Content Detection Market

Content Detection Market by Detection Type (Content Moderation, AI-generated Content Detection, Plagiarism Detection), Content Type (Video, Text, Image, Audio), Offering (Solutions, Services), End- User, and Region - Global Forecast to 2029

OVERVIEW

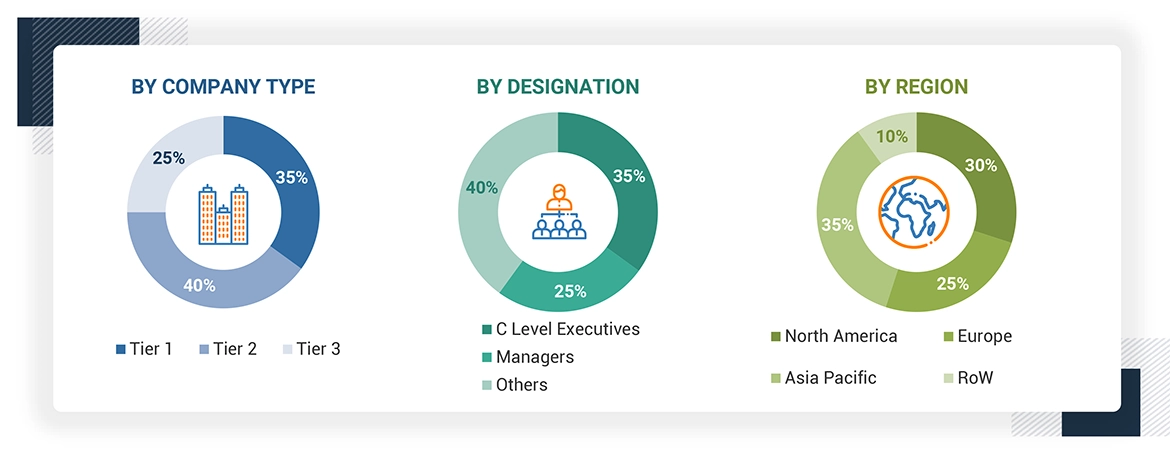

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The content detection market is projected to reach USD 31.42 billion by 2029 from USD 16.48 billion in 2024, at a CAGR of 13.8% from 2024 to 2029. The growth of the content detection market is due to proliferation of user-generated content on social media platforms, forums, and video-sharing sites has created a demand for effective content detection tools to manage vast amounts of uploaded material and ensure compliance with community guidelines and laws.

KEY TAKEAWAYS

-

By RegionThe North America content detection market accounted for a 30.3% revenue share in 2024.

-

By OfferingBy offering, the services segment is expected to register the highest CAGR of 14.9%.

-

By Detection TypeBy detection type, the content moderation segment is projected to hold the largest market size of USD 6,907.0 billion in 2024.

-

By Content TypeBy content type, the video segment is expected to dominate the market.

-

By End UserBy end user, the social media platforms segment will grow the fastest during the forecast period.

-

Competitive LandscapeCompany Amazon, Microsoft, IBM, Google, Alibaba Cloud, HCL Technologies, and Huawei Cloud were identified as some of the star players in the content detection market (global), given their strong market share and product footprint.

-

Competitive LandscapeCompanies ActiveFence, Hive, and QuillBot, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The content detection market is witnessing steady growth, driven by the rise of user-generated content, particularly on social media platforms, growing concerns about copyright infringement, and calls from government organizations to control offensive or illegal content. Furthermore, there is a great need for efficient content detection systems due to the increase in cyber dangers, the need for real-time content moderation, and the addition of more video and streaming services.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business in the content detection market stems from evolving customer needs and industry disruptions. social media platforms, marketplace & eCommerce, Media & Streaming platforms, Education & EdTech, and Government & public sector companies are the primary users of content detection solutions, with safer user communities as the key focus area. Shift towards proactive, AI-driven multimodal moderation. Vendors combine real-time AI, human-in-the-loop review, edge/on-prem options and compliance tooling, delivering faster removals, fewer false positives and stronger regulatory protection. These impacts, in turn, drive the demand for advanced content detection solutions and services, shaping the market's growth trajectory.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising concerns over content authenticity

-

Increasing online content volume

Level

-

Adapting to legal and regulatory requirements

-

Complexity in language and cultural nuances

Level

-

Increasing demand for real-time moderation solutions

-

Integration with social media and live-streaming

Level

-

Managing large volumes of content

-

Data security and privacy concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising concerns over content authenticity

