Containerized Battery Energy Storage System (BESS) Market Size, Share & Trends

Containerized Battery Energy Storage System (BESS) Market by Battery Type (Lithium-ion, Advanced Lead-acid, Sodium-based Batteries), Capacity (<1,000 kWh, 1,000-5,000 kWh, >5,000 kWh), Container Size (10 Feet, 20 Feet, 40 Feet) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global containerized BESS market is projected to grow from USD 13.87 billion in 2025 to USD 35.82 billion by 2030, at a CAGR of 20.9%. This robust growth is fueled by the increasing integration of renewable energy sources, the rising demand for grid flexibility, and the need for reliable backup power across residential, commercial, and utility sectors. As global focus intensifies on decarbonization, grid modernization, and electrification, containerized BESS is emerging as a key enabler of the clean energy transition. Supportive policies, renewable integration mandates, and large-scale utility investments are expected to sustain market momentum through the decade's end.

KEY TAKEAWAYS

- Asia Pacific dominated the market with a 52.9% market share in 2024.

- The lithium-ion battery type segment is expected to hold the largest market share in 2030.

- Medium-capacity systems (1,000–5,000 kWh) are anticipated to gain the largest market size during the forecast period.

- Modular 20-feet containers are expected to grow with the highest CAGR of 23.1% during the forecast period.

- Commercial & Industrial applications to grow with the fastest CAGR of 22.1%.

- Tesla, BYD, and Contemporary Amperex Technology Co., Limited,were identified as Star players in the Containerized BESS market, as they have focused on innovation and have broad industry coverage, and strong operational & financial strength.

- Alpha ESS, TLS Offshore Containers, and Shanghai OE Industrial have distinguished themselves among startups and SMEs due to their strong product portfolio and business strategy

The containerized BESS market is poised for robust growth, due to the rising demand for grid-scale energy storage, renewable integration, and commercial & industrial energy management. Lithium-ion batteries dominate, supported by modular container designs for scalable deployment across residential, commercial, and utility applications. Asia Pacific is the fastest-growing region, fueled by industrialization, government incentives, and large renewable projects. Declining battery costs, technological advancements, and a focus on sustainability and energy resilience also support the adoption of containerized BESS.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The containerized BESS market is growing rapidly, driven by increasing demand for flexible and scalable storage solutions amid ongoing grid modernization, the global shift toward low-carbon energy, and the rising use of lithium-ion batteries in renewable integration. Continued innovation in battery technologies and system integration is expected to open new revenue streams, especially in emerging markets and fast-developing energy ecosystems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing emphasis on renewable energy generation

-

Increasing global investment in the innovation of grid infrastructure

Level

-

High initial investment costs

Level

-

Rising demand for off-grid and remote energy solutions

-

Expansion of EV charging infrastructure and urban grid support

Level

-

Complex system integration and site-specific requirements

-

Battery degradation, safety risks, and thermal management challenges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing emphasis on renewable energy generation

The world is accelerating its energy transition, driven by ambitious decarbonization targets, rising renewable energy integration, and the imperative to mitigate climate change. As solar, wind, and other renewables grow fast, their variable and intermittent nature poses tremendous challenges to the grid's stability and energy reliability. Containerized BESS are becoming a key facilitator of the new energy infrastructure. These pre-engineered, modular solutions support rapid deployment, scalability, and cost-effective installation, making them extremely appealing to a range of grid-scale and behind-the-meter applications.

Restraint: High initial investment costs

One of the primary restraints hindering the growth of the containerized BESS market is the high upfront capital investment required for deployment. While lithium-ion batteries, the core component of most energy storage systems, have declined significantly over the past decade, the total system cost for containerized solutions remains relatively high. This is because a containerized ESS includes the battery packs and power conversion systems (inverters), battery management systems (BMS), thermal management units (cooling or heating), fire suppression systems, and container housing, all of which contribute to a high capital expenditure (CAPEX).

Opportunity: Expansion of EV charging infrastructure and urban grid support

Containerized BESS offers a highly adaptable and modular solution to mitigate the grid stress challenges. By storing electricity during off-peak hours or from on-site renewable sources, such as rooftop solar, containerized systems, can deliver energy during peak demand periods at EV charging stations, effectively balancing loads and avoiding spikes that could otherwise overload distribution networks. This helps reduce the operational burden on utilities and enables EV charging operators to manage electricity costs more efficiently through peak shaving and time-of-use optimization.

