Cross Laminated Timber Market

Cross Laminated Timber Market by Type (Adhesive Bonded, Mechanically Fastened), End Use (Structural, Non-Structural), Industry (Residential, Non-Residential), and Region (Europe, North America, Asia Pacific, and the Rest of the World) - Global Forecast to 2030

Updated on : December 11, 2025

CROSS LAMINATED TIMBER MARKET

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

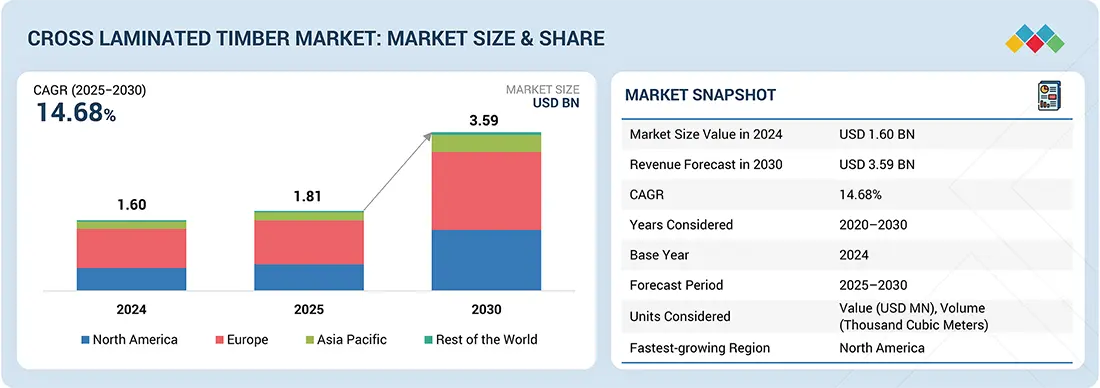

The global cross-laminated timber market was valued at USD 1,809.3 million in 2025 and is projected to reach USD 3,588.8 million by 2030, growing at 14.68% cagr from 2025 to 2030. Cross-laminated timber is an engineered wood product made by stacking layers of solid-sawn lumber boards in alternating directions (typically at 90-degree angles) and bonding them with structural adhesives. The market is growing due to rising demand for sustainable, low carbon building materials and increasing preference for faster, cost-efficient, and eco-friendly construction solutions.

KEY TAKEAWAYS

-

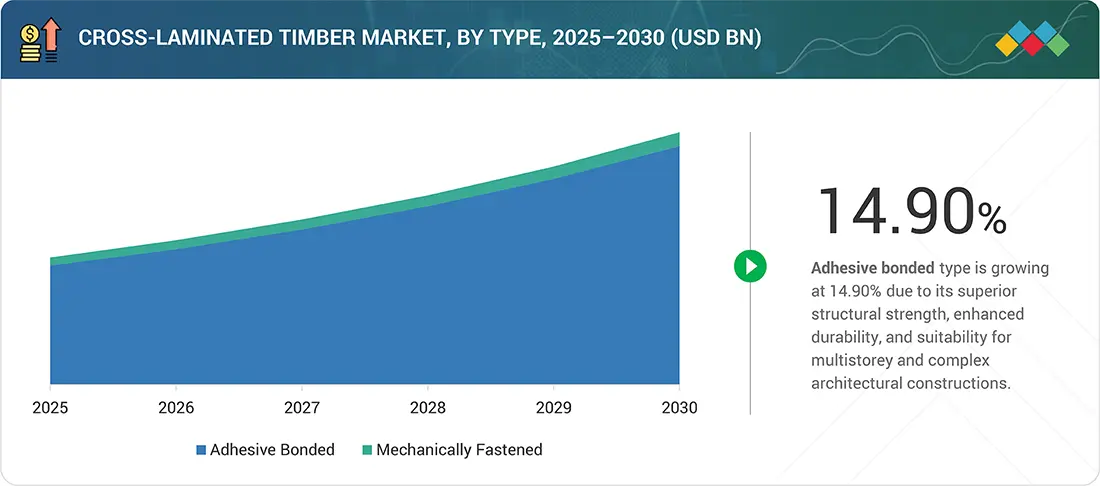

BY TYPEIn the type segment, the adhesive bonded cross-laminated timber is showing the fastest growth rate due to its superior load-bearing capacity, design flexibility, and suitability for large-scale modern construction projects.

