Consumer Mobile Video Camera Market

Consumer Mobile Video Camera Market by Product Type (Gimbal, Action, 360), Form Factor (Wearable, Handheld, Modular), Specification (Frame Rate, Sensor Size), Use Case (Sports, Vlogging, Education), Price (Flagship, High, Low) - Global Forecast to 2035

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global consumer mobile video camera market was estimated at USD 8.50 billion in 2025 and is projected to reach USD 27.32 billion by 2035, growing at a CAGR of 12.4% from 2025 to 2035. Market growth is driven by the rapid expansion of the creator economy, rising consumption of short-form and live video content, and increasing demand for high-quality, portable video recording solutions beyond smartphones. Growing adoption across vlogging, social media, sports and adventure, education, and event coverage is accelerating unit shipments across action cameras, handheld pocket/gimbal cameras, and 360° cameras. Technological advancements in image stabilization, AI-enabled shooting modes, low-light performance, and seamless mobile connectivity are improving user experience and widening adoption among general users and prosumers. The shift toward online sales channels and strong demand from the Asia Pacific further support sustained market expansion across major regions.

KEY TAKEAWAYS

-

BY REGIONNorth America is expected to dominate the consumer mobile video camera market, with a share of 35.1% in 2025.

-

BY PRODUCT TYPEThe 360-degree segment is projected to register the highest CAGR of 13.3% during the forecast period.

-

BY SALES CHANNELThe online segment is projected to register the higher CAGR of 12.9% than the offline segment during the forecast period.

-

BY FORM FACTORThe wearable/mountable/clip-on segment is projected to register the highest CAGR during the forecast period.

-

BY PRICE RANGEThe flagship above 700 segment is projected to register a CAGR of 14.1% during the forecast period.

-

BY USE CASEThe vlogging/social media segment is projected to register the highest CAGR of 13.6% during the forecast period.

-

BY END USERThe prosumer/creator/vlogger segment is projected to register the highest CAGR of 13.6% during the forecast period.

-

COMPETITIVE LANDSCAPE (KEY PLAYERS)DJI (China) and GoPro Inc. (US), among others, were identified as star players in the consumer mobile video camera market due to their strong market share and extensive product footprint.

-

COMPETITIVE LANDSCAPE (STARTUPS/SMES)Ordro (China) and Midland Europe S.r.l. (Italy), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders in the consumer mobile video camera market.

The consumer mobile video camera industry is witnessing steady growth as users increasingly adopt dedicated video cameras for high-quality content creation across vlogging, sports, travel, education, and professional applications. Demand is driven by the need for superior video stabilization, enhanced low-light performance, high frame rates, and compact, portable form factors beyond smartphone capabilities. Advancements in imaging sensors, AI-powered shooting modes, gimbal stabilization, and seamless smartphone and cloud integration are improving usability and video quality.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Several trends and technological disruptions are reshaping customer operations in the consumer mobile video camera market, transforming how users capture, edit, manage, and distribute video content. Rapid growth in social media, vlogging, live streaming, and short-form video is driving demand for portable, high-quality, and user-friendly cameras. Manufacturers are shifting from hardware-centric models toward software- and service-led ecosystems incorporating AI-powered features, companion apps, cloud storage, and subscription-based editing tools. AI, computational imaging, edge processing, and cloud connectivity enable real-time stabilization, auto-framing, low-light enhancement, instant editing, and seamless sharing. These advancements support creators seeking mobility, speed, platform compatibility, and data-driven insights to maximize engagement.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid growth of social media, vlogging, and creator economy

-

Rising popularity of adventure sports, travel, and experiential lifestyles

Level

-

Strong competition from advanced smartphone camera systems

-

Limited product differentiation in lower-priced segments

Level

-

Growing adoption of immersive, 360°, and spatial video content

-

Expanding creator communities in emerging markets

Level

-

Rapid technological changes and short product lifecycles

-

Price sensitivity, brand dominance, and customer retention

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid growth of social media, vlogging, and creator economy

The rapid expansion of social media platforms and the global creator economy is a major driver of the consumer mobile video camera market. The increasing demand for high-quality video content for vlogging, live streaming, and short-form platforms is encouraging creators and prosumers to invest in dedicated cameras that offer superior stabilization, audio quality, and cinematic video performance beyond smartphones.

