Compounding Pharmacy Market Size, Growth, Share & Trends Analysis

Compounding Pharmacy Market by Product (Oral, Topical, Parenteral), Compounding Type (Ingredient Alteration, Dosage Alteration), Therapeutic Application (Pain Management, HRT), Sterility (Sterile), End User (Pediatric, Adult) - Global forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The compounding pharmacy market is projected to reach USD 19.41 billion by 2030 from USD 14.72 billion in 2025, at a CAGR of 5.7% from 2025 to 2030. A compounding pharmacy is a practice in which a licensed pharmacist combines, mixes, or alters the ingredients of a drug to create a medication tailored to the needs of an individual patient. Its market growth is fueled by persistent drug shortages in North America and Europe and continued supply gap for GLP-1 drugs to enhance compounding pharmacy revenues.

KEY TAKEAWAYS

-

BY PRODUCTThe compounding pharmacy market comprises topical drugs, oral drugs, parenteral drugs, rectal drugs, nasal drugs, ophthalmic drugs, and other products. Oral drugs are used widely because they are customized for patient-specific therapies that address individual medical needs.

-

BY COMPOUNDING TYPEIt includes pharmaceutical ingredient alteration, currently unavailable pharmaceutical manufacturing, and pharmaceutical dosage alterations. Pharmaceutical dosage alteration dominates the compounding pharmacy market as it addresses the widespread need for patient-specific doses, strengths, and forms that are not commercially available.

-

BY THERAPEUTIC APPLICATIONTherapeutic applications include pain management, hormone replacement therapy, dermal disorders, nutritional supplements, and other applications. Pain management dominates the compounding pharmacy market due to the high prevalence of chronic and localized pain conditions that require customized formulations for effective treatment relief.

-

BY STERILITY TYPEIt includes sterile and non-sterile preparations, in which sterile preparations dominate the compounding pharmacy market.; this dominance is attributed to the increasing demand for injectable medications, parenteral nutrition, and advanced biologic therapies

-

BY END USERThe compounding pharmacy market is segmented into pediatrics, adults, and geriatrics. Adults represent the largest segment by end user. This dominance mainly results from the high rate of chronic conditions and lifestyle-related diseases among adults, which often require personalized medication solutions.

-

BY REGIONThe Asia Pacific is expected to grow fastest, driven by factors such as rapid healthcare infrastructure development, increasing disposable incomes, and a growing demand for personalized medicines.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Fagron and B. Braun Melsungen AG entered into agreements and partnerships to cater to the growing demand for compounding pharmacy across innovative applications.

The compounding pharmacy market is projected to grow rapidly over the next decade, supported by the full enforcement of USP standards, which boosts demand for compliant compounding services, and a safety push for ready-to-administer (RTA) and standardized doses. Compounding pharmacy is gaining momentum as a vital part of healthcare, providing customized medications tailored to individual patient needs that cannot be met by commercially available drugs. Growing demand for personalized treatments, management of rare conditions, and alternatives during drug shortages highlight its significance. By allowing flexibility in dosage forms, strengths, and formulations, compounding pharmacies are becoming a key element of patient-focused care, encouraging use across hospitals, specialty clinics, and community health settings.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on compounding pharmacies’ business stems from changing patient and healthcare provider trends. The market has seen major shifts that are likely to speed up during the forecast period. These include the increasing prevalence of chronic diseases, the greater use of personalized medicines with tailored dosage forms, rising demand for sterile compounding and biologics support, and growing interest in weight management and hormone replacement therapies. These short- and long-term trends are expected to alter demand patterns across hospitals, specialty clinics, and retail pharmacies, creating growth opportunities for compounding pharmacies and their suppliers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Persistent drug shortages in North America and Europe

-

Full enforcement of USP standards boosts demand for compliant compounding services.