-

BY INDUSTRYIn the industry segment, the residential sector is projected to grow at the fastest CAGR as cross-laminated timber is increasingly preferred for sustainably constructed homes. It also offers benefits such as reduced construction time, improved energy efficiency, design flexibility, and lower overall environmental impact.

-

BY END USEThe structural segment is projected to witness the fastest growth rate. Cross-laminated timber is highly suitable for load-bearing walls, floors, and roofs, providing high strength, stability, fire resistance, and sustainability benefits in modern construction projects.

-

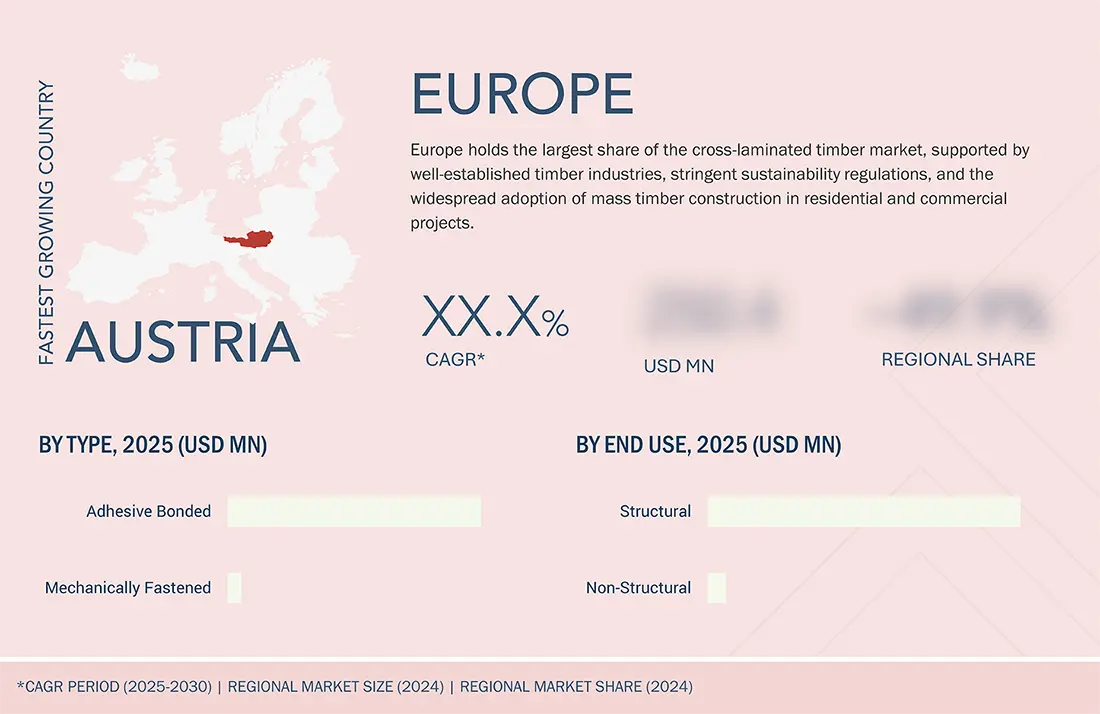

BY REGIONEurope holds the largest share of the cross-laminated timber market at the regional level, primarily due to its mature timber construction ecosystem, strong regulatory push for green buildings, widespread acceptance of mass timber in urban projects, and advanced manufacturing capacities.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including expansions, acquisitions, and investments. For instance, Mercer Mass Timber acquired Structurlam, a leading mass timber manufacturer based in British Columbia, Canada. This acquisition provided MMT with additional facilities, expanded its production capacity to 255,000 m³ of cross-laminated timber and glulam annually, and integrated Structurlam’s design and engineering expertise with MMT’s operations, supporting rapid scaling and innovation in North America.

The cross-laminated timber market is projected to grow steadily at the global level, driven by the increasing emphasis on sustainable construction and the urgent need to reduce carbon emissions in the building sector across the globe. Cross-laminated timber offers significant advantages such as high structural strength, design flexibility, reduced construction timelines, and superior thermal efficiency, making it an attractive alternative to traditional concrete and steel. Europe currently dominates the market due to its established timber industry, stringent sustainability regulations, and widespread adoption of mass timber solutions in residential and commercial projects. Meanwhile, North America is witnessing the fastest growth, fueled by growing acceptance of eco-friendly building materials and supportive policies promoting green construction. Among the types, adhesive-bonded cross-laminated timber is gaining traction at the fastest pace owing to its superior durability and suitability for complex structures, while the residential sector is the leader in the industry segment, driven by the rising adoption of prefabricated timber homes. Overall, cross-laminated timber is emerging as a transformative material that aligns with global sustainability goals and modern architectural trends.

