Coated Ducts Market

Coated Ducts Market by Coating Type (ETFE, ECTFE, Others), Type (Powder, Liquid), End-use Industry (Semiconductor Manufacturing, Pharmaceutical, Oil & Gas, Others), & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global coated ducts market is projected to reach USD 0.66 billion by 2030 from USD .52 billion in 2025, at a CAGR of 4.8% during the forecast period. The market for coated ducts is experiencing significant growth due to several factors, such as the increasing demand from the semiconductor industry and ongoing technological advancements. The coating type segment significantly contributes to the market as these coatings are lightweight, durable, and corrosion-resistant. They enhance energy efficiency and lower maintenance costs.

KEY TAKEAWAYS

-

BY TYPEThe coated ducts market includes powder and liquid type of coated ducts. Powder coatings have become a highly preferred option in the coated ducts market due to their durability, environmental benefits, and efficiency. As a dry finishing process, powder coating eliminates the need for solvents, reducing volatile organic compound (VOC) emissions and making it an eco-friendly choice.

-

BY COATING TYPEThe coating types in coated ducts market includes ETFE coatings, ECTFE coatings and other coating types. Coating types have witnessed continuous technological advancements, with coating formulations evolving to meet the increasingly stringent demands of sectors such as pharmaceuticals, semiconductors, food processing, water treatment, and commercial buildings. Modern coating technologies are being developed with enhanced properties such as improved adhesion, surface smoothness, and reduced emissions during application

-

BY END-USE INDUSTRYThe end-use industry segment of the coated market is broadly categorized into semiconductor manufacturing, pharmceutical, oil & gas, food processing, chemical manfacturing and other end-use industries. As industries continue to evolve and face new challenges, the demand for high-performance, customized coatings for ducts is growing. Coated ducts play a critical role in maintaining operational efficiency, reducing maintenance costs, and ensuring compliance with regulatory standards across these diverse industries

-

BY REGIONThe coated ducts market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific is expected to grow fastest, with a CAGR of 5.3%, driven by rapid industrialization and expanding infrastructure across key sectors such as semiconductors, chemical processing, food processing, oil & gas, and pharmaceuticals. Countries like China, South Korea, and Japan are global leaders in semiconductor production, with significant investments in cleanroom facilities that rely on coated ducts to maintain particle-free environments and ensure contamination control.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic collaborations, capacity expansions, and technological innovations from leading players such as Kenyon Pte Ltd., Exyte Group, Acesian Partners Limited, SEBO MEC, and Uangyih-Tech . Manufacturers are increasingly prioritizing product innovation while adopting expansions and acquisitions to penetrate emerging markets.

The coated ducts market is driven by the rising demand for coated ducts, high chemical resistance requirements, and compliance with environmental and safety regulations across sectors such as semiconductor manufacturing, chemical processing, and pharmaceuticals. Furthermore, innovations in coating technologies, such as eco-friendly and high-performance coatings, are driving market growth.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The coated ducts market is being transformed by several disruptive trends that are reshaping customer demands. Rapid innovations in material technologies, particularly ETFE and ECTFE coatings, are fueling the need for ducts that offer enhanced corrosion resistance, durability, and energy efficiency. This is especially evident in industries such as chemical processing, pharmaceuticals, and large-scale construction. Sustainability has become a major priority, with clients increasingly opting for recyclable and eco-friendly solutions to meet stricter environmental regulations and green building codes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

High Chemical Resistance Requirements

-

Compliance with environmental and safety regulations

Level

-

High Material & Installations Costs

-

Availability of alternative solutions

Level

-

High purity materials create demand for high cleanliness standards in manufacturing sector

-

Expansion of semiconductor fabs and industrial manufacturing facilities

Level

-

Chemical resistance limitations and permeation

-

Limited awareness and market penetration outside semiconductor sector

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:High chemical resistance requirements

The demand for high chemical resistance is a key growth driver for the coated ducts market. Industries are increasingly seeking materials that can withstand aggressive and corrosive chemicals and extreme operating conditions. Sectors such as chemical processing, pharmaceuticals, semiconductors, and food & beverage production rely on duct systems that can endure continuous exposure to acids, solvents, and other reactive chemicals. Fluoropolymer-coated ducts, particularly those lined with ETFE or PTFE, offer exceptional chemical inertness and resilience. This makes them a preferred choice in environments where preventing contamination and maintaining operational integrity are crucial. The adoption of these advanced coatings not only extends the service life of the ductwork, thereby minimizing maintenance needs and costs but also helps industries comply with increasingly stringent environmental and safety regulations globally.