Tools to determine the authenticity of the contents are needed because misinformation, manipulated media, and deepfakes have been on a significant rise. Social media's widespread use frequently plays a significant role in producing false narratives and information that mislead the public and distort their perceptions. As a result, governments and other institutions are being urged to look for tools that can automatically verify data and flag questionable sources or content. The development of deepfake technology is also questioning the use of such tools due to the extreme damages brought about by the use of fake but real-looking audio and video content. Also, both individuals in the public space and corporations are interested in safeguarding their image with the help of content detection tools that search for altered or non-consensual pictures, words, or goods. In addition, the rising regulatory initiatives like the Digital Services Act (DSA) introduced by the European Union also highlighted the importance of content management, raising expectations from technology companies to procure measures that alleviate content risk and enhance transparency. Meanwhile, the rising need for verified information among users drives social media and news platforms to issue labels for verified content to build trust. Enhanced by advanced Al and machine learning, detection tools have become more sophisticated by incorporating indicators such as metadata anomalies or visual inconsistencies to spot alterations to content. In essence, these increasing issues are compelling governments, organizations, and digital platforms to focus on the solutions for the detection of content, which creates the necessity for innovation and acceptance of the solution in the market

Restraint: Adapting to legal and regulatory requirements

The content detection market is faced with is the need to comply with legal and regulatory frameworks because these factors vary significantly from one location to another and are constantly changing. For instance, the implementation of different data protection regulations, such as the General Data Protection Regulation (GDPR) within several countries under the European Union (EU), as well as censorship regulations in several other countries, makes it very hard to deploy content detection systems. There are also constraints associated with the user-generated content policy, which, in simplistic terms, means that systems have to find a middle point between the policies of moderating certain content against the rights of the users. Global corporations have to abide by local laws or carry out local operations within the ambit of specific existing or new regulations; content detection systems are expected to be capable of taking on a large variety of undifferentiated legal systems for efficient use, which calls for expensive and time-consuming new adaptations. In addition, the protection of original content and the fear of vague censorship policies make the legal environment much more complex, creating even more difficulty for the players in the content detection market

Opportunity: Increasing demand for real-time moderation solutions

The growing need for content moderation services in the content detection market is due to the fact that all these platforms are safe, moderated, and have an engaging online presence. With the increase in social media, live streaming, and real-time communication, it has since become a requirement to be able to detect, identify, and act on harmful, abusive, or even illegal content swiftly to safeguard not only users but also the reputation of the brands as well. Also, regulated content takedown orders, as seen in the EU’s Digital Services Act, have made it mandatory for content-driven platforms to integrate Al technologies that can analyze text and images in real time in compliance with the law or face heavy sanctions. Again, nowadays, instantaneous content management reduces the risks posed by annoying those customers who trust a brand, promoting their loyalty. It protects advertisers by ensuring that advertising does not appear close to offensive content. In recent years, the improvement of existing technologies used in artificial intelligence systems, and especially in linguistics and computer graphics, has made it easy to moderate the content in real-time as there is a rate of processing vast volumes of data in a short time, In addition, the factor of increased demand and usage of such real-time technologies even in social networks, video conference calls, online gaming and the e-sport digital arena. Nowadays, most of them encourage some form of automated moderation together with potential human intervention under challenging cases for escalation, thus refining the moderating processes and enabling real-time moderation to be practicable without any overwhelming resource costs

Challenge: Managing large volumes of content

The market for detecting harmful content is greatly challenged by managing high volumes of content mostly due to the rapid increase of data on social media, streaming services, and user-generated content sites. Such content detection systems are expected to scale as the volume of data increases, such as the number of texts, images, and videos to be processed in real-time, which requires a lot of computing power and good infrastructure. Maintaining accuracy is even more difficult in situations where high volume is involved; hence, there are increased chances of false positives and negatives. There are also operational issues as there is the need to control the size of the databases in the context of data localization and data privacy compliance. With regard to content moderation, real-time processing is complicated as there are platforms that demand quick steps taken in dealing with any threatening content, which calls for complex Al models and fast processing. This forces them to cut down on resource allocation and operational costs in addition to regular EM training and model upgrade costs, in which, in most cases, these companies are small. Also, there is the challenge of maintaining a similar standard of content finding and content blocking across different editable environments because the content is often interactive and capable of being designed within various systems and complexity

