Coring Market

Coring Market by Technology (Rotary, Wireline, Sidewall Coring), Well Type (Exploration, Appraisal, Development), Application (Onshore, Offshore), End-use Industry (Oil & Gas, Geothermal, Carbon Capture & Storage), Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global coring market is projected to reach USD 0.69 billion by 2029 from an estimated USD 0.49 billion in 2024, at a CAGR of 7.1% during the forecast period. The market is driven by the growing need for precise subsurface data to support resource extraction and environmental assessments. Technological advancements in coring methods, such as non-invasive techniques and enhanced recovery tools, have increased the efficiency of drilling operations. Furthermore, rising investments in critical sectors, such as renewable energy particularly geothermal and hydrogen storage are expanding the market. Additionally, the expansion of infrastructure in developing economies, along with increasing demand for raw materials and energy resources, strengthens the need for advanced coring solutions.

KEY TAKEAWAYS

-

BY REGIONThe North American region held the largest share of the coring market in 2024 (~30%), driven by its significant exploration and production activities, which propel the demand for accurate core sampling.

-

BY TECHNOLOGYThe wireline coring segment is expected to grow at the highest CAGR of 7.7% during the forecast period. It allows for precise core retrieval without the need for a full drill string, reducing operational downtime and improving overall productivity.

-

BY APPLICATIONOnshore applications account for the largest market share of the applications market. This segment held ~60% of the market in 2024 due to the higher volume of drilling activity conducted onshore.

-

BY END-USE INDUSTRYCarbon capture and storage is expected to register the highest growth during the forecast period, driven by the need to achieve net-zero emissions goals and the rising demand for cleaner geothermal energy.

-

COMPETITIVE LANDSCAPEBaker Hughes, Halliburton, and SLB are identified as key players in this market with their strong portfolios, geographic reach, and significant customer base.

The coring market is witnessing steady growth driven by increasing exploration and production activities across the oil and gas, mining, and geological research sectors. Rising demand for accurate subsurface data to optimize drilling efficiency and resource evaluation is fueling the need for advanced coring technologies. Innovations in core drilling equipment, such as automated and high-pressure coring systems, are improving operational safety and sample quality. Additionally, the expansion of unconventional resource exploration and geothermal projects is further boosting market opportunities. Growing investment in energy transition and sustainable extraction practices continues to support the coring market’s long-term growth outlook.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The growing focus on efficient resource extraction, improved reservoir characterization, and sustainable drilling operations is expected to accelerate the coring market. Additionally, coring equipment manufacturers and service providers are increasingly required to adopt innovations in automation, digital data acquisition, and advanced material technologies to remain competitive. The shift toward real-time core analysis and integrated coring solutions is transforming traditional exploration models by enabling higher accuracy, reduced non-productive time, and better decision-making in field operations. These advancements also support sustainability goals in oil & gas, mining, and geothermal projects, where precision and operational efficiency are critical. The coring market is undergoing a strategic evolution, driven by technological breakthroughs, digitalization, and increasing exploration investments that make advanced coring systems more viable across diverse geological applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing shale exploration

-

Advancements in coring technologies boosting efficiency and safety in coring operations

Level

-

Volatility in oil prices

-

High initial costs and exploration risks hindering carbon capture, use and storage (CCUS) and geothermal projects

Level

-

Untapped geothermal potential in regions such as Indonesia and East Africa

-

Supportive policies and rising investments in geothermal and carbon capture & storage

Level

-

Shift to renewable energy, reducing investments in coring for oil & gas exploration

-

Complex coring operations in harsh High-Pressure and High-Temperature (HPHT) environmental conditions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing shale exploration

Recent mergers and acquisitions in the US shale sector have surpassed USD 100 billion, signaling strong investment momentum. These deals, led by major players such as ExxonMobil and Chevron, aim to consolidate shale assets, improve operational efficiency, and meet the rising energy demand. As new shale wells are planned across acquired sites, the need for coring services becomes critical to evaluate well potential and guide efficient drilling strategies. Horizontal and directional drilling techniques continue to dominate the US oil and gas landscape, with 81% of well completions in 2021 falling into these categories. These advanced drilling methods not only improve access to shale formations but also enhance the economic feasibility of such operations. Beyond the US, India is making notable progress in shale exploration. ONGC has estimated approximately 187.5 TCF of shale gas reserves across five key basins Cambay, Ganga Valley, Assam & Assam Arakan, Krishna Godavari On-land, and Cauvery On-land. Unlocking these resources will require advanced coring techniques to accurately assess subsurface characteristics. As hydraulic fracturing and horizontal drilling evolve, the global coring market is set to benefit from increasing shale development initiatives.

