Copper Products Market

Copper Products Market by Product (Bars, Wires, Rods, Tubes & Pipes, Strips, Foils, Alloy Products, Profiles, Tapes, Others), Application (Conductive Use, Structural Use, Earthing, Shielding, Others), End-Use Industry (Electrical & Power Transmission, Industrial Equipment & Machinery, Metallurgy & Foundry, Electronics, Building & Construction, Transportation, Plumbing, Power Generation, Others), and Region - Global Forecast to 2035

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The copper products market is projected to reach USD 645.86 billion by 2035, growing from USD 375.47 billion in 2025 at a CAGR of 5.6% during the forecast period. The market is witnessing robust growth, primarily driven by the critical role of copper across the construction, power, electronics, automotive, and renewable energy industries. Additionally, copper’s exceptional electrical and thermal conductivity makes it indispensable in wiring, cabling, transformers, and motors, especially as global power consumption continues to rise.

KEY TAKEAWAYS

-

BY PRODUCTBy product, the copper products market is segmented into bars, wires, rods, strips, foils, tubes& pipes, alloy products, profiles, tapes and others. In 2024, the wires segment accounted for the largest market share, in terms of value, in the global market. Copper wires hold the largest share of the copper products market primarily because of their indispensable role in electricity transmission and distribution. With superior electrical conductivity, durability, and flexibility, copper wires are the preferred choice for power grids, residential wiring, and industrial electrical systems.

-

BY APPLICATIONBy application, the copper products market has been segmented into conductive use, structural use, earthing, shielding, and other applications. in 2024, the conductive use segment accounted for the largest market, in terms of value, in the global market. Copper is widely used for electrical conductivity after silver, offering an optimal balance of performance and cost. Its superior ability to conduct electricity and heat makes it indispensable in power transmission, distribution networks, and renewable energy systems, where efficiency and reliability are critical.

-

BY END-USE INDUSTRYBy end-use industry, the copper products market has been segmented into electrical & power transmission, industrial equipment & machinery, metallurgy & foundry, electronics, building & construction, transportation, plumbing, power generation, and other end-use industries. in 2024, the electronics segment accounted for the largest share, in terms of value, in the global market. The growth of the industry is due to copper’s critical role in enabling high-performance electrical and thermal conductivity. Copper is essential in printed circuit boards, semiconductors, connectors, wiring, and microprocessors, forming the backbone of modern electronic devices.

-

BY REGIONThe copper products market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific is projected to account for the largest share of the copper products market due to rapid industrialization, strong manufacturing bases, and rising infrastructure investments. Countries like China, India, Japan, and South Korea are major consumers, driven by robust demand from construction, automotive, electronics, and power sectors.

-

COMPETITIVE LANDSCAPEMajor market players have adopted organic and inorganic strategies, including acquisitions and product launches. For instance, Mueller Industries acquired Elkhart Products Corporation (EPC), a US-based manufacturer of copper solder fittings, with manufacturing facilities in Elkhart, Indiana, and Fayetteville, Arkansas.

The growth of the copper products market is driven by copper’s exceptional electrical and thermal conductivity, corrosion resistance, and malleability, which makes it indispensable across the construction and infrastructure industries. In modern buildings, copper wiring is essential for electrical systems, while copper pipes are widely used in plumbing, heating, and cooling applications. Additionally, urbanization and rapid population growth are leading to a surge in real estate projects, smart cities, and sustainable building designs, all of which require large amounts of copper-based products.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The copper products market is undergoing significant trends and disruptions that directly impact customer businesses across industries. One major trend is the rising demand from the clean energy transition. Solar panels, wind turbines, and electric vehicles require substantially higher copper intensity, which create opportunities and supply challenges for manufacturers and end-users. At the same time, the electrification of transport and expansion of charging infrastructure are reshaping copper consumption patterns, compelling businesses to adapt to evolving product specifications. Another disruption is price volatility, driven by fluctuating global demand, mining constraints, and geopolitical uncertainties.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Industrialization and growing urbanization driving demand for copper

-

100% recyclability of copper reducing production costs, ensuring raw material stability, and aligning with sustainability goals

Level

-

Limited raw material availability & mining challenges

-

Availability of alternative materials like aluminum, polyethylene, and optical fiber limiting growth

Level

-

Rising adoption of AI, data centers, and cloud infrastructure unlocking new opportunities

-

Rapid expansion of the electric vehicle (EV) industry

Level

-

Highly energy-intensive production process & supply chain challenges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: 100% recyclability of copper reduces production costs, ensures raw material stability, and aligns with sustainability goals

Copper stands out as a critical industrial material due to its 100% recyclability and exceptional performance in electrical applications. Unlike many materials, copper can be recycled repeatedly without losing quality, allowing secondary production to match primary mined copper in performance. This interchangeability supports cost efficiency and sustainability, as recycling requires up to 85% less energy than mining, while also cutting CO2 emissions significantly. As a result, over 30% of annual copper demand is met through recycled sources, which makes recycling an essential driver of market growth.