Restraint: Strong competition from advanced smartphone camera systems

Advanced smartphone camera systems present a key restraint to market growth, as flagship smartphones increasingly offer high-resolution sensors, AI-driven image processing, and built-in stabilization. For general users, smartphones often provide sufficient video quality and convenience, reducing the perceived need for standalone mobile video cameras, particularly in the low- and mid-price segments.

Opportunity: Growing adoption of immersive, 360°, and spatial video content

Rising interest in immersive content, including 360° and spatial video, presents a strong growth opportunity for the consumer mobile video camera market. Applications in virtual tours, travel, events, gaming, and social media storytelling are expanding, driving demand for specialized cameras capable of capturing interactive and immersive experiences beyond traditional video formats.

Challenge: Rapid technological changes and short product lifecycles

Rapid technological advancement and short product lifecycles pose a key challenge for manufacturers in the consumer mobile video camera market. Frequent upgrades in sensors, AI features, and connectivity increase R&D costs and inventory risks, while pressuring companies to accelerate product launches and maintain differentiation in a highly competitive environment.

CONSUMER MOBILE VIDEO CAMERA MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Provides handheld pocket and gimbal cameras for vlogging, travel content creation, education, and professional video production, with strong integration across mobile apps and creator workflows | Delivers superior stabilization, cinematic video quality, ease of use, and fast content sharing, enabling creators and professionals to produce high-quality videos with minimal setup and post-processing effort |

|

Supplies rugged action cameras for sports, adventure, outdoor recreation, events, and social media content creation in dynamic and extreme environments | Enables durable, waterproof, and hands-free video capture, high frame-rate recording, and reliable performance in harsh conditions, supporting immersive storytelling and action-focused content |

|

Offers 360° and modular cameras for immersive video creation, virtual tours, travel experiences, real estate visualization, and social media storytelling | Supports interactive and immersive content creation, flexible reframing, automated editing, and creative effects, allowing users to maximize engagement and reuse content across multiple platforms |

|

Provides advanced compact and mirrorless video cameras for prosumers, professional creators, education, events, and commercial video production | Delivers industry-leading image sensors, superior low-light performance, accurate autofocus, and professional-grade video quality, supporting high-end content creation and commercial use cases |

|

Supplies compact and 360° cameras for real estate, construction documentation, tourism, training, and virtual walkthrough applications | Enables efficient spatial documentation, immersive visualization, and simplified content capture, reducing production time while enhancing clarity and audience engagement across commercial applications |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The consumer mobile video camera companies ecosystem comprises camera manufacturers, software and service providers, system integrators, and end users working together to enable end-to-end video creation. Manufacturers such as DJI, GoPro, Sony, Insta360, and Ricoh deliver hardware innovation, while software providers support editing, analytics, and cloud services. System integrators enable workflow compatibility, and end users, including creators, educators, and professionals, drive demand through diverse content applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Consumer Mobile Video Camera Market, By Product Type

The handheld pocket/gimbal cameras segment is projected to capture the largest market share during the forecast period due to, their portability, ease of use, and advanced stabilization features make them highly attractive to casual users and content creators alike. With growing consumer demand for high-quality, on-the-go video recording, these cameras are positioned to capture the largest market share, offering flexibility and superior performance compared to traditional devices.

Consumer Mobile Video Camera Market, By Sales Channel

The online sale channel segment is projected to capture the dominant market share during the forecast period due to the fact that e-commerce platforms offer convenience, wider product selections, competitive pricing, and direct delivery, attracting tech-savvy buyers and younger demographics. Additionally, online channels provide access to detailed reviews, product comparisons, and promotional offers, which influence purchasing decisions. The digital shopping experience, combined with the growing preference for home delivery, drives dominance in sales through online platforms.