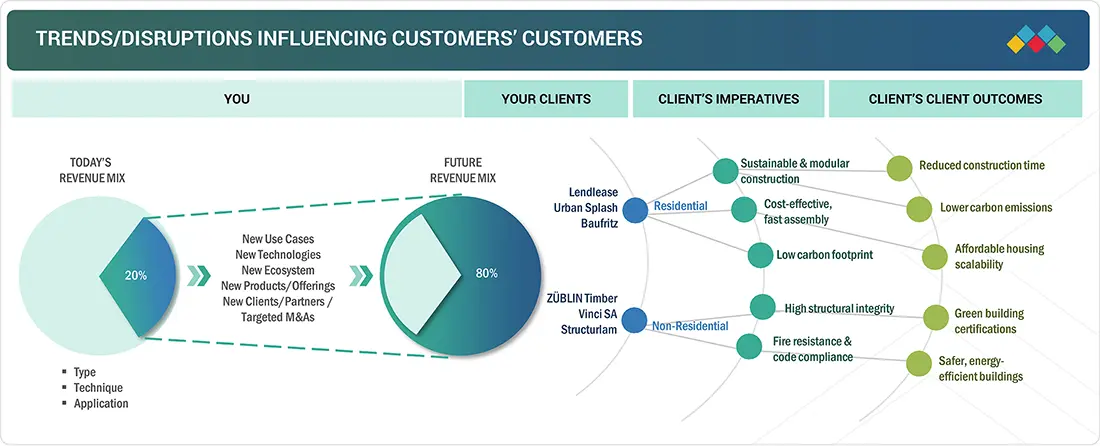

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Megatrends like urbanization, sustainability, and more stringent green building laws are reshaping the market for cross-laminated timber. Innovation is driven by developments in fire-resistant panels, the growing use of mass timber in mid- to high-rise projects, and the mix of digital design and prefabrication. Strong growth is being driven by rising demand from the public infrastructure, commercial, residential, and educational sectors. Cross-laminated timber is being chosen more for its strong structural performance, lower carbon footprint, compatibility with contemporary modular construction techniques, and compliance with changing environmental standards.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

CROSS LAMINATED TIMBER MARKET DYNAMICS

Level

-

Favorable government policies and building code advancements

-

Rapid urbanization and demand for prefabricated construction

Level

-

Limited manufacturing capacity and supply chain gaps

-

Lack of skilled workforce

Level

-

Growing demand in commercial and institutional buildings

-

Potential in renovation and adaptive reuse projects

Level

-

Moisture sensitivity and durability concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Favorable government policies and building code advancements

The growth in the cross-laminated timber market is immense, and the main reason is the strong policies and emerging regulation systems, mainly in Europe and North America. The commonly used sustainable construction materials that governments within such areas are attempting to recommend are currently beating the trend of climate change challenges, which include cross-laminated timber, among others, because of their ability to be renewable and carbon sequestering. Theoretically, it is possible to erect multi-storey, mid-rise, and even high-rise buildings using engineered wood such as cross-laminated timber, which has seen different regulating authorities around the world revise building codes and fire safety requirements to cater to and promote the use of engineered wood products in high-rise construction. An example of such changes to codes would include Austria, Germany, Canada, and the United States revising the codes (such as the International Building Code (IBC)) to permit taller mass timber construction (to 18 storeys, or more in special cases).

Restraint: Limited manufacturing capacity and supply chain gaps

Although there is increasing interest in sustainable construction globally, the cross-laminated timber market involves a number of critical issues that limit the potential in emerging and underdeveloped markets. Among the most serious constraints, the fact that there are few manufacturing facilities, especially beyond Europe, which is currently controlling the production and technological development of CLT, can be mentioned. Where European nations, including Austria, Germany and Switzerland, have mature supply chain, and well-established CLT plants and established skilled labor, some regions still remain behind the manufacturing infrastructure, namely, Asia Pacific, Latin America and parts of North America. This creates a twofold problem: longer lead times and higher prices on importing CLT as well as a shortage of regionally specific panel sizes and grades in the required credentials of the local building codes.

