Product" award |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Prominent Cloud AI market players serve cloud providers, AI platform providers, AI service providers, data providers, business applications, and regulatory bodies. These vendors offer comprehensive AI solutions and services, leveraging cloud-native architectures, generative AI, machine learning, and intelligent automation to enable real-time insights, predictive analytics, and scalable operations across diverse enterprise environments.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cloud AI Market, By Offering

The infrastructure segment is expected to dominate the cloud AI market throughout the forecast period, fueled by the growing demand for high-performance computing power, storage scalability, and network optimization to support AI workloads. Enterprises increasingly rely on robust cloud infrastructure to: Train and deploy large-scale generative AI and machine learning models | Handle massive data processing requirements with low latency and high reliability | Enable seamless integration of AI applications across hybrid and multi-cloud environments | Support advanced use cases such as real-time analytics, autonomous systems, and intelligent automation These capabilities allow organizations to accelerate innovation, enhance computational efficiency, and scale AI initiatives globally. Cloud providers are expanding their infrastructure offerings with GPU- and TPU-optimized instances, AI-accelerated networking, and specialized storage architectures to meet the growing needs of AI-driven enterprises.

Cloud AI Market, By Business Function

Operations & Supply Chain AI applications are projected to grow at the fastest rate in the Cloud AI market, driven by their critical role in: Automating supply chain planning, inventory management, and logistics operations | Enhancing real-time visibility, demand forecasting, and operational efficiency | Integrating AI insights across procurement, production, and distribution workflows Key features include: Predictive analytics for demand and inventory optimization | AI-powered route planning and warehouse automation | Real-time dashboards for operational monitoring and decision-making | Scalable deployment across multi-site and multi-entity organizations These solutions are essential for operations and supply chain teams seeking to modernize legacy systems, reduce costs, and leverage cloud-native AI platforms for smarter, data-driven supply chain management.

Cloud AI Market, By Hosting Type

Self-hosting deployments are projected to grow at the fastest rate in the Cloud AI market, driven by enterprise demand for: Greater control over sensitive data, AI models, and proprietary algorithms | Enhanced customization and optimization of infrastructure for specific AI workloads | Compliance with industry regulations and data residency requirements | Reduced dependency on third-party cloud providers while leveraging on-premises scalability This hosting model is particularly favored in BFSI, healthcare, and government sectors, where security, privacy, and regulatory adherence are critical, and enterprises seek full control over AI operations and integration with existing IT systems.

Cloud AI Market, By Vertical

The BFSI sector is expected to hold the largest market share in the Cloud AI market, as enterprises seek solutions that: Automate fraud detection, risk assessment, and credit scoring processes | Enhance customer experience through AI-driven personalization and recommendation engines | Provide real-time analytics and predictive insights for investment, lending, and insurance operations | Integrate with core banking systems, payment platforms, and regulatory compliance tools Cloud AI platforms enable BFSI organizations to improve operational efficiency, reduce financial risks, and deliver secure, data-driven services at scale. Key drivers of adoption include digital banking, insurance automation, and growing demand for AI-powered financial decision-making.

REGION

North America is expected to hold largest market share in the cloud AI market during the forecast period.

North America, particularly the US, is emerging as the dominant region in the global Cloud AI market, with growth fueled by enterprise innovation, government initiatives, and a robust AI ecosystem. Key factors driving this surge include: Technology-Driven Enterprises & Early AI Adoption: US businesses are among the earliest adopters of cloud AI, leveraging advanced algorithms, generative AI, and machine learning to automate processes, enhance decision-making, and improve operational efficiency | Government-Led AI Strategies & Investments: The US government supports AI growth through initiatives like the AI National Strategy (2024) and investments in research, regulatory frameworks, and public-private partnerships | Industry-Specific Cloud AI Solutions: Leading tech companies, including Amazon, Google, IBM, and Microsoft, are offering tailored AI solutions for sectors such as BFSI, healthcare, and manufacturing, focusing on cost optimization, accelerated AI adoption, and scalable, secure AI services

CLOUD AI MARKET SIZE, SIZE, GROWTH & LATEST TRENDS: COMPANY EVALUATION MATRIX

AWS (Star) leads the cloud AI market with a strong global footprint, offering comprehensive AI solutions across BFSI, healthcare, retail, and enterprise sectors. Its scale, continuous innovation in generative AI, machine learning, and cloud-native AI services, and extensive deployment network make it a preferred choice for enterprises seeking end-to-end AI-driven digital transformation. Salesforce (Emerging Leader) is gaining traction with cloud AI solutions focused on CRM automation, personalized customer engagement, and scalable AI workflows. While AWS dominates through breadth, global reach, and enterprise-grade AI capabilities, Salesforce shows strong potential in specialized, cloud-native AI applications for customer-centric operations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Google (US)

