Connected Car Security Market Size, Share & Analysis

Connected Car Security Market by Type (Endpoint, Application, Network, Security), Solution (Software & Hardware), Application (TCU, Infotainment, ADAS, Communication Modules), Form (In-vehicle, External Cloud), EV Type & Region- Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global connected car security market is projected to grow from USD 3.37 billion in 2025 to USD 6.99 billion by 2032, reflecting a steady CAGR of 11.0%. As vehicles become more connected and dependent on software, protecting them from cyber risks has become a top priority. Thus, automakers are increasingly adopting secure gateways, intrusion detection systems, and cloud-based threat monitoring systems to keep vehicle data and communication safe. The industry is also shifting from traditional hardware-heavy setups to more flexible, software-driven security, allowing quicker updates and real-time protection through OTA upgrades. With AI-powered threat detection, stronger encryption, and safer communication protocols becoming standard, vehicles are gaining better resilience and privacy. These advancements not only improve safety but also support the smooth rollout of new connected features, making cybersecurity a crucial driver of the automotive industry's future growth.

KEY TAKEAWAYS

-

By RegionAsia Pacific is projected to grow at the highest rate during the forecast period.

-

By Security TypeBy security type, the cloud security segment is projected to grow at the highest CAGR of 15.3%.

-

By Electric Vehicle TypeBy electric vehicle type, the FCEV segment is projected to grow at the highest rate from 2025 to 2032.

-

By Solution TypeBy solution type, the hardware-based solutions segment is expected to dominate the market during the forecast period.

-

By ApplicationBy application type, the ADAS & autonomous driving systems segment is projected to grow at the highest rate during the forecast period.

-

By FormBy form, the in-vehicle solutions segment is projected to lead the market during forecast period.

-

Competitive LandscapeAUMOVIO SE, NXP Semiconductors, HARMAN International, Vector Informatik GmbH, and BlackBerry Limited were identified as some of the star players in the connected car security market, given their strong market share and product footprint.

-

Competitive LandscapeUpstream Security Ltd, Trustonic, and Wireless Car, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Connected car security systems protect internet-enabled vehicles from cyberattacks targeting data, networks, and critical systems. They use encryption, authentication, intrusion detection, and secure OTA updates to prevent unauthorized access or tampering. Their goal is to ensure safe, private, and reliable communication across connected vehicles while meeting global cybersecurity standards. The connected car security market covers multiple security types, solution types, applications, forms, and regions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Connected car security is undergoing a major transformation as rising connectivity, stricter regulations, and expanding attack surfaces push OEMs toward software-defined protection. Traditional hardware-led security is giving way to cloud-based architectures, continuous OTA protection, intrusion detection, and AI-driven threat analytics. This evolution is accelerating new service-led revenue models and deeper ecosystem integration, making scalable, modular cybersecurity essential for long-term resilience and future SDV platforms.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing vehicle connectivity through telematics and V2X

-

Mandatory compliance with global automotive cybersecurity regulations

Level

-

Legacy ECU and vehicle architectures complicating security upgrades

-

High implementation and integration costs

Level

-

Growth of managed security services and vehicle SOCs

-

Rising demand for secure OTA and lifecycle management

Level

-

Evolving cyber threats

-

Minimizing false positives without compromising safety-critical functions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing vehicle connectivity through telematics and V2X

Growing use of telematics and V2X is driving how vehicles connect and share data, widening the door for cyber threats. Therefore, automakers are responding with stronger, layered security and real-time authentication. With 5G and smarter vehicles, cybersecurity is now a core necessity, not an extra feature.

Restraint: Legacy ECU and vehicle architectures complicating security upgrades

Many connected cars still rely on old ECUs and outdated networks like CAN and LIN, which weren’t built for cybersecurity. Adding modern protections requires costly hardware and software upgrades. Unencrypted communication, fragmented security standards, and compatibility issues make it difficult for automakers to deploy consistent, end-to-end protection across mixed vehicle fleets.