Opportunity: Potential in renovation and adaptive reuse projects

Cross-laminated timber is also becoming an attractive option as a solution in the large market of retrofit and renovation of buildings in cities, mainly because of its remarkable strength-to-weight ratio. Cross-laminated timber panels are also much lighter compared to other common building materials, such as concrete or steel, which explains why they are ideal in vertical extensions or use as a rooftop add-on in an old building. In built-up urban areas--where there is not much room to generate new structures and where zoning is restricted, cross-laminated timber allows the construction of high and old buildings without imposing excessive stress on the old foundations or load-bearing walls. With the aging of urban infrastructure, cities worldwide would focus on renovation and adaptation of the existing buildings instead of demolishing and rebuilding to maintain the heritage of architecture and minimize the environmental impact. This has especially been the case in Europe and certain sections of North America, where most of the 1940s to 1960s buildings are being reutilized as modern residential homes, commercial, or combined residential/commercial establishments. The modular design possibilities, the lack of in situ disruption and speed of construction mean that cross-laminated timber fits these timely renovation projects very well as a material.

Challenge: Moisture sensitivity and durability concerns

The sensitivity to moisture and humidity is one of the main technical issues that negatively affect the wider usage of cross-laminated timber. Even though the properties of cross-laminated timber panels were preconditioned to be strong and dimensionally stable, they were made of wood, a material that is inherently absorbent of moisture, and which naturally releases the moisture that it absorbed. Otherwise, it may cause swelling, delamination, fungal decay, mold growth, and a deterioration of mechanical properties, which will eventually reduce safety and compromise the lifespan. This is especially acute in a high-humidity area, the coast, and an area with frequent rainfall or long-term and wet conditions, since moisture penetration is difficult to contain. In such environments, water intrusion into the CLT panels can occur even because of minor flaws in the design, i.e., inadequate sealing, inadequate ventilation, or imperfectly installed vapor barriers. When moisture becomes trapped in panel joints or other open surfaces over time, the moisture that is trapped and properly humidified at the correct temperature may have conditions that favor biological attack, e.g., fungus attack or wood rot.

Cross Laminated Timber Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Constructing hyperscale datacenters using cross-laminated timber for floors and ceilings in a hybrid model with steel and concrete | Reduces embodied carbon footprint by 35% compared to steel and 65% compared to concrete; lighter and stronger material; enables prefabrication for faster, safer installation; promotes sustainability and carbon negativity goals |

|

Building a new corporate headquarters campus, featuring multiple mass timber office buildings | Enhances sustainability through regionally sourced lumber; creates a nature-connected workspace; sets a milestone as the largest mass timber campus in the US; reduces environmental impact and supports greener construction practices |

|

Leading the design of Walmart's mass timber headquarters incorporating cross-laminated timber and glulam at an unprecedented scale | Facilitates large-scale sustainable construction; integrates nature-inspired elements for employee well-being; significantly cuts carbon emissions through timber use |

|

Developing office buildings such as Google Borregas using mass timber for structural design and elements like cross-laminated timber members | Achieves net-zero emissions targets and incorporates biophilic design for improved occupant well-being |

|

Piloting mass timber construction for sustainable data centers | Lowers emissions through greener building materials |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The cross-laminated timber ecosystem involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, and end users. The raw material suppliers provide the key inputs required for resin production, which further enables the manufacturers to develop cross-laminated timber using specialized technologies. The distributors and suppliers are the ones who establish contact between the manufacturing companies and end users to concentrate on the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Cross-Laminated Timber Market, by Type

Adhesive-bonded cross-laminated timber is the most widely used type of cross-laminated timber, with both market share and the application scope of the product ahead of mechanically fastened products. It has been embraced mostly because of its better mechanical performance, greater dimensional accuracy, and in industrial-sized prefabrication requirements. Primarily, adhesive bonding requires structural adhesives of high strength, which enable fusing multiple layers of timber at an intersection angle that creates a monolithic, rigid panel that provides a greater amount of uniformity and a higher capacity of handling loads than can be achieved through mechanical fastening applications.