Consumer Mobile Video Camera Market, By Form Factor

The wearable/mountable/clip-on segment is projected to capture the largest market share during the forecast period due to the compact design and hands-free functionality appeal to adventurers, athletes, and vloggers who prioritize mobility and convenience. These cameras enable creative content capture in diverse environments, providing versatility for active lifestyles. The increasing popularity of immersive, first-person videos and social media sharing further strengthens demand for these adaptable camera formats.

Consumer Mobile Video Camera Market, By Price Range

The flagship above 700 segment is projected to record the highest CAGR due to the advanced features of the premium model, such as high-resolution sensors, superior stabilization, enhanced low-light performance, and extensive connectivity options. Professionals and enthusiasts seeking high-quality video production are driving demand for these high-end cameras. Their ability to deliver exceptional performance and durability makes them attractive investments, fueling market growth in the premium price segment.

Consumer Mobile Video Camera Market, By Use Case

The vlogging/social media segment is projected to record the highest CAGR during the forecast period, driven by the increasing popularity of content creation platforms such as YouTube, TikTok, and Instagram, which drive demand for cameras optimized for self-recording, streaming, and live broadcasting. Users prioritize features like image stabilization, compact size, and connectivity to social platforms. The trend of documenting experiences digitally and sharing them widely continues to boost growth in this use-case segment.

Consumer Mobile Video Camera Market, By End User

Prosumers, creators, and vloggers are expected to capture the largest market share in the consumer mobile video camera market. These users seek high-performance cameras that combine portability, advanced features, and ease of use. Driven by social media content creation, influencer marketing, and professional hobbyist needs, this segment demands versatile devices capable of producing high-quality videos. Their willingness to invest in premium equipment ensures strong market growth among this end user segment.

REGION

Asia Pacific to be fastest-growing region in consumer mobile video camera market during forecast period

The Asia Pacific region is projected to record the highest CAGR in the consumer mobile video camera market during the forecast period. Rapid urbanization, rising disposable incomes, and growing adoption of smartphones and digital content creation are driving market growth. Increasing social media engagement, vlogging trends, and e-commerce penetration in countries like China, India, and Japan further fuel demand, positioning Asia Pacific as a key growth hub for innovative camera technologies.

CONSUMER MOBILE VIDEO CAMERA MARKET: COMPANY EVALUATION MATRIX

In the consumer mobile video camera market matrix, DJI is positioned as a star player, supported by its strong portfolio of handheld gimbal cameras, action cameras, and creator-focused video devices, combined with advanced stabilization, superior imaging performance, and tight integration with editing and content-sharing ecosystems. Nikon, positioned as an emerging leader, is gaining momentum by evolving beyond core action cameras through enhanced software capabilities, cloud-based editing, subscription services, and improved social media integration, with continued investments in usability, AI-driven features, and ecosystem expansion driving its progression toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- DJI

- GoPro Inc.

- Insta360

- Sony Corporation

- Ricoh

- AKASO Tech LLC

- SJCAM

- Nikon Corporation

- Panasonic Holdings Corporation

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 8.50 Billion |

| Market Forecast in 2035 (Value) | USD 27.32 Billion |

| Growth Rate | CAGR of 12.4% from 2025–2035 |

| Years Considered | 2021–2035 |

| Base Year | 2024 |

| Forecast Period | 2025–2035 |

| Units Considered | Value (USD Billion), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific and RoW |

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Consumer Mobile Video Camera OEM | Mapping of camera portfolios across handheld, pocket, gimbal, wearable, mountable, and clip-on devices by resolution, stabilization, connectivity, and battery performance | Benchmarking entry-level, mid-range, and premium cameras (>USD 700) by video quality, stabilization technology, and feature differentiation |

| Component & Technology Supplier | Competitive mapping of key components such as image sensors, lenses, gimbals, processors, batteries, and wireless modules across leading camera brands | Benchmarking CMOS sensors, AI-based image processing, electronic vs. mechanical stabilization, and low-light enhancement technologies |

| Content Creator & Platform-focused Stakeholder | Assessment of camera adoption across vlogging, live streaming, social media, travel, sports, and action content creation use cases | Benchmarking creator-focused features such as livestream compatibility, platform integration (YouTube, TikTok, Instagram), accessories ecosystem, and ease of content sharing |

RECENT DEVELOPMENTS

- December 2025 : Insta360 (China) partnered with Leica Camera AG (Germany) to combine Leica’s century-long expertise in high-quality optics with Insta360’s innovative 360° and action camera technology, aiming to elevate image quality and creative potential in next-generation action and 360° cameras.