Restraint: High material and installation costs

High material and installation costs pose significant challenges for the coated ducts market, particularly for high-performing products like ETFE-coated ducts. Upfront, coated ducts are more expensive than traditional duct materials such as galvanized steel or aluminum. Although these advanced ductwork solutions offer benefits like enhanced chemical resistance, longer useful life, and improved operational performance, the initial purchase price can deter potential buyers and decision-makers. Specialized fluoropolymer coatings come at a premium, and the production of specific models must adhere strictly to specifications; any deviation, whether too little or too much performance variation, can lead to costly consequences. Additionally, skilled manpower and specialized tools are required for safe and accurate installation, adding to overall costs.

Opportunity: High-purity materials create demand for higher cleanliness standards in manufacturing sector

As industries such as semiconductors, pharmaceuticals, and biotechnology strive to enhance product quality and comply with government standards, there is a growing opportunity in the coated ducts market. This demand is largely driven by the need for extremely high-purity materials in the manufacture of advanced products. Environments that involve sensitive manufacturing processes or the use of hazardous chemicals require effective ventilation and exhaust systems to prevent contamination of materials and avoid residue buildup from aggressive cleaning processes. This necessity has led to the increased use of fluoropolymer-coated stainless steel ducting systems, specifically those with ETFE or ECTFE liners. These materials are valued for their temperature tolerance, chemical resistance, and smooth, non-porous surfaces, making them ideal for maintaining ultra-clean conditions in harsh operating environments. Coated ducts have demonstrated their ability to meet strict cleanliness and hygiene requirements while allowing for quick assembly and efficient manufacturing of housing constructions.

Challenge: Chemical resistance limitations and permeation

Coated ducts, particularly those lined with advanced fluoropolymers such as ETFE or ECTFE, are recognized for their exceptional chemical resistance and durability in extreme conditions. However, these coatings still face challenges regarding their chemical resistance, applicability limits, and permeability. They are not universally effective against all chemicals; while ETFE and ECTFE offer a broad range of resistance, certain aggressive acids, solvents, or chemical mixtures can degrade these coatings, significantly shortening their lifespan. Permeation occurs when chemicals diffuse through the duct lining at a slow rate, leading to a gradual loss of containment and the potential contamination of cleanroom environments or sensitive manufacturing processes. This risk is heightened in systems that collect exhaust from multiple sources, as it can create unexpected chemical interactions that exceed the coatings’ resistance capabilities.

Coated Ducts Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of coated stainless steel exhaust duct for use in odor control applications | Eliminated the need to mix catalysts/resins to meet fluctuating weather conditions. |

|

Coated stainless steel duct installed replacing FRP (Fiber-reinforced plastic) duct system | Coated stainless steel has great advantage due to its FM approved fire and smoke rating in addition to not requiring future maintenance costs. |

|

Deployed ETFE coated ducts, elbows & valves in wafer processing facilities | The coated duct ensured FM4922 fire safety compliance, minimized fluoride leaching, and allowed rapid installation in cleanrooms. |

|

Used coated ducts for corrosive exhaust in laboratories and bio-medical cleanrooms | The system met the regulatory standards and enabled sprinkler free designs along reduced installation and insurance costs. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The coated ducts market ecosystem comprises raw material suppliers, manufacturers, distributors, and end users. The raw materials for manufacturing coated ducts include base metals such as stainless steel and galvanized iron and specialized materials such as ETFE (ethylene tetrafluoroethylene) or PTFE (polytetrafluoroethylene) fluoropolymers. Raw material suppliers supply the necessary materials for the manufacturing of coated ducts. These materials should comply with strict regulatory standards for safety and biocompatibility. The raw materials are then processed by manufacturers into different types of coated ducts. The distribution of the product is crucial for the delivery of products to the consumers. End-use industries include semiconductor manufacturing, chemical processing, food processing, pharmaceutical, and oil & gas that use coated ducts for various applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Coated Ducts Market, By Type