Cross-Laminated Timber Market, by Industry

The cross-laminated timber market is dominated by the non-residential sector in the industry segment, which has a larger share than the residential segment. Non-residential projects like commercial complexes, educational institutions, and public infrastructure account for higher consumption, even though residential construction is expanding quickly due to the growing demand for sustainable and prefabricated housing. Large-scale structures need stronger, more resilient, and environmentally friendly materials, and cross-laminated timber provides all three in terms of load-bearing capacity, construction speed, and adherence to green building standards. Consequently, when compared to the residential sector, non-residential applications continue to drive overall market demand.

Cross-Laminated Timber Market, by End Use

The major impact of cross-laminated timber end use has become the use of structural timber elements across the globe. The engineering characteristics of cross-laminated timber itself result in it being particularly suited to core structural applications, such as load-bearing walls, floor slabs, roofs, and decking, and lateral stability structures (e.g., shear walls). The nature of optimized strength to weight ratio is what distinguishes cross-laminated timber and the traditional building materials such as concrete or steel. Cross-laminated timber panels are substantially lighter and capable of supporting high vertical loads as well as lateral loads, as a result of a layered, cross-laminated structure. Not only does that make on-site handling easier and require fewer foundations, it also speeds up construction schedules due to off-site prefabrication and modular assembly.

REGION

Europe is the largest and North America is estimated to be the fastest-growing market for cross-laminated timber during the forecast period.

Europe dominates the cross-laminated timber market, not only owing to the early historical start, but also fundamental cultural, environmental, and politically driven propensities toward timber construction. The construction industry in the region has been around sustainable material use for some time, where the stewardship of the environment and a gripping urge to undertake a decarbonization process apply. The provision of European Union regulations, including the Green Deal and measures that are part of the Fit for 55 packages, directly promotes low-carbon construction technology use, establishing a positive environment to adopt cross-laminated timber. Such countries as Austria, Germany, and Sweden have instituted mass timber as one of the desired building materials, wherein there are favorable zoning regulations, subsidies, and simplified processes for permitting timber buildings. These governments have funded educational buildings and other public works in terms of infrastructure using cross-laminated timber to set an example and make the use of the material a standard.