- September 2025 : GoPro launched two new products that expand its content-creation ecosystem with advanced imaging and smart stabilization tools: the MAX2 360° camera featuring True 8K resolution, twist-and-go replaceable lenses, and enhanced audio and editing support; the LIT HERO, an ultra-compact lifestyle action camera with a built-in light for “whatever, whenever” 4K/60?fps capture.

- October 2023 : DJI launched the Osmo Pocket 3, a pocket-sized, handheld gimbal camera that pairs a powerful 1-inch CMOS sensor with three-axis mechanical stabilization and a rotatable touchscreen, allowing users to capture detail-rich 4K/120fps video and high-quality photos with smooth motion and intelligent tracking features.

- January 2022 : Ricoh announced the launch of RICOH THETA X, an advanced model of the RICOH THETA series of 360-degree cameras capable of shooting 360-degree still images and videos in a single shot.

Table of Contents

Methodology

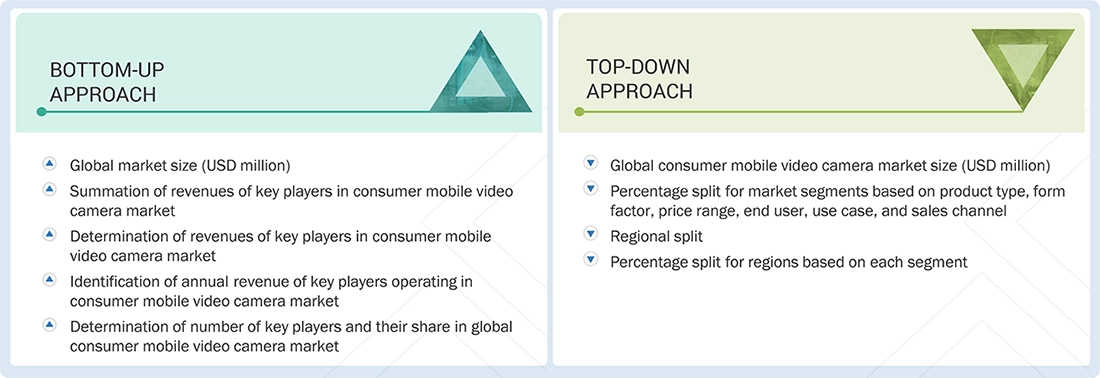

The study involves four major activities in estimating the current size of the consumer mobile video camera market. Extensive secondary research has been conducted to gather information on the market, adjacent markets, and the broader consumer electronics ecosystem. This has been followed by primary research with industry stakeholders across the value chain, including manufacturers, distributors, technology providers, and end users, to validate assumptions and market sizing. Both top-down and bottom-up approaches have been used to estimate the overall market size. Market breakdown and data triangulation techniques have then been applied to derive the size of individual segments and subsegments. Secondary and primary sources have been jointly used to support a comprehensive technical and commercial analysis of the consumer mobile video camera market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