Powder accounts for the largest market share, by type, in the coated ducts market. Powder type is majory used due to its distinct environmental, economic, and performance advantages that align with the ever-changing demands of the ducting industry. Powder coatings are solvent-free, emitting minimal amounts of volatile organic compounds (VOCs), which helps address global sustainability initiatives and stricter environmental regulations. The application of powder coatings generates minimal waste, as any excess powder can be collected and reused, leading to reduced material costs and increased operational efficiency.

Coated Ducts Market, By Coating Type

The ETFE segment held the largest share in 2024. Its unique combination of chemical resistance, durability, and lightweight performance makes it precisely suited to demanding industrial applications such as semiconductor manufacturing, chemical processing, pharmaceuticals, and construction. ETFE coatings exhibit superior chemical resistance, high-temperature resistance, and ultraviolet (UV) resistance, thereby promoting long-term effectiveness and low maintenance in harsh environments. As a result, ETFE has emerged as a popular choice across various industries, preferring energy-efficient and sustainable ducting solutions with reliability.

Coated Ducts Market, By End-use Industry

The semiconductor industry is projected to be the largest end-use market for coated ducts in terms of value during the forecast period. This industry has strict requirements for contamination control, chemical resistance, and durability, necessitating the use of high-performance coated ducts, particularly those lined with ETFE and ECTFE. Although duct systems represent only a small portion of the overall semiconductor environment, it is crucial to maintain their cleanliness to comply with cleanroom standards. This cleanliness is essential for controlling environmental factors and preventing contamination from components within the system.

REGION

Asia Pacific to be fastest-growing region in global Coated Ducts market during forecast period

Slide No. 8

The Asia Pacific region holds the largest share of the coated ducts market, primarily driven by rapid urbanization, a large manufacturing industry, and extensive infrastructure projects in countries such as China, India, South Korea, and Southeast Asia. The region’s expanding construction sector has led to significant commercial, residential, and industrial developments. Additionally, increased awareness of indoor air quality has boosted demand for new ventilation and HVAC systems, including coated ducts that offer enhanced chemical resistance and durability. The implementation of stricter building codes and a rise in government-backed energy efficiency programs have encouraged the acceptance of new and sustainable ducting products.

Coated Ducts Market: COMPANY EVALUATION MATRIX

In the Coated Ducts market matrix, Exyte Group, is one of the leading global suppliers of coated duct solutions, with wide range of product portfolio, strong market presence, and effective business strategies. Acesian Partners Limited is gaining traction with substantial product innovations over their competitors and strong strategy to expand their business

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.50 Billion |

| Market Forecast in 2030 (value) | USD 0.66 Billion |

| Growth Rate | CAGR of 4.8% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Meter) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Coated Ducts Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| APAC-based Coated Ducts Manufacturers |

|

|

| Cleanroom Manufacturer |

|

|

| Coated Ducts Distributor |

|

|

| Raw Material Supplier |

|

|

RECENT DEVELOPMENTS

- October 2024 : Exyte Group rebranded its Technology & Services division as Exentec, focusing on high-tech sectors such as life sciences and semiconductor manufacturing.

- May 2024 : Acesian Partners Limited established a wholly owned subsidiary in Singapore named Acesian Technologies Solutions Pte. Ltd.

- April 2024 : Exyte Group acquired Kinetics, a provider of installation services and technical facility management.

- March 2024 : Exyte Group expanded in the US, with two of its subsidiaries, Diversified Fluid Solutions (DFS) and NEHP, establishing a presence in Nampa, Idaho.

- March 2024 : Exyte Group acquired CollabraTech Solutions, a US-based specialist in delivery systems and contract manufacturing services for high-tech facilities.

Table of Contents

Methodology

The study involved four major activities in estimating the market size of the coated ducts market. Exhaustive secondary research was done to collect information on the market, the peer market, and the grandparent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to to identify and collect information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases. Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The coated ducts market comprises several stakeholders in the value chain, which include manufacturers and end users. Various primary sources from the supply and demand sides of the coated ducts market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in the industrial sector. The primary sources from the supply side include manufacturers, associations, and institutes involved in the coated ducts industry. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to coating type, type, end-use industry, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of coated ducts and the outlook of their business, which will affect the overall market.