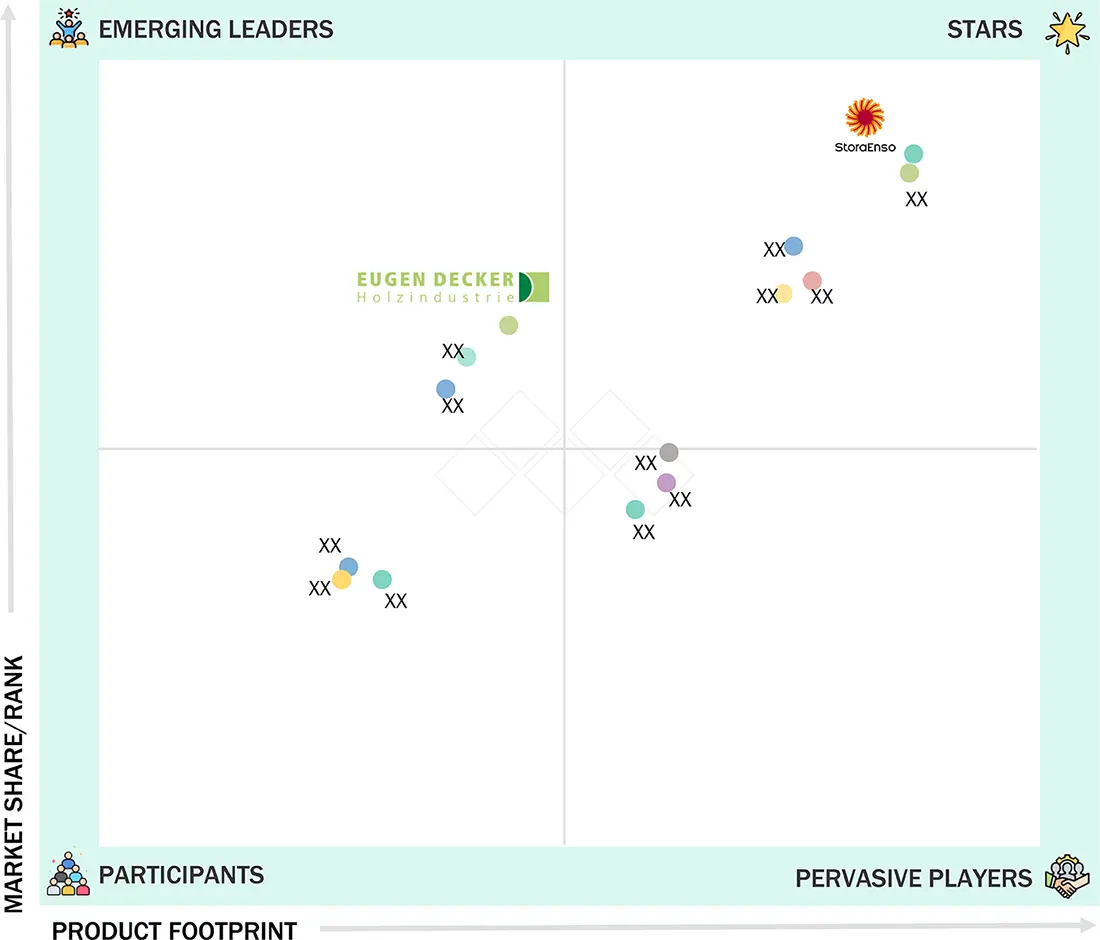

Cross Laminated Timber Market: COMPANY EVALUATION MATRIX

Stora Enso (Star) leads with a strong market presence and wide product portfolio, driving large-scale adoption across the construction industry. Eugen Decker Holzindustrie KG (Emerging Leader) is gaining traction with the research and developments related to cross-laminated timber for various areas in the construction industry. While Stora Enso dominates with scale, Eugen Decker Holzindustrie KG shows strong growth potential to advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 1.60 BN |

| Revenue Forecast in 2030 | USD 3.59 BN |

| Growth Rate | CAGR of 14.68% from 2025−2030 |

| Actual Data | 2020−2030 |

| Base Year | 2024 |

| Forecast Period | 2025−2030 |

| Units Considered | Value (USD Million), Volume (Thousand Cubic Meter) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | Type: Adhesive Bonded, Mechanically Bonded End Use: Structural, Non-Structural Industry: Residential, Non-Residential |

| Regional Scope | Asia Pacific, North America, Europe, Rest of the World |

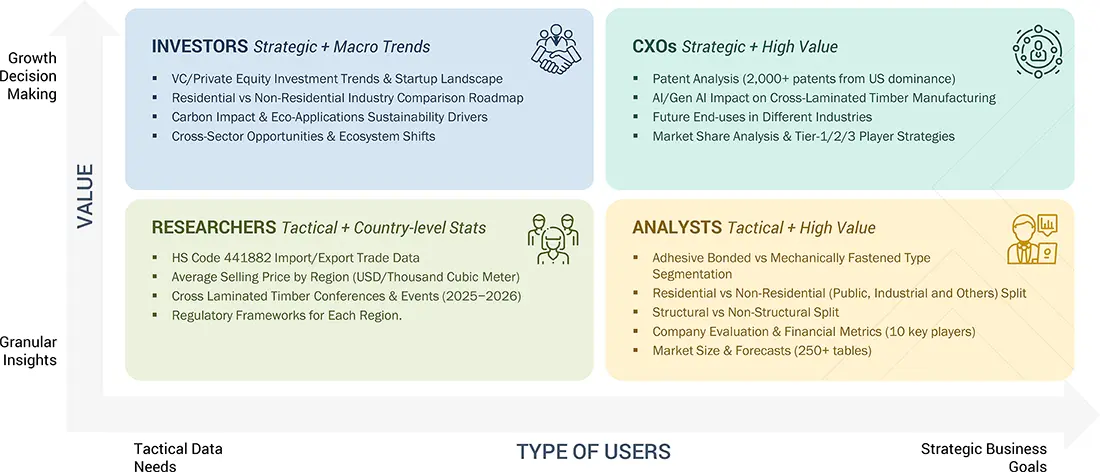

WHAT IS IN IT FOR YOU: Cross Laminated Timber Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-Based Cross-Laminated Timber Manufacturer | • Detailed Europe based company profiles of competitors (financials, product portfolio) • Customer landscape mapping by end-use sector • Partnership ecosystem analysis | • Identify interconnections and supply chain blind spots • Detect customer migration trends across industries • Highlight untapped customer clusters for market entry |

| Asia Pacific-Based Cross-Laminated Timber Manufacturer | • Global & regional production capacity benchmarking • Customer base profiling across the application industries | • Strengthen forward integration strategy • Identify high-demand customers for long-term supply contracts • Assess supply-demand gaps for competitive advantage |