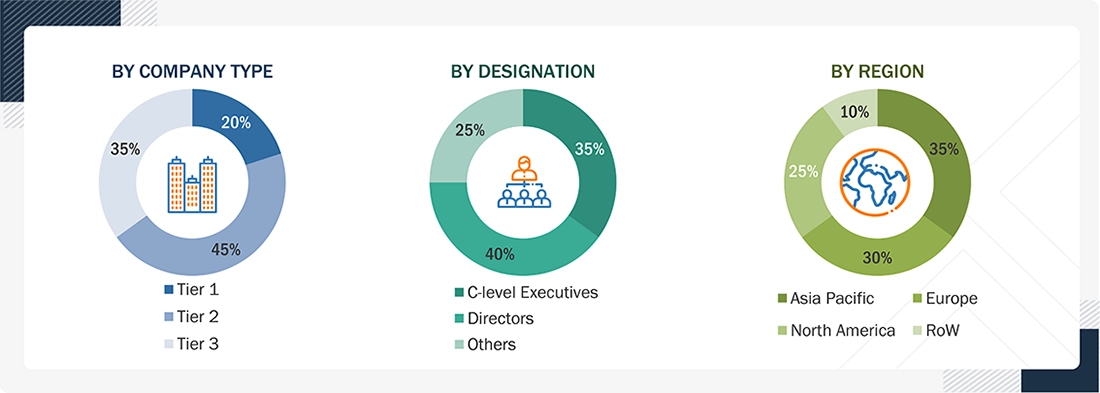

Primary Research

Extensive primary research has been conducted after gaining knowledge about the current scenario of the consumer mobile video camera market through secondary research. Several primary interviews have been conducted with experts from the demand and supply sides across four major regions, North America, Europe, the Asia Pacific and the RoW. This primary data has been collected through questionnaires, emails, and telephonic interviews.

Breakdown of Primary Interviews

Note: The three tiers of the companies are defined based on their total revenue in 2023: Tier 1 - revenue greater than or equal to USD 1 billion; Tier 2 - revenue between USD 100 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 100 million. Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the consumer mobile video camera market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

The market sizing includes the following:

Data Triangulation

After arriving at the overall size of the consumer mobile video camera market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

A consumer mobile video camera refers to a compact, portable video recording device designed primarily for personal, recreational, and semi-professional uses. These cameras enable users to capture high-quality video content on the go and include handheld cameras, gimbal-stabilized pocket cameras, wearable or clip-on cameras, mountable devices, and modular or convertible camera systems. They are optimized for mobility, ease of use, and quick content sharing across digital platforms.

The market encompasses devices offering features such as high-definition and ultra-high-definition video recording, advanced electronic or mechanical stabilization, wide-angle or multi-lens capture, wireless connectivity, and integration with mobile apps or cloud services. Consumer mobile video cameras are widely used by general users, creators, vloggers, travelers, and enthusiasts for activities including social media content creation, travel documentation, sports and outdoor recording, events, and lifestyle storytelling.

- Autonomous

- Government bodies and policymakers

- Industry organizations, forums, alliances, and associations

- Market research and consulting firms

- Component suppliers and distributors (image sensors, lenses, processors, batteries)

- Research institutes and technology organizations

- Analysts and strategic business planners

- End users across consumer segments, such as general users, creators/vloggers, professionals, sports and adventure enthusiasts, and travel consumers

Report Objectives

-

- To describe and forecast the size of the consumer mobile video camera market, by product type, form factor, price range, end user, use case, and sales channel in terms of value

- To describe and forecast the market size for four major regions—North America, Europe, Asia Pacific, and RoW, in terms of value

- To describe and forecast the market size, by product type, in terms of volume

- To provide a detailed overview of the consumer mobile video camera product specifications

- To provide detailed information regarding major factors, such as drivers, restraints, opportunities, and challenges, influencing the market growth

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, value chain analysis, trends/disruptions impacting customers' business, the impact of AI/Generative AI, key conferences and events, pricing analysis, Porter’s five forces analysis, US Tariff analysis, and regulations pertaining to the market under study

- To strategically analyze micromarkets1 with regard to individual market trends, growth prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with a detailed competitive landscape for the market leaders

- To analyze major growth strategies, such as product launches, joint ventures, and acquisitions, adopted by key market players to enhance their market position

- To describe macroeconomic factors impacting market growth in each region

- To analyze the AI/Gen AI impact on the consumer mobile video camera market

- To analyze the 2025 US tariff impact on the consumer mobile video camera market

Available customizations:

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Consumer Mobile Video Camera Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Consumer Mobile Video Camera Market