Restraint: Volatility in oil prices

Oil prices are estimated to average approximately USD 81 per barrel at the end of 2024, slightly down from the 2023 average of USD 83 per barrel. This modest decline reflects persistent market volatility, largely fueled by ongoing geopolitical tensions and global economic uncertainties. A significant surge in oil prices was observed following the Russia-Ukraine conflict, with WTI crude prices rising by USD 37.14 (a 52.33% increase) and Brent crude climbing by USD 41.49 (a 56.33% increase). Oil price trends remain interdependent and subject to abrupt shifts, which introduces a high level of uncertainty for investors. This unpredictability can hinder exploration and development efforts, as companies become more cautious about committing to long-term projects. Such hesitancy often results in reduced drilling activity, ultimately impacting the demand for coring services. In essence, while oil prices remain relatively high, the instability in market conditions continues to pose a significant challenge to exploration investments, leading to potential slowdowns in subsurface evaluation and data collection efforts.

Opportunity: Untapped geothermal potential in Indonesia and East Africa

Indonesia boasts the world’s largest geothermal potential, estimated at approximately 27.79 Gigawatts (GW), accounting for nearly 40% of the global geothermal resources. This immense geothermal reserve is a key driver for the rising demand for coring activities in the region, which are essential for assessing subsurface conditions and ensuring the viability of geothermal projects. The country currently has 16 operational geothermal power plants, with capacities ranging from 2.5 MW to 377 MW, highlighting its commitment to harnessing renewable energy. Similarly, Eastern Africa holds an estimated geothermal capacity of around 15,000 MW. Kenya leads the region with several geothermal plants situated in high-enthalpy areas along the Kenya Rift. Over the next decade, the region is expected to witness the addition of approximately 4,000 MW of geothermal capacity, as nations like Rwanda, Ethiopia, Djibouti, and Tanzania continue to invest in geothermal energy development. The ongoing and planned projects across Indonesia and Eastern Africa not only signify growing interest in sustainable energy but also create opportunities for expanded coring activities. Continued geothermal development in these regions may pave the way for potential energy exports, attract greater foreign investment, and promote technological advancements in exploration, particularly in subsurface evaluation and coring solutions.

Challenge: Shift to renewable energy reducing investments in coring for oil & gas exploration

Major oil companies are increasingly reallocating their budgets from traditional exploration and production (E&P) operations toward renewable energy projects. This strategic shift aligns with the global transition to lower-carbon energy systems, where the reliance on hydrocarbons is gradually diminishing. The share of fossil fuels in the global primary energy mix, which stood at around 80% in 2019, is projected to decline significantly to between 55% and 20% by 2050. In contrast, the contribution of renewables is expected to grow substantially from approximately 10% in 2019 to between 35% and 65% by mid-century. This transition is primarily driven by the improving cost competitiveness of renewable technologies and strengthened by government policies promoting clean energy adoption. As renewables become more economically viable and policy-backed, oil and gas companies are scaling down their exploration activities. Consequently, the demand for coring services is witnessing a decline. With energy companies focusing more on solar, wind, hydrogen, and other alternative sources, the traditional upstream sector is undergoing a transformation. This evolution is reshaping investment priorities, which is impacting the equipment and services tied to oil and gas exploration, including coring. This shift is likely to increase coring activities in geothermal and CCS projects.