Challenge: Battery degradation, safety risks, and thermal management challenges

Containerized BESS offers a highly adaptable and modular solution to mitigate these grid stress challenges. By storing electricity during off-peak hours or from on-site renewable sources, such as rooftop solar, containerized systems can deliver energy during peak demand periods at EV charging stations, effectively balancing loads and avoiding spikes that could otherwise overload distribution networks. This helps reduce the operational burden on utilities and enables EV charging operators to manage electricity costs more efficiently through peak shaving and time-of-use optimization.

Containerized Battery Energy Storage System (BESS) Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Megapack containerized BESS for utility-scale renewable integration and grid balancing | High-capacity energy storage | Fast deployment | Modular scalability | Grid stability |

|

Blade battery-based containerized BESS for commercial and industrial energy management | Enhanced safety | Long lifecycle | Space optimization | Reliable power supply |

|

Lithium-ion and sodium-ion containerized BESS for large-scale energy storage and microgrid solutions | High energy density | Cost-efficient | Adaptable to wide temperature ranges | Faster charging |

|

Integrated containerized BESS with smart monitoring for commercial buildings and industrial sites | Improved energy efficiency | Predictive maintenance | Operational cost savings |

|

Modular containerized BESS for commercial, industrial, and utility backup applications | Reliable power supply | Grid support | Easy scalability | Reduced operational downtime |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The high power and energy density requirements have led to a rise in demand for reliable and safe battery use in different industries. The advent of electric vehicles, renewable energy storage systems, and consumer electronics has been driving investments in the field of batteries, from incumbents and new players. With the rise in the adoption of electronic devices, the demand for containerized BESS has also grown significantly. There are several participants in the ecosystem of batteries, and each participant has a specific and vital role. Participants include Li-on battery manufacturers, metal-air battery manufacturers, solid-state battery manufacturers, containerized BESS manufacturers, component providers, system integrators, and battery recycling companies.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Containerized BESS Market, By Battery Type

Lithium-ion batteries are projected to capture the largest market share due to their excellent performance attributes, high technological maturity, and widespread market penetration across a broad array of applications. Their high energy density, long cycle life, quick response time, and low maintenance requirements make them highly adaptable to short-duration and medium-duration storage applications, spanning peak shaving and frequency regulation to renewable energy integration and grid stabilization.

Containerized BESS Market, By Capacity

The 1,000–5,000 kWh capacity segment is estimated to capture the largest share of the containerized BESS market, driven by its optimal balance between energy capacity, cost-efficiency, and operational flexibility. This range is ideally suited for various commercial, industrial, and utility applications, including peak shaving, load shifting, backup power, and renewable energy integration. Containerized BESS units in this capacity range are often deployed in 20-foot and 40-foot containers, offering modularity, scalability, and ease of transportation.

Containerized BESS Market, By Container Size

20-foot containerized BESS units are expected to capture the largest market share, owing to their ideal balance between storage capacity, mobility, and ease of deployment. These containers offer a mid-size, modular format highly favored across various applications, from commercial and industrial (C&I) installations to utility-scale grid support, providing flexibility without the logistical challenges of larger units. The 20-foot size offers superior space-to-capacity efficiency while complying with global shipping and transport standards.

Containerized BESS Market, By Application

The commercial and industrial (C&I) segment is the most likely to experience the highest growth in the containerized BESS market due to the rising energy costs, business continuity, and business sustainability needs. Multiple categories of C&I buildings, including corporate campuses, data centers, manufacturing facilities, hospitals, municipalities, and schools, are rapidly adopting containerized BESS to maximize energy usage, reduce peak demand charges, and ensure power continuity during power outages.

REGION

During the forecast period, Asia is expected to be the fastest-growing region in the global containerized BESS market

Asia Pacific is expected to register the highest CAGR in the containerized BESS market based on its status as the global battery manufacturing hub, rapid industrialization, and government support in clean energy transformation. China, South Korea, Japan, and India are leaders in battery manufacturing with key players, such as CATL, BYD, LG Energy Solution, and Samsung SDI, which provide strong supply chains, cost savings, and technology innovation for containerized BESS solutions.

Containerized Battery Energy Storage System (BESS) Market: COMPANY EVALUATION MATRIX

In the containerized BESS market matrix, Tesla (Star) leads with a strong global presence and a comprehensive portfolio of containerized BESS spanning various applications, including commercial, industrial, and utilities. GE Vernova (Emerging Leader) is gaining momentum with its new and improved containerized BESS solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS - Containerized BESS Companies

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 9.33 Billion |

| Market Forecast in 2030 (Value) | USD 35.82 Billion |

| Growth Rate | CAGR of 20.9% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) and Volume (In GWh) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Middle East, South America, and Africa |

WHAT IS IN IT FOR YOU: Containerized Battery Energy Storage System (BESS) Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Utility-Scale Developer |

|

|

| Commercial & Industrial Energy User |

|

|

| Residential Energy Solutions Provider |

|

|

| Energy Storage Investor |

|

|

RECENT DEVELOPMENTS

- May 2025 : Contemporary Amperex Technology Co., Limited (CATL) launched the TENER Stack, the world’s first 9 MWh ultra-large capacity energy storage system, at Entry/Exit System (EES) Europe 2025. The product was introduced to meet rising global demand for high-density, flexible, and transportable energy storage solutions. Targeted at utilities, developers, and industrial users, the TENER Stack delivers significant advancements in space utilization, energy efficiency, and cost performance. It supports various applications, including AI data centers and industrial electrification.