Level

-

Resolution of GLP-1 shortages reduces reliance on compounded alternatives

-

Stricter FDA oversight & Insanitary Conditions enforcement

Level

-

Radiopharmaceutical compounding standardization

-

Expansion of hospital outsourcing into anesthesia, critical care, ophthalmic & chemo-adjuncts

Level

-

Capacity bottlenecks in API, excipient supply, and CCI/testing

-

Limited quality-system maturity and gaps in stability/BUD evidence generation

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Persistent drug shortages in North America and Europe

Persistent drug shortages in North America and Europe are driving the growth of the compounding pharmacy market. As conventional manufacturers struggle to meet demand, healthcare providers increasingly rely on compounding pharmacies to supply customized, high-quality medications, ensuring continuity of care for adults, pediatrics, and geriatric patients across diverse therapeutic areas.

Restraint: Resolution of GLP-1 shortages reduces reliance on compounded alternatives

The resolution of GLP-1 drug shortages has reduced the reliance on compounded alternatives, restraining growth in the compounding pharmacy market. With commercial manufacturers now meeting demand, healthcare providers and patients increasingly access standard formulations, limiting the need for customized compounding solutions across adults, pediatrics, and geriatric populations.

Opportunity: Radiopharmaceutical compounding standardization

Standardizing radiopharmaceutical compounding offers a major opportunity in the compounding pharmacy market. Applying consistent protocols and quality standards improves safety, effectiveness, and regulatory adherence. This enables pharmacies to efficiently produce personalized radiopharmaceuticals for adults, pediatrics, and geriatric patients, increasing adoption in hospitals, specialty clinics, and nuclear medicine facilities.

Challenge: Capacity bottlenecks in API, excipient supply, and CCI/testing

Capacity bottlenecks in API, excipient supply, and CCI/testing present a key challenge for the compounding pharmacy market. Limited availability of high-quality raw materials and restricted testing capabilities slow down the production of customized medications, affecting timely delivery to adults, pediatrics, and geriatric patients, and could impact overall market growth and service reliability.

Compounding Pharmacy Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Specializes in Bioidentical Hormone Replacement Therapy (BHRT) for menopause and hormonal imbalances | Personalized hormone formulations (creams, gels, capsules) based on lab results |

|

Creates custom pain creams combining NSAIDs, anesthetics, and muscle relaxants | Tailored topical treatments for chronic pain and neuropathy; avoids systemic side effects |

|

Compounds veterinary and human medications, including hormone therapies and dermatological treatments | Offers niche formulations not available commercially; supports individualized care |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The compounding pharmacy ecosystem comprises interconnected relationships among various stakeholders, including raw material suppliers, compounding pharmacies, contract compounding organizations (CCOs), distributors, and end users. Raw material suppliers provide essential components such as active pharmaceutical ingredients (APIs), excipients, sterile and non-sterile bases, and specialized chemicals to compounding pharmacies. These pharmacies use customized formulations and compounding technologies to create patient-specific medications, including oral, topical, injectable, and parenteral products. CCOs and specialized service providers support scale-up, quality assurance, and regulatory compliance. Distributors and supply partners facilitate the delivery of compounded medications to end users, including pediatric, adult, and geriatric populations, thereby optimizing the supply chain. This integrated ecosystem improves operational efficiency, ensures personalized therapeutic solutions, and promotes the growth and commercialization of compounded medications across diverse therapeutic areas.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

compounding pharmacy Market, By Product

In 2024, oral drugs held the highest share in the compounding pharmacy market due to the Customization of dosage, flavor, and release profiles, which improves patient adherence. Growing chronic disease prevalence and advances in formulation technologies support market growth.

Compounding pharmacy Market, By Compounding Type

In 2024, pharmaceutical dosage alteration accounted for the highest share by compounding type, driven by the need for personalized dosing, patient-specific formulations, improved adherence, and flexibility across pediatric, adult, and geriatric populations.

compounding pharmacy Market, By Therapeutic Applications

In 2024, pain management held the highest share by therapeutic area in the compounding pharmacy market, driven by rising chronic pain prevalence, increasing demand for personalized therapies, and the growing adoption of customized topical and oral formulations.

Gene delivery technology Market, By Sterility

In 2024, sterile compounding dominated the compounding pharmacy market due to the increasing demand for injectable medications, parenteral nutrition, and advanced biologic therapy.

compounding pharmacy Market, By End User

Adults segment held the highest share by end user in 2024; this trend is linked to the increasing rate of chronic conditions among adults, requiring tailored treatment options.

