Continuous Thermal Monitoring Market

Continuous Thermal Monitoring Market by Offering (Hardware, Software, Service), Application (Bus Duct Monitors, Switchgear, Motor Control Centers, Low-voltage Transformers, Dry Transformers), End User, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The continuous thermal monitoring market is projected to reach USD 1.49 billion by 2030 from an estimated USD 1.00 billion in 2024, at a CAGR of 6.8% during the forecast period (2024–2030). The increasing need for efficient energy management and better safety in industrial and commercial facilities, as thermal monitoring systems are able to identify overheating conditions and prevent equipment failure.

KEY TAKEAWAYS

-

BY OFFERINGThe offering segment includes hardware, software, and services. The hardware segment is the largest growing segment due to its indispensable role in the system’s functionality. These hardware components are the backbone of thermal monitoring systems, as they are directly responsible for detecting and capturing temperature data in real-time.

-

BY APPLICATIONThe application segment is segregated into switchgear, bus duct monitors, dry transformers, low-voltage transformers, motor control centers, and other applications. This segment demand is propelled by bus duct monitors, which is expected to be the fastest-growing segment due to the critical role of bus ducts in power distribution, along with increasing emphasis on ensuring their reliability and effeciency.

-

BY END USERThe end user segment includes Utilities, Manufacturing, Data Centers, Oil & Gas, Telecommunication, Logistics, Retail, Healthcare, and other end users. The data centers segment is the fastest-growing in the continuous thermal monitoring market due to its crucial role in ensuring optimal performance and preventing downtime in facilities supporting cloud computing and data storage.

-

BY REGIONThe regions considered are North America, Europe, Asia Pacific, Middle East & Africa and South Africa. Asia Pacific is projected to hold the largest market size of the continuous thermal monitoring market during the forecast period. This can be attributed to growing demand for reliable and efficient power infrastructure and region’s expanding manufacturing base, especially in countries like China, India, and Japan. These major economies like China, India, and Japan are scaling up their manufacturing capabilities and investing heavily in IT infrastructure, which amplifies the need for advanced thermal monitoring systems that can ensure operational reliability, efficiency, and equipment protection.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including acquistion and expansion. For instance, Siemens strengthened its digital enterprise services by acquiring Senseye, a leading provider of AI-driven predictive maintenance solutions. This strategic move enhances Siemens' offerings by integrating Senseye's technology, which reduces unplanned machine downtimes by up to 50% and boosts maintenance staff productivity by up to 30%.

Adoption of advanced IoT-enabled and AI-powered thermal monitoring solutions has further fuelled market growth by providing real-time data and predictive analytics. In addition, with the increasing trend of infrastructure modernization, especially in power generation, oil and gas, and manufacturing sectors, there is an increased demand for these systems. The strict government rules and regulations to ensure workplace safety and energy efficiency also force the organizations to spend on continuous thermal monitoring.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The continuous thermal monitoring market is rapidly evolving with AI, IoT, and infrared thermal imaging advancements, enabling real-time data insights and predictive maintenance for critical equipment like transformers and switchgear. Automation and remote monitoring streamline operations, reducing downtime and improving efficiency. Customer demands for operational reliability, energy efficiency, and compliance with safety regulations are driving innovation in CTM solutions. By understanding these dynamics, businesses can identify new revenue opportunities, mitigate potential risks, and adapt to the shifting market environment. This informed approach enables companies to strategically position themselves to capitalize on emerging trends and drive future growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing emphasis on predictive maintenance

-

Increasing adoption of industrial automation

Level

-

High initial costs associated with advanced monitoring systems

-

Technical complexities in integrating advanced monitoring systems with existing industrial infrastructure

Level

-

Rise in hyperscale data centers

-

Reduced certification workload

Level

-

Rising cyberattacks

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing emphasis on predictive maintenance

The main driver for the continuous thermal monitoring market is the increasing focus on predictive maintenance. Advanced monitoring systems collect real-time data on which predictive maintenance strategies heavily rely, predicting equipment failures before they occur. Continuous temperature monitoring has been found to be an essential tool for enabling predictive maintenance as industries look to minimize downtime while improving operational efficiency and reducing maintenance expenses. Temperature anomalies usually precede a problem in the equipment, either overheating electrical systems, bearings worn out or failing insulation within transformers. Thus, these can be diagnosed beforehand, and correction actions can be done in time; costly breakdowns would be avoided as well as regular operations.