- April 2025 : Honeywell commissioned a 1.4 MWh microgrid BESS for SECI’s Lakshadweep Islands project, India’s first on-grid solar-plus-storage system, integrating its Energy Management and microgrid control systems to decarbonize the remote Kavaratti microgrid.

- September 2024 : GE Vernova was selected by Quinbrook Infrastructure Partners to serve as the integration provider for stages 1 and 2 (totaling 500 MW/1,500 MWh) of the Supernode BESS project in Queensland, Australia. The deal aims to enable large-scale wind and solar energy storage, supporting one of Australia’s biggest grid-connected BESS installations and advancing renewable energy integration.

- June 2024 : NGK Insulators secured a contract to supply containerized NAS batteries for a grid-storage demonstration project at Hungary’s state-owned MVM Balance power station. The project aims to stabilize the electric grid by storing surplus energy and providing adjustment capacity.

Table of Contents

Methodology

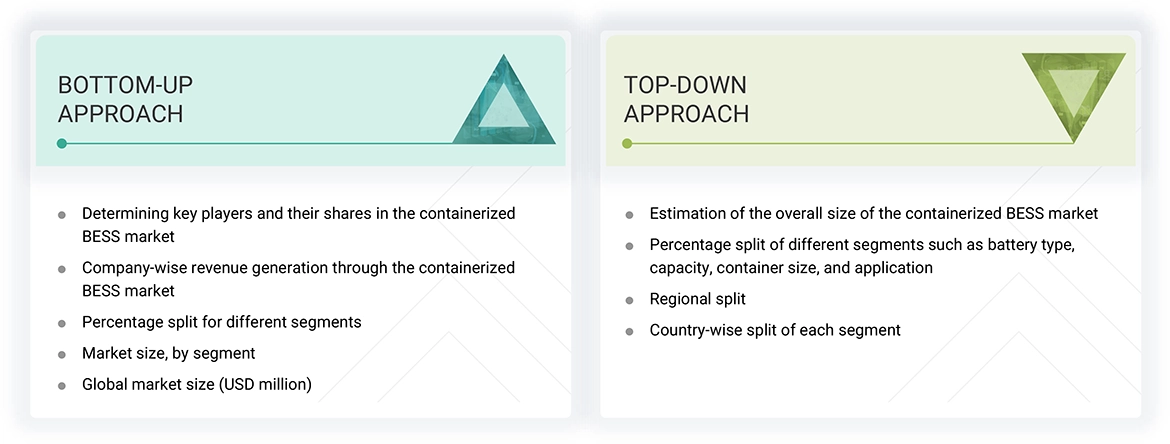

The study involved major activities in estimating the current market size for the Containerized Battery Energy Storage System (BESS) Market. Exhaustive secondary research was done to collect information on the building information modeling industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Containerized Battery Energy Storage System (BESS) Market.

Secondary Research

The secondary research for this study involved gathering information from a wide range of credible sources. These included company annual reports, investor presentations, press releases, whitepapers, certified publications, and articles from reputable associations and government publications. Additional data was obtained from corporate filings, professional and trade associations, journals, and industry-recognized authors. Research from consortia, councils, and gold- and silver-standard websites, directories, and databases also contributed to the qualitative framework. Key global sources such as the International Trade Centre (ITC) and the International Monetary Fund (IMF) were consulted to support and validate the market analysis.