CONTENT DETECTION MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Enterprise multimodal moderation and generative-AI safety APIs for platforms and apps. | Automated filtering, policy controls, human-review workflows, unified scalable content safety. |

|

Toxicity scoring and multimodal safety filters for comments, chat and generated content. | Configurable thresholds, integrated pipelines, automation, analytics, robust moderation at scale. |

|

Image and video moderation with custom labels and human-review workflows. | Scalable multimedia moderation, reduced manual review, customizable taxonomies, faster decisions. |

|

API-first multimodal moderation for social platforms, marketplaces and streaming at scale. | Single API, rapid model updates, enterprise-scale moderation and risk detection. |

|

Visual and multimodal moderation with custom models for marketplaces and UGC. | Customizable models, OCR and NLP pipelines, fast deployment for brand safety. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The content detection market ecosystem consists of software/ service providers (Google, IBM) and technology providers (AWS, clarifai). The content detection ecosystem is a complex interplay of technologies, tools, and services designed to identify, classify, and analyze digital content. It is crucial for various applications, including brand protection, copyright enforcement, content moderation, and cybersecurity.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Content Detection Market, By Offering

The content detection market relies heavily on providing professional and managed services, as they improve the efficiency and extend the capabilities of content monitoring systems. Managed service involves real-time content moderation and AI optimization. While in consulting services, clients reach out to professionals for recommendations on the most suitable content detection technology for their cases. These services also provide ongoing support, addressing the AI optimization of content employing real-time monitoring and moderation aimed at curbing abuse or objectionable content, for instance hate speech or illegal materials such as pirated content or pornography. The offered services also ensure that compliance with data privacy is maintained by providing detailed reporting and analytics on the performance of the systems

Content Detection Market, By Detection Type

Content moderation helps to eliminate hate speech, false information, obscene material, or trolling but extends to many digital platforms. Social media platforms, for instance, rely on content moderation techniques to protect users against bullying and also the spreading of falsehoods. At the same time, in e-commerce sites, internal structures check all postings and reviews to deter any possible rule infringements and scamming. Content moderation solutions include elements like AI, machine learning, natural language processing (NLP), and computer vision to facilitate the automated scanning and filtering of text, images, audio and videos, usually complemented by human control for more subjective cases. With real-time moderation, the rise of needed multilingual abilities for online platforms, and the need for culture-sensitive systems that are well integrated within online platforms, online content moderation is increasingly critical in achieving a quality experience online

Content Detection Market, By Content Type

The video content detection is to analyze audio-visual content for detecting objectionable, pirated, or Al-generated content. Such technologies like computer vision and machine learning algorithms actively participate in detecting nudity, violence, and hate speech in video streams. This technology were widely adopted by the streaming platforms to comply with required community guidelines. Furthermore, Google is working with YouTube in producing a set of technologies that will enable it to learn how to detect faces and videos generated using artificial intelligence. The company is still refining the tech, having scheduled an initial stage pilot program in early 2025. With the rise of modern emerging platforms for short videos, video detection solutions have become important in opening up places for compliance with community norms

Content Detection Market, By End User

Social media platforms utilize content detection technologies to identify inappropriate, harmful, or non-compliant content across text, images, videos, and audio. Platforms such as Twitter, Facebook, Reddit, and Instagram are popular and widely used platforms that enable people to access and connect to world by forming a social network to express share and publish information. Considering the huge volume of user-generated content (UGC) on various social media platforms, detection and moderation of detrimental content on social media has become paramount. According to National Crime Records Bureau (NCRB) data, cybercrimes have increased on social media. In India, there were 578 cases of fake news on social media, 972 related to cyberbullying of women and children, and 149 incidents of fake profiles, as reported in Times of India 2020. When content is published on social media platforms, it is detected to identify or classify whether the published content is harmful or non-harmful. Artificial Intelligence (AI) has emerged as an upcoming tool for automated detection of detrimental content on social media through Machine Learning (ML) algorithms and Natural Language Processing (NLP). use of these AI-based detection methods assists the human moderators in flagging the content

REGION

Asia Pacific to be fastest-growing region in global content detection market during forecast period

The content detection market is growing fastest in the Asia Pacific region. The increasing consumption of user-generated content, the need for plagiarism detection services, and the development of tools employing advanced AI capabilities, such as ML and NLP are responsible for the thriving content detection industry in the region. The increase in the number of business transactions taking place online and the sheer amount of content generated daily also necessitates the need to promote safer interaction among business partners and adhere to industry standards. Content moderation is in high demand in India and China, which have vast user interactions. Given the regional linguistic and cultural diversity, content detection tools that incorporate machine learning, natural language processing, and computer vision techniques are used to minimize the manual processes of detecting undesirable text, pictures, audio, and videos.