Restraint: High initial costs associated with advanced monitoring systems

The most significant restraint for the growth of the continuous thermal monitoring market is the high initial cost required to install and deploy advanced monitoring systems. Such costs include those related to the deployment of sophisticated sensors, data analytics platforms, installation processes, and integration with existing industrial or commercial setups. Although the advantages are obvious, for organizations, especially small and medium enterprises, the initial investment in such advanced monitoring solutions is quite heavy, which limits their adoption despite the long-term benefits. Generally, continuous temperature monitoring systems utilize relatively advanced technologies like IoT sensors, AI-based analytics, and cloud computing for real-time processing and predictive maintenance. While these technologies increase performance and efficiency in operations, they increase the cost of procurement and setup. Additionally, the calibration, integration, and maintenance of such systems require specialized personnel, further increasing the overall expenditure. In industries like manufacturing, food storage, and energy, where cost optimization is crucial, the high upfront investment can be a barrier to adopting these solutions

Opportunity: Rapid deployment of smart grids

One of the key market opportunity in the continuous thermal monitoring market include smart grid adoption, which can be potentially capitalized on with sensor technology improvement. In due course of time, the governments of this world are escalating investment in developing smart grid infrastructures that can enable efficient distribution of energy coupled with renewable energy sources, thus electrical component monitoring will become a necessity which should be both accurate and reliable. With this understanding, it shows that smart grids utilize digital technology in the flow of electricity as optimized and managed; thus, real-time monitoring of temperatures proves crucial for diverse assets including transformers, circuit breakers, and power lines. From here emanates the value of CTM in enhancing reliability and efficiency within the grid while detecting overheating, which preempts system collapse, and thereby permitting predictive maintenance. Advanced sensor technology enables the CTM market to be sensitive enough to determine minute temperature variations within a smart grid. Different forms of sensor technology including fiber-optic sensors, thermocouples, and infrared sensors allow readings on time at any given level of accuracy and give feedback to the operation of the grid.

Challenge: Rising cyberattacks

In the marketing realm, cyberattacks are one big problem especially as IoT, AI, and cloud increase their integration. Nowadays, most CTM systems enabled by interconnected networks and smart sensors collect, transmit, and analyze real-time field temperature data. This is an added advantage-making it more productive, but in turn, allows such connectivity to be exposed to cyber threats such as data breach, ransomware, and unauthorized access to critical infrastructure. Essentially crucial CTM systems are those easily breached through cybercriminal activity because the data targeted on potential or criminal instances exposes hyper-value systems in healthcare, manufacturing, and data centers. Weak encryption, unsecured endpoints, or outdated software can be exploited by attackers to enter the system and cause increased exploitation. Increasing numbers of users have adopted cloud platforms to remote monitoring tools services, boosting exposure to vulnerabilities and thus inviting attacks from combining weak encryption offerings with a lack of technical controls due to obsolete products.

Continuous Thermal Monitoring Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Continuous monitoring of transformer temperatures in substations to ensure optimal operating conditions and prevent thermal overloads. | Reduces risk of equipment failure, supports predictive maintenance, and increases grid reliability. ? |

|

Thermal monitoring of critical rotating machinery and motor drives to detect overheating, insulation degradation, and abnormal load conditions in real time. | Minimizes downtime, extends asset life, and enhances workplace safety. |

|

Monitoring server racks, power distribution units, and switchgear for thermal anomalies to prevent fire hazards and unplanned outages in large data centers. | Prevents costly disruptions, improves energy efficiency, and enables automated alarm response. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The continuous thermal monitoring market ecosystem comprises raw material suppliers, manufacturers, distributors, end users, and regulatory bodies/standards organizations. The end users of the continuous thermal monitoring market primarily include data centers, oil & gas, retail, utilities, logistics, manufacturing, healthcare, retail, telecommunication, and others. This list is not exhaustive and is meant to explain the key players involved in the market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Continuous Thermal Monitoring Market, By Offering

The growth observed in the hardware segment of the continuous thermal monitoring market is modestly significant because the industry sector has a huge demand for reliable and precise temperature monitoring solutions. Infrared cameras, thermal sensors, and other specialized devices are necessary for identifying temperature anomalies and preventing equipment failure. These devices will monitor real time, perform predictive maintenance, and can even foresee major problems; therefore, their presence reduces the likelihood of machine downtime and related risks in the operational arena. More focus on energy efficiency combined with adoption of Industry 4.0 and IoT-based solutions has augmented demand for hardware which integrates into the digital domain without issues.