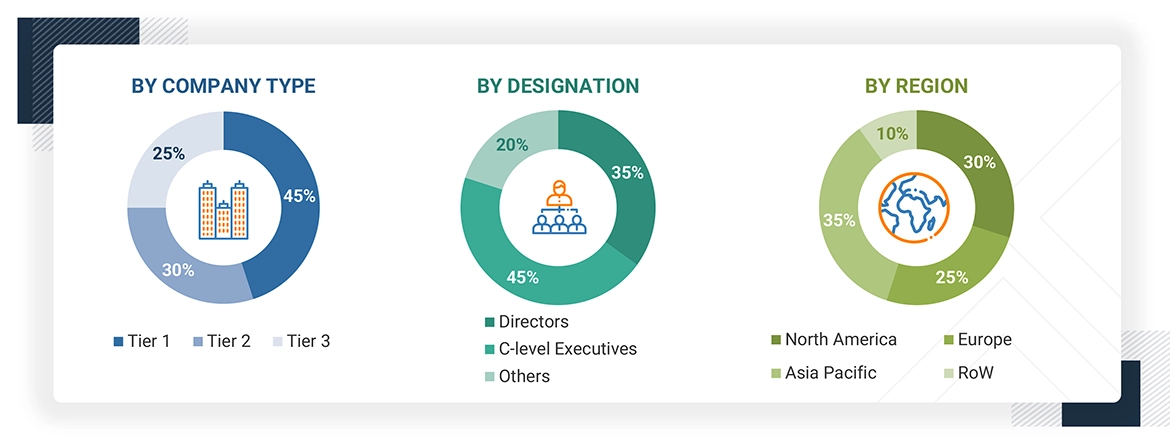

Primary Research

Extensive primary research was conducted after understanding and analyzing the Containerized Battery Energy Storage System (BESS) Market scenario through secondary research. Several primary interviews were conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 20% of the primary interviews were conducted with the demand side and 80% with the supply side. Primary data was collected through questionnaires, e-mails, and telephonic interviews. Various departments within organizations, such as sales, operations, and administration, were contacted to provide a holistic viewpoint in the report.

Note: Three tiers of companies are defined based on their total revenue as of 2024: tier 1 = revenue more than USD 5 billion; tier 2 = revenue between USD 500 million and USD 5 billion; and tier 3 = revenue less than USD 500 million. Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the containerized BESS market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Containerized Battery Energy Storage System (BESS) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the containerized BESS market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

A containerized battery energy storage system (BESS) is a plug-and-play, pre-assembled energy storage solution housed within standard 10-ft, 20-ft, or 40-ft containers. It integrates batteries, inverters, thermal management, and safety systems into a modular and transportable unit. Designed for fast deployment and easy scalability, it minimizes on-site work and supports various grid and off-grid applications. Its standardized design ensures efficient logistics, making it ideal for utility, commercial, and industrial use. These systems enable flexible, space-efficient energy storage with reduced installation time and costs..

Key Stakeholders

- BESS manufacturers and integrators

- Lithium-ion battery manufacturers

- Government bodies and policymakers

- Standards organizations, forums, alliances, and associations

- Market research and consulting firms

- Raw material suppliers and distributors

- Research institutes and organizations

- Material and technology providers

- Battery cell and battery pack manufacturers

- Consumer electronics manufacturers

- Testing, inspection, and certification providers

- Distributors and resellers

Report Objectives

- To define, describe, and forecast the containerized BESS market in terms of battery type, capacity, container size, application, and region

- To describe and forecast the market, in terms of value, with regard to four main regions: North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the value chain of the containerized BESS market.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the containerized BESS market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the containerized BESS market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive strategies, such as product launches, expansions, and mergers & acquisitions, adopted by key market players in the containerized BESS market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the total CAGR estimated to be recorded for the containerized BESS market between 2025 and 2030?

The global containerized BESS market is expected to record a CAGR of 20.9% from 2025 to 2030.

What are the driving factors for the containerized BESS market?

The containerized BESS market is driven by integration with renewable energy generation, which is driving the containerized battery storage market, lithium-ion battery scalability in the renewable energy sector, declining battery costs, and technological advancements are the major driving factors for the containerized BESS market.

What is the impact of AI on the containerized BESS market?

Artificial intelligence (AI) is playing a pivotal role in advancing the containerized BESS market by enabling smarter energy management and system optimization. AI-powered analytics help monitor battery performance in real time, predict faults, and extend battery life through intelligent charge-discharge control. In containerized setups, AI supports automated thermal regulation and fault detection, ensuring operational safety and efficiency. These capabilities are especially valuable for remote or large-scale deployments, where AI-driven insights reduce downtime, improve grid responsiveness, and lower overall maintenance costs, making containerized BESS more reliable, scalable, and cost-effective.

Which are the significant players operating in the containerized BESS market?

Tesla (US), Contemporary Amperex Technology Co., Limited (China), BYD (China), Honeywell International, Inc. (US), and Eaton (Ireland) are some of the major companies operating in the containerized BESS market.

Which region is projected to offer lucrative growth for the containerized BESS market by 2030?

During the projected period, the Asia Pacific is expected to offer lucrative opportunities in the containerized BESS market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Containerized Battery Energy Storage System (BESS) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Containerized Battery Energy Storage System (BESS) Market