REGION

Asia Pacific to be fastest-growing region in global compounding pharmacy market during forecast period

In 2024, the Asia Pacific region is the fastest-growing market for compounding pharmacies, driven by rising healthcare awareness, increasing prevalence of chronic diseases, expanding geriatric and pediatric populations, and growing adoption of personalized medications. Supportive government initiatives, improved healthcare infrastructure, and the presence of skilled pharmacists further fuel growth in the region.

Compounding Pharmacy Market: COMPANY EVALUATION MATRIX

In the compounding pharmacy market matrix, Empower Pharmacy (Star Player) leads with a strong market presence, an extensive portfolio of sterile and non-sterile compounded medications, and a robust distribution network, driving widespread adoption across hospitals, clinics, and specialty care centers. Quva (Emerging Leader) is gaining traction with personalized formulations, innovative compounding services, and expanding reach in niche therapeutic areas. Meanwhile, companies such as Baxter dominate in manufacturing scale, while smaller players such as Fusion Apothecary show strong growth potential to advance toward the leaders’ quadrant

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USS 13.48 Billion |

| Market Forecast in 2030 (Value) | USS 19.41 Billion |

| Growth Rate | CAGR of 5.7% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

WHAT IS IN IT FOR YOU: Compounding Pharmacy Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Formulation Insights | Analysis of dosage forms (e.g., topical, oral, injectable) and excipient compatibility | Helps pharmacists optimize stability, bioavailability, and patient compliance |

| Regulatory & Compliance Overview | Summary of FDA 503A/503B guidelines, USP standards, and state-specific regulations | Ensures legal compliance and supports audit readiness |

| Technology Comparison | Comparison of compounding vs. commercial alternatives in terms of cost, efficacy, and access | Informs strategic decisions on service offerings and pricing |

RECENT DEVELOPMENTS

- February 2024 : Fagron acquired University Compounding Pharmacy (UCP), a 503A pharmaceutical compounder specializing in the health and wellness segment in California. This acquisition enhances Fagron’s national footprint in the U.S., complementing its existing 503A and 503B operations and expanding its offerings in hormone and urology treatments.

- February 2024 : Empower Pharma acquired Eugia US Manufacturing LLC's manufacturing facility in East Windsor, New Jersey. This acquisition expands Empower Pharma's sterile development and bulk manufacturing capabilities for personalized compounded medicine.

- September 2022 : Walgreens acquired Shields Health Solutions, a leader in hospital and health system specialty pharmacy services. This acquisition bolstered Walgreens' position in the compounding pharmacy market, particularly in providing specialized medications to hospital patients

Table of Contents

Methodology

This research extensively used secondary sources, directories, and databases to gather valuable information for analyzing the global compounding pharmacy market. In-depth interviews were conducted with various primary respondents, including key industry players, subject-matter experts (SMEs), C-level executives of major market companies, and industry consultants, to obtain and verify critical qualitative and quantitative data and evaluate the market's growth prospects. The global market size estimated through secondary research was then validated and refined with inputs from primary research to determine the final market size.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the compounding pharmacy market. The secondary sources used for this study include US Food and Drug Administration (FDA), American Pharmacists Association (APhA), International Academy of Compounding Pharmacists (IACP), National Community Pharmacists Association (NCPA), Parenteral Drug Association (PDA), American Society of Health-System Pharmacists (ASHP), Pharmacy Compounding Accreditation Board (PCAB), European Directorate for the Quality of Medicines & HealthCare (EDQM), European Medicines Agency (EMA), International Pharmaceutical Federation (FIP), Journal of Compounding & Specialty Pharmacy (JCSP), National Center for Biotechnology Information (NCBI), Pharmaceutical Research and Manufacturers of America (PhRMA), Pharma & Biopharma Outsourcing Association (PBOA), World Journal of Pharmaceutical Research (WJPR). Secondary sources also include corporate and regulatory filings, such as annual reports, SEC filings, investor presentations, and financial statements; business magazines & research journals; press releases; and trade, business, and professional associations, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