Continuous Thermal Monitoring Market, By Application

The switchgear application segment is further segmented into low-voltage switchgear and medium-voltage switchgear. The market for low-voltage switchgear application is witnessing growth, with a steady rate, attributed to high adoption rates of continuous thermal monitoring solutions because of its integral significance in secure and efficient power distribution. Continuous thermal monitoring is used for the detection of hot spots, overloads, and other thermal anomalies in switchgear systems and is an important measure in avoiding electrical faults and ensuring operational reliability of systems.

Continuous Thermal Monitoring Market, By End User

The data center end-use segment is a major driver in the global continuous thermal monitoring market due to the exponential growth of digitalization, cloud computing, and edge computing. Increasing reliance on data centers for critical operations necessitates maintaining optimal thermal conditions to avoid overheating, equipment failures, and costly downtime. Increasing energy usage and heat emissions from high-density server racks require continuous thermal monitoring to maintain efficiency and reliability. The integration of IoT and AI-based thermal monitoring solutions provides the means to instantly identify hotspots and thus provide proactive maintenance. Further, aggressive standards on energy efficiency and green operations have resulted in pushing the boundaries for advanced thermal monitoring solutions within data centers for optimization of cooling, reduced energy expenditure, and enhanced performance.

REGION

Asia Pacific to be fastest-growing region in global continuous themal monitoring market during forecast period

The continuous thermal monitoring market in Asia Pacific is estimated to grow from USD 417.8 million in 2024 to USD 629.4 million by 2030, at a CAGR of 7.1% during the forecast period. The continuous thermal monitoring market in Asia Pacific is experiencing significant growth, driven by rapid industrialization and urbanization in countries like China, India, and Southeast Asia. The expanding industrial base and urban infrastructure demand reliable electrical systems to ensure uninterrupted operations, prompting the need for continuous monitoring to prevent costly downtime. Furthermore, the region’s increasing reliance on stable power supplies across manufacturing, IT, and healthcare sectors highlights the importance of detecting early thermal anomalies. The surge in electrical equipment usage, including bus ducts, switchgear, and transformers, fueled by the growth of manufacturing plants, data centers, and smart grids, further drives the adoption of monitoring solutions. Safety and preventive maintenance are critical motivators, as thermal monitoring mitigates risks like overheating and equipment failure, aligning with stringent regulatory requirements and enhancing operational reliability in high-stakes industries such as oil and gas.

Continuous Thermal Monitoring Market: COMPANY EVALUATION MATRIX

In the continuous thermal monitoring market matrix, Schneider Electric (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across industries like data centers, utilities, and manufacturing. Powell Industries (Emerging Leader) is gaining traction with its solutions used across manufacturing sector. Although WIKA Wiegand SE & Co. KG currently holds an advantage due to its broad portfolio and demonstrates robust growth potential and could progress into the leaders' quadrant with further advancement.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1,000.7 MN |

| Market Forecast in 2030 (Value) | USD 1,488.6 MN |

| Growth Rate | 6.80% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2024–2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Offering: Hardware, Software, Services By Application: Bus Duct Monitors, Switchgear, Motor Control Centers, Low-voltage Transformers, Dry Transformers, Other Applications By End User: Data Centers, Oil & Gas, Logistics, Utilities, Manufacturing, Healthcare, Retail, Telecommunications, Other End Users |

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa and South America |

WHAT IS IN IT FOR YOU: Continuous Thermal Monitoring Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Continuous Thermal Monitoring Market | Market sizing for Asia Pacific countries - China, India, Japan, South Korea and Rest of Asia Pacific | Country level analysis, Key insights on end users, potential application of continuous thermal monitoring system |

RECENT DEVELOPMENTS

- June 2024 : ABB introduced the NINVA TSP341-N, the first SIL2-certified non-invasive temperature sensor. Designed for industries like chemical, oil & gas, it simplifies temperature measurement by eliminating the need for thermowells, reducing CAPEX by up to 75%. The sensor ensures safety, accuracy, and easy installation without requiring pipe perforation or process shutdowns, making it a cost-effective and reliable solution

- February 2024 : ABB introduced the NINVA TSP341-N, the first SIL2-certified non-invasive temperature sensor. Designed for industries like chemical, oil & gas, it simplifies temperature measurement by eliminating the need for thermowells, reducing CAPEX by up to 75%. The sensor ensures safety, accuracy, and easy installation without requiring pipe perforation or process shutdowns, making it a cost-effective and reliable solution.

- February 2024 : Honeywell invested USD 84 million to expand its aerospace manufacturing facility in Kansas. This expansion aims to enhance production capabilities, support advanced aerospace technologies, and create new job opportunities in the region.