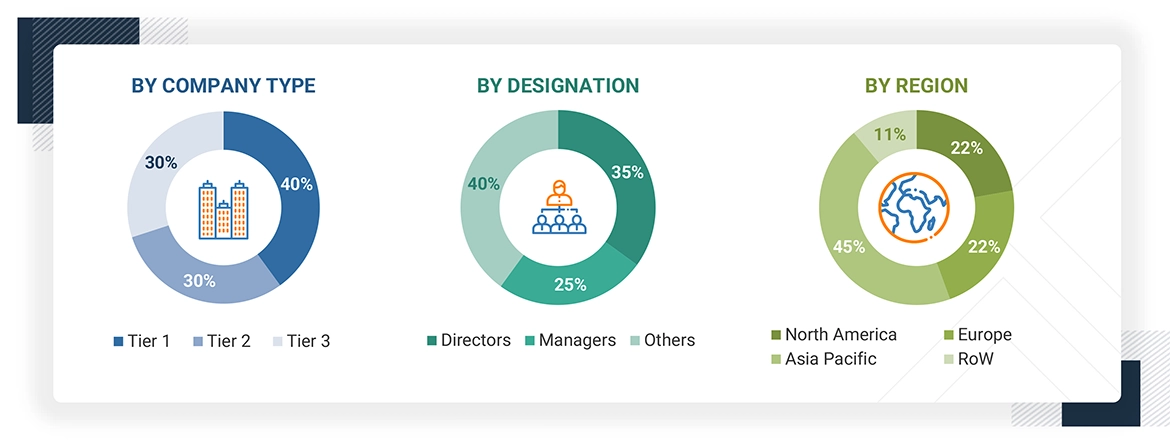

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023, which is available in the public domain, their product portfolios, and their geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the coated ducts market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Data Triangulation

After arriving at the total market size from the estimation process, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there are three sources: the top-down approach, the bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Coated ducts are air ducts used in HVAC systems that have a specialized coating, often a thick, antimicrobial layer applied to their interior or exterior surfaces to reinforce structural integrity, prevent microbial growth, and enhance resistance to corrosion and environmental damage. Coated ducts are widely used across various end-use industries, including semiconductors, pharmaceuticals, chemical processing, and high-tech manufacturing, where strict standards for air quality and system reliability are essential.

Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

- Manufacturers

- Raw Material Suppliers

Report Objectives

- To define, describe, and forecast the size of the coated ducts market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing market growth

- To estimate and forecast the market size based on coating type, type, end-use industry, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What is the current market size, and what is the growth forecast for coated ducts?

The coated ducts market is valued at an estimated USD 0.52 billion in 2025 and is estimated to reach USD 6.5 Billion by 2030, at a CAGR of 4.8% during the forecast period.

Who are the major players in the coated ducts market?

Key companies include Kenyon Pte Ltd. (Singapore), Exyte Group (Germany), Acesian Partners Limited (Singapore), Sigma Roto Lining Pvt. Ltd. (India), Viron International (US), Dongsheng (Zhangjiagang) Environmental Protection Technology Co., Ltd. (China), Spiral Manufacturing Co., Inc. (US), ChenFull International Co., Ltd. (Taiwan), Junhao Co., Ltd. (China), Epiroc Mining India Limited (India), LBF Technik (Germany), SEBO MEC (South Korea), Shanghai Shengjian Technology Co., Ltd. (China), Uangyih-Tech Industrial Co., Ltd. (Taiwan), and ATS Duct Inc (US).

What are the key market drivers of coated ducts market?

Key drivers include high chemical resistance requirements, compliance with stringent environmental and safety regulations, and a growing need for long-term durability and low maintenance.

What are the different coating types used in coated ducts?

ETFE and ECTFE coating types are widely used in this market.

What are the major types of coated ducts?

Powder and liquid are the major types in this market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Coated Ducts Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Coated Ducts Market