Opportunity: Growth of managed security services and vehicle SOCs

Rising vehicle connectivity is pushing automakers toward managed security services and vehicle SOCs. Specialists using AI and real-time monitoring help detect threats, ensure compliance, and manage fleet security. As cars become software-driven, subscription-based cybersecurity and vSOCs are becoming essential for continuous protection.

Challenge: Evolving cyber threats

Rapidly evolving cyber threats are widening vulnerabilities in connected vehicles, from data breaches to remote takeover and weak software management. Automakers must adopt security-by-design, real-time monitoring, and strict supply-chain standards to ensure long-term protection in an ever-changing threat landscape.

connected-car-security-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Secure gateways, IDS, and OTA protection for connected vehicles | Prevents unauthorized access | Secures data flow | Supports global compliance |

|

Secure chipsets, HSMs, and V2X communication security | Improves data integrity | Protects ECUs | Scalable for next-gen vehicles |

|

Cloud security, threat detection, and vSOC monitoring | Reduces cyber risks | Provides real-time visibility | Enhances fleet safety |

|

Security testing tools, embedded security, ECU protection | Ensures secure ECU communication | Improves robustness | Supports compliance |

|

QNX OS security, IVY platform, real-time threat protection | Enhances resilience | Secures data processing | Lowers cyber risks |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The connected car security ecosystem is driven by multiple participant categories working in sync. Cloud, telematics, and connectivity providers enable real-time data exchange, while cybersecurity software providers ensure secure communication across vehicle systems. Security hardware manufacturers supply the foundational protected chips and modules. Tier 1 and Tier 2 suppliers integrate these technologies into vehicle architectures, and OEMs embed them into final vehicle platforms. End users of these technologies ultimately drive demand for safe, seamless, and intelligent mobility services.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Connected Car Security Market, By Security Type

The network security segment is projected to lead the market during the forecast period. The growth of the segment is driven by rising data exchange across connected systems, increasing need for secure communication layers and heightened focus on protecting vehicle networks from intrusion and unauthorized access.

Connected Car Security Market, By Application

The Telematics Control Units (TCUs) segment is projected to lead the market during the forecast period. The growth of the segment can be driven by increasing demand for safe data handling, stringent privacy requirements, and rising integration of communication and infotainment functions that require robust cybersecurity.

Connected Car Security Market, By Solution Type

The software-based solutions segment is projected to lead the market during the forecast period. The growth of the segment is driven by the rising adoption of OTA updates, growing need for flexible and scalable protection, and increasing reliance on software-defined vehicle architectures.

Connected Car Security Market, By Form

The in-vehicle systems segment is projected to lead the market during the forecast period. The growth of the segment is driven by the need to safeguard core vehicle functions, strengthen embedded system protection, and ensure secure internal communication within modern connected vehicles.

Connected Car Security Market, By Electric Vehicle Type

The BEV segment is projected to lead the market during the forecast period. The growth of the segment is driven by accelerating BEV adoption, increased dependency on software-driven vehicle control, and rising cybersecurity needs to secure EV communications, charging systems, and digital interfaces.

REGION

Asia Pacific to be dominant region in connected car security market during forecast period

Asia Pacific is expected to lead the connected car security market during the forecast period. The growth of the region is driven by rapid growth in connected and electric vehicles, expansion of 5G and V2X networks, and evolving cybersecurity regulations in countries like China, Japan, and South Korea. Additionally, strong government mandates, rising consumer awareness, and increasing partnerships between automakers and security providers are accelerating the adoption of intrusion detection, encryption, OTA protection, and other advanced security solutions across the region.

connected-car-security-market: COMPANY EVALUATION MATRIX

In the connected car security matrix, NXP Semiconductors stands out as a Star, backed by strong market presence, advanced automotive security chips, and deep collaboration with global OEMs. Companies like AUNOMOS SE, Vector Informatik, BlackBerry, and Harman also shine in this quadrant with robust platforms and proven cybersecurity capabilities. Meanwhile, firms such as Intertek, ETAS, Trend Micro, and T-Systems are rising as Emerging Leaders. They are gaining traction through specialized testing, secure software solutions, and expanding partnerships—showing clear potential to move into the top-right quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- NXP Semiconductors (Netherlands)