- June 2022 : Siemens acquired Senseye, a leading provider of AI-powered predictive maintenance solutions for industrial companies. This acquisition enhances Siemens' digital enterprise services by integrating Senseye's technology, which can reduce unplanned machine downtimes by up to 50% and increase maintenance staff productivity by up to 30%.

Table of Contents

Methodology

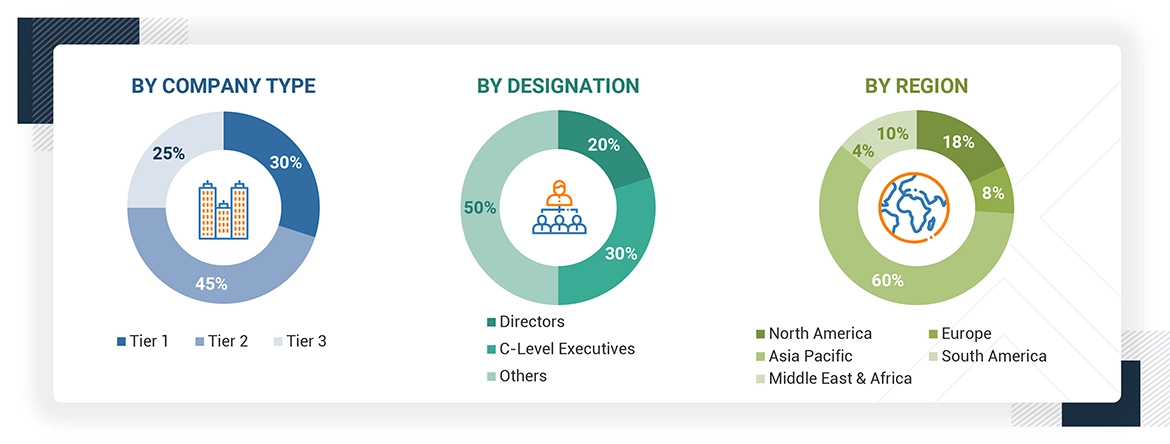

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the global continuous thermal monitoring market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess growth prospects of the market.

Secondary Research

Secondary sources include annual reports, press releases, and investor presentations of companies; directories and databases, which include D&B, Bloomberg, and Factiva, white papers and articles from recognized authors, and publications and databases from associations, such as the BP Statistical Review of World Energy, Energy Information Administration, and Department of Energy. Secondary research has been used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders has also been prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides have been interviewed to obtain and verify qualitative and quantitative information for this report as well as analyze prospects. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various leading companies and organizations operating in the continuous thermal monitoring market. Primary sources from the demand side include experts and key persons from the end user segment.

After the complete market engineering process (which includes calculations of market statistics, market breakdown, market size estimations, market forecasts, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the critical numbers arrived at. Primary research has also been conducted to identify the segmentation, applications, Porter’s Five Forces, key players, competitive landscape, and key market dynamics such as drivers, opportunities, challenges, industry trends, and strategies adopted by key players.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

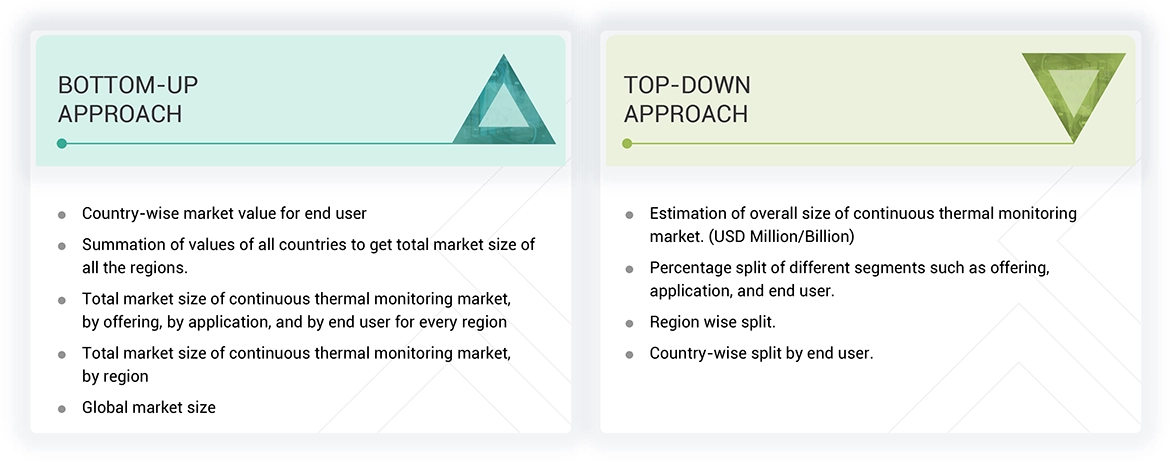

In the complete market engineering process, both top-down and bottom-up approaches have been extensively used along with several data triangulation methods to estimate and forecast the overall market segments listed in this report.