- IBM (US)

- AWS (US)

- Microsoft (US)

- Oracle (US)

- Nvidia (US)

- Salesforce (US)

- SAP (Germany)

- Alibaba Cloud (China)

- HPE (US)

- Intel (US)

- Tencent Cloud (China)

- H2O.ai (US)

- OpenAI (US)

- Baidu (China)

- DataRobot (US)

- Huawei (China)

- C3 AI (US)

- Cloudera (US)

- Altair Engineering (US)

- Cohere (Canada)

- Glean (US)

- Scale AI (US)

- CloudMinds (China)

- Inflection AI (US)

- Any scale (US)

- Frame AI (US)

- Dataiku (US)

- InfraCloud Technologies (India)

- Yellow.ai (US)

- Viso.ai (Switzerland)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 80,307.6 MN |

| Revenue Forecast in 2029 | USD 327,159.1 MN |

| Growth Rate | CAGR of 32.4% from 2024-2029 |

| Actual data | 2019-2029 |

| Base year | 2023 |

| Forecast period | 2024-2029 |

| Units considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Offering: Infrastructure, AI-as-a-Service (AIaaS) I By Technology Type: Generative AI, Other AI I By Hosting Type: Managed Hosting, Self-Hosting I By Organization Size: Large Enterprises, SMEs I By Business Function: Marketing, Sales, Human Resources, Finance & Accounting, Operations & Supply Chain I By Vertical: BFSI, Retail & E-commerce, Manufacturing, Government & Defense, Healthcare & Life Sciences, Technology & Software Providers, IT & Telecom, Energy & Utilities, Media & Entertainment, Automotive, Transportation, & Logistics, Other Verticals |

| Regional Scope | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: CLOUD AI MARKET SIZE, SIZE, GROWTH & LATEST TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | In-depth segmentation of the North American Cloud AI market and extended regional breakdowns for Europe, Asia Pacific, Middle East & Africa, and Latin America. |

|

| Leading Solution Provider (EU) | Detailed profiling of up to 5 additional market players, including: Product portfolios Strategic initiatives Regional presence |

|

RECENT DEVELOPMENTS

- September 2024 : Salesforce strengthened its partnership with Google Cloud, launching Agentforce Agents that enable safe collaboration between Salesforce Customer 360 and Google Workspace apps. This release improves previous connections, allowing mutual customers to deploy autonomous agents that work smoothly within their regular apps while benefiting from solid privacy and user data protection from Salesforce and Google Workspace.

- August 2024 : IBM and Intel announced a cooperation to deploy Intel Gaudi 3 AI accelerators as a service on IBM Cloud, with a launch date of early 2025. This collaboration intends to help enterprises expand their AI initiatives more effectively while maintaining high reliability and security. Gaudi 3 will be integrated into IBM's Watsonx AI and data platform, making IBM Cloud the first provider to provide Gaudi 3 for both hybrid and on-premises settings.

- July 2024 : AWS launched AWS GenAI Lofts, a global initiative to foster innovation and engagement in the generative AI area. This program will set up temporary spaces in key AI hubs worldwide, allowing developers, companies, and AI enthusiasts to learn, create, and interact. Visitors can expect engaging experiences featuring exciting generative AI projects, workshops, informal talks, and hands-on sessions led by AI experts, community groups, and AWS partners like Anthropic, Cerebral Valley, Weights & Biases, and venture capital investors.

- May 2024 : IBM launched the AI Gateway for IBM API Connect, which became available in June. This new functionality enables users to access AI services from a single control point, enabling secure interaction between internal applications and external AI APIs. It also monitors AI API usage and gives insights for faster decisions about which large language models (LLMs) to utilize.

- April 2024 : NVIDIA acquired Run: ai, an Israeli firm, highlighting the significance of Kubernetes in AI infrastructure. Run: AI's technology improves GPU utilization for AI workloads, benefiting NVIDIA's ecosystem, broadening market reach, and advancing Kubernetes in cloud-native AI architecture.