Restraint: Limited raw material availability & mining challenges

Currently operating copper mines are expected to meet more than half of future demand over the next decade; however, production from these existing sites is projected to fall by about 15% by 2035 compared to today’s levels. One of the main reasons is the steady decline in copper ore grades worldwide. Mining-related challenges in the copper industry primarily stem from operational, technical, and environmental difficulties. These include the high energy intensity of extraction and processing, complex ore grades, and the need for advanced equipment and skilled labor. Mines also face geological uncertainties, regulatory constraints, and environmental compliance requirements, which can limit productivity.

Opportunity: Rising adoption of AI, data centers, and cloud infrastructure unlocking new opportunities

The rapid growth of artificial intelligence (AI), generative AI, and cloud computing is creating a powerful new driver of copper demand. AI tools like Microsoft Copilot, OpenAI’s ChatGPT, and Google’s Gemini require massive data processing capacity, which, in turn, relies on energy-intensive data centers. These facilities act as the backbone of AI, providing the computational power, storage, and high-speed networks needed to train and operate complex machine learning models. Copper is essential across data centers: server chips, busbars, wiring, cooling systems, power transmission, and external cabling.

Challenge: Highly energy-intensive production process & supply chain challenges

The copper products market faces a significant challenge due to high energy-intensive process involved in producing copper. Smelting and refining of copper require substantial electricity and fuel, which drives costs and carbon emissions. With global decarbonization goals, this reliance on energy raises sustainability concerns and regulatory pressures. In 2025, global copper mine disruptions are expected to reduce output by up to 7%, creating significant ripple effects across industries and international supply chains. Supply chain challenges, ranging from raw material availability, geopolitical tensions, and transportation bottlenecks to fluctuating concentrate supply, further strain the industry.

Copper Products Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Use of copper wires and cables in power generation, transmission, and distribution networks | High conductivity, durability, and reduced power losses in grid infrastructure |

|

Adoption of copper in EV motors, batteries, and charging infrastructure | Improved energy efficiency, heat dissipation, and longer EV performance life |

|

Use of high-purity copper in PCBs and semiconductors | Reliable signal transmission and miniaturization in electronic devices |

|

Use of copper tubes and alloys in heavy machinery cooling and hydraulics | Enhanced corrosion resistance, heat transfer efficiency, and equipment life |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The copper products market ecosystem includes raw material suppliers (Glencore, Hindustan Copper Limited), manufacturers (Wieland Group, Aurubis AG, Mitsubishi Materials, Mueller Industries), distributors (R.K. Copper & Alloy LLP, Mueller Industries), and end users (Tesla, Samsung, General Motors, Tata Power). Copper ore and concentrates are mined and refined into cathodes, which are used to manufacturer wires, rods, tubes, sheets, and alloys. These products are then distributed across industries, such as construction, power generation, electronics, automotive, and renewable energy. End users drive demand through applications in electrical wiring, motors, plumbing, EV charging infrastructure, and industrial machinery, while manufacturers ensure product quality, customization, and performance. Collaboration across this value chain is critical for meeting rising demand, ensuring sustainability, and enabling innovation in the copper products market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Copper Products Market, By Product

In 2024, the wires segment accounted for the largest share of the copper products market due to copper’s unmatched electrical conductivity, durability, and flexibility. As global electricity demand rises, copper wires are indispensable in residential, commercial, and industrial electrical systems, supporting applications from basic household wiring to large-scale grid infrastructure.

Copper Products Market, By Application

In 2024, the conductive use segment accounted for the largest share of the copper products market as copper is the best commercially available metal for electrical conductivity, second only to silver but far more cost-effective. Additionally, its ability to efficiently transmit electricity with minimal energy loss makes it indispensable for power generation, transmission, and distribution networks.

Copper Products Market, By End-Use Industry

In 2024, electronics was the largest end-use industry segment for the copper products market as copper is fundamental to the performance, efficiency, and miniaturization of modern electronic devices. Moreover, its exceptional electrical and thermal conductivity makes it essential for printed circuit boards (PCBs), semiconductors, connectors, switches, and wiring in consumer electronics such as smartphones, laptops, and household appliances.

REGION

Asia Pacific to be fastest-growing region in global copper products market during forecast period

Asia Pacific is projected to be the fastest-growing market for copper products market due to rapid industrialization and urbanization in the region and its dominance in key copper-consuming industries. The region is home to major electronics manufacturing hubs like China, Japan, South Korea, and Taiwan. These countries heavily depend on copper for semiconductors, circuit boards, cables, and consumer electronics. China, in particular, is the world’s largest consumer of copper, driven by its massive construction, infrastructure, and power transmission projects.

Copper Products Market: COMPANY EVALUATION MATRIX

In the copper products market matrix, Aurubis AG (Star) leads with a strong market share and extensive product footprint, driven by its huge production capacities and global footprint. On the other hands, Hindalco Industries Ltd. (Pervasive Player) has comparatively less capacity and a more regionally concentrated presence, which limits its scale compared to other global leaders. However, it can grow by expanding capacity, and forming strategic partnerships to enhance its global footprint in copper products.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 354.96 USD Billion |

| Market Forecast in 2035 (Value) | USD 645.86 Billion |

| Growth Rate | CAGR of 5.6% from 2025–2035 |

| Years Considered | 2021–2035 |

| Base Year | 2024 |

| Forecast Period | 2025–2035 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Copper Products Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Construction Contractor |

|

|

| Automotive & EV Manufacturer |

|

|

RECENT DEVELOPMENTS

- August 2024 : Mueller Industries acquired Elkhart Products Corporation (EPC), a US-based copper solder fittings manufacturer, with facilities in Elkhart, Indiana, and Fayetteville, Arkansas. EPC was earlier owned by Dutch company Aalberts N.V. This acquisition strengthened Mueller's position to supply various industries, like plumbing, HVAC, automotive, and aerospace.

- July 2023 : n Wieland Group acquired Farmers Copper Ltd., a top copper, brass, and bronze alloy supplier in North America to strengthen its presence in the region. Through this acquisition, the company solidified Wieland's significant footprint and extensive market involvement in North America.

- March 2023 : n Wieland introduced cuprolife, a newly developed copper tube produced from 100% recycled copper, representing an important milestone towards sustainable and circular building. With cuprolife, Wieland develops building technology by combining fully recycled materials without any loss of performance or quality.

Table of Contents

Methodology

The study involved four major activities in estimating the market size of the copper products market. Exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

The secondary research process referred to various secondary sources to identify and collect information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research was used to obtain key information about the industry's value chain, the market's monetary chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The copper products market studies several stakeholders in the value chain. Some value chain stages include raw material sourcing, manufacturing, distribution, and end users. Various primary sources from the supply and demand sides of the copper products market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in the chemicals sector. The primary sources from the supply side include manufacturers, associations, and institutions involved in the copper products industry.

Primary interviews were conducted to gather insights into market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped me understand the various trends related to products, end-use industries, applications, and regions. Demand-side stakeholders, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, fabricators, and their current usage of the copper products market and the outlook of their business, which will affect the overall market.

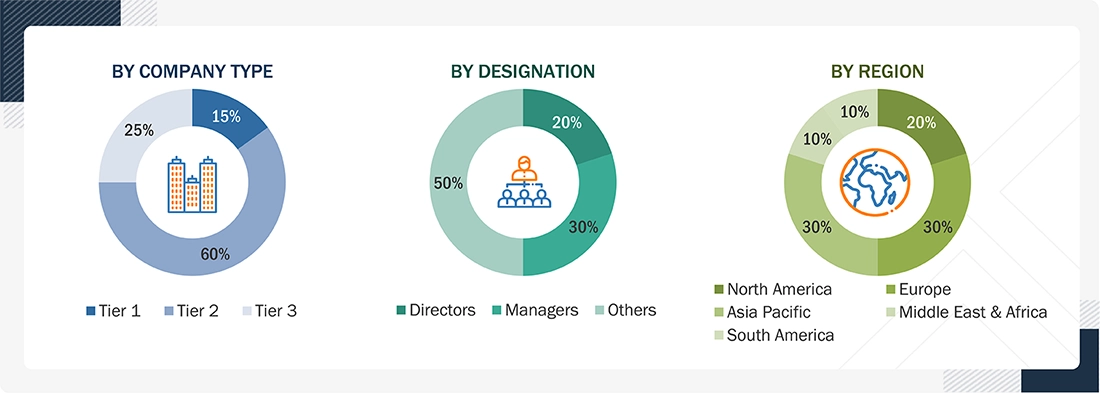

Notes: Tier-1, Tier-2, and Tier-3 companies are classified based on their market revenue as of 2024. The data is available in the public domain, as well as the companies’ product portfolios and their geographical presence.

Others include Technical Experts, Strategy Experts, and Industry Experts.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Mitsubishi Material Corporation (Japan) | Product Manager | |

| KOBE STEEL, LTD. (Japan) | Sales Executive | |

| Wieland Group (Germany) | Research Scientist | |

| Mueller Industries (US) | Marketing Personnel | |

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the copper products market. The following considerations have been made:

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes explained above. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The copper products market encompasses producing, distributing, and consuming copper-based materials such as wires, cables, tubes, sheets, rods, plates, and alloys used across multiple industries. Leveraging copper’s superior electrical and thermal conductivity, corrosion resistance, and recyclability, these products serve critical applications in construction, infrastructure, electrical and electronics, automotive, renewable energy, and telecommunications. The market integrates upstream mining and refining, midstream processing, and downstream manufacturing, supported by recycling to ensure supply sustainability. Driven by urbanization, industrialization, and electrification trends, the copper products market is vital in enabling global energy efficiency, connectivity, and technological advancements.

Stakeholders

- Copper Product Manufacturers

- Distributors and Suppliers of Copper Products

- End Users of Copper Products

- Retailers of Copper Products

Report Objectives

- To define, describe, and forecast the size of the copper products market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on product, end-use industry, application, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, the Middle East & Africa, and South America

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Copper Products Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Copper Products Market