Top-down and bottom-up approaches have been used to estimate and validate the market size of continuous thermal monitoring for various applications in each region. The key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the key market players and extensive interviews for insights from industry leaders such as CEOs, vice presidents, directors, and marketing executives. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Continuous Thermal Monitoring Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and sub-segments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and to arrive at the exact statistics for all segments and sub-segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has been validated using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—the top-down approach, the bottom-up approach, and expert interviews. When the values arrived at from the three points matched, the data was assumed to be correct.

Market Definition

Continuous thermal monitoring (CTM) is a process of continuously tracking and recording the temperature of electrical equipment by utilizing thermal sensors strategically placed on electrical components. By collecting and analyzing temperature data, CTM helps predict potential failures, inform predictive maintenance, and improve overall equipment reliability.

The CTM involves deploying thermal sensors, infrared cameras, other hardware, and specialized software for data acquisition and analysis. This enables the detection of issues such as overheating, poor connections, insulation failure, or excessive load conditions.

Stakeholders

- Government Organizations and Regulatory Agencies

- Investors/Shareholders

- Shipping Companies

- Organizations, Forums, Alliances, and Associations Related to Continuous Thermal Monitoring Market

- Continuous Thermal Monitoring Manufacturing Companies

- Manufacturers and Equipment User Associations and Groups

- Electrical Association

- Environmental Research Institutes

- Consulting Companies in Energy and Power Domain

- Manufacturing Industry

- Investment Banks

- State and National Regulatory Authorities

- Venture Capital Firms

- Financial Organizations

- Research Institutes and Organizations

Report Objectives

- To describe and forecast the continuous thermal monitoring market size in terms of value based on offerings, applications, end users, and region

- To provide detailed information about key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the continuous thermal monitoring market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and their contribution to the overall market size

- To forecast the market size for five key regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete supply chain and allied industry segments and perform a supply chain analysis of the continuous thermal monitoring market landscape

- To analyze market trends, patent analysis, trade analysis, tariff and regulatory landscape, Porter’s Five Forces analysis, value chain analysis, pricing analysis, key conferences and events, macroeconomic outlook, the impact of AI, ecosystem mapping, technologies, investment and funding scenario, key stakeholders & buying criteria, and case studies pertaining to the continuous thermal monitoring market

- To analyze opportunities for various stakeholders by identifying high-growth segments of the continuous thermal monitoring market

- To profile key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive developments, such as contracts, collaborations, expansions, product launches, investments, and acquisitions, in the continuous thermal monitoring market

Note: 1. Micromarkets are defined as the further segments and subsegments of the continuous thermal monitoring market included in the report.

2. Core competencies of companies are captured in terms of their key developments and product portfolios, as well as key strategies adopted to sustain their position in the continuous thermal monitoring market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the continuous thermal monitoring market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What was the size of the continuous thermal monitoring market in 2024?

The market size of the continuous thermal monitoring market was valued at USD 1.00 billion in 2024.

What are the major drivers for the continuous thermal monitoring market?

The continuous thermal monitoring market is driven by factors such as growing emphasis on predictive maintenance, rising adoption of AI and IoT technology, and increasing adoption of industrial automation.

Which region is projected to be the fastest-growing during the forecast period in the continuous thermal monitoring market?

Asia Pacific is expected to register the highest growth rate during the forecast period, followed by North America and Europe. Increasing industrial developments and increased usage of transformers and switchgear in these industries can be attributed to regional growth.

Which will be the fastest segment, by application, in the continuous thermal monitoring market during the forecast period?

The continuous thermal monitoring market will experience the highest growth in the busduct monitors segment due to increased demand from industries and infrastructure projects for reliable power distribution systems.

Which segment is projected to be the fastest, by offering, during the forecast period in the continuous thermal monitoring market?

The hardware segment is expected to have the highest growth rate during the forecast period due to its critical role in ensuring accurate and reliable temperature measurement across various applications. The increasing deployment of advanced thermal imaging cameras, infrared sensors, and other equipment in industries such as manufacturing, utility, and data centers is driving demand for high-quality hardware.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Continuous Thermal Monitoring Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Continuous Thermal Monitoring Market