Table of Contents

Methodology

The study comprised four main activities to estimate the cloud AI market size. We conducted significant secondary research to gather data on the market, the competing market, and the parent market. The following stage involved conducting primary research to confirm these conclusions and hypotheses and sizing with industry experts throughout the value chain. The overall market size was evaluated using a blend of top-down and bottom-up approach methodologies. After that, we estimated the market sizes of the various cloud AI market segments using the market breakup and data triangulation techniques.

Secondary Research

We determined the size of companies offering cloud AI based on secondary data from paid and unpaid sources. We also analyzed major companies' product portfolios and rated them based on their performance and quality.

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the spending of various countries on the cloud AI market was extracted from the respective sources. We used secondary research to obtain the critical information related to the industry's value chain and supply chain to identify the key players based on offering, market classification, and segmentation according to components of the major players, industry trends related to components, users, and regions, and the key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, we interviewed various primary sources from the supply and demand sides of the cloud AI market to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from vendors providing offerings, associated service providers, and operating in the targeted countries. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), we conducted extensive primary research to gather information and verify and validate the critical numbers arrived at. The primary research also helped identify and validate the segmentation, industry trends, key players, competitive landscape, and market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies. In the complete market engineering process, the bottom-up approach and several data triangulation methods were extensively used to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. We conducted an extensive qualitative and quantitative analysis of the complete market engineering process to list the key information/insights throughout the report.

Note 1: Tier 1 companies have revenues greater than USD 10 billion; tier 2 companies' revenues range

between USD 1 and 10 billion; and tier 3 companies' revenues range between USD 500 million and 1 billion

Note 2: Others include sales, marketing, and product managers.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The cloud AI market and related submarkets were estimated and forecasted using top-down and bottom-up methodologies. We used the bottom-up method to determine the market's overall size, using the revenues and product offerings of the major market players. This research ascertained and validated the precise value of the total parent market size through data triangulation techniques and primary interview validation. Next, using percentage splits of the market segments, we utilized the overall market size in the top-down approach to estimate the size of other individual markets.

The research methodology used to estimate the market size included the following:

- We used primary and secondary research to determine the revenue contributions of the major market participants in each country after secondary research helped identify them.

- Throughout the process, we obtained critical insights by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

- We used primary sources to verify all percentage splits and breakups, which we calculated using secondary sources.

Cloud AI Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall market size was determined, we divided the market into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from government entities' supply and demand sides.

Market Definition

Considering the views of various sources and associations, MarketsandMarkets defines cloud AI as combining cloud computing with artificial intelligence to provide businesses and individuals easy access to advanced AI tools and services. Organizations can streamline their operations and enhance their capabilities by integrating technologies like machine learning, natural language processing, and computer vision into cloud platforms such as Google Cloud AI, Amazon Web Services (AWS), and Microsoft Azure. Cloud AI enables companies to harness the full potential of AI without heavy upfront investments, making it scalable and cost-effective. As a result, cloud AI empowers businesses to innovate, improve decision-making, and gain a competitive edge in their industries.

Stakeholders

- Research organizations

- Third-party service providers

- Technology providers

- Cloud services providers

- AI consulting companies

- Independent software vendors (ISVs)

- Service providers and distributors

- Application development vendors

- System integrators

- Consultants/consultancy/advisory firms

- Training and education service providers

- Support and maintenance service providers

- Managed service providers

Report Objectives

- To define, describe, and forecast the cloud AI market based on offering (infrastructure [Cloud AI Infrastructure, AI and ML Platforms, MLOPS, and Lifecycle Management], AI-as-a-service), technology type, hosting type, organization size, business function, vertical, and region

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets for growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for prominent players

- To analyze the impact of AI/GenAI on the cloud AI market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product launches and enhancements, and partnerships & collaborations in the market.

Available Customizations

MarketsandMarkets provides customizations based on the company's unique requirements using market data. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's portfolio.

Geographic Analysis

- Further breakup of the cloud AI market

Company Information

- Detailed analysis and profiling of five additional market players

Key Questions Addressed by the Report

Stakeholders in the cloud AI market include the following:

- Research organizations

- Third-party service providers

- Technology providers

- Cloud services providers

- AI consulting companies

- Independent software vendors (ISVs)

- Service providers and distributors

- Application development vendors

- System integrators

- Consultants/consultancy/advisory firms

- Training and education service providers

- Support and maintenance service providers

- Managed service providers

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cloud AI Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Cloud AI Market