- AUMOVIO SE (Germany)

- Harman International (US)

- Vector Informatik GmbH (Germany)

- BlackBerry Limited (Canada)

- Thales (France)

- ARM Limited (UK)

- WirelessCar (Sweden)

- Astemo Ltd. (Japan)

- Keysight Technologies (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 | USD 3.06 Billion |

| Market Forecast in 2032 | USD 6.99 Billion |

| Growth Rate | CAGR of 11.0% from 2025–2032 |

| Years Considered | 2019–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | USD Billion |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Asia Pacific, Europe, North America, Rest of the World |

WHAT IS IN IT FOR YOU: connected-car-security-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Automotive Supplier |

|

|

| Automotive Software Solution Providers |

|

|

| Automotive Tier 1 Supplier |

|

|

RECENT DEVELOPMENTS

- September 2025 : Vector announced SDx Cloud, a scalable software-defined systems platform to enable cloud-based deployment and updates across vehicle domains.

- August 2025 : Trustonic unveiled the Kinibi 700a, an advanced Trusted Execution Environment (TEE) that enhances cybersecurity for device manufacturers globally. Kinibi 700a features support for fault injection mitigations, cryptographic enhancements, and post-quantum cryptography. The new Kinibi OS meets ASPICE and ISO 9001 standards, ensuring product quality commitment.

- March 2025 : AUTOCRYPT launched an India-compliant V2X security certification system, becoming the only company to support V2X standards across North America, Europe, China, Korea, and India. The launch strengthened its global presence amid India’s growing smart mobility and smart city initiatives.

- December 2024 : Upstream Security unveiled an AI-driven proactive vehicle quality detection solution to help automakers minimize warranty claims and recall costs through predictive analytics.

- December 2024 : Thales launched its Advanced Vehicle Access Solutions. The new offerings included a Digital Car Key for smartphone access, featuring an NFC CARd Key as an alternative access method.

- May 2024 : PlaxidityX, a global leader in automotive cybersecurity, launched its DevSecOps platform to tackle complex security challenges for software-defined vehicles (SDVs) and suppliers. The platform integrates a decade of PlaxidityX’s cybersecurity technologies and services for automakers.

- December 2023 : At CES 2024, BlackBerry showcased its BlackBerry IVY connected vehicle data platform through demos with ecosystem partners. The platform enables faster development of AI-driven automotive services, helping automakers deploy new, insight-based features to enhance differentiation and monetize connected vehicles.

- May 2023 : T-Systems introduced a secure OTA framework to safeguard vehicle software updates and data transmission, ensuring continuous compliance with UNECE R155 and ISO/SAE 21434 standards.

Table of Contents

Methodology

The research uses extensive secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the connected car security market. Primary sources, such as experts from related industries, OEMs, and suppliers, have been interviewed to obtain and verify critical information and assess the growth prospects and market estimations.

Secondary Research

Secondary sources referred to for this research study include connected car security industry organizations, such as the World Electric Vehicle Association. It also includes corporate filings such as annual reports, investor presentations, and financial statements. The secondary data collected and analyzed to arrive at the total market size has been validated by primary research.