CONTENT DETECTION MARKET: COMPANY EVALUATION MATRIX

In the content detection market matrix, Amazon (Star) leads with a strong market share and extensive product footprint, driven by its advanced composites and high-performance materials widely adopted in commercial and Defense aviation. Accenture (Emerging Leader) is gaining visibility with its specialized alloys and tailored solutions for aerospace applications, strengthening its position through innovation and niche product offerings. While Syensqo dominates through scale and a diverse portfolio, Swiss Steel Group shows significant potential to move toward the leaders’ quadrant as demand for high-strength alloys continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Microsoft (US)

- Google (US)

- Amazon (US)

- Alibaba Cloud (China)

- IBM (US)

- HCL Technologies (India)

- Huawei Cloud (China)

- Wipro (India)

- Accenture (Ireland)

- Clarifai (US)

- Cogito Tech (US)

- TaskUS (US)

- Cognizant (US)

- Proofpoint (US)

- Concentrix (US)

- SunTec.ai (US)

- Besedo (Sweden)

- ActiveFence (US)

- Sensity (Netherlands)

- Hive (US)

- QuillBot (US)

- Originality AI (Canada)

- Imerit Technology (US)

- Dataloop (Israel)

- WebPurify (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 14.25 Billion |

| Market Forecast in 2029 (Value) | USD 31.42 Billion |

| Growth Rate | CAGR of 13.8% from 2024-2029 |

| Years Considered | 2019-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: CONTENT DETECTION MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider (US) | Product Analysis: Product Matrix, which gives a detailed comparison of the product portfolio of each company | Enhanced understanding of competitive positioning and product offerings |

| Leading Service Provider (EU) | Company Information: Detailed analysis and profiling of additional market players (up to 5) | Deeper insights into market dynamics and potential strategic partnerships |

RECENT DEVELOPMENTS

- November 2024 : Clarifai Joins the Berkeley Artificial Intelligence Research (BAIR) Open Research Commons to Advance AI Innovation. Clarifai's involvement reinforces BAIR’s its commitment to advancing state-of-the-art AI, especially in areas such as content moderation, visual and cross-modal similarity search, and open vocabulary small object detection and tracking.

- September 2024 : Microsoft announced a new feature called "Correction," which, according to the company, will automatically detect and rectify false information generated by AI. This new tool is part of Microsoft's Azure AI Content Safety API.

- September 2024 : Tata Consultancy Services (TCS) expanded its partnership with Google Cloud to launch two new AI-powered cybersecurity solutions aimed at strengthening enterprise cyber resilience. The new offerings include TCS Managed Detection and Response (MDR) and TCS Secure Cloud Foundation.

Table of Contents

Methodology

This research study involved extensive secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect valuable information for a technical, market-oriented, and commercial study of the content detection market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering content detection solutions and services to different verticals has been estimated and projected based on the secondary data made available through paid and unpaid sources and by analyzing their product portfolios in the ecosystem of the Content detection market. It also involved rating company products based on their performance and quality. In the secondary research process, various sources such as the International Journal of Content detections and Networking (IJSCN), the International Journal of Remote Sensing, and the Einstein International Journal Organization (EIJO) have been referred to for identifying and collecting information for this study on the Content detection market. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles by recognized authors, directories, and databases. Secondary research has been mainly used to obtain essential information about the supply chain of the market, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives that primary sources have further validated.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related critical executives from Content detection service vendors, SIs, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using Content detection services, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of Content detection services which would impact the overall Content detection market.

Note: Others include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the content detection market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of content detection offerings. Both top-down and bottom-up approaches were used to estimate and validate the total size of the content detection market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Content Detection Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the content detection market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Content detection is the process of identifying, analyzing, and categorizing of digital content, including text, images, audio, and video, using algorithms, tools, or software systems. It involves recognizing patterns, features, or specific elements in the content to achieve objectives such as moderation, copyright enforcement, sentiment analysis, or data categorization. Content detection employs techniques such as machine learning (ML), natural language processing (NLP), computer vision, and audio signal processing to detect and classify elements like keywords, objects, behaviors, or metadata.

Stakeholders

- Content detection technology providers

- Content detection solution providers

- Content detection service providers

- Regulatory authorities

- Content creators and rights holders

- Content moderators and reviewing Teams

- Civil Society groups

- Advertisers and brands

- Legal and compliance teams

- Academic and research communities

Report Objectives

- To determine, segment, and forecast the content detection market by offering, detection type, content type, end user, and region in terms of value

- To forecast the size of the market segments concerning 5 main areas: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market's growth.

- To study the complete supply chain and related industry segments and perform a supply chain analysis of the market landscape

- To strategically analyze the macro and micro-markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Content Detection Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Content Detection Market