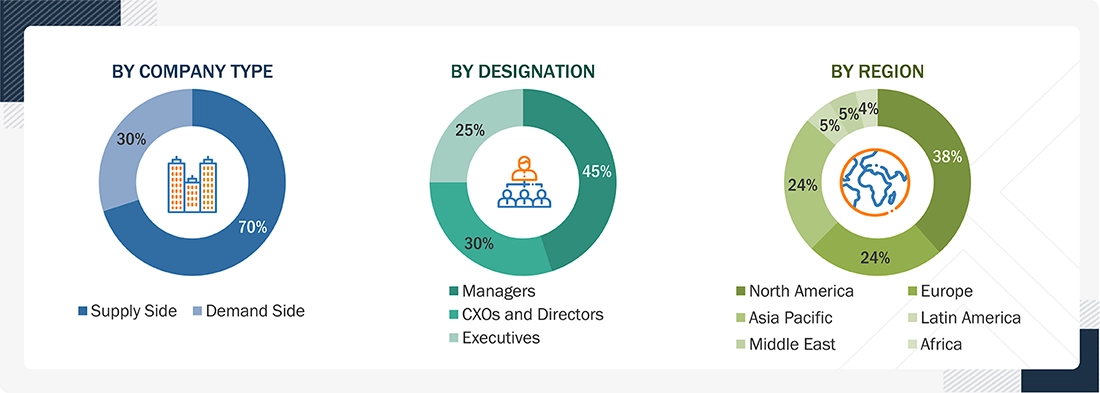

After an initial assessment of the global compounding pharmacy market landscape through secondary research, comprehensive primary research was conducted. This included in-depth interviews with market experts from the demand side, such as stakeholders from pharmaceutical and biotechnology companies, CROs, CMOs, and academic and research institutions. Additionally, interviews were held with key supply-side participants, including C-suite and senior executives, product managers, and marketing and sales leaders from leading manufacturers, distributors, and channel partners. The research covered six major regions: North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa. About 70% of the primary interviews involved supply-side participants, while 30% involved demand-side experts. Data collection methods included structured questionnaires, email correspondence, online surveys, personal interviews, and telephonic discussions to understand market dynamics comprehensively.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both bottom-up and top-down approaches were used to estimate and validate the total size of the compounding pharmacy market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- A list of the major global players operating in the compounding pharmacy market was generated.

- The revenues generated from their compounding pharmacy product have been determined through annual reports and secondary sources (including paid databases)

- The products were mapped according to the segments of the market. Percentage shares and splits were determined based on the revenue contributed to each segment. This was verified using secondary sources and by industry experts.

- All assumptions, approaches, and individual shares/revenue estimates were validated through expert interviews.

Global Compounding Pharmacy Market Size: Bottom-up and Top-down Approach

Data Triangulation

After estimating the market size using the process described above, the total market was divided into several segments and subsegments. To finish the overall market analysis and obtain precise statistics for all segments and subsegments, data triangulation and market breakdown methods were used where applicable. The data was triangulated by examining various factors and trends from both the demand and supply sides.

Market Definition

A compounding pharmacy is a practice in which a licensed pharmacist combines, mixes, or alters the ingredients of a drug to create a medication tailored to the needs of an individual patient.

Stakeholders

- Pharmaceutical and Biotechnology Companies

- Compounding Pharmacies

- Research and Consulting Firms

- Academic Medical Centers

- Government Regulatory and Research Organizations

- Quality Assurance and Accreditation Bodies

- Clinical Research Institutes

Report Objectives

- To define, describe, and forecast the compounding pharmacy market based on product, compounding type, therapeutic application, sterility, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 concerning individual growth trends, prospects, and contributions to the compounding pharmacy market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments concerning five main regions—North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa

- To profile the key players in the global compounding pharmacy market and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as product approvals and launches, expansions, agreements, and collaborations in the Compounding pharmacy market

- To benchmark players within the compounding pharmacy market using the company evaluation matrix framework, which analyzes market players based on various parameters within the broad categories of business and service strategy

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Compounding Pharmacy Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Compounding Pharmacy Market