RECENT DEVELOPMENTS

- June 2024 : Mercer Mass Timber acquired Structurlam, a leading mass timber manufacturer based in British Columbia, Canada. This acquisition provided MMT with additional facilities, expanded its production capacity to 255,000 m³ of cross-laminated timber and glulam annually, and integrated Structurlam’s design and engineering expertise with MMT’s operations, supporting rapid scaling and innovation in North America.

- March 2024 : Mercer Mass Timber launched "Mercer Mass Timber Construction Services," a new division offering on-site mass timber installation and project consulting. This end-to-end service integrates engineering, manufacturing, and construction, enabling faster project completion and efficiency, and aims to bridge the knowledge gap for first-time mass timber users in the construction industry.

- Feb-24 : HASSLACHER Group invested in Element5, becoming the first European company to support mass timber production expansion in North America. The investment funded a new glulam line at Element5’s St. Thomas, Ontario site, enabling a full range of machined glulam beams, columns, and assemblies. The expanded site has reached 100,000 m³ annual mass timber capacity and has gone into full operation in the first half of 2025.

- November 2023 : At its Küssnacht, Switzerland site, Schilliger Holz AG completed a rebuilding of its cross-laminated timber plant after a fire, installing a fully automated production line featuring the MINDA TimberPress X 134 HS. This system allows for flexible, large-format cross-laminated timber panel production (up to 14 m x 3.4 m x 0.4 m), continuous side gluing, and order-oriented manufacturing, preparing the company for increased international demand and efficient, high-quality output.

Table of Contents

Methodology

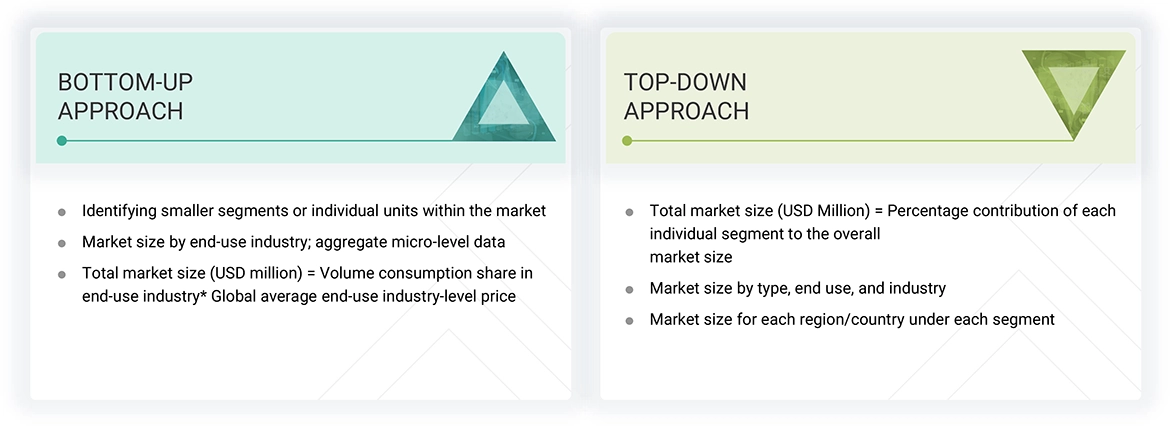

The study involved four major activities in estimating the size of the cross-laminated timber market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