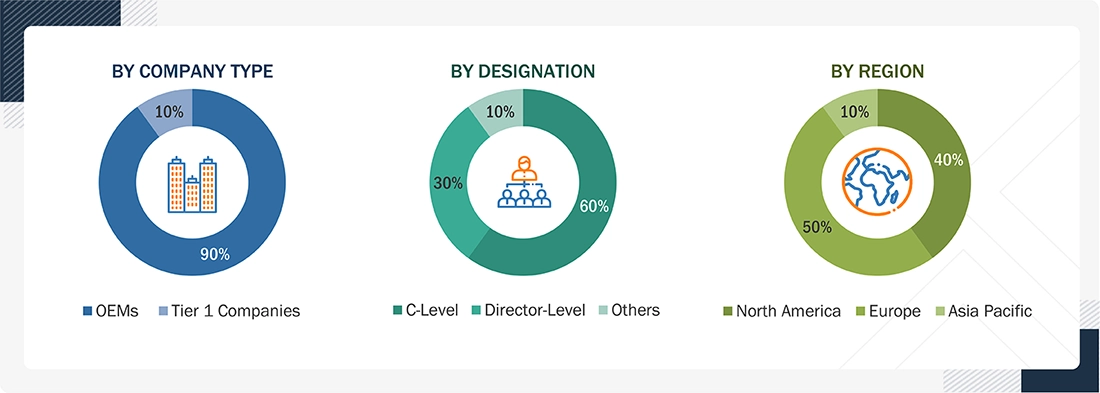

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the connected car security market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand (OEMs) and supply (connected car security solution providers) sides across major regions, namely the Asia Pacific, Europe, North America, and Rest of the World. Primary data was also collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and marketing departments, have been covered to provide a holistic viewpoint in the report.

After interacting with industry experts, brief sessions have been conducted with highly experienced independent consultants to reinforce the findings from primaries. This, along with the in-house subject matter experts’ opinions, has led to the conclusions described in the remainder of this report.

Note: Others include Sales Managers and Product Managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the top-down approach, an exhaustive list of all the vendors who offer connected car security solutions and services was prepared. The revenue contribution for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on their security type, application, solution type, form, and EV type. The aggregate of all company revenues was extrapolated to reach the overall market size. Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives. These market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Connected Car Security Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the vehicles complying with the connected car security market through the methodology explained above, the market has been split into several segments and subsegments. Data triangulation is a research technique used to increase the validity and reliability of findings by cross-validating data from multiple sources or methods. This technique involves the use of multiple sources of data, such as surveys, interviews, observations, and secondary data, to confirm and corroborate the findings obtained from each source. The extrapolated market data has been triangulated by studying various macro indicators and regional trends from both the supply and demand sides.

Market Definition

Connected car security is the protection of internet-enabled vehicles from cyber threats targeting communication networks, data, and safety-critical systems. It involves using encryption, authentication, intrusion detection, and secure over-the-air (OTA) updates to prevent unauthorized access or manipulation. The approach ensures secure data storage, transmission, and communication while maintaining compliance with global cybersecurity standards, safeguarding vehicle safety, privacy, and reliability in connected environments.

Key Stakeholders

- Original Equipment Manufacturers (OEMs)

- Cybersecurity Solution Providers

- Semiconductor and Chipset Manufacturers

- Telematics and Infotainment System Providers

- Cloud and Network Service Providers

- Telecom and Internet Service Providers

- Government Regulators and Policymakers

Report Objectives

-

To segment and forecast the connected car security market size in terms of value, based on

- Security Type (Endpoint Security, Application Security, Network Security, and Cloud Security)

- Application (Telematics Control Units (TCUs), Infotainment Systems, ADAS & Autonomous Driving Systems, and Communication Modules)

- Electric Vehicle Type (BEV, PHEV, HEV, and FCEV)

- Solution (Software-based Solutions and Hardware-based Solutions)

- Form (In-Vehicle Solutions and External Cloud Services)

- Region (Asia Pacific, Europe, North America, and the Rest of the World)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the evaluation matrix of leading players operating in the market (Players have been categorized as stars, pervasive players, emerging leaders, and participants. The categorization has been done based on recent developments, product launches, the company’s regional presence, and product portfolio.)

- To strategically analyze the key player strategies and company revenue analysis of key players in the connected car security market from 2019 to 2032

-

To study the following aspects of the report:

- Macroeconomics Indicators

- GDP Trends and Forecasts

- Global Connected Car Industry Trends

- Global Automotive & Transportation Industry Trends

- Ecosystem Analysis

- Value Chain Analysis

- Pricing Analysis

- Trade Analysis

- Key Conferences & Events (2025–2026)

- Investment & Funding Scenario

- Trends/Disruptions Impacting Customers’ Business

- Case Study Analysis

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributes 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle East & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Connected Car Security Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Connected Car Security Market