Coring Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The challenge in this case study was accurately identifying and evaluating potential hydrocarbon-bearing zones in a complex offshore geological formation in Australia. Traditional methods struggled to deliver reliable formation evaluation, leading to increased uncertainty in subsurface understanding, inefficiencies in well placement, and the need for additional wireline runs and post-drill evaluations. | The problem was addressed using SLB's IriSphere look-ahead-while-drilling service, which confirmed reservoir position and thickness for coring operations. This technology enabled real-time detection of formation boundaries while drilling, providing accurate subsurface data and reducing operational uncertainties. By optimizing well placement and eliminating the need for additional runs or evaluations, the solution significantly enhanced efficiency and reduced costs. |

|

The challenge involved conducting conventional coring to test the permeability of a targeted unconventional formation composed of soft to medium interbedded sandstone and shale. Increased drilling parameters aimed at improving the Rate Of Penetration (ROP) led to downhole vibrations and a heightened risk of jamming, complicating the coring process and potentially compromising sample integrity. | The solution involved deploying the Rock Strong coring system alongside unique Bottom-hole Assembly (BHA) modeling programs to better understand BHA and drill string dynamics by Halliburton. The approach included enhancing the core head design using an 8-1/2 × 4 in. FC74WRKs bit equipped with Machete cutters for drill bits and Shyfter active backup elements to ensure maximum performance and efficiency. Additionally, the core barrel length and coring parameters were optimized based on insights from BHA modeling, resulting in improved operational precision and core recovery. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem analysis represents the interconnection/adjacency of the coring market with other markets and their effects on it using the MnM coverage. Some of the major coring service providers include SLB, Halliburton, Baker Hughes, and NOV

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Coring market, By Technology

Coring technology plays a pivotal role across the oil and gas, geothermal, and carbon capture and utilization (CCU) industries by enabling detailed analysis of subsurface formations. The primary coring technologies include rotary coring, sidewall coring, and wireline coring. Sidewall coring involves taking small core samples from the walls of an existing borehole, typically after the well has been drilled. This method allows operators to gather additional geological data without the need for extensive drilling operations. Sidewall cores are often smaller in diameter compared to those obtained through rotary coring, but they are valuable for assessing reservoir characteristics in already drilled wells

Coring market, By Well type

The well type segment encompasses three primary categories: exploration wells, appraisal wells, and development wells. Each type serves a distinct purpose in the lifecycle of resource extraction, particularly in the oil and gas, geothermal, and carbon capture utilization (CCU) sectors. Exploration wells are drilled to locate and assess potential hydrocarbon or geothermal resources. These wells are often the first step in determining the viability of a site for further development. In oil and gas, exploration wells provide crucial data about the geological formations and fluid characteristics present in a region. In geothermal projects, they help identify viable geothermal reservoirs by assessing temperature gradients and fluid compositions

Coring market, By Application

The coring market is segmented into onshore and offshore applications, each serving critical roles in oil and gas exploration, geothermal energy production, and carbon capture utilization (CCU). Onshore coring involves drilling activities conducted on land, primarily targeting oil and gas reservoirs, geothermal resources, and potential CO2 storage sites. This segment has historically captured the largest market share due to the high volume of drilling activities in regions rich in hydrocarbons.

Coring market, By End-Use Industry

The coring market is segmented into oil & gas, Geothermal, and Carbon capture & storage end-use industry. The global oil & gas industry has seen a notable increase in new well drilling, driven by rising energy demands and advancements in extraction technologies. For instance, the US shale boom continues to drive new well completions, particularly in prolific regions like the Permian Basin, where production is expected to exceed 5 million barrels per day by 2024. This increase in drilling activity necessitates effective coring services to ensure accurate reservoir characterization and formation evaluation.

REGION

North America holds the largest share in global Coring market

North America is expected to lead the coring market, driven by a combination of robust oil and gas activity and the growing focus on renewable energy, particularly geothermal. The region hosts some of the world’s largest and most productive shale oil and gas formations, such as the Permian Basin and Marcellus Shale, where obtaining detailed geological data through coring is essential for effective reservoir management and production optimization. The rise of tight oil, shale gas, and other unconventional hydrocarbon resources has further increased the demand for advanced coring techniques to evaluate complex rock formations and enhance recovery rates. North America’s significant geothermal potential, especially in the US and Canada, is fueling the need for accurate subsurface assessment through coring to support geothermal exploration and development projects. As the energy transition gains momentum, the shift toward renewable energy sources, particularly geothermal, is further accelerating the demand for high-quality core analysis. These factors make North America a key region driving the growth of the global coring market