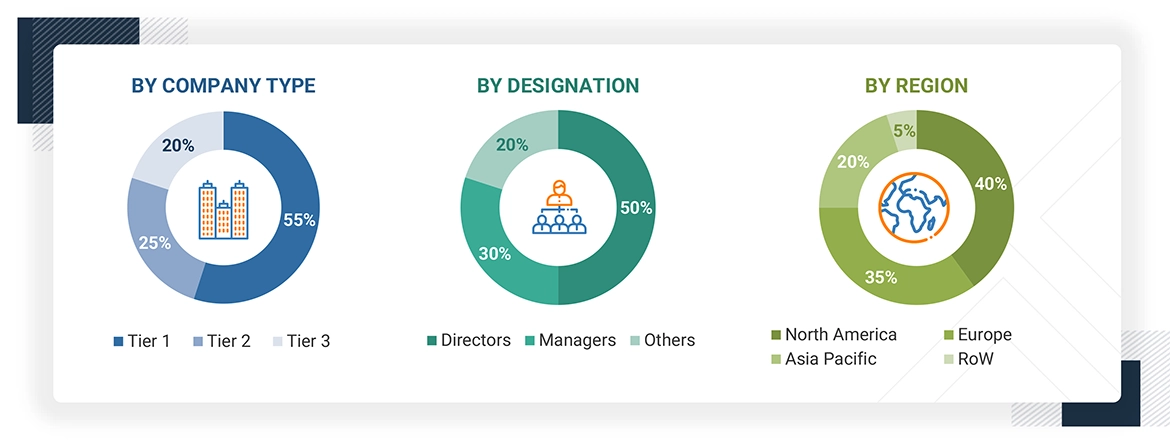

The cross-laminated timber market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the cross-laminated timber market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| Mayr-Melnhof Holz | Senior Manager | |

| Stora Enso | Innovation Manager | |

| Binderholz GmbH | Vice-President | |

| HASSLACHER Holding GmbH | Production Supervisor | |

| Schilliger Holz AG | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cross-laminated timber market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the cross-laminated timber industry.

Market Definition

Cross-laminated timber (CLT) is an engineered wood product made by stacking layers of solid-sawn lumber boards in alternating directions (typically at 90-degree angles) and bonding them with structural adhesives. This crosswise arrangement significantly enhances the strength, rigidity, and dimensional stability of the panel, making CLT ideal for load-bearing applications. It is widely used in the construction of walls, floors, and roofs in both residential and commercial buildings. CLT is prefabricated and offers advantages such as faster installation, reduced waste, and a lower carbon footprint compared to traditional concrete or steel. Recognized by associations such as the American Wood Council and WoodWorks, CLT aligns with modern sustainable building practices and green certification standards.

Stakeholders

- Manufacturers, dealers, and suppliers of cross-laminated timber and their raw materials

- Manufacturers in various end-use industries, such as automotive, building & construction, packaging, leather & footwear, general industrial, and furniture & decoration

- Traders, distributors, and suppliers of cross-laminated timber

- Regional manufacturers’ associations and polyurethane adhesive associations

- Government & regional agencies and research organizations

Report Objectives

- To analyze and forecast the cross-laminated timber market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To define, segment, and project the size of the global cross-laminated timber market based on type, end-use, and industry

- To project the market size for the four main regions: North America, Europe, Asia Pacific, and the Rest of the World

- To analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To track and analyze R&D and competitive developments such as expansions, product launches, collaborations, investments, partnerships, agreements, developments, and mergers & acquisitions in the cross-laminated timber market

Key Questions Addressed by the Report

Who are the major players in the cross-laminated timber market?

The key players include Mayr-Melnhof Holz (Austria), Stora Enso (Finland), BINDERHOLZ GmbH (Austria), HASSLACHER Holding GmbH (Austria), Schilliger Holz AG (Switzerland), Eugen Decker Holzindustrie KG (Germany), KLH Massivholz GmbH (Austria), Mercer Mass Timber (Canada), XLam (Australia), and Pfeifer Holding GmbH (Austria).

What are the drivers and opportunities for the cross-laminated timber market?

Major drivers include favorable government policies, building code advancements, rapid urbanization, and demand for prefabricated construction. Opportunities lie in growing demand in commercial and institutional buildings, as well as renovation and adaptive reuse projects using cross-laminated timber.

Which strategies are the key players focusing upon in the cross-laminated timber market?

Key players are focusing on product launches, partnerships, mergers & acquisitions, agreements, and expansions to strengthen their global presence.

What is the expected growth rate of the cross-laminated timber market between 2025 and 2030?

The cross-laminated timber market is projected to grow at a CAGR of 14.68% during the forecast period.

Which major factors are expected to restrain the growth of the cross-laminated timber market during the forecast period?

Limited manufacturing capacity, supply chain gaps, and a lack of skilled workforce are expected to restrain market growth during the forecast period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Cross Laminated Timber Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Cross Laminated Timber Market