Copper Wire & Cable Market

Copper Wire & Cable Market by Insulation Type, Voltage Type, Installation (Underground, Overhead, Submarine), Application (Building Wires, Power Cables, Communication, Automotive Wiring), End-use Industry, and Region - Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The copper wire & cable market is projected to reach USD 324.7 billion by 2032 from USD 182.0 billion in 2025, at a CAGR of 8.6% over the same period. Market growth is primarily driven by rising investments in power generation, transmission, and distribution infrastructure, as well as by increasing urbanization and construction activity across residential, commercial, and industrial sectors. Rapid electrification across industries, particularly the expansion of renewable energy, electric vehicles, charging infrastructure, and data centers, is significantly boosting demand for high-conductivity and reliable copper cables. Ongoing grid modernization, underground cabling projects, and stricter safety and energy-efficiency regulations are further driving the adoption of copper wire and cable solutions globally.

KEY TAKEAWAYS

-

By RegionAsia Pacific dominated the copper wire & cable market with a share of 43.4% in terms of value in 2024.

-

By Insulation TypeThe XLPE segment is projected to grow at the highest CAGR of 9.6% during the forecast period.

-

By Voltage TypeThe low-voltage segment dominated the copper wire & cable market with a share of 50.0% in terms of value in 2024.

-

By InstallationThe underground segment is expected to register the highest CAGR during the forecast period.

-

By ApplicationThe power cables segment is expected to register the highest CAGR during the forecast period.

-

By End-use IndustryThe energy & power segment is projected to register the fastest CAGR during the forecast period.

-

Competitive Landscape-Key PlayersPrysmian, Sumitomo Electric Industries, Ltd., Nexans, LS Cable & System, and NKT A/S are star players in the copper wire & cable market, given their broad industry coverage and strong operational & financial strength.

-

Competitive Landscape- StartupsTratos Group, Hubbell, TT Cables, Studer Cables Ag, Brugg Cables, Doncaster Cables, Cords Cable, and Remee Wire & Cable have distinguished themselves among startups and SMEs due to their well-developed marketing channels and extensive funding to build their product portfolios.

The copper wire & cable market is witnessing strong growth driven by increasing demand for efficient, reliable electrical conductivity across the power, construction, industrial, automotive, and telecommunications sectors. Continuous advancements in conductor design, insulation materials such as XLPE and PVC, and manufacturing processes have improved thermal performance, safety, and durability, expanding the use of copper cables in medium- and high-voltage as well as specialized applications. This demand is further reinforced by rapid electrification trends, including renewable energy integration, electric vehicle adoption, and expansion of charging infrastructure, all of which require high-quality copper wiring solutions. At the same time, ongoing grid modernization, underground cabling projects, and the need to enhance energy efficiency and system reliability are driving sustained adoption of copper wire and cable products globally.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of copper wire & cable suppliers, which, in turn, impacts the revenues of copper wire & cables manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of power transmission & distribution networks

-

Rapid growth in renewable energy installations

Level

-

High and volatile copper prices

-

Capital-intensive manufacturing processes

Level

-

Grid modernization and underground cabling projects

-

Expansion of smart cities and metro rail infrastructure

Level

-

Raw material price volatility and supply risks

-

Managing cost competitiveness against aluminum cables

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Expansion of power transmission & distribution networks

Rising electricity demand from urbanization, industrialization, and electrification is driving large-scale investments in transmission and distribution infrastructure worldwide. Utilities are expanding and upgrading networks to connect renewable energy sources, improve grid reliability, and reduce technical losses, directly increasing demand for copper wires and cables due to their high conductivity and long service life.

Restraint: High and volatile copper prices

Copper prices are highly sensitive to global supply-demand dynamics, geopolitical factors, and energy costs, which creates cost uncertainty for wire and cable manufacturers. Frequent price fluctuations increase production costs, pressure margins, and make long-term pricing contracts with utilities and infrastructure developers more challenging.

Opportunity: Grid modernization and underground cabling projects

Modernization of aging power grids and the shift toward underground cabling in urban areas and smart cities present significant growth opportunities for copper wire and cable suppliers. Underground networks offer improved safety, reliability, and aesthetics, driving demand for high-value insulated copper cables, particularly in developed and rapidly urbanizing regions.

Challenge: Raw material price volatility and supply risks

Dependence on copper as a primary raw material exposes manufacturers to supply disruptions caused by mining constraints, trade restrictions, and logistics issues. Managing procurement risks while maintaining competitive pricing and consistent supply remains a key challenge, especially during periods of global economic or geopolitical instability.

COPPER WIRE & CABLE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Copper power and control cables used in power plants, substations, and industrial automation systems | High conductivity | Low transmission losses | Reliable power distribution |

|

Copper wiring harnesses, battery connections, and charging systems in electric vehicles | Efficient power transfer | Thermal stability | Improved vehicle performance |

|

Copper cables for data centers, servers, and backup power systems | High-speed data transmission | Reliability | Operational continuity |

|

Copper cables in wind turbines and grid interconnections | Efficient energy transmission | Durability | Reduced electrical losses |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The copper wire & cable market ecosystem comprises upstream raw material suppliers such as global copper miners and refiners, midstream manufacturers producing low-, medium-, and high-voltage copper cables, and downstream distributors that enable broad market reach across regions. These products ultimately serve diverse end users including utilities, telecom operators, automotive OEMs, renewable energy developers, and industrial players, reflecting a tightly integrated value chain driven by electrification, infrastructure development, and energy transition trends.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Copper Wire & Cable Market, by Installation

The underground segment held the largest share of the copper wire & cable market in 2024, driven by rising urbanization and demand for reliable, space-efficient power distribution. Its widespread adoption in smart cities, metro rail, and commercial projects, owing to higher safety, lower losses, weather resistance, and better aesthetics, along with ongoing grid modernization and replacement of aging overhead lines, continues to support its market leadership.

Copper Wire & Cable Market, by Voltage

In terms of value, the low-voltage segment accounted for the largest share of the overall copper wire and cable market in 2024, supported by its widespread application in residential, commercial, and industrial electrical systems. Low-voltage copper cables are extensively used for internal wiring, lighting, appliances, control systems, and data connectivity due to their safety, flexibility, and ease of installation. Continued growth in construction and infrastructure development, increasing renovation and retrofitting of aging buildings, and rising electrification across emerging and developed economies further reinforced the segment’s dominant market position.

Copper Wire & Cable Market, by Insulation

In terms of value, the PVC segment accounted for the largest share of the overall copper wire and cable market in 2024, supported by its cost-effectiveness, ease of processing, and broad applicability across low-voltage applications. PVC-insulated copper cables are widely used in residential and commercial building wiring, appliances, control panels, and light industrial installations due to their flexibility, adequate thermal performance, and compliance with electrical safety standards. Additionally, strong construction activity, renovation of existing buildings, and rising electrification in emerging economies continue to sustain high demand for PVC-insulated copper wire and cable solutions.

Copper Wire & Cable Market, by Application

In application segments, the power cables segment accounted for the largest share of the overall copper wire & cable market in 2024, driven by its extensive use across power generation, transmission, and distribution infrastructure. Copper power cables are widely deployed in utilities, renewable energy projects, industrial plants, and large commercial facilities due to their high conductivity, superior current-carrying capacity, and long operational life. Ongoing investments in grid expansion, renewable energy integration, underground cabling, and modernization of aging electrical networks further reinforced the segment’s dominant contribution in value terms.

Copper Wire & Cable Market, by End-use Industry

In terms of value, within the end-use industry segmentation, the power cables segment accounted for the largest share of the overall copper wire and cable market in 2024, driven by extensive deployment across power generation, transmission, and distribution networks. Strong investments in grid expansion, renewable energy integration, and electrification of urban and industrial infrastructure increased demand for high-capacity, reliable copper power cables. Additionally, modernization of aging electrical networks and growing adoption of underground cabling continued to support the segment’s dominant market position.

REGION

Middle East to be the fastest-growing market for copper wire & cables during forecast period.

The Middle East is projected to be the fastest-growing region in the copper wire & cable market during the forecast period, supported by large-scale investments in power generation, transmission, and distribution infrastructure to meet rising electricity demand. Rapid deployment of renewable energy projects, particularly utility-scale solar and wind, along with grid modernization and cross-border interconnection initiatives, is significantly increasing demand for high-capacity copper cables. In addition, strong growth in construction, smart city developments, metro rail projects, and industrial expansion across countries such as Saudi Arabia and the UAE, coupled with government-led electrification and energy diversification programs, continues to accelerate market growth in the region.

COPPER WIRE & CABLE MARKET: COMPANY EVALUATION MATRIX

In the copper wire & cables market, Prysmian (Star) leads with a strong market share and extensive product footprint, driven by its vertically integrated operations and strategic partnerships for the copper wire & cable portfolio. Polycab (Emerging Leader) is gaining visibility due to its specialized copper wire and cable portfolio and advanced manufacturing technologies. While Prysmian dominates through scale and a diverse portfolio, Polycab shows significant potential to move toward the leaders’ quadrant as the demand for copper wire & cables continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- NKT A/S (Denmark)

- Prysmian (Italy)

- Hellenic Cables (Greece)

- Sumitomo Electric Industries Ltd. (Japan)

- Helukabel (Germany)

- Nexans (France)

- LS Cable & System (South Korea)

- KEI Industries Limited (India)

- Polycab India Limited (India)

- Lapp Group (Germany)

- Ducab (UAE)

- Bahra Electric (Saudi Arabia)

- Riyadh Cables (Saudi Arabia)

- Jeddah Cables Company Ltd. (Saudi Arabia)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 171.2 Billion |

| Market Size in 2032 (Value) | USD 324.7 Billion |

| Growth Rate | CAGR of 8.6% from 2025 to 2032 |

| Years Considered | 2022–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | Americas, Europe, Asia Pacific, the Middle East, Sub-Saharan Africa, North Africa and Rest of the World |

WHAT IS IN IT FOR YOU: COPPER WIRE & CABLE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Raw Material Suppliers (Copper cathodes, rods, recycled copper, insulation materials) |

|

|

| Cable Manufacturers & Fabricators |

|

|

| OEMs & EPC Contractors |

|

|

| End-use Industries (Construction, Energy & Power, EVs, Data Centers, Telecom) |

|

|

RECENT DEVELOPMENTS

- December 2025 : The European Investment Bank approved a €300 million financing package for Prysmian to support R&D activities across Europe for 2025–2028, accelerating the development of innovative, low-emission solutions to enhance energy security and digital communication networks; the first tranche of €200 million has been signed.

- December 2025 : Nexans completes the acquisition of Electro Cables Inc. to strengthen low-voltage solutions (PWR-CONNECT) in the North America region.

- December 2025 : A joint venture between NKT and Walsin Lihwa inaugurated Taiwan’s first offshore power cable factory in Kaohsiung. The facility spans 231,000 m² with a 50-m extrusion tower and will produce high- and medium-voltage AC offshore power cables primarily for the offshore wind market. Commercial production is scheduled to begin in 2027 following type tests and prequalification.

Table of Contents

Methodology

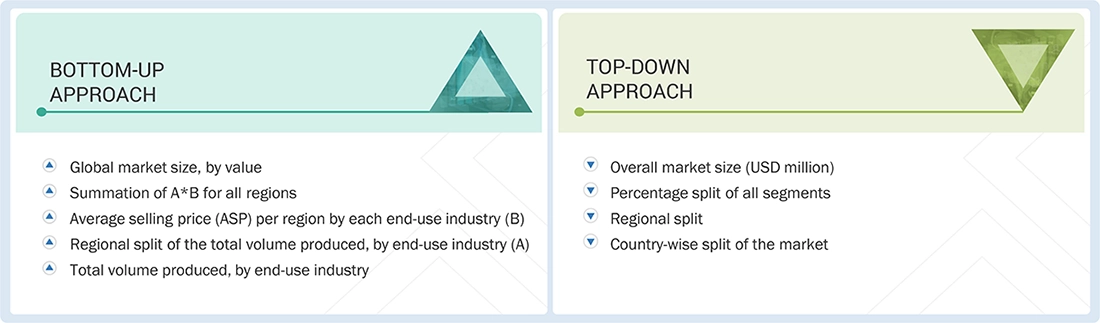

The study involves two major activities to estimate the current market size of the copper wire & cable market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources used for this research include the financial statements of companies that offer copper wire & cable and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. Secondary data were collected and analyzed to determine the overall size of the copper wire & cable market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the copper wire & cable market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from copper wire & cable industry vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights into market statistics, revenue from products and services, market breakdowns, market size estimates, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to insulation type, voltage type, installation, application, end-use industry, and region.

Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customers/end users who are using copper wire & cable, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of copper wire & cable and future outlook of their business which will affect the overall market.

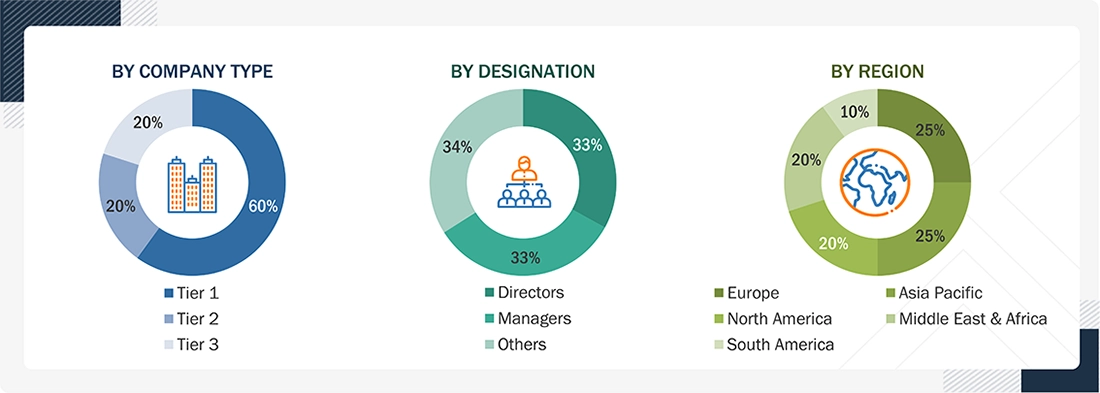

Breakdown of Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the copper wire & cable market includes the following details. The market size was determined from the demand side. The market was upsized based on procurements and modernizations of copper wire & cables across different end-use industries at the regional level. Such procurements provide information on the demand aspects of the copper wire & cable industry for each application. For each end-use industry, all possible segments of the copper wire & cable market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The copper wire & cable market comprises the manufacturing, distribution, and application of copper-based conductors used for the transmission and distribution of electricity and signals across various end-use sectors. These products include low-, medium-, and high-voltage wires and cables insulated with materials such as PVC and XLPE, and are widely utilized in power generation and distribution, building & construction, industrial, automotive, telecommunications, and renewable energy applications. Driven by copper’s high electrical conductivity, durability, and thermal efficiency, the market plays a critical role in supporting global electrification, infrastructure development, and energy transition initiatives.

Key Stakeholders

- Copper Wire & Cable Manufacturers

- Government and Research Organizations

- National and Local Government Organizations

- Institutional Investors

Report Objectives

- To define, describe, and forecast the copper wire & cable market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global copper wire & cable market by insulation type, voltage type, installation, application, end-use industry, and region

- To forecast the market size for main regions (along with country-level data), namely, the Americas, Europe, Asia Pacific, the Middle East, Asia Pacific, Sub-Saharan Africa, North Africa, and Rest of the World, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product developments/product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Available customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the copper wire & cable market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Copper Wire & Cable Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Copper Wire & Cable Market