Coring Market: COMPANY EVALUATION MATRIX

Baker Hughes Company (Market Leader) dominates the coring market, backed by its extensive expertise in subsurface technologies, global presence, and advanced coring solutions. The company offers a comprehensive range of coring tools and services designed to deliver high-quality core samples and precise reservoir data across both onshore and offshore operations. Baker Hughes’ continuous innovation in pressure coring, automated systems, and digital core analysis has enhanced accuracy, operational efficiency, and safety in drilling environments. Its strong collaboration with major oil and gas operators and investment in data-driven technologies further strengthen its leadership, enabling superior performance and reliability in exploration and production activities worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.48 Million |

| Market Forecast in 2030 (Value) | USD 0.69 Billion |

| Growth Rate | CAGR of 7.1% from 2024-2029 |

| Years Considered | 2023-2029 |

| Base Year | 2023 |

| Forecast Period | 2029 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East, Africa, South America |

WHAT IS IN IT FOR YOU: Coring Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global coring market study focused on North America |

|

|

RECENT DEVELOPMENTS

- June 2024 : Baker Hughes and Petrobras signed an agreement. Under this agreement, Baker Hughes has deployed wireline, coiled tubing, cementing, tubular running, wellbore intervention, fishing, and geosciences services in all of Petrobras’ offshore fields. The agreement also includes Baker Hughes’ remedial tools, completion fluids, and production chemicals.

- January 2024 : Equipment Corporation of America, a leading provider of construction and drilling equipment, entered into a partnership with Boart Longyear, a supplier of drilling services, drilling equipment, and performance tooling. This collaboration marks a significant expansion in ECA's offering of technologically advanced drilling solutions. A highlight of the Boart Longyear product line that ECA will now offer is the LF 90D surface coring drill. Known for its robust hydraulic system and user-friendly controls, the LF 90D excels in diamond core drilling, especially under challenging conditions .

- September 2022 : SLB launched its Digital Platform Partner Program, which enables Independent Software Vendors (ISV) to leverage the openness and extensibility of the SLB digital platform to build new applications and software and offer them to the market. SLB customers will access a broad range of interoperable digital solutions, enabling data-driven decision-making across the energy value chain and rapidly accelerating the time to value from digital transformation, at a global scale.

- November 2021 : Cairn Oil & Gas, India’s largest private oil & gas exploration and production company, signed a Memorandum of Understanding (MoU) with Halliburton at the ongoing ADIPEC 2021 held in Abu Dhabi. With the MoU, Halliburton has worked with Cairn in its target of increasing its recoverable reserve from offshore assets to 300 MMboe - a 10-fold increase from the present cumulative of 30 MMboe. This announcement follows Cairn’s commitment of doubling its capacity, contributing 50% to India’s domestic crude production and assisting the country in its goal of achieving energy autonomy.

Table of Contents

Methodology

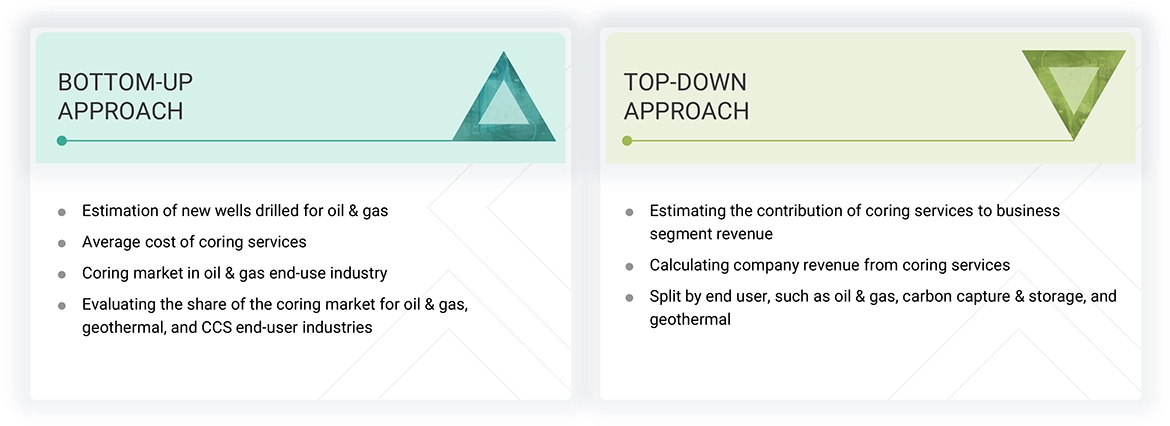

The study involved major activities in estimating the current size of the coring market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, and databases of various companies and associations. Secondary research has been mainly used to obtain key information about the supply chain and to identify the key players offering products and services, market classification, and segmentation according to the offerings of the leading players, along with the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

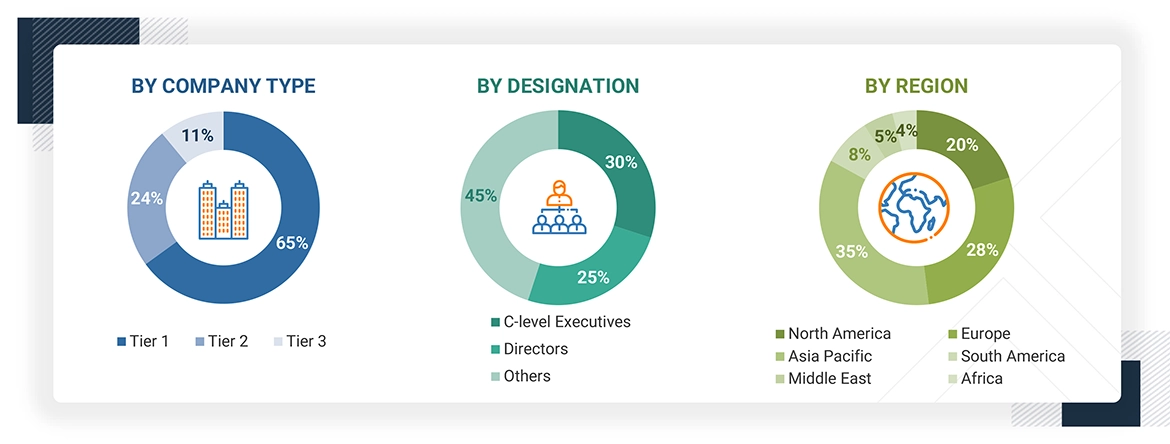

Primary Research

Primary sources included several industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, technology developers, standard and certification agencies of companies, and organizations related to all the segments of this industry’s supply chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SME), C-level executives of the key market players, and industry consultants, among other experts, to obtain and verify qualitative and quantitative information and assess prospects.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were extensively used, along with data triangulation methods, to perform market size estimation and market size forecasts for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted on the complete market engineering process to list key information/insights throughout the report.

Coring Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using both the top-down and bottom-up approaches.

Market Definition

Coring refers to the process of extracting core samples from subsurface formations during drilling operations. These samples provide direct geological, petrophysical, and geomechanical insights into the reservoir, enabling better evaluation and planning for resource extraction.

The coring market is growing due to rising energy demand, the expansion of geothermal and carbon capture and storage (CCS) projects, and advancements in coring technology. Geothermal and CCUS projects require precise subsurface evaluation, while supportive policies and efficient hydrocarbon extraction further fuel the demand.

Stakeholders

- Oil & Gas Companies

- Coring Service Providers

- Drilling Contractors

- Equipment Manufacturers

- Geological Survey Organizations

- Government and Regulatory Bodies

- Environmental Agencies

- Geotechnical and Engineering Firms

- Investors and Financial Institutions

- Technology Providers

Report Objectives

- To define, describe, segment, and forecast the coring market by technology, well type, application, and end-use Industry

- To provide detailed information about major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To strategically analyze the market with respect to the individual growth trends of each segment, future expansions of each segment, and contribution of each segment to the market

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis as per Feasibility

- Further breakdown of the coring market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